Briefly: in our opinion, full (250% of the regular size of the position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this Alert.

Following our regular procedure while preparing the Gold & Silver Trading Alerts, we went through more than 100 charts (close to 150) in order to find game-changing, important, and interesting developments. There were no game-changers and the outlook remains intact, but there were couple of interesting developments that we would like to comment on. We will also take this opportunity to reply to a question that we received about waiting for the decline in the precious metals market to finally take place. Just how long can one wait for it?

Precious Metals’ Reversal

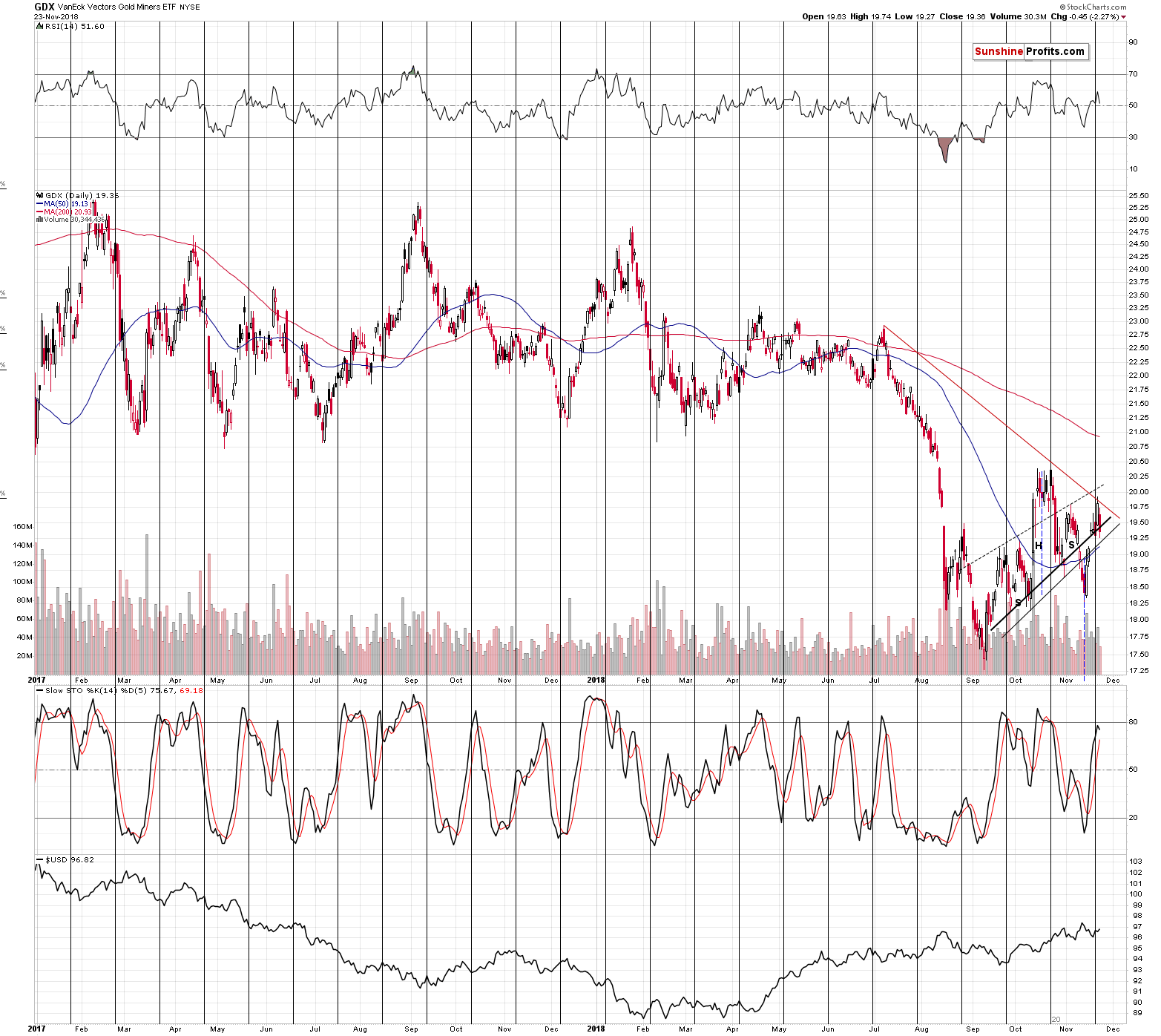

The GDX ETF moved lower on Friday after reversing very close to its reversal turning point and after moving to its declining red resistance line, which is in tune with what we’ve been expecting it to do. To be precise, it’s in tune with what was possible, assuming that we didn’t get an immediate plunge in the precious metals’ prices. The latter may come as a surprise to almost everyone, just like it did in 2013. And we don’t want you to be among the surprised ones - we want you to be among those, who profit from this move.

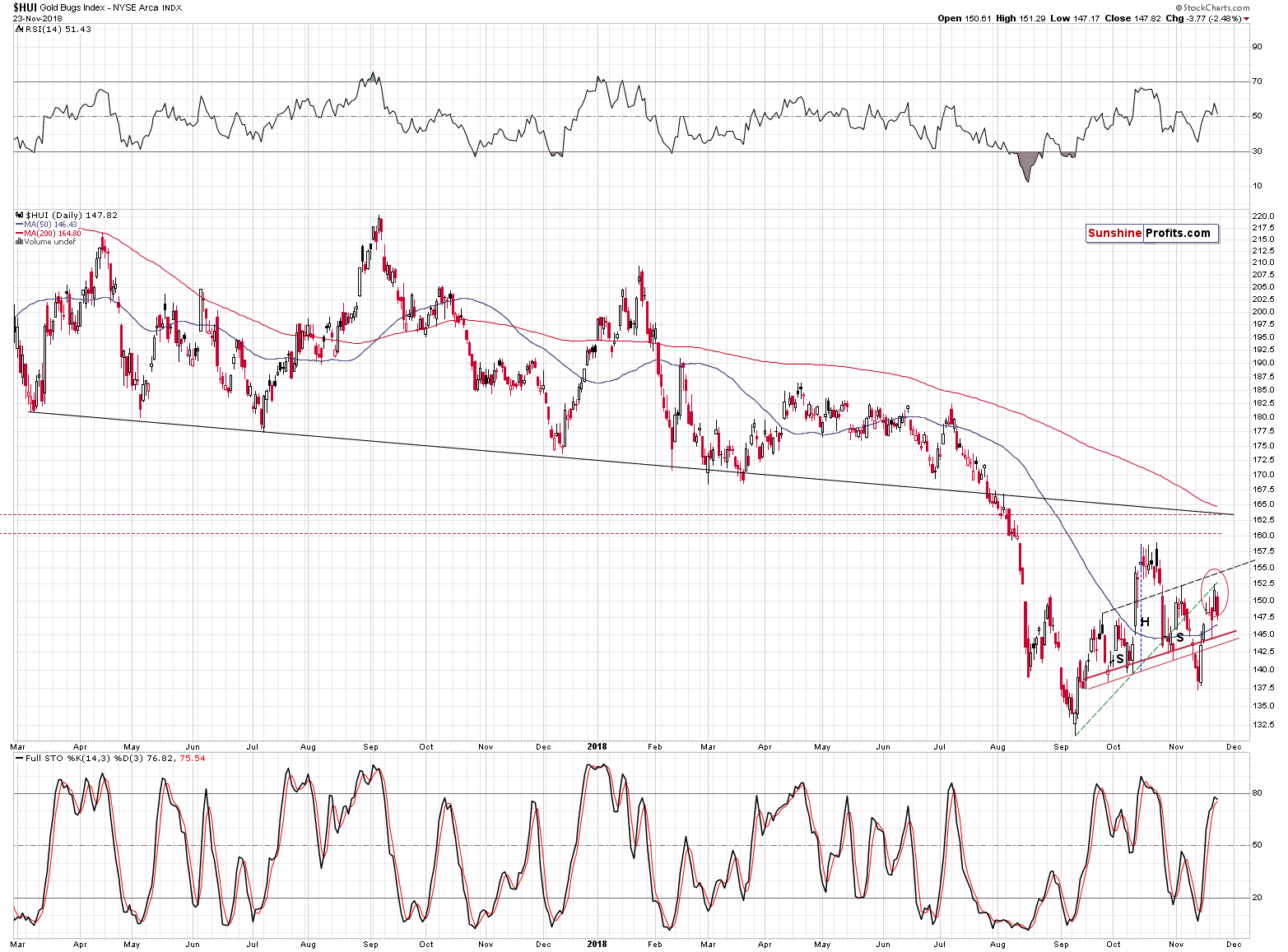

The HUI Index moved back to the rising green resistance line and then it declined once again. The local top may already be in. Then again, an attempt to move higher that takes the HUI Index temporarily to 155 wouldn’t be very surprising either. That’s the nearest resistance, reaching which wouldn’t change anything regarding the outlook for gold stocks and the rest of the PM sector.

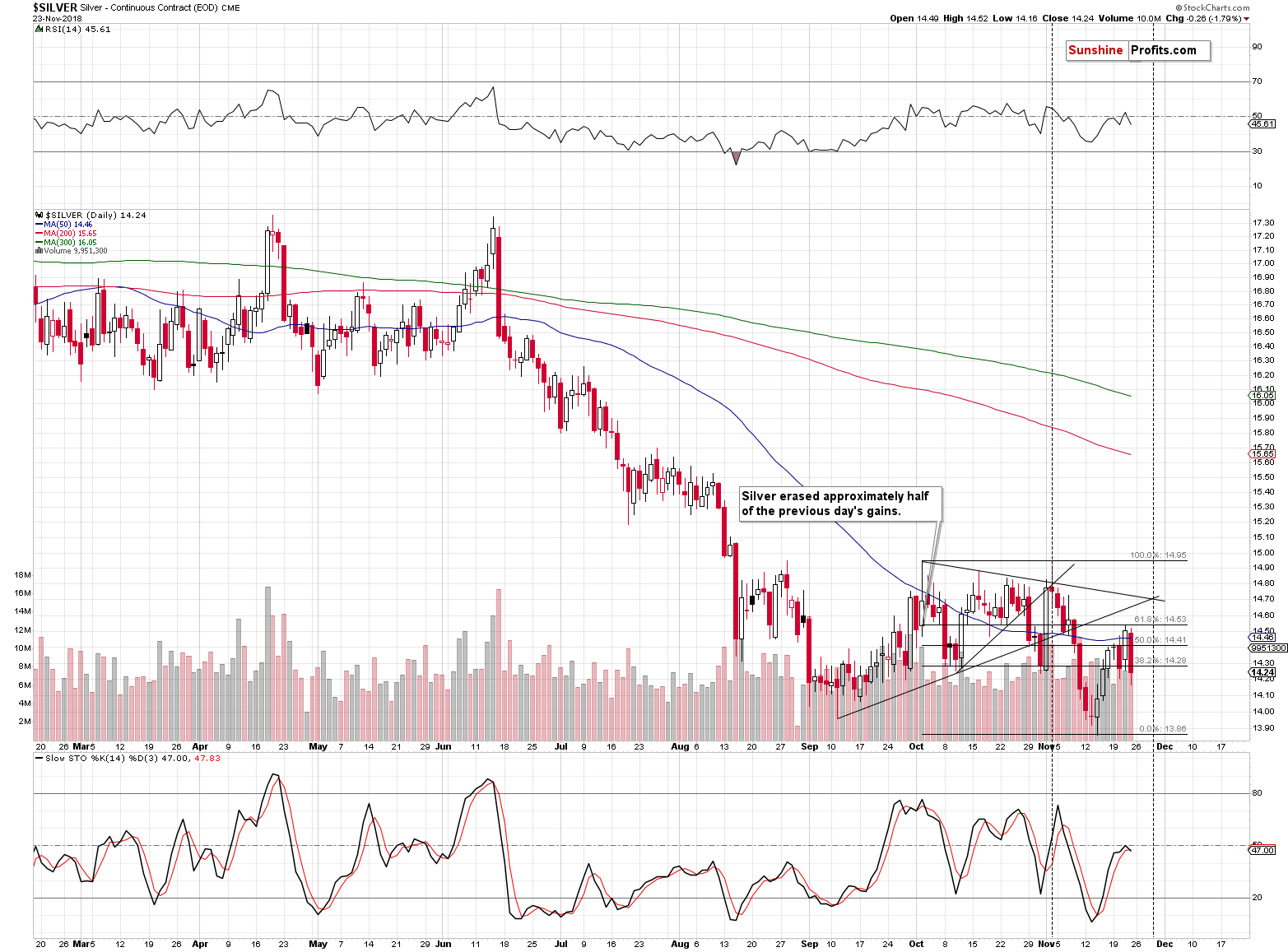

Silver took a dive, just as it should have done, given a move higher in the USD Index. Back in 2013, silver had corrected 50% of its preceding decline. This time, silver moved to its 61.8% Fibonacci retracement level and then declined back below the 50% retracement on the very next day. The situation continues to be similar to what happened in 2013 shortly before the big multi-dollar decline.

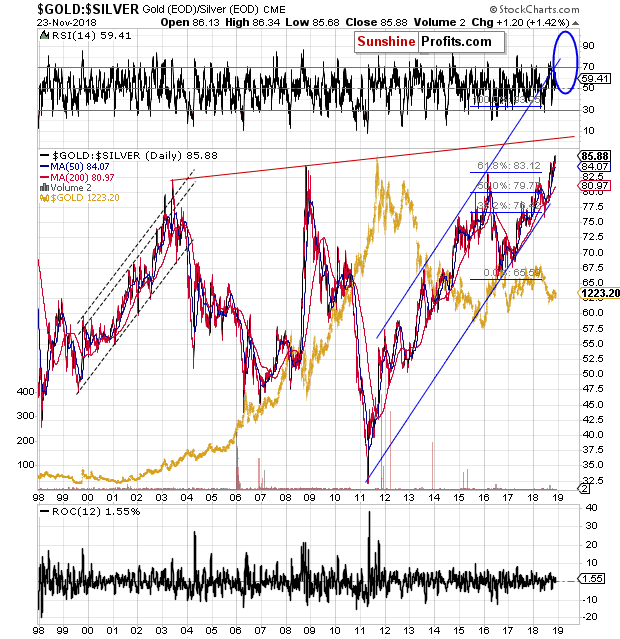

Decisive Breakout in the Gold to Silver Ratio

The gold to silver ratio closed the week visibly above the 85 level (almost at 86), thus further confirming its previous breakout. The implications remain very bearish for the PM sector as the increases in the ratio usually correspond to major declines in the prices of PMs. Silver simply declines faster than gold.

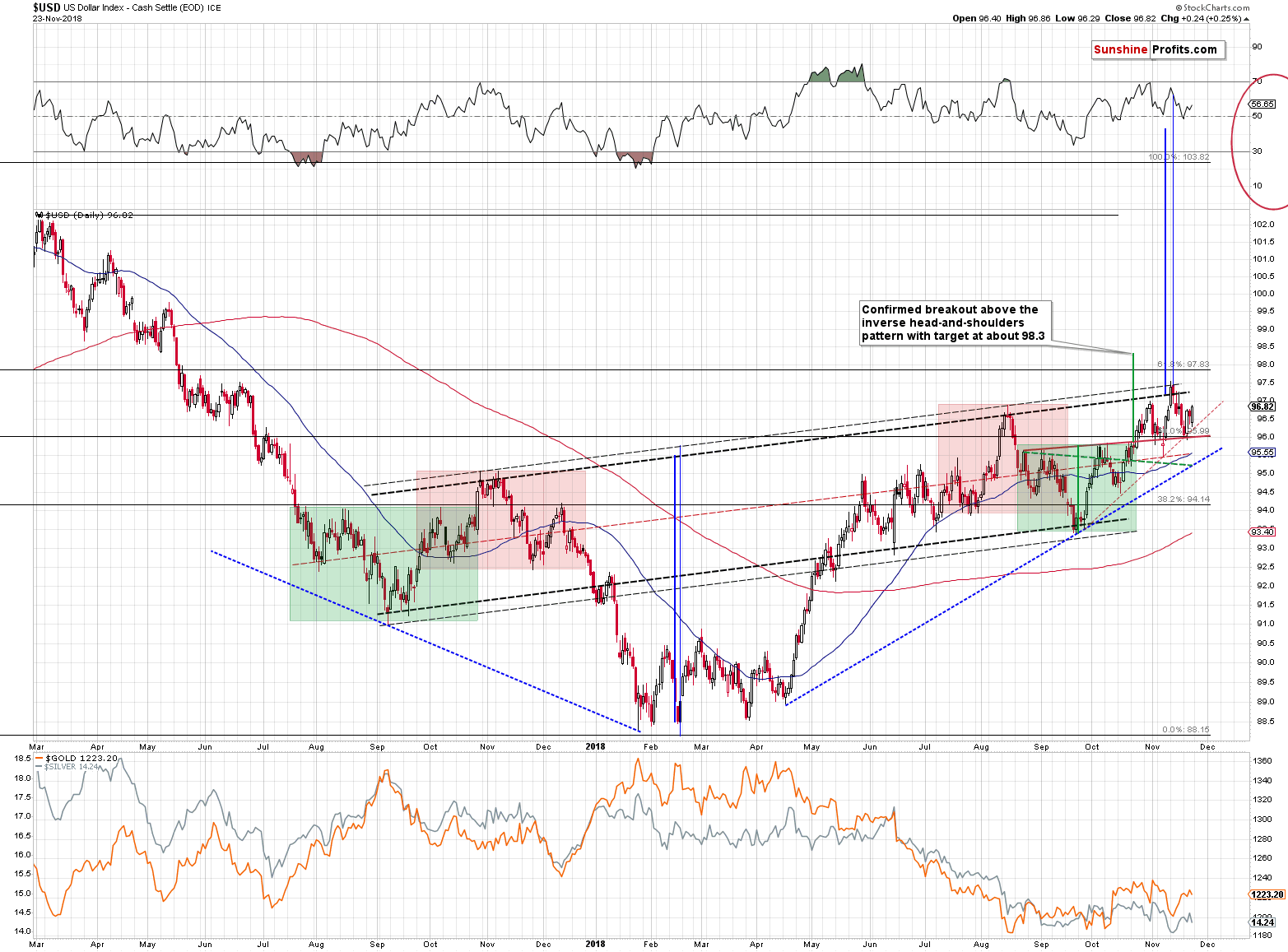

Bullish Outlook for the USD Index

The USD Index moved higher on Friday, but nothing really changed because of this move. The medium-term trend remains very bullish and the implications for gold, silver, and mining stocks remain very bearish.

The Death by a Thousand Cuts

Before summarizing, we would like to reply to a question that we recently received. We get the feeling that it might be something that more people are thinking, so we’ll address it here:

I joined the service in September and POG and miners are just range bound. Each alert mentions a big drop. There have been a few opportunities to go long and short since September. It just seems like the safe position from a public relations analysis is to stay short because eventually you will be right...or maybe not. There has been major volatility in the miners and POG over the past months. When I asked about the slide to $900 dollars I was told soon back in September. Now it appears that slide is going to occur in February.

I am getting confused here and it is really difficult to hold on to the short position here...it feels like death by a thousand cuts.

The first two sentences are definitely true. The precious metals and mining stocks have been moving back and forth for several weeks now. In 2013, the back and forth movement took about 2 months and this time the correction is about 3 months long at this point. The history doesn’t have to repeat itself to the letter, but it’s likely to be repeated more or less nonetheless. And this appears to be the case. Each Alert does indeed mention a big price drop. The reason that we repeat it in each Alert is because of two main reasons. First, because in order to succeed in investing (we’re not talking about day-trading here) it’s imperative to keep the big picture in mind (looking at the forest, not only at single trees). Second, because that’s what justifies our current short position along with its details (target prices and stop-loss levels). If it wasn’t for this big move and the analogy to 2013, it would not make much sense to have target prices this low. An additional reason is that if we stopped writing about the upcoming big decline, new subscribers might not know about it (even though we make all the previous Alerts available and we strive to provide links to the previous important Alerts) and some of the current subscribers might think that the big decline is no longer likely.

Have there really been good opportunities to go long? A good opportunity to go long or short is when the risk to reward ratio is favorable. With regard to the possible reward, one could say the price moves were decent for a very short-term trade (looking in hindsight), but what about the other key element of the ratio – risk? The charts will show you price moves, sometimes volume, but none of them will show you the risk that accompanied taking on a position on a given day. At least not directly. Given all the long-term factors that could have triggered a powerful decline practically any day in the past several weeks, was the risk associated with a long position really low on any of them? We don’t think so, and you can review the Alert from each day to check why we decided to keep the position intact. On a side note, why didn’t we receive this message on the day when the long position was supposedly a good idea, but we are receiving it now when it’s known what the price moves were? Perhaps the decision to go long was not so clear after all at the time, when one would need to make it?

Regarding the public relations analysis, the reality is exactly the opposite. Staying short is a business-killer in the gold-newsletter business and we are doing it at our own expense, precisely, because we are convinced that this is the position that is justified from the risk to reward point of view. Many people who like gold and the PM sector in general, hate the idea of shorting it and would never pay for any analysis that suggests it. It’s a safe and easy bet to be a perma-bull and just emphasize gold’s potential in the long run. But it’s not the most profitable thing to do, in our view, so while it would be easy to join the gold-promoting crown, we will not do it unless the market situation (looking at it as objectively as we possibly can) justifies it. We simply care about our clients too much to just do the easy thing instead of doing the right thing.

Fortunately for us, the above approach has a very special long-term implication. Namely, if someone stays with us for at least several months (and preferably for more than a year), they get to know us, and they know that it does really pay off in the long run, even if something may be unpleasant to read in the short run. And many subscribers decide to stay with us for many years, because of the above. Thanks to this, we are able to grow our business even despite the prolonged consolidation on the gold market (the last few years), while our colleagues go bust. The reason is, we are not being a perma-bull. The reason is, we are not being a perma-bear. The reason is caring about the clients and doing so by delivering the analysis that’s as objective as possible. Sometimes it means sticking to a given position even if it’s boring, because it’s what the situation on the market justifies. And that’s what appears to be the case right now.

As far as adjusting the outlook and moving the likely time target for the final bottom are concerned, we are not sure why would this be viewed as a bad thing. Investing and trading is not a business like a maths exam, where you have all the details right from the start, which you take, do some calculations and arrive at the final outcome. In case of such maths-like business, changing the outcome would mean that there were some errors that were corrected and that one should have not made them the first place. Investing and trading involves probability and more details become available on each day. Consequently, it’s a normal course of action that you take the new details and adjust the original forecast so that it becomes the most likely scenario that includes all the information that are available, not only the original ones. Moreover, failure to do so and sticking to the original forecast while choosing to ignore the new information is an error – it’s called a conservatism bias. We are reviewing the market each day and we make the decisions as if we never had any position in the first place. If we wouldn’t open a given position on a given day, and we already have a position opened – we simply close it without regrets.

We know that it’s difficult to hold on to a position if it doesn’t do anything for many weeks. But who said that investing and trading was supposed to be easy? Most people lose money on trading and some of them do so because of overtrading. Trading is a game of probabilities, somewhat similar to poker. In case of the latter, it’s obvious that it doesn’t make sense to play every game, but only when one’s cards are promising. In case of short-term trading, it’s very similar. The risk to reward ratio for very short-term trades was not favorable with regard to long positions, so it made sense to pass. At the same time, the risk to reward situation for the medium-term price move has been very favorable, so it made, and it continues to make sense to keep the position intact and not make any changes.

Moreover, please note that even if nothing is happening with regard to the positions, it doesn’t mean that we are not making any decisions. Conversely, we are making a decision each day. Just because we had a given trading/investment position previously, it doesn’t mean that it should be kept on the next day. Our position (as well as its status) doesn’t determine the outlook for the market – other factors do (the ones that we discuss in the Alerts). If the factors that we analyze on a certain day point to a given position and we had the same position on the previous day, we are making a decision to keep the position intact. Nothing happens in terms of the changes, but these happen behind the scenes: we conducted the analysis as objectively as we could, and we made a decision. That’s why we have the following phrase in the opening paragraph of each Alert: “(…) positions (…) are justified from the risk/reward perspective at the moment of publishing this Alert.”

On a side note, many analysts divide their views on different stocks, by describing them as buy, accumulate, hold, sell, etc. – the point is that there are more descriptions than two categories (stocks to own and stocks not to own, regardless of the name of the category). If that is the case, then please keep in mind that anything else than a “buy” is really a sell, even if it is disguised as a “hold” or something similar. If there are stocks that are clearly better (on “buy” signal) in terms of outlook, then some other stocks (on “hold” etc. signal) in terms of outlook, then why own the less-than-top stocks? Unless there is a decent diversification potential, it makes no sense to own the laggards. It’s better to get rid of them and diversify among the assumed winners (those on the “buy” signal). The logic is a key requirement for growing one’s portfolio over time and it’s no wonder that it’s been one of the main areas on which the philosophers focused throughout the ages (it was one of the key issues for the Stoic philosophers).

The decision to open a position is exactly the same decision when one makes to keep it. There are other examples when lack of action is still an important decision. For instance, when Fed keeps the rates unchanged, it’s also a decision. And if one decides to manage their investments on their own, take care of diversification, rebalancing, changing portfolio weights, adjusting the exposure and engaging in research leading to individual stock selection, instead of having a professional do it, it’s also a decision, even though it appears that only engaging the mentioned professional would be a decision by itself.

The reply to the question from the title is quite simply based on the above. Waiting for the big decline in the precious metals sector will continue as long as (and only as long as) the major, long- and medium-term factors continue to support this outlook and the bullish signals remain weak and of short-term nature at best.

Summing up, the outlook for the precious metals market remains very bearish for the following weeks and months and short position remains justified from the risk to reward point of view, even if we see a few extra days of back and forth trading or even a small brief upswing. It is the very good possibility of a huge downswing that makes this positions justified, not the outlook for the next few days. It seems that our big profits on this short position will become enormous in the future and that we will not have to wait for much longer.

As always, we’ll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short positions (250% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and exit profit-take price levels:

- Gold: profit-take exit price: $1,062; stop-loss: $1,257; initial target price for the DGLD ETN: $82.96; stop-loss for the DGLD ETN $49.27

- Silver: profit-take exit price: $12.32; stop-loss: $15.11; initial target price for the DSLV ETN: $47.67; stop-loss for the DSLV ETN $28.37

- Mining stocks (price levels for the GDX ETF): profit-take exit price: $13.12; stop-loss: $20.83; initial target price for the DUST ETF: $80.97; stop-loss for the DUST ETF $27.67

Note: the above is a specific preparation for a possible sudden price drop, it does not reflect the most likely outcome. You will find a more detailed explanation in our August 1 Alert. In case one wants to bet on junior mining stocks’ prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and target prices:

- GDXJ ETF: profit-take exit price: $17.52; stop-loss: $31.23

- JDST ETF: initial target price: $154.97 stop-loss: $51.78

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Important Details for New Subscribers

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Stocks slightly extended their downtrend on Friday despite a long-holiday-weekend shortened trading session. The S&P 500 index traded closer to its late October low. Will it reverse upwards off the support level?

Sentiment Improves - Upward Reversal or Just Another Bounce?

=====

Hand-picked precious-metals-related links:

PRECIOUS-Gold prices flat amid stronger dollar, investors look to G20 summit

Gold production to grow in the next four years: report

Goldman Predicts Commodities Will Soar in 2019

=====

In other news:

Shares tick up on U.S. holiday sales hopes, but oil rout checks enthusiasm

Stock market turmoil: Will the Fed come to the rescue?

Grim Stock Signals Piling Up as Wall Street Mulls Recession Odds

ECB may provide clarification on reinvestment duration in December: Praet

Will May Get Her Deal Passed The Second Time? Markets Think So

Brexit won't affect only the UK – it has lessons for the global economy

Italy Studying Lower Deficit Goal After EU Talks: Budget Update

Bitcoin extends falls as selloff in crypto currencies resumes

Shale boom raises specter of new glut: Gulf Coast oil terminals

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts