Gold and mining stocks closed below their key support levels yesterday - this is an unconfirmed breakdown. The breakdown is now more visible also in the gold:bonds ratio. Silver has also moved below its support line, however breakdowns in silver are less meaningful, so we don't view it as an important factor for the whole precious metals market from the technical point of view.

So, what do we do given all of the above? We wait for a confirmation of these breakdowns before taking any action. Until we actually have the confirmation, the breakdown is not really meaningful. At this point we could be at the verge of a huge rally or even deeper decline, however the first is still much more probable.

In our latest update we mentioned that there was something that created a resistance level for the USD Index close to 80.5. Please take a look below for details (chart courtesy of http://stockcharts.com.)

As you can see, the US dollar is right at the long-term resistance line. As the recent decline in gold took place along with the rally in USD a top in the latter would likely mean a bottom in the former. Since USD is at the resistance level right now, it could either break out, or decline. At this point the breakout has not been confirmed, so a decline is much more probable (and so is a rally in gold).

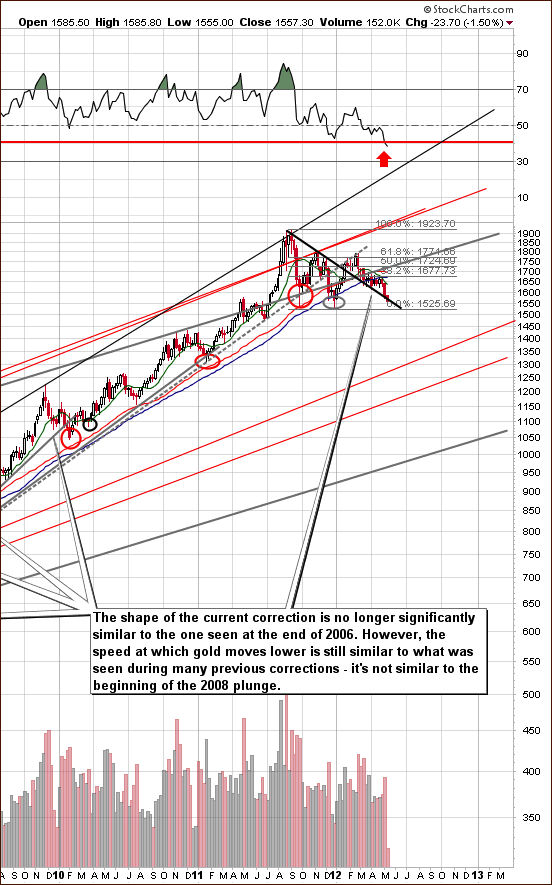

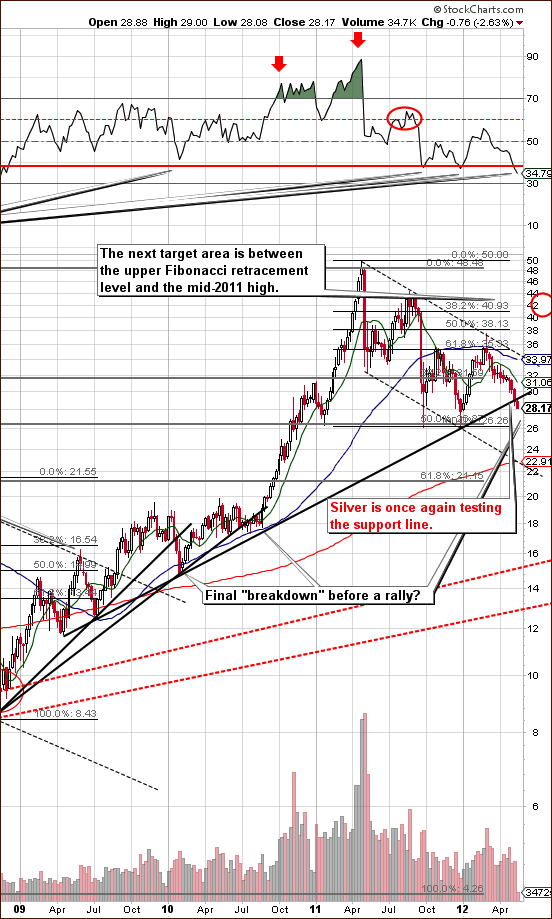

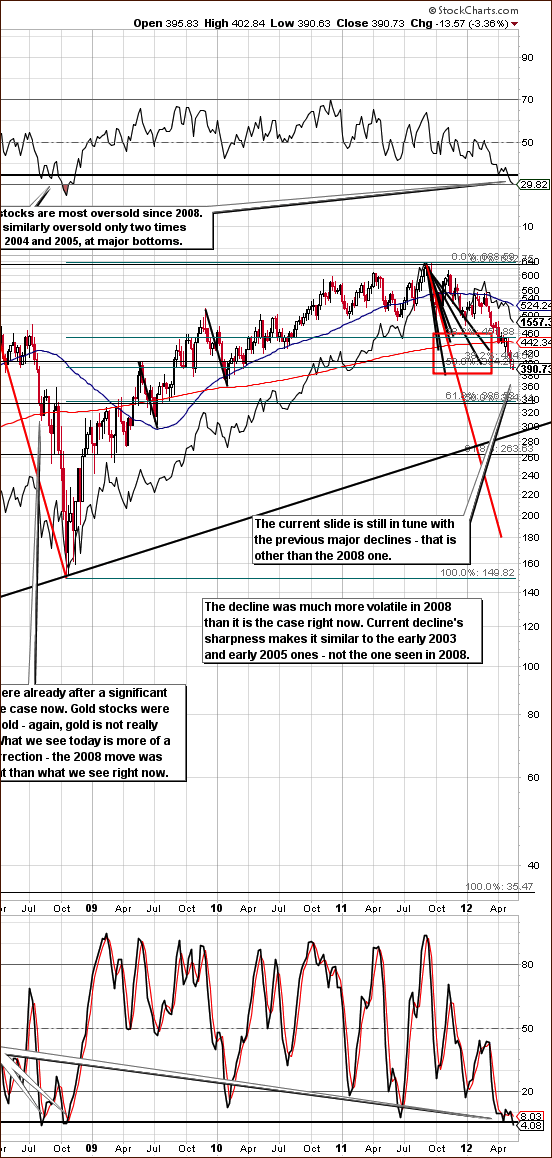

We received many questions in the past few days and a lot of them revolved around the worst-case scenario. The following charts (please click on them to enlarge) feature what could happen if the breakdown is confirmed.

The support levels are at two rising red lines and one rising gray line – that’s the worst case scenario – with gold around $1,000.

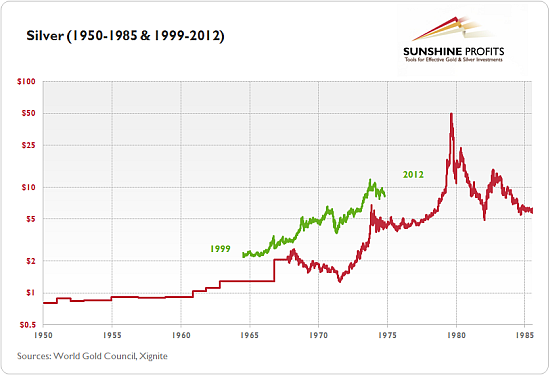

The support levels are at two rising red lines – one is currently close to $15 and the other close to $13.

In case of the HUI Index we have two support levels – one at the rising black resistance line – currently close to 300 and the other one at 150 – at previous low.

All of the above-mentioned targets are much below where the precious metals market is today, which means that if markets are going to move lower, then by getting out before the worst comes one might save a lot compared to the buy-and-hold approach.

It might even be the case that based on the breakdown we will consider partly closing (or preferably hedging) our long-term precious metals investments. It all depends on how the situation develops in the following days, but that possibility is certainly present.

Can metals really go that low? Wouldn’t that invalidate some kind of trend that is supposed to be in place since we are in a secular bull market?

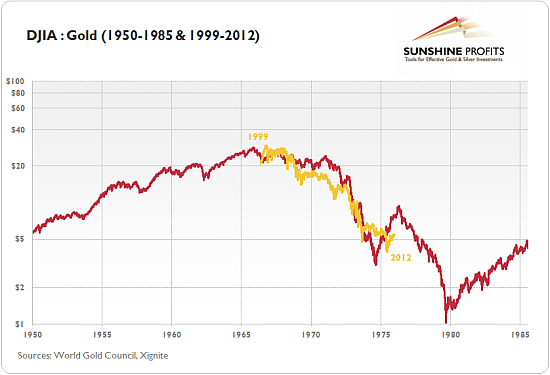

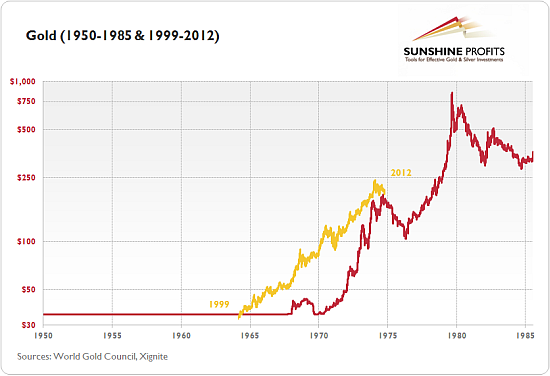

Yes, they can and this has happened in the previous bull market as well. We have emphasized the this fact several months ago, at the beginning of the September 8th, 2011 Premium Update – as it turned out it was right after the final top for that year. Actually, it might be a good idea to go through these several paragraphs once again at this time.

In today’s update we will provide you with updated versions of the charts featured at that time. In a nutshell, we compared the previous bull market to the current one, to see if we can really see a bigger decline in metals and still stay in the secular bull market.

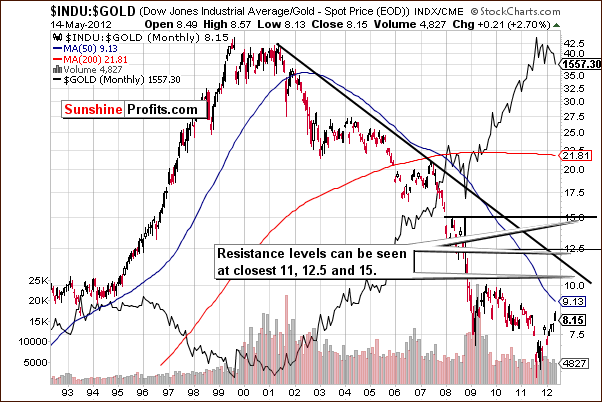

If precious metals are about to consolidate for one more year or so, then we could indeed see much lower prices. Taking the previous bull market as a guide tells us that dow:gold ratio could correct a significant portion of its over-10-year slide. Based on an approximate analogy – we could now see dow:gold ratio at 15 or so. Without any move in stocks, this implies gold at $850. If the ratio went to 12.5 without a move in stocks, gold would trade just above $1,000.

As you can see, based on more detailed version of the dow:gold chart, both levels could be reached. There is also resistance level at 11 that would correspond to $1,150 gold if stocks didn’t move.

Consequently, the worst-case scenario is really bad and actually makes what we’ve seen so far relatively small.

Then again, if one gets out and the markets soar then it will be quite difficult – both: financially and emotionally – to get back in. An invalidation of an important breakdown would be a major medium- and short-term buy signal that would likely be followed by a sharp rally. Those who will be betting on higher prices in this scenario will profit greatly and those who will be short, will lose just as much.

Both outcomes have significant consequences and both are possible. However, since the breakdowns have not been confirmed, the bullish point of view is still much more probable and therefore the potential gain for those who are long in this market is significant. That’s why we emphasize the importance of confirmation and that’s why we keep you particularly updated on this.

To sum up, let’s repeat what we wrote at the beginning of this update: so, what do we do given all of the above? We wait for a confirmation of these breakdowns before taking any action.

Our next Premium Update is scheduled for Friday, May 18, 2012. As always, we'll keep you updated.

Thank you for using the Premium Service.

Przemyslaw Radomski