Briefly: in our opinion, full (300% of the regular position size) speculative short positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

While gold declined yesterday, silver and miners truly plunged. Gold was down by 0.38%, silver declined by 2.57%, and junior mining stocks (GDXJ) ended yesterday’s session 5.54% lower.

So much for gold miners’ strength.

Technically, we didn’t see anything new in the gold market.

It declined after Monday’s reversal, in tune with what I wrote previously, and that’s perfectly normal at this time.

Silver declined more visibly, and is now almost done erasing its entire April rally. It also managed to close the day back below its January high, thus invalidating the breakout above it – once again.

This is very much in tune with the back-and-forth decline that we saw at the beginning of the huge 2012-2013 decline.

Junior miners declined the most – over 5%. However, technically, they didn’t invalidate the breakout above their triangle pattern, as well as above their late-2021 high.

The breakout below the March lows was quite clear, though.

What’s next? The long-term analogy to 2012-2013 is likely to continue, and miners are likely to decline along with the rest of the precious metals sector. The fact that miners stopped at their support level means that they could move sideways for a day or few. However, even if that happens, it won’t change the above-mentioned analogy or the fact that the two most important drivers for the gold price (rallying USD Index and real interest rates) are pointing to its lower values.

All in all, technicals favor a decline in the precious metals sector sooner rather than later.

Having said that, let’s take a look at the markets from a more fundamental point of view.

The Message Man

While I have been warning about the “expeditiously” hawkish monetary policy actions that should commence over the next several months, the man at the top put a stop to investors’ games on Apr. 21. To explain, Fed Chairman Jerome Powell said:

“It is appropriate in my view to be moving a little more quickly” to raise interest rates. He added: “I also think there is something to be said for front-end loading any accommodation one thinks is appropriate (…). I would say 50 basis points will be on the table for the May meeting.”

“It’s absolutely essential to restore price stability. Economies don’t work without price stability.”

Moreover, there is that word again:

As a result, while investors finally got the message, I warned on Apr. 21 that officials' guidance had been loud and clear for months. I wrote:

It’s funny how obvious Fed officials’ messaging has become. In a nutshell: Powell sets the tone, and his deputies recite his message in hopes that investors will react accordingly. However, with investors in denial and/or unable to see the forest through the trees, they’re not heeding the warnings.

Well, suddenly, the wake-up call elicited a shift in sentiment. With the S&P 500 under pressure and the GDXJ ETF suffering mightily on Apr. 21, reality finally re-emerged. However, with plenty of downside still left for both assets, the medium term should elicit plenty of hawkish fireworks. To explain, I wrote on Apr. 6:

Please remember that the Fed needs to slow the U.S. economy to calm inflation, and rising asset prices are mutually exclusive to this goal. Therefore, officials should keep hammering the financial markets until investors finally get the message.

Moreover, with the Fed in inflation-fighting mode and reformed doves warning that the U.S. economy “could teeter” as the drama unfolds, the reality is that there is no easy solution to the Fed’s problem. To calm inflation, it has to kill demand. And as that occurs, investors should suffer a severe crisis of confidence.

To that point, Powell said on Apr. 21 that the U.S. labor market is "too hot" and that the Fed needs to cool it down. "It is a very, very good labor market for workers," he said. "It is our job to get it into a better place where supply and demand are closer together."

Moreover, while I've warned on numerous occasions that Fed officials have sounded the alarm on the economic challenges that lie ahead, Powell said that it won't be "straightforward or easy" to administer a soft landing.

Please see below:

However, while investors’ light bulbs went off on Apr. 21, the reality is that these medium-term ramifications have been hiding in plain sight. Moreover, while Powell said that a 50 basis point rate hike in May is “on the table,” it’s likely a done deal. Here is why: I noted on Apr. 14 that the Bank of Canada (BoC) announced a jumbo rate hike at its last monetary policy meeting. I wrote:

The Bank of Canada (BoC) announced a 50 basis point rate hike on Apr. 13, and with the Fed likely to follow suit in May, the domestic fundamental environment confronting the PMs couldn’t be more bearish.

Please see below:

Moreover, BoC Governor Tiff Macklem (Canada's Jerome Powell) said that "We are committed to using our policy interest rate to return inflation to target and will do so forcefully if needed."

Furthermore, while he added that the BoC could "pause our tightening" if inflation subsides, he cautioned that "we may need to take rates modestly above neutral for a period to bring demand and supply back into balance and inflation back to target."

However, with the latter much more likely than the former, the BoC's decision is likely a preview of what the Fed should deliver in the months ahead.

To that point, Canadian inflation data was released on Apr. 20. Surprise, surprise: the scorching results came in hotter than expected. For context, the figures in the middle column represent economists’ consensus estimates.

Please see below:

Furthermore, the most important point that investors miss is the political ramifications of inflation. For example, when low and middle-class citizens suffer financially, their hardship becomes front-page news. As a result, the unwanted attention is bearish for the financial markets because it forces politicians and, therefore, central banks to act.

Please see below:

Likewise, while America’s neighbor to the north is feeling the inflationary heat, the political story is the same in the U.S. To explain, I wrote on Apr. 20:

CNBC released its All-America Economic Survey on Apr. 13. The report revealed that “47% of the public say the economy is ‘poor,’ the highest number in that category since 2012. Only 17% rank the economy as excellent or good, the lowest since 2014.”

Please see below:

Likewise, I’ve also noted on numerous occasions that U.S. President Joe Biden’s approval rating is inversely correlated with inflation.

As a result, while investors assume that the Fed will bow down to the financial markets, the reality is that the game has changed. Previously, the Fed could support asset prices without the general public noticing. Now, inflation is front-page news and is hurting middle-class and poor Americans. Therefore, the Fed has to deal with the issue, and political pressure should force officials’ hands, whether they like it or not.

Thus, while the S&P 500 and the PMs have largely denied these hawkish realities, their price action on Apr. 21 is likely a sign of things to come. In addition, with the inflation story far from resolved, my comments on Apr. 6 still stand: [Fed] officials should keep hammering the financial markets until investors finally get the message.

A case in point: the Philadelphia Fed released its Manufacturing Business Outlook Survey on Apr. 21. The report revealed:

“The indicators for prices paid and prices received continued to suggest widespread price increases and inched higher this month. The prices paid index rose 4 points to 84.6, its highest reading since June 1979 (…). The current prices received index edged up from 54.4 to 55.0.”

Please see below:

On top of that, this month’s special questions revealed that inflation expectations have also increased. The report stated:

“The firms still expect higher costs across all categories of expenses in 2022: Responses indicate a median expected increase of 10 to 12.5 percent for raw materials and of 7.5 to 10 percent for energy and for intermediate goods, higher than when this question was asked back in January. The median expected change for total compensation (wages plus benefits) was unchanged at 5 to 7.5 percent.”

Please see below:

Also, please remember that the survey data was collected from Apr. 11 to Apr. 18. Therefore, inflation is still running away from the Fed. As further evidence, Tracker Supply released its first-quarter earnings on Apr. 21.

For context, the company operates a “retail chain of stores that sells products for home improvement, agriculture, lawn and garden maintenance, livestock, equine and pet care for recreational farmers and ranchers, pet owners, and landowners.”

CEO Hal Lawton said during the Q1 earnings call:

“What we’re seeing is very consistent with what we’re all reading in the headlines every day. I’ll start with persistent inflation. We had the CPI of 8.5% in the month of March, that we’ve seen 0.5 point increases a month for the last handful of months. It’s tough to say if we’re at peak inflation, the way I think about it is that we’re seeing persistent inflation. And I think we will see, strong inflation, not only through this year, but in the next year.”

As a result, the company is pricing its products ahead of the 8.5% CPI:

Source: Tractor Supply/Seeking Alpha

Source: Tractor Supply/Seeking Alpha

Furthermore, I wrote on Apr. 21 that Procter & Gamble (P&G) had a similar message:

CFO Andre Schulten noted that ~5% price hikes in Q3 will look more like ~6% in Q4.

Please see below:

For your reference, favorable price elasticities mean that when P&G raises prices, the company is not seeing a drop-off in demand.

Likewise, with Lawton also highlighting consumers’ lack of resistance to the company’s price increases, his observations are bullish for Fed policy and bearish for the PMs.

Please see below:

Source: Tractor Supply/Seeking Alpha

Source: Tractor Supply/Seeking Alpha

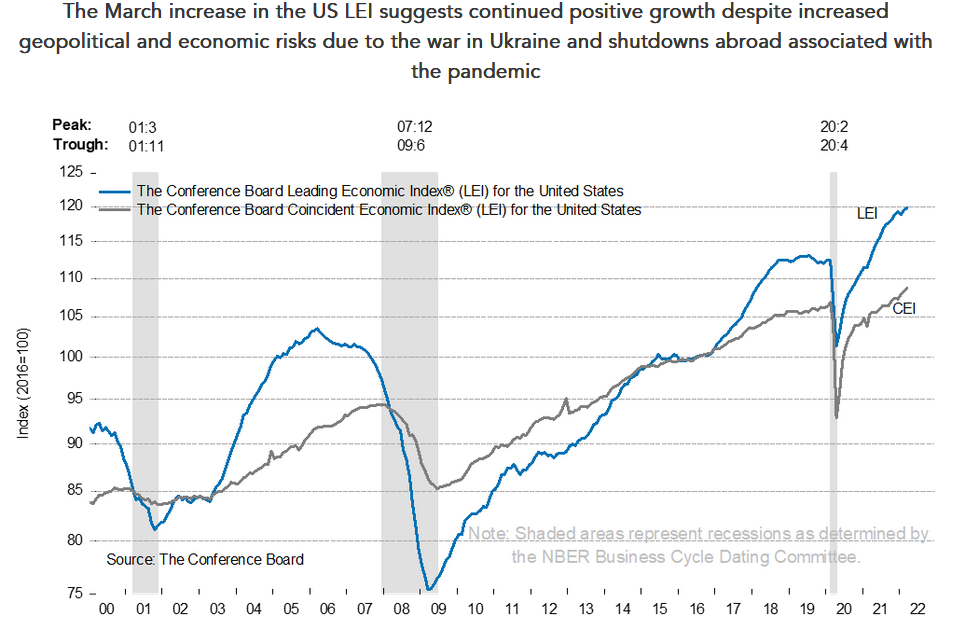

Finally, The Conference Board released its Leading Economic Index (LEI) on Apr. 21. After increasing by 0.3% month-over-month (MoM) in March, the LEI has risen by 1.9% from September 2021 to March 2022. Ataman Ozyildirim, Senior Director of Economic Research at The Conference Board, said:

“The US LEI rose again in March despite headwinds from the war in Ukraine. This broad-based improvement signals economic growth is likely to continue through 2022 despite volatile stock prices and weakening business and consumer expectations. The Conference Board projects 3.0 percent year-over-year US GDP growth in 2022, which is slower than the 5.6 percent pace of 2021, but still well above pre-covid trend.”

Please see below:

The bottom line? The data continues to support hawkish Fed policy and has only intensified in recent months. Therefore, while I’ve noted that the PMs’ medium-term fundamentals are more bearish than at the end of 2021, the consequences of the Fed’s rate hike cycle should knock some sense into investors over the next few months.

Moreover, while Fed officials have been parroting the same message for weeks, Powell’s reality check on Apr. 21 is extremely bullish for the USD Index and U.S. real yields. Remember, the Fed needs to kill demand to tame inflation, which means pushing up real yields and reducing wages. As such, does this seem like a bullish six-to-12-month environment for risk assets?

In conclusion, the PMs declined on Apr. 21, and mining stocks were material underperformers. However, the daily damage still leaves gold, silver and mining stocks’ prices well above their fundamental values. As a result, there is likely plenty of room for further downside over the medium term.

Overview of the Upcoming Part of the Decline

- It seems to me that the post-decline consolidation is now over or very close to being over , and that gold, silver, and mining stocks are now likely to continue their medium-term decline.

- It seems that the first (bigger) stop for gold will be close to its previous 2021 lows, slightly below $1,800 . Then it will likely correct a bit, but it’s unclear if I want to exit or reverse the current short position based on that – it depends on the number and the nature of the bullish indications that we get at that time.

- After the above-mentioned correction, we’re likely to see a powerful slide, perhaps close to the 2020 low ($1,450 - $1,500).

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place, and if we get this kind of opportunity at all – perhaps with gold close to $1,600.

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold close to $1,350 - $1,400. I expect silver to fall the hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,375, but at the moment it’s too early to say with certainty.

- As a confirmation for the above, I will use the (upcoming or perhaps we have already seen it?) top in the general stock market as the starting point for the three-month countdown. The reason is that after the 1929 top, gold miners declined for about three months after the general stock market started to slide. We also saw some confirmations of this theory based on the analogy to 2008. All in all, the precious metals sector is likely to bottom about three months after the general stock market tops.

- The above is based on the information available today, and it might change in the following days/weeks.

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding or clear enough for me to think that they should be used for purchasing options, warrants or similar instruments.

Summary

Summing up, despite the recent rally in gold, the outlook for junior mining stocks remains exactly as I described previously.

Investing and trading are difficult. If it was easy, most people would be making money – and they’re not. Right now, it’s most difficult to ignore the urge to trade along with the crowd that’s ignoring two critical factors:

- rising real interest rates,

- rising USD Index values.

Both of the aforementioned are the two most important fundamental drivers of the gold price. Since neither the USD Index nor real interest rates are likely to stop rising anytime soon (especially now that inflation has become highly political), the gold price is likely to fall sooner or later. Given the analogy to 2012 in gold, silver, and mining stocks, “sooner” is the more likely outcome.

It seems that our profits from short positions are going to become truly epic in the coming months.

Moreover, let’s keep in mind that we are not patient with this trade to just get out of it close to being even or with a reasonable (10%-30%) profit. Of course, I can’t promise anything, but this entire short trade is likely to end with gold below $1,500 and junior miners close to or below their 2020 lows. The upside potential for the inversely trading instruments is likely enormous. Yes, we might adjust the trade or exit it temporarily, only to get back to it shortly thereafter, but the overall potential remains gargantuan. It’s quite likely that none of those gains will be reaped by precious metals perma-bulls.

After the sell-off (that takes gold to about $1,350-$1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

As always, we'll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $34.63; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged) and GDXD (3x leveraged – which is not suggested for most traders/investors due to the significant leverage). The binding profit-take level for the JDST: $14.98; stop-loss for the JDST: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the GDXD: $25.48; stop-loss for the GDXD: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures downside profit-take exit price: $19.12

SLV profit-take exit price: $17.72

ZSL profit-take exit price: $38.28

Gold futures downside profit-take exit price: $1,683

HGD.TO – alternative (Canadian) inverse 2x leveraged gold stocks ETF – the upside profit-take exit price: $11.79

HZD.TO – alternative (Canadian) inverse 2x leveraged silver ETF – the upside profit-take exit price: $29.48

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief