Briefly: in our opinion, full (150% of the regular position size) speculative short positions in mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

Some are really simple and casual. Some are intense and intimate. Some blossom, while other deteriorate over time. Some make one a better person, and some drag one straight to hell.

Relationships.

And yes, we didn't mix-up headers in today's analysis. Relationships are the foundation of social life, and probably the single most important factor that impacts peoples' happiness. And you know who ultimately creates markets? People. People are making decisions to buy or sell (or to program algorithms that do). Since relationships are so important and ubiquitous in each individual's life, is it any wonder that we can spot them also in the markets?

In case of the precious metals market, we have quite a few such relationships, or how we quite often call them - links. Some market relationships are simple and straightforward. Senior mining stocks (producers) and junior mining stocks practically always move together, for example. Other relationships are inverse but not as straightforward, like the one between gold and the USD Index. Or the one between gold and silver.

Oh yeah, right, some markets move together and some move in the opposite directions, but so what? - one might ask, and rightfully so.

If one stops their analysis by simply acknowledging the above, it won't matter much. It won't help in determining the direction in which the market is likely to move. Those, however, who dig deeper in the way prices move relative to each other, might be able to discover some specific clues that will make one outlook much more likely than the other.

The real-world example would be a couple that mutually respect each other, and one can tell that by the way they are looking at each other and the words they use toward each other. That's "bullish" for this relationship. On the other hand, one might detect tiny signs of contempt in the facial micro-expressions of one of the partners while the other talks or does something. That would "make the outlook bearish" for the relationship. And at first sight, both couples would just be talking and sometimes have better or worse days.

In today's analysis, we'll guide you through some of the most important relationships in the precious metals market. These gold trading tips are worth keeping in mind as they work on their own, as well as together with other techniques (in combination with them).

Let's start with the relationship between gold and the USD Index. We previously wrote that this link is inverse, but not particularly straightforward. With regard to the inverse direction in which they move, the explanation is simple. Gold is generally priced in the US dollar, so it cannot move entirely independently from it. Of course, the link goes deeper than just that, for instance, a given move in interest rates usually affects the USD and gold adversely. Gold doesn't pay interest by itself (not many people reported tiny bars popping up next to bigger bars just like that), but the USD does. If the rates go very low (or negative), there is little incentive to hold paper dollars, and there is a big incentive to buy gold, as it's performing very well during hyperinflationary periods, and during stagflation.

On the short-term basis, however, things don't have to work as outlined above. Traders might focus on something else than the above fundamental principles, like extreme fear of economic collapse - just like what we saw in March 2020 and in 2008. During such times, both markets are still likely to move inversely, but the moves might not match exactly.

Instead, on a very short-term basis, the markets might focus - and have been doing so - on technical developments, such as breakouts and breakdowns in the other market. In particular, gold has been more interested in USD's breakouts and breakdowns, than it's been in its price moves at their face value.

USDX Signs for Gold and the Miners

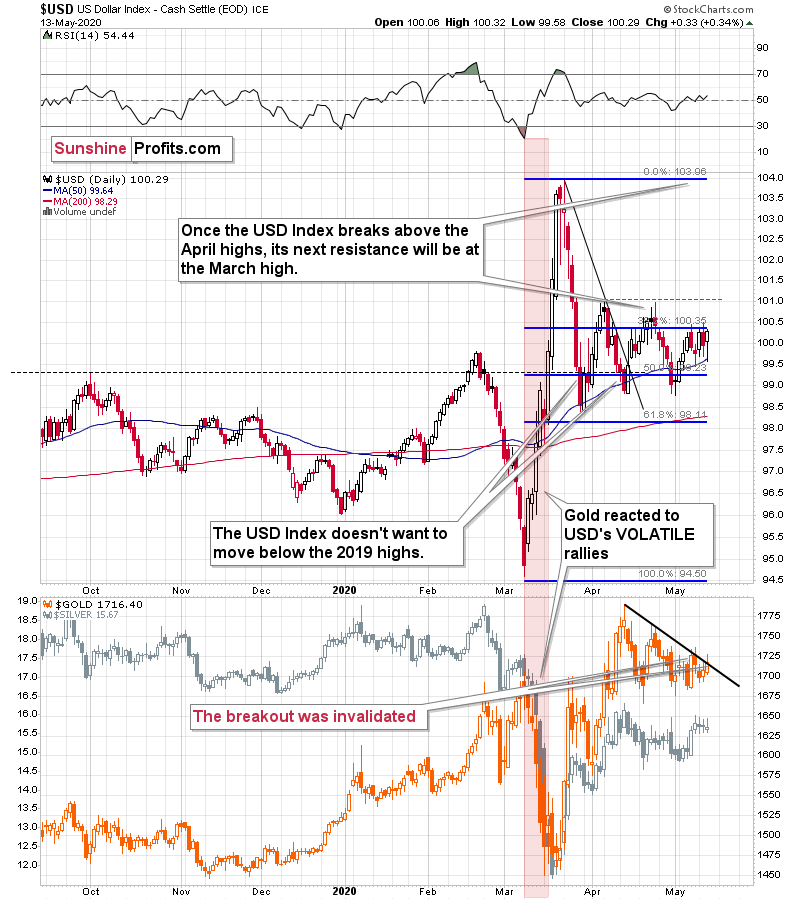

Please consider the last few (April and May) tops in the USD Index. Gold (in the lower part of the above chart) rallied particularly significantly right after the USDX topped - not during its declines.

The USD Index just seemed to have topped earlier this month, and what did gold do? It soared - quite likely based on the expectation that the USD is going to decline, just like what it did twice in April. When instead of declining, the USDX moved back up, gold erased almost the entire daily gain. As the USD Index consolidates without a breakout, traders seem to be increasing their bets on the downturn in the US currency.

Will they be proven correct? In our view, is likely that the USD Index will soar - if not right away, then shortly. It's after major technical breakouts, and the Covid-19 situation is getting much worse for the developing / BRIC countries, which is likely to trigger demand for the US dollars.

Let's keep in mind that back in 2008 (and the current situation is still very similar to 2008 i.a. due to the sudden nature of the crisis) the final slide in gold started when the USD Index rallied decisively, breaking above the previous highs.

Back then, gold more or less ignored the earlier USDX gains, but when it finally broke higher, gold plunged, just as if it was catching up with the declines that it ignored previously.

The USD Index has been trading back and forth for several weeks now without a meaningful breakout whatsoever. Perhaps the confirmed breakout above the 101 level will be what triggers the first part of what we think is going to be the final washout slide in the precious metals market.

All in all, we can say that the implications of the relationship between gold and the USD Index appear bearish for gold at this time.

There's one more relationship that we would like to feature today. It's the one between gold and gold stocks. It should be really straightforward. Gold producers produce gold, so if the price of gold is going up, the value of the shares of said gold producers should move up as well. And it does work in this way, but it's not that straightforward as one would think.

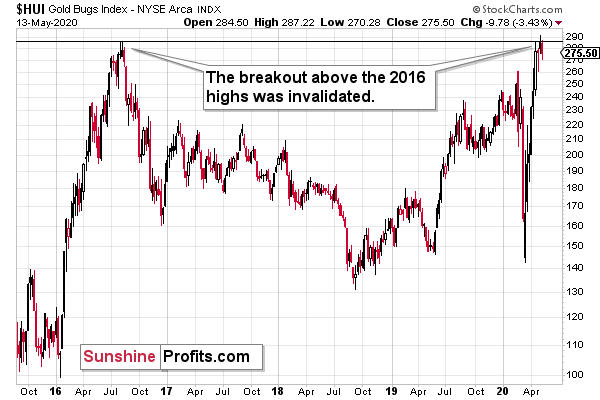

For instance, as gold is right now over $300 above its 2016 high, one would expect prices of gold stocks - on average - to be well above their recent 2016 highs as well, right? Especially that due to lower crude oil prices now vs. in 2016, their operational costs should be viewed as lower.

The chart below features gold stocks' performance since late 2015.

Instead of rallying well above their 2016 highs, they recently attempted to just move above them... And - despite gold being above $1,700 - they actually failed to break higher. The small breakout was quickly invalidated, which shows that something might not be right in case of the precious metals market.

In case of gold - USDX link, we saw that gold reacts with particular sensitivity to USD's technical developments. In case of the gold - gold stocks link we have a different kind of detail. This detail is that mining stocks tend to stop reacting to gold's bullish (or bearish) lead before the trend reverses. This doesn't happen in all cases, but it happens often enough to be viewed as very important detail for one to be on the lookout for.

Remember THE 2011 top in gold? The HUI Index formed the initial high in December 2010 (598) and moved only about 7% higher above this top in August 2011, despite gold's 30%+ gain during the same time. This kind of link also worked on numerous occasions on a short-term basis.

What does this link tell us now?

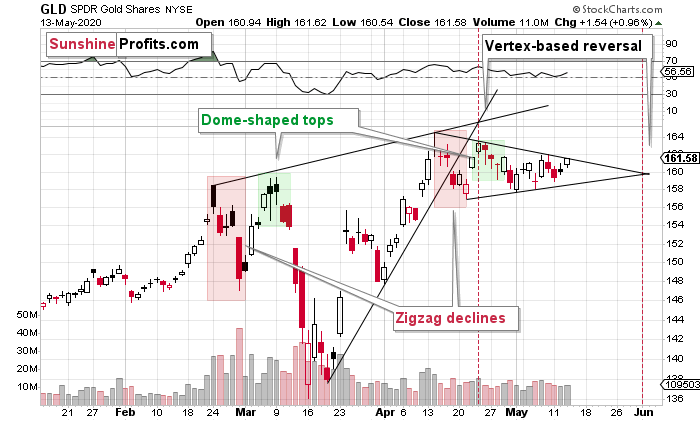

To make the comparison more reliable, we'll use the GLD ETF as a proxy for gold and we'll use the GDX ETF as a proxy for mining stocks - so that the opening and ending hours of the sessions are identical.

GLD just moved higher yesterday, and that was the highest daily closes of May.

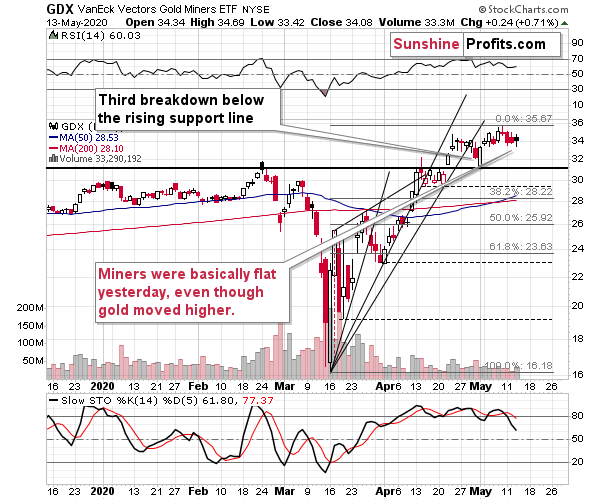

And the GDX?

The GDX did almost nothing yesterday. It moved a bit higher, but yesterday's close was still almost 3% below the highest close of this month. What does it tell us?

It's a sign that gold is likely topping here. The 2011 example showed a much more profound top than the one that we likely see right now. After the 2011 high, gold declined for years, and given the looming stagflation, gold is unlikely to decline for long. If the upcoming decline is likely to be short, then a more short-term topping signal seems to be an appropriate trigger. And that's what the very recent GDX performance provides.

Consequently, even despite the very positive outlook for gold for the following years, it seems that it will still decline in the following weeks. Naturally, this gold forecast is based on more factors than just the two intra-market relationships that we discussed today, but they serve as a good confirmation of the bearish outlook.

From the Readers' Mailbag

Q: What do you think of next week's massive Treasury auction? There are two schools of thoughts

a) yields will likely be lower which is bearish dollar & bullish gold,

b) money might flow into Treasuries which could soften gold price.

The probability of (b) in current scenario seems low. Looking past quarter they do seem to setup off some trends.

CPI & PPI however are confusing - i don't really see them initiating decent trend breakout.

A: (answer provided by Arkadiusz Sieron, PhD): Good question. Generally, economic theory says that increase in public debt should increase bond yields as government has to compete for loanable funds, offering higher interest rates (the so-called crowding-out effect). However, the Fed is ready to buy as many Treasuries as needed to assure that Treasury yields will remain very low. Hence, the Treasury auction does not have to bearish for the gold prices. Some funds may flow into Treasuries, which are considered to be safe assets, but gold should remain to be well-bid, especially in the current environment of low real interest rates, high indebtedness, dovish Fed and elevated uncertainty. Actually, the massive increase in the federal deficit could raise some worries at some point in the future about the US public debt, which could soften the US dollar or even trigger sovereign-debt crisis (although other countries such as Italy are more likely to suffer from such a crisis), supporting gold prices from the fundamental point of view.

Q: I'm a gold/silver subscriber with a question. If I understand your analysis correctly, you expect a large general market downdraft which will take the gold/silver market with it. You also expect the gold/silver market to enter a long term bull market directly afterward.

If that is correct, then the question becomes "why enter a short position on an expected bull market sector when other short positions can result in the same gain"?

It seems like we are picking up nickels in front of a steamroller with this short gold strategy.

Why not go with SDOW or SPXU as a short position and be either out of gold or neutral in that position?

With all the controversy surrounding the manipulation of gold, why take the chance that there is something out there that you don't know is happening which would render your analysis incorrect for the gold market ONLY? To me anyway, it seems your strategy is risky from that point of view when you could easily de-risk it, to the extent possible, by using other unrelated instruments. Thanks for any feedback you can offer.

A: Generally, yes, you are correct - I expect the big decline in the general stock market (and a big rally in the USD Index), which would take gold and silver along with it (that is lower). And I expect the long-term gold/silver bull market to start right at the bottom of this upcoming decline.

Why enter a short position on an expected bull market sector, when other short positions can result in the same gain?

What we emphasized in the previous paragraph does not imply that other short positions can result in the same gain. Many assets declined during the March slide, but very few of them declined as much as mining stocks did. This makes them a quite good candidate for capitalizing on the decline. Another thing is the number of signals that I can use to time this particular market. This is the market that I specialize in and this is the market where I was able to enter long positions practically right at the bottom in mid-March thanks to having exceptionally sound expertise in it. I don't have the same kind of expertise with regard to other markets, which is why I'm including them in my analysis as support tools for the precious metals analysis, but I'm not taking positions in them.

This doesn't mean that absolutely has to focus on this single (precious metals) market only for this particular (or any other) trade. We have Trading Alerts dedicated to other markets as well, and those who subscribed to them (and, of course, those with the All-inclusive access that will automatically get access to whatever new feature or product we add) have likely been doing what you described.

In particular, in our Oil Trading Alerts, we made substantial profits on the decline in crude oil (and we recently took profits from a long position), and we managed to make money on the decline in stocks (and rebounds) as well in our Stock Trading Alerts. Plus, our individual stock picks from Stock Pick Updates have been outperforming the S&P 500 - it's a market-neutral strategy that lists 5 long and 5 short candidates. The theory is that while the market goes up, the long candidates should rally more than the short candidates fall. During stock market declines, the short candidates should make more. Overall, it should make money over time. And it delivers - ever since we started publishing these stock picks, (mid-November 2019), the results are that the stock picks have gained 2.80%, while the S&P 500 declined by 7.24% during the same time. This is all without any leverage, by the way.

So, while I personally view the precious metals market as the place where I'm able to utilize my skills to the greatest extent, and thus to optimize the risk to reward ratio (if I had to choose one market that is), diversification between various strategies and markets might be a good way to go, especially that the All-inclusive package is now available at the 10% discount for the first paid period (even in case of the yearly subscription).

With the never-ending controversy regarding gold and silver manipulation, we have been writing about a full position in case of the insurance capital - and we've done it for years. It's in each Gold & Silver Trading Alert, below the summary in the "To summarize:" part. There's a description of the trading capital, long-term investment capital, and insurance capital. And the "portfolio" link provides details regarding what we understand as each type of capital, and why we specifically divided the portfolio in this way.

Summary

Summing up, the outlook for the precious metals market remains bearish for the next few weeks, mostly based on what we saw last week and on Monday. The latest additions to the bearish picture are silver's outperformance and miners' underperformance.

After the sell-off (that takes gold below $1,400), we expect the precious metals to rally significantly. The final decline might take as little as 1-3 weeks, so it's important to stay alert to any changes.

Most importantly - stay healthy and safe. We made a lot of money on the March decline and the subsequent rebound (its initial part) price moves (and we'll likely make much more in the following weeks and months), but you have to be healthy to really enjoy the results.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (150% of the full position) in mining stocks is justified from the risk to reward point of view with the following binding exit profit-take price levels:

Senior mining stocks (price levels for the GDX ETF): binding profit-take exit price: $10.32; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the DUST ETF: $231.75; stop-loss for the DUST ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

Junior mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $9.57; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the JDST ETF: $284.25; stop-loss for the JDST ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway. In our view, silver has greater potential than gold does):

Silver futures downside profit-take exit price: $8.58 (the downside potential for silver is significant, but likely not as big as the one in the mining stocks)

Gold futures downside profit-take exit price: $1,382 (the target for gold is least clear; it might drop to even $1,170 or so; the downside potential for gold is significant, but likely not as big as the one in the mining stocks or silver)

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one, it's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (DGLD for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn't, then we will view both positions (in gold and DGLD) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager