Briefly: in our opinion, full (300% of the regular position size) speculative short positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

Today’s short-term analysis will once again be in video format. However, to make a long story short, the precious metals sector declined yesterday, and what we wrote previously remains up-to-date.

Having said that, let’s take a look at the markets from a more fundamental angle.

It’s March Madness All Over Again for Gold

With China ending its zero-COVID policy on Dec. 26, the bulls rejoiced as the second-largest importer should uplift economically-sensitive commodities; and with the optimism spreading to the precious metals, gold, silver and mining stocks joined in the festivities. However, while immaterial catalysts help push the PMs higher, the domestic fundamentals continue to deteriorate.

For example, we’ve noted how the U.S. 10-Year real yield has risen rapidly in December; and after ending the Dec. 27 session at 1.58%, the metric has rallied by 50 basis points from its Dec. 2 low, and is only 16 basis points below its 2022 high.

Furthermore, with nominal interest rates seeking higher ground as well, ignoring the developments came back to haunt the bulls in 2021 and 2022.

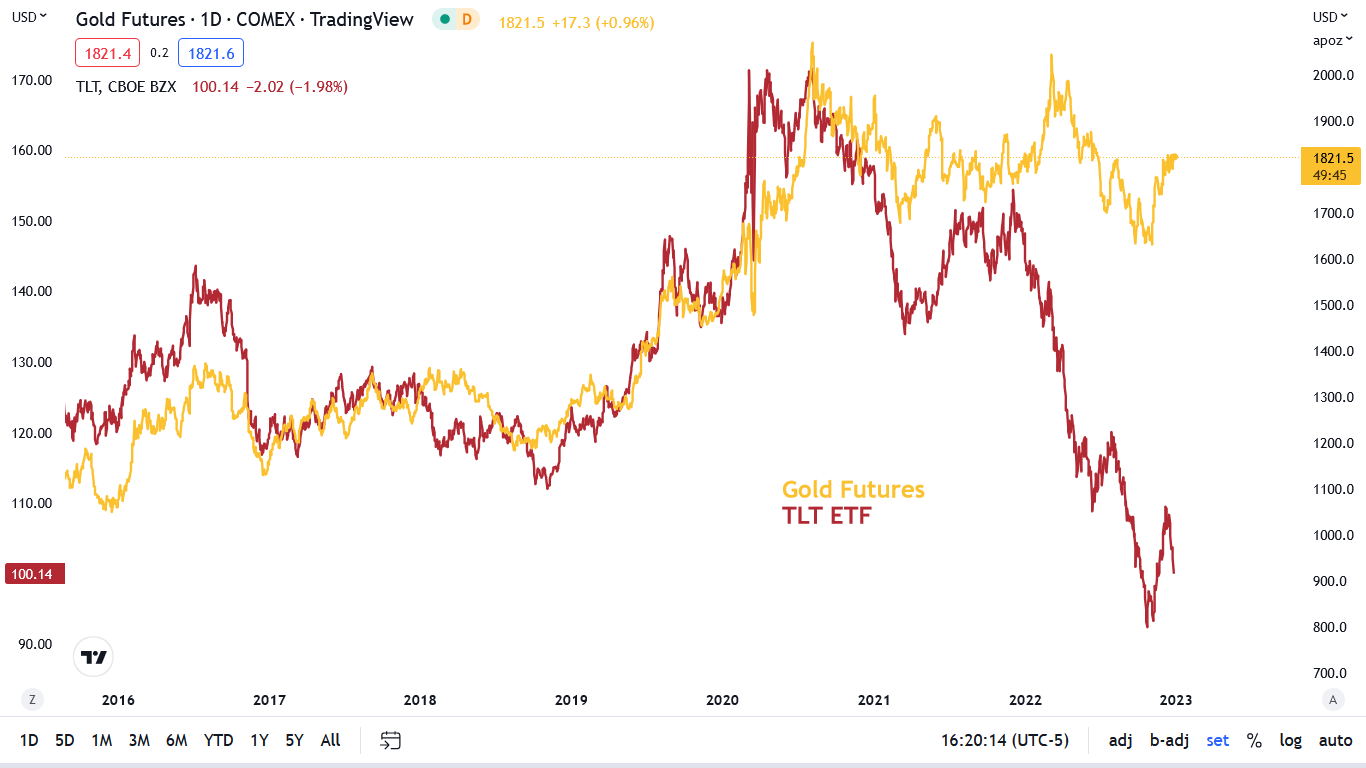

Please see below:

To explain, the gold line above tracks the gold futures price, while the red line above tracks the iShares 20+ Year Treasury Bond (TLT) ETF. For context, bond prices move inversely to interest rates, so the TLT ETF declines when long-term interest rates rise.

If you analyze the relationship, you can see that the pair had largely moved in lockstep in the years before the pandemic. Yet, with misguided investors assuming that new rules apply post-pandemic, the yellow metal has outperformed the TLT ETF.

Conversely, the divergences on the right side of the chart highlight how gold declined sharply when it attempted to run away from the TLT ETF. In mid-2021, the red line declined materially as long-term interest rates rose and gold headed in the opposite direction. Soon after, though, gold suffered a sharp drawdown and gave back most of its gains.

Likewise, when the Russia-Ukraine crisis sent gold soaring in February/March 2022, the TLT ETF was already in the midst of its monumental decline; and surprise, surprise, the gold price fell hard and sunk to new lows.

So, with the red line declining on the right side of the chart, the TLT ETF has given back roughly half of its countertrend rally. Conversely, gold continues to rise, and another divergence has materialized.

Thus, with a third rendition unfolding now, we expect the gold price to fall sharply in the months ahead. Remember, the Fed needs higher long-term interest rates to cool inflation, and the recent economic data has been hawkish, not dovish. That’s why the TLT ETF is down by 8.5% from its December closing high.

On top of that, the global liquidity drain continues to accelerate, as the Fed, the ECB, and even the BOJ have upped the hawkish ante. As such, while stocks and bonds got the bearish memo in February/March 2022, the PMs were the last to suffer; and with stocks and bonds selling off in December, the PMs are ignoring the developments at their own peril. Consequently, gold’s medium-term outlook remains highly bearish.

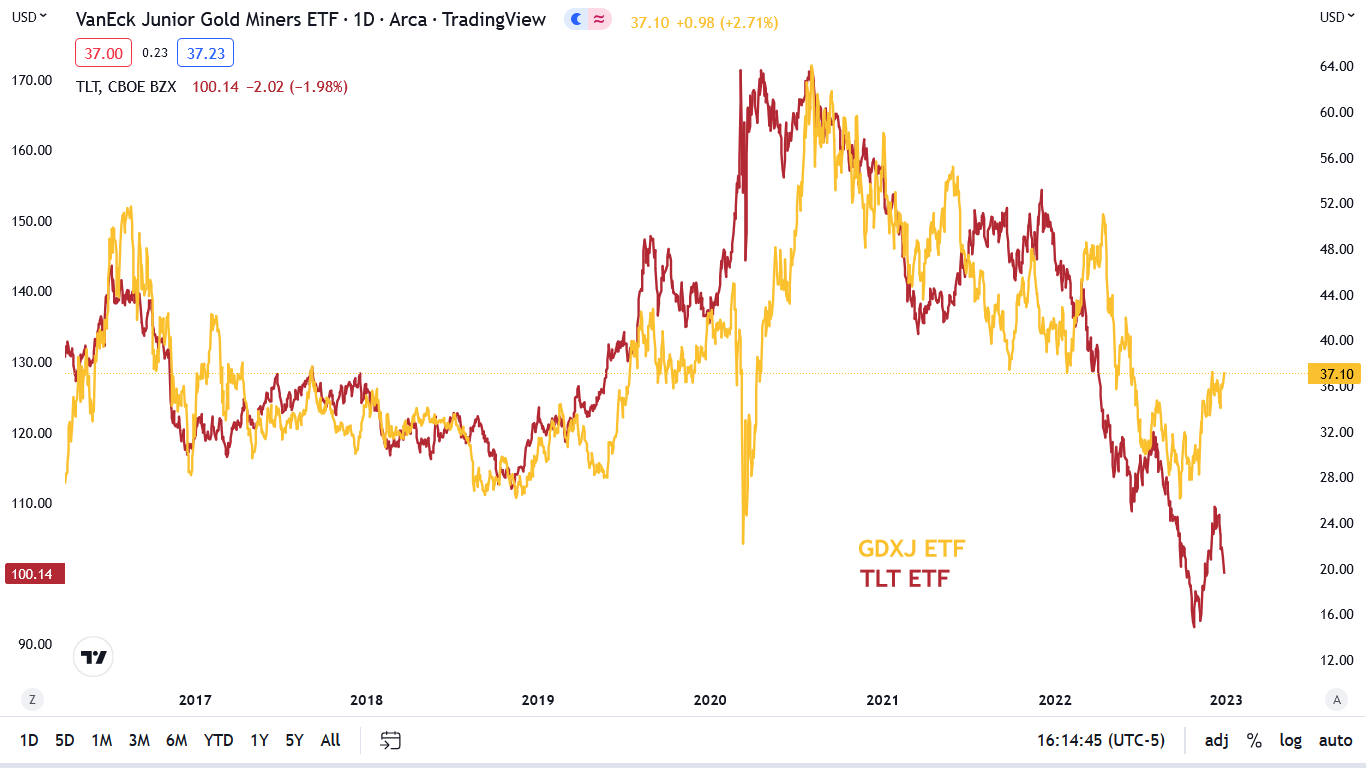

From another angle, while the GDXJ ETF’s rally has been more pronounced relative to gold, its medium-term plight has almost mirrored the TLT ETF. Therefore, its likely reversal should be even sharper.

Please see below:

To explain, the gold line above tracks the GDXJ ETF, while the red line above tracks the TLT ETF. If you analyze the relationship, you can see that the GDXJ ETF has been more volatile than gold, and it’s also declined by more from its post-pandemic high.

In addition, with a similar divergence on the right side of the chart, the TLT ETF’s recent rout highlights why the PMs’ uprisings are unsustainable. Not only are non-yielding assets less attractive when interest rates rise, but we saw this movie throughout 2021 and 2022: when momentum investors decouple the PMs from long-term nominal and real yields, sharp drawdowns unfold when they rush for the exits.

Please remember that momentum investors don’t care about the fundamentals. As long as their algorithms are flashing green, they ride the hot hand until sentiment shifts. However, the gambit is risky because waterfall declines often occur when everyone tries to exit at once, and the next bout of panic should be no different.

On top of that, while we warned throughout 2021 and 2022 that interest rates would rise from the ashes, the fundamentals still support a higher U.S. federal funds rate (FFR) in 2023. For context, while the consensus has predicted demand destruction for many months, we warned that American households are still flush with cash. We wrote on Dec. 13:

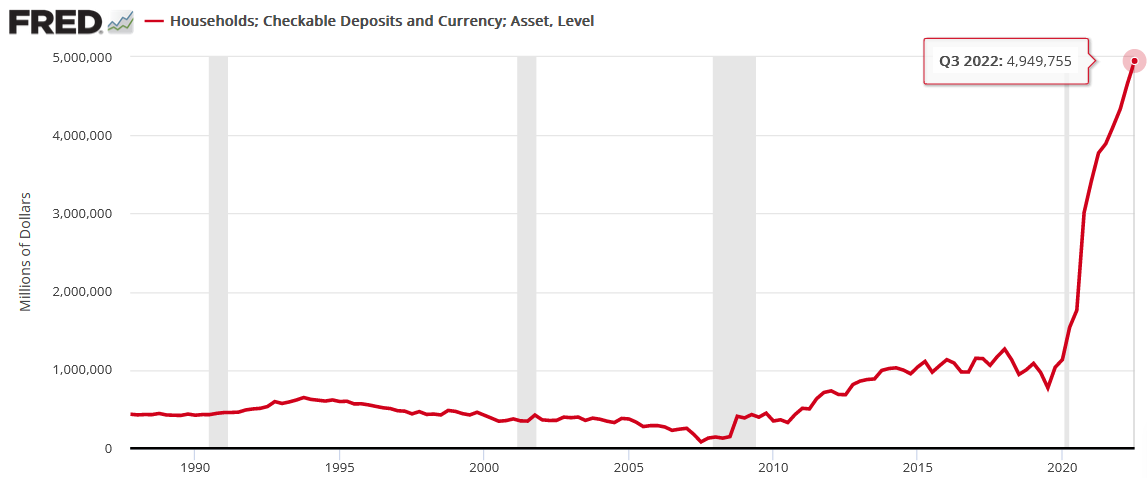

While the FFR has surged in 2022 and the crowd still assumes that demand will collapse, the Fed revealed on Dec. 9 that U.S. households have a record ~$4.95 trillion (as of Q3 2022) in their checking and/or demand deposit accounts, which is 379% more than Q4 2019 and 6.3% more than Q2 2022.

Please see below:

While investors wait for a destitute consumer to reduce inflation and allow the Fed to pivot, the vertical ascent on the right side of the chart above highlights the profound stimulus imbalance that materialized during the pandemic; and with wage growth also near an all-time high, investors are kidding themselves if they think monetary policy can return to its pre-pandemic state when Americans’ checking account balances have gone parabolic.

To that point, Mastercard revealed on Dec. 26 that holiday retail sales remained buoyant. The report stated:

“U.S. retail sales excluding automotive increased 7.6% year-over-year (YoY) this holiday season, running from November 1 through December 24…. Online sales grew 10.6% compared to the same period last year,” while “in-person dining continued to show strong momentum with restaurants up 15.1% YoY.”

Michelle Meyer, North America Chief Economist at the Mastercard Economics Institute, said:

“Inflation altered the way U.S. consumers approached their holiday shopping – from hunting for the best deals to making trade-offs that stretched gift-giving budgets. Consumers and retailers navigated the season well, displaying resilience amid increasing economic pressures.”

Please see below:

Overall, the fundamentals continue to unfold as expected: U.S. consumers remain resilient, and their ability and willingness to spend should keep the economic data elevated and put upward pressure on interest rates. As a result, with nominal and real yields on the rise in December, it’s likely only a matter of time before the PMs follow stocks and bonds lower.

Is Silver Investors New Superhero?

While a lack of positive signals helped the S&P 500 continue its recent downtrend, silver could care less. Despite the index’s plight, rising nominal and real yields, and liquidity-fueled assets being left for dead (like Bitcoin and the ARKK ETF), the silver price behaves as if none of it matters.

Although, while its resilient response may seem like a sign of strength, we know from experience that silver’s outperformance is bearish, not bullish. So, while the momentum investors have ditched stocks and bonds and piled into the PMs, the ominous fundamentals should reign supreme in the months ahead.

For example, nine of the last 10 inflation fights have ended with recessions since 1948; and when liquidations occur, risk assets suffer mightily. As evidence, we wrote on Nov. 28:

Since no bear market since 1929 has ended before a recession began, a confluence of historical data materially contrasts the bullish narrative.

Please see below:

To explain, the light green blocks above represent bear markets and the horizontal dark green lines represent recessions. The data shows that bear markets suffer more downside when recessions hit, while the gray arrows show that bear markets without recessions are often short-lived.

Furthermore, since a recession hasn’t occurred in 2022, the bulls can point to 1966 and 1987 as similar analogies. However, with significant economic weakness poised to materialize as the Fed battles inflation, even the FOMC thinks a 2023 recession is highly likely. As such, this bear market should have plenty of room to run.

To that point, history shows that battling inflation is highly troublesome, and higher interest rates should demonstrate their might in 2023.

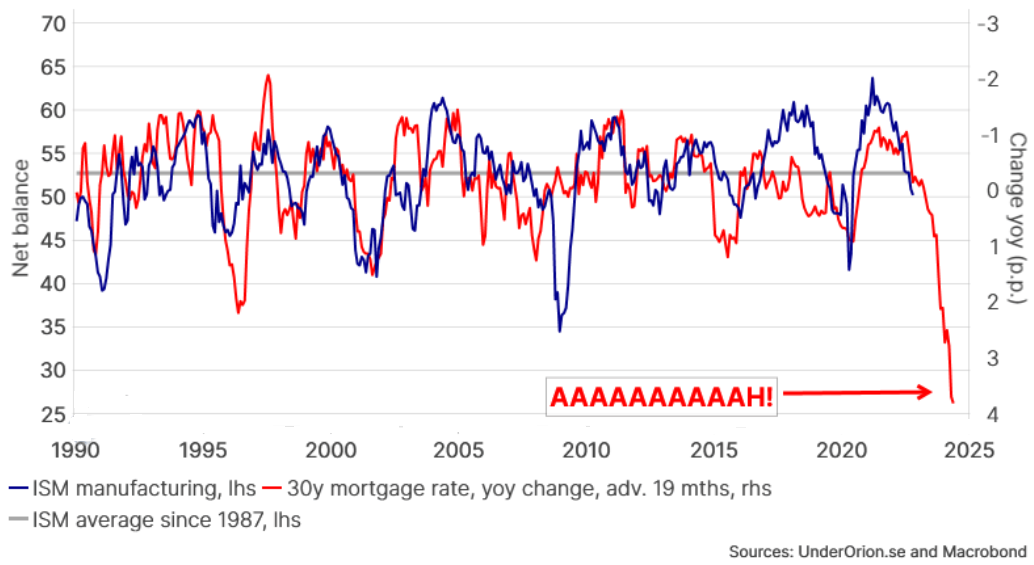

Please see below:

To explain, the blue line above tracks the Institute for Supply Management’s (ISM) manufacturing PMI, while the red line above tracks the inverted (down means up) YoY change in the 30-year fixed mortgage rate (30YM).

If you analyze the relationship, you can see that higher long-term mortgage rates often capsize demand and weigh on the American manufacturing sector. Moreover, while an ISM PMI below 50 signals a contraction in economic output, the red line on the right side of the chart is calling for ~25. Therefore, major economic slack could materialize in 2023.

Yet, please note that the 30YM often leads the ISM PMI by 19 months, so it’s not an instantaneous recalibration. But, with a higher FFR needed to curb inflation, higher Treasury yields and mortgage rates should be the drivers of a late 2023 recession.

In addition, with U.S. banks tightening their lending standards, their credit conservatism is another indicator of trouble ahead.

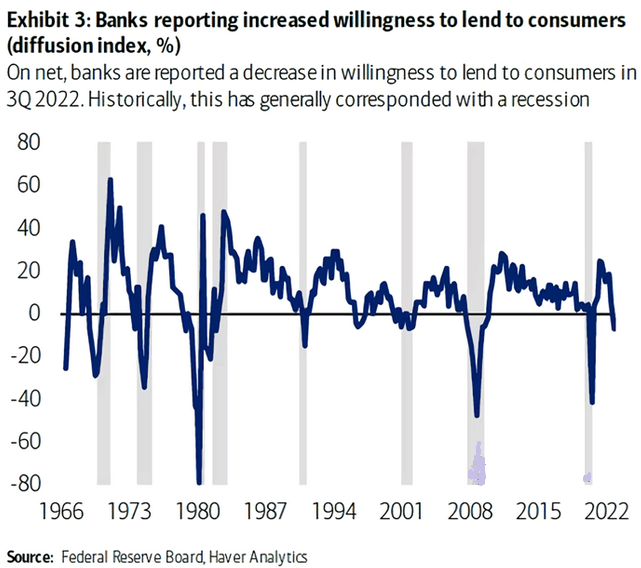

Please see below:

To explain, the blue line above tracks the net percentage of banks that are more/less willing to lend money to consumers. If you analyze the relationship, you can see that recessions (the vertical gray bars) often follow when the spread turns negative.

As such, with the blue line falling below zero on the right side of the chart, the implications are bearish and silver has not priced in the ramifications.

Speaking of which, if a recession occurs in late 2023, a liquidation-style event will likely upend all risk assets, especially the S&P 500, silver and mining stocks.

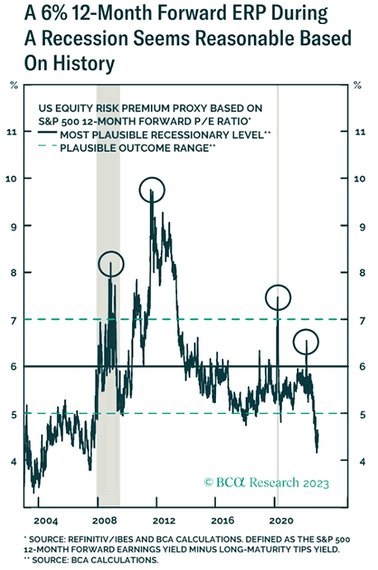

Please see below:

To explain, the green line above tracks the S&P 500’s equity risk premium (ERP). If you analyze the right side of the chart, you can see that the abnormally low reading rivals the compliancy that occurred before the 2008 global financial crisis (GFC).

Furthermore, the black circles above show how high the metric can rise when bouts of panic occur. Therefore, while a mild recession could normalize the ERP near 6%, a hard landing could push it toward the 7% to 10% range. Consequently, with the current ERP closer to 4%, investors are pricing in an unrealistic outcome, and a profound wake-up call should commence in the months ahead.

Overall, while silver has been unflappable in the face of several bearish developments, it’s likely only a matter of time before reality remerges. Throughout 2021 and 2022, we witnessed periods where the PMs ignored the plight of stocks and bonds, only to suffer sharp drawdowns soon after. Thus, is this time really different?

The Bottom Line

Santa has come and gone, and the S&P 500 was left without any presents. Moreover, the U.S. 10-Year real yield is gunning for its 2022 high, the ARKK ETF sunk to a new 2022 low, and Tesla – which was one of the largest S&P 500 companies – has crashed by more than 40% in December. So, while the PMs believe these issues don’t impact them, their confidence is misguided, and the momentum investors should regret their dismissal of the fundamentals over the medium term.

In conclusion, the PMs rallied on Dec. 27, as the commodity bulls celebrated China’s new COVID-19 policy. Yet, divergences are popping up everywhere, and history shows they don’t last forever. As a result, reversals are on the horizon, and we believe they will be driven by lower precious metals prices.

Overview of the Upcoming Part of the Decline

- It seems to me that the corrective upswing is over (or about to be over) and that the next big move lower is already underway (or that it’s about to start).

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place and if we get this kind of opportunity at all – perhaps with gold prices close to $1,500 - $1,550.

- I plan to switch from the short positions in junior mining stocks or silver (whichever I’ll have at that moment) to long positions in junior mining stocks when gold / mining stocks move to their 2020 lows (approximately). While I’m probably not going to write about it at this stage yet, this is when some investors might consider getting back in with their long-term investing capital (or perhaps 1/3 or 1/2 thereof).

- I plan to return to short positions in junior mining stocks after a rebound – and the rebound could take gold from about $1,450 to about $1,550, and it could take the GDXJ from about $20 to about $24. In other words, I’m currently planning to go long when GDXJ is close to $20 (which might take place when gold is close to $1,450), and I’m planning to exit this long position and re-enter the short position once we see a corrective rally to $24 in the GDXJ (which might take place when gold is close to $1,550).

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold prices close to $1,400 and GDXJ close to $15 . This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,400, but at the moment it’s too early to say with certainty.

- The above is based on the information available today, and it might change in the following days/weeks.

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding nor clear enough for me to think that they should be used for purchasing options, warrants, or similar instruments.

Letters to the Editor

We received a few messages over e-mail, but as we are moving to our new platform, we will be transferring them below the articles as comments – and that’s where we’ll be replying to them.

Asking your questions below the articles or in the spaces called “Ask the Community” or “Position Sizes” directly will help us deliver a reply sooner. In some cases, someone from the community might reply and help even before we do.

Please remember about the Pillars of our Community, especially about the Kindness of Speech Pillar.

Also, if there’s anything that you’re unhappy with, it’s best to send us a message at [email protected].

Please note that this section is going to go away within the next 1-8 weeks, as you can add comments/questions below the article on Golden Meadow – the platform that we’re using to provide our analyses. Your notification e-mails include an invitation link that allows you to access the “Gold Trading Alerts” space.

Also, if you haven’t had the chance to see the video, in which I’m talking about the new platform and why we essentially moved from Sunshine Profits to Golden Meadow, I strongly encourage you to do so:

Summary

Summing up, it seems that the major bottom in the USD Index is in, while the correction in stocks, gold, silver, and mining stocks is over.

The nature of the recent corrections was mostly technical and rumor-based. The rumor was that the Fed would be making a dovish U-turn soon, and it recently became clear that this was not going to be the case. Consequently, the corrective upswing is likely to be reversed, and medium-term downtrends are likely to resume.

In my opinion, the current trading position is going to become profitable in the following weeks, and quite possibly in the following days. And while I can’t promise any kind of performance, I fully expect it to become very profitable before it’s over and to prolong our 2022 winning streak.

After the final sell-off (that takes gold to about $1,350-$1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

As always, we'll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $20.32; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged). The binding profit-take level for the JDST: $22.87; stop-loss for the JDST: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures downside profit-take exit price: $14.32

SLV profit-take exit price: $13.42

ZSL profit-take exit price: $48.87

Gold futures downside profit-take exit price: $1,504

HGD.TO – alternative (Canadian) 2x inverse leveraged gold stocks ETF – the upside profit-take exit price: $16.47

HZD.TO – alternative (Canadian) 2x inverse leveraged silver ETF – the upside profit-take exit price: $36.87

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you’ve already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (as it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief