Briefly: in our opinion, full (300% of the regular position size) speculative short positions in mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

Despite all the bullish investor sentiment and a collective habit of ignoring obvious warning signs, the precious metals and equities are right on track... downwards that is.

The precious metals and the USD Index are not moving significantly this week, but there are subtle clues that continue to point to lower PM prices.

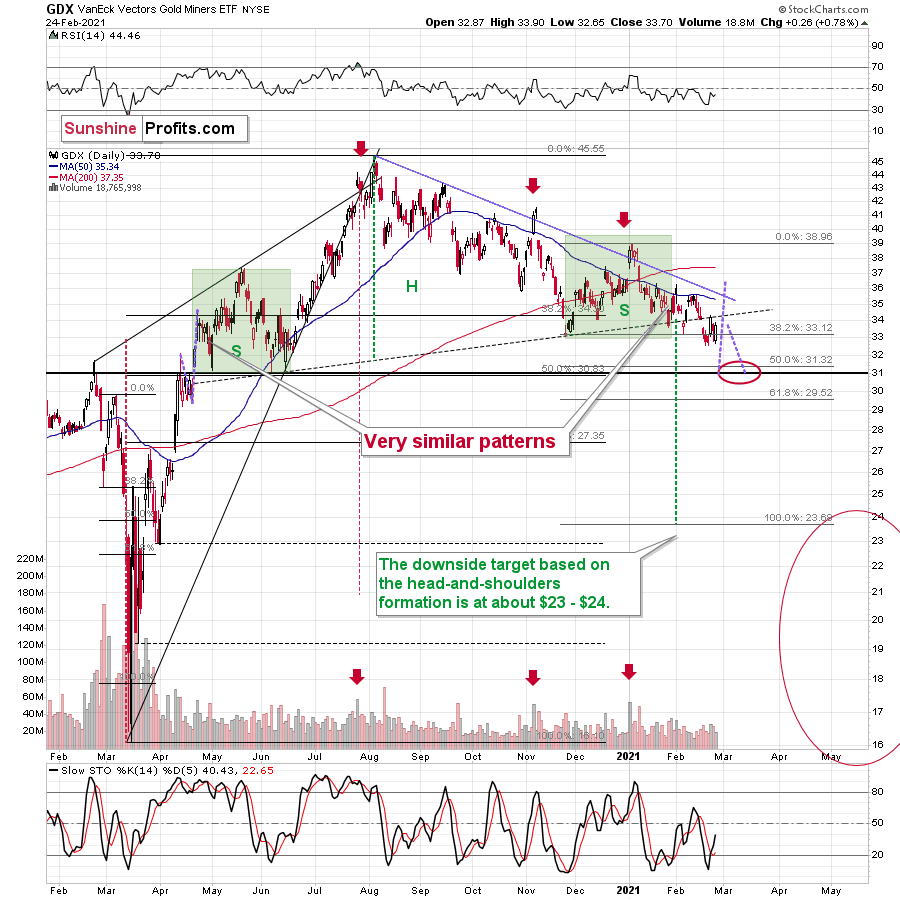

This is definitely the case with the mining stocks. They are consolidating, but they are doing so below the neck level of the head and shoulders formation, which means that the recent back and forth movement simply validates the breakdown. It doesn’t mean that miners are “considering rallying”, but rather that they are preparing for a move lower.

Figure 1

Despite Monday’s (quite sharp for a daily move) upswing, the breakdown below the neck level of the broad head-and-shoulders remains intact. It wasn’t invalidated. In fact, based on Monday’s rally and the subsequent decline, it was verified. One of the trading guidelines is to wait for the verification of the breakdown below the H&S pattern before entering a position.

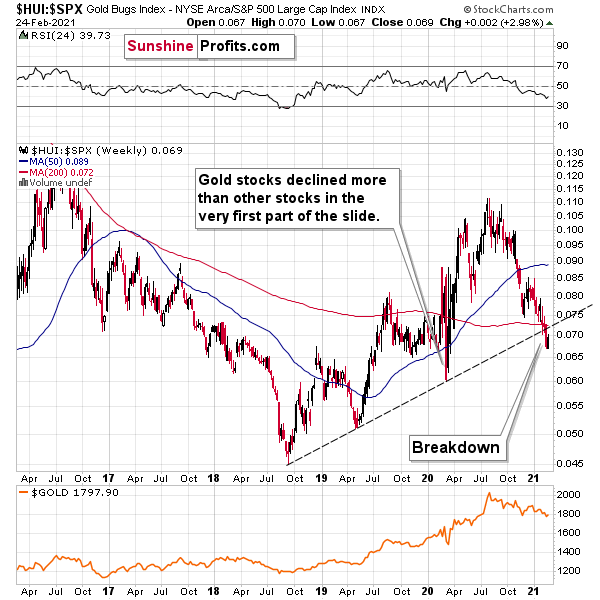

What about gold stocks ratio with other stocks?

Figure 2

It’s exactly the same thing. Nothing changed since yesterday. The breakdown below the rising long-term support line remains intact. The recent upswing was just a quick comeback to the broken line that didn’t take it above it. Conversely, the HUI to S&P 500 ratio declined once again.

Consequently, bearish implications of the breakdowns remain up-to-date.

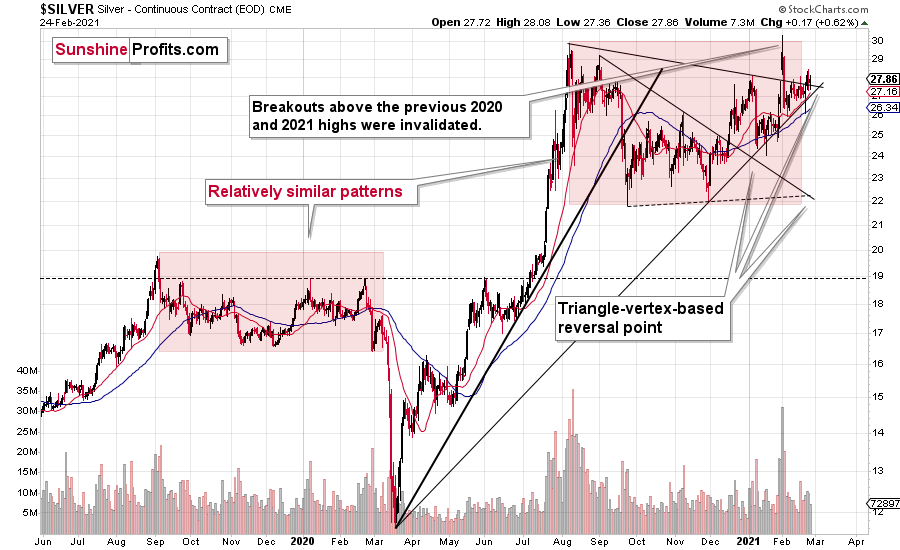

Silver just went through a triangle-vertex-based reversal, and it seems to have indeed triggered a reversal.

Figure 3

Silver moved a bit higher yesterday (Feb. 24) and in today’s pre-market trading, but it didn’t exceed the recent high. This means that my previous comments on the above chart remain up-to-date:

The move lower is not yet super significant, but given the reversal point, it could just be the beginning. Remember the triangle-vertex-based reversal at the beginning of the year? Back then, practically nobody wanted to believe that silver and the precious metals market was topping at that time. It was the truth, though. Gold and mining stocks were never higher since that time and the same thing would have most likely happened to silver if it wasn’t the #silversqueeze popularity that gave it its most recent boost.

Now, there’s also another triangle-vertex-based-reversal in a few days, and since these reversals tend to work on a near-to basis, silver might top any day now, even if it hasn’t topped earlier today.

Gold moved lower once again, and it currently seems to be invalidating its recent breakout. That’s something that I previously commented on in the following way:

Figure 4

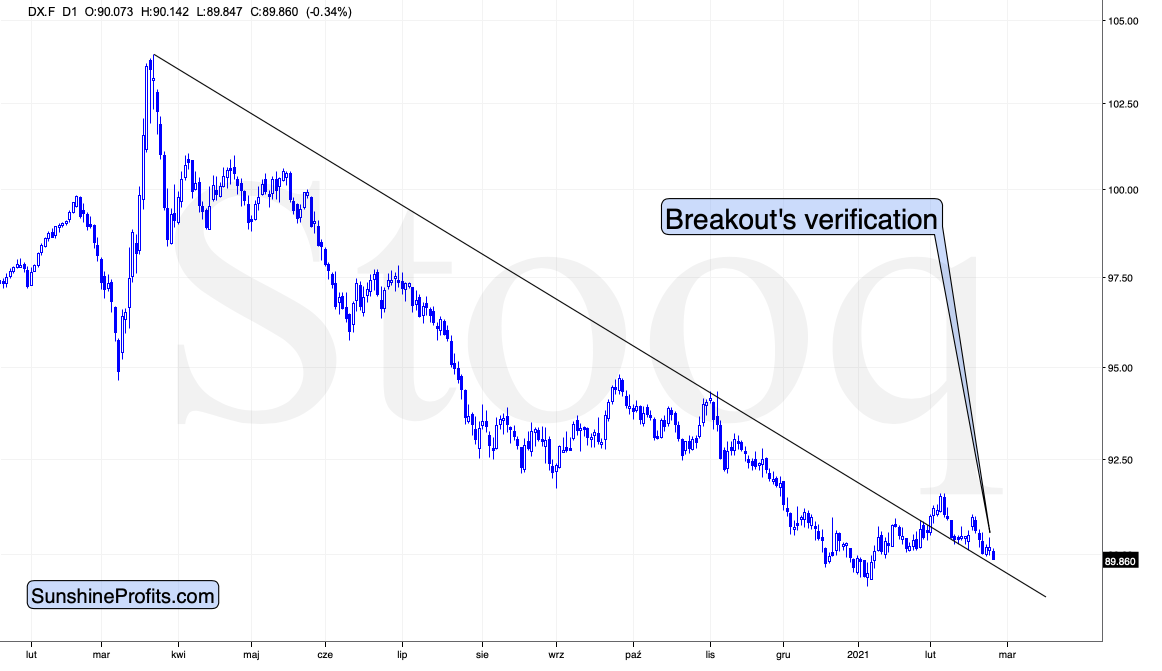

The move higher in gold was notable, but nothing game changing. The last time gold moved above the declining short-term resistance line, was when it actually topped. The invalidation of the breakdown marked the start of another very short-term decline. The small decline in today’s overnight trading might be the very beginning of this invalidation that leads to another slide.

What’s particularly notable is that gold is declining today despite another overnight move lower in the USDX. This is yet another show of gold’s weakness.

Does the USDX’s overnight decline change anything? Absolutely not, because the U.S. currency remains above the declining medium-term support line. It broke above it in early February, and it’s been verifying this breakout since that time. Given the popularity of the ABC (zigzag) corrections, it seems that the move lower might already be very close to being over. And once the verification of the breakout is completed, the implications will be very bullish as I’ve been outlining previously.

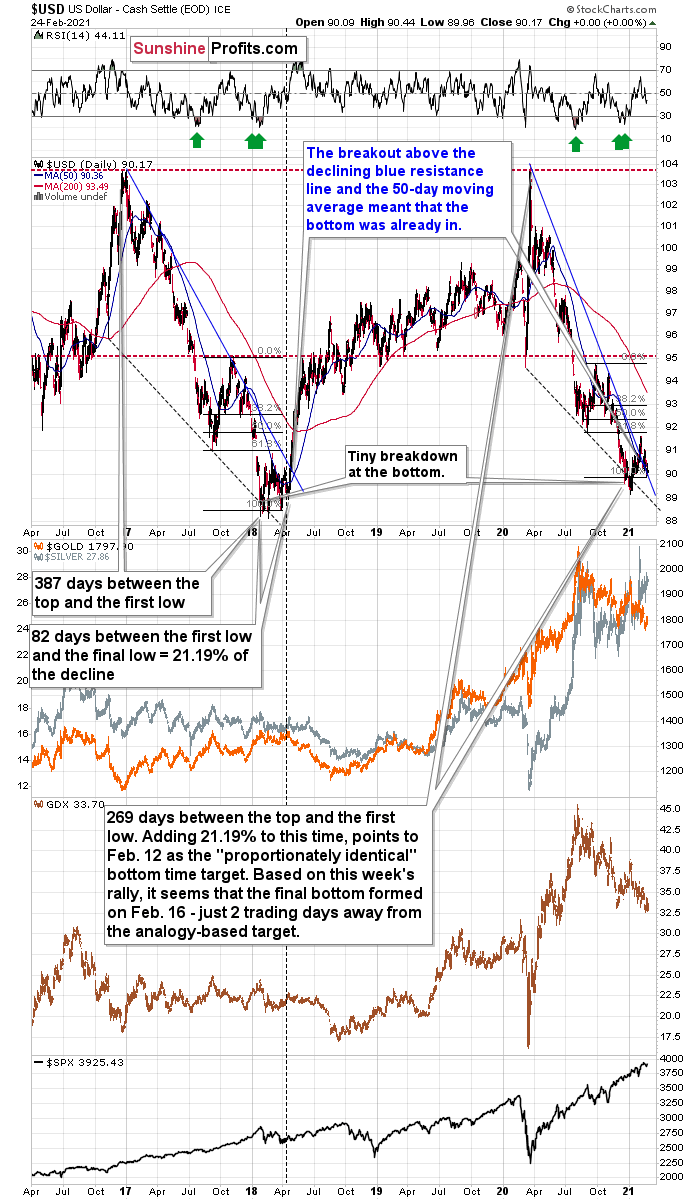

Figure 5

Based on the obvious similarity to early 2018, the verification of the breakdown is likely the final step before a major rally in the USDX. This will likely translate into lower precious metals and mining stock prices, especially if the general stock market declines as well.

Having said that, let’s consider the more fundamental side of things.

Risk is Rising

Yesterday, I highlighted the direct effect that rising interest rates are having on gold. However, the indirect effect could be just as devastating. With U.S. equities living on a knife-edge, one slip could add another gear to the pace of gold’s likely decline.

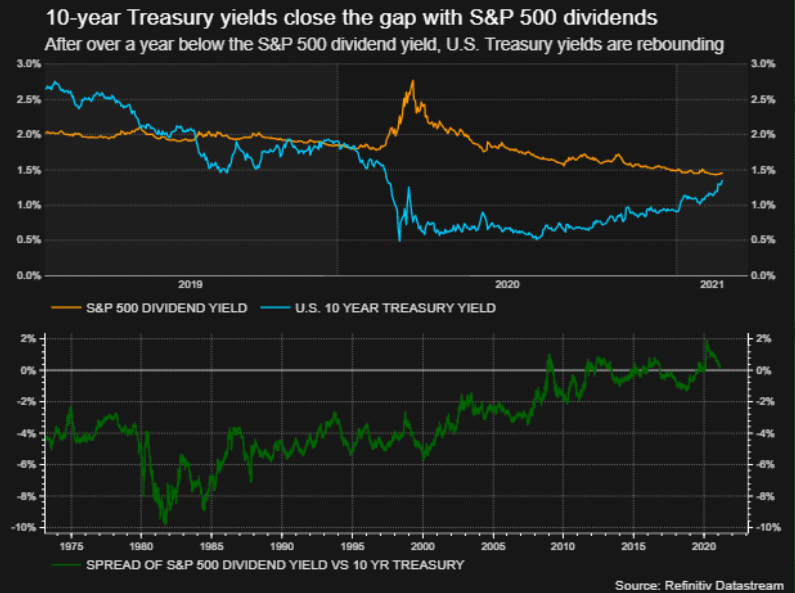

For months, equity investors’ ‘forget the fundamentals’ mentality was underpinned by the TINA concept – ‘there is no alternative.’ However, with the U.S. yield curve beginning to roar like a lion marking his territory, the difference between the U.S. 10-Year Treasury yield and the S&P 500 dividend yield is fast-approaching zero.

Please see below:

Figure 6

To explain, the orange line above tracks the S&P 500 dividend yield, while the blue line above tracks the U.S. 10-Year Treasury yield. At the bottom-half, the green line tracks the spread between the two. If you focus on the orange and blue lines, you can see that the two yields are about to collide. Singing a similar tune, the spread (the green line) between the two yields is also nearing zero.

Thus, with Treasuries now offering an ‘alternative’ for dividend investors, record valuations have essentially lost one of their most staunch supporters.

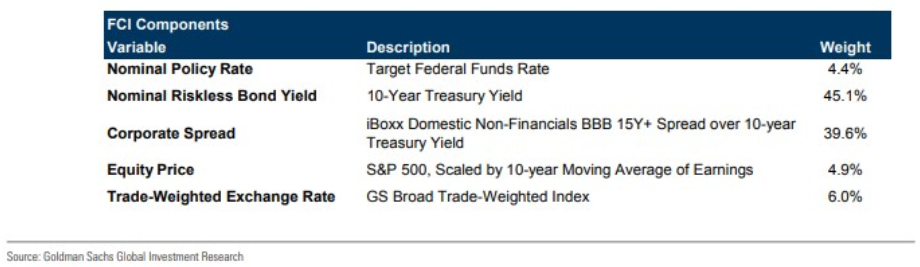

A symptom of the U.S. Federal Reserve (FED)-induced sickness, financial conditions are easier now than they’ve ever been. Per Goldman Sachs, the U.S. investment bank’s Financial Conditions Index (FCI) is derived by calculating the weighted-average impact of the FED’s overnight lending rate, Treasury yields, corporate bond spreads, equity prices and cross-border trade conditions.

Figure 7

More importantly though, the real story is the impact that loose financial conditions have on investors’ risk-taking behavior.

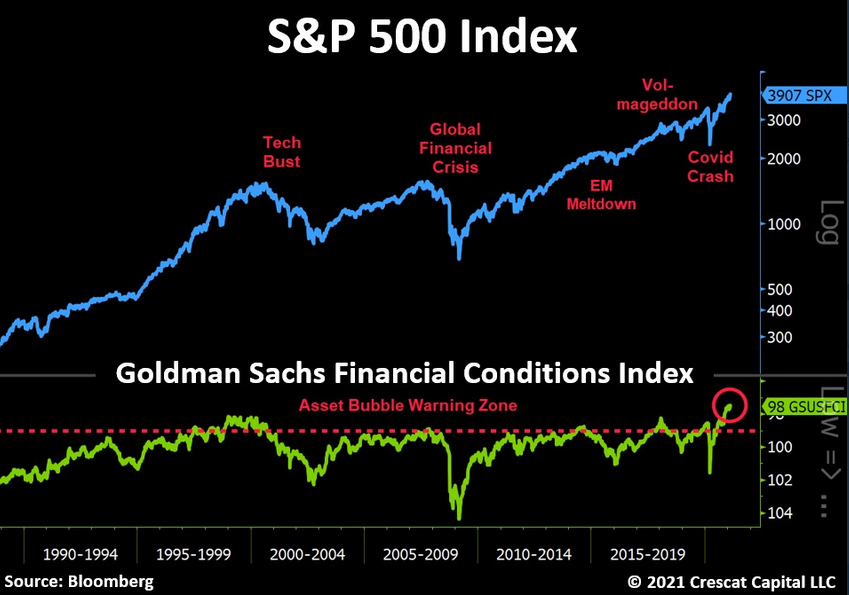

Please see below:

Figure 8

To explain, the blue line above tracks the performance of the S&P 500, while the green line above tracks the change in Goldman Sachs’ FCI. As you can see, excessive liquidity preceded the dot-com bubble, the Global Financial Crisis (GFC) and the 2018 style taper tantrum. Moreover, if you analyze the red circle on the right side of the chart (intersecting with the green line), you can see that today’s liquidity actually exceeds 30+ years of historical precedent. The key takeaway? Rising interest rates are on a collision course with the largest liquidity excess that we’ve ever seen.

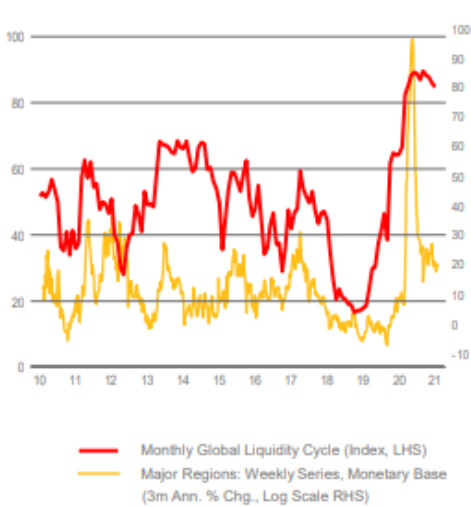

To that point, CrossBorder Capital – an independent investment advisory and macro research firm that specializes in monitoring global liquidity flows – revealed that its Monthly Global Liquidity Cycle Index peaked on Feb. 19.

Please see below:

Figure 9 - Source: CrossBorder Capital

To explain, if you analyze the top-right area of the chart, you can see that the Monthly Global Liquidity Cycle Index has begun to roll over. Thus, if liquidity conditions have peaked, this is the second (and arguably more important than Treasury yields) staunch supporter to abandon equities.

Moreover, please note that the previous peak formed in 2013 – that’s the year when the precious metals market declined substantially.

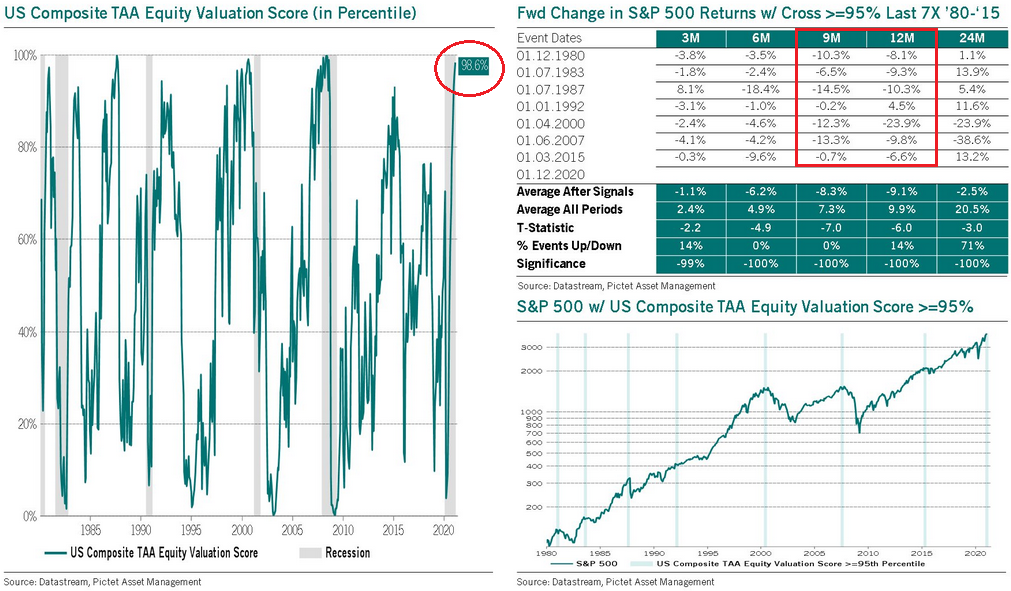

From a valuation perspective, Pictet Asset Management’s TAA S&P 500 Equity Valuation Score just reached the 98.6th percentile (the red circle below). For context, the reading implies that 98.6% of the time, the S&P 500’s weighted-average valuation score has either been equal to, or less than, the current reading.

Figure 10

Even more informative, the TAA Score has only exceeded the 95th percentile seven other times since 1980. And if you analyze the red box at the top-right, you can see that S&P 500 returns (during the prior seven readings) ranged from – 0.22% to – 14.5% (with an average decline of 8.3%) over the following nine months and +4.5% to – 23.9% (with an average decline of 9.1%) over the following 12 months.

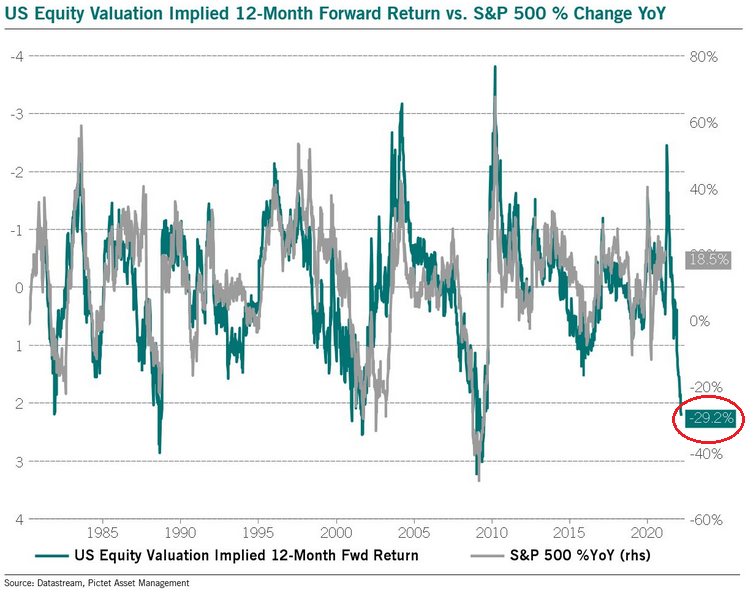

But making its own case for ‘this time is different’, the European asset manager estimates that the current reading implies a 29.2% drawdown of the S&P 500 over the next 12 months.

Please see below:

Figure 11

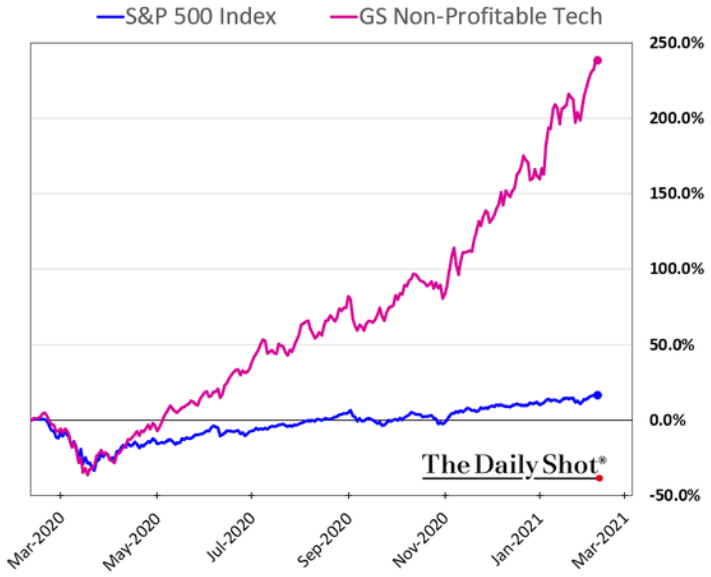

Exacerbating the situation, technology companies with negative earnings are still trading like its 1999. Despite the NASDAQ’s one-and-a-half day freak out (on Feb. 22/23), Goldman Sachs’ Non-Profitable Tech Index continues to drastically outperform the S&P 500 in 2021.

Please see below:

Figure 12

To explain, the purple line above depicts the performance of Goldman Sachs’ Non-Profitable Tech Index, while the blue line above depicts the performance of the S&P 500. As you can see, mirroring the dot-com bubble, companies with negative earnings are trading at multiples unseen since 1999/2000.

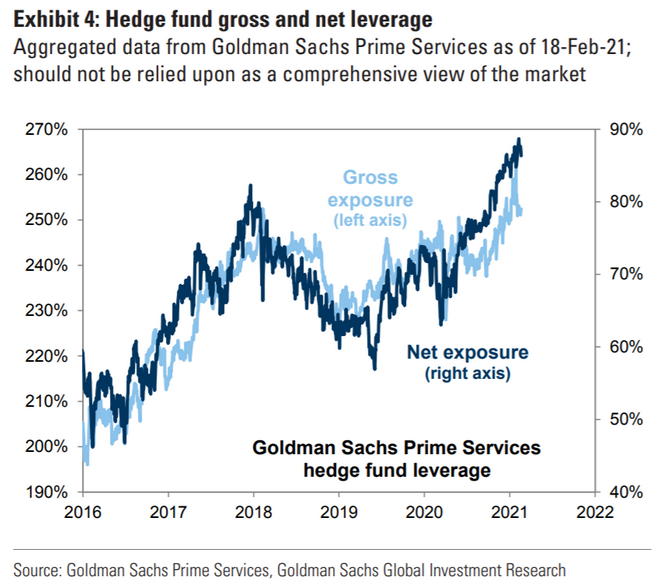

Continuing the theme, hedge funds’ gross and net leverage exposures have become extremely bloated.

Figure 13

To explain, the light blue line above represents hedge funds’ gross exposure, while the dark blue line above represents hedge funds’ net exposure. As of Feb. 18, hedge funds have more than 260% of their portfolios in combined long and short equity positions (using leverage), while net exposure of nearly 90% indicates that hedge funds’ portfolios are overwhelmingly long. Thus, a reversion to their means could usher in a wave of selling.

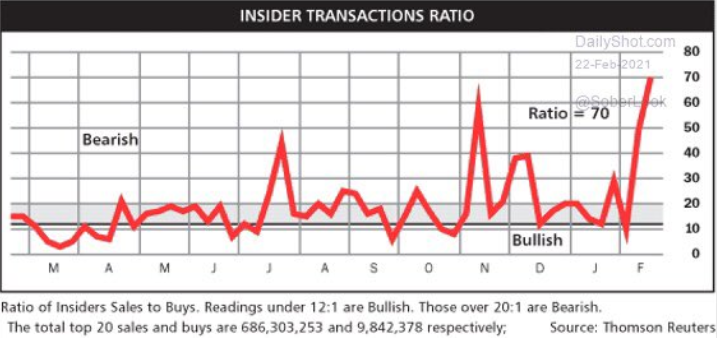

But always one step ahead, corporate insiders are selling stocks like there’s no tomorrow. For context, an Insider Transaction Ratio of 20 indicates heavy insider selling. As of Feb. 22, the reading is at 70 – a roughly one-year high.

Please see below:

Figure 14

For more context, I wrote previously:

Insiders are executives of S&P 500 companies who periodically buy and sell their own stock. Because ‘insiders’ possess inside information about their companies’ fundamentals, their buying/selling activity is a reliable indicator of the market’s future prospects.

As for the potential impact on the precious metals, it’s important to distinguish orderly equity drawdowns from liquidity events. In the short-term, the PMs tend to shrug off the former. In contrast, they suffer mightily from the latter.

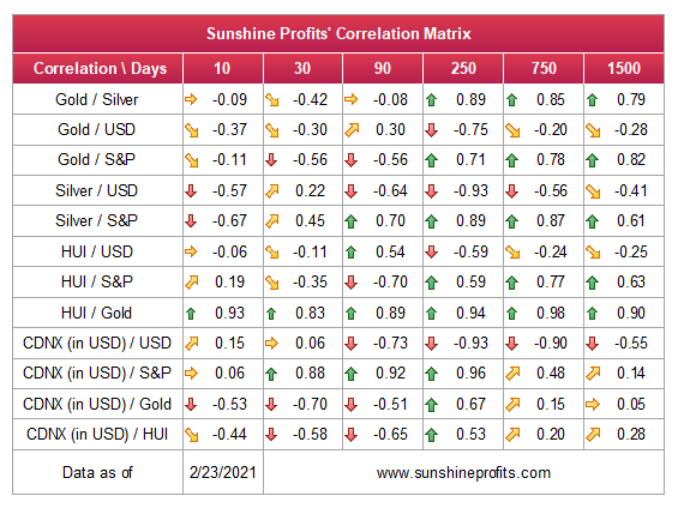

If you analyze the Correlation Matrix below, you can see that gold, silver and the miners’ 10- and 30-day correlations have become increasingly scrambled.

Figure 15

Relative to one another, gold and silver have traded in opposite directions over the previous 10 and 30 days. Also unusual is the fact that gold has moved inversely of the S&P 500 over that same stretch, while silver and the miners have been all over the place.

More importantly though, over a 250-day period (roughly one year), gold, silver and the miners’ have moderate-to-strong correlations with the S&P 500 of 0.71, 0.89 and 0.59 respectively. As a result, if the equity bubble pops, glass will shatter across the precious metals’ market.

In conclusion, rising interest rates are spreading like wildfire, and if uncontained, they could engulf everything from equities to the PMs. Headlining the uncertainty, with the FED’s bond-buying program to supress interest rates beginning to have the opposite effect (due to rising inflation expectations), the central bank is also living on a knife-edge. Thus, one misstep could induce a cascading effect that accelerates the PMs likely decline. However, once the liquidity high gives way to more sensible valuations, gold, silver, and mining stocks will once again swim with the bullish current, rather than against it.

Letters to the Editor

Q: My question specifically refers to taking a 12-month and 18-month position in gold futures contracts. If you consider that your analysis for gold will mean a good long-term investment once gold bottoms out at approximately $1500, it would seem that buying a 12-month gold futures contract on Dec.21 GCZ21 OR Dec.22 GCZ22. would be a good way to play the rebound of gold.

A: Indeed, that would be one of the ways to do it. Some would prefer something more tangible in case of long-term investments, like a gold bar, or a share in an ETF that holds physical gold in a way that’s verifiable (for example, by allowing in-kind redemptions). Personally, I would go with the latter, because of the mix of security and convenience that it provides. In order to gain geographical diversification (and also one between gold and silver), I would use the following:

Gold:

- JBGOUA

- 4GLD

- PHYS

Silver:

- PHSP

- SIVR

- PSLV

To be clear, I think that at the very bottom, mining stocks will present the best buying opportunity, so this is the part of the precious metals sector in which I’m going to make large purchases, while planning to switch to gold and silver later.

Q: Hi PR. I hope you are doing well now. I really like reading your analysis on gold and silver. I don’t know about your age and experience from these analyses but you are pretty good in doing your job and I feel lucky that I have subscribed to your emails. You have already told us about bitcoin plunging but Elon Musk recently invested billions in bitcoin, and bitcoin’s drop yesterday resulted in a valuation loss to Tesla measured in the billions. Don’t they do proper analysis before investing?

From last year, you have already told us that gold will not rally before touching 1300-1500/ oz when everyone else was saying it’s going to touch 2500-3000/oz. Now everyone on Kitco and other analysts are saying it’s going to touch 1250-1500. I want to ask what analysis are you doing that others are not, and why they’re also not near to your predictions? And what are your views on Elon Musk’s investment?

And please take care of your health because it will result in millions of dollars in losses to many subscribers and I am one of them :)

A: Thank you very much. I’ve almost fully recovered now.

I’ve been in this business for quite some time and I’ve seen a chart or two. I published my first gold analysis in 2008, but personally, I’ve been engaged in this market for longer. You can read my longer bio over here (that picture is about a decade old, by the way).

As far as bitcoin is concerned, it seems to me that it’s in a short-term bubble (which might have already burst), but it could be in a long-term uptrend as well. Perhaps Elon Musk is investing with the long-term in mind, or perhaps that was simply a publicity stunt (after all, he did name his car models in a way that make them say S3XY, didn’t he? …And let’s not even discuss his son’s name).

What am I doing that others are not? I noticed that many other analysts are focusing only or almost exclusively on the market that they are analyzing, while thinking that it’s enough. If I’m a gold analyst, I should focus on gold, right? This approach makes some sense, but it’s not enough in my view. Thoroughly looking at the key market is essential, but it’s just the very minimum of what one needs to do. There are many other stones that one can turn over in order to get a clearer and more coherent picture. I tend to look at the markets from multiple time perspectives (including ones extending over many decades) and with an emphasis not only on the key market, but also on its sister markets and the markets that it’s closely tied to (it’s biggest drivers). Analysing them and the way their relationships take shape provides very important details that are simply not visible to those who stick to gold charts or gold fundamentals alone. That’s what I’d say that I’m doing differently. Of course, other analysts might have their own special approaches that would provide them with an edge over the market as well.

Overview of the Upcoming Part of the Decline

- I expect the initial bottom to form with gold falling to roughly $1,700, and I expect the GDX ETF to decline to about $31 - $32 at that time. I then plan to exit the short positions in the miners and I will consider long positions in the miners at that time – in order to benefit from the likely rebound.

- I expect the above-mentioned decline to take another 1 – 7 weeks to materialize and I expect the rebound to take place during 1-3 weeks.

- After the rebound (perhaps to $33 - $34 in the GDX), I plan to get back in with the short position in the mining stocks.

- Then, after miners slide once again in a meaningful and volatile way, but silver doesn’t (and it just declines moderately), I plan to switch from short positions in miners to short positions in silver (this could take another 1-4 weeks to materialize). I plan to exit those short positions when gold shows substantial strength relative to the USD Index, while the latter is still rallying. This might take place with gold close to $1,500 and the entire decline (from above $1,700 to about $1,500) would be likely to take place within 1-10 weeks and I would expect silver to fall hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold – after gold has already declined substantially) is likely to be the best entry point for long-term investments in my view. This might happen with gold close to $1,500, but it’s too early to say with certainty at this time.

- Consequently, the entire decline could take between 3 and 20 weeks, while the initial part of the decline (to $1,700 in gold) is likely to take between 1 and 7 weeks.

- If gold declines even below $1,500 (say, to ~$1350 or so), then it could take another 10 weeks or so for it to bottom, but this is not what I view as a very likely outcome.

- As a confirmation for the above, I will use the (upcoming or perhaps we have already seen it?) top in the general stock market as the starting point for the three-month countdown. The reason is that after the 1929 top, gold miners declined for about three months after the general stock market started to slide. We also saw some confirmations of this theory based on the analogy to 2008. All in all, the precious metals sector would be likely to bottom about three months after the general stock market tops .

- The above is based on the information available today and it might change in the following days/weeks.

Summary

To summarize, the PMs’ short-term downswing has likely just begun, as miners broke below the neck level of their almost-yearly head-and-shoulders formation. We saw a small invalidation, but we don’t trust its bullish implications – we just saw something similar that failed to ignite a lasting rally and the USD’s decline seems to be a normal, post-breakout pullback.

In addition, because we’re likely entering the “winter” part of the Kondratiev cycle (just like in 1929 and then the 1930s), the outlook for the precious metals’ sector remains particularly bearish during the very first part of the cycle, when cash is king.

Silver’s strength seems bullish at first sight, but taking a closer look at this move, and comparing it with previous cases (when silver got so much attention) and with miners’ weakness, provides us with bearish implications for the medium term.

The confirmed breakout in the USD Index is yet another confirmation of the bearish outlook for the precious metals market.

Naturally, everyone's trading is their responsibility. But in our opinion, if there ever was a time to either enter a short position in the miners or increase its size if it was not already sizable, it's now. We made money on the March decline, and on the March rebound, with another massive slide already underway.

After the sell-off (that takes gold to about $1,500), we expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

Most importantly, please stay healthy and safe. We made a lot of money on the March decline and the subsequent rebound (its initial part) price moves (and we'll likely earn much more in the following weeks and months), but you have to be healthy to enjoy the results.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in mining stocks is justified from the risk to reward point of view with the following binding exit profit-take price levels:

Senior mining stocks (price levels for the GDX ETF): binding profit-take exit price: $31.22; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade); binding profit-take level for the DUST ETF: $24.88; stop-loss for the DUST ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

Junior mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $42.72; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade); binding profit-take level for the JDST ETF: $14.19; stop-loss for the JDST ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway. In our view, silver has greater potential than gold does):

Silver futures downside profit-take exit price: unclear at this time - initially, it might be a good idea to exit, when gold moves to $1,703.

Gold futures downside profit-take exit price: $1,703

Symbols to be on a lookout for in case of possible future transactions (leveraged and non-leveraged):

Gold: GLD (non-leveraged, regular), UGL (2x leverage, regular), GLL (2x leverage, inverse)

Silver: SLV (non-leveraged, regular), AGQ (2x leverage, regular), ZSL (2x leverage, inverse)

Mining stocks:

Senior mining stocks: GDX (non-leveraged, regular), NUGT (2x leverage, regular), DUST (2x leverage, inverse)

Junior mining stocks: GDXJ (non-leveraged, regular), JNUG (2x leverage, regular), JDST (2x leverage, inverse)

-----

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash

-----

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief