Briefly: in our opinion, full (250% of the regular size of the position) speculative short position in gold, silver, and mining stocks is justified from the risk/reward point of view at the moment of publishing this Alert.

So, did U.S. and Iran just become best friends?

Gold's huge reversal and a decline of about $50 in 24 hours might certainly suggest so to those, who choose to follow the news instead of estimating market's moves using more reliable tools.

Of course, the two countries are not on friendly terms at this time. So, what happened that gold declined so much, so fast? Let's start with going over what we explained yesterday as gold's price action confirmed it so well.

Gold, News and Market Expectations

When something happens that shocks the market - a missile strike, a drone airstrike, a new military threat or a sudden shift in trade relations between superpowers such as U.S. and China - the markets have to react. Why? Because markets are essentially people that adjust their views on the world based on new facts. Their reactions to new information is based not only on the information itself, but also on how people really view it (important or not? permanent or not?), what they were expecting previously (even a rate cut could be bearish for stocks if people were previously expecting a bigger rate cut that they got), and what's their emotional status at the moment they received the news. Ever tried asking for a raise when the boss was angry? The risk to reward ratio for this request would go against the one asking...

The gold-related news that hits the market is one thing and it doesn't depend on investors' approach, views, emotions etc. That's an important factor that investors will need to discount in the price (by buying or selling) in some way. And they will.

Should gold move up if an Iranian missile hits a U.S. target? Of course.

But should gold move up by $0.10, $1, $10, $50, $100, or $1000? And how long should the reaction last? A minute, an hour, a day, a week, a month, or maybe a year?

These two questions are really the key to determining what action to take. And none of them is answered or explained by the news itself. One could try to estimate how long are the threats going to take place or if they escalate into a full-blown conflict. We received numerous messages after Russia took over Crimea years ago, and we received messages as the U.S. - North Korea tensions hit its peak. The messages were from people, who were absolutely convinced that this is just the beginning of war. This didn't turn out to be correct, and gold moved lower in the following months as the uncertainty eased.

Remember how sudden the U.S. - North Korea's conflict's end was? Remember how gold performed at the beginning of the Gulf War 1, the 9/11 attack and last year's attack on Saudi Aramco's Abqaiq facility? Gold rallied initially, but the rally soon reversed and turned into a decline. Predicting how the events will unfold is difficult enough on its own, but in case of gold forecasts, it gets extra complicated.

You see, gold doesn't simply rally the less peaceful the situation gets. It generally moves up depending on how uncertain the situation is and how badly people want to insure themselves. The markets are said to buy the rumor and sell the fact, and this is also the case - in a way - with gold. Remember when the SLV ETF was launched and everyone and their brother were expecting silver to shoot for the moon based on that? Silver collapsed immediately after the launch as people who wanted to buy, had already bought based on the expectation (!) that the ETF will be launched.

So, instead of estimating the outcome of the U.S. - Iran tensions, one would need to forecast what path will the uncertainty itself take with regard to the conflict. We already saw the first military moves on both sides of the conflict.

Missiles were launched from both sides. In yesterday's analysis we emphasized that this might not be the end of the conflict, but... It could be the case that it's the peak of the uncertainty.

After the U.S. killed the Iranian general Qasem Soleimani, Iran was practically forced to react in a visible way as otherwise the regime would be viewed as extremely weak by the Iranian people. It did, but perhaps it did so in a way that would not lead to the escalation of conflict. We will never know the details of the missile attack, but we can't rule out the possibility that out of the ways that it could have been carried out, it was done in a way that would make it clearly visible to everyone, but with as little damage as possible. This way - along with the "we do not seek escalation or war" tweet - Iran might be aiming to really end the conflict and the tensions. Of course, it could have just not carried out the attack, but that would have probably been a political suicide for its leaders.

As it turned out, the retaliatory Iranian missile attack on two U.S. bases in Iraq caused no casualties and it was an opportunity for the U.S. President to become less hostile toward Iran. Trump took this opportunity. "We must also make a deal that allows Iran to thrive and prosper, and take advantage of its enormous untapped potential." See how quickly and unpredictably the news can change?

If there only was a way to focus on something that's more stable, more comparable to other cases, and at the same time based on proven methodology... That's what gold's technical analysis is all about.

Most importantly, the technical analysis does reply to the two questions: how long a given move could take, and how big a given rally or decline is likely to be. Of course, nobody in the world has an all-knowing crystal ball, which means that not all signals will work exactly as one thinks, but overall the technical signals proved to be useful over and over again. Looking at just the news themselves might explain why something just happened (which might be a true explanation or not), but it doesn't imply that much for the future. Remember that we have to estimate the trends in tensions and uncertainty, not the escalation of conflict per se. If the conflict gets worse, but the news is less and less surprising while at the same time they normalize in a way, this could result in lower uncertainty.

Focusing on technicals gives us the chance to estimate the next moves, the direction, and time the likely moments of reversals. Looking at news is still useful, but the biggest usefulness comes from checking whether the market is reacting the way it should.

If it's clearly underperforming compared with what it "should" be doing given a certain piece of news, it's a useful sign showing that something from the emotional state of market or something about market's perception and expectations, is likely to make the market either move up or down. This, combined with nearby support and resistance levels, turning points, and signals from indicators that proved to be useful in case of a given market can give one insights that are simply unavailable to those, who focus on just the news.

Yesterday's missile launch was definitely an escalation of conflict, at least at first sight. Consequently, gold should have rallied substantially on this piece of news.

And how did gold market react just several hours after the missile strike?

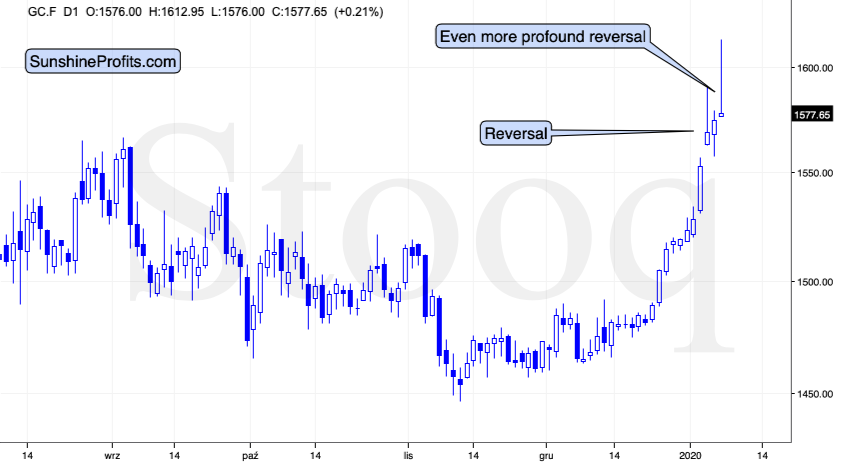

It did rally, but only for a few hours. Then it declined and at the moment of writing these words, it is trading exactly where it had been trading 24 hours earlier. In other words, gold completely shrugged off the news that was supposed to make it soar. In yesterday's Gold Trading Alert, we wrote that it was a crystal-clear sign that gold doesn't want to move higher here, and that it's most likely topping right now.

The reversal itself is a profound sell sign, but "it doesn't count" yet as the session is not over. Still, given that it's a reaction to the news that "should have caused" gold to launch a sustainable rally, it's already a major show of weakness.

Gold really topped on Monday when it erased most of the overnight gains and formed a reversal. Today's pre-market action is a repetition of the same signal but with an even bigger strength and importance.

There's also one additional factor that it's still worth mentioning. Gold just got Cramerized. "Gold, gold, gold, gold" is what CNBC's Mad Money host featured recently. Gold received all the publicity it could get from multiple angles, and people had the chance to react to a missile strike. And what did gold to? It reversed. Twice. Each time failing to break above the key 61.8% Fibonacci retracement level based on the 2011 - 2015 decline.

Perhaps the gold - Iran link is not that simple...

And what did gold do after we posted yesterday's analysis?

It declined even more. At the moment of writing these words, gold is verifying the breakdown below the very short-term support line. However, the key thing that gold just did was to invalidate the breakout above the 2019 high. This is a major technical development. One of the trading tips specific for gold is that in case of the gold market, it takes three consecutive closes above a certain level to confirm a breakout. On the third day, gold invalidated it and it's declining in today's pre-market session.

And speaking of invalidations...

Those PMs Reversals

Gold stocks plunged almost 5% yesterday and then closed well below its 2019 high. The HUI Index seems to have formed an island top and is now likely to slide even faster than it had rallied.

Silver showed strength at the very end of the decline, just like it tends to do at the tops. We have many factors in place arguing for a decline in the precious metals market and for the targets and key long-term points made in this week's flagship Gold & Silver Trading Alert (Monday's issue) : they remain up-to-date.

To reply to the question that we started this analysis with - gold declined so much so fast yesterday as that was in tune with the emotional / technical condition of the market. It didn't really want to move higher - essentially, it was forced to based on the news that kept emerging. It only took a decrease in the uncertainty for gold to plunge and for both: gold and gold stocks to invalidate their breakouts above the 2019 high.

In our view, if there ever was an excellent time to enter or add to one's short positions in the precious metals sector - this is it. Mining stocks and silver are likely to decline more than gold, but diversification might be a good way to go for most investors.

Summary

Summing up, gold declined so much, so fast yesterday as that was in tune with the emotional / technical condition of the market. It didn't really want to move higher - it was forced to based on the news that kept emerging. It only took a decrease in uncertainty for gold to plunge and for both the yellow metal and gold stocks to invalidate their breakouts above the 2019 highs. Based on the crystal-clear shooting star reversals, gold getting Cramerized, very weak gold response to yesterday's missile strike, the 61.8% Fibonacci retracements that were just hit, along with multiple similarities present in gold, silver, and mining stocks, as well as on the critical situation in the USD Index, the medium-term, and short-term outlooks for the precious metals market are very bearish. Given the proximity of the triangle-based reversals in gold, silver stocks' big volume spike, and the extreme weakness in gold stocks relative to gold, it seems that the short-term rally in gold, silver, and miners is now over. In other words, the profit potential of our trading positions remains intact.

In our view, if there ever was an excellent time to enter or add to one's short positions in the precious metals sector - this is it.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short position (250% of the full position) in gold, silver, and mining stocks is justified from the risk/reward perspective with the following stop-loss orders and binding exit profit-take price levels:

- Gold futures: profit-take exit price: $1,391; stop-loss: $1,622; initial target price for the DGLD ETN: $36.37; stop-loss for the DGLD ETN: $22.89

- Silver futures: profit-take exit price: $15.11; stop-loss: $19.06; initial target price for the DSLV ETN: $24.88; stop-loss for the DSLV ETN: $14.07

- Mining stocks (price levels for the GDX ETF): profit-take exit price: $23.21; stop-loss: $30.11; initial target price for the DUST ETF: $14.69; stop-loss for the DUST ETF $5.09

In case one wants to bet on junior mining stocks' prices, here are the stop-loss details and target prices:

- GDXJ ETF: profit-take exit price: $30.32; stop-loss: $44.22

- JDST ETF: profit-take exit price: $35.88 stop-loss: $9.68

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one, it's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (DGLD for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn't, then we will view both positions (in gold and DGLD) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager