Briefly: in our opinion, full (250% of the regular size of the position) speculative short position in gold, silver, and mining stocks is justified from the risk/reward perspective at the moment of publishing this Alert.

And it's a fact. Miners supposedly bullish reversal was followed by a sizable daily decline. Just like it was supposed to based on the extremely low volume. GDX broke below its triangle pattern even without gold's help. Moreover, silver stocks broke to new 2019 lows. What's next?

The decline is likely to pick up speed. The above-mentioned technical developments in the mining stocks point to further weakness in the precious metals sector. Let's take a closer look at the charts.

Gold and Silver Miners' Assessment

We dedicated most of yesterday's Alert to GDX's volume, so today we'll just add that low-volume sessions emphasize market's indecisiveness. Quite often, whichever way the market moves after the low-volume day, marks the beginning of a new move in that direction. Miners definitely moved down and meaningfully so.

They moved and closed below the lower border of the triangle pattern, which means that they are likely to slide shortly.

The sell signal from the Stochastic indicator serves as a confirmation.

Silver miners not only moved, but actually closed at a new 2019 low. In fact, it's more than a yearly low. We haven't seen the SIL ETF this low since the first quarter of 2016. The only near-term support is the March 2016 low of about $21. Once this level is broken, there is no meaningful support all the way down to the 2016 low of below $15. Yes, this level is likely to be reached and then, silver miners are likely to head even lower. Of course, these prices - below the 2016 lows - will not last for years, but they can last for weeks.

Looking for Targets Throughout the PMs Sector

Apart from the move lower in the miners, nothing really changed. Gold and silver remained flat. The white metal has more than verified the breakdown below the previous 2019 lows and appears ready to slide further.

The HUI Index moved lower and at first sight, its slide seems to be in line with what we saw on May 10th. Both moves were clear daily declines to more or less similar levels. But, that's as far as the similarity goes. This time, the HUI Index is already after a confirmed breakdown below the January 2019 lows, which makes the technical picture much more bearish than it had been about 2 weeks ago.

The target for the HUI Index based on the repeat of the initial decline is the September 2013 bottom, but if the GDX ETF is to complete its head and shoulders pattern and then decline to the target based on it, we can expect the HUI to move even lower.

If the 2018 low doesn't manage to stop the decline and trigger a temporary turnaround, we might see the HUI even lower. How low?

The late 2015 and early 2016 highs provide support between 120 and 125 and approximately the same goes for the declining support lines based on the late-2016 and 2018 lows.

There is also one additional technique that points to this level as the likely target. If the declines take place at a relatively normal pace and then accelerates, the size of the move before the acceleration quite often corresponds to the size of the accelerated move. At times, the length of the line connecting the initial extreme and the mid-point equals the length of the line connecting the mid-point and the final extreme. On the above chart, we marked the former type of analogy. The blue lines that we marked in 2018 are identical - the size of the decline that preceded the most volatile plunge was just like the size of the accelerated decline. If we see something like that also this time, and the acceleration starts right now (which seems likely based on the ultra-low volume in GDX, the breakdown to new lows in SIL and the verified breakdowns in gold and silver), the HUI would likely slide to about 123 - right in the middle of our target area based on the previously mentioned support lines and levels.

Will it move as low before correcting first? It's impossible to say for sure, but it seems best to look at gold for guidance as that's where the target level of about $1,240 is most clear. The target for silver at the 2015 low also seems quite likely. If both are reached, then the HUI and GDX are likely to bottom (temporarily) as well, regardless of price levels at which they would be at that time exactly.

Speaking of gold and silver, let's take a look at their relative performance.

Consulting the Gold to Silver Ratio

After the clear breakout above the previous highs, the gold to silver ratio started to climb as we had expected it to. It now reached its rising resistance line, which may trigger a corrective bounce, but we wouldn't bet the farm on this scenario. The ratio might as well rally all the way to the 90 (round level) or 94 (Fibonacci price extension that we marked on the above chart) level only to correct to the resistance line next and verify it as support. This would perfectly fit the situation in which gold and silver slide much lower (with silver underperforming) and then we see a rebound, where the white metal rebounds with a temporary, yet greater, strength.

With gold at $1,240 and silver at $13.70, the ratio would be at 90.51 - which might trigger a corrective decline in the ratio, perhaps to the rising red line at about 88. This also sounds reasonable, as the corrective upside target for gold would be $1,260 and 88 level in the ratio would imply silver at about $14.30. A correction to 89 in the ratio would imply silver at about $14.16 - this also makes sense in light of where the resistance and support levels are in gold, silver and in the ratio itself.

Please note that the point of the above discussion is not to make precise targets based on the ratio alone, but rather to make sure that the targets based on other techniques fit what's happening in the ratio on an approximate basis. And that is indeed the case.

There's one more metal that we would like to discuss today.

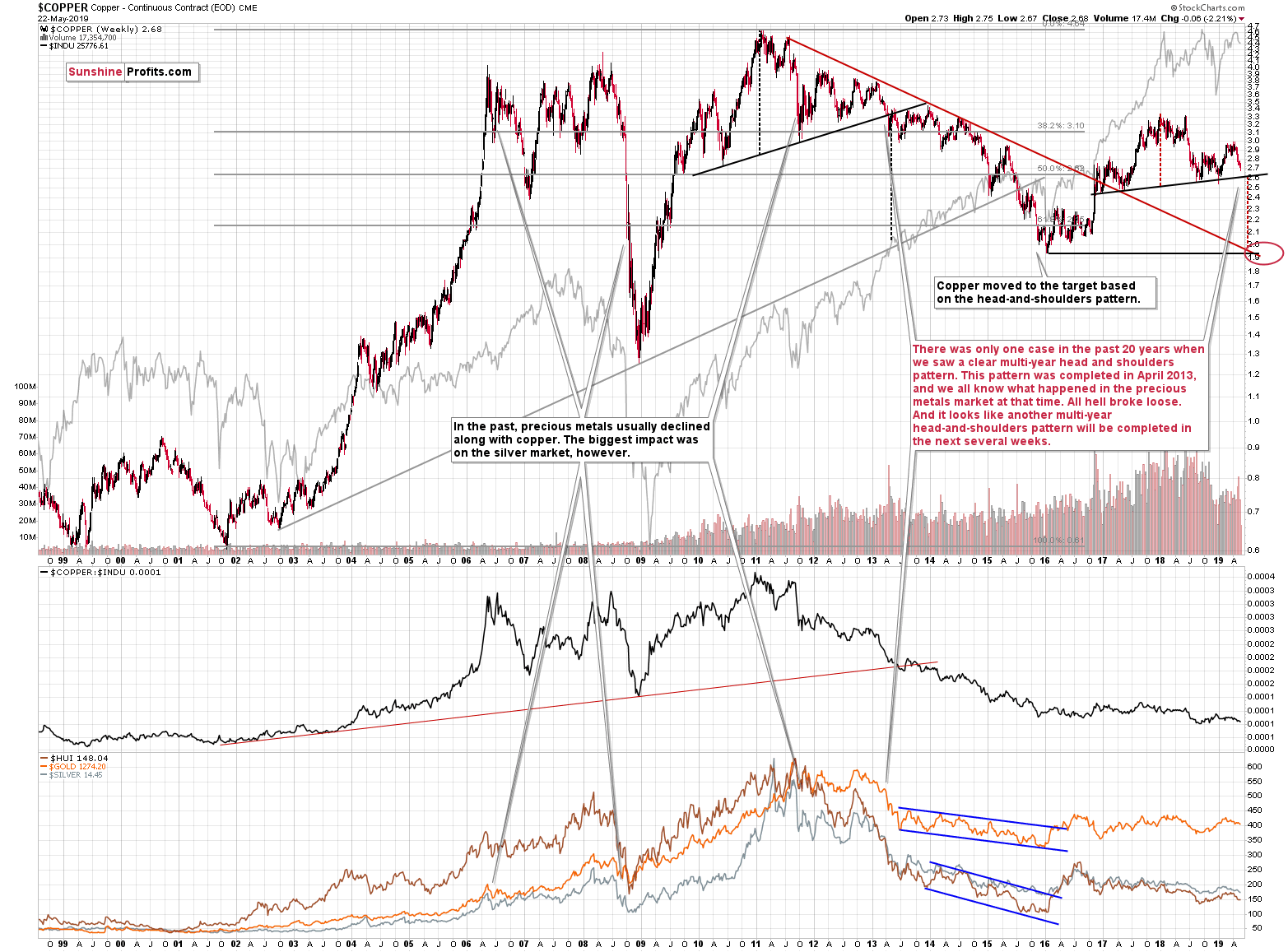

Copper. We haven't discussed it in a while, but it doesn't mean that we haven't been monitoring the developments on this market. Conversely, we have, just as we keep track of multiple other markets that might have impact on the precious metals sector, but since most of the time there are no signals, we are not reporting it.

Copper: Enter, Stage Right

To be clear, there is no definitive signal just yet. But the foundation for the epic signal is as clear as it could be. Take a look for yourself.

What we have is a huge, multi-year head-and-shoulders pattern in the making. Until it is completed, it has no implications, but the shape of the almost-complete pattern tells us that it's extremely important to monitor the situation.

Why would it be important for the precious metals' investors?

Because of what happened when the only similar multi-year head-and-shoulders pattern in copper was completed previously. It was in April 2013 and right after that all hell broke loose.

Yes, that's only one similarity in case of the copper market, but it's yet another confirmation that the current situation in the precious metals market is just like what we saw in 2012 and 2013. This means that this analogy is even more confirmed, and the implications are even more bearish for the following months.

Before summarizing we would like to let you know how our Day Trading Signals are performing. That's a timely point, because everyone can view them for free for only one more week. They show quite a lot of potential. When we announced their launch in early April, we told you that we will not tell you about the test performance, but we will show you the real-life performance instead. All of you who sent us a note, were added to our (still free) day trading mailing list and were able to monitor every trade live.

If you're not interested at all, it's safe to jump to the summary, but we still encourage you to take a look at the last 3 paragraphs of the below section.

Day Trading Signals - Quick Update

When we launched the section of the website, one trade was immediately realized (GBP/USD) before we managed to announce it, so nobody saw it. Just before the launch we had 3 other profitable trades that we initially kept in the performance table, so that it was clear what kind of price moves we were aiming to catch. But again, that was not something that you could have verified in real time. So, to keep the data consistent, and to provide more conservative numbers, we decided to remove these 4 profitable trades from the performance table.

At the beginning, you may have not been interested in this service. After all, everyone claims that their day trading market calls are and will be great. But that's usually not the case. Some say that day trading is the most difficult part of trading. In fact, we even received messages, in which our loyal subscribers suggested that we don't introduce this service at all, because it might lower the good performance of our other products. But knowing just how ridiculously profitable these Signals were during our internal tests, we knew that we can't not show it to you. You wouldn't have believed us how profitable these Signals were, so we didn't tell you - we asked you to monitor them instead.

Before sharing the up-to-date numbers, we want to tell you that there was approximately one week during the last two months that was affected by a one-of-a-kind personal event that likely impacted the results in a negative way. Looking at the performance table, you will easily notice when it was as we have kept all the results intact - exactly as they were. We have now introduced more than one counter-measure against something like that happening in the future, so I - your Editor - think that the results are likely to be better than the ones that we have to show you, in terms of both: percent of profitable trades, and number of trades. Naturally, that's just my opinion, not a guarantee, as nobody can guarantee anything with regard to any trading.

Don't get us wrong - the results are way better than what might have seen elsewhere, but we felt it necessary to highlight that they're not "artificially boosted". No. Conversely, the performance was impacted negatively by something that's unlikely to be repeated, but we will present the results with this impact anyway, because we want to keep the results overall conservative. Of course, it's up to you to decide if the above additional detail changes anything or not, but we want you to be fully informed while making your judgement.

Having said that, here's the key takeaway from the full performance table.

Between April 10th and May 22nd, our Day Trading Signals featured 38 trades and their average performance (per trade and assuming no leverage in case of cryptocurrencies and 10x leverage in case of all other assets) was 1.12%.

Starting with $50,000 on April 10th, right after we launched the Day Trading Signals service and notified you about it, one would now have $73,294, assuming that they would use no leverage for cryptocurrencies and 10x leverage for everything else. That's a simulation based on no brokerage fees, taxes, interest etc. - just the entry and exit prices for the CFDs that we based the Signals on. By the way, the futures prices will be available shortly.

That's almost $25k (almost half of the initial capital) in about 6 weeks, but let's be conservative and round it to $20k profit only. And that's based on real-time-available and verifiable data only. As always, we can't guarantee anything, but in our view, the above numbers speak for themselves.

Since it's still one week before the free trial of this service is over, it may be a good idea to sign up for the Day Trading Signals mailing list. If you're interested, please let us know, and we'll sign you up shortly.

Summary

Summing up, the outlook for the precious metals sector remains very bearish for the following weeks and months. Even if we see a daily move higher (perhaps a verification of the breakdown from the triangle pattern in the GDX), it will not change anything. The next big move lower appears to be just around the corner. The most likely time target for the next short-term (and temporary) turnaround is the end of May or the first days of June. In other words, gold might reach our interim target level of $1,240 shortly and thus we might adjust our trading position also relatively soon.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short position (250% of the full position) in gold, silver, and mining stocks is justified from the risk/reward perspective with the following stop-loss orders and exit profit-take price levels:

- Gold: profit-take exit price: $1,241; stop-loss: $1,357; initial target price for the DGLD ETN: $51.87; stop-loss for the DGLD ETN $39.87

- Silver: profit-take exit price: $13.81; stop-loss: $15.72; initial target price for the DSLV ETN: $39.38; stop-loss for the DSLV ETN $26.97

- Mining stocks (price levels for the GDX ETF): profit-take exit price: $17.61; stop-loss: $24.17; initial target price for the DUST ETF: $34.28; stop-loss for the DUST ETF $15.47

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so - we think senior mining stocks are more predictable in the case of short-term trades - if one wants to do it anyway, we provide the details), here are the stop-loss details and target prices:

- GDXJ ETF: profit-take exit price: $24.71; stop-loss: $35.67

- JDST ETF: profit-take exit price: $78.21 stop-loss: $30.97

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one, it's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (DGLD for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn't, then we will view both positions (in gold and DGLD) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Stocks traded within a short-term consolidation yesterday following their Tuesday's rebound. The S&P 500 index remains close to the 2,850 mark. Will it break below the recent local lows? Or is this just another bottoming pattern before upward reversal?

Bearish Expectations, Will Stocks Continue Lower?

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager