We will begin today's message just like we began the one yesterday: the precious metals sector moved higher yesterday, but the question is if the move was significant enough to change the outlook. Let's examine the situation.

- There was a breakout above the declining resistance line in gold, silver, and mining stocks. It hasn't been confirmed in time (3 consecutive trading days would be required - we have one, so far), nor in price (there's been no move above the stop-loss levels that we featured yesterday).

- The volume in GDX was significant but it was surprisingly small in case of GLD ETF. It was average in case of the SLV ETF. Therefore, the breakout is not that reliable in our view.

- The USD Index declined quite significantly yesterday and yet we saw a rather average move higher in gold, so we decided to analyze the relative performance (USD - precious metals) more thoroughly. USD closed approximately at the 83 level, something it had previously done on May 10. On May 10 gold, silver and the HUI Index closed at: $1,448, $23.88 and 280, respectively. This means that mining stocks are where they were back then and gold and silver are considerably lower now. This does not bode well for the precious metals in the short and medium term.

- We have previously mentioned the reverse parabola in the GLD to GDX ratio which meant that miners were declining more and more rapidly relative to gold. This parabola was broken yesterday, which is a bullish sign - not a strong one, but still.

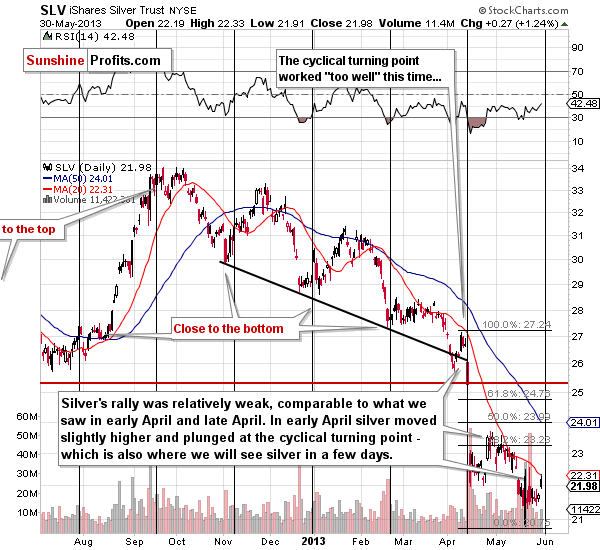

- The move higher in silver just ahead of the cyclical turning point is actually a bearish phenomenon. If the price is to reverse its direction shortly, then if the most recent move is up, then the reversal should take the market lower. The previous cyclical turning point in silver worked in this way and it worked only too well. Silver's price plunged at the cyclical turning point after moving slightly higher - to the 20-day moving average.

Also, Jim Rogers recently said that it may take a bit longer for gold to make a new bottom. We don't view this as a contrary sign, as it's not a change in opinion.

Summing up, at this time we still think that the breakout in precious metals will be invalidated and that they will decline significantly once again creating an exceptional buying opportunity. If the breakout is confirmed - in time or price - we will move to the bullish camp. We will also let you know what to do with the long-term investments (meaning, when to get back). So far the USD-gold link is a strong indication against going long and we don't think that the odds for the decline have really changed. Not only have we seen a long-term breakout in the USD Index, but we also see that gold is responding more singificantly to the dollar's rallies than to its declines.

The stop-loss levels for the current short positions are quite close to where precious metals and miners are right now, so we will not stick with the short position if just a little more strength is seen. Please note that we have slightly increased the stop-loss level for the GDX ETF:

- Gold: $1,428

- Silver: $23.55

- GDX ETF: $30.6

- HUI Index: 282

We currently think that gold will temporarily move below $1,285, but pull back soon and close that week (the one in which it moves below $1,285) around this level. How low gold will temporarily go is unclear - perhaps it will form an intra-day bottom close to $1,200 or even $1,100.

Here's the up-to-date version of our trading/investment plan:

- When gold moves to $1,305 close the speculative short position in gold and get back in the market with half of your long-term gold and platinum investments.

- When silver moves to $18.20 close the speculative short position and in silver get back in the market with half of your long-term silver investments.

- When the XAU Index moves to 84, close the speculative short position in mining stocks and get back in the market with half of your long-term mining stock investments.

We will send a separate confirmation to get fully back in.

As far as trading capital is concerned we currently think that placing distant bids is appropriate. They may not get filled, but if we place them too high, we risk being thrown out of the market via stop-loss orders or margin calls if the volatility gets too high (and it's unpredictable how volatile the markets will get as gold is in a reverse parabola right now). If they don't get filled, we plan to go long after gold has pulled back significantly on an intra-day basis on huge volume (thus creating a bullish candlestick - probably a "hammer candlestick").

The distant buy price levels are:

- Gold: $1,120 (stop-loss: $970)

- Silver: $16.20 (stop-loss: $14.4)

- $HUI: 155 (stop-loss: 137)

As we wrote, these levels are distant and will probably not be reached, but if they do, they will present a great buying opportunity, one that will likely disappear almost immediately - that's why we we think that placing orders in advance is appropriate.

As always, we'll keep you updated should our views on the market change. We will continue to send out Market Alerts on a daily basis (except when Premium Updates are posted) at least until the end of June, 2013 and we will send additional Market Alerts whenever appropriate. We have prolonged the time in which you - our subscribers - will receive Market Alerts daily for another full month.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA