We generally covered yesterday's changes in the precious metals market in yesterday's second Market Alert, so in today's daily commentary we will show you two charts that made use suggest what we did (re-opening the short positions in gold and mining stocks and keeping the speculative short position in silver).

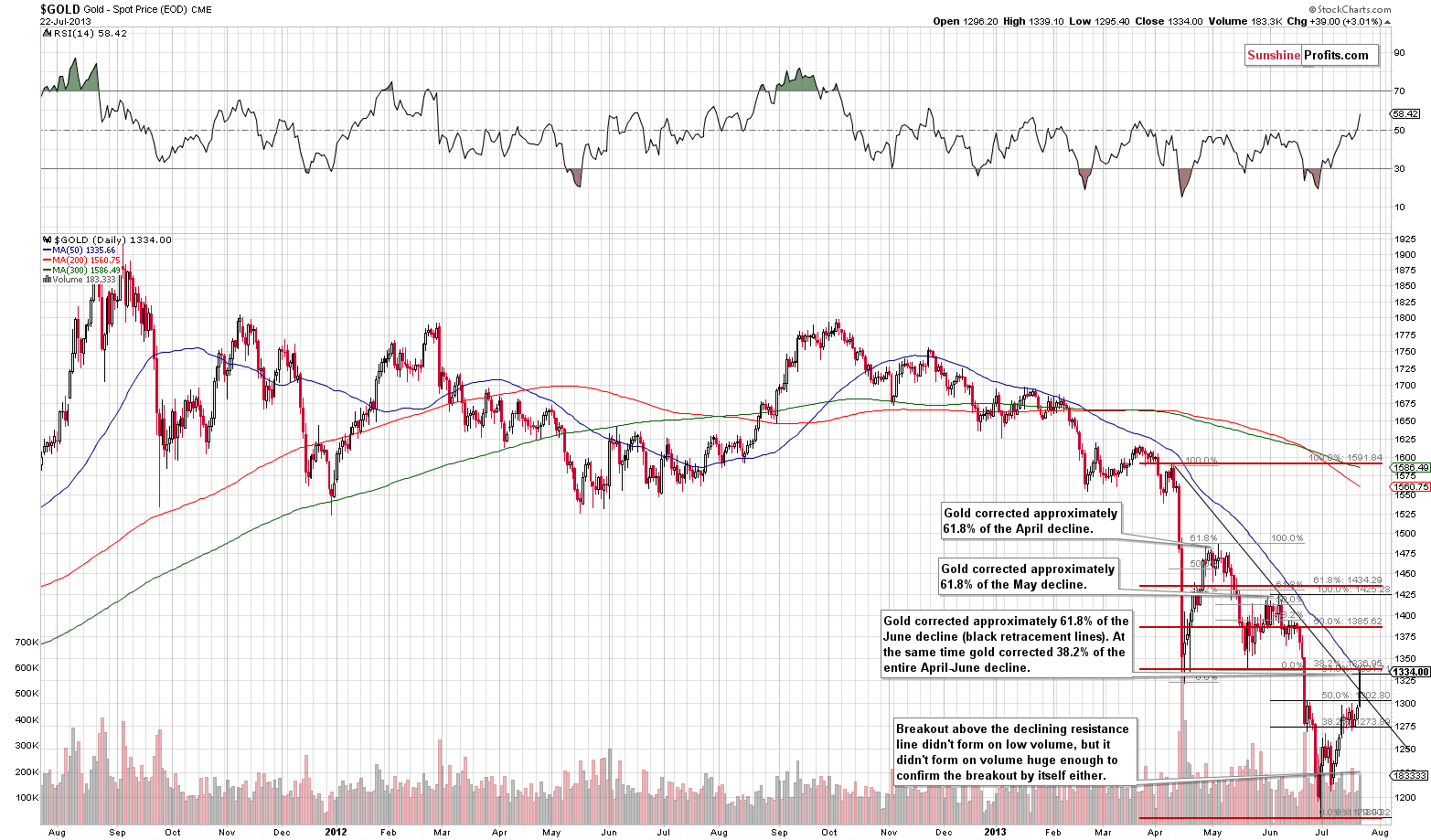

The first chart is the one featuring gold:

Please compare the Fibonacci retracement levels with their descriptions on the chart and what we wrote yesterday:

In case of gold we have an unconfirmed (!) breakout above the declining resistance line based on April and June tops. However, the current move up is very similar to what we saw after the April decline. In fact, it seems that the April decline-and-pullback pattern is repeating here. Please note that after April's huge decline gold corrected 61.8% and then declined once again. This week gold rallied to the 61.8% retracement based on the June decline, so we can say that things are in tune with the previous pattern. Unless we see more strength in the coming days, it seems that we will see another decline.

All in all, we saw an unconfirmed breakout, but the situation is still in tune with the previous pullback and the outlook remains bearish in our view.

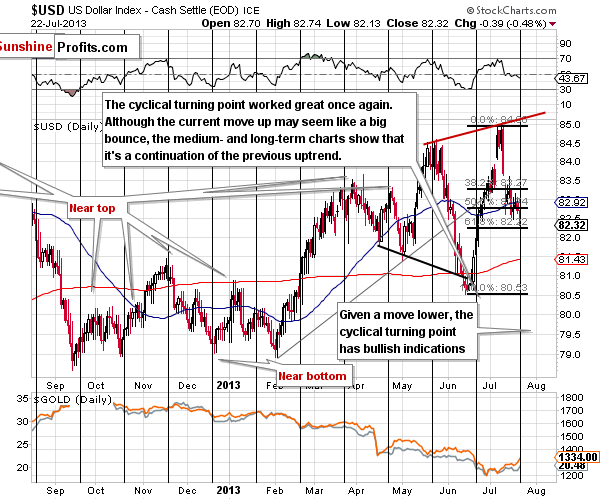

The second chart that we would like to feature today is the one featuring the USD Index.

Here's what we wrote about the USD Index yesterday (please compare it to the above chart):

(...) the USD Index moved temporarily below its 61.8% Fibonacci retracement level, which might be the reason that made people buy gold today (yes, there are multiple fundamental reasons for gold to move higher, but in the very short term, technical factors are more important). At the moment of writing these words, the USD Index is back above / at the 61.8% Fibonacci retracement level (strong support) and right at its cyclical turning point. The outlook here remains bullish for the coming weeks.

The USD Index closed above the Fibonacci retracement level and is right at the cyclical turning point - the outlook here is clearly bullish.

Naturally, you will see the analysis of gold, silver and mining stock charts in tomorrow's Premium Update (it will be posted early this week) along with other related charts and comments. As always, we will also reply to the questions that we have received from you recently.

To summarize:

Long-term capital: Half position in gold, silver, platinum and mining stocks. As far as long-term mining stock selection is concerned, we suggest using our tools before making purchases: the Golden StockPicker and the Silver StockPicker

Trading capital: Short positions (half) in gold, silver and mining stocks.

We are not ruling out the case in which we're going to see a breakout today (which is not likely, even though another small move higher could be seen), and in this case the short position would have to be closed. Consequently, we suggest placing the following stop-loss orders:

- Stop loss for gold's speculative short position: $1,356

- Stop loss for silver's speculative short position: $20.90

- Stop loss for the HUI Index's speculative short position (theoretically, as you can't short the index by itself): 266

- Stop loss for GDX ETF's speculative short position: $28.60

We suggest placing buy orders for the speculative long positions in gold at $1,105 and for silver at $15.20 (and closing the short position at that time - if these levels are reached). The analogous level for the HUI Index is 155. If gold moves to $1,105 but other market don't move to their targets - we suggest closing short positions in gold, silver and mining stocks and going long these sectors anyway. If silver or the HUI reach the target but gold doesn't, we suggest closing all above-mentioned short positions, but going long only the market that has reached its target. In this case you will likely hear from us shortly, but you know what our take is even before that happens.

Entry levels and stop losses for the above rather-soon-to-be-opened long positions:

- Gold: $1,105 (stop-loss: $970)

- Silver: $15.20 (stop-loss: $14.20)

- HUI: 155 (stop-loss: 137)

These levels are slightly above the price targets to maximize the odds of entering the trade (if everyone thinks that gold will move to $1090 they will buy before it reaches this level and ultimately gold may not drop as low at all).

As always, we'll keep you updated should our views on the market change. We will continue to send out Market Alerts on a daily basis (except when Premium Updates are posted) at least until the end of July, 2013 and we will send additional Market Alerts whenever appropriate.

As a reminder, Market Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA