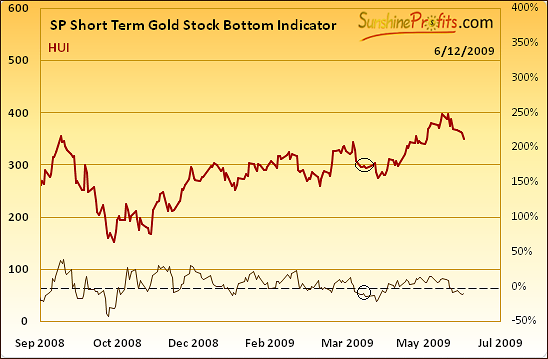

During the previous week, I wrote about one of our indicators, the SP Short Term Gold Stock Bottom Indicator in both: previous Premium Update and in the following Market Alert. Since I will begin this week's update by commenting on recent signals from two of our indicators, so it is useful to include a brief reminder of my previous comments. Just before the last Market Alert, the Short Term Bottom Indicator flashed a buy signal. Consequently, I wrote the following:

(...) it seems that we will have a pause in this correction, but it doesn't mean that it's over yet. In the past I have emphasized that corrections in the precious metals stocks often materialize in the ABC (zigzag) fashion. Currently, the most likely outcome in my view is that we are about to see the B part of the ABC correction - a small pullback to the upside, after which PM stocks would go lower in the short term.

This is exactly what took place during the rest of the week - we had slightly higher prices of gold, silver and mining stocks in the middle of the week, but they closed lower on Friday. Of course the key question here are: "Is the bottom already in?" and "Is it safe to get back on the long side of the market?" In short, it seems that we are going a little lower before we will reach a local bottom.

As mentioned in the first paragraph of this update, I will begin with commenting on recent signals from our indicators. As you may have already noticed, we have just received a BUY signal from the previously covered indicator, but also a SELL signal from the SP Gold Stock Top Indicator. Since these signals are exactly opposite, we need to take a closer look at the whole situation to estimate what is likely to happen next.

SP ST Gold Stock Bottom Indicator turned up for the second time during this upswing, which by itself suggests that higher prices are likely in the near term. Although it usually means that a bottom is near, please note that it does not mean that it must materialize immediately. For instance, that was the case at the beginning of March 2009 - we had a buy signal and prices have indeed moved much higher, but not until about a week after the signal. It seems that this may be the case also today. This theory is confirmed by a different indicator - SP Gold Stock Top Indicator.

Historically, this indicator signaled extremes once it broke through either of the dashed lines (still, most of them were tops), but during recent months it proved to be particularly useful in timing bottoms. During most of the recent bottoms we have seen similar patterns, which we may see once again in coming days. The pattern that I'm referring to is the breakout above the upper dashed line which took place just before the bottom and the following breakdown through the lower dashed line - which confirmed the bottom. According to the above interpretation, we have seen the "bottom is near" warning, but we are still to see the confirmation signal.

Summing up, the aforementioned indicators suggest that the bottom in the precious metals sector is close.

Gold

Moving on to the more commonly known methodology, let's begin with a gold chart. Charts are courtesy of stockcharts.com.

At the first glance, the situation on the gold market looks quite bullish. Gold has advanced substantially from April to June, and has been correcting since the beginning of this month. Corrections are to be expected on any market, and gold is no exception here, so until we see evidence that this correction is anything more than just that, we remain bullish in the long run. Right now the price of gold (and also the value of the GLD ETF) has closed at its long term support level (solid blue line), which generally indicates that a rebound is likely.

Generally doesn't mean always, and it is usually useful (and profitable) to put "general rules" into proper context before making any investment decisions. As mentioned above, the price of gold stopped at the rising support line. However, did gold rebound in the past when the situation was similar? I have marked two situations with dashed lines on the above chart.

Please note that each time price got to the analogical support line it has briefly broken it before rising again, so this may be the case also now. Additionally, previous bottoms were accompanied by particular signals from the stochastic indicator (as seen on the bottom of the gold chart). Several weeks ago I wrote about the RSI indicator as particularly useful in timing top on the precious metals market. Naturally - there is no perfect tool. RSI is not that useful in determining bottoms on the PM market, as it is the case with tops. Still, there are many more indicators than just the Relative Strength Index, and one of them proved to be particularly useful in estimating bottoms in the recent past. During the past several days most meaningful bottoms took place when stochastic indicator was below the 20 level and it started to rise (thus crossing its moving average) - I have marked these situations with red ellipses.

Currently, the stochastic indicator has moved lower, but it is not yet below the 20 level. Therefore, there is another significant confirmation of the previous conclusion - the bottom is near, but it is yet to materialize. How low can it go temporarily? It's a tough call, but a short-term chart should provide us with additional insight.

Short-term trend lines and Fibonacci retracement levels suggest that there is still room for further declines, but the bottom is likely to be put in this week. In the latest Market Alert i mentioned that precious metals tend to correct in a zigzag fashion. Should the decline materialize in the form of the C part of the perfect ABC zigzag pattern (where A downswing is very similar to C), we would see gold bottom in the middle of the area marked with red ellipse.

Other price levels that can provide a strong support are &89.5 and $91 in the GLD ETF, which corresponds to gold at $911 and $926. The 50-day moving average is also within this range, which makes it even more likely to prove a significant support.

Silver

The first thing that comes into mind after taking a glimpse at the above chart is that silver has held very well during the current decline. The strength in the silver market should not surprise you, if you've been following my analysis for some time now - I've written about the particularly favorable situation on the silver market on 19th of April.

As far as the target for this decline is concerned, the situation is similar to the one in the gold market. The area in which the bottom is likely to take place is marked with a red ellipse and it contains levels corresponding to two important Fibonacci retracement levels: 38.2% and 50%. Prices of many assets often correct these parts of their previous move before resuming their main trend (for example the 38.2% level stopped the decline at the beginning of March 2009). Another important level that this ellipse contains is the lower border of the short term trend channel - if we get the C decline of the ABC correction it may go exactly to this support level.

The stochastic indicator is not as efficient here, as it was the case with the gold market. This should not surprise our Subscribers, as I've written about silver in one of the previous Premium Updates. Back then I wrote:

(...) silver market is much smaller than the gold market, and as such it is more vulnerable to short-term manipulation. The same applies to big up/downswings caused by a large entity moving in or out of the market. This means that one has to be careful when applying the technical analysis to the silver market.

(...)

The direct implication of the above analysis is that if we get a move in either direction in silver that would have critical implications (i.a. breakdown through a very important support/resistance level), but it is NOT confirmed by a similar move in other markets, there is a big chance that this move is a "fake" one. Most of the time technical analysis does work with silver, but there are times when it does not, and we must take that into account while making our investment decisions. You may want to read this reply for more details.

Summing up, situation on the silver market is less clear than it is the case with gold, but since both precious metals are so highly correlated, they are likely to bottom at the same time.

Precious Metals Stocks

The situation in the HUI Index is currently similar (not identical) to the one on the gold market, so the interpretation is also alike. Therefore, I will focus only on the differences. The first one is that HUI has not yet reached its long term support line, but it's so close that I think we can safely ignore this fact.

However, the important difference here is that on the above chart the stochastic indicator drops below the 20 level much sooner than it is the case with the yellow metal. I have marked two situations when we had low values of this indicator in the past with vertical blue lines. Please note that in both cases: at the end of February and at the beginning of April, the stochastic indicator dropped below the 20 level along with the first part of the decline - the second part materialized several days later. This does not automatically mean that it is useless for PM stocks, but it implies that additional caution is necessary, and that the correction is not necessarily over yet.

Other Factors

Another factor suggesting that a reversal is near is the fact that a considerable amount of people have recently contacted me, as they were somewhat concerned about falling gold prices. That's right - we have gold trading only 8% below its 4-digit high and investors (I'm not talking about short-term speculation here) are concerned about "low" prices. This type of confirmation is useful, because once people get too concerned, they sell, and once they have sold they are ready to jump back in, as prices head higher, thus fueling the rally.

Generally, since my essays are posted on many websites, I often receive e-mails from various investors, and thus I have the privilege of getting to know their thoughts on the market. This means that I'm able to detect moments where the sentiment is particularly bearish/bullish, and report it to you. In addition to receiving these messages online, my friends, who are aware of my interest in the precious metals market, often contact me when they notice precious-metals related news and ask me about my view on the market. I discovered that whenever they point my attention to a piece of news that is particularly bullish, it is near a local top, and when they send me something bearish, it is near a local bottom. You can find a list of other "signs" of sentiment extremes in the "Top or Not?" tool.

Yesterday a friend of mine, who doesn't follow the precious metals market on a regular basis, called and asked me about gold, as she heard (!) that prices were declining substantially and the bull market is over. She was very surprised to hear that gold has been recently trading near $1000 and is now only about 8% below its 2008 high. This serves as another indication that many people are already out of the market and that a local bottom is near.

As I mentioned above, I'm able to gain and share additional insight into the sentiment analysis, but that does not mean that you are not able so at all. There are various indicators that can help you with that, for instance the S&P Energy Sector Bullish Percent Index and Gold Miners Bullish Percent Index, but today I would like to write more about less quantitative method of analyzing the sentiment.

I realize that the following part of this update is not very helpful in terms of determining the exact time/price levels at which this particular bottom will be in, but it may help you "read" your own emotions and better position yourself in the market in the future.

What I believe is worth keeping in mind at all times, is what most investors/speculators feel during particular stages of each upswing/downswing. If you follow precious metals market on a daily basis and you notice that you share similar emotions, this may prove a valuable sign contributing to making correct investment/speculative decision.

The general rule for investors either holding an asset (precious metals, mining stocks or related derivatives) or those convinced that its price is going higher, is that once prices start to decline, people tend to feel about that decline in "stages". The first stage is ignorance ("hey, that's just one down day - it doesn't make any difference"). The second stage is acceptance ("ok, we've had a correction, but that's it, prices are going higher from now on"). The third stage here is doubt ("maybe this is not an ordinary correction and prices will stay lower for a long time") and the final, fourth stage is fear ("ok, this is it, I'm getting out before I lose everything"). In other words - prices tend to decline lower than most people fear (!), they would and then they decline some more.

Realizing this psychological phenomenon does not only make one more "resistant" to it (less likely to sell at the bottom), but it can also help to estimate a favorable buying opportunity. The buying opportunity presents itself somewhere between third and fourth of the abovementioned stages - when most investors become convinced that precious metals will decline much more. This is also the moment when even investors, who are well aware of the bull market's existence, become anxious. This brings me to the conclusion - the most favorable buying opportunities emerge, when you feel that "maybe it's time to sell".

Some might say that this is totally subjective, and they would be correct, however this can be seen as an advantage here. The interesting characteristic of this mechanism is that investor's emotions are usually connected with the time frame that is particularly important to them. This means that long term investors are likely to change their attitude during multi-month declines, whereas short-term traders are likely to feel the anxiety much sooner. The benefit of this self-analysis is that it automatically adapts to your trading/investing approach.

As it is the case with most "general rules", there are exceptions. Obviously, every investors/speculator is different and thus each will perceive market's signals differently (from the psychological point of view). Before adding this type of analysis to your own selection of techniques, please test it. Remember how you felt during current downswing and how you will feel about the market in the coming days. Most likely after a few weeks at most, this downswing will be over and you will be able to recall how you felt during the exact bottom and remember it. This type of "feeling" is likely to materialize during future bottoms as well. Naturally, this makes sense and works only if you really want to time this bottom, and the accuracy of this "prediction" is limited after just one "trial". In other words, if you pay attention to your emotions during this and future declines (and also upswings), then you will learn how to read them and position yourself accordingly.

Please note that I'm not advocating trading or making long term purchases on this particular "signal" only. The point that I'm trying to make here is that ignoring one's emotions in trading is great, but learning how to read them and using this knowledge to gain advantage over other market participants is way better. If you are not trading, but you rather invest in the long term and want to add to your positions at the most favorable moments, then this type of analysis should help you stay focused on the long-term trends and prevent you from selling at local bottoms.

Summing up, one should not directly follow greed or fear in their investment decisions and realizing that it really makes sense to do the opposite should help to prevent it. If fundamentals remain in place and only the price action itself (!) makes you feel concerned about your holdings, then this fact alone suggests that it is buying, not selling, that you should be considering.

Junior Sector

As stated in the Key Principles section, the list of top juniors will be updated approximately every 4 weeks, so this is the Update that should contain the revised version of the list.

The tables below feature our favorite junior stocks at the moment of writing these words. For more information on how you can use these lists please refer to the Key Principles section, especially to the part dedicated to juniors.

The most visible change from last month's ranking can be found in the table dedicated to silver juniors. The Silverstone Resources (SST.V), which had previously topped our ranking, has been acquired by Silver Wheaton Corp (SLW). SLW agreed to acquire all of the issued and outstanding common shares of SST.V at an exchange ratio of 0.185. Given this ratio and Friday's closing price of 11.28 CAD for SLW.TO (in order to compare prices, we need to use the same currency), the previous shares of SST.V would be worth 2.09 - 24% higher than 1.68, which was the price when we featured it on top of our silver junior's ranking last month. Naturally, at the beginning of June the price was even higher.

Summary

After having rallied in May, the whole precious metals sector entered a corrective phase, which began two weeks ago. Currently many factors suggest that the end of this correction is near. Should this decline take form of the perfect ABC pattern, where A and C declines are identical, we are likely to bottom during this week. While we cannot make any guarantees, the aforementioned ABC patterns are quite common during corrections on the precious metals market, and it seems that this time will not be any different. Naturally, there are no certainties in the market, so we will continue to monitor the market for any significant developments.

The coming bottom is likely to provide a favorable buying opportunity for long-term investors with the "buy more on the dips" approach. If you are risk-averse, you might want to add to your positions right away, without waiting for the final confirmation. After all, during the bull market the risk is to be out of the market, not to be in it.

Short-term traders are advised to consider preparing themselves for opening long positions and closing remaining short ones in the coming days.

This completes this week's Premium Update.

Thank you for using the Premium Service. Have a great weekend and profitable week!

Sincerely,

Przemyslaw Radomski