Briefly: in our opinion, full (300% of the regular position size) speculative short positions in mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

And so, it happened – the USD Index just moved below the 90 level, and PMs responded with an overnight rally.

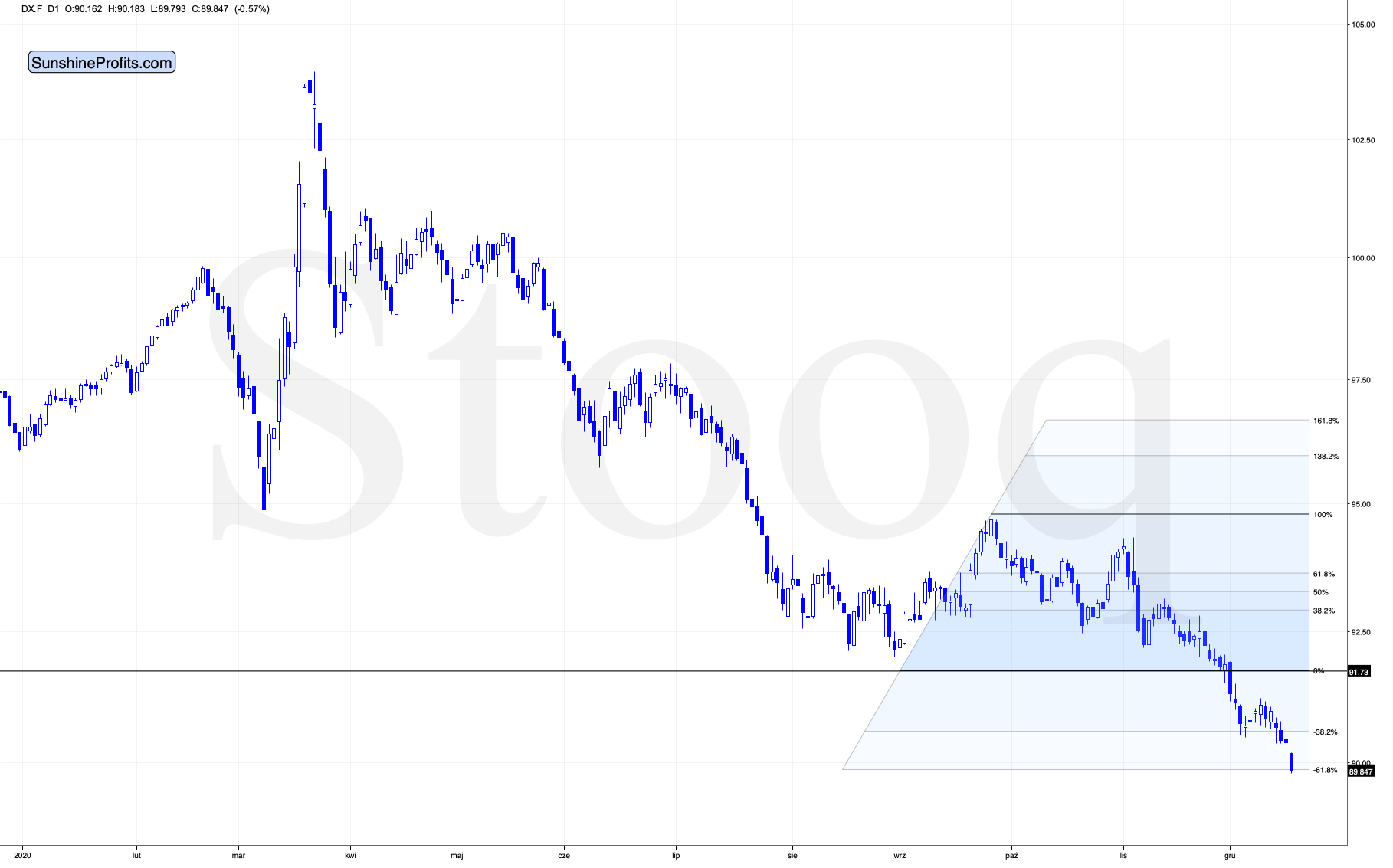

Based on the Fibonacci extension of the mid-2020 correction, the downside target [for USDX] is at about 89.8 – 90. Why use this approach? Because the same technique would have correctly predicted the target for the decline in early 2018 and the 2018 and 2020 declines are very similar with regard to starting points, the situation in the CoT reports (futures positions), and the overall shape of the moves.

Why would the bottom in the USD Index form at about 90? Because this would be yet another way in which the history could rhyme. In case of the USD Index, we have more of a 1:1 repeat of what we already saw a few years earlier.

Namely, it appears that the USD Index is repeating its 2017 – 2018 decline to some extent. The starting points of the declines (horizontal red line) as well as the final high of the biggest correction are quite similar. The difference is that the recent correction was smaller than it was in 2017.

Since back in 2018, the USDX’s bottom was at about 1.618 Fibonacci extension of the size of the correction, we could expect something similar to happen this time. Applying the above to the current situation would give us the proximity of the 90 level as the downside target.

And how will gold respond? Well, if the USDX follows a similar script, gold is likely to reprise its former role as well:

If the early 2018 pattern was being repeated, then let’s check what happened to precious metals and gold stocks at that time:

In short, they moved just a little higher after the USDX’s breakdown. I marked the moment when the U.S. currency broke below its previous (2017) bottom with a vertical line, so that you can easily see what gold, silver, and GDX (proxy for mining stocks) were doing at that time. They were just before a major top. The bearish action that followed in the short term was particularly visible in the case of the miners.

Consequently, even if the USD Index is to decline further from here, then the implications are not particularly bullish for the precious metals market.

In today’s pre-market trading, the USD Index moved to 89.793 before moving slightly back up. The above-mentioned target was just reached.

I wrote about the good possibility of gold testing its September lows one more time if the USDX declined to this target, and that’s exactly what is happening at the moment of writing these words.

Is the gold price moving higher right now? Absolutely. Is it well above its mid-year highs just as the USD Index is well below its mid-year lows? Absolutely not. All gold did was just correct a small part of its August – November decline.

If we look at gold through a slightly different chart, we get the same implications.

(Dec. 16)

The moves higher in gold are way too small to be considered a proper reaction. Coronavirus cases are soaring, the USD Index is plummeting, and the Fed is as dovish as it gets. Why is gold not rallying above its August highs?! Because it’s not ready to rally and it doesn’t want to rally before declining in a profound manner.

On Wednesday, gold closed below its September low (in terms of the daily closing prices) and remains a fair distance from its December high. Moreover, the yellow metal is fast-approaching its 50-day moving average – a near-term top seems likely in the near future based on this.

Both above-mentioned levels were touched in today’s pre-market trading. Is the top in? This seems quite likely. If not, it’s likely at hand.

Now, about those miners…

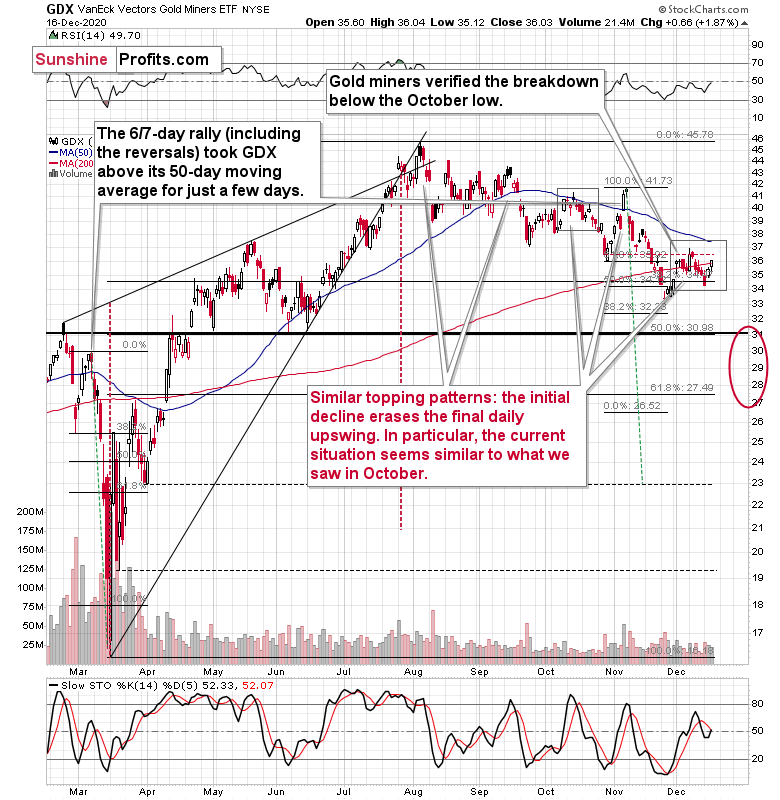

As a leveraged play on the yellow metal, bullish moves in bullion tend to make waves across gold mining stocks. However, the GDX ETF continues to underperform gold, and the relative weakness implies that Wednesday’s bounce was an unsustainable rally.

Despite gold making a run at its December high, the GDX ETF isn’t gaining much traction toward its October low (the verified breakdown level), let alone its December high.

Yesterday, I wrote:

The GDX ETF – proxy for precious metals mining stocks – moved higher yesterday, more than nullifying the previous day’s decline. But, overall, was it really strong? Absolutely not. In today’s trading on the London Stock Exchange, the GDX is up only a bit above Tuesday’s intraday highs, and it corrected only a bit more than a half of the December decline.

Simply put:

- Gold is relatively weak compared to what’s happening in the USD Index

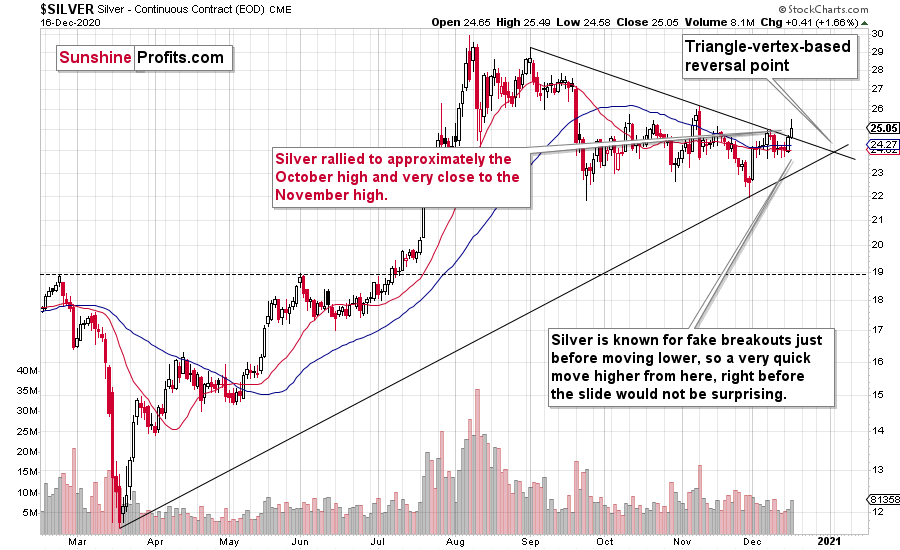

- Silver is relatively strong to gold and breaking above the previous resistance levels without confirmations from neither gold, nor mining stocks

- Gold and silver mining stocks are weak compared to what’s happening in gold

The above is a perfectly bearish combination on the relative strength front. Combining this with USDX’s proximity to its target area makes the overall implications for the precious metals market very bearish.

Now, unless gold reverses before the end of today’s session, it could be the case that miners make a move to their December high (while gold moved slightly above its December high), but it’s unlikely that this move would hold. Especially considering that the recent price moves resemble the pattern that we saw in October. In the above chart, I marked both cases with gray rectangles – this similarity has bearish implications as miners declined after completing the previous pattern.

The lone victor in Wednesday’s battle was silver. Today’s aftermath also “belongs” to silver.

Showing relative outperformance, the white metal is trading above its December high and is in the early innings of a triangle-vertex breakout. But while silver is making a dash for its October and November highs, gold’s little brother is well-known for its false breakouts.

The overnight action in silver might seem encouraging…

…but it isn’t.

Yesterday, I wrote:

This is exactly what silver tends to do right before significant declines – it’s exceptionally strong – more than gold and mining stocks. Why would this be the case? Because silver is a relatively thin market, where many institutional investors can’t go as there’s not enough silver for them. The “big players” generally go for gold, and silver is favored by the investment public. The silver manipulation theories are making the demand among the investment public even stronger, and the investment public (as a general group, not any individual person) tends to enter the market close to the tops.

And today, very little has changed. Silver moved to its November high, while gold and miners didn’t. In fact, please note how far miners are from their November high.

History shows that silver outperforms near market tops. And the lack of liquidity in the silver market is the driving force behind large swings to the upside (and downside). Of course, one can’t analyze data in a vacuum. Additional confirmation is warranted (like when a silver rally coincides with weak miners), but I’ll reiterate what I wrote yesterday:

It’s best not to take silver’s strength at its face value, and definitely not to view it as bullish unless it’s confirmed by the rest of the precious metals sector. Today’s breakout in silver and lack thereof in gold is not a bullish development, but a bearish one.

It was definitely a good choice to use mining stocks as a proxy for our short position instead of using gold or – in particular – silver. There will be a time, when silver declines faster than miners, but – as I had indicated earlier – we are not there yet.

Overview of the Upcoming Decline

As far as the current overview of the upcoming decline is concerned, I think it has already begun.

During the final part of the slide (which could end within the next 1-5 weeks or so), I expect silver to decline more than miners. That would align with how the markets initially reacted to the Covid-19 threat.

The impact of all the new rounds of money printing in the U.S. and Europe on the precious metals prices is incredibly positive in the long run, which does not make the short-term decline improbable. Markets can and will get ahead of themselves and decline afterward – sometimes very profoundly – before continuing with their upward climb.

The plan is to exit the current short positions in miners after they decline far and fast, but at the same time, silver drops just “significantly” (we expect this to happen in 0 – 3 weeks). In other words, the decline in silver should be severe, but the decline in the miners should look “ridiculous”. That’s what we did in March when we bought practically right at the bottom. It is a soft, but simultaneously broad instruction, so additional confirmations are necessary.

I expect this confirmation to come from gold, reaching about $1,700 - $1,750. If – at the same time – gold moves to about $1,700 - $1,750 and miners are already after a ridiculously big drop (say, to $31 - $32 in the GDX ETF – or lower), we will probably exit the short positions in the miners and at the same time enter short positions in silver. However, it could also be the case that we’ll wait for a rebound before re-entering short position in silver – it’s too early to say at this time. It’s also possible that we’ll enter very quick long positions between those short positions.

The precious metals market's final bottom is likely to take shape when gold shows significant strength relative to the USD Index. It could take the form of a gold’s rally or a bullish reversal, despite the ongoing USD Index rally.

Summary

It was more of the same for the precious metals on Wednesday – as the technicals remain bearish, the Fed remains bullish, and movement beneath the surface implies fading the recent rally.

Despite an ‘all-clear’ signal by the FOMC on Wednesday, gold failed to respond in kind. The yellow metal continues to underperform – relative to the slide in the U.S. dollar – and the relative breakout in silver signals a toppy market that’s prime for a reversal. Today’s pre-market strength in silver along with gold’s relatively weak reaction to the USD’s slide make the above even clearer. Moreover, since the USD Index might have already bottomed (or is about to do so), it seems that the top in the precious metals market might be already in, or at hand.

All in all, a big move lower in the precious metals market is already underway.

Despite a recent decline, it seems that the USD Index is going to move higher in the following months and weeks, in turn causing gold to decline. At some point gold is likely to stop responding to dollar’s bearish indications, and this will serve as the most important and major buy signal for gold.

Naturally, everyone's trading is their responsibility. But in our opinion, if there ever was a time to either enter a short position in the miners or increase its size if it was not already sizable, it's now. We made money on the March decline, and on the March rebound, with another massive slide already underway.

After the sell-off (that takes gold to about $1,700 or lower), I expect the precious metals to rally significantly. The final decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

Most importantly, please stay healthy and safe. We made a lot of money on the March decline and the subsequent rebound (its initial part) price moves (and we'll likely earn much more in the following weeks and months), but you have to be healthy to enjoy the results.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in mining stocks is justified from the risk to reward point of view with the following binding exit profit-take price levels:

Senior mining stocks (price levels for the GDX ETF): binding profit-take exit price: $32.02; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the DUST ETF: $28.73; stop-loss for the DUST ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

Junior mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $42.72; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the JDST ETF: $21.22; stop-loss for the JDST ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway. In our view, silver has greater potential than gold does):

Silver futures downside profit-take exit price: unclear at this time - initially, it might be a good idea to exit, when gold moves to $1,703.

Gold futures downside profit-take exit price: $1,703

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief