Briefly: in our opinion, full (300% of the regular position size) speculative short positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

Some might consider an additional (short) position in the FCX.

Credit Suisse just got saved by the Swiss National Bank, but the real damage can’t be undone. The real damage here is the fact that a really big name in the banking world showed severe problems. This is the next domino piece and yet another – even more important than SVB – indication that it’s 2008 all over again.

I wrote about the fundamental details on Monday, and I wrote about the technical similarities in the latest flagship Gold Trading Alert (the next update is scheduled for tomorrow).

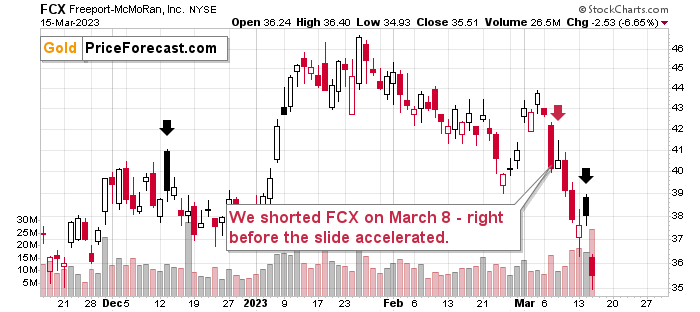

The Credit Suisse crisis serves as confirmation that the situation continues to develop just like in 2008, and yesterday’s freefall in the FCX prices serves as a technical confirmation. Let’s take a look at the latter.

It’s been just 5 trading days since we entered the short positions in the FCX and plunged substantially, making those positions very profitable. But from an analytical point of view, it tells us much more.

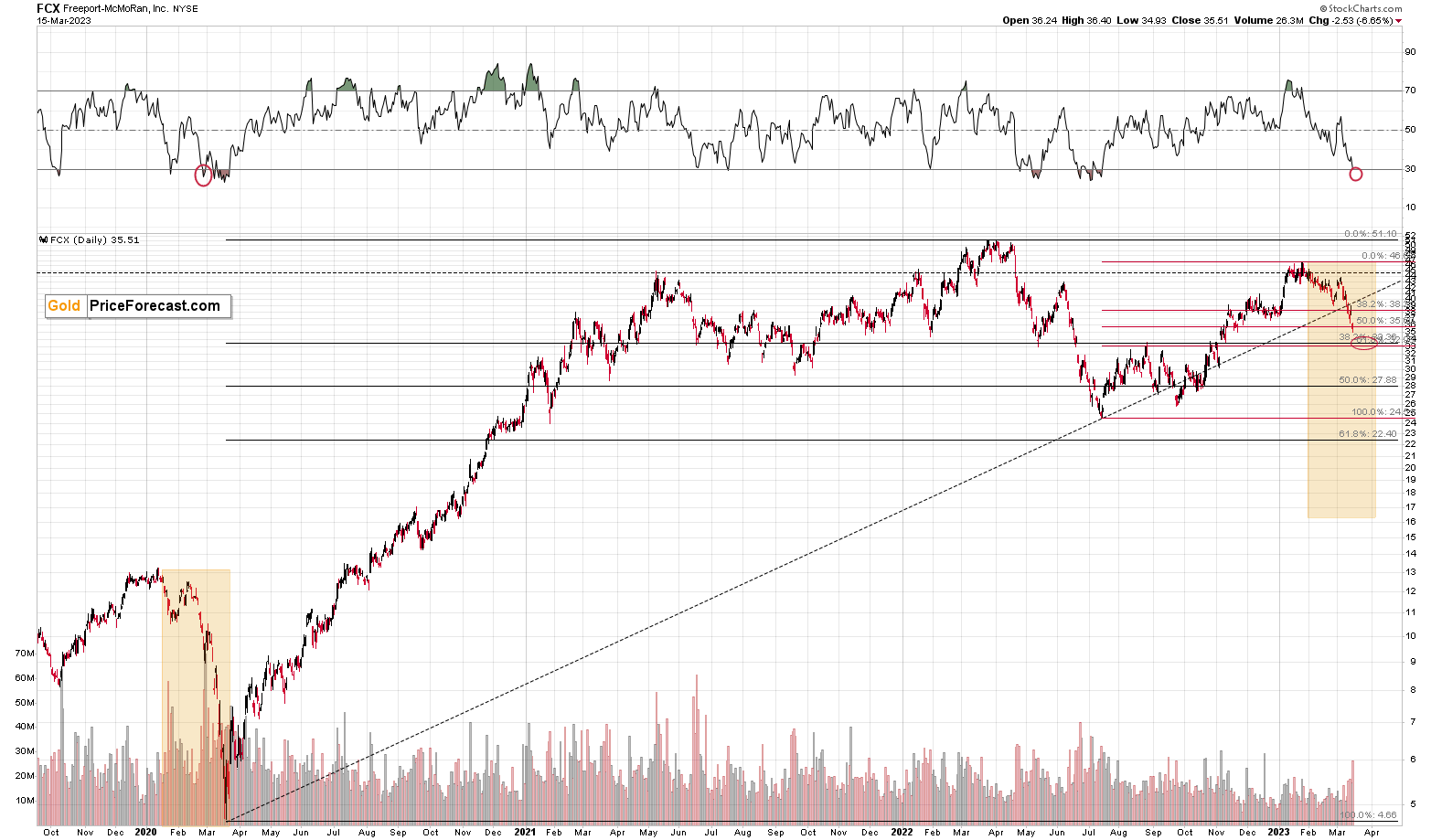

Zooming out a bit shows us that the price of FCX is behaving just like it did in 2020, during the huge decline.

There was an initial decline and an initial rebound. Now, the decline has accelerated, just like I described it on March 8.

This shows just how big the bearish potential is, but… it’s actually much bigger, as the above is “just” a link to 2020, and the decline in 2008 was even bigger.

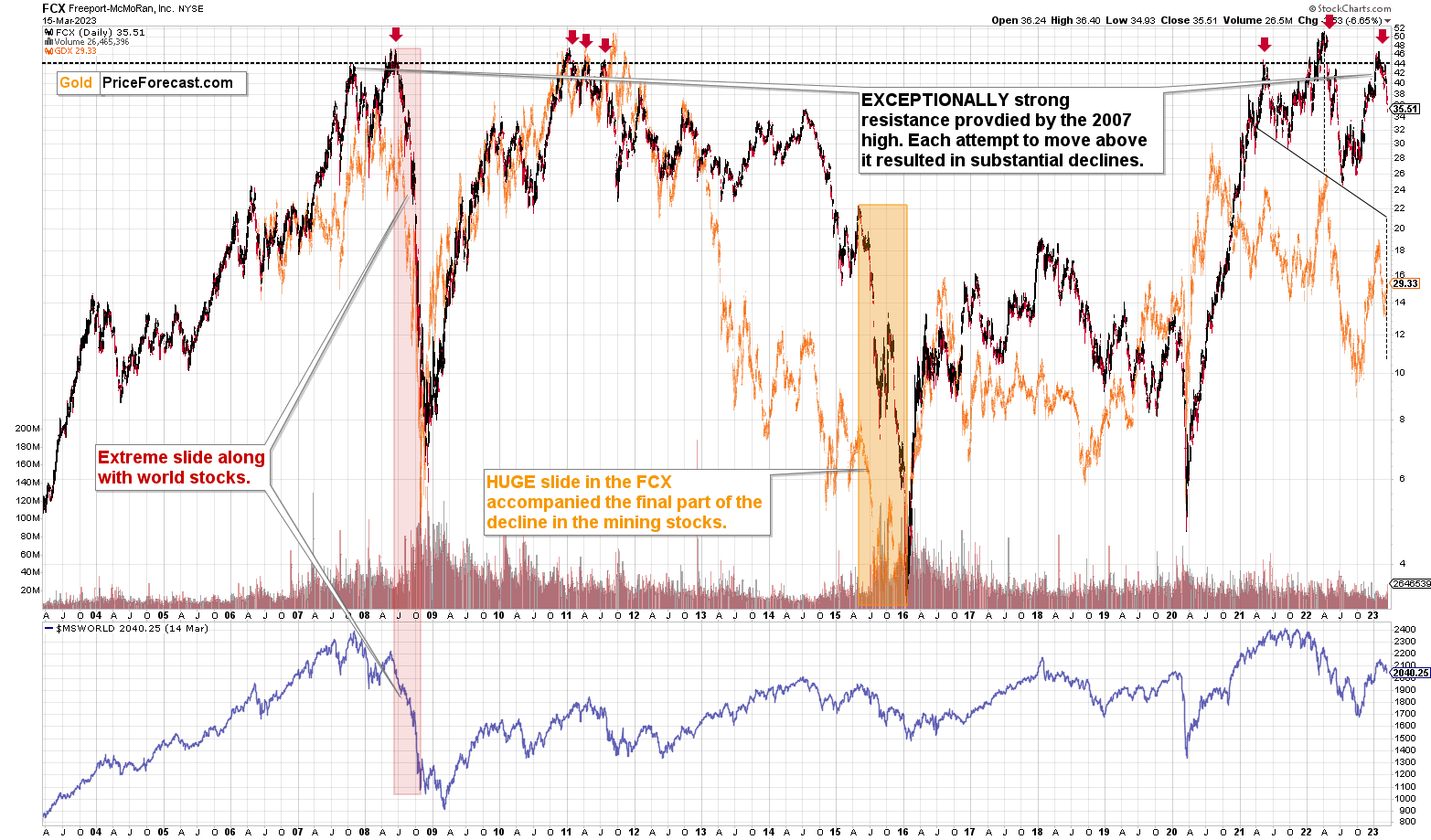

The truly remarkable thing about this similarity is that both declines – the current one and the 2008 one – started from similar price levels.

If you look at how fast FCX fell in 2008, it becomes clear that those cases are indeed analogous.

And yes, the downside potential for this stock is truly extraordinary, and profits can – in my opinion – become breathtaking. Of course, in the near term, we can (and are likely to) see periodic corrections.

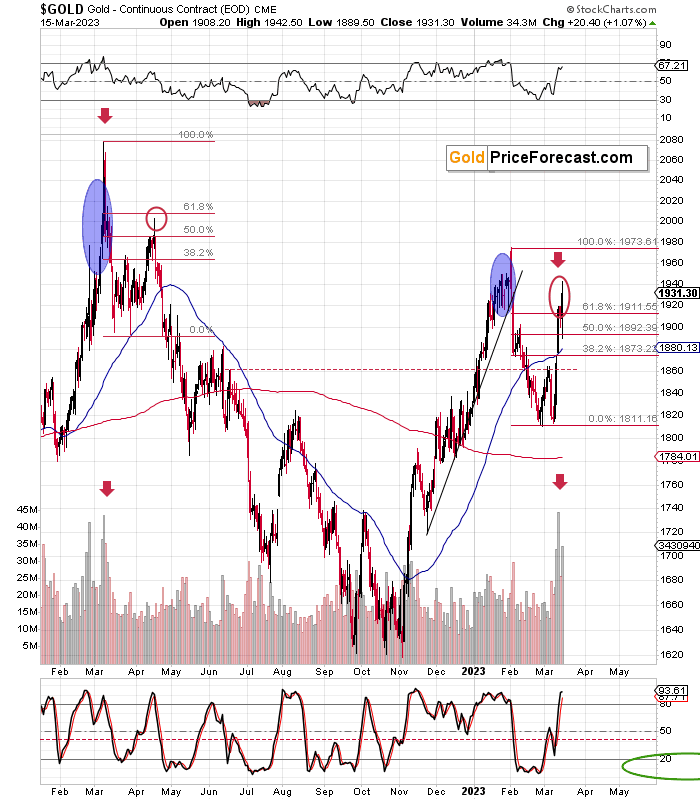

Now, if the situation is developing just like in 2008, then we can expect something similar to happen in the precious metals market as well.

Let’s see if we indeed have some confirmation that what we saw is what already happened back in 2008.

Gold’s final pre-slide corrective upswing was based on turmoil, uncertainty, and safe-haven buying. It was volatile, it was large, and it was accompanied by huge volume.

The RSI indicator moved a bit below the 70 level.

Sounds familiar?

Back in September and October, 2008, gold even rallied above its 61.8% Fibonacci retracement level.

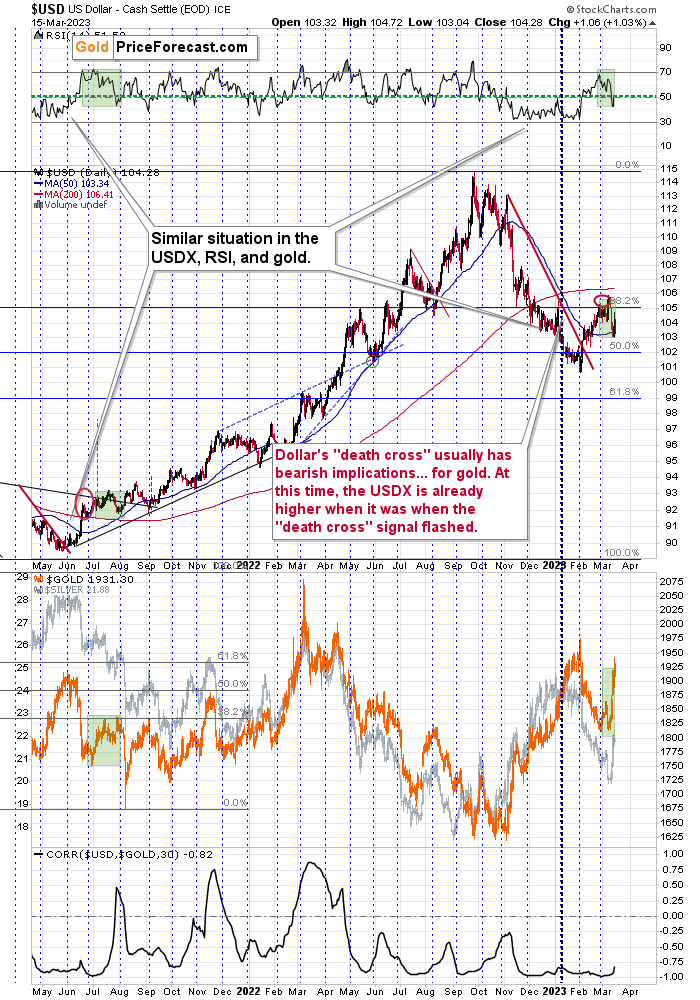

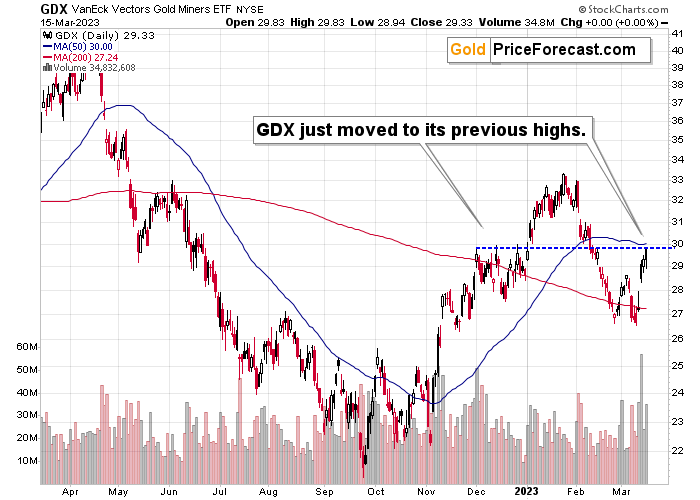

During that time, the USD Index declined in a relatively sharp manner, and the GDX ETF moved to its previous highs. The stock market moved up and down.

Gold just rallied on huge volume, and it moved somewhat above the 61.8% Fibonacci retracement level.

The RSI is slightly below 70.

Just. Like. In. 2008.

The USD Index is after a sharp corrective downswing.

Just. Like. In. 2008!

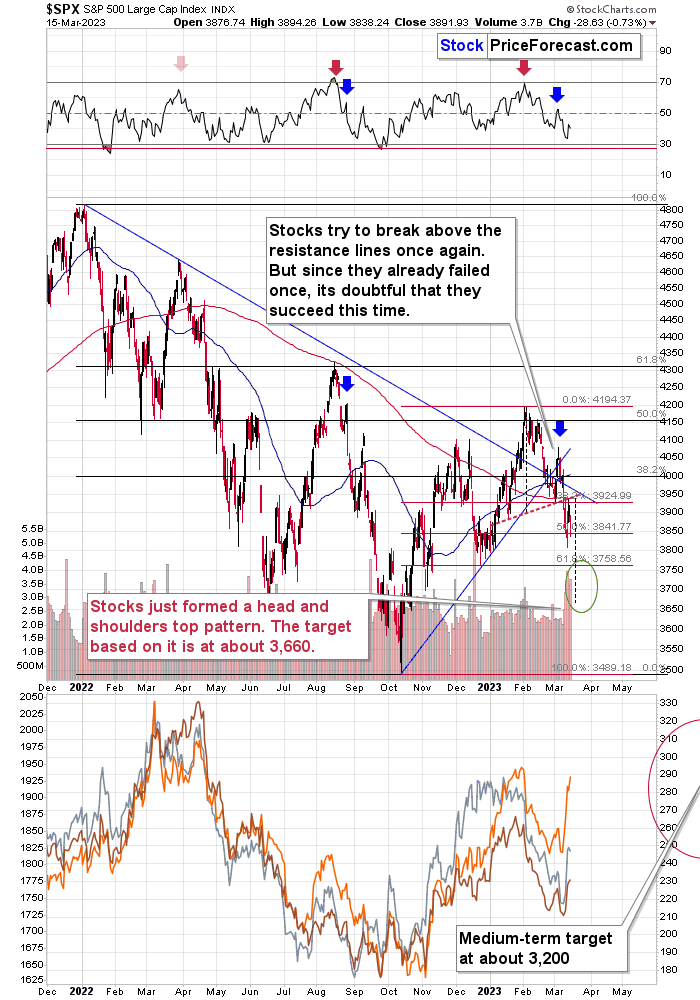

The stock market is moving back and forth while confirming the verification of the breakdown below its head-and-shoulders pattern.

That’s actually not like in 2008. It’s even more bearish due to the existence of the verified head-and-shoulders pattern.

And the GDX ETF?

Is it at its previous highs?

You bet!

That’s exactly where the GDX ETF is – at its December 2022 highs.

Just. Like. In… that’s right, you guessed it - 2008!

Is the history rhyming here?

Most likely, yes.

Does it create a massive opportunity, in my opinion?

Also – YES!

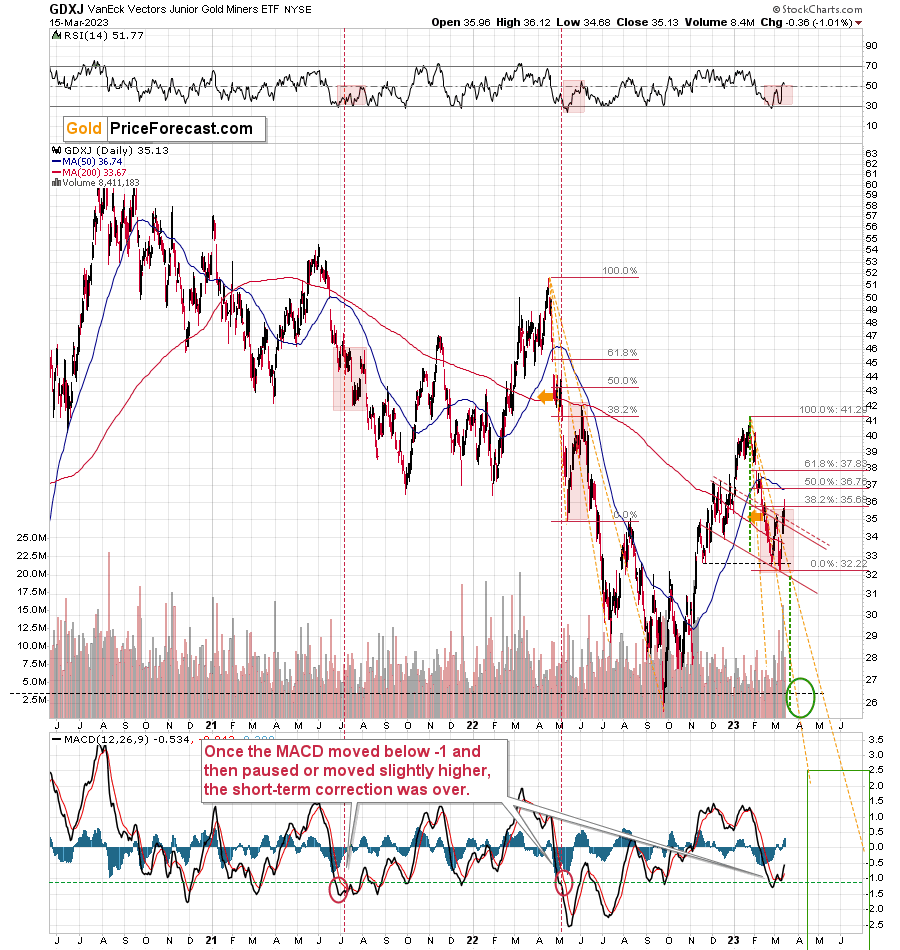

The best part is that the junior mining stocks (GDXJ) are showing weakness relative not just to gold, but also to the GDX, so they are likely to fall even more than the latter.

While GDX moved to its Dec. 2022 high yesterday, the GDXJ topped lower than that, and it ended the day over 1% lower (unlike the GDX, which ended the session unchanged).

The enormous bearish potential of the move, and the gargantuan profit potential of this entire setup remain fully intact.

Stay tuned!

Overview of the Upcoming Part of the Decline

- It seems that we’re seeing another – and probably final – corrective upswing in gold, which is likely to be less visible in the case of silver and mining stocks.

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place and if we get this kind of opportunity at all – perhaps with gold prices close to $1,500 - $1,550.

- I plan to switch from the short positions in junior mining stocks or silver (whichever I’ll have at that moment) to long positions in junior mining stocks when gold / mining stocks move to their 2020 lows (approximately). While I’m probably not going to write about it at this stage yet, this is when some investors might consider getting back in with their long-term investing capital (or perhaps 1/3 or 1/2 thereof).

- I plan to return to short positions in junior mining stocks after a rebound – and the rebound could take gold from about $1,450 to about $1,550, and it could take the GDXJ from about $20 to about $24. In other words, I’m currently planning to go long when GDXJ is close to $20 (which might take place when gold is close to $1,450), and I’m planning to exit this long position and re-enter the short position once we see a corrective rally to $24 in the GDXJ (which might take place when gold is close to $1,550).

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold prices close to $1,400 and GDXJ close to $15 . This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,400, but at the moment it’s too early to say with certainty.

- The above is based on the information available today, and it might change in the following days/weeks.

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding nor clear enough for me to think that they should be used for purchasing options, warrants, or similar instruments.

Letters to the Editor

Please post your questions in the comments feed below the articles, if they are about issues raised within the article (or in the recent issues), and if they are about other, more universal matters, I encourage you to use the Ask the Community space (I’m also part of the community, after all), so that more people can contribute to the reply and then enjoy the answer. Of course, let’s keep the target-related discussions in the premium space (where you’re reading this).

Summary

To summarize, in my view, the real interest rates are up and about to soar higher, the USD Index is likely to soar, and the precious metals are likely to slide – most likely in the 2008 style. Silver, miners, and especially junior mining stocks (and the FCX) are likely to slide the most.

In the very near term, the price of gold (and, to a much smaller extent, the prices of other parts of the precious metals sector) might be chaotic, as safe-haven buying is likely to be mixed with all sorts of other factors (like the initially declining USDX and then truly soaring USDX, a falling stock market in the U.S., a falling international stock market, etc.).

Not all trades are worth making, and let’s keep in mind that we just profited from a quick long position and re-entered the short positions in GDXJ just $0.10 from the first top in terms of the closing prices.

Junior miners were ONCE AGAIN REMARKABLY weak relative to gold, which is a SCREAMING confirmation that a huge decline is likely underway.

This might be a good moment to check if the size of your position is appropriate – if it’s too big, then it’s a good idea to moderate it, but if one was just “testing the water” with a tiny amount of capital, it might be a good moment to take a more “regular” approach.

===

Also, congratulations to those of you that took advantage of the extra trade that I featured in the FCX – the positions entered became profitable almost immediately, and it looks like those profits are about to increase much more in the following days/weeks.

===

As a reminder, we still have a “promotion” that allows you to extend your subscription for up to three (!) years at the current prices… with a 20% discount! And it would apply to all those years, so the savings could be substantial. Given inflation this high, it’s practically certain that we will be raising our prices, and the above would not only protect you from it (at least on our end), but it would also be a perfect way to re-invest some of the profits that you just made.

The savings can be even bigger if you apply it to our All-inclusive Package (Stock- and Oil- Trading Alerts are also included). Actually, in this case, a 25% discount (even up to three years!) applies, so the savings are huge!

If you’d like to extend your subscription (and perhaps also upgrade your plan while doing so), please contact us – our support staff will be happy to help and make sure that your subscription is set up perfectly. If anything about the above is unclear, but you’d like to proceed – please contact us anyway :).

As always, we'll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $26.13; stop-loss: none.

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged). The binding profit-take level for the JDST: $13.87; stop-loss for the JDST: none.

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures downside profit-take exit price: $17.83 (stop-loss: none)

SLV profit-take exit price: $16.73 (stop-loss: none)

ZSL profit-take exit price: $32.97 (stop-loss: none)

Gold futures downside profit-take exit price: $1,743 (stop-loss: none)

HGD.TO – alternative (Canadian) 2x inverse leveraged gold stocks ETF – the upside profit-take exit price: $10.97 (stop-loss: none due to vague link in the short term with the U.S.-traded GDXJ)

HZD.TO – alternative (Canadian) 2x inverse leveraged silver ETF – the upside profit-take exit price: $25.47 (stop-loss: none)

///

Optional / additional trade idea that I think is justified from the risk to reward point of view:

Short position in the FCX with $34.13 as the short-term profit-take level. (stop-loss: none)

///

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you’ve already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (as it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief