We posted our regular update yesterday, but we found that the situation is too important right now, not to let you know what we think about the market before it closes today. So, here we go. Actually we have only one chart (courtesy of http://stockcharts.com) but that’s the most important one for precious metals investors.

The HUI Index immediately invalidated it’s “breakdown” below the 395 level and is trading at 408 at the moment of writing these words, so it’s safe to say that there breakdown was not and will not be seen this week – or at least it will not be confirmed.

As a reminder, the breakout/breakdown is confirmed when price closes below a certain price level for at least three consecutive trading days (there are some schools that say that 2 days is enough, but we prefer 3). For very long-term moves we would say that 3 consecutive weeks below a certain level would be significant.

Another way in which a breakout/breakdown can be confirmed is when a move is significant and it takes place on huge volume. There is no clear rule as to when a move is significant or not, but as a rule of thumb – if you’re not sure if it’s significant or not, it most likely isn’t (just like if you have to tell people that you’re powerful, then you’re not).

Final way in which a breakout/breakdown can be confirmed is if price moves far below/above the critical support/resistance level even without significant volume. Again, there is no clear way of determining if a move is significant enough. These confirmations are rarely seen compared to the first two ways. The reason is that if price is to move far, then it is very likely that the move will be either seen along with high volume or that it will take some time.

The breakdown in gold stocks has been invalidated immediately (bullish for metals), and it looks like the short-term breakout in the USD will be confirmed today (bearish for metals). The gold market appears to have the deciding voice on whether we should “run for the hills” or not. That’s why it was urgent to send this information to you today.

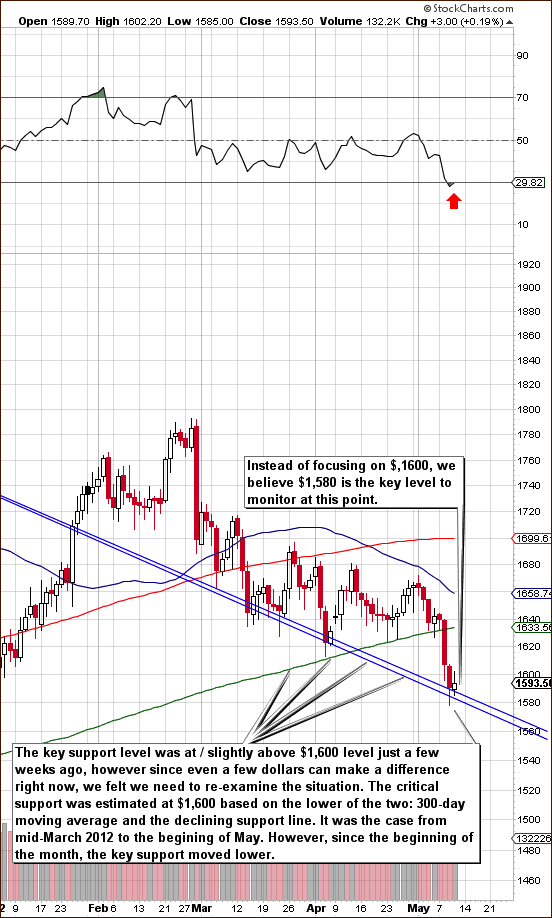

Since price levels are so critical here and more important than volume (which we will not have before the end of the session anyway), we recreated the short-term chart in spot gold instead of using the GLD ETF as a proxy. Please click the above chart to enlarge.

We paid special attention to drawing the support line – we decided to draw two of them based on different tops earlier in 2011 as due to the leverage effect, small difference there, can have a big difference in the outcome. In the end it turned out that the support lines provide us with the same picture.

Yesterday, we mentioned two major support levels: $1,600 and the support line based on the major 2011 tops. Gold was right between them. The question is which of them carries more weight. Actually, when we wrote about $1,600 as the key support level, it was based on two factors – 300-day moving average and the declining support line. The lower of the two was the final support.

This estimation was more or less accurate before the end of April. Since the beginning of May, the declining support line moved below $1,600 and is currently close to $1,580 – a level that has not been decisively broken. Today gold made a second attempt to move below it, but it was not successful – it’s at $1,583 at the moment of writing these words. We realize that you should have been notified about the decline in the major support line at the beginning of the month and we apologize for not letting you know earlier. Gold was much higher back then and we somehow missed reporting on this issue. Actually, it was quite strange to see HUI moving below an important support line and then moving back up without an analogous situation in gold – these events are usually related. Looking at $1,580 as the key support line makes these two pictures more similar.

The main point is that the breakdown below $1,600 will most likely be confirmed, but that is not the support level that we should have paid attention to this week - $1,580 is. Gold made two attempts to move below this level this week but it was not successful. In fact, even if gold closes below $1,580 it will be actually the first closing price below the critical support that will need to be confirmed. In terms of the GLD ETF, we will likely see a first close below the key support line today (based on the $153.65 price).

Getting back to what we wrote earlier – the “breakdown” in gold stocks was invalidated, the USD Index picture is rather unfavorable, but there was no breakdown in gold so far.

Summing up, we remain bullish on the precious metals market. The USD Index alone does not make the situation bearish. Actually, there is something bearish about USD that creates a resistance level close to 80.5, but this topic will have to wait because it’s getting late and we want to send this out as soon as possible (also please excuse any typos/errors in the text because of this reason).

Our next Premium Update is scheduled for Friday, May 18, 2012.

Thank you for using the Premium Service. Have a great weekend!

Przemyslaw Radomski