This week precious metals and corresponding equities have been trading sideways after a significant short-term rally. But, before we sink our teeth into technical analysis of the PM markets, I want to bring you a few news stories that appeared this week that might indicate the sentiment about gold or have particular economic implications.

As of Friday, July 24th, the minimum wage in the US was set to rise from $6.55 to $7.25, an 11% increase, affecting workers in 29 states.

Some economists believe that the Friday increase couldn't be happening at a worse time. The U.S. economy lost nearly 3.4 million jobs in the first half of 2009, which is more than the 3.1 million lost in all of 2008.

The general idea behind this decision, other than helping the weakest sector of the working population, is to stimulate the economy by injecting even more money into the system. Congress voted on this action two years ago and I wonder whether they would have approved it had legislators known how bleak the economy would look two years later. Without a doubt the timing is awkward.

Even if it were true that more fiat money is the economy's cure, not its illness, I don't think increased regulation of the labor market is the way to go. As most people correctly assume, a free market ensures the optimal allocation of capital. (Let's not go into a microeconomic discourse about whether or not monopoly or oligopoly is indeed a free market.) The labor market is no exception - the more regulated, the less efficient it becomes.

Increasing regulation by increasing the minimum wage does not automatically mean everyone gets more money. It means that those, who are still employed, will get more money (at least in nominal terms). However, those who will lose their job because of the minimum wage increase, will now have less money. The final outcome (in terms of increasing the money supply) depends on the structure of the labor market. If there are many workers who create between $6.55 and $7.25 of value per hour, the net effect will be negative for the money that can be spent.

I'm suggesting that the increase in the minimum wage will lead to rising unemployment. The logic behind this phenomenon is as follows: employers will not pay more than the work is worth to them. If you have an employee whose work increases your revenue by $7 per hour, and you pay them $6.45 per hour, you gain 55 cents per hour per employee and it makes sense to keep them on the payroll. However, if the same work, with the same revenue stream ($7 per hour) now costs you $7.25, you will lose 25 cents per hour, per employee. It is no longer economically viable to pay for this work, and sooner or later, the worker will need to look for another job.

As far as stimulating the economy is concerned, I don't think increasing unemployment is the way to go. I view the increase in the minimum wage as a negative fundamental factor for the economy, and consequently, also for the stock market. As I have emphasized on numerous occasions in the past, fundamentals are ultimately what drive prices of assets in the long term, while in the short term, prices are driven by emotions. The wage increase is fundamental news, therefore, it does not automatically mean that prices are going lower immediately.

In conclusion, here is yet another reason for steering clear of broad market stocks as a long term investment, or at the very least, not to make them the main part of the portfolio. Given declining real estate prices and the fact that bonds are less and less in demand by foreign financial institutions (Chinese officials have indicated many times that they want to limit their U.S. bond holdings, or at least stop increasing them), commodities and the precious metals market are the most promising place in which to invest your money in the coming years.

Other reports I've read this week are also positive for the precious metals sector.

One news report says that Swiss banks are running out of secure storage space for gold bullion held by investors and institutions. The story said that fears of hyperinflation, the grim economic news and the success of the gold ETF's, has led to a run on the yellow metal and a shortage of safe places in which to store it. When you're holding gold (especially at these prices) you need security guards, surveillance cameras and room, lots of it. One Swiss bank relocated its stored silver bullion to another site to make more room for gold.

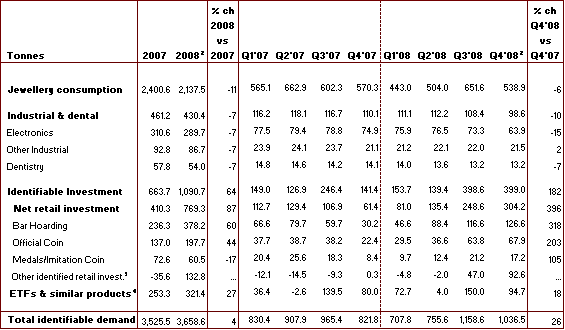

As you might have read in the Key Principles section of my website, I suggest keeping about 20% of capital in physical gold and silver, with the mix depending on your age, risk preferences and whether you believe inflation is in the cards. If you cannot hold it yourself in a safe place, I suggest being very careful where to store it. The story about the shortage of storage space in the vaults of venerable Swiss banks tells me that long-term gold investors are out in force and that gold is in its groove. The investment demand has become even more important driver of gold prices. Please take a look at the table (source: World Gold Council) below for details.

Not only has the investment demand increased by 64% in 2008, but also the news about the Swiss banks storage problem signals that investment demand is still rising, putting an upward pressure on gold prices.

Additionally, you know gold is a good bet when you read that cash-strapped Spain has ordered its navy to begin radar and sonar surveys to search for gold treasure buried in the ocean. According to news reports, Spain is banking on finding Inca and Aztec gold in sunken ships lost at sea in the 16th century whose wrecks are believed to lie on the seabed off the coast of southern Spain.

The economic downturn has hit Spain especially hard and anxiety in the country grows at the end of a boom that hinged on speculative housing investment and cheap credit. The low morale that comes from high debt and an 18% joblessness rate is a reason Spain could take longer than other countries to pull out of recession. Desperate times call for desperate measures.

Perhaps Spain got the appetite for gold treasure when it won a two-year legal battle against American treasure-hunters who were ordered to hand over an estimated L250 million worth of gold and silver coins salvaged from a Spanish shipwreck in Atlantic waters. There are estimates that some 3,000 shipwrecks filled with treasure lie at the bottom of the world's oceans.

Since finding one of those wrecks is not an option for most of us, let's hope to find our treasure in this week's charts. We'll begin with the U.S. Dollar (charts courtesy of stockcharts.com).

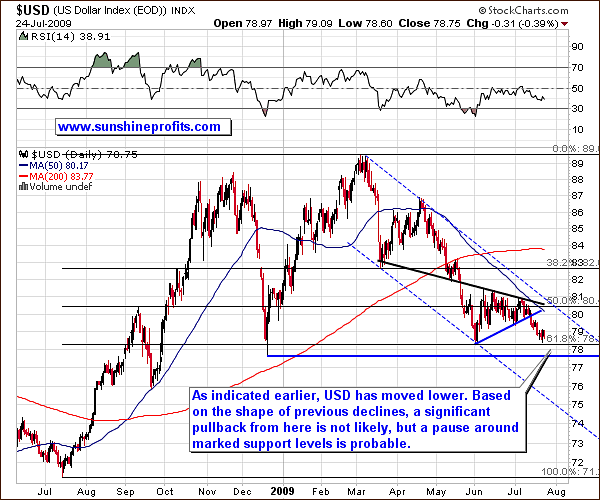

U.S. Dollar

Fundamental factors such as twin deficits (budget deficit and current account deficit), the bad shape of the U.S. economy and the declining willingness of U.S. creditors to accept dollars and U.S. bonds, tell us that over time, the USD Index is going to go lower. However, how it will get there and what are the most favorable entry points for entering speculative trades, are another matter. We must use other means to properly assess the situation, and one of the best methods is technical analysis.

This week, the chart shows us that the USD has been trading lower for the last two weeks, and it is now just above its June low of 78.33. If this decline was sharp, then I would infer that we are very likely to see the buck bounce from here. However, the decline was visibly slower than the previous downswings, so emotions are not that rampart. This means that if we move higher from here (or move lower, to the thick blue line at 77.69, and then bounce), the move higher is not likely to be large, as small volatility during downswing usually suggest also small volatility during a pullback if one is to materialize.

During the previous two weeks the USD Index has moved steadily lower, while the general stock market has moved higher almost on a daily basis.

General Stock Market

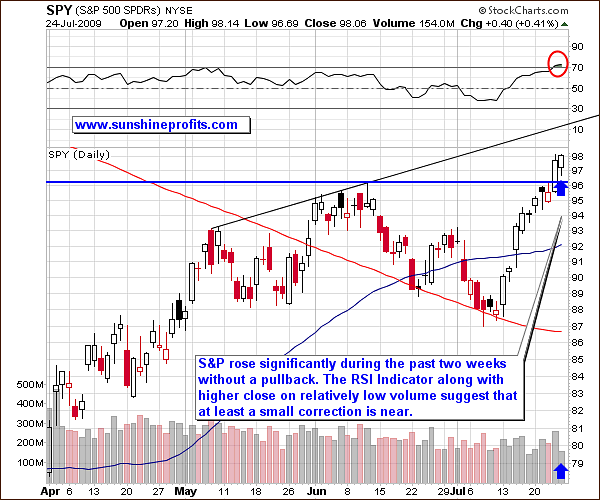

In the previous Premium Update I wrote the following regarding the previous Friday in which prices barely moved, but the volume was relatively small:

Had we seen higher prices along with visibly declining volume, we could have inferred that a correction is likely.

This is exactly what took place this week. We have just seen higher values of main stock indices along with relatively low volume, so we might infer that a correction is likely. This would be confirmed by the high value of the RSI Indicator, as marked on the chart with a red ellipse. The most visible support level is currently just above the 96 level ($96.11) in the SPY ETF.

However, since this rally broke above its previous high of $96.11, we may need to wait for the SPY to go to the black, thin resistance line (about the 100 level) before it moves lower. The 100 level is a resistance level due to the fact that it is a round number and likely to draw media atttention. (The 96.11 level corresponds to 956.23 in the S&P).

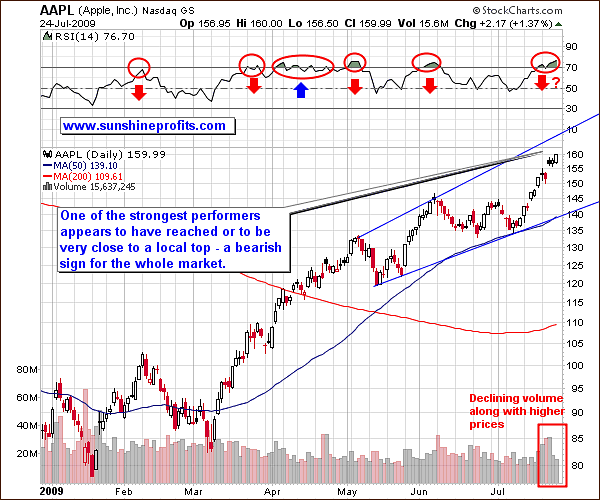

Additionally, one of the strongest performers - Apple, Inc. appears to be very close, or already at a local top.

When the strongest stocks in the industry become vulnerable to a technical downswing, it is not a good sign for the whole market. After all, if the leading stocks form a top, other equities are likely to follow.

Summing up, both important markets, (stocks and the dollar) are now suggesting a pullback is likely to take place, but not necessarily immediately. Since in the previous weeks gold, silver, and corresponding equities were trading in the opposite direction to the U.S. Dollar, and in tune with the general stock market, we may expect precious metals to take a small breather soon as well.

Before making any specific calls, we need to analyze the precious metals themselves.

Gold

Volume has been remarkably low three times this month (as shown by the three arrows in the above chart.) You can see that each of the two previous times of low volume was followed by a visible move that was brief and reversed. We may expect this to take place this time as well. Combining this with the points made about the U.S. Dollar and the general stock market, we may infer that gold is likely to move just a little higher before correcting.

Since gold and silver are strongly correlated and usually move similarly, it is often profitable to check the silver market for confirmation of signals from gold market (and vice-versa)

Silver

Silver has broken out of the delining trendling, but the low volume on Friday, suggests that we may see prices dip or consolidate before they resume their upward path. During a similar breakout in May, silver has consolidated around the price level corresponding to the previous local top - the $13 - $14 area. The analogical price level today is several cents higher - around $14.

The more similarities there are between two situations, the more probable it is that the history will repeat itself. The additional factor that suggests that the rally in silver is likely to take a pause is the action in volume. In May, slow volume after the breakout preceded the consolidation, so there is one more piece of the puzzle that fits the whole picture. With gold and silver suggesting a small consolidation, let's take a look at the precious metals stocks.

Precious Metals Stocks

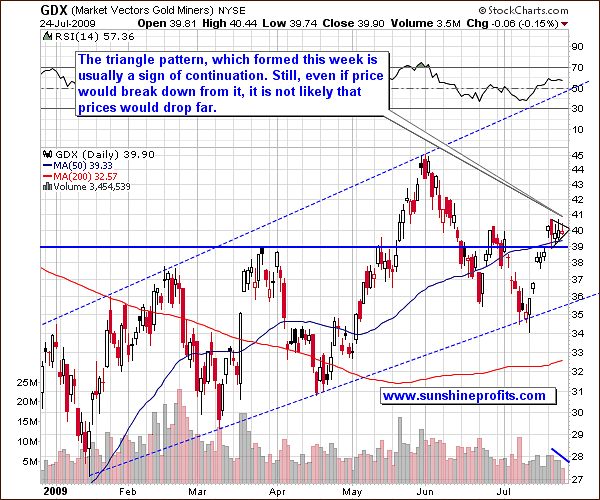

Mining stocks have also consolidated in the middle of May, and now they formed a triangle pattern, which is usually a sign of trend continuation. The volume has been declining this week, as PM stocks were trading sideways, thus confirming the triangle pattern.

Taking into account points raised earlier, even if mining stocks break down from the triangle pattern, the following move should be rather insignificant - I don't think that it would take the GDX ETF below 37 level. On the other hand, if we get a breakout to the upside, but gold and silver move lower soon, I would expect mining stocks to correct along with them, most likely once again to the upper border of the triangle - below 41 level.

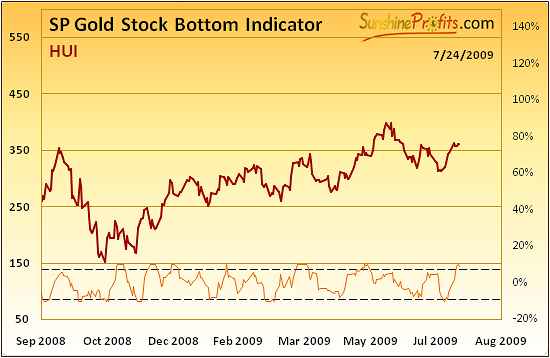

Moreover, one of our indicators signals that a pause is rather likely.

Please note that usually when SP Gold Stock Bottom Indicator broke above the upper dashed line it meant at least a brief pullback in the coming days. This has been the case during this week, so we may indeed see lower prices of PM stocks in the coming days.

Summary

Precious Metals are still in a favorable fundamental situation, and with the recent news confirming the strength of the investment demand, the overall picture is even more bullish. However, as far as timing is concerned, we may need to consolidate for several days. Since in the past few weeks, dollar has been declining steadiliy and the general stock market moved in the exactly opposite direction, the influence for the PM stocks and for the metals themselves were positive. Still, both abovementioned markets are now reaching support/resistance levels, thus making a pullback probable. This is especially the case with the main stock indices, as they have been rallying particularly strongly in the past two weeks. Once we see that the technical situation has improved in the USD Index and S&P 500, the precious metals should be ready to move much higher, probably above the $1000 level.

This completes this week's Premium Update.

Thank you for using the Premium Service. Have a great weekend and a profitable week!

Sincerely,

Przemyslaw Radomski