Briefly: in our opinion, full (100% of the regular position size) speculative short positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

Some might consider an additional (short) position in the FCX.

Is bad news really good news? Or is it bad news after all? Job openings plunged recently, and yet, stocks and miners rallied. What gives?

In today’s analysis, we’ll focus on the fundamental aspects of the precious metals market, and I’ll add a quick technical note at the end.

So, what’s the current status?

Miners ended the Aug. 31 session in the red, as the GDXJ ETF declined by 0.99% and the GDX ETF by 0.88%. Likewise, gold and silver sunk by 0.36% and 1.16%, respectively.

Furthermore, while the pivot crowd assumes 2023 is a lot like 2021 and 2022, the economic backdrop is much different now, and recession watch has officially begun.

Bad News Is Bad for Gold

With the crowd still exhibiting soft landing optimism, the ‘bad news is good news’ mantra has returned to the financial markets. If you’re unfamiliar, the phrase means that weak economic data is positive because it will allow the Fed to pause and/or cut interest rates, which is bullish for risk assets. As such, the S&P 500 and gold lauded the recent data dip.

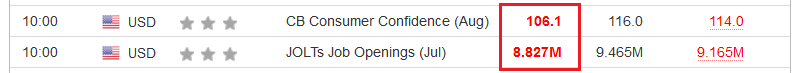

However, that analysis is shortsighted, and it’s likely only a matter of time before bad news results in bad outcomes for the PMs. To explain, JOLTS job openings sunk on Aug. 29 and came in well below economists’ consensus expectations. In addition, consumer confidence declined materially as inflation and higher long-term interest rates eat away at Americans’ disposable incomes.

Please see below:

Yet, the crowd often opines that ‘the stock market is not the economy’ despite years of mounting evidence to the contrary. Consequently, don’t be surprised when a recession rains on the bulls’ parade and silver suffers during the downpour.

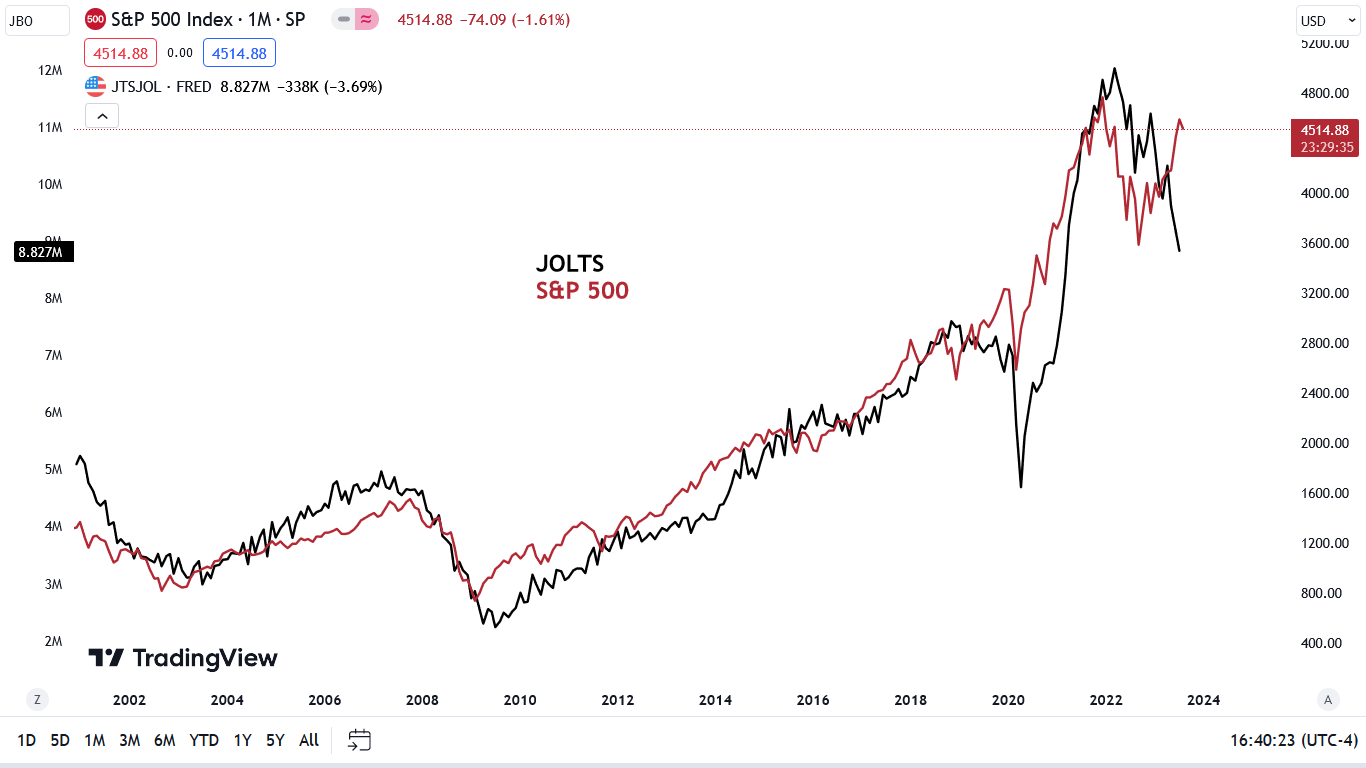

Please see below:

To explain, the black line above tracks JOLTS job openings, while the red line above tracks the S&P 500. As you can see, the pair largely moved in lockstep for more than 20 years. But, with a major divergence present on the right side of the chart, the S&P 500 assumes that the connection no longer matters.

Although, please remember that JOLTS should decline significantly in the months ahead, making the gap even worse. Furthermore, job openings are a leading indicator of consumer demand because when demand is robust, companies respond by increasing their workforce to match their order books. In contrast, when demand weakens, they reduce job openings, as their current staffing is sufficient.

Moreover, lower job openings are the first step to a rising unemployment rate. After employers reduce their openings to match weaker demand, a continuation of the theme results in furloughs and layoffs. As such, while we warned that higher long-term interest rates are the perfect ingredient for a recession, a spike in unemployment should rattle the bulls and uplift the USD Index.

For context, we wrote on Oct. 6, 2021:

The USD Index’s fundamental strength is underwritten by the ‘dollar smile.’ When the U.S. economy is trudging along, the U.S. dollar tends to underperform. However, when the U.S. economy craters and a safe-haven bid emerges, the U.S. dollar often outperforms. Conversely (and similarly), when the U.S. economy is booming and higher interest rates materialize, the U.S. dollar also outperforms.

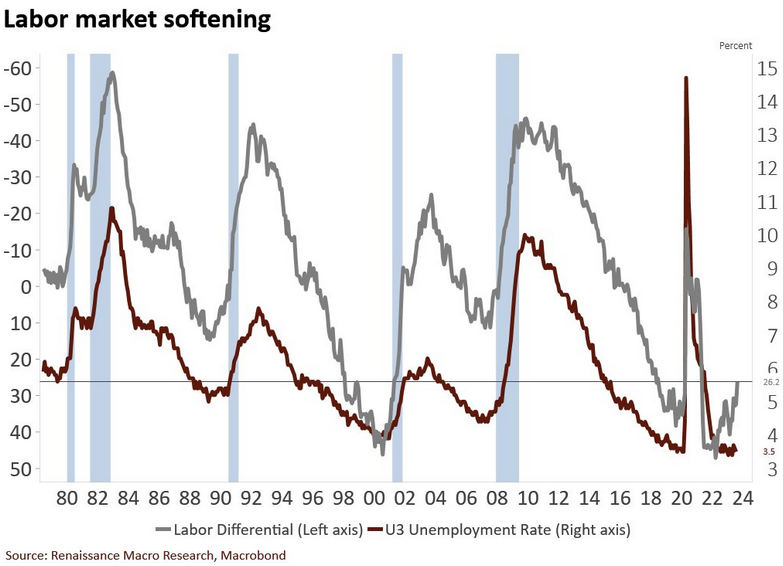

Please see below:

Thus, while part one of our fundamental thesis unfolded as expected (hawkish Fed, higher real yields), the second part is underway. Now, the crowd still assumes that ‘bad news is good news,’ so the price action does not reflect the economic scars. Yet, in the months ahead, a crisis of confidence should unfold, and the S&P 500 should come under heavy pressure.

Please see below:

To explain, the brown line above tracks the U.S. unemployment rate, while the gray line above tracks The Conference Board’s inverted (down means up) labor differential. For context, the latter tracks the spread between Americans who say jobs are “plentiful” versus jobs are “hard to get.”

If you analyze the relationship, you can see that when the labor differential sinks (gray line rises), the U.S. unemployment rate has not been far behind. More importantly, the labor differential hit a new cycle low on Aug. 29. The gray line has risen materially, and like JOLTS, it should only worsen in the months ahead.

Don’t Quit

While trudging through challenges signals perseverance, when Americans stick with their employers, it’s a sign that economic weakness has spread.

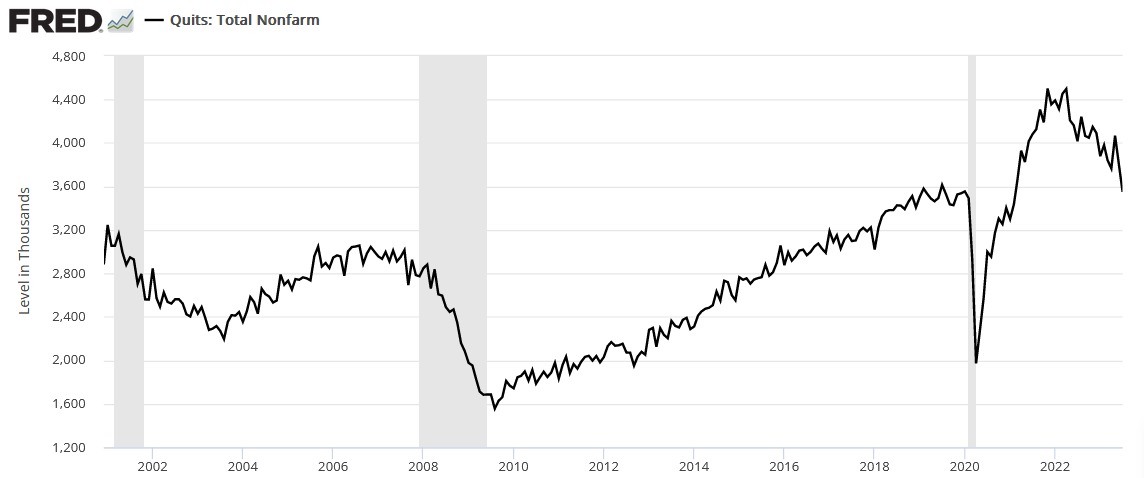

Please see below:

To explain, the black line above tracks nonfarm quits. For context, the metric tallies the number of Americans voluntarily leaving their jobs each month. In a nutshell: when employment opportunities are robust, Americans jump from one job to another and capture the salary gains. Consequently, it’s no surprise that record quits in 2021/2022 culminated with record wage inflation (according to the Atlanta Fed).

But, if you analyze the right side of the chart, you can see that those days are long gone. Quits have collapsed over the last two months and are now below their pre-pandemic highs. Furthermore, notice how falling quits coincided with the last three recessions?

So, while we faded the recession hysteria throughout 2021 and 2022, that was due to a robust labor market and rampant wage inflation enhancing consumers’ spending power. However, these metrics have weakened materially, and they should only worsen the longer long-term interest rates remain high.

Overall, investors are blinded by the fallacy that weaker data is bullish because the Fed can pivot. History shows that when dovish pivots occur, liquidations are already underway across the financial markets. Therefore, when bad news becomes bad news again, don’t be surprised if the next bout of panic sinks assets like crude oil, stocks, and the PMs and uplifts the USD Index.

The Countdown to Silver’s Crash

Like mining stocks, silver is sensitive to volatility. And with the ‘bad news is good news’ optimism filtering through the financial markets, the narrative has aided the white metal.

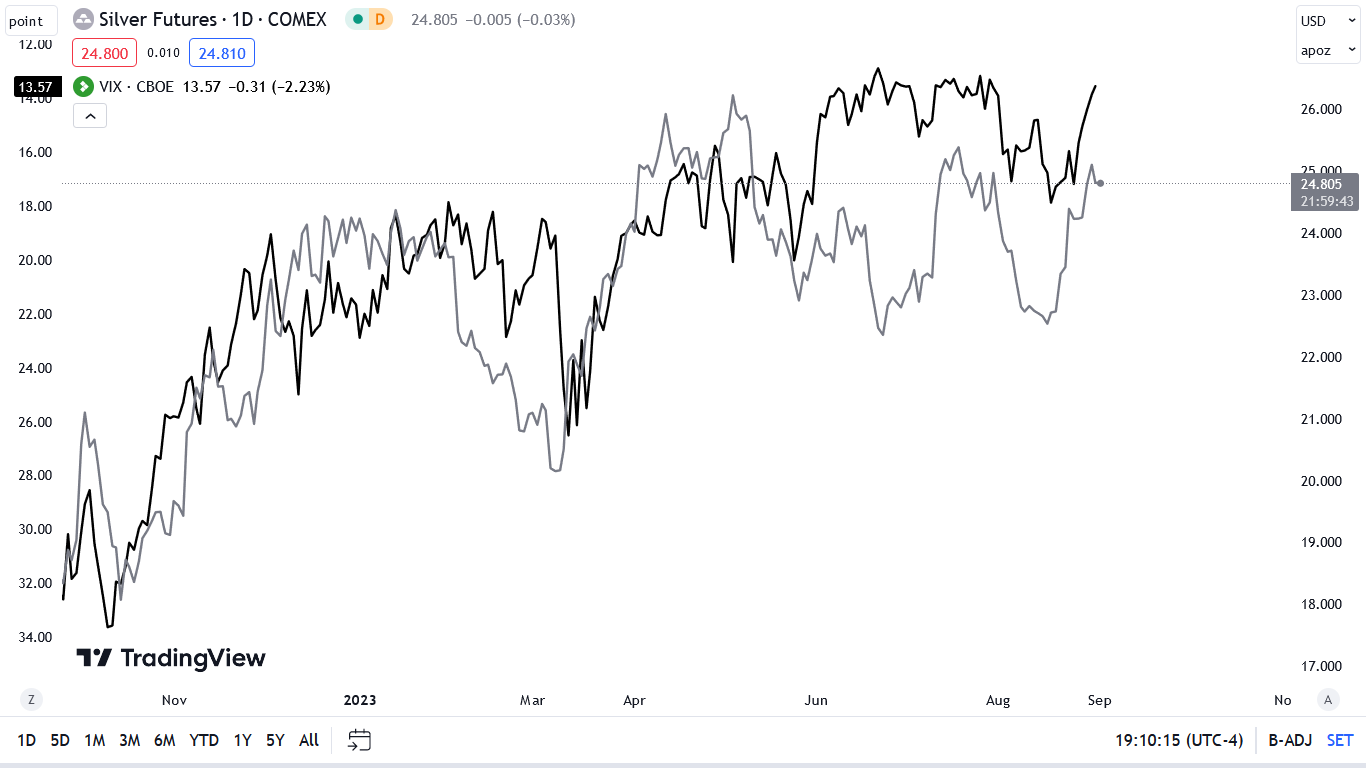

Please see below:

To explain, the gray line above tracks the silver futures price, while the black line above tracks the inverted (down means up) Cboe Volatility Index (VIX). If you analyze the relationship, you can see that silver has largely moved opposite to the VIX for roughly 12 months. And with lower volatility reigning in recent days, silver sees few reasons not to celebrate.

Despite that, we mentioned that recession winds have begun to blow, and gold is far from immune. Consequently, while the price action seems bullish, the bearish fundamentals continue to head in an ominous direction. To explain, we wrote on Aug. 24:

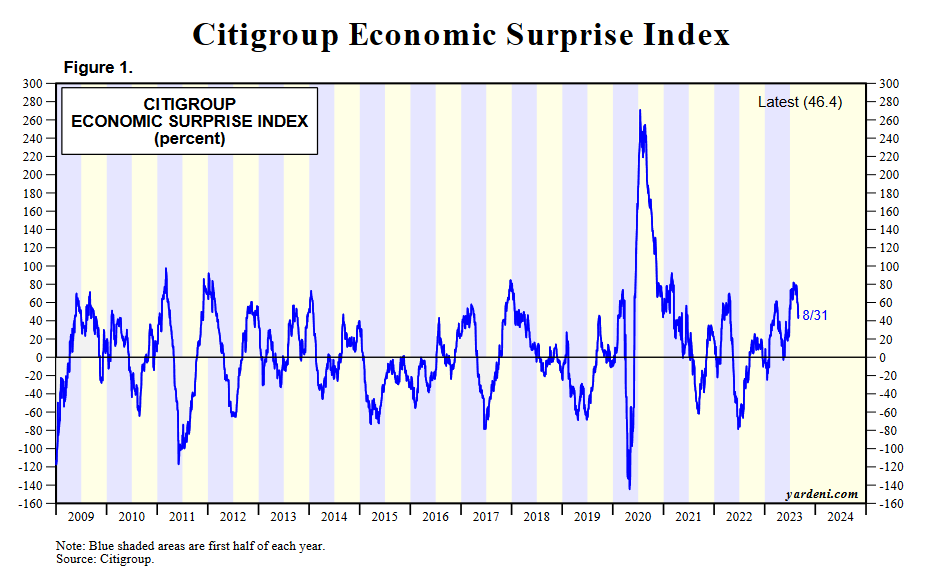

The blue line above tracks Citigroup’s U.S. Economic Surprise Index (ESI). For context, a surprise occurs when a data point outperforms economists’ consensus expectations. And with the metric peaking near 85, the recent run of hot data is on par with the highs seen over the last ~20 years.

However, if you analyze the movement of the blue line after reaching these heights, you can see that sharp drops often followed, and readings near -80 can materialize. As a side note, the metric was much more volatile during the pandemic, as base effects played a key role. As a result, -80 to +80 is a more appropriate range.

The moral of the story is that while Europe looks poised for an abrupt recession, the U.S. may not be far behind. When interest rates were too low, they helped the ESI soar as relatively cheap money made borrowing more affordable. Although, the recent rate surge means those days are over, and major volatility should be on the horizon.

To that point, it’s been roughly a week, and the metric has already declined materially.

Please see below:

To explain, the ESI has fallen from 60.5 on Aug. 24 to 46.4 on Aug. 31. Furthermore, it was north of 80 two weeks ago. As such, if (when) it crashes into deeply negative territory, investors’ calm should dissipate, and the VIX and the USD Index should soar.

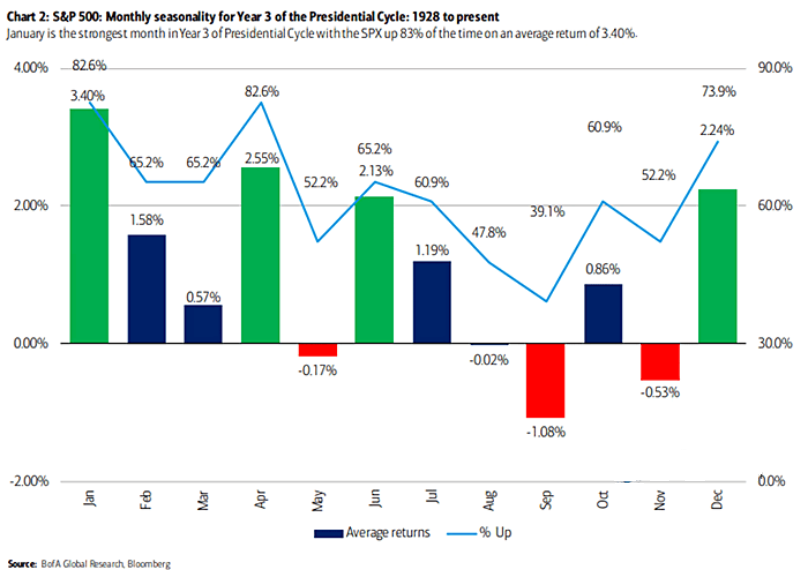

Likewise, September is often the worst month for the S&P 500 during the third year of a presidential cycle.

Please see below:

To explain, the red bar near the right side of the chart shows how the S&P 500 often loses more than 1% in September (since 1928), as poor performance dominates. Moreover, the blue line above shows how September rallies only occur 39.1% of the time, which is the worst of any month.

In addition, this occurs alongside VIX seasonality, which is bullish in September and October. We wrote on Aug. 24:

If you analyze the red circle on the right side of the chart, you can see that it often peaks in early October. Consequently, we’re not even halfway through the VIX’s typical seasonal surge, and if history repeats, it’s profoundly bearish for the S&P 500 and silver.

The Rates Conundrum

While it may seem confusing, it’s important to distinguish when lower interest rates are bullish and bearish for the PMs. When the U.S. economy is resilient, and the Fed is doing QE, the fundamental backdrop is bullish for the PMs because lower interest rates reduce the opportunity cost of owning gold (it’s non-yielding), weaken the USD Index, and enhance inflation.

However, when an economic calamity unfolds, lower interest rates are bearish for the PMs because Treasuries are the main beneficiaries when panic strikes.

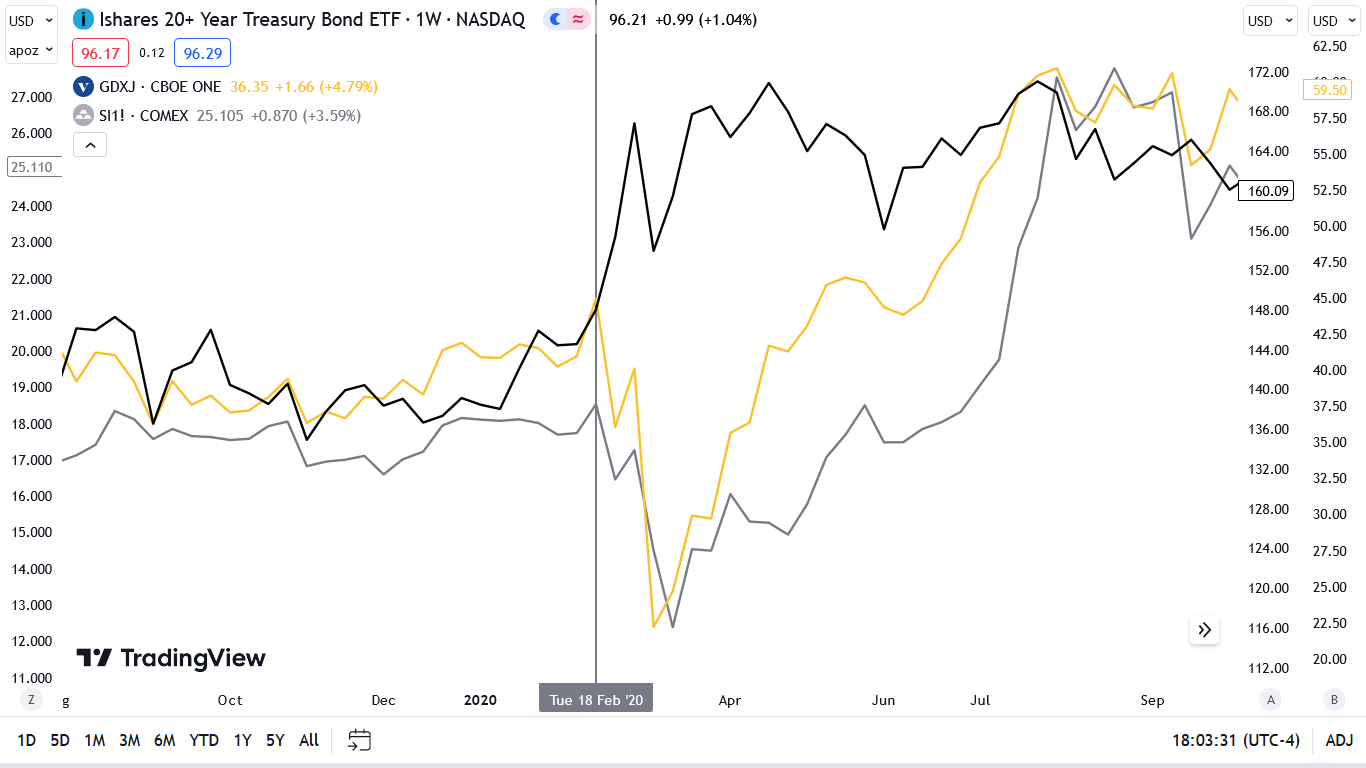

Please see below:

To explain, the black, gray, and gold lines above track the iShares 20+ Year Treasury Bond (TLT) ETF, silver, and the GDXJ ETF before and after the COVID-19 crash. If you analyze the vertical gray line near the middle of the chart, you can see that TLT soared as silver and the GDXJ ETF plunged. As a result, while we successfully predicted that lower TLT prices were bearish for the PMs in 2021 and 2022 when the recession arrives, the opposite should have the same bearish ramifications.

Overall, oil prices have rallied as the crowd assumes that weaker data is a good thing. But, long-term interest rates have largely ignored the recent data dump, meaning that little has been done to reverse the recent rate rally. Consequently, if one month of higher long-term Treasury yields did this much damage to the U.S. economy, imagine how bad the data will be by year-end. Thus, the fundamentals continue to unfold as expected, and we think a major recession will occur before this cycle ends.

The Bottom Line

The crowd remains sanguine for the time being, as the thought of a dovish Fed garners all of investors’ attention. However, we warned repeatedly that a higher U.S. federal funds rate (FFR) is not what causes recessions, it’s higher long-term interest rates. And with borrowing costs rising dramatically, consumers have less money to spend, and we’re already seeing the effects in the job openings data. As such, we’re likely in the second inning (of nine) of what should be a cold winter for the soft-landing bulls.

In conclusion, the PMs declined on Aug. 31, as silver and mining stocks led the move lower. And with the USD Index rallying sharply, more pain should confront the PMs before long-term buying opportunities emerge.

Technically Speaking

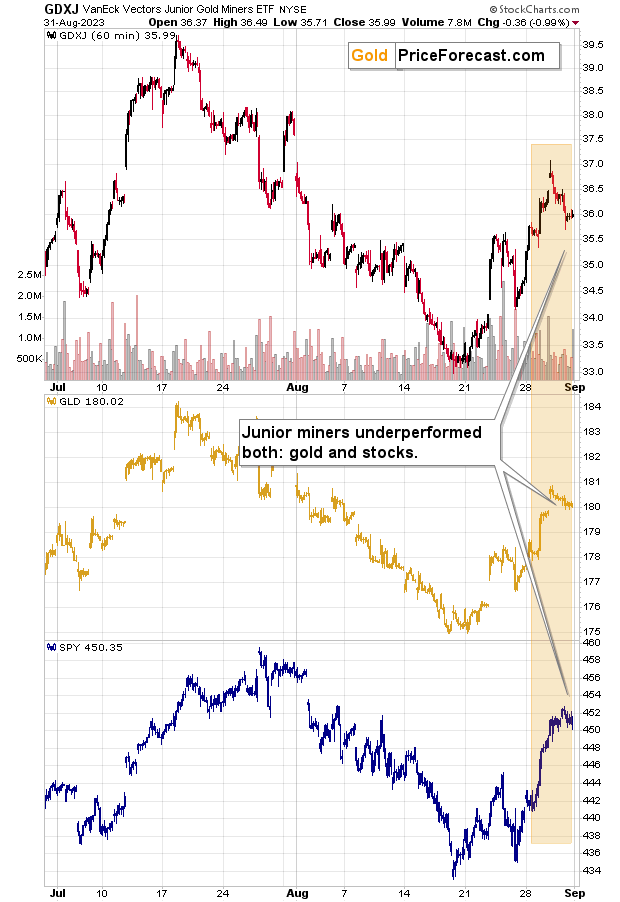

Junior miners moved lower in a quite visible manner yesterday, while both gold and stocks moved lower rather insignificantly.

The orange area shows that junior miners declined almost to the price that started the area, whereas neither gold nor stocks did something like that.

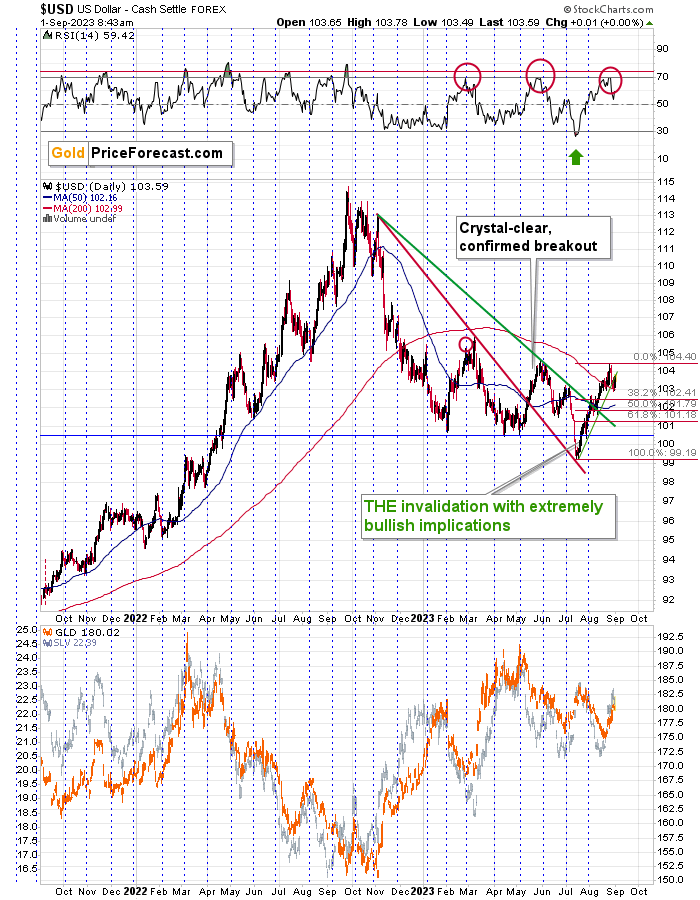

Miners are weak, and this is a bearish sign. And yet, I’m not further increasing the size of the current short position. At least not yet. The reason is visible on the USD Index chart.

The U.S. currency moved below the rising green support line, and it only moved back to it. It didn’t invalidate the breakdown. This means that the USDX could still fall further – for example, to its 38.2% Fibonacci retracement, that’s currently at about 102.4.

This, in turn, could lead to higher precious metals prices. Now, given that junior miners showed weakness here, it could be the case that gold moves to new short-term highs, but miners don’t or move above them just slightly.

Such continued weakness in miners, along with the USDX reaching its downside target, would provide a great chance to add to the current short positions.

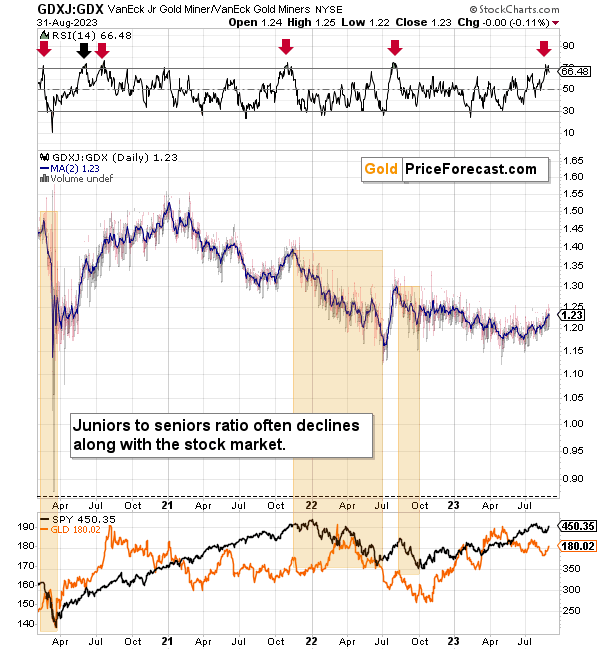

Before summarizing, if you’ve been wondering why I’m focusing on junior miners and not senior miners in this short position, here’s a reply that’s better than 1000 words.

The above chart shows a medium-term downtrend in the ratio between juniors and seniors, and it also shows that juniors are currently overvalued relative to seniors from a short-term point of view. That’s what the RSI above 70 (that’s where it just was) indicated.

As the ratio is likely to move lower once again, juniors are likely to fall more than seniors.

There’s also a closer link between juniors and the general stock market. The above chart features three orange areas, where the ratio fell along with stocks (marked with black in the bottom part of the chart). Since I expect stocks to decline, the ratio has yet another reason to decline.

Fundamentally speaking, junior miners are more likely to face the risk of bankruptcy in the high-interest-rate environment. Seniors sell metals so they can cover the interest on their debt from revenue. Juniors oftentimes can’t, and they need to rely on cash reserves or additional investment capital. Again, this is a good reason to expect junior miners to move lower more than seniors in the upcoming months.

So, all in all, the profits that we reaped from the short and long positions in the GDXJ recently are likely to be joined by massive profits from the current short positions in the junior mining stocks and in the FCX.

===

If you’d like to participate in my Mastering Multidimensional Wealth | 1:1 Coaching Experience (perhaps by re-investing some of your profits into yourself) or become a partner/investor in Golden Meadow, you’ll find more details in the above links.

Overview of the Upcoming Part of the Decline

- It seems that the recent – and probably final – corrective upswing in the precious metals sector is over.

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place and if we get this kind of opportunity at all.

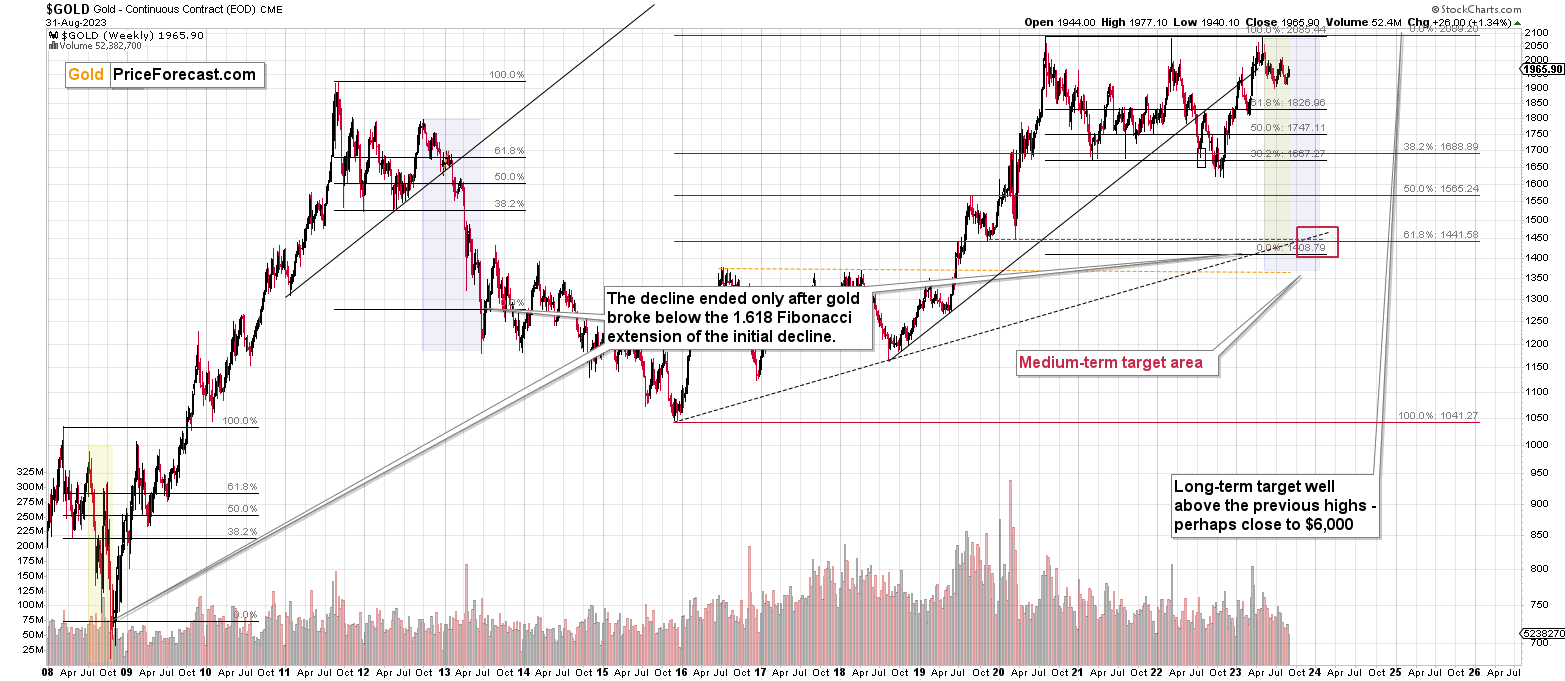

- I plan to switch from the short positions in junior mining stocks or silver (whichever I’ll have at that moment) to long positions in junior mining stocks when gold / mining stocks move to their 2020 lows (approximately). While I’m probably not going to write about it at this stage yet, this is when some investors might consider getting back in with their long-term investing capital (or perhaps 1/3 or 1/2 thereof).

- I plan to return to short positions in junior mining stocks after a rebound – and the rebound could take gold from about $1,450 to about $1,550, and it could take the GDXJ from about $20 to about $24. In other words, I’m currently planning to go long when GDXJ is close to $20 (which might take place when gold is close to $1,450), and I’m planning to exit this long position and re-enter the short position once we see a corrective rally to $24 in the GDXJ (which might take place when gold is close to $1,550).

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold prices close to $1,400 and GDXJ close to $15 . This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,400, but at the moment it’s too early to say with certainty.

- The above is based on the information available today, and it might change in the following days/weeks.

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding nor clear enough for me to think that they should be used for purchasing options, warrants, or similar instruments.

Letters to the Editor

Please post your questions in the comments feed below the articles, if they are about issues raised within the article (or in the recent issues). If they are about other, more universal matters, I encourage you to use the Ask the Community space (I’m also part of the community), so that more people can contribute to the reply and enjoy the answers. Of course, let’s keep the target-related discussions in the premium space (where you’re reading this).

Summary

To summarize, the medium-term trend in the precious metals sector remains clearly down, and it seems that the corrective upswing is already over or about to be over. We just caught the 10th profitable trade in a row – congratulations. The outlook for the short positions in junior miners and in the FCX remains very favorable.

===

Finally, since the 10th profitable trade in a row is such a great piece of news, here’s… Even more great news! The possibility to extend your subscription for up to three years (at least by one year) with a 20% discount from the current prices is still open.

Locking in those is a great idea not only because it’s the perfect time to be ready for what’s next in the precious metals market but also because the inflation might persist longer than expected, and prices of everything (including our subscriptions) are going to go up in the future as well. Please reach out to our support – they will be happy to assist you and make sure that your subscription days are properly extended at those promotional terms. So, for how many years would you like to lock-in your subscription?

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (100% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $26.12; stop-loss: none.

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged). The binding exit level for the JDST: $12.18; stop-loss for the JDST: none.

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures downside exit price: $20.22 (stop-loss: none)

SLV exit price: $18.62 (stop-loss: none)

ZSL exit price: $24.98 (stop-loss: none)

Gold futures downside exit price: $1,812 (stop-loss: none)

Spot gold downside exit price: $1,792 (stop-loss: none)

HGD.TO – alternative (Canadian) 2x inverse leveraged gold stocks ETF – the exit price: $10.38 (stop-loss: none)

HZD.TO – alternative (Canadian) 2x inverse leveraged silver ETF – the exit price: $18.87 (stop-loss: none)

///

Optional / additional trade idea that I think is justified from the risk to reward point of view:

Short position in the FCX with $27.13 as the short-term profit-take level.

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you’ve already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (as it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

===

On a side note, while commenting on analyses, please keep the Pillars of the Community in mind. It’s great to provide points that help others be more objective. However, it’s important to focus on the facts and discuss them in a dignified manner. There is not much of the latter in personal attacks. As more and more people join our community, it is important to keep it friendly. Being yourself, even to the point of swearing, is great, but the point is not to belittle other people or put them in a position of “shame” (whether it works or not). Everyone can make mistakes, and everyone does, in fact, make mistakes. We all here have the same goal: to have a greater understanding of the markets and pick better risk-to-reward situations for our trades. We are on the same side.

On another – and final – side note, the number of messages, comments etc. that I’m receiving is enormous, and while I’m grateful for such engagement and feedback, I’m also starting to realize that there’s no way in which I’m going to be able to provide replies to everyone that I would like to, while keeping any sort of work-life balance and sanity ;) Not to mention peace of mind and calmness required to approach the markets with maximum objectivity and to provide you with the service of the highest quality – and best of my abilities.

Consequently, please keep in mind that I will not be able to react / reply to all messages. It will be my priority to reply to messages/comments that adhere to the Pillars of the Community (I wrote them, by the way) and are based on kindness, compassion and on helping others grow themselves and their capital in the most objective manner possible (and to messages that are supportive in general). I noticed that whatever one puts their attention to – grows, and that’s what I think all communities need more of.

Sometimes, Golden Meadow’s support team forwards me a message from someone, who assumed that I might not be able to see a message on Golden Meadow, but that I would notice it in my e-mail account. However, since it’s the point here to create a supportive community, I will specifically not be providing any replies over email, and I will be providing them over here (to the extent time permits). Everyone’s best option is to communicate here, on Golden Meadow, ideally not in private messages (there are exceptions, of course!) but in specific spaces or below articles, because even if I’m not able to reply, the odds are that there will be someone else with insights on a given matter that might provide helpful details. And since we are all on the same side (aiming to grow ourselves and our capital), a ton of value can be created through this kind of collaboration :).

Thank you.

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief