Briefly: in our opinion, full (150% of the regular size of the position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this Alert. Consequently, we are re-opening the position in the mining stocks, but we are lowering the overall exposure of this transaction. We are adjusting the stop-loss levels as well.

In yesterday’s analysis, we wrote that gold is likely to stop at $1,315 and gold closed yesterday’s session at $1,315. It moved visibly higher on an intraday basis, and miners – along with silver - soared to new short-term highs. Perhaps, the limit for gold’s price rally is the sky and not the $1,315 that we outlined previously? And you know what? That’s not even the most important thing right now. The most important thing is… The time.

And the time for this upswing is almost up.

Let’s discuss details, starting with gold.

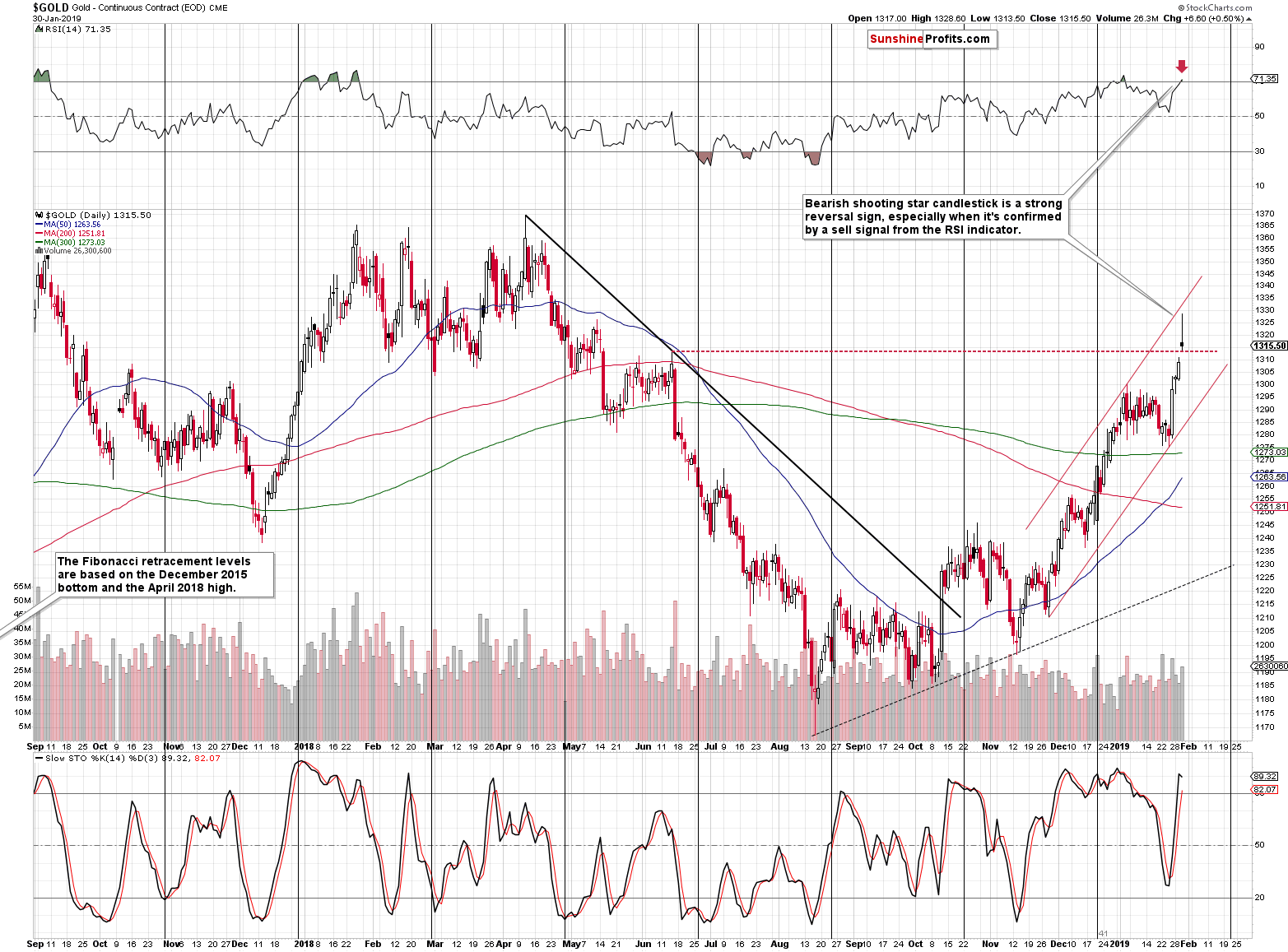

Gold’s Powerful Reversal

Quoting our yesterday’s intraday Alert:

(…) Based on the news from the Fed, gold rallied above the combination of the strong resistance levels in a very volatile manner. However, shortly after the intraday rally, gold started giving away its gains.

(…) Moreover, this means that gold is most likely almost done forming a very bearish shooting star reversal candlestick.

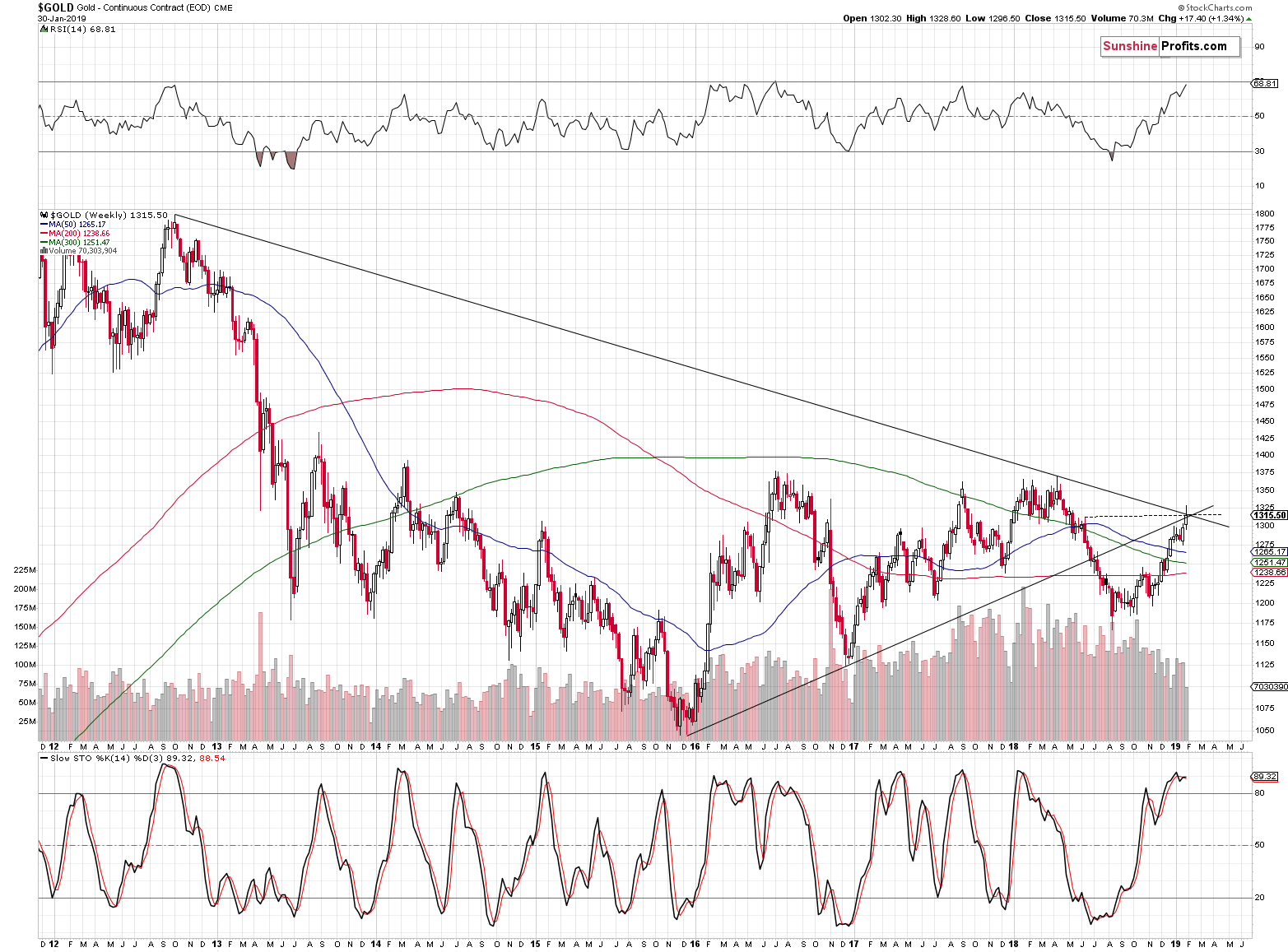

Looking at the chart, this has indeed been the case. The bearish shooting star made on significant volume that lends credibility to the fact that the buyers have been rejected with force. Even though RSI does not have a track record of always being on time calling the tops, it is just plain early, but it gets the direction of the next move right. Here, the implication is that the next sizable move will be down.

That may come any day. Today's pre-market strength (gold futures trade at $1,320 at this moment) does not change it and is a typical part of a topping process. Overall, it looks like an analogical situation to the one experienced in May 2018 and the assumption of topping action is definitely warranted. Quoting our yesterday’s Alert:

(…) Several weeks earlier, in May 2018, gold also rallied above the previous pattern and then stayed there for a second day. It declined shortly thereafter, though. Will we see the same thing this time? It’s quite possible that gold will reverse today, but – especially in light of the pre-market rally - it’s definitely not inevitable.

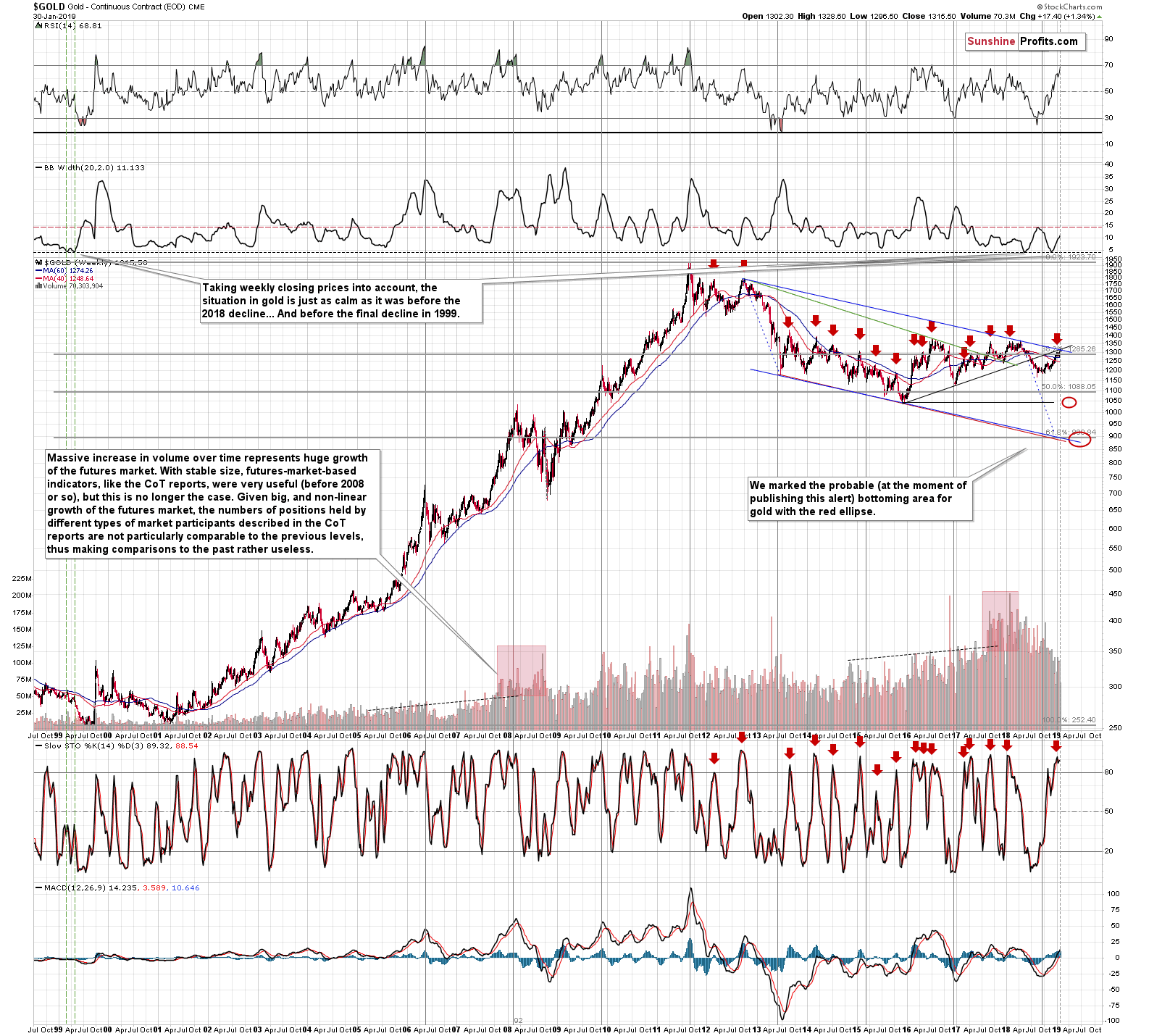

That was the very short-term point of view. The medium- and long-term factors are more important and we discussed multiple powerful reversal signs about two weeks ago. Staying on the theme, the triangle reversal technique supports the above assumption and shows yesterday's rejection of the move higher:

Let's not forget about the reversal dates being a few days away and the fact we have two significant resistance lines meeting here (marked with blue and black on the more long-term chart). This is a formidable obstacle, and a temporary short-term overshoot we are witnessing doesn't change the longer-term outlook. Markets have their own minds and ways, but, the higher timeframe factors tend to win out. Just like gravity.

We previously discussed a confirmation of the topping process – but what indicated it in the first place? The critical resistance being reached. Yesterday, we outlined the following:

The most important declining resistance line that we see on the above chart and one of the most important rising resistance lines are just above the current gold value. Only one of these lines would be strong enough to stop the rally and trigger a major reversal. We have both of them crossing each other for several days. This makes the resistance extremely strong.

This is not only a resistance – it’s the most important of the triangles that we see in gold and gold is just below its vertex. We can’t stress this enough, how important and strong both: the triangle and the resistance lines are. If one was wondering what justifies the position size that’s bigger than usual, the above serves as a critical indication that it is indeed justified.

The intersection of the two above-mentioned lines is approximately at the level of the June 2018 high – at about $1,315, which is where gold is most likely heading.

The intersection of both critical lines was reached in terms of the daily closing prices, so the top is likely in and if not, it’s not more than a few dollars away.

Now, while the top may have been reached in terms of the price, it may not have been reached in terms of the time. The exact intersection of the triangle (the vertex) is not this week, but either next week (more likely) or in 2 weeks time. Does this mean that we’ll see the continuation of the rally? Saying that would be an exaggeration. After all, we have gold at the combination of very strong resistance lines. But, what we might see is a pause, double-, or even a triple top. As you will see in the following part of this Alert, this would correspond very well to the likely action in the USD Index.

For now, let’s take a look at silver.

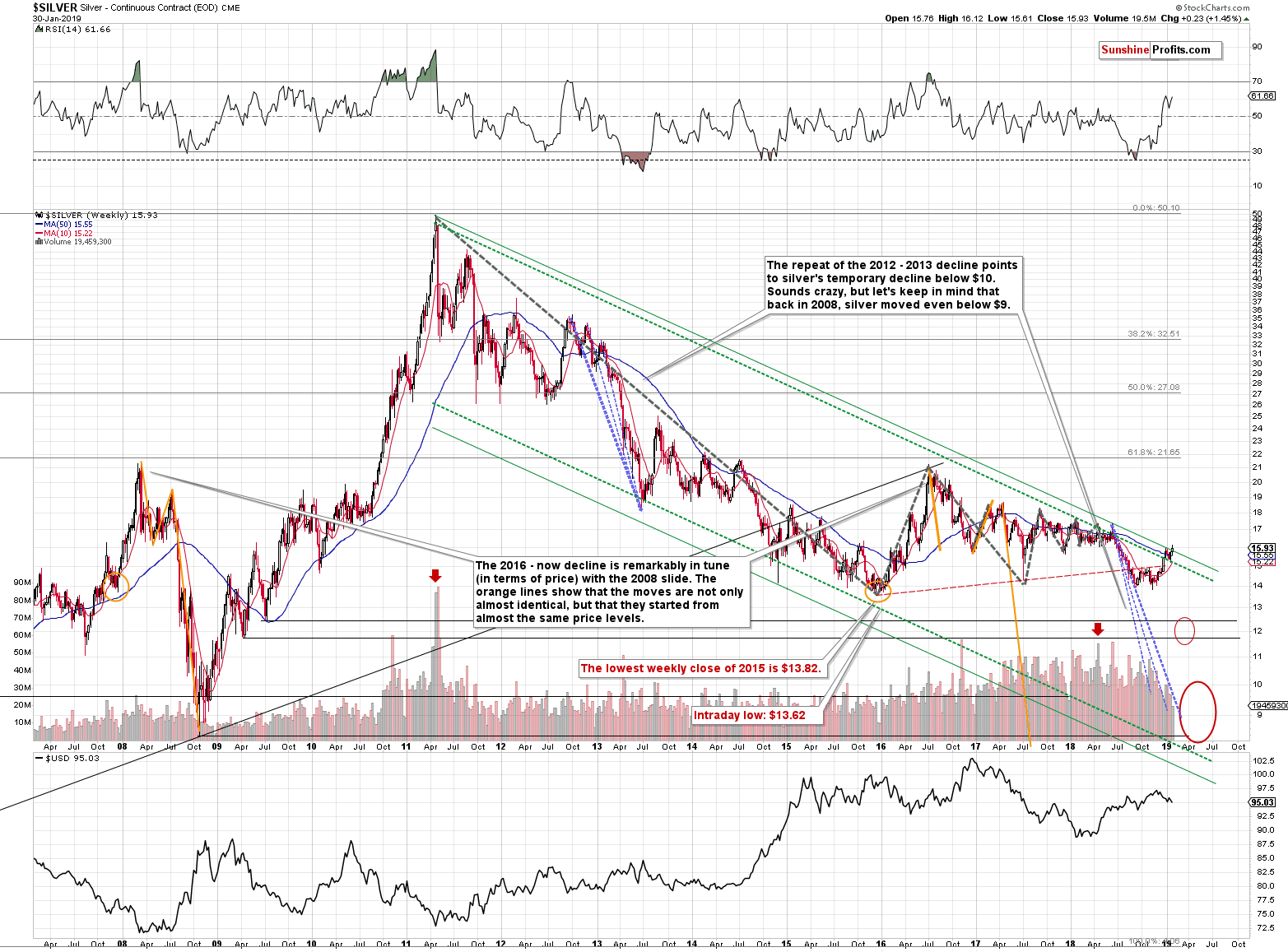

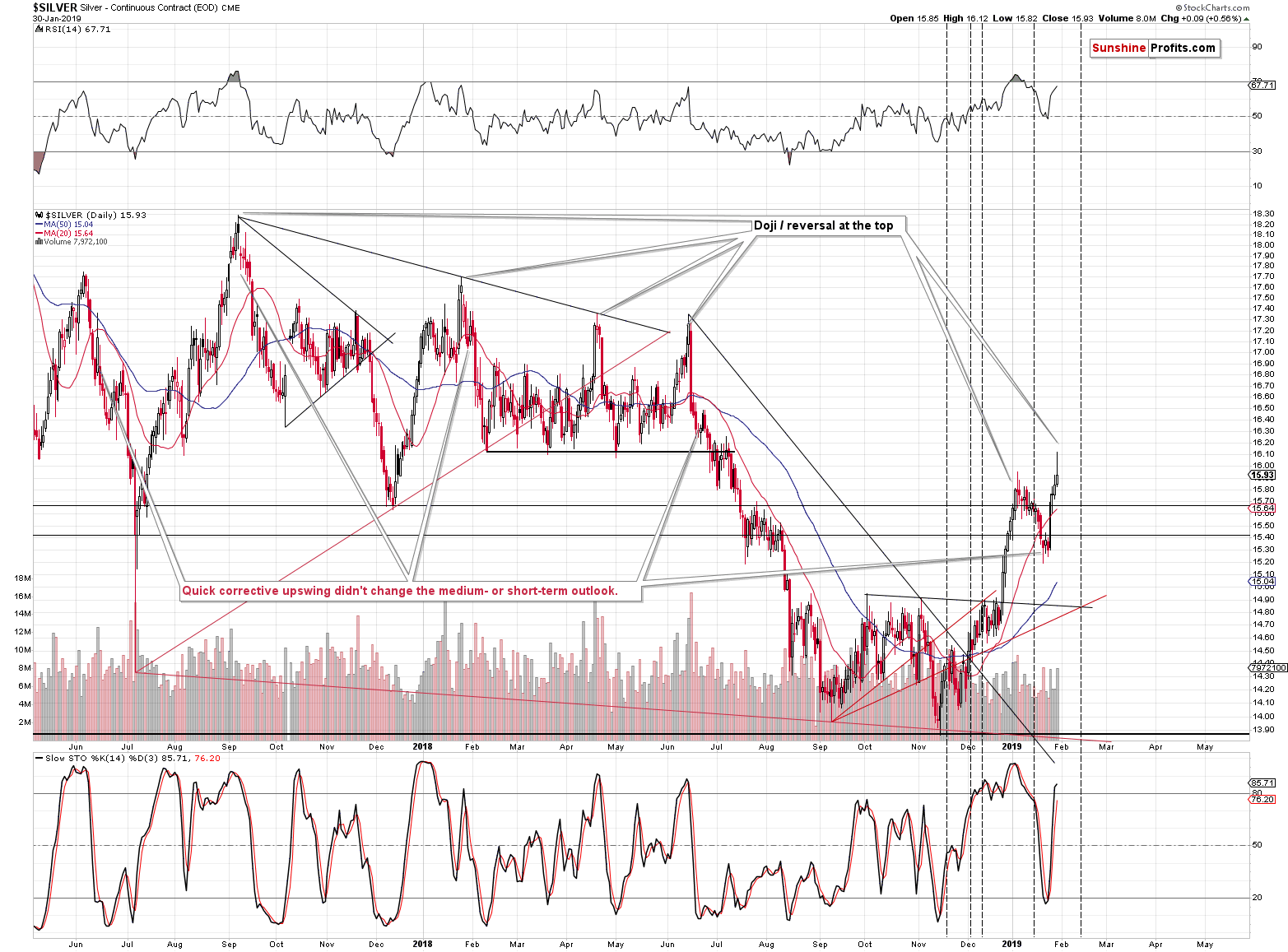

Silver vs. Its Long-term Resistance

Silver closed slightly above the declining resistance line, so the breakout was not particularly visible. By no means is the breakout confirmed.

Let’s keep in mind that silver sometimes tends to provide fake signals, so unless silver’s breakout is confirmed by a one in gold, it should not be trusted. And gold didn’t break above its long-term resistance levels in terms of the daily closing prices and we can say the same thing about gold miners. Consequently, yesterday’s move was most likely a fakeout.

On a very short-term basis, silver’s strength looks more like a weakness than a strength. The white metal initially rallied $0.28, but ended the session only $0.09 higher, giving away more than 2/3 of the initial upswing. And it formed a clear shooting star – a strong bearish sign.

In early January, we wrote the following about the way silver tends to top:

Practically all recent major tops formed this way. Sometimes silver started the session and ended it at the same price level and sometimes silver moved higher during the pre-market trading already and then declined during the day. Both mean essentially the same thing, only the time of the initial rally is a bit different.

The first type of action is represented on the above chart with doji candlesticks. The second type of action is represented by the black candlesticks that appears when silver declines between the opening and closing bells, but ultimately ends the session above the previous day’s close. All recent major tops ended in one of the above ways. The least representative case was the January 2018 top, as it’s not too similar to the doji pattern, but the intraday volatility was definitely at its peak at that time.

Moreover, please note that the tops usually took place on at least decent volume. It was big in all cases except for the September 2017 top where the volume spike took place a few days before the top. We just saw the biggest daily volume in several weeks, which definitely fits the above analogy.

All in all, even though the long-legged doji session that we just saw is – by definition – a sign of uncertainty, it is exactly this kind of performance that we saw right at the major silver tops and thus it is a strong bearish sign.

We didn’t see a doji candlestick yesterday, but we saw an even more powerful reversal candlestick and the implications are therefore even more bearish. The above-mentioned doji candlestick was indeed the top for the next several weeks, but the decline didn’t start until a few days have passed. Silver moved back and forth below the intraday top from the doji candlestick and declined not immediately, but shortly after.

The history tends to rhyme, and action similar to the above would fit the current situation very well.

What about gold miners?

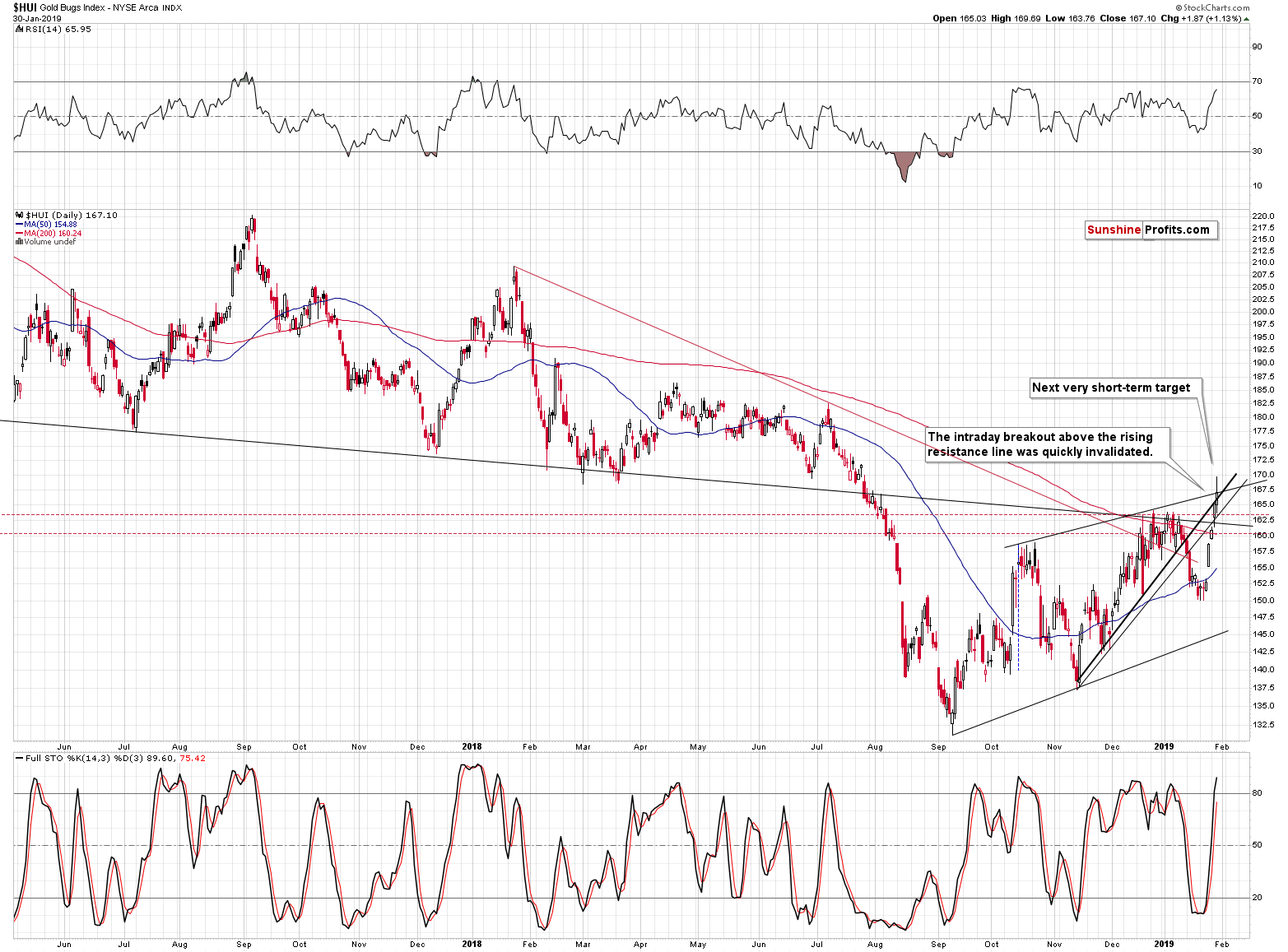

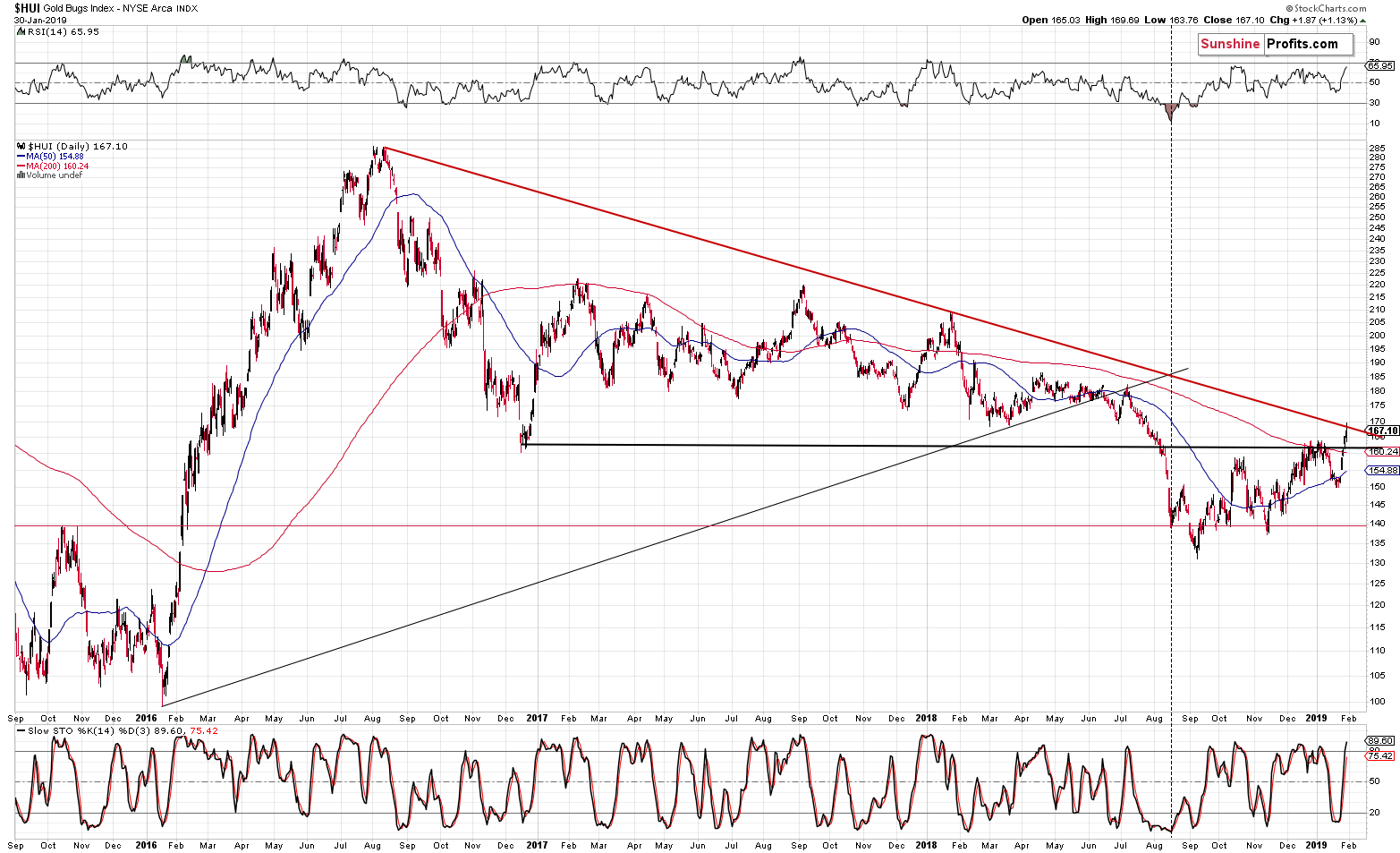

Gold Miners’ Breakout and Resistance

In short, the mining stocks reached the key resistance lines, and while the intraday move above it was surprisingly significant, the lines held in terms of the daily closing prices.

Quoting our yesterday’s analysis:

The HUI just closed the day above the lowest close of December 2016. This is a notable development. But just like it was the case with gold, there is a very strong resistance just ahead.

The line based on the 2016 and 2018 highs that we marked with red provides very strong resistance. After all, the more important the highs are that create a given line, the more important and stronger implications it has. This line is not as significant as the two lines that we see on the gold chart, but it’s definitely one of the strongest lines that we have in case of the mining stocks.

It’s at about 167 – 168, which is in tune with what we wrote based on HUI’s short-term chart. It’s only about 2 index points above yesterday’s close, so the upside for gold miners is very limited.

The above remains up-to-date. The upside is very limited, however, we cannot exclude the possibility in which there are more intraday attempts to move higher, or even a single- or double-day close above this line that is then invalidated.

Before summarizing, let’s take a look at the USD Index.

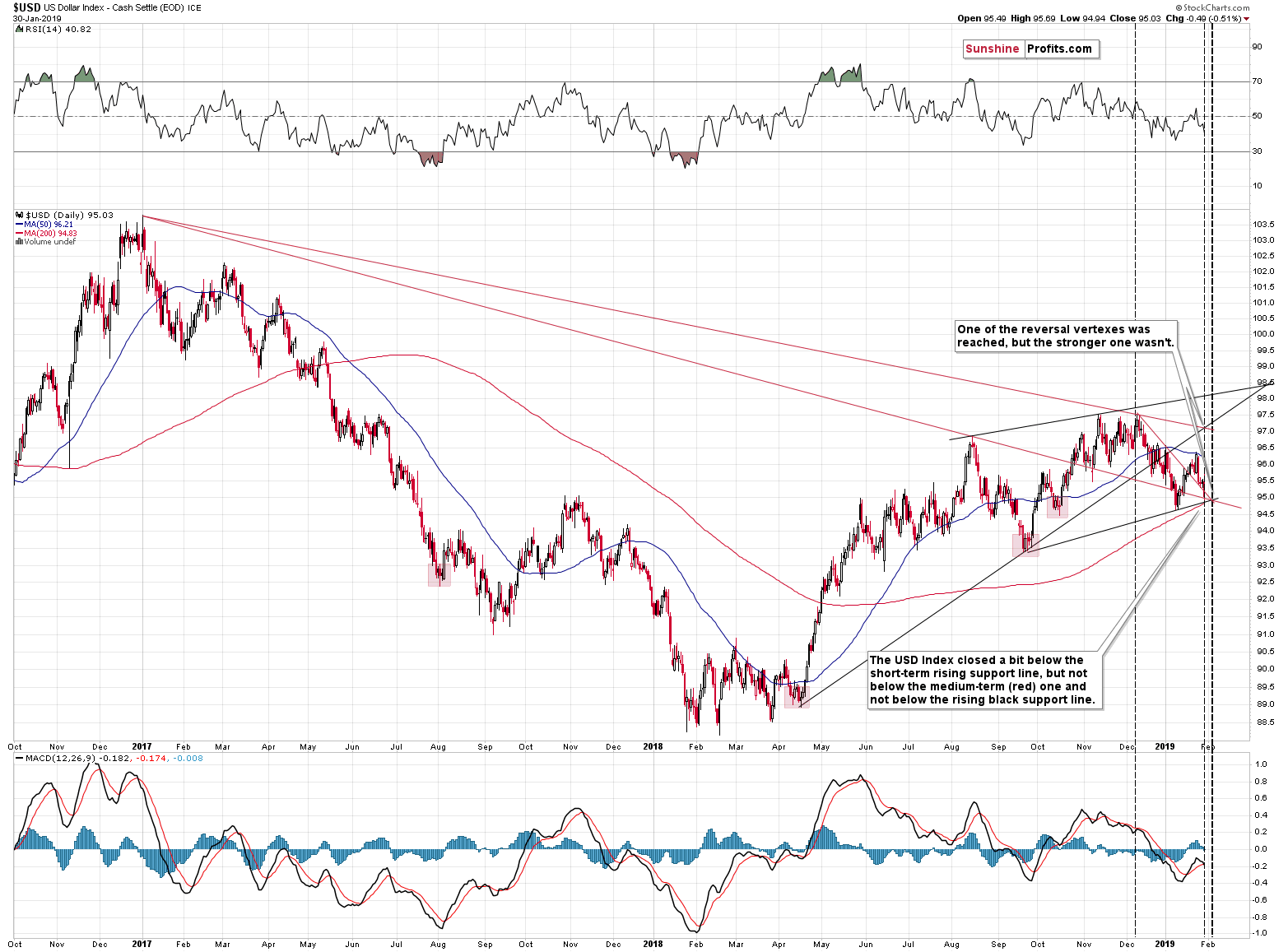

The USD Index and Its Upcoming Reversals

The USD Index moved a bit below the most short-term declining support line but it stopped at medium-term line based on the January 2017 and August 2018 tops. It’s also above the rising line based on the September 2018 and January 2019 bottoms. Consequently, instead of viewing yesterday’s slide as a breakdown, it seems more appropriate to view it as a move to the strong support area.

Was the final low reached? It’s certainly possible, but the USDX could briefly move to the January lows before rallying. The USD Index has been moving lower on a short-term basis and we have an upcoming reversal that’s based on several vertexes of triangles that confirm each other. We also have one smaller reversal that took place yesterday.

To be clear, the USDX doesn’t have to decline until the second reversal day – it can just trade sideways and start the rally in the first days of February.

How far could it fall? Not far – the January 2019 low is the lowest of the nearby support levels and we expect it to hold even if the combination of the support lines doesn’t. The more important thing is the looming reversal that’s confirmed by analogous indications for gold, silver, and mining stocks.

But could the USD Index simply trade sideways for a few days and bottom in this way? Yes and it would not be anything odd. In fact, it’s one of the most common ways for the USD Index to form its bottoms. We marked several bottoms with red rectangles – they all formed in this way. In particular, the mid-October 2018 bottom looks interesting. The USDX first moved a bit higher, then erased this small move lower and then formed the final intraday low. Then we saw much higher USDX values.

Summary

Summing up, the strong resistance levels in gold and mining stocks that we featured previously, were reached and they stopped the rally in terms of the daily closing prices, so the medium-term outlook didn’t change. Neither the intraday moves above the resistance in gold or gold stocks, nor silver’s daily closing price slightly above its own resistance invalidate the above. Silver is known for its fakeouts that are not and it seems to be one of them.

The very important detail about yesterday’s price moves is that they took place in light of a very positive news from the Fed. The thing is that the dovish comments from the Fed (“the case for raising rates has weakened somewhat”) should have caused a much more spectacular rally. Despite the intraday rally, gold ended the session just $7 higher, while it could have easily (based on the news alone) rallied 4 – 10 times more.

One of the most bullish situations is in any market is when everything that could go wrong for it… Already did. The best confirmation of such bullishness is when the market doesn’t decline despite the facts that should make it decline. We seem to have just witnessed the exact opposite of the above. Gold doesn’t really want to move higher from here, and its technical situation is perfect for a start of a profound decline to the final lows of the prolonged slide that started in 2011.

The upside remains limited, while the downside remains enormous. However, since the turning points have not yet been reached (there are several more days) it wouldn’t be surprising to see a pause here or a brief decline that is immediately followed by a re-test of yesterday’s intraday highs.

Consequently, the short position remains justified, but given the level of volatility that we just saw, it’s possible that we will still see some short-term strength. The latter would be likely invalidated soon, but in case it’s a lot in terms of price moves, we prefer to temporarily lower the exposure. We will most likely increase it once again shortly.

As always, we’ll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short positions (150% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and exit profit-take price levels:

- Gold: profit-take exit price: $1,062; stop-loss: $1,337; initial target price for the DGLD ETN: $82.96; stop-loss for the DGLD ETN $41.27

- Silver: profit-take exit price: $12.32; stop-loss: $16.44; initial target price for the DSLV ETN: $47.67; stop-loss for the DSLV ETN $24.18

- Mining stocks (price levels for the GDX ETF): profit-take exit price: $13.12; stop-loss: $23.27; initial target price for the DUST ETF: $80.97; stop-loss for the DUST ETF $16.27

Note: the above is a specific preparation for a possible sudden price drop, it does not reflect the most likely outcome. You will find a more detailed explanation in our August 1st Alert. In case one wants to bet on junior mining stocks’ prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and target prices:

- GDXJ ETF: profit-take exit price: $17.52; stop-loss: $34.62

- JDST ETF: initial target price: $154.97 stop-loss: $35.87

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Important Details for New Subscribers

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Big win for the doves! And for gold, as it jumped above $1,320 amid the soft FOMC statement. What’s next?

Will Fed’s Dovish Shift Support Gold?

Stocks rallied on Wednesday following the Fed's Rate Decision announcement. The broad stock market extended its month-long advance, as the S&P 500 index got closer to the 2,700 mark. Will the uptrend continue today?

Rally After Fed, but Will Uptrend Continue?

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager