In short: Short-term outlook deteriorated based on yesterday’s price action, but not significantly enough for us to open any position.

We saw another move higher in gold and the situation basically remains unchanged from yesterday. Please take a look below (charts courtesy of http://stockcharts.com.)

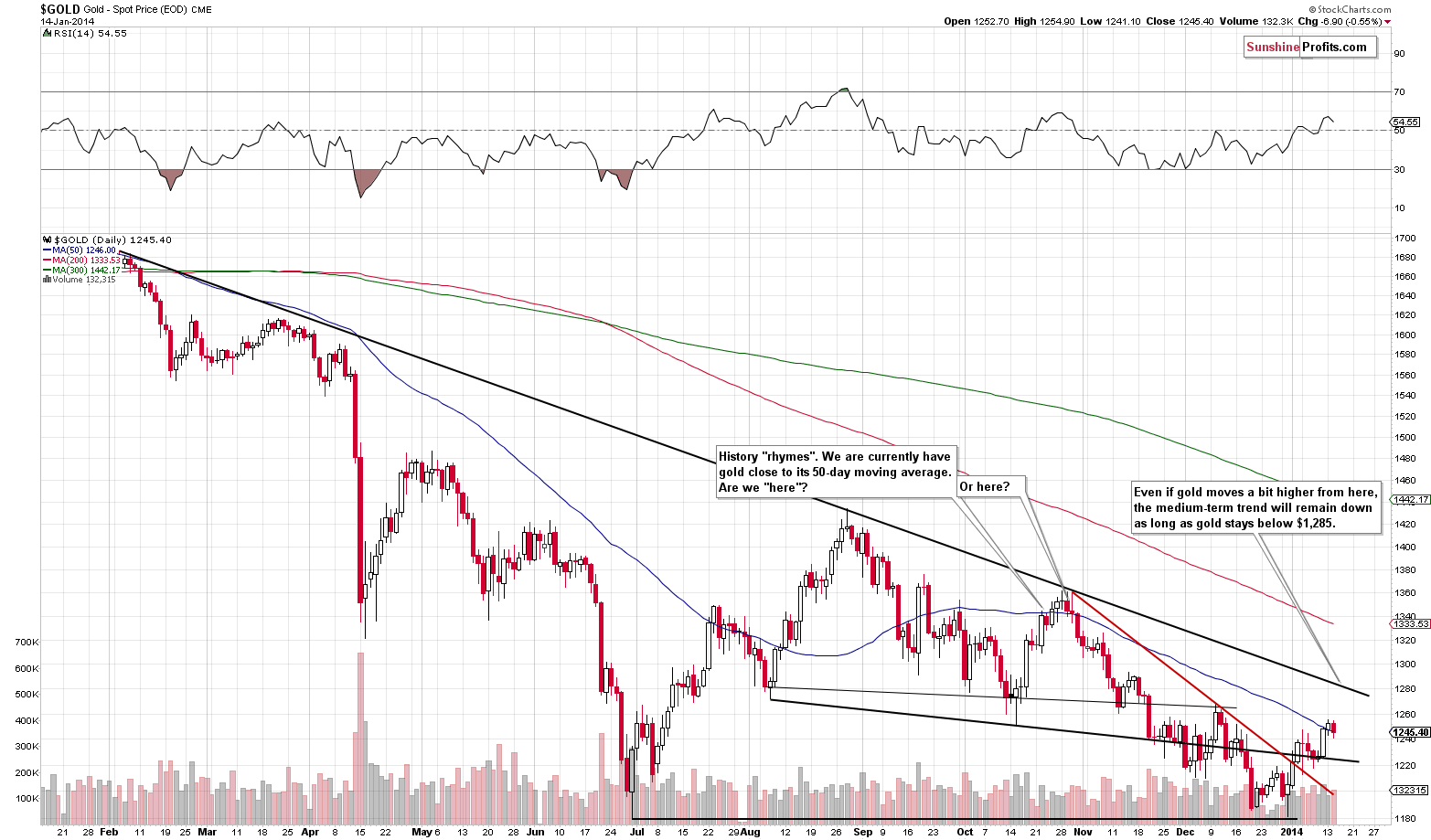

Gold corrected after moving above its 50-day moving average and now it’s less than $1 below it. This could be viewed as a confirmation or an invalidation, depending on how "picky" one decides to be. We’re "picky" in terms of not making decisions until the situation becomes clearer, so we will simply consider the current situation as one in which gold is just "close to its 50-day moving average."

This actually tells us something. The previous time gold was close to this moving average, it was close to its local top. However, it is not clear if we are before it or right at it. This means that the next few days are unclear, but we should see another move to the downside quite soon.

Let’s check the non-USD perspective.

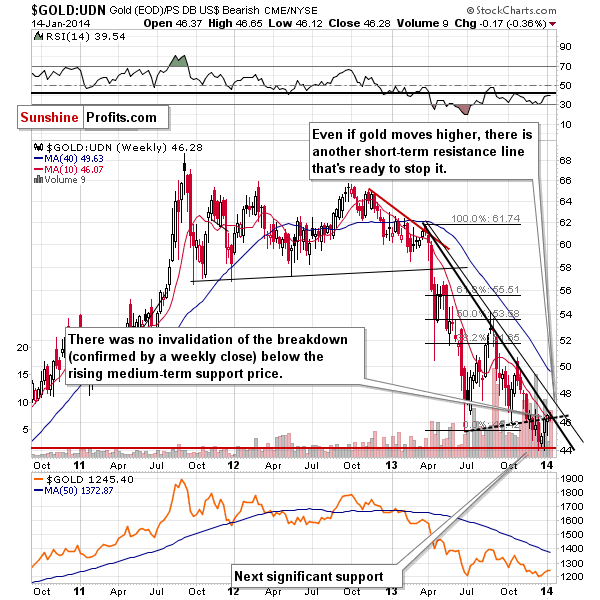

From the non-USD perspective, gold is once again slightly below both of the closest resistance lines: the rising one (marked with a dashed line) and the thick black declining one.

The trend remains down here and very little has changed. Gold could decline right away from here, but it could also rally a bit further – to the upper declining resistance line (thin black line) and decline thereafter. The former scenario seems a bit more likely, though.

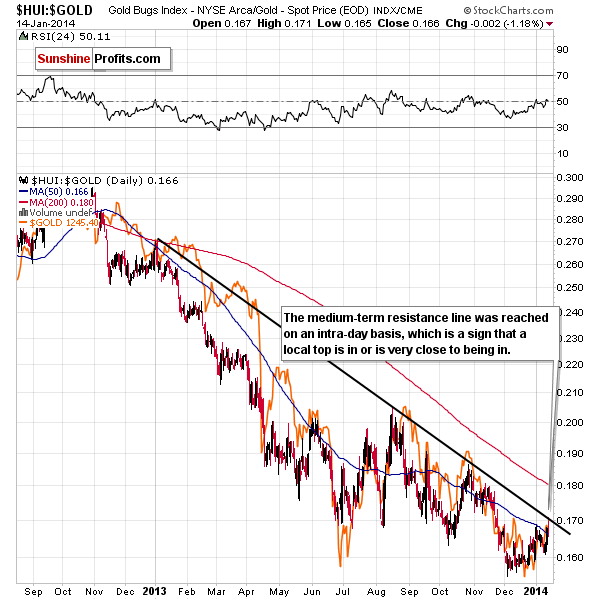

Speaking of ratios (after all, the non-USD gold price is the gold to UDN ETF ratio), we just saw something important on the HUI to gold ratio chart.

The medium-term resistance line was reached, which is quite a big deal. The last time that this line was touched, was when metals and miners topped in late October 2013. We’re at the same line once again. More precisely, we were on Tuesday, on an intra-day basis.

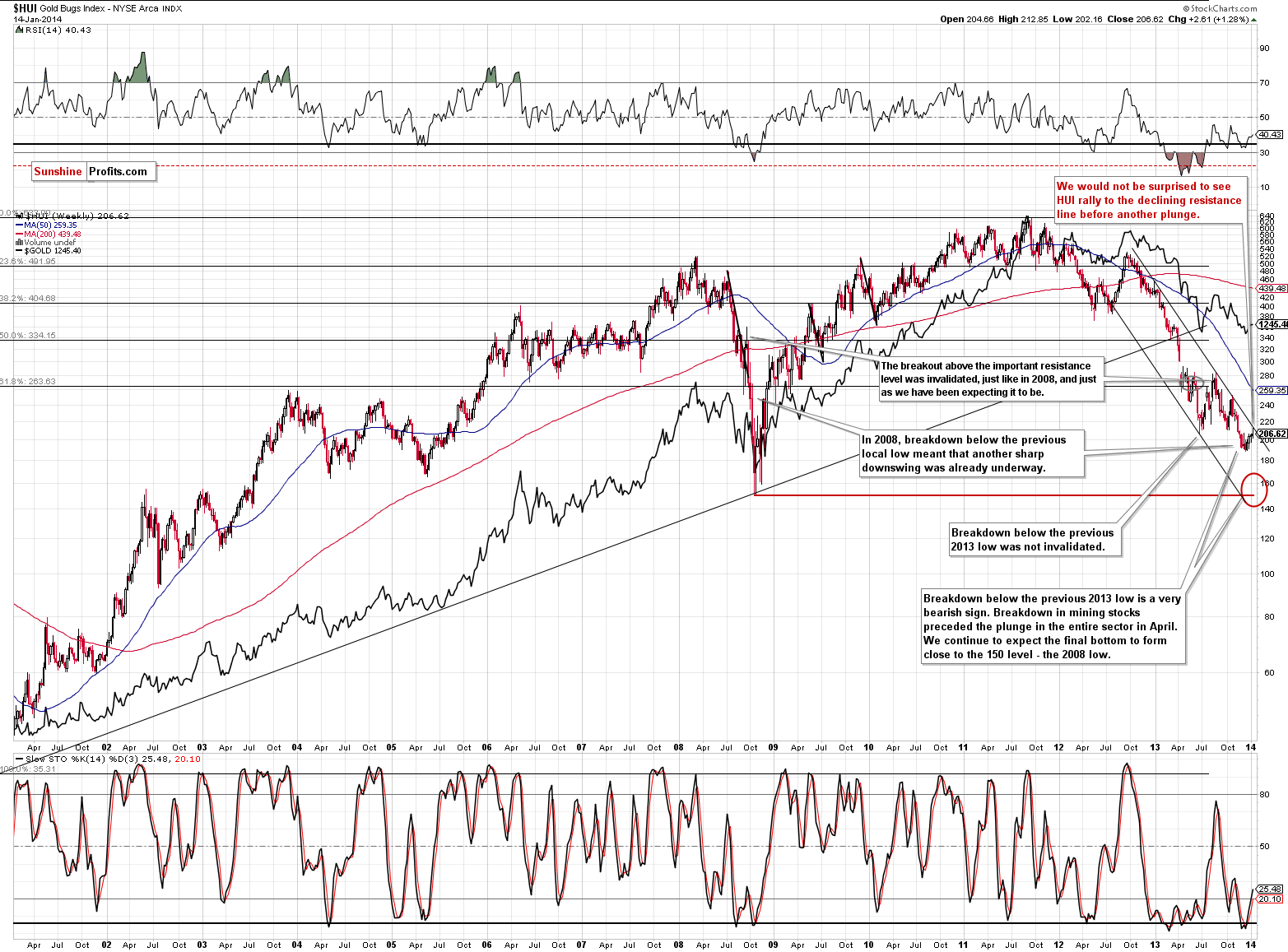

The HUI Index – gold stocks – hasn’t moved right to the 215 level, but it has moved high enough (on an intra-day basis) to touch the declining support line when we examine it from the long-term perspective.

So, was it reached or not? – one might ask. It was definitely close enough for the local top to be formed, but at the same time there was an intra-day reversal, which means that HUI has room for another move higher. The intra-day reversal is a bearish sign by itself, but at the same time it’s not, because gold miners haven’t declined as much as gold has.

There’s not much more that we can say about silver than what we wrote yesterday. It moved lower once again, but it’s recent movement was quite erratic and it’s hard to draw meaningful conclusions based on it.

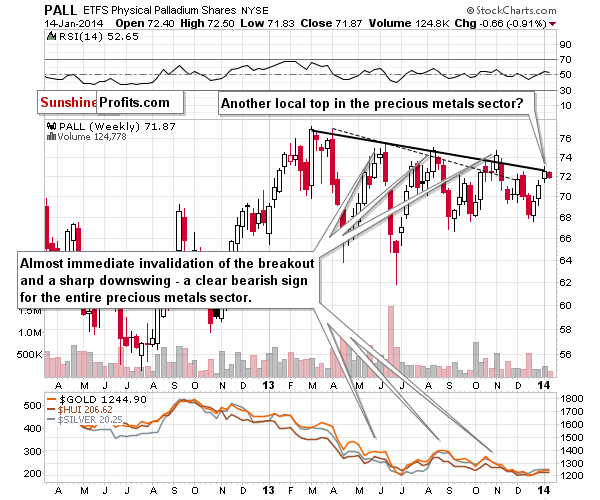

Meanwhile, the palladium market still suggests that we’re at a local top, or at least very close to one.

Taking all of the above into account, we get the same result we got yesterday. The situation is rather unclear for the short term but remains bearish for the medium term. Our best guess is that we will see a decline in the coming weeks but not necessarily right away. We will consider opening speculative short positions once we see some kind of confirmation, but we understand that what we wrote above may be sufficient for some to open them.

To summarize:

- Trading capital: No positions.

- Long-term capital: No positions.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Market Alerts on a daily basis (except when Premium Updates are posted) and we will send additional Market Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool). You will find more information by following links in the summary of the latest Premium Update.

As a reminder, Market Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

We have an important administrative announcement.

As you have noticed, Market Alerts that we have been sending this week are a bit different from what we used to send previously - they now include updated charts on each day.

In our recent survey, 10 times more subscribers selected the option that mentioned daily alerts + additional alerts whenever the situation requires it, than the option with 1 weekly update + additional alerts whenever the situation requires it.

This got us thinking that perhaps we are not providing our service in the way that is most suitable for you. Naturally, this led us to thinking how we could improve it. If daily alerts are so much more important than weekly updates, then perhaps we should move our focus to them. We thought that instead of 1 weekly update with charts (most of them don't change from one week to the next, for instance the long-term USD Index chart), we would be sending you alerts with charts on each trading day. In this case, we would be providing charts on which something actually happened and we would have something new to say (or we would stress particularly useful parts of previous alerts).

Having charts in front of you when we describe various resistance / support levels and when we discuss potential sizes of given price moves should help to make it clear what we mean and to decide more easily if a given price move is something that you might be interested in trading on. Until this week, you received charts from us on a weekly basis and now you would get them on each trading day. In this way, the daily alerts would be a smaller version of our current Premium Update. It seems to us that 5 small alerts would be much more useful than 1 big one published once a week. However, the decision is up to you. We have already started providing analysis in the "new form", but we can go back to the previous one if you find it less suited to your needs than the previous setup.

We plan to continue sending bigger Market Alerts that include charts... Unless, of course, you tell us that you think the previous system (with charts once a week in Premium Updates) was better. Naturally, we work for you, and we want to provide our analysis in the most convenient form, but we want to be sure we are going in the right direction. If you think that the previous way of providing the analysis was better, please let us know.

So far we received only positive feedback to the above-mentioned change. Thank you.

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA