Let’s begin by quoting our yesterday’s update:

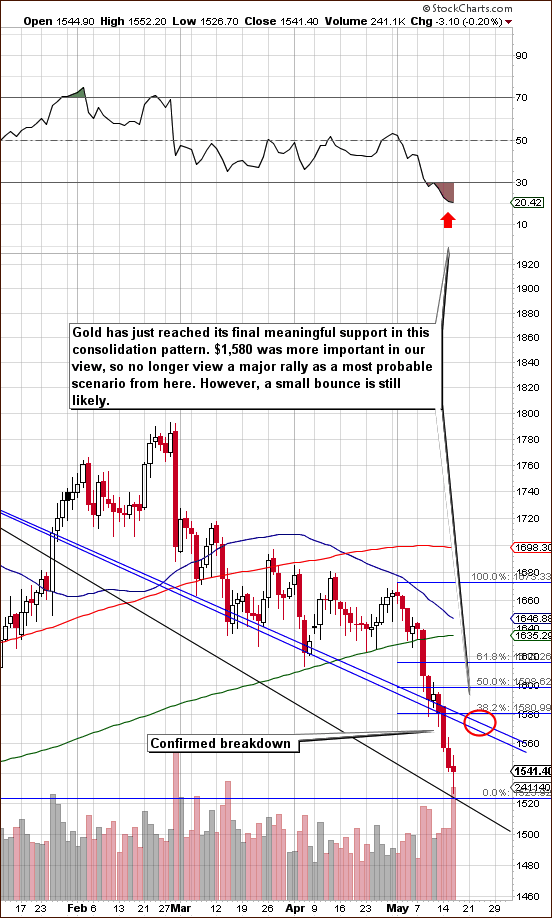

Gold and mining stocks closed below their key support levels yesterday - this is an unconfirmed breakdown. The breakdown is now more visible also in the gold:bonds ratio. Silver has also moved below its support line, however breakdowns in silver are less meaningful, so we don't view it as an important factor for the whole precious metals market from the technical point of view.

So, what do we do given all of the above? We wait for a confirmation of these breakdowns before taking any action. Until we actually have the confirmation, the breakdown is not really meaningful. At this point we could be at the verge of a huge rally or even deeper decline, however the first is still much more probable.

The key point was the confirmation of the breakdown and we have seen it today. In short, this is a huge deal, but please read the whole update before taking any action.

The first chart for today will be the one featuring the USD Index (chart courtesy of http://stockcharts.com.)

We have just written that USD was at its long-term resistance line, but this level was broken soon after that. At this point we await confirmation of the breakout, but since it takes only one more close and USD is visibly above 80.5, it seems that the breakout will be confirmed.

Therefore, the USD Index picture has just become bullish and consequences for metals are bearish.

Almost the opposite is seen on the above chart – DIA ETF (a.k.a. diamonds; a proxy for Dow Jones Industrial Average). Despite a buy signal from the volume, price moved lower and even moved below the support line created by previous lows. One more close below it will confirm the breakdown. The situation here is not strongly bearish, but still, more bearish than not. The same can be said about the impact on precious metals.

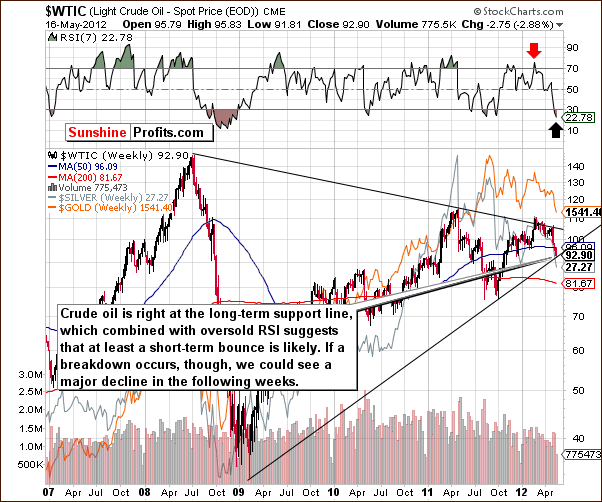

Crude oil is at the long-term support line which actually has bullish implications for gold as it might ignite at least a short-term rally especially that the RSI indicator based on the price of oil is now oversold. The implications are bullish but their nature is short term.

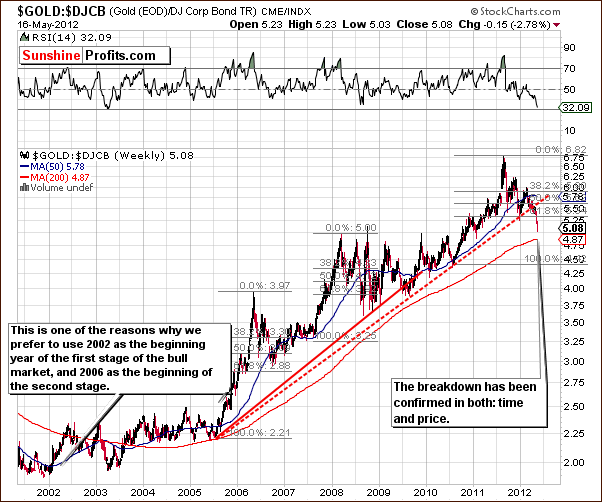

Gold-bonds ratio has broken below the long-term support line which is a major factor. After all, this support line held through the whole second stage of this bull market. In fact, this factor alone would likely make us consider (!) getting out of the precious metals market.

The ratio is low enough to say that the breakdown has been confirmed, even without counting days. The RSI based on this ratio is very low, so a bullish signal is also present, but we think that the breakdown itself is more meaningful.

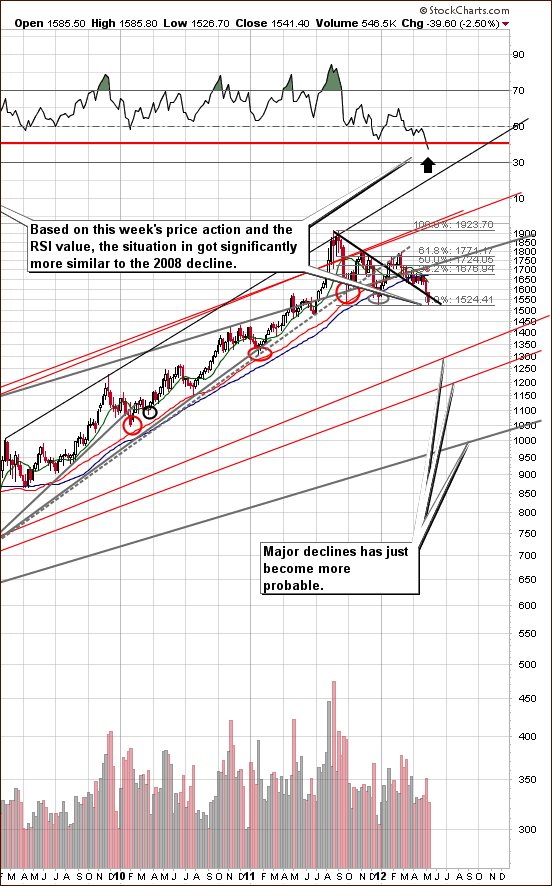

As always, please click on the above chart to enlarge it. Based on this week’s price action, the similarity between now and 2008 has greatly increased. Directly – because of the confirmed (!) breakdown below declining support line, and indirectly – because RSI moved below its own critical levels. The medium-term picture is now more bearish than not.

Right now RSI looks similarly to what we saw right after the first part of the decline and before a small pullback. The very interesting thing is that when looking at RSI for silver, we get identical picture.

However, on a short-term basis, gold is extremely oversold and it touched a final support level for this consolidation (silver moved close to previous major low as well). The breakdown that is behind us is more important in our view (and that’s why we called the medium-term picture more bearish than not), but a short-term pullback appears probable as no market can move down indefinitely without corrections. The RSI is extremely oversold and we have just seen an intraday turnaround on huge volume. It looks kind of like the mid-March bottom – a small rally was seen back then.

It now seems that gold would not move above the previously broken line - it will probably reach the area marked with red ellipse. Then the decline would continue. We realize that this is not what you wanted to read, and we don’t like writing it either, but that is what appears to be the most likely outcome. Originally, we wanted to send you an update during today’s market session, but as it became more and more evident that today’s closing prices will affect our medium- and long-term views about the market, we chose to wait for all the information to become available before writing this update.

Still, a small rally is quite likely (70% or so) to be seen in the following days and this is something that we might profit on.

The key question is what to do with all of the above.

The speculative capital:

- We suggest closing the speculative position that was opened based on the expected medium-term rally, as this rally is no longer highly probable (because of the confirmation of the breakdown),

- We suggest opening a small speculative long position in order to bet on the expected short-term pullback in the price of gold.

The action that you could take based on two of the above depends on the instruments that you used to bet on higher precious metals prices previously. If you used stocks / ETFs, you might simply wait to exit positions at a higher price. If you used futures / CFDs, you could enter/adjust position’s size (only a small exposure is suggested at this time). Options - purchasing GLD June 150 calls should be fine in most cases.

The long-term investment capital:

We previously mentioned that we will consider a confirmed breakdown below the $1,500 as something that will likely make us close/hedge our positions. At this time, we believe that if gold rises to the area marked with red circle without immediately moving right through it, we will also suggest closing / hedging part of the long-term investments. With long-term precious metals investments the risk is to be out of the market, so we want to be more confident that a major decline is about to start before we decide to get out.

Our next Premium Update is scheduled for Friday, May 18, 2012. As always, we’ll keep you updated.

Thank you for using the Premium Service.

Przemyslaw Radomski