Briefly: in our opinion, full (250% of the regular size of the position) speculative short position in gold, silver, and mining stocks is justified from the risk/reward perspective at the moment of publishing this Alert. In other words, we are once again increasing the size of the speculative short position.

Gold and silver moved higher yesterday, but we definitely can't say the same thing about the mining stocks. After the initial rally, the buying power dried up and miners declined. Silver and gold are also declining in today's pre-market trading. These moves in miners and metals may be small, but their implications are huge.

The implication is that the top is likely in and the corrective upswing is likely over. And if the corrective upswing is likely over, then the medium-term trend is very likely to resume. Let's dig into the details.

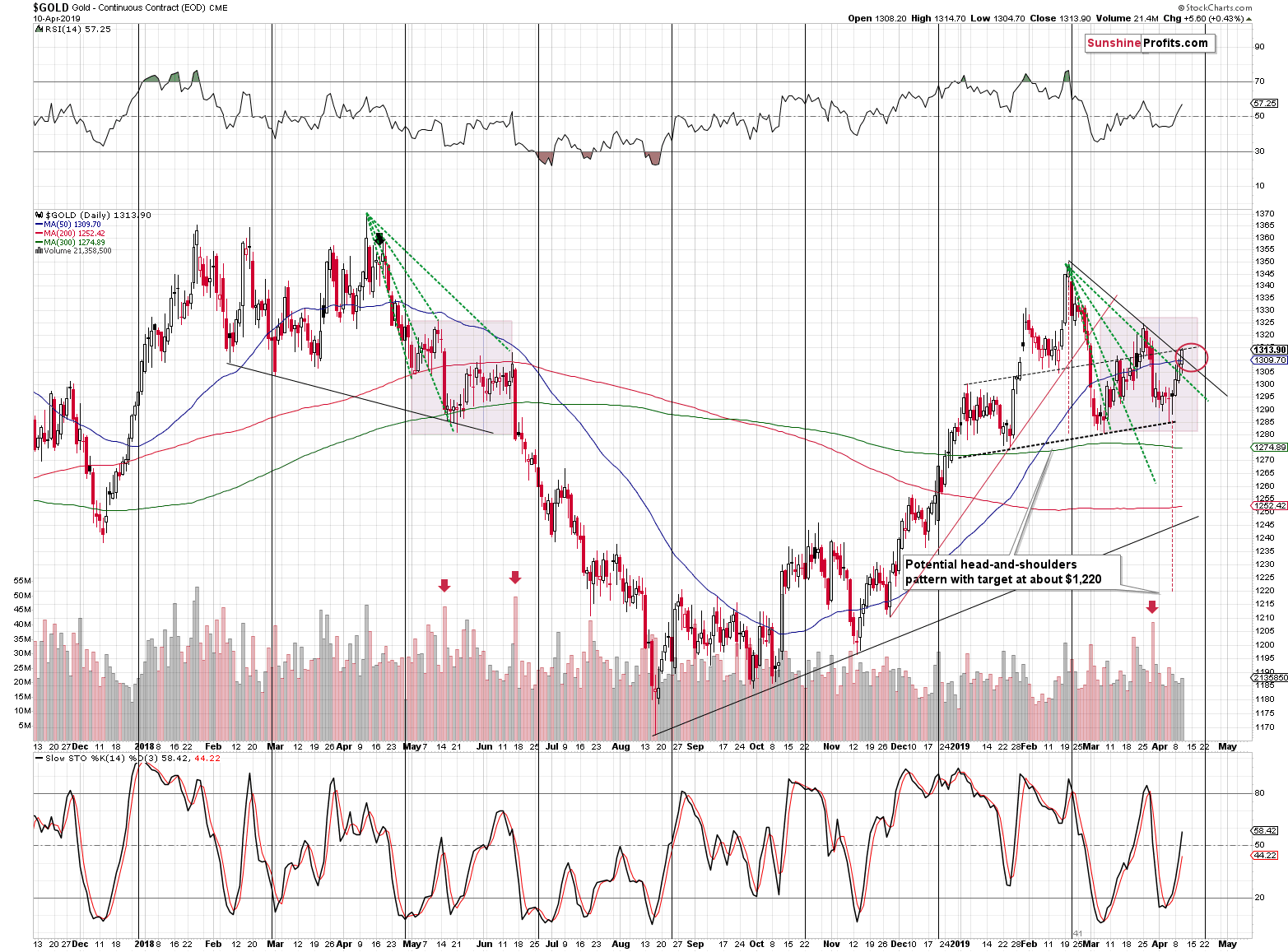

Gold At Its Resistance

Gold moved to the upper part of our target area - to the rising dashed resistance line created as parallel to the neck level of the head-and-shoulders formation. It also broke above the declining resistance line and closed above it. However, this bullish change has already became a bearish sign, as the breakout was already invalidated today. Based on this sign, on the analogy to the May - June 2018 consolidation and on the similarity to how gold performed in December 2012, it seems that the rally has already ran its course.

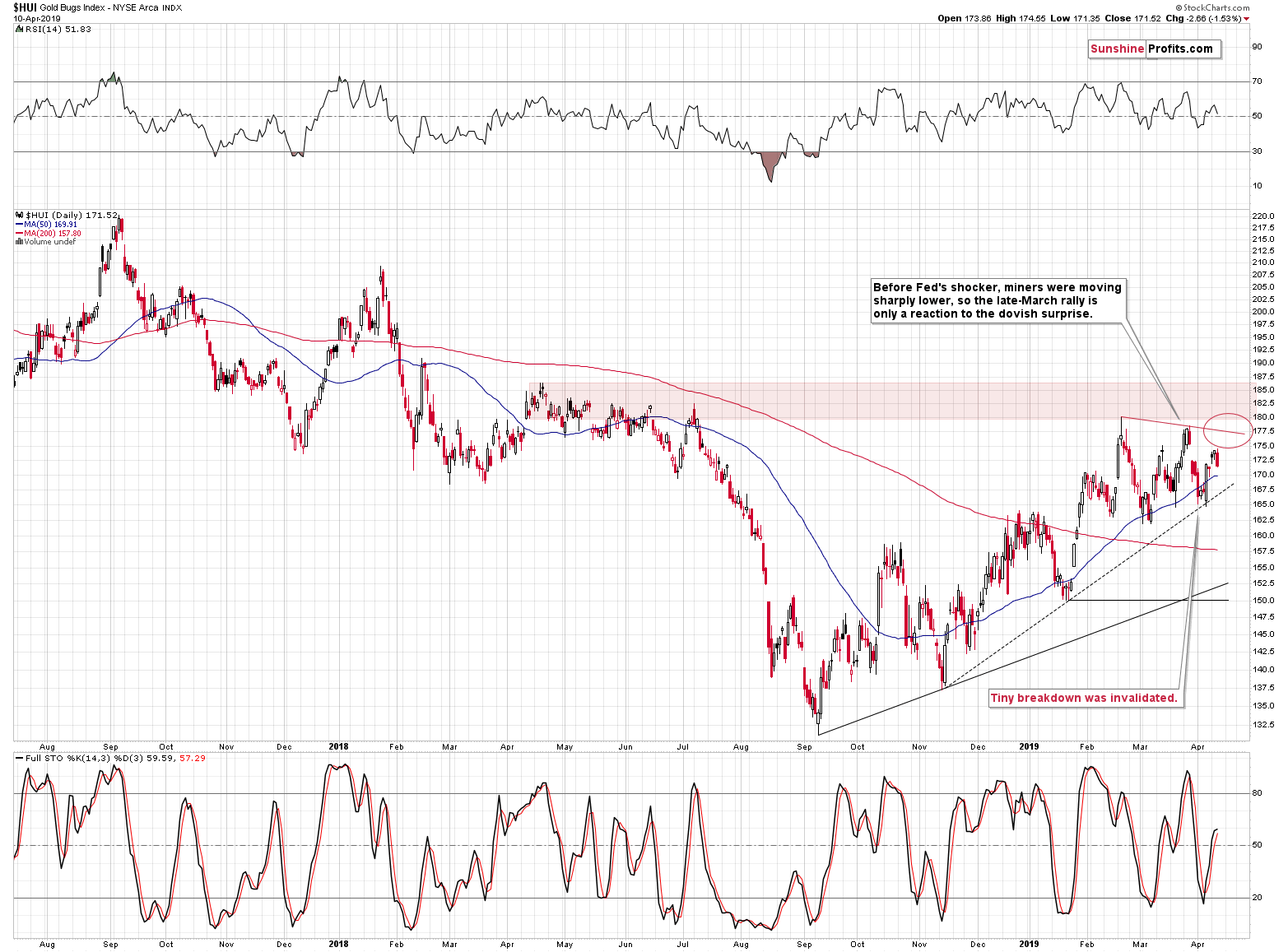

Miners' Reversal

Miners moved higher early during yesterday's session, so the odds are that - if you followed our yesterday's Alert - you increased the size of the short position or exited any remaining long positions very close to the intraday high. After a few hours of higher prices, miners took a dive and ended the session more or less where they had closed the April 4 session. The HUI Index closed a bit below its April 4 close, and the GDX ETF closed a bit above its April 4 close.

Even though yesterday's decline took form of a bearish reversal, that's not the most bearish thing about it. The key thing is how significant this decline has been compared to what has happened in gold. The underperformance is clear and significant, and it serves as a strong confirmation of the bearish signals from gold.

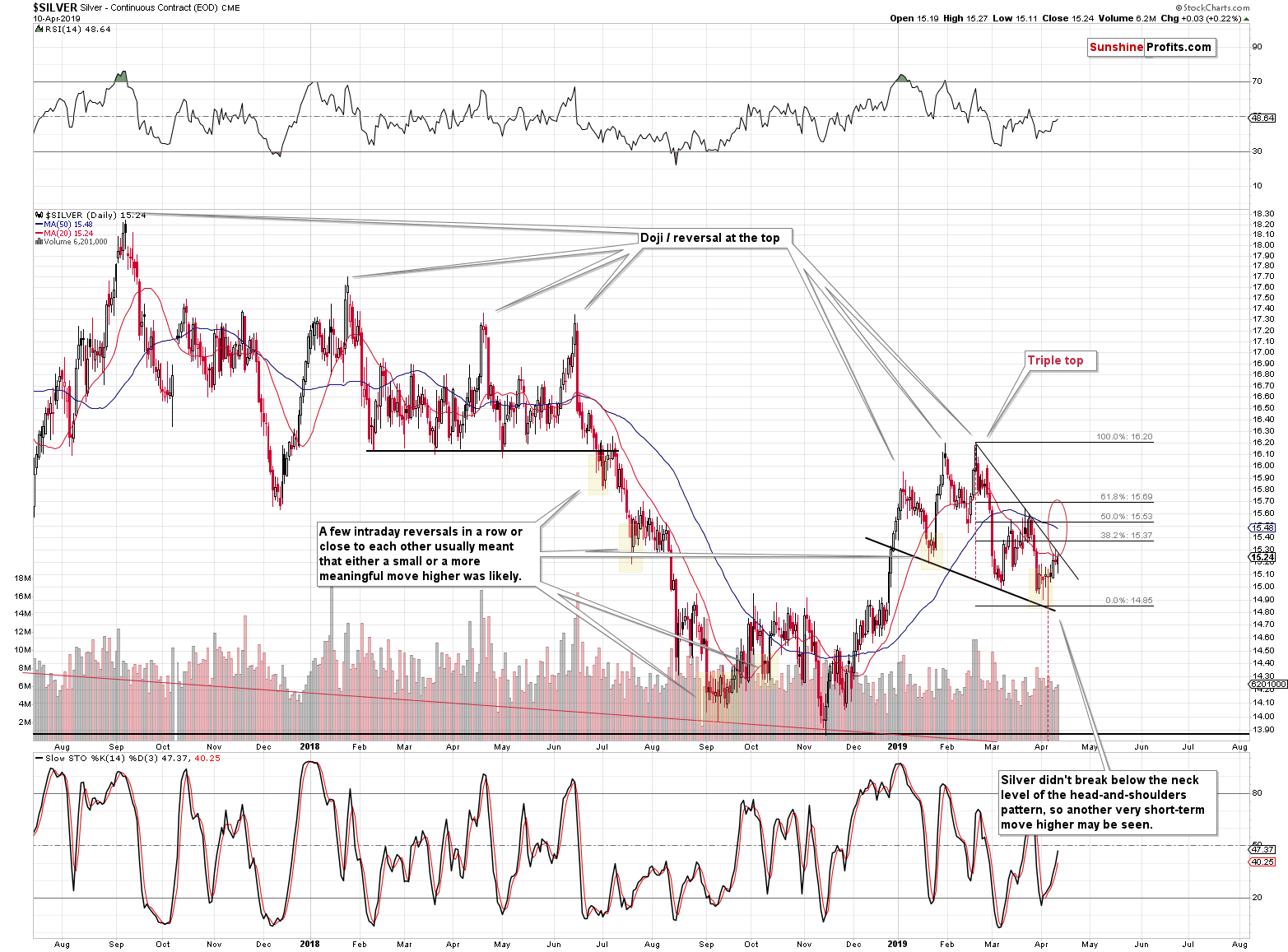

Silver and Gold-to-Silver Ratio Implications

Silver didn't outperform, so we didn't get the short-term confirmation, but miners' indication was clear enough to make the short-term picture more bearish.

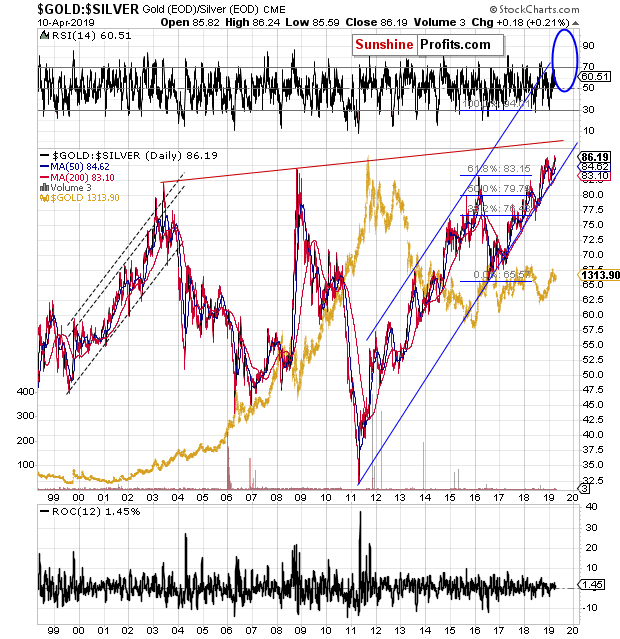

Besides, given the current situation in the gold to silver ratio, silver's lack of strength is not that surprising.

The ratio is breaking to new highs and this may prevent silver's relative strength. This means that waiting for silver to outperform may not be the best idea - it simply might not happen anytime soon.

Summary

Summing up, after exiting almost the entire short position several days ago, we are re-entering it in a stable manner as the situation is becoming increasingly more bearish. And we are doing so at higher prices, thus increasing the overall profitability of the trade. The final confirmation from silver didn't arrive yet, but gold and silver have both reached their targets, the USD Index might have already bottomed, and we just saw a clear sell sign from the mining stocks. Given the long-term breakout in the gold to silver ratio, waiting for silver's outperformance appears to be unnecessary. Based on multiple strong medium-term sell signals and analogies to previous declines that we discussed in the previous Alerts, we think that the risk to reward ratio once again favors extra-large short positions in gold, silver, and mining stocks.

If you entered a long position based on our analysis of short-term factors and you didn't exit it yet, this might be the final call to take your profits off the table. The next big move in the PMs is likely to be to the downside.

Please keep in mind that the profit-take levels that we have for the current short position are placed as an "insurance" against a sharp drop in the PM prices. Given the myriads of very strong, medium-term bearish factors, the surprising moves are likely to be to the downside and we can't rule out a situation in which gold drops to the December 2015 lows very soon. It's not the most likely outcome, but it's professional to be prepared for even the less likely - yet still possible - scenarios. We would like to emphasize that these targets absolutely do not mean that there will be no changes in the trading position in the meantime. In fact, you are currently witnessing the short-term adjustments. We may - and are quite likely to - adjust the current position, or even close it, and - perhaps - enter a long position once gold moves to the $1,215 - $1,240 area. The exact details of this trade are not yet known as they will depend on how gold moves to this area and what other signals we see at that time.

As always, we will keep you - our subscribes - informed.

Quick note on Day Trading Signals: out of 5 Signals that we provided, 4 were profitably closed and 1 trade remains opened (it was adjusted today and it's currently very close to its profit-take level). There were 3 Signals today, including a short position in gold. If you're interested, here's the link to the Day Trading Performance page. If you'd like to get notifications about new Signals ASAP, please let us know.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short position (250% of the full position) in gold, silver, and mining stocks is justified from the risk/reward perspective with the following stop-loss orders and exit profit-take price levels:

- Gold: profit-take exit price: $1,062; stop-loss: $1,357; initial target price for the DGLD ETN: $82.96; stop-loss for the DGLD ETN $39.87

- Silver: profit-take exit price: $12.32; stop-loss: $16.44; initial target price for the DSLV ETN: $47.67; stop-loss for the DSLV ETN $23.68

- Mining stocks (price levels for the GDX ETF): profit-take exit price: $13.12; stop-loss: $24.17; initial target price for the DUST ETF: $76.87; stop-loss for the DUST ETF $15.47

Note: the above is a specific preparation for a possible sudden price drop, it does not reflect the most likely outcome. You will find a more detailed explanation in our August 1st Alert. In case one wants to bet on junior mining stocks' prices (we do not suggest doing so - we think senior mining stocks are more predictable in the case of short-term trades - if one wants to do it anyway, we provide the details), here are the stop-loss details and target prices:

- GDXJ ETF: profit-take exit price: $17.52; stop-loss: $35.67

- JDST ETF: initial target price: $143.87 stop-loss: $30.97

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one, it's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (DGLD for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn't, then we will view both positions (in gold and DGLD) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Super Wednesday is behind us! The masters of monetary policy have revealed their cards. The Fed released the fresh minutes, the ECB held its monetary policy meeting, while the Brexit was postponed again. How will all these play out in the gold market?

The Gold Market Right After Super Wednesday

Stocks retraced some of their Tuesday's decline yesterday, as they continued to fluctuate following the recent rally. The S&P 500 index traded slightly below the 2,900 mark. Will the uptrend continue despite some technical overbought conditions?

S&P 500 at 2,900 Mark, Will Stocks Break Higher?

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager