Briefly: In our opinion, full (150% of the regular full position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this alert.

It was just two days ago when the USD Index plunged and gold stocks soared and it didn’t take long for both moves to be reversed. Both markets gave up parts of their previous moves, but none of them was erased entirely. Which implications – bullish or bearish – will prevail and in which direction will the precious metals market head in the short term?

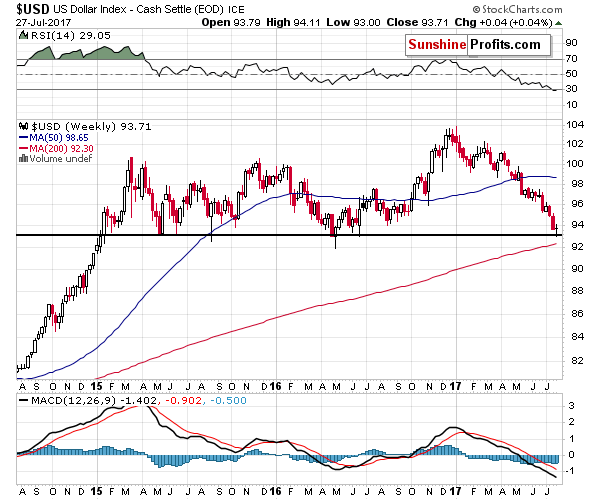

Let’s examine the situation starting with the USD Index (chart courtesy of http://stockcharts.com).

In the July 24, 2017 Alert, we wrote the following regarding the USD Index:

The USD Index broke below the late-2016 lows on Friday and there are a few things that we would like to stress. Firstly, the USD Index declined in an accelerated manner (reverse parabola), which is how the most volatile price swings end (remember the 2011 top in gold?). Secondly, the RSI indicator is the most oversold since the 2011 bottom (yes, the situation is so extreme at this point), while the fundamental picture still favors higher USD Index values (rising rates in the U.S. compared to expansive monetary policy in the EU and Japan, despite somewhat hawkish comments from Mario Draghi). Thirdly, while the USD broke through the short-term support levels, it is now approaching a long-term one – the 2015 and 2016 lows in terms of the weekly closing prices. They are just above the 93 level – about 0.6 below last week’s low. That’s only half of last week’s decline that would need to be seen for the USD to reach these key lows. In fact, just a repeat of Friday’s decline would almost be enough.

All of these factors point to a nearby reversal and the way that gold, silver, and – in particular – mining stocks have been reacting to the USD’s decline (to a limited extent) suggests that a reversal in the USD is likely to trigger a sharp decline in the precious metals sector.

Even if the USD was to repeat it’s Friday’s decline, would it be a good idea to bet on higher PM prices or even stay on the sidelines, especially given the recent show of volatility in silver?

In yesterday’s Alert, we added:

The mentioned target area – just above the 93 level – was just reached. The USD Index moved to 93.152 (Bloomberg data), which was below the May 2015 bottom (in terms of the weekly closing prices - 93.18), but above the lowest weekly close of 2016 (93.03). Overall, it seems that the weekly support level was reached. It’s only two sessions until the week ends, so it could be the case that the bottom is already in. If it’s not, it’s likely at hand.

As you can see on the above chart, based on Stockcharts data, the intra-day low was exactly 93, so both previous bottoms (weekly closing prices) were reached. This could be enough to trigger a reversal, especially that the week is just ending – there will most likely (unless the USD slides today) be no breakdown this week - only a tiny attempt at it.

If this is the case, the outlook will improve as a result.

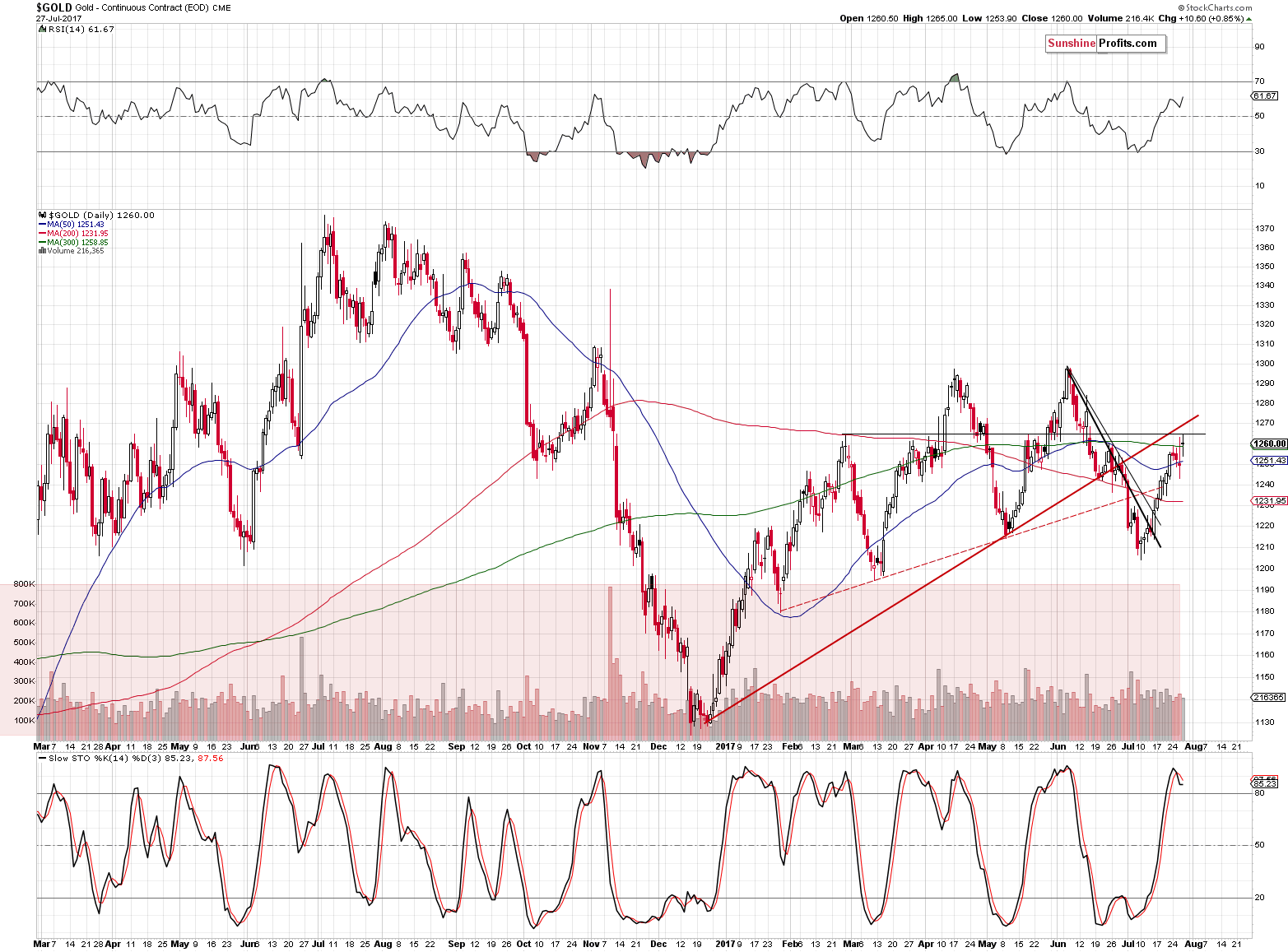

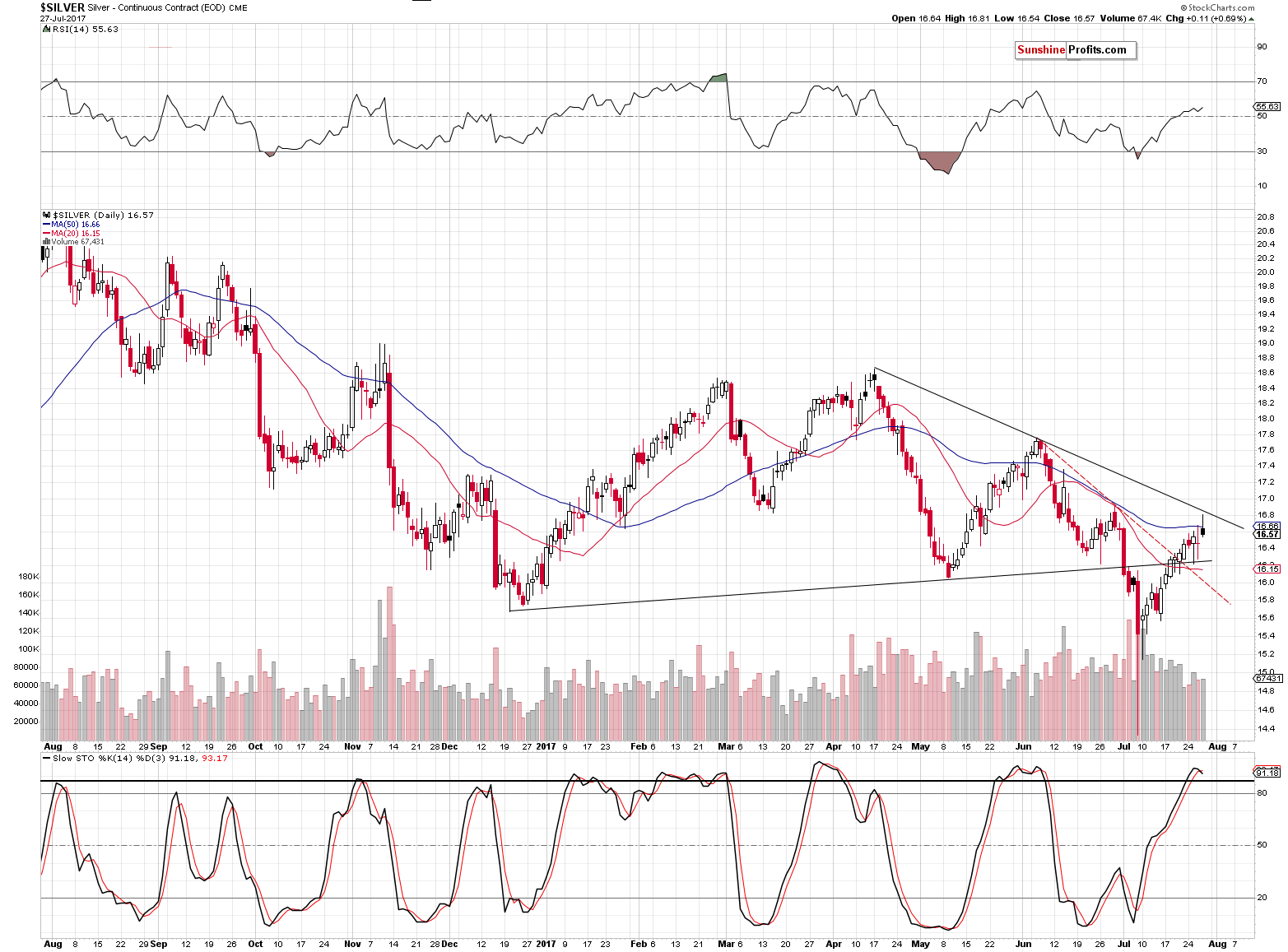

On June 24, we also wrote the following regarding gold and silver:

Can gold and silver move higher temporarily? Yes, but very likely not much higher. Can gold and silver plunge shortly after reaching their tops and decline in a very volatile manner, similarly to what silver did recently? Naturally, that’s the key thing in the current situation – the downside potential is multiple times greater than the temporary upside potential.

Gold could move to $1,265 or so (the previous top and the rising support line), but would that really matter if gold plunged over $150 shortly thereafter? The analogous price level for silver would be $16.90 and everyone saw recently just how fast silver could decline once it’s time for it.

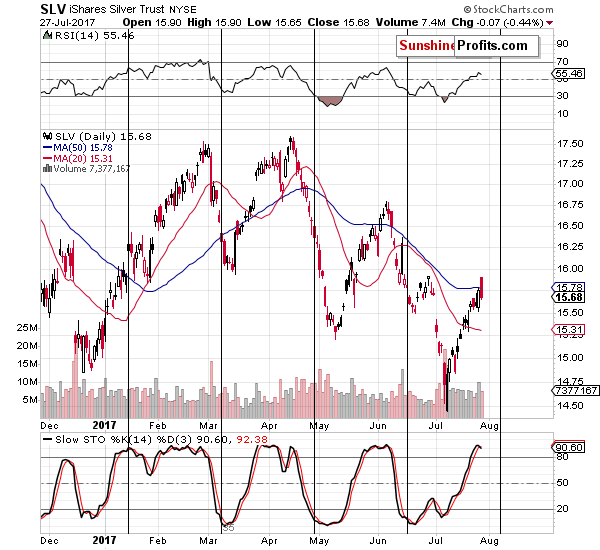

The $1,265 was precisely yesterday’s intra-day high and the intra-day high for silver was only 9 cents below our previous target. Still – as we wrote yesterday - gold could move to about $1,270 and reverse after that as the rising red resistance line is now higher than when we wrote the above. Silver could move just a bit higher as well, but it doesn’t mean that it has to. Given the situation in the USD Index and the mining stocks’ underperformance (on Wednesday, we saw only one session that was an exception to the above rule) it seems that the surprising move (remember the flash crash in silver earlier this month?) could be to the downside, so adjusting the position based on the possibility of seeing a small upswing doesn’t seem justified.

Also, let’s keep in mind that silver’s turning point is just around the corner and in all 3 previous cases, the major top (followed by a sharp decline) was seen right before the turning point. Consequently, seeing a top shortly appears very likely.

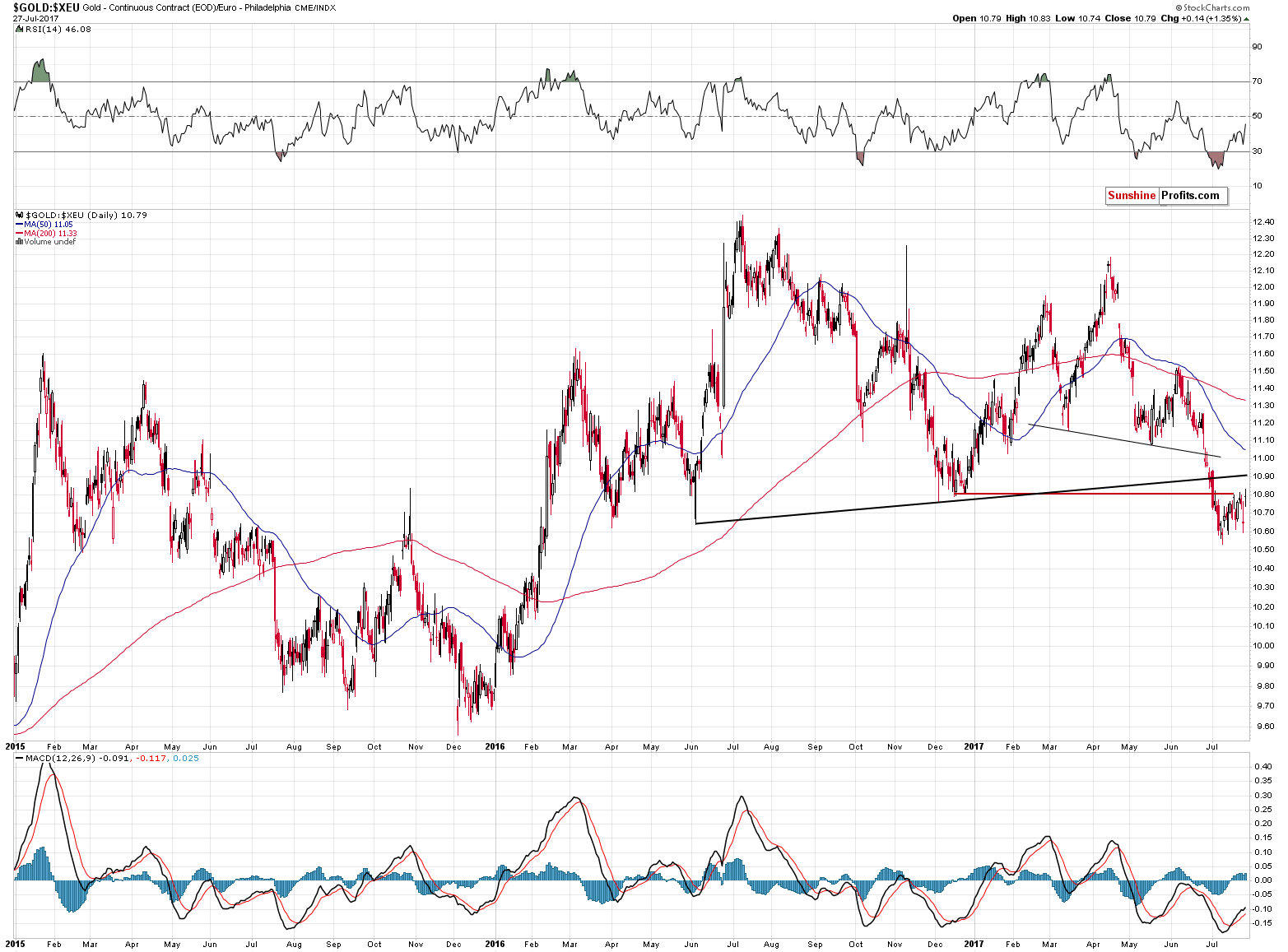

Moving back to the price of gold, let’s take a look at it in terms of the euro.

As you can see on the above chart, the gold price didn’t move back above the December 2016 lows despite the strength in terms of the USD. Consequently, the breakdown was not invalidated and the bearish implications remain in place.

In yesterday’s alert, we wrote the following:

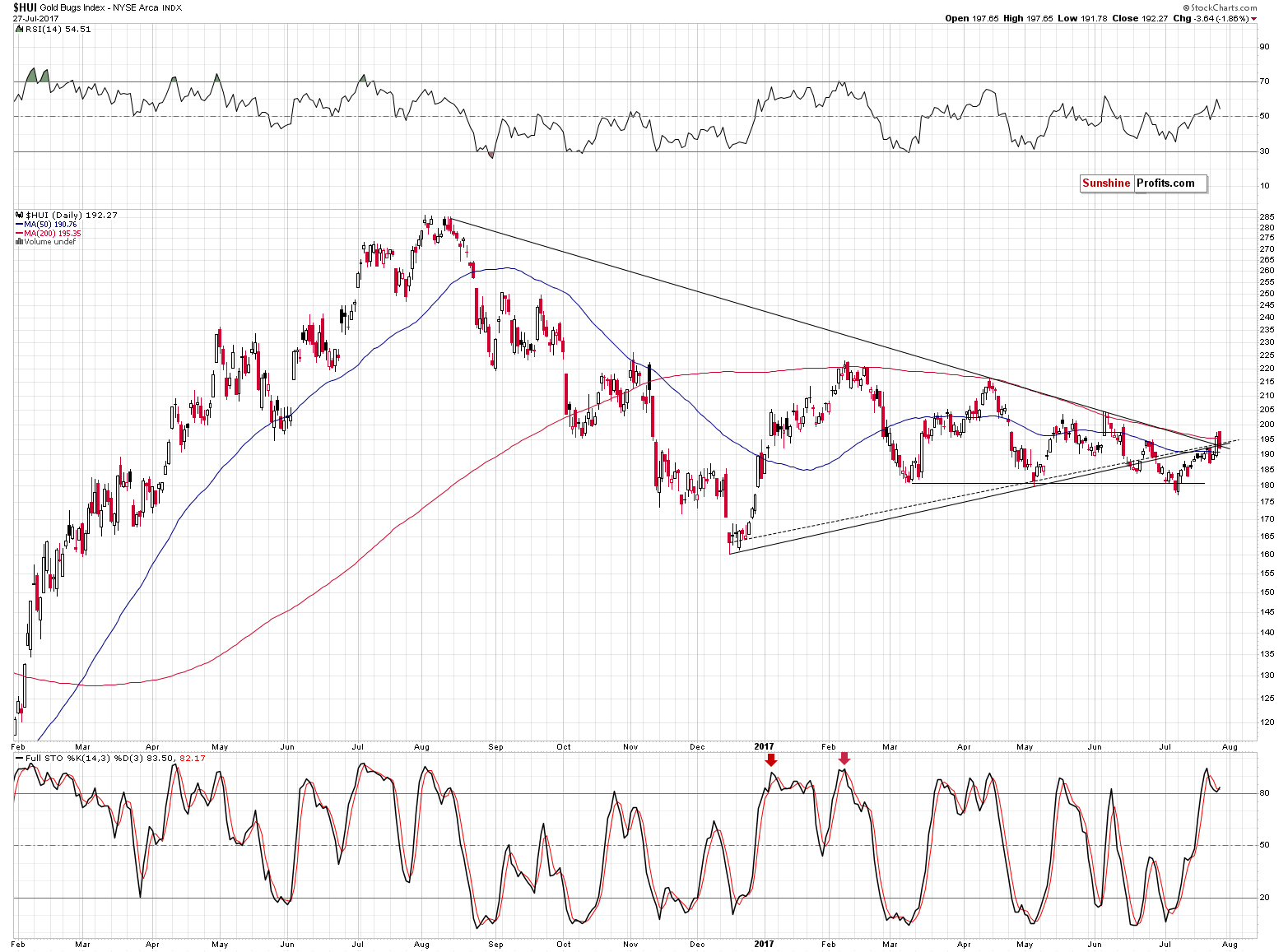

Speaking of reactions, mining stocks finally showed strength, but a single day thereof doesn’t appear convincing and there are several reasons for it. First of all, it is generally a good idea to wait for a given breakout’s confirmation before taking any action based on it, so the gold stocks’ move above two resistance lines and a single close above them is not convincing.

The second reason is that it is quite common for the lagging market to outperform right before / at the top and there’s little doubt regarding what part of the precious metals market was underperforming in the past days and weeks. The above mechanism works in this way as the general public enters the market at the tops, favors things that are cheaper without thinking, considering that perhaps they are cheaper or have been underperforming for a reason. It’s the same thing with junior mining stocks, which quite often outperform senior mining stocks close to the tops (that was the case yesterday, by the way). It didn’t have to be the case yesterday (it would have been more profound if silver had soared and miners hadn’t, but given the recent obvious lag in mining stock prices, this mechanism could be in play).

We didn’t have to wait long for the breakout to be invalidated. The HUI Index closed yesterday’s session back below the two resistance lines that we discussed earlier. Since the breakout was invalidated, the bullish implications were nullified.

Summing up, one of the most important downside targets for the USD Index was reached and the upside targets for gold and silver were reached and almost reached, respectively, and this, combined with the invalidation of the breakout in gold stocks and the looming turning point in silver paints a bearish picture for the precious metals sector. The medium-term outlook remains bearish and any strength here – if we see it at all – is likely to be only temporary.

As always, we will keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Short positions (150% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels / profit-take orders:

- Gold: initial target price level: $1,063; stop-loss: $1,317; initial target price for the DGLD ETN: $81.88; stop-loss for the DGLD ETN $44.57

- Silver: initial target price: $13.12; stop-loss: $19.22; initial target price for the DSLV ETN: $46.18; stop-loss for the DSLV ETN $17.93

- Mining stocks (price levels for the GDX ETF): initial target price: $9.34; stop-loss: $26.34; initial target price for the DUST ETF: $143.56; stop-loss for the DUST ETF $21.37

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $14.13; stop-loss: $45.31

- JDST ETF: initial target price: $417.04; stop-loss: $43.12

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Important Details for New Subscribers

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

This week, two member of the European Central Bank’s (ECB) governing council gave speeches. What can we learn from them?

Mersch and Nowotny's Comments and Gold

Platinum and palladium are important but often overlooked precious metals. We invite you to read our today’s article about the potential benefits of adding these precious metals into investment portfolio and find out whether we should add them to the gold portfolio.

Investment Potential of Platinum and Palladium

=====

Hand-picked precious-metals-related links:

Gold prices stabilize amid profit-taking, U.S. data on tap

LAWRIE WILLIAMS: GLD bleeds 71.58 tonnes of gold in just over a month

Chinese Demand for Gold Bars Climbs by Half on Hunt for Havens

India Trade Ministry Sees Scope for Lowering Gold Import Tax

=====

In other news:

Tech, Automakers Drag Down Stocks as Euro Climbs: Markets Wrap

Consumers, businesses likely spurred U.S. economic pickup in second quarter

Obamacare Repeal Collapses as Senate GOP Blocks Health Bill

Euro Area Gets Strong Economic Report Card as ECB Mulls Exit

Pound Heads for Weekly Advance Even as BOE Tightening Odds Ease

Oil Prices May Stay Low ‘Forever’

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts