Briefly: In our opinion, full (100% of the regular full position) speculative long positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this alert.

Yesterday’s main news came from Mario Draghi, who sounded more hawkish than investors had expected. As a consequence, the euro soared and the USD Index (EUR/USD is the biggest part of the index) plunged. Gold didn’t really react, neither by rallying nor by declining. Did gold outperform, by staying strong despite Mario Draghi’s hawkish tone, or did gold underperform by not rallying in spite of the USD’s slide?

In short, the implications are unclear, with the former of the above interpretations being more reasonable. After all, the key question is how gold reacted to a given piece of news, event, or development. If gold acts strongly (better than expected), the implications are bullish. If gold is weak in its reaction, the implications are bearish. The main piece of news came from the Eurozone – the hawkish remarks – and it was the news to which both: the USD Index and gold reacted.

Let’s take a look at the charts (charts courtesy of http://stockcharts.com).

Gold’s Price Changes

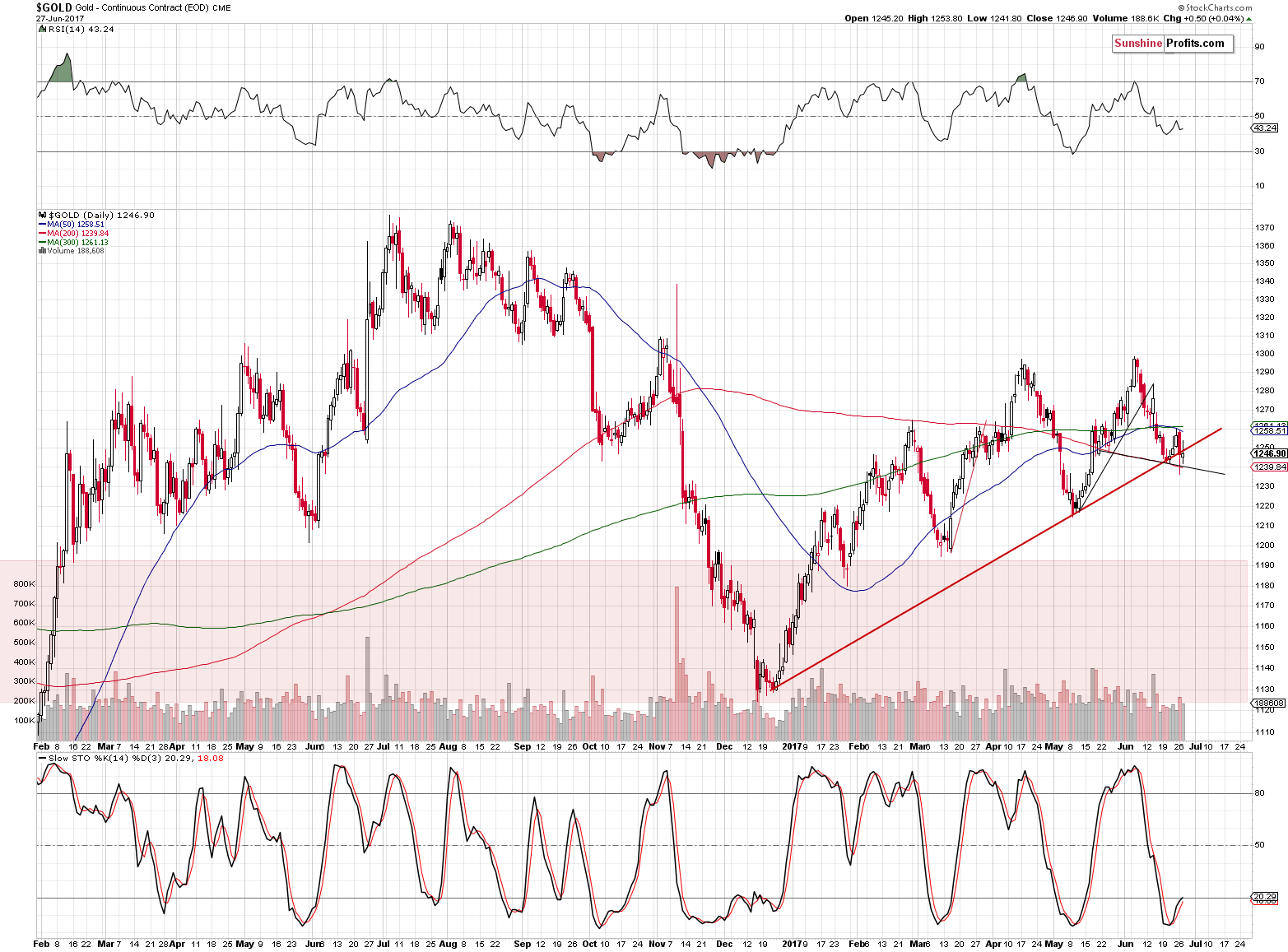

Gold closed more or less at the rising support line (and it’s above it in today’s pre-market trading), and the buy signal from the Stochastic indicator was not invalidated. Consequently, our yesterday’s comments on the above chart (and the implications) remain up-to-date:

Gold declined yesterday, so one might be wondering what can be so significantly bullish about it. The key word here is “invalidation”. Gold’s price was strongly pushed below 2 important support levels – the rising red support line (based on the 2016 bottom and the May 2017 bottom) and the declining black support line, which is also the neck level of the head-and-shoulders pattern (the late-May consolidation being the left shoulder and the most recent upswing being the right shoulder). Gold moved temporarily below these 2 levels and quickly invalidated both breakdowns. Additionally, gold moved to new short-term lows and invalidated this move as well.

Invalidations are strong signals that the market wants to move in the opposite direction, at least in the short term. Why? Because if the market was able to show enough strength to move above the previously broken levels, even though it was supposed to slide based on the breakdown, then it very likely has the strength to move higher. In analogy, if your car is powerful enough to drive with the parking brake on, it is certainly able to drive even faster without the parking brake.

The above is true in general, but based on our experience, in the case of the precious metals market, invalidations of head-and-shoulders patterns are particularly reliable – and that’s what we’ve just seen.

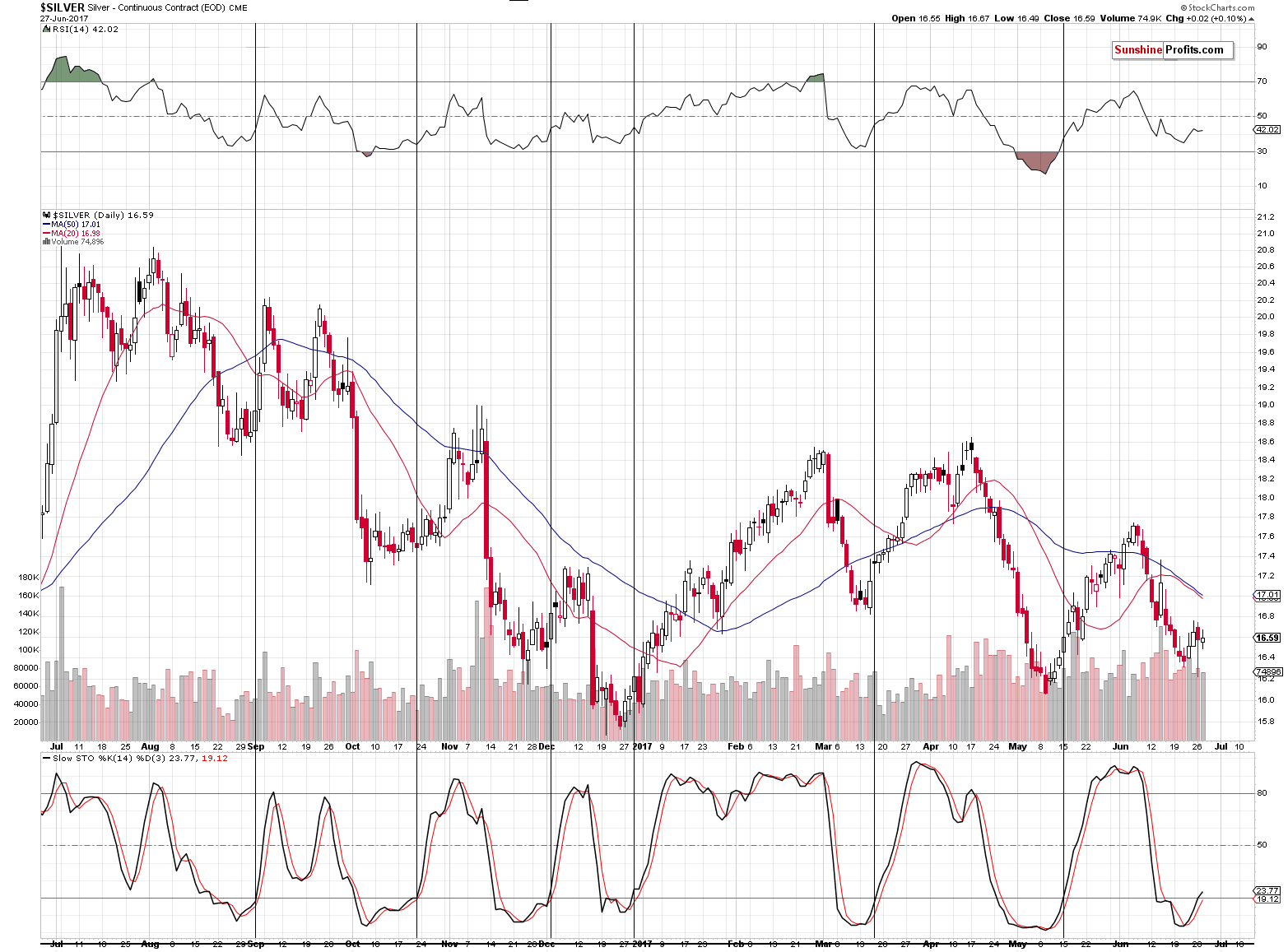

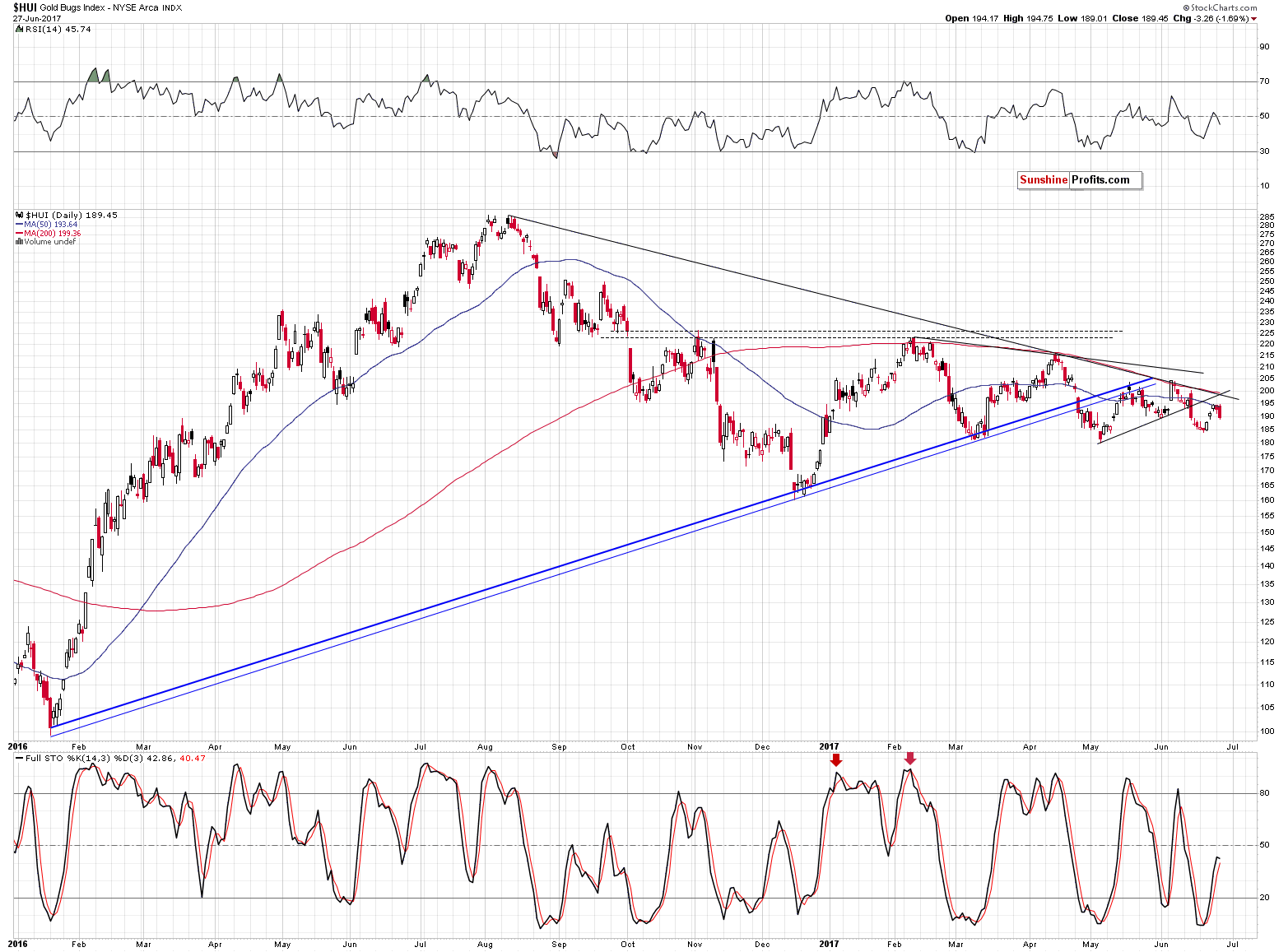

The daily Stochastic indicator has recently flashed a buy signal and it wouldn’t be a big deal if it hadn’t been accompanied by the same signal from silver and mining stocks as well – but it was.

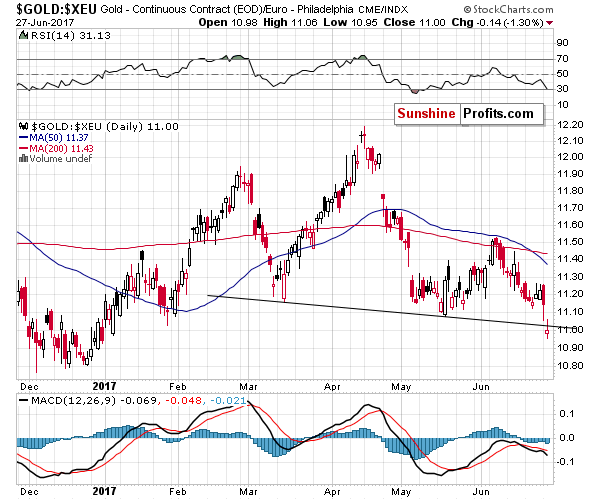

Gold price in the euro showed a major development yesterday – it broke below the neck level of a quite clear head-and-shoulders formation and this serves as a sell signal from this perspective (in terms of the euro). However, the breakdown is not yet confirmed, which means that it’s vulnerable to an invalidation and if we see one, it will be a very bullish development (as discussed earlier today).

The Stochastic buy signals were not invalidated in the case of silver and gold stocks either.

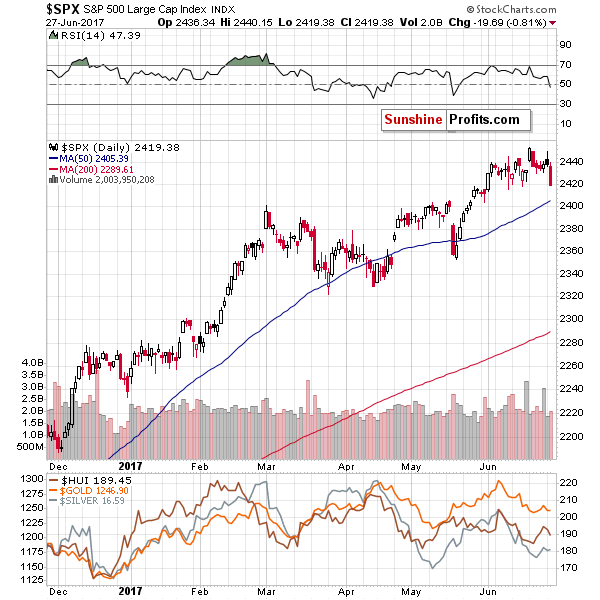

Mining stocks declined yesterday, but it seems they had a good reason to do so – the general stock market moved significantly lower yesterday. Even if this is followed by lower stock market values in the following days, the impact on mining stocks doesn’t have to be consistent – miners tend to react to the main stock indices’ lead every now and then, but the reaction tends to be of short-term nature. The main drivers of precious metals stocks are the things on which their profits depend – the prices of precious metals themselves.

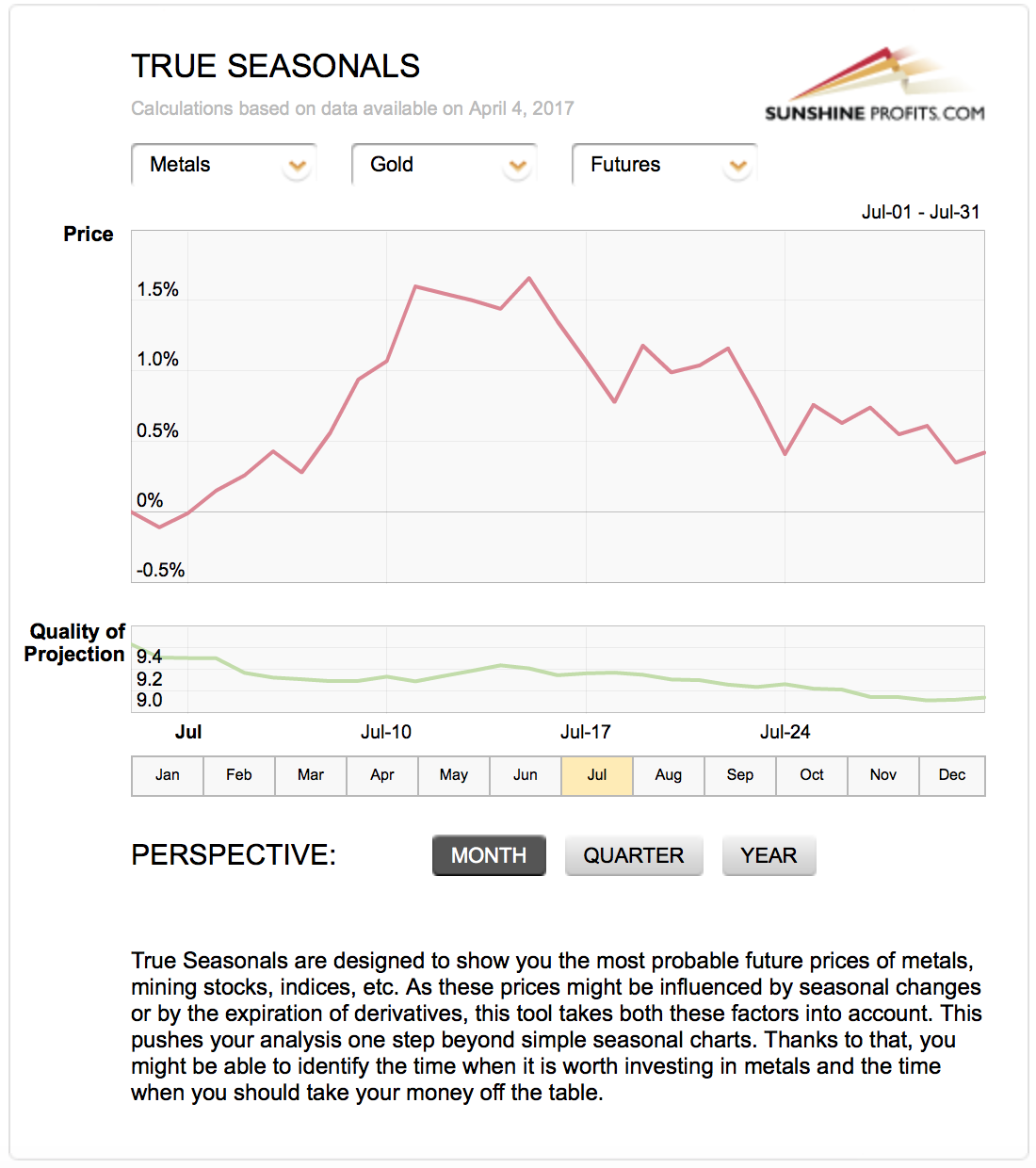

In yesterday’s alert, we featured the True Seasonal chart pattern for silver and since we received requests for an analogous chart for gold, we deliver in today’s alert. The first 2 weeks of July could be the time when gold appreciates in value, however, let’s keep in mind that this is only a tendency, nothing more. Other factors can (and often are) more important than a regular tendency, so we will be looking for signs of weakness and sell signals as it’s quite possible that the next local top will be formed before the middle of July.

Summing up, Monday’s – likely artificial – decline in gold showed strength in the precious metals sector – gold’s small breakdown below support levels was immediately invalidated, the miners showed significant outperformance and silver reversed in a meaningful way.

The above has strongly bullish implications, and yesterday’s lack of action the precious metals sector didn’t change anything. Even though it seems that gold failed to rally despite the USD’s slide, it was also the case that gold didn’t slide (in USD terms) despite hawkish remarks by Mario Draghi. Overall, it seems that implications of Monday’s session remain in place.

As always, we will keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Long positions (100% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels / profit-take orders:

- Gold: initial target price: $1,289; stop-loss: $1,227; initial target price for the UGLD ETN: $11.15; stop-loss for the UGLD ETN $9.64

- Silver: initial target price: $17.29; stop-loss: $15.94; initial target price for the USLV ETN: $13.33; stop-loss for the USLV ETN $10.45

- Mining stocks (price levels for the GDX ETF): initial target price: $23.57; stop-loss: $21.43; initial target price for the NUGT ETF: $37.13; stop-loss for the NUGT ETF $27.81

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $35.57; stop-loss: $31.68

- JNUG ETF: initial target price: $22.48; stop-loss: $15.79

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Yesterday, three renowned central bankers delivered speeches. What can we learn from them?

Draghi, Carney, Yellen, and Gold

=====

Hand-picked precious-metals-related links:

PRECIOUS-Weaker Dollar and Stock Market Jitters Drive Gold Higher

AngloGold Plans Job Cuts, Closures to Revive S. Africa Mines

Infographic | 38 incredible facts on the modern U.S. dollar

New Gold on track to open Ontario mine in September

=====

In other news:

Draghi Tried to Be Cautious But Spooked the Market Anyway

'What's the rush' on interest rate hikes, asks Fed's Kashkari

The Federal Reserve Is Too Optimistic in the Face of a Stealth Economic Slowdown: Market Recon

Slack in European economy looks worse than we thought, says ECB vice president

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts