The evil nemesis in the 1964 James Bond movie is international bullion dealer Auric Goldfinger who is stockpiling vast quantities of gold. Bond investigates at the request of The Bank of England and soon uncovers a dastardly plan by Goldfinger and Chinese agents to bring economic chaos to the West by irradiating the U.S. gold supply at Fort Knox with an atomic device, rendering it useless for 58 years. This would greatly increase the value of Goldfinger's own gold supply and give the Chinese increased power following economic chaos in the West. Bond dodges steel-rimmed killer hats, overcomes Goldfinger's sexy pilot and saves the day.

Goldfinger could have done very well if he had just waited patiently for 1999, which is when some of Europe's central banks began selling their gold reserves under the first Central Bank Gold Agreement - 3,800 tons of it. We know in hindsight that they began selling at the bottom of the market, around $252 an ounce. Since then the price of gold has almost quadrupled. An astute evil-doer like Goldfinger could have made a fortune just by snapping up all those ingots.

Today gold is a hedge against the chance that the world's central banks will prove no more astute at preventing high inflation than they were at timing their sales of gold. But in the current economic environment the central banks are generally not selling. Rather they are holding on to their gold reserves, a move that could further increase sentiment to the yellow metal, and thus positively influence prices in the long term. The recently released data showed that the banks have not disposed of much gold in the first half of the year under the terms of the Central Bank Gold Agreement, set to expire this September. Compared to last year, the banks' sale of gold in the first 6 months of the year was down by around 73 per cent at 39 tons, the lowest level since 1994.

Central banks have been major holders of gold for more than 100 years and currently account for about 20% of aboveground stocks (yes, this implies that the rest - 80% is NOT government-controlled). In the 1980s and 1990s central banks began re-appraising gold in their external reserves and began putting more emphasis on yields. Gold, as an asset that earns no interest, began to look less attractive. In September 1999, a group of European central banks agreed, in the first Central Bank Gold Agreement, to limit disposals to 400 tons a year for five years. Their aim was to bring stability to gold prices by guaranteeing signatories would not flood the market with bullion. They also reaffirmed their confidence in the future of gold as a reserve asset. The agreement reassured the market about the intentions of central banks, since the signatories included those that had been seen as the most likely major sellers, and the price, which had reached a low of $252 an ounce in July 1999, stabilized. The agreement was renewed by 15 European central banks in 2004. The signatories agree to limit their sales over a five-year period to 2,500 tons, with annual sales limited to 500 tons. This Friday the European Central Bank confirmed signing another renewal of the five-year agreement to replace the existing pact. They reduced the annual limit to 400 tons, down 25 per cent from the previous level.

Under the current economic system, owning gold for countries is the same as for individuals--an option against an unknown future. It provides a form of insurance against what could be devastating events such as war, an unexpected surge in inflation, economic crisis leading to repudiation of foreign debts by major sovereign borrowers, or even the end of the current financial system.

In emergencies countries may need liquid resources such as gold, universally accepted as a means of payment, or as collateral for borrowing. The public takes confidence from knowing that its Government holds at least some gold - an indestructible asset, and one not prone to the inflationary dangers of fiat money.

With even governments becoming more bullish on gold (especially taking actions, not words into account), the odds that the price of gold will eventually go much above the $1000 level are very high. However, the timing of when this will that happen is a different matter. In order to estimate the most probable outcome, as far as timing is concerned, we need to refer to the charts (courtesy of http://stockcharts.com). Let's begin with gold.

Gold

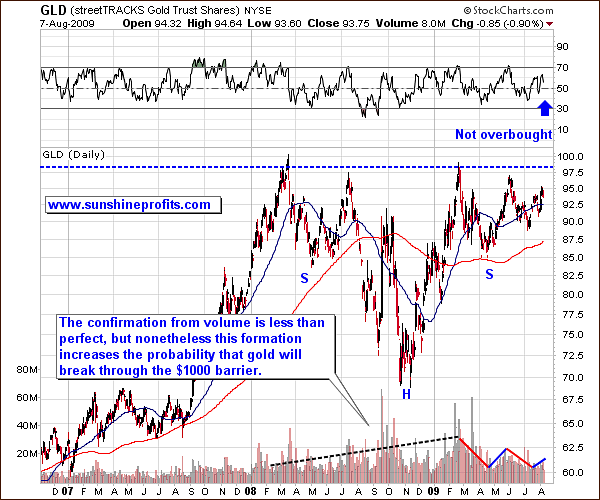

Gold moved higher at the beginning of the week, but corrected these gains at week's end, dented by a stronger dollar. Price stopped at the previous local high, which also corresponds to the 38.2% Fibonacci retracement level of the previous downswing. Normally, one might expect this level to prove a solid resistance. However, this time, gold has already broken above it and closed above three consecutive days, thus confirming the breakout. The resistance level has turned into support.

Another thing to notice is that the volume was relatively low on Friday, which was also the day when price dropped the most. This means that a significant move lower is not very likely. However, should such a move take place, it would most likely be stopped by the rising blue support line drawn from the two previous local bottoms - not far from the current price levels.

Since gold is often purchased as a hedge against erosion in the value of the U.S. dollar, let's take a look at the USD's performance for additional clues.

USD Index

The USD started this week a little lower, but ended with a sizable upswing after reaching the levels that stopped a decline back in December 2008. This large daily move up was stopped by the combination of two resistance lines (red line, and thin, blue line).

Last week I mentioned that the USD gave a bearish signal as it broken out of the declining trend line (false breakout), and plunged almost immediately. This week, the USD moved below the June lows, and then even lower to the 78 level, before moving higher. This makes last week's signal less significant. The general rule is that absent a decisive technical development, the prices of assets tend to resume their previous trend, which - in the case of USD - is down. Going forward, the risk of a rally is larger than it was a week ago, but we need to take additional factors into account.

We examined both charts independently, now let's compare them. Please note that the USD Index moved up more than 50% of its decline during the past ten days, whereas gold moved lower only about 25% of its gains during that same time.

Here's a quick reminder of the correlation between the US Dollar Index and the price of gold from one of my previous essays:

Let's assume theoretically that the main factor determining gold prices is the value of the US dollar. Gold is priced in dollars and has to respond to the USD's movements by moving in the opposite direction. If the value of gold is perceived as constant by investors the world over, and the value of the dollar falls, then in order for the price of gold in their respective national currencies to be stable, the price of gold has to rise in terms of US dollars. If the gold price did not rise when the dollar falls, then foreign investors would see the price of gold fall in their own national currencies.

They would then start buying gold, as it is now cheaper for them, pushing up the price of gold in all currencies, including the US dollar. For people who make transactions in the US dollar it would seem as if the price of gold went up out of the blue, when in fact it would be their dollars that lost value, while gold's "real" price remains unaffected. The correlation between the USD and gold is more complicated that this simplistic explanation, but it's enough to make a few key points.

Since the USD Index is generally considered the key driving force for gold prices, the fact that gold is not declining fully and proportionally to the dollar's upswing, is positive for the entire precious metals sector. It means that the market doesn't believe the bounce in the USD Index is anything more than a temporary blip. People seem to believe that the dollar's trajectory is similar that of a hammer dropped from the Empire State Building. They are not willing to sell gold if they think the USD's rise is short-lived. Since the attitude towards gold is positive, this positive sentiment can only increase if the USD moves lower. The good news is that gold would likely move higher with much greater force than the corresponding decline in the dollar.

As far as long term is concerned, the situation remains bullish. This week I would like to remind you of another head-and-shoulders pattern in gold that is much more profound and meaningful for the PM markets. I commented on it in early May, and the pattern developed as I assumed back then - the March downswing proved to be the beginning of the formation's right shoulder.

In early may, I mentioned that volume is supposed to decline during the configuration phase of a head-and-shoulders formation. This has not been the case here. However, when one takes a short term perspective - focusing on the right shoulder - and corresponding volume, (red and blue lines marked on the volume) the situation begins to look favorable. This head-and-shoulders formation is not perfectly in tune with volume, but it is "close enough" to increase the probability that we are going above the $1000 level sooner rather than later. In conclusion, the final interpretation of the chart is more bullish now than a few months earlier and makes the move above $1000 more probable

The situation on the silver market is currently similar to the one on the gold market, so I will not cover it deeply this week. Should gold either sell off, or soar from here, I would expect silver market to follow golds footsteps. I will keep you updated should anything change on that matter during this week.

Precious Metals Stocks

PM stocks failed to break above the neckline of their own head-and-shoulders pattern, but, as I already mentioned, the decline at the end of the week has been rather insignificant, especially if one compares it to the corresponding upward move in the USD Index. We will need to wait for additional signals before making any specific calls. For now, the trend remains up.

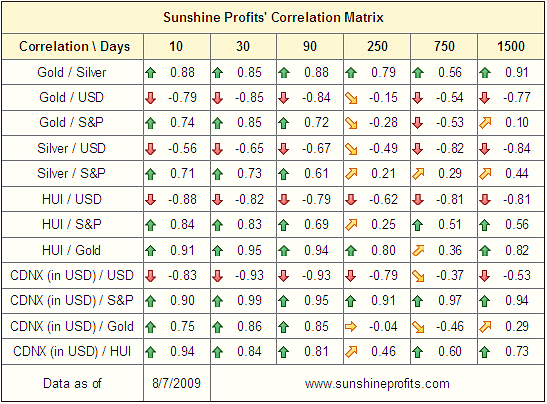

Correlations

Although last week the very-short-term column in the correlation matrix implied that the general stock market may stop being significant for short-term price swings in precious metals, the latest data does not confirm this. High values of correlation coefficients in the 30-day- and also in the 10-day column mean that the action in the main stock indices still needs to be taken into account if one trades the precious metals, and especially PM stocks.

Therefore, let's take a look at the general stock market

General Stock Market

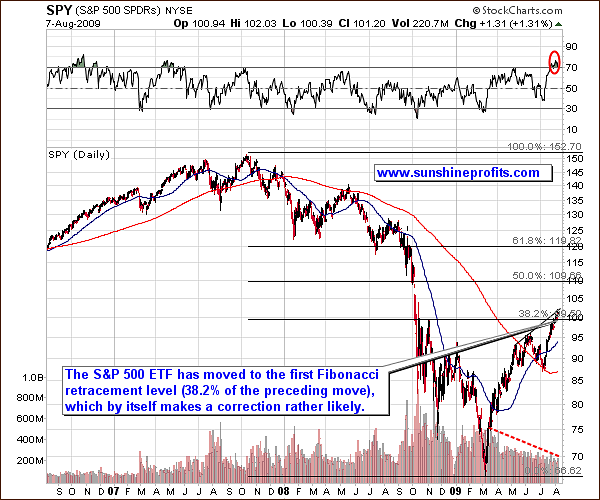

The SPY ETF (S&P 500 ETF) has moved to the first Fibonacci retracement level, thus correcting 38.2% of the whole massive downswing. This one factor makes a correction likely. However, there are more factors that need to be considered. Volume - often overlooked, but very important in every market - has been declining during the recent multi-month rally, thus increasing the probability of a downswing soon.

The RSI is currently in the overbought territory, however this indicator is not as efficient for the stock market as it is in the precious metals sector. Still, the short term trend line suggests that a local top is very near.

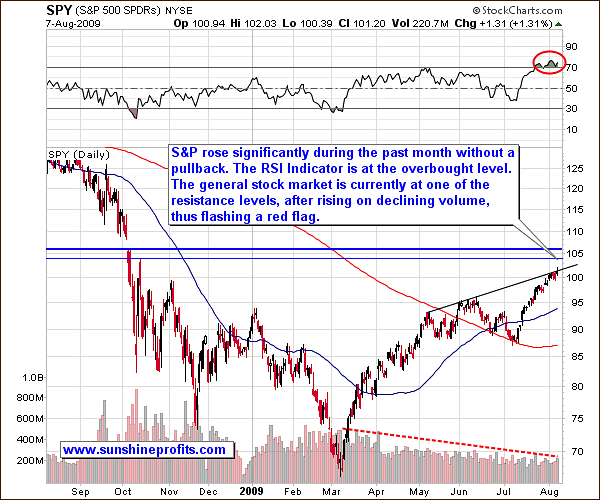

Taking a closer look reveals that the general stock market has just reached a resistance level, and is very close to two additional ones. The lower horizontal line is created by using the October 2008 local top. Please note that this period from October 2008 was characterized by exceptionally high volume, which makes this level particularly important. Additionally, the similar thing can be said about the lower border of the price gap.

With the price of the SPY ETF so close to these important short-term resistance levels, it is difficult for me believe that in the short run stocks will go much higher. The red "beware" signals are flashing for investors who are long the stock market. So, if you own a lot of stocks, especially volatile ones, now might be a good time to consider limiting your exposure. This, despite Friday's employment report, the most heartening one since last summer, which suggests to some that a recovery is under way.

Summary

The fundamental situation in the precious metals market justifies a move above the $1000 level, as does the size of the correction that followed the initial breakout above the four-digit barrier. Still, despite the previous bearish signals, the situation in the USD market has become murky, and consequently, makes specific calls for the PM sector very risky. The precious metals themselves are showing strength, but if the USD will move higher from here, the PM's rise could be delayed.

This is not the most probable outcome, as the main trends are for USD are down, while for gold, silver and mining stocks they are up.

In the current market juncture (high correlation between PM sector and the general stock market) this may pose a threat to further gains in gold, silver, and mining stocks. I will be monitoring the markets and report to you as soon as I see signals confirming either further gains, or those indicating lower prices.

This completes this week's Premium Update.

Thank you for using the Premium Service. Have a great weekend and a profitable week!

Sincerely,

Przemyslaw Radomski