Gold moved much lower in today’s pre-market trading, and since we realize that the emotional tension related to the precious metals market is enormous at this point, we would like to comment on this move as soon as possible.

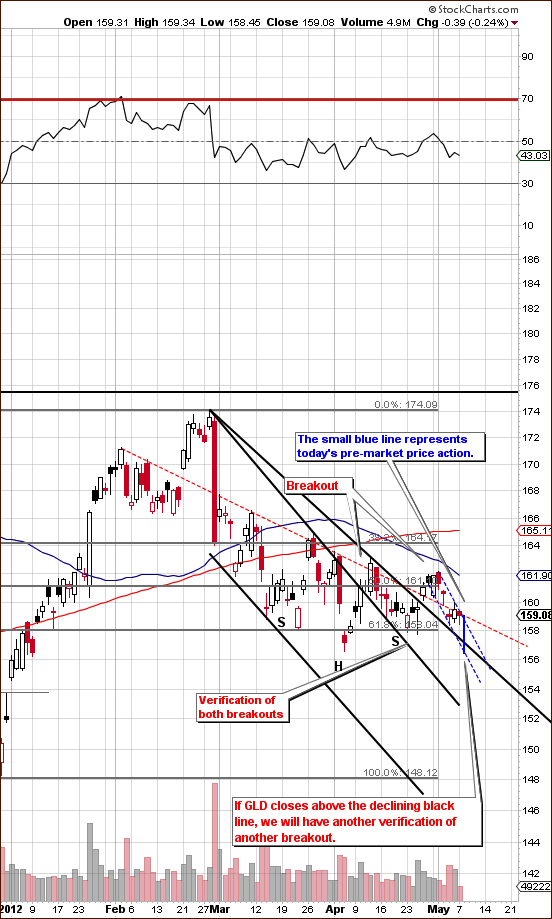

We will use the GLD ETF chart (charts courtesy by http://stockcharts.com) to put today’s move into perspective. Since the market is not opened at the moment of writing these words, we will draw today’s pre-open price move on yesterday’s chart. The blue line represents today’s downswing. You may click on the chart to enlarge it.

On the above picture, we see that while the move is deep and sharp if you take a look at the intra-day chart, the truth is that this downswing didn’t take gold much below the recently broken support line which has now turned into resistance, which makes this downswing’s bearish appearance rather inconsequential so far (!).

Another point is worth mentioning is that the decline took gold only slightly below the previous lows. Consequently, we might be looking at a double-bottom pattern.

The bad news is that the reverse head-and-shoulders pattern that we commented on recently is no longer in place. The double-bottom pattern and a reversal after reaching the highest declining black support line would be bullish as well, but clearly, the reverse H&S pattern has been invalidated as the right shoulder has just moved below the “head level”.

The good news is that dollar’s rally took it to the highest short-term resistance line, which suggests that it is now likely to decline – and that move is likely to take gold higher.

The bottom line is that we are still in a post-breakout consolidation pattern (see the long-term gold chart in last week’s Premium Update for details) and just because a reverse head-and-shoulders pattern has been invalidated, doesn’t make the situation bearish.

Putting facts aside, to be honest, we are not really happy to see gold moving lower today – we would "like" it to move higher and complete the reverse head-and-shoulders formation in a symmetrical fashion that would ignite even bigger rally. However, our preferred shape of gold’s price swings, disappointment or being tired of waiting has nothing to do with what the market is likely to do next – and even if that is the case, the link is very indirect. The market doesn’t "care" about our or anybody else’s wishes and as soon as we start allowing our emotions interfere with our investment decisions, we can rest assured that our rate of return will drop.

Having said that - as objectively as we can - we currently view the probability of an upswing in gold (instead of a confirmed move below $1,600) at 70%. It’s a bit lower than what we reported on Friday, but the number is still high enough in our view to justify open speculative long positions in the precious metals market. Naturally, the long-term investment positions are justified as well.

This completes today’s Mid-week Update. Our next Premium Update is scheduled for Thursday, May 10, 2012, a day earlier than usual.

Thank you for using the Premium Service.

Przemyslaw Radomski