Briefly: in our opinion, small (50% of the regular position size) speculative long positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

Gold moved higher after my Feb. 24 buy Alert, but the question now becomes – how high is it likely to move before the next top? Why?

To start with the latter, it’s usually not possible to say exactly why a given market is going to move in a certain direction. It can rally based on all sorts of reasons, but all those reasons (news, reports, announcements) are ultimately filtered through the market’s (markets are made of people, after all) emotions.

Fear and greed are common in the market, and due to them, people tend to follow specific patterns over and over again, regardless of the exact economic surroundings and also pretty much regardless of the time when it’s all taking place. That’s why the market’s performance and analogy from a decade or a few decades ago are still relevant today – because people felt greed and fear just like they do now, and they are likely to react similarly to similar price developments.

This time is no exception. What already happened is likely to happen again – in a slightly different way, but still. Consequently, let’s check which parts of the current environment are similar to previous patterns – and what kind of price action followed those patterns.

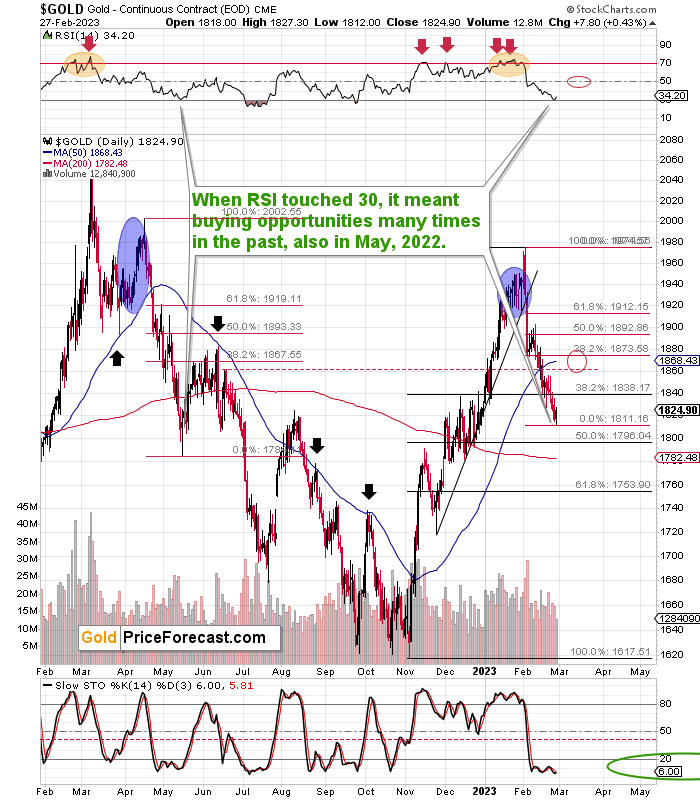

The first thing that is immediately visible (it’s in the upper part of the chart, after all) is the RSI indicator, which just moved to the 30 level and then bounced higher.

This already makes the short-term outlook bullish, because that’s one of the more reliable short-term indicators for gold out there. As you can see, the RSI close to 30 has corresponded to local bottoms many times in the recent past. You don’t see it on the above chart, but it has been the case for many years now. Of course, it’s not a 100% certain signal (there are no certainties on any market), but I found it to be very useful.

Now, what makes the situation particularly interesting – and bullish for the short term – is that the recent downswing (as well as the preceding rally) is similar to what we saw last year in April and May. Back then, gold plunged after a sizable rally, and we see the same thing right now.

If gold declined just like it did in May 2022, then it’s quite possible that the corrective upswing would also be similar. What happened then?

Gold rallied until it moved slightly above the 38.2% Fibonacci retracement and until it touched its 50-day moving average (marked with blue). Back then, the 50-day moving average was above the retracement. This time it’s a bit below it.

Still, those two levels seem to point to a quite coherent target area for the current rally at about $1,870.

We see one more resistance level close to this – the mid-June 2022 high, which I marked with a red dashed line. It’s just above the $1,860 level.

That’s as far as the price is concerned, but what about the RSI analysis? It’s currently still very close to 30, which leaves gold with some room to rally. Back in mid-2022, the RSI moved close to the middle of its trading range – the 50 level – before gold reversed. And since history tends to rhyme and both periods have been similar so far, one can expect the RSI to move to 50 (approximately) again this time.

Given how big rallies have accompanied big rallies in the RSI, gold at around $1,860 to $1,870 appears to correspond to an RSI close to 50. Consequently, we have yet another confirmation that gold is likely to move to this level before turning south again.

Why would gold and silver want to turn south again? For example, due to soaring real interest rates, which are one of the two primary drivers of gold prices (the other is the USD Index).

What one decides to do with the above target information is up to them. It’s your capital, and it’s your choice what you decide to do with it. In my opinion, the medium-term outlook is so extremely bearish that it makes sense to focus on the “easy part of the rally” and, once it’s over, take profits and perhaps re-enter the short position. As we just profitably closed the short position in the GDXJ, which was the fifth profitable trade in a row, closing the long position would imply a sixth (it’s already profitable, by the way, and the profits increased yesterday). The key thing is that the next short trade is probably going to be a really big and profound one. Based on the historical analogies, it seems that the biggest part of the decline is just ahead (after this corrective upswing).

Consequently, from my point of view, it’s most important not to miss the profits on the upcoming slide – and that’s why my focus here would be to ride and profit on the easy part of the rally only. And that’s why I placed the take-profit in the lower part of the target area that you can see on the above gold chart.

As a reminder, I’m providing the above comments on gold as a courtesy to those that cannot trade the GDXJ or its counterparts – I do not have a trading position in gold, but I do have one in junior mining stocks. You will find details in the “Summary” part of the Alert (as always).

Speaking of junior mining stocks, my yesterday’s comments about them remain up-to-date:

If you thought that was the end of the good news, I have a pleasant surprise for you.

After taking a look at the markets once more, it seems to me that the end of the easy part of the rally in the GDXJ is at higher levels than I previously thought – so the profit potential from the current long position appears to be bigger than we previously assumed.

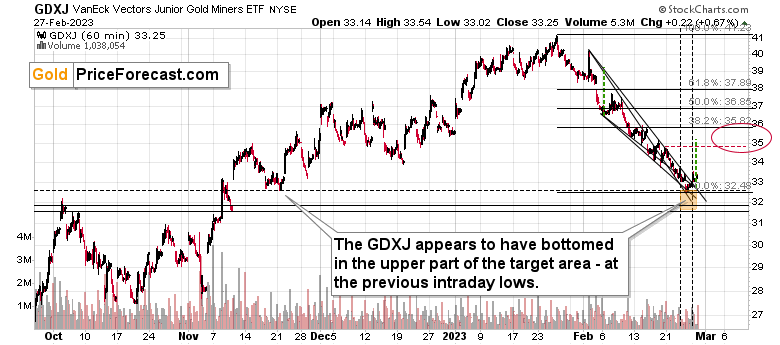

It’s not visible from the broader perspective, but after zooming in, it’s clear that the GDXJ declined within a falling wedge pattern. Breakouts and breakdowns from this pattern are likely to be followed by moves that are just like the height of the wedge.

I marked it with a green, dashed line, and I copied it to the current situation. It points to a target above the $35 level.

That’s great, because there are a couple of very short-term price extremes there – local highs and lows. There’s also the 38.2% Fibonacci retracement level just below $36.

I marked the likely target area with a red ellipse. However, since the medium-term downtrend is likely extremely powerful (please read Friday’s extensive Gold Trading Alert for details), the risk – in my view – is to be outside of the short position, and in particular in a long position. Consequently, my focus will be to catch the easy part of the rally, take profits off the table, and re-enter the short position in order to capitalize on the enormous move lower.

So, the question is not when the rally is likely to end, but when the easy part of the rally is likely to end. In my opinion, the answer to that question is provided by the lowest of the above-mentioned target levels – the Feb. 17 intraday high. That’s $34.77. That day’s closing price was $34.59.

Now, since markets tend to view round numbers as important, this gets us to $34.50 as a potentially important level. Therefore, I’m placing the profit-take level for this long position a few cents below this level (at $34.47) – you will find details below the “Summary” paragraph.

And no, I’m not placing a stop-loss level at all, as my trades simply work better without them (in most cases, there are exceptions to this rule; I sometimes DO use them, usually to let the profits grow while ensuring that even if the trade goes sour, we’ll still come out ahead). I tested this over and over again, and that remains to be the case. It doesn’t mean that I’m letting the trade “run wild,” though. I’m simply focusing on more inputs than just the price of the asset when deciding whether to close a position or not. Of course, if you’d like to add a stop-loss level, feel free to do so – it’s your capital, and you can do with it as you see fit.

Either way, the upside potential for this likely quick trade appears bigger than it initially seemed, which also means that we’ll probably be able to get back to the short position at even higher levels, thus increasing profits on the short side as well.

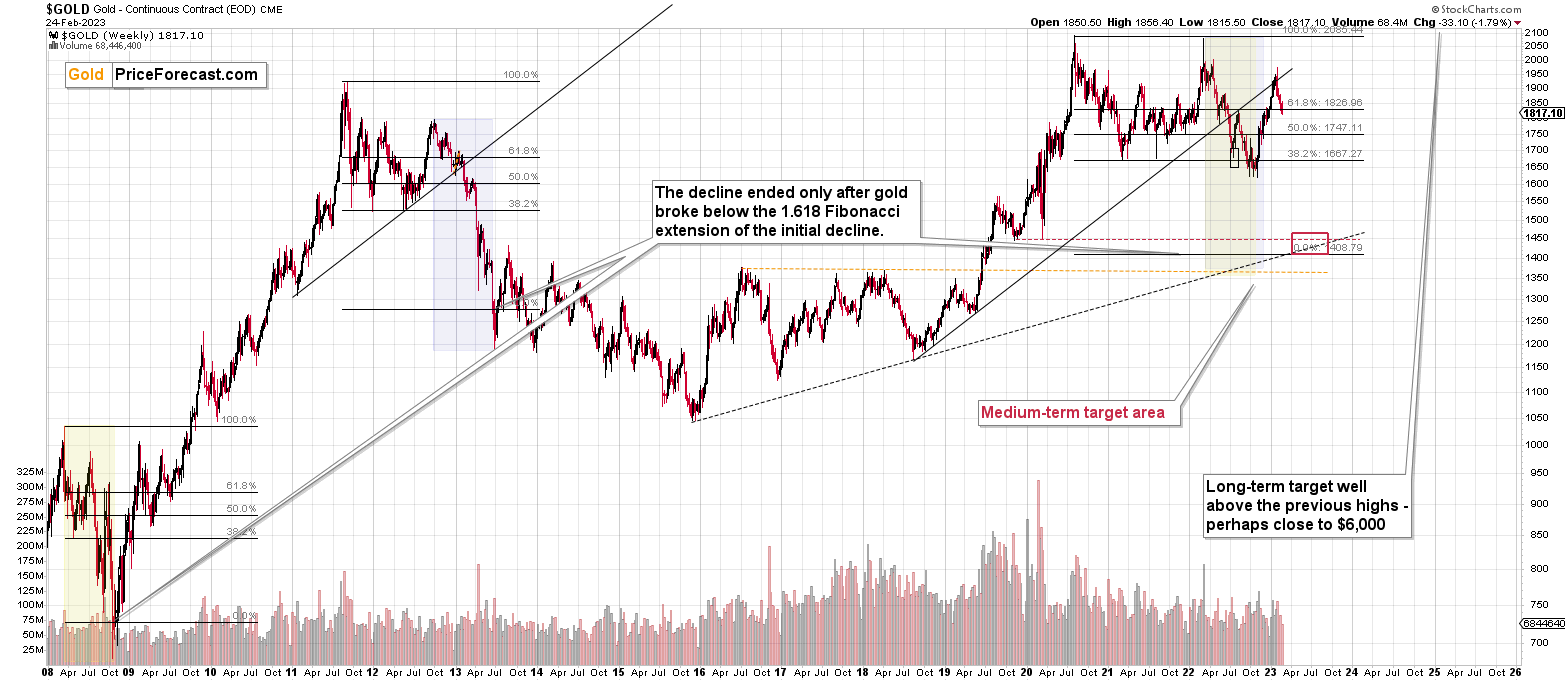

Overview of the Upcoming Part of the Decline

- It seems to me that the big corrective upswing is over, and we’ll see just a small correction before the decline really picks up.

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place and if we get this kind of opportunity at all – perhaps with gold prices close to $1,500 - $1,550.

- I plan to switch from the short positions in junior mining stocks or silver (whichever I’ll have at that moment) to long positions in junior mining stocks when gold / mining stocks move to their 2020 lows (approximately). While I’m probably not going to write about it at this stage yet, this is when some investors might consider getting back in with their long-term investing capital (or perhaps 1/3 or 1/2 thereof).

- I plan to return to short positions in junior mining stocks after a rebound – and the rebound could take gold from about $1,450 to about $1,550, and it could take the GDXJ from about $20 to about $24. In other words, I’m currently planning to go long when GDXJ is close to $20 (which might take place when gold is close to $1,450), and I’m planning to exit this long position and re-enter the short position once we see a corrective rally to $24 in the GDXJ (which might take place when gold is close to $1,550).

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold prices close to $1,400 and GDXJ close to $15 . This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,400, but at the moment it’s too early to say with certainty.

- The above is based on the information available today, and it might change in the following days/weeks.

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding nor clear enough for me to think that they should be used for purchasing options, warrants, or similar instruments.

Letters to the Editor

Please post your questions in the comments feed below the articles if they are about issues raised within the article (or in recent issues), and if they are about other, more universal matters, I encourage you to use the Ask the Community space (I’m also part of the community, after all), so that more people can contribute to the reply and then enjoy the answer. Of course, let’s keep the target-related discussions in the Gold Trading Alerts space.

Summary

To summarize, while the precious metals sector is likely to move much lower in the following months, it seems likely that we’re seeing a short-term corrective upswing right now, similar to the ones on which we profited in 2022 (as a reminder, we went long on May 12, took profits on May 26, and we went long between Jul. 11 and Jul. 18 and took profits on Jul. 28).

As a reminder, since the medium-term downtrends are so strong, I’m not aiming to catch the perfect top but rather to catch the easy part of the rally, cash profits, and get back on the short side once that easy part of the rally is over. Missing the huge move might be costly in terms of missed profits.

From a medium-term point of view, real interest rates are up and about to soar higher, the USD Index has most likely bottomed and is likely to soar, while the precious metals topped in a spectacular manner and are now likely to slide – either shortly or soon enough.

What’s likely to happen after the corrective upswing? Something exciting (and, in my view, very lucrative) or something scary – depending on how positioned and informed one chooses to be.

Also, please note that (paraphrasing Sun Tzu) “understanding the enemy without understanding your true self is only half of a victory.” Before applying any insights into actionable practice (and placing or adding to your trades), please make sure that the position that you’re about to enter and its size are aligned with your approach, your investment goals, and your risk tolerance.

In other words, I suggest starting with yourself, and tailoring the trade to you, not the other way around. Please consider your motivation for this trade and how it aligns with the rest of your approach and life in general.

Hint: don’t go for the easy answer like “money” or “profits,” but consider why the result of the trade is important – is this a part of your well-designed strategy and “you have it,” or is it something you “must absolutely do” – in other words, “it has you”…).

This will save you lots of stress, which is not only end in and of itself (your happiness and health are both closely linked to your stress levels), but it also helps you become a more profitable investor as less stress (or none thereof) means more objectivity and less risk of “running for the hills” right before a given trade becomes profitable (perhaps extremely so).

Given the above, gold’s invalidation of the temporary move above its very long-term resistance (the 2011 high!), and the situation in the USD Index, it seems that the next big move lower in the precious metals sector is already underway.

Now, as more investors realize that interest rates will have to rise sooner than expected, the prices of precious metals and mining stocks (as well as other stocks) are likely to fall. In my opinion, the current trading position is going to become profitable in the following weeks, and quite possibly in the following days. While I can’t promise any kind of performance, I fully expect it to become very profitable before it’s over and to prolong our 2022 winning streak.

After the final sell-off (that takes gold to about $1,350-$1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

As always, we'll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $34.47; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JNUG (2x leveraged). The binding profit-take level for the JNUG: $32.77; stop-loss for the JNUG: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures profit-take exit price: $21.97

SLV profit-take exit price: $20.17

AGQ profit-take exit price: $26.34

Gold futures profit-take exit price: $1,857

HGU.TO – alternative (Canadian) 2x leveraged gold stocks ETF – the upside profit-take exit price: $12.67

HZU.TO – alternative (Canadian) 2x leveraged silver ETF – the upside profit-take exit price: $19.57

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you’ve already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it was up-to-date on the day it was posted. We are also featuring the initial target prices to help you decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder, "initial target price" means exactly that: an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (as it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial,” but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief