It’s been almost a month since we’ve posted our latest mid-week update (sent/posted ahead of schedule; featuring charts) in which we suggested using speculative capital to bet on higher precious metals prices, and here we go again, as we once again believe that desperate times call for desperate measures.

The markets in the US have been closed today, but based on Kitco’s internal gold/silver prices we might infer that silver has just moved to new highs and gold moved much higher as well. Consequently, unless the situation is just as extreme tomorrow but in the opposite direction (not likely), we’re going to see much higher prices of GLD and SLV ETFs along with rising values of mining stocks. Silver moved over $1 higher today, so the situation is becoming critical, as these types of rallies usually take place close to the end of a rally. Are we there yet?

In terms of days we might be close – please note that the True Seasonal pattern for gold suggests a local top in early March, and we’re almost there. Conversely, strong resistance levels (and with this type of momentum in the market, it’s not likely that a weak resistance will stop the rally) have not been reached, so the rally may have more room to go.

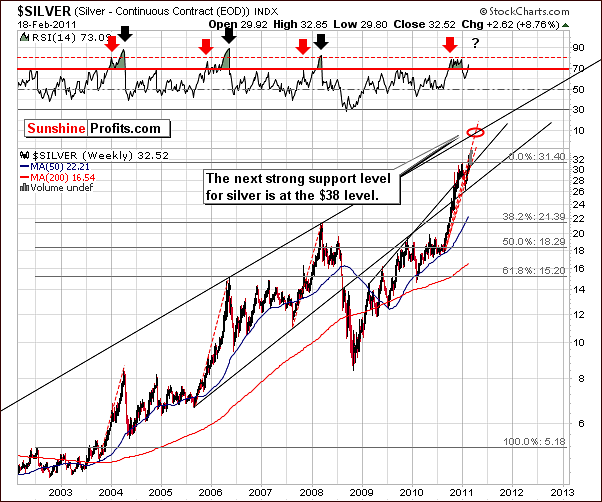

Let’s take a look at the following silver chart for details (charts courtesy by http://stockcharts.com.)

While the markets were closed today based on Kitco’s prices we’ve added a gray line symbolizing today’s move, so that we can still take it into account. Today’s over $1 upswing is not only profound because of its size; it’s crucial because it took silver above the long-term trend channel, which means that the move up could be upheld or resumed after a few days of pause. Either way, another over $1 rally is not out of the question here.

How much is over $1?

Perhaps even $4. The current move is a long-term phenomenon, so it is best to analyze it from the long-term perspective. The latter allows us to see that even if this rally continues for $4, then it still won’t be the biggest rally we’ve seen in this bull market. Please note the rising dashed line that exceeds the target marked with red ellipse. This line is the size of the rally that would be seen if the 2005-2006 upswing in silver was to be repeated.

Of course, history doesn’t repeat itself in a strict way, but it rhymes and that’s close enough for us to infer that even a $4 rally from here is possible. Whether it’s probable is a different story, but that appears quite probable anyway, as the momentum is very strong and the breakout above the long-term trend channel has been seen.

Why $4? Because that’s where the rising long-term resistance level is currently at, and there is no significant resistance level lower than at $38. It’s based on two important tops: the 2006 and 2008 ones and this makes the resistance line strong enough to stop the current rally. Additional confirmation comes from the RSI indicator, which is rising once again after a mid-rally consolidation. This is what we’ve seen in the past, so we know what to look for as a sell signal. Previously, it was a good moment to exit one’s speculative long positions once RSI moved above the 80 level – marked with the red dashed line. We are not there yet.

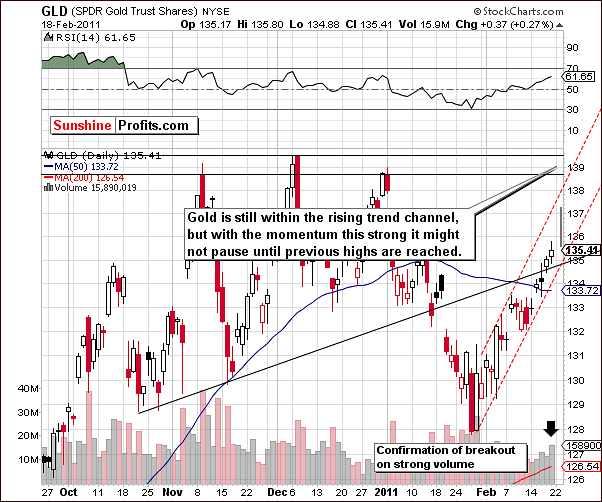

Silver is not the only market that moved higher today – gold rallied as well.

The bad news is that since the markets were closed, we don’t have volume information that we could use as a confirmation of the move higher. However, based on Friday’s volume we might infer that the buying power is still strong as the volume has been rising along with the price.

Again, with momentum this strong, we are expecting that gold’s rally will not end until a significant resistance is reached. In case of the yellow metal, the resistance is provided by the previous highs, as marked with horizontal black lines. Either of them could stop the rally, so much will depend on the analysis of volume and how other markets perform.

The situation in gold is similar to the one seen in mining stocks (please take a look at the GDX ETF chart in the latest Premium Update for details). On that chart, we have analogous target levels in the $62 - $64 range. In case mining stocks move to their previous highs and the volume will be very small during the final part of the upswing, but we have a similar move on normal volume in gold, then it might be a good idea to close one’s long positions not only in mining stocks but also in gold and silver. However, this is just a pure speculation on our part right now, as we don’t even have Monday’s volume.

Naturally, the $38 target for silver and 2010 highs for gold and mining stocks are not a sure bet – there are no sure bets in any market. However, with market rallying quickly and without any significant bearish signs exiting one’s speculative position at this point might be premature. In most cases after a few-dollar rally the situation becomes bearish as the buying power dries up and technical picture changes. Still, right now we have a positive technical situation even despite the rally that we’ve seen so far. In other words, the $38 level for silver appears to be the most probable target at this point, but we will still monitor the market on a daily basis and report to you accordingly, should anything change.

The target levels for silver ($38) are distant compared to the ones for gold and mining stocks (2010 highs: $1,430 and $64 respectively), however the main point that we are trying to convey in this quick update is that exiting speculative positions at this point still doesn’t appear justified from the risk/reward perspective.

Since gold, silver and mining stocks are positively correlated and usually move in the same direction, we could have a situation where gold and mining stocks form tops which causes silver’s rally to pause/stop before reaching the $38 level. We could also see gold and mining stocks move past their 2010 highs as silver leads them higher, and then gold, silver and mining stocks could form tops in the same time, when silver reaches $38. At this point it’s too early to say, which of these outcomes is more probable, but being aware of these scenarios makes you prepared for taking necessary action once more information becomes available.

Our next Premium Update is scheduled for Friday, February 25, 2011.

Thank you for using the Premium Service.

Sincerely,

Przemyslaw Radomski