Gold declined slightly yesterday and the same was the case for the mining stocks. Silver was flat, but it seems it wants to move lower based on today's pre-market decline before the USD Index declined. The two developments alone can make one ask themselves: "Is the rally over?"

The HUI to gold ratio declined once again and so far the statement that we made yesterday remains up-to-date. In fact, it was somewhat confirmed by the decline, since the ratio didn't break above the 2008 low. Yesterday, we wrote the following:

"We previously emphasized that this important ratio broke below its 2008 low. Last week, the ratio moved back to this level and then declined slightly once again without breaking it. So far it's just a verification of the breakdown and a bounce similar to what we saw in mid-2012. The move up was significant back then and it looked like the precious metals market would shoot up higher and instead we saw the final top before move below the previous lows."

Adding to all of that is the fact that the USD Index remains at its medium-term support line. It seems that it will rally sooner rather than later, fueling declines in the precious metals market. In fact, before the USD Index declined slightly today metals have declined and dollar's move lower resulted in a pullback.

In case of silver, if the white metal moves back below the $21.45 level (the 2008 high and the 61.8% Fibonacci retracement level based on the entire bull market up-to-date), we will view this move as a bearish confirmation and a sign that bigger declines will follow.

Moving on to mining stocks, there was an important development in the HUI Index yesterday, one that went under most investors' radar, as it seems. Namely, the HUI Index moved back below the 266.98 level, which is the 61.8% Fibonacci retracement level based on the entire bull market. The invalidation of a breakout above the retracement is a sell signal by itself.

From other news, the financial sector (measured by the Broker-Dealer Index) corrected to its 2011 high without moving below it, and from this perspective the move down in the general stock market is just a small correction and higher stock values could be seen right away, even though the confirmed breakdown in the S&P 500 suggest a move lower to the 1,575 - 1,600 area.

Naturally, the precious metals sector is not the only asset class that has rallied recently. Copper moved higher as well, touching the neck level of the 2010-2013 head-and-shoulders pattern without (!) breaking it. This means that nothing has changed as far as bearish implications of this pattern are concerned. We saw another pullback which doesn't invalidate the pattern or its implications - which are bearish for the medium term.

Unlike copper, palladium moved above its upper resistance line (marked with a dashed line on the chart from our Premium Update). Whether the move holds up remains to be seen. In one of the recent Premium Updates we wrote: "(...) there is another declining resistance line based on the 2013 top and the May peak (on an intraday basis), which may trigger a correction." This is the resistance that was "breached" last week and which was once again broken, this time to the downside, this week (the previous breakout was invalidated resulting in a sell signal).

As far as indicators are concerned, the RSI based on the GDX:GLD ratio moved to the 70 level which had already marked local tops 3 times this year, and it seems that we saw a top once again.

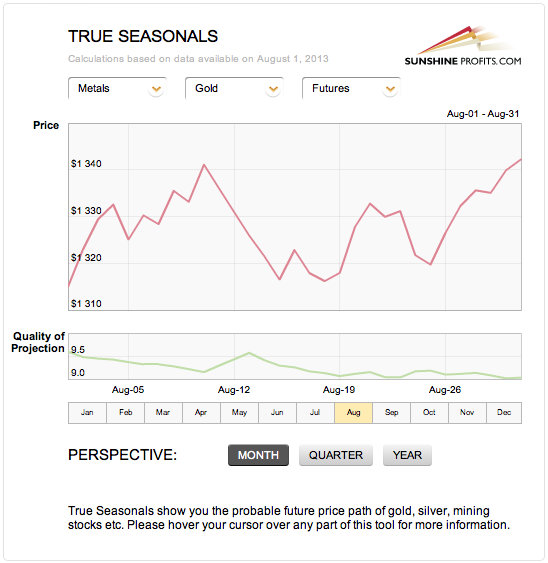

Last but definitely not the least, we would like to show you the True Seasonal patterns for this month:

In yesterday's message, we wrote:

"The True Seasonal patterns for August generally show a move up in the first half of the month which move is then erased close to the middle of the month. The tendencies in silver and mining stocks are similar - initial move up, and then a slide. The USD Index usually drops in the first few days of the month and then continues to rally peaking before the end of August. It peaks before gold, silver and mining stocks bottom, so there's usually a confirmation of the change in the trend in the form of the sector's lack of reaction to the dollar's weakness. On the other hand, if we don't see a correction this week, the True Seasonal patterns will become bullish for the precious metals market."

The most recent developments seem to confirm the seasonal patterns, at least to some extent (the actual moves might be delayed in comparison with the pattern). It appears that the price action yesterday played out in line with the previous indications of True Seasonals - we are seeing a slight decline now. The next few days may prove crucial, as they will clarify if the price action is actually delayed compared with the seasonal pattern or if the price will follow the pattern immediately. The first case would suggest a move down in the nearest future, while the second case would imply a move up in the very short term. Either way, it will be worth paying extra attention to how things develop in the coming days.

Quite importantly, the seasonal analysis is now available for you at Sunshine Profits in its final, interactive form. We release True Seasonals - a tool which enables you to see whether the price of an asset is usually growing or declining during a particular part of the year, and whether the risk involved tends to be relatively high or relatively low. While various Internet blogs are thrashing out this subject, you can now confront the buzz with real data. Do you recall that gold, silver and mining stocks can at times act very specifically around expiration dates of futures, options and stock options? That's a critical piece of information that every seasonal analysis that we've seen (except for True Seasonals that is) fails to take into account. We have not only researched this topic thoroughly, but we have also combined it with the seasonal patterns. Moreover, we automatically detect which of the expiration dates is likely to have the greatest impact on the current tendencies and automatically apply it. Basically all of that is done behind the scenes, you get the final easy-to-use product that simply includes both the seasonal tendencies and the effect that the expiration of derivatives has on various markets.

In its new incarnation, True Seasonals received a new, easy to use interface. But the changes were more in depth. We tweaked the engine to improve accuracy of analysis, and added quality of projection which tells you whether you can rely on a particular forecast. Plus dynamically updated descriptions if you're not sure what something means - just put your cursor over it and read the interpretation below.

See for yourself - you can learn more about True Seasonals and how they are different from virtually any other seasonal charts in the video below:

The tool itself is available starting today and it covers True Seasonal patterns for: gold, silver, DJIA, S&P500, USD Index, HUI Index, XAU Index, TSX Venture Index (juniors), CADUSD exchange rate, individual gold stocks (ABX, AEM, AU, AUY, BVN, EGO, FCX, GFI, GG, GOLD, GSS, HMY, IAG, KGC, NEM, RGLD) and individual silver stocks (CDE, HL, PAAS, SLW, SSRI, SVM.TO). The tool is updated monthly and it covers access to yearly, quarterly and monthly True Seasonal patterns. You can .

Summing up, the situation on the precious metals market remains very tense. A move down in the stock market could trigger another move up in the precious metals sector, however a move up in the USD Index could trigger a powerful decline. In fact, the latter can happen even if metals move higher from here without a breakdown in the USD Index. The seasonal tendencies point to either a delayed decline or to a move up in the coming days. All in all, the situation remains mixed, but it seems that we will see a meaningful signal to go either short or long in the coming days (our best guess is that the next big move will be to the downside and that it will be the final part of the decline).

Long-term capital: Half position in gold, silver, platinum and mining stocks.

Trading capital: No positions

As always, we'll keep you updated should our views on the market change. We will continue to send out Market Alerts on a daily basis (except when Premium Updates are posted) at least until the end of August, 2013 and we will send additional Market Alerts whenever appropriate.

As a reminder, Market Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA