Briefly: In our opinion, full (150% of the regular full position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this alert. In other words, we are increasing the size of the speculative short position.

There is no doubt that the silver market and its overnight action between Thursday and Friday is what stole the spotlight last week. We thoroughly discussed the likely implications in Friday’s alert, but after looking at the price move from the weekly perspective, it appears that the implications of the decline are much more important than we initially assumed. The thing is that last week’s silver price performance made the analogy to the previous price patterns quite clear. This may sound less exciting than “silver plunged $2 temporarily”, but in reality the opposite is the case.

The reason is that the self-similar analogies in any market, including the precious metals market, can provide a quite reliable roadmap for as long as the current price pattern is similar to what has happened previously. In other words, until we see a big deviation from the self-similar pattern, it’s likely to continue. In a way, it works like a trend, but in a much more precise way – trends also remain in place until there are good reasons to believe this is no longer the case (confirmed breakouts / breakdowns).

So, what’s more important – an exciting overnight decline, or a roadmap for the following months? Naturally, the latter.

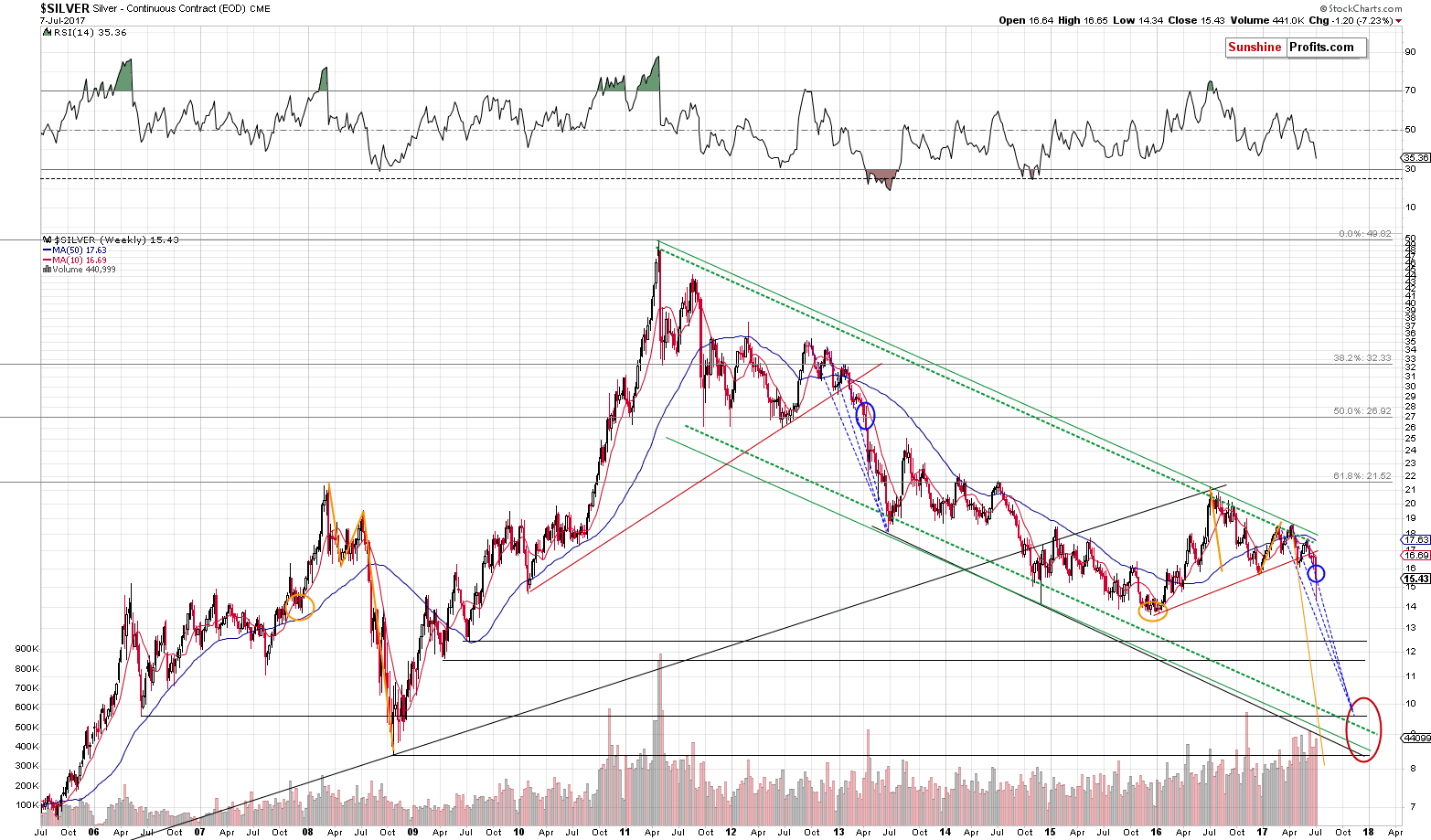

Let’s take a look at silver’s long-term chart for details (chart courtesy of http://stockcharts.com).

The above chart is very rich in important data and analogies and it will take us some time to discuss all of them. Let’s start with the one that was already present before Friday’s session and then we’ll move to the one that became apparent based on what happened based on it.

The first thing is that silver’s recent, and not so recent (mid-2016 – today) performance is to a large extent a repeat of what we saw in 2008. This time, the price moves took more time, but the price levels themselves are almost identical. The 2008 and 2016 tops both formed a bit above $21 and both were followed by a decline to about $16 (marked with orange lines), which was in turn followed by a rally to about $19 (again, in both cases). Then a huge plunge followed in 2008 – why shouldn’t it follow this time if the previous price swings are so similar in terms of price? The decline in 2008 took silver below $9, so based on this analogy alone, it appears that silver is once again likely to test these levels.

Also, both rallies (the ones that ended in 2008 and 2016) started from about $14, which further strengthens the analogy between these situations.

Let’s move to the second analogy – the one that seems even more important.

The three local tops in silver that we saw this year are similar to the ones that we saw in 2012 and 2013, right before the big plunge in the price of white metal. This can be seen on a stand-alone basis, but it’s even clearer when we realize that both three-top patterns were preceded by proportionately similar action.

The late-2015 and 2010 bottoms were the ones that preceded the big upswings in silver. In both cases, the initial rally was shortly followed by a consolidation (mid-2010 and Q1 2016), then a sharp rally with a quick correction in the middle (late 2010-early 2011 and Q2 2016) and then a top that formed after a very sharp upswing. Both tops were followed by a zig-zag correction and local bottoms (mid-2011, end of Q3 2011, end of 2011, mid-2012, Q3 and Q4 2016). After these bottoms (the final ones took place in mid-2012 and at the end of 2016), we saw rallies that took silver much higher and that ended below the most recent local top (the Q3 2012 rally ended below the Q1 2012 top and the Q1 2017 rally ended below the Q4 2016 top).

Both preceding actions were not identical, but quite similar. This makes the three-top similarity much more profound than if we saw it on a stand-alone basis.

But wait, there’s more. The rising support/resistance lines that we can draw (red lines) based on the initial bottom and the interim one also show similarity – both final local bottoms took silver right to this line and the corrective upswing that followed was the final one (Q1 2013 and the May-June 2017 rallies) before the big dive.

With similar preceding action, similar follow-up action is to be expected. We marked the follow-up declines of the 2012 and 2013 tops with blue, dashed lines. Applying these lines to the recent 3 tops in silver provides us with a coherent price and time target. The fact that they all point to a similar price-time combination further confirms the analogy between the tops. The target based on the three tops and the analogy to the previous ones is about $9.60, which is also the 2006 bottom. So, based on the above analogy, $9.60 is the downside target and the blue ellipses mark the current moment and the moment in the past that is analogous to it. It seems that the most volatile part of the decline is just ahead.

With two analogies pointing to different price targets (and important long-term declining support lines and levels being between them), what will the final target be? It will depend on what happens in the precious metals market (not only in silver) once we get closer to these levels. If miners show significant strength and gold reaches an important support level, we may not wait for silver to decline to the lowest of targets before moving back into the precious metals market with the long-term investments.

For now, it seems that the final bottom in silver form between $8 and $10.

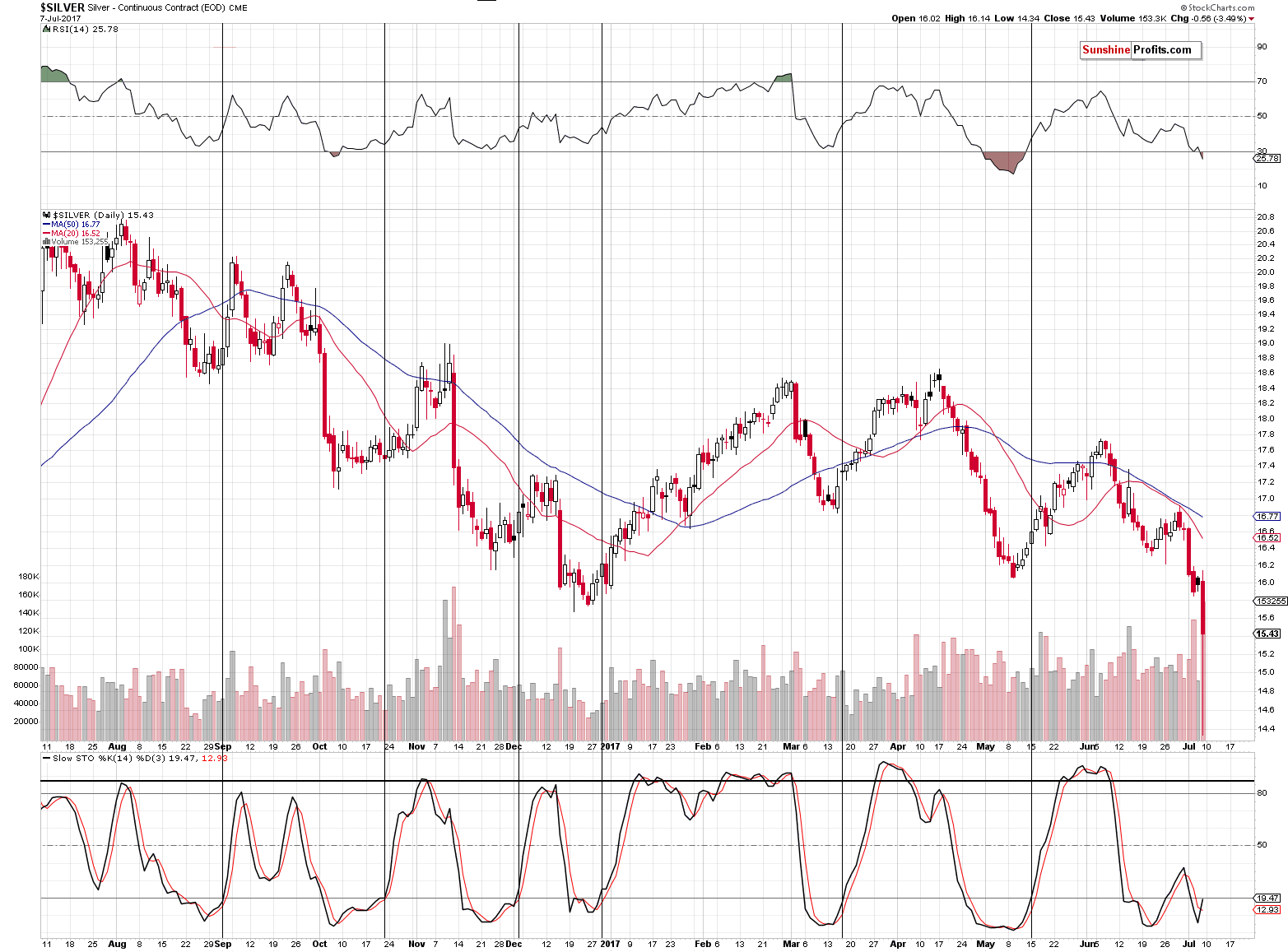

On the short-term chart we can also see that the white metal broke and closed the week below the late-2016 low. Naturally, the implications of such a breakdown are bearish, especially that it was confirmed by the weekly closing price and significant volume.

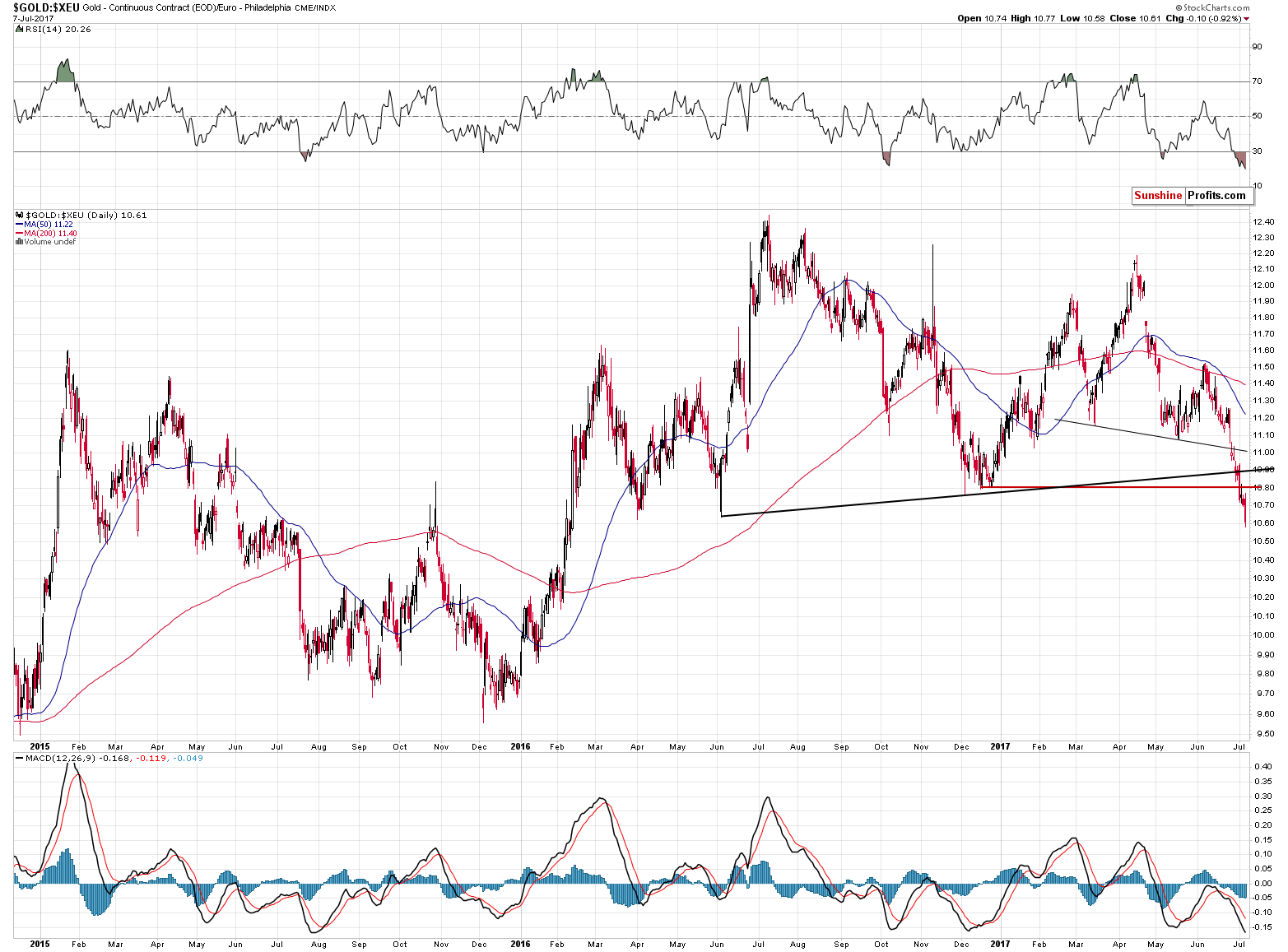

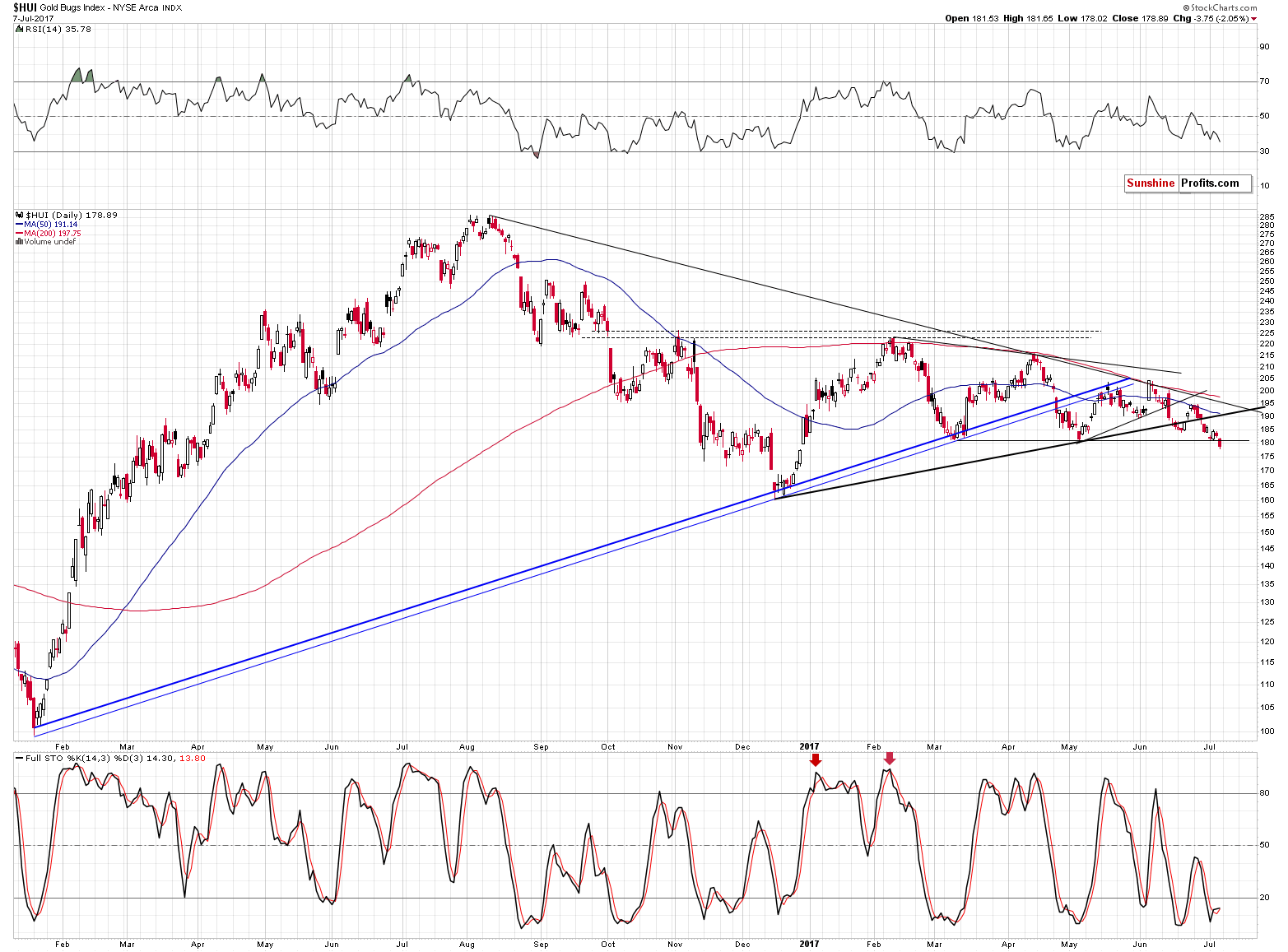

Gold price in the euro and the HUI Index also broke and closed the week below the important support levels. The former close below the key 2016 lows, while gold stocks closed the week below the previous 2017 lows. In both cases the implications are bearish.

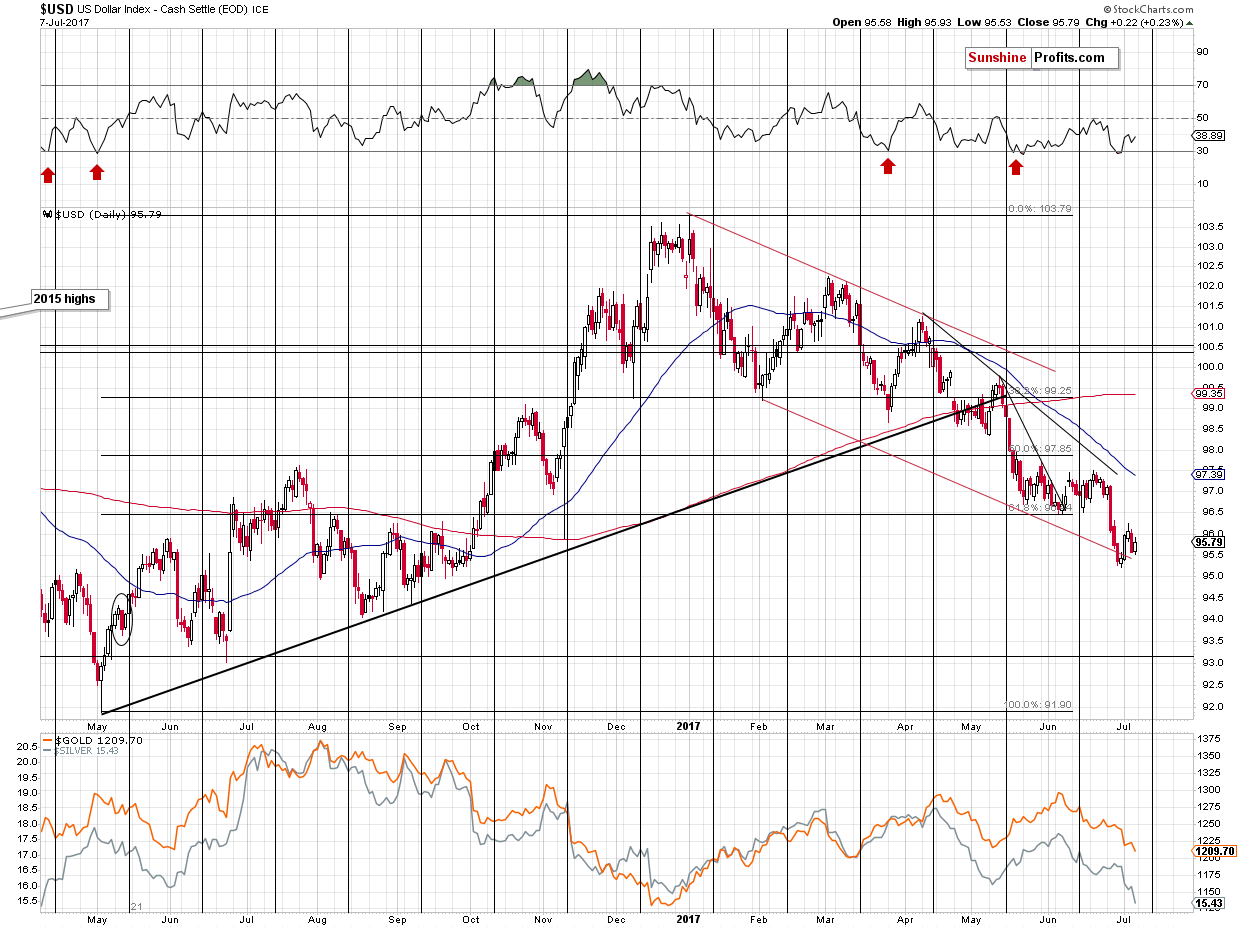

Interestingly, all the above action took place on a relatively small upswing in the USD Index. While the gold-USD link seems to be back, it appears that that gold and (!) silver are magnifying the bearish signals while mostly ignoring the bullish ones. This is a very bearish combination of factors for the precious metals market.

Summing up, the outlook for the precious metals market is very bearish and it appears that the decline will take on a much more visible form in the coming days and weeks. While it does present an excellent trading opportunity (and the previously-entered short positions are already profitable), let’s keep in mind that the biggest gains in the coming years will be made with the investment capital and the upcoming decline will very likely provide us with an epic buying opportunity – that’s something worth preparing for.

As always, we will keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Short positions (150% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels / profit-take orders:

- Gold: exit-profit-take level: $1,063; stop-loss: $1,317; initial target price for the DGLD ETN: $81.88; stop-loss for the DGLD ETN $44.57

- Silver: initial target price: $13.12; stop-loss: $19.22; initial target price for the DSLV ETN: $46.18; stop-loss for the DSLV ETN $17.93

- Mining stocks (price levels for the GDX ETF): initial target price: $9.34; stop-loss: $26.34; initial target price for the DUST ETF: $143.56; stop-loss for the DUST ETF $21.37

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $14.13; stop-loss: $45.31

- JDST ETF: initial target price: $417.04; stop-loss: $43.12

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the Tools and Indicators.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

The U.S. economy added 222,000 jobs in June. What does it mean for the gold market?

S&P 500 index gained 0.6% on Friday, following better-than-expected economic data releases. Will uptrend continue? Or is this just an upward move within month-long consolidation? Is holding short position still justified?

Stocks Retrace Their Recent Weakness, New Uptrend?

=====

Hand-picked precious-metals-related links:

Gold Buyers Flee a Month After Their Most Bullish Bet of '17

How London’s Gold Market, the World’s Largest, Evolved: Timeline

CME Stays Silent on Cause of COMEX Silver Price Glitch

India imports more gold in H1 than all of 2016

=====

In other news:

How healthy is the global financial system?

Aramco CEO sees oil supply shortage as investments and discoveries drop

Deutsche Sees Trouble Ahead for the World's ‘Frothy’ Stock Markets

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts