Briefly: in our opinion, full (250% of the regular size of the position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this Alert. We are moving the stop-loss for gold higher.

Stocks plunged to new lows, the USD Index declined as well, and gold rallied to new highs. The yellow metal was even featured in Jim Cramer’s Mad Money! Is gold the only asset worth owning right now? What should one do, given all this strength in the precious metals sector?

In our opinion, one should make sure that one is prepared for a reversal because so many signals point to it. And gold being featured in Mad Money does not make the outlook for it bullish – it suggests that we just saw the final part of the upswing. Let’s take a look at the details.

Precious Metals’ Rally and the Specific Reason Behind It

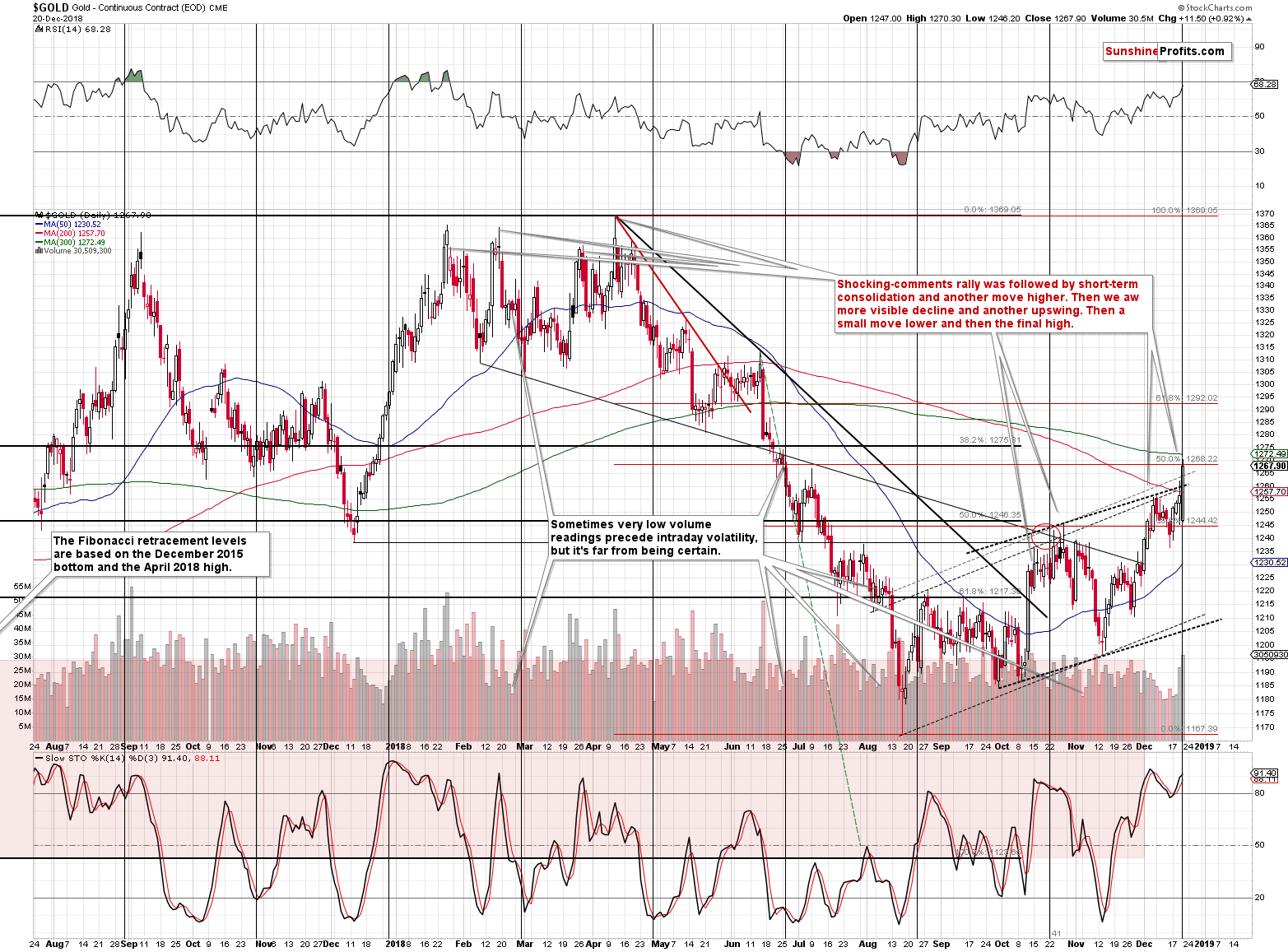

The yellow metal corrected to the 50% Fibonacci retracement level, the July high, and it very insignificantly broke above the previous rising support lines (the upper border of the rising trend channel). This is a strong combination of resistance. It all happened on big volume and right at gold’s cyclical turning point, which very strongly suggests that this move was excessive and temporary. A reversal. The RSI is close to 70, which means that a topping action is to be expected and the above signs fit this indication very well.

There is also an important non-price-and-volume factor for gold. Gold just got Cramerized. The Mad Money host is largely followed, mostly by the individual investors, not by institutions or sophisticated investors. Individual, unexperienced investors tend to enter the market right at the tops after seeing that a given investment is popular and that it provided some gains in the recent past. And it’s difficult to imagine a more direct signal that they could get than gold being featured as a buy by Jim Cramer. Maybe Oprah’s recommendation would be even more important in that regard? It’s a tough call, but what is clear is that gold price got a significant boost and it was quite likely from the extreme case of the making-headlines factor.

Tiny, unconfirmed breakout + very good chance that it was the general investment public that was buying + huge volume + cyclical turning point + resistance levels + RSI = great time to be positioned for profiting on the upcoming price decline in gold.

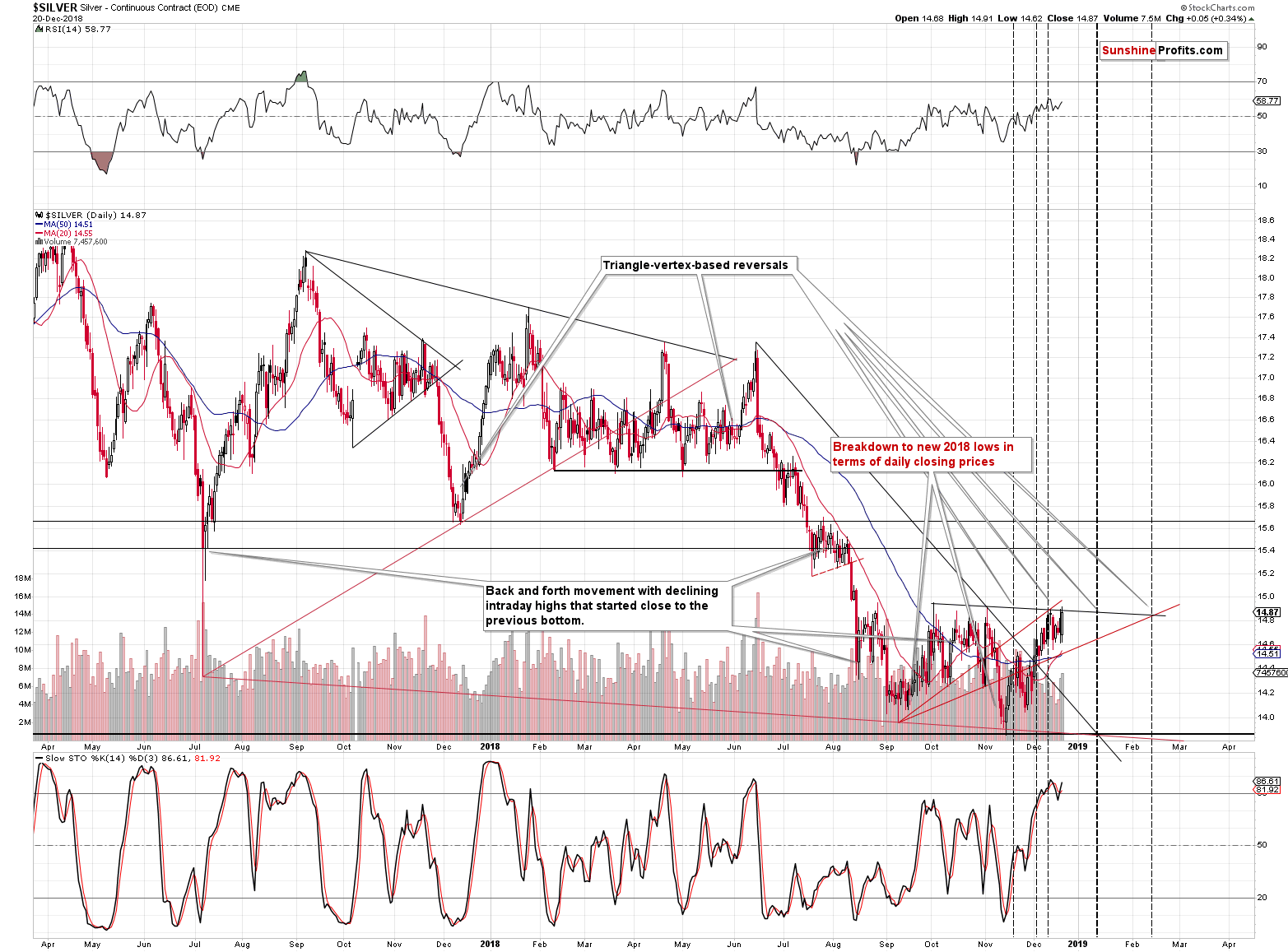

On a side note, gold getting Cramerized is a good explanation of why silver didn’t outperform gold even if we just saw an important top. Silver simply wasn’t featured – gold was.

Despite moving higher, silver didn’t break above the previous highs. The breakout in the gold to silver ratio is keeping silver’s gains in check, even though it shows intraday strength from time to time. Please note that on the Fed day, silver soared outperforming gold on a very short-term basis while miners underperformed – that’s exactly what silver tends to do at the tops.

Decline in the Miners – Nothing but a Bad Dream?

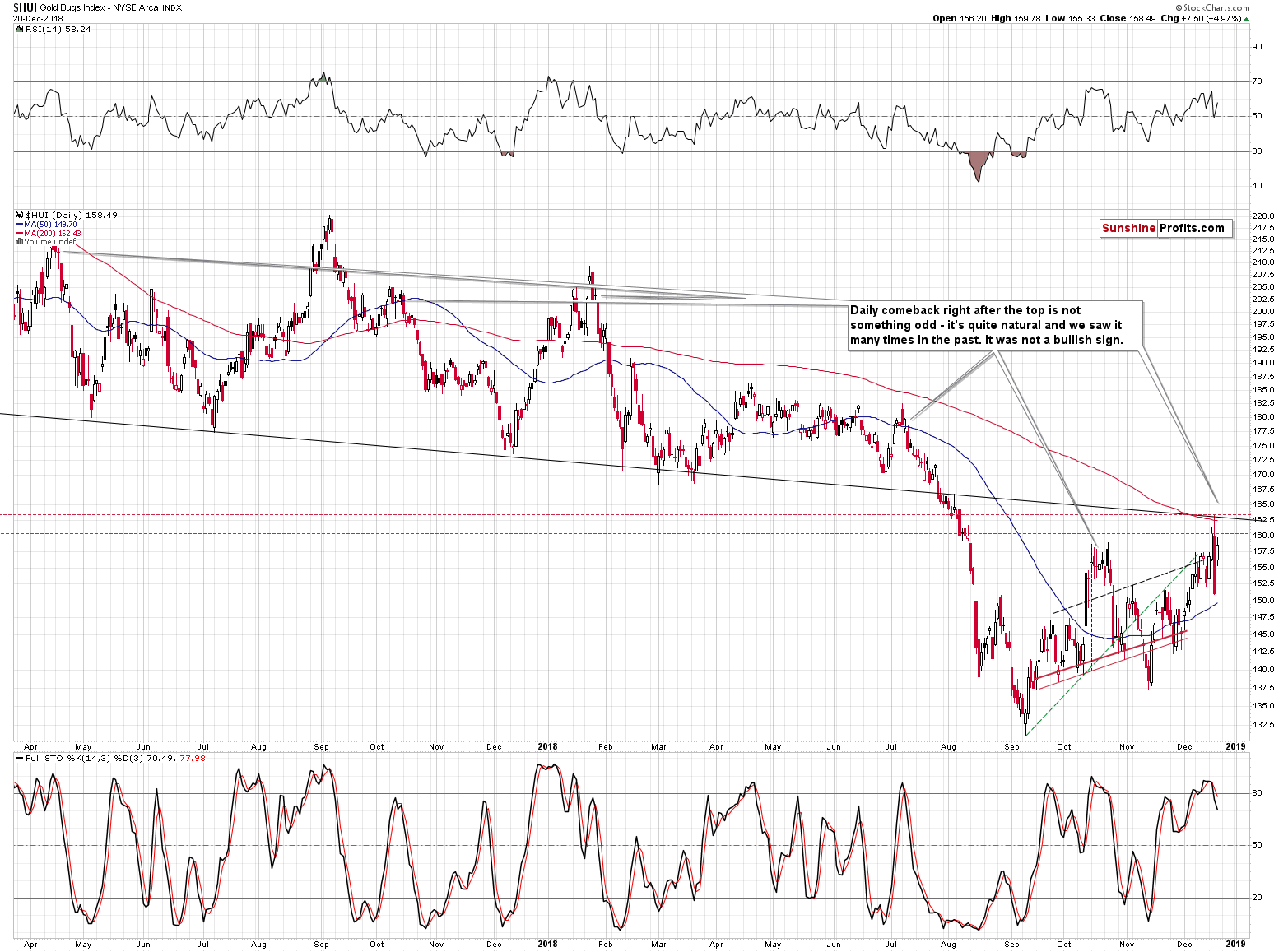

Gold miners moved higher and while yesterday’s upswing was not as significant as Wednesday’s downswing, it definitely made many investors and traders question the validity of the initial move lower. No wonder – it’s quite natural to question a move that appears to have been just a one-day event that doesn’t change anything overall as the price is back up.

It was not just a one-day event. It was the big crack on the massive dam that is now followed by a (dramatic?) pause. Those who are not looking carefully, are either ignoring what happened, or are reassuring themselves that it was nothing and that it’s over. Of course, the perma-bullish camp can say the same thing about us. But, the fact (!) is that yesterday’s action was normal in a way, and bearish in another way. It was not bullish.

It was normal, because we saw many cases when the start of the declines in the HUI Index was immediately followed by a quick rebound. It didn’t change anything with regard to the decline’s continuation. We marked several such cases on the above chart. It was not always the case, but it took place often enough to view this as something normal, not a bullish indication.

It was bearish, because gold made new high yesterday and gold miners didn’t. They underperformed on such important occasion. Moreover, the sell signal from the Stochastic indicator remains in place and it’s been effective in detecting the previous major declines.

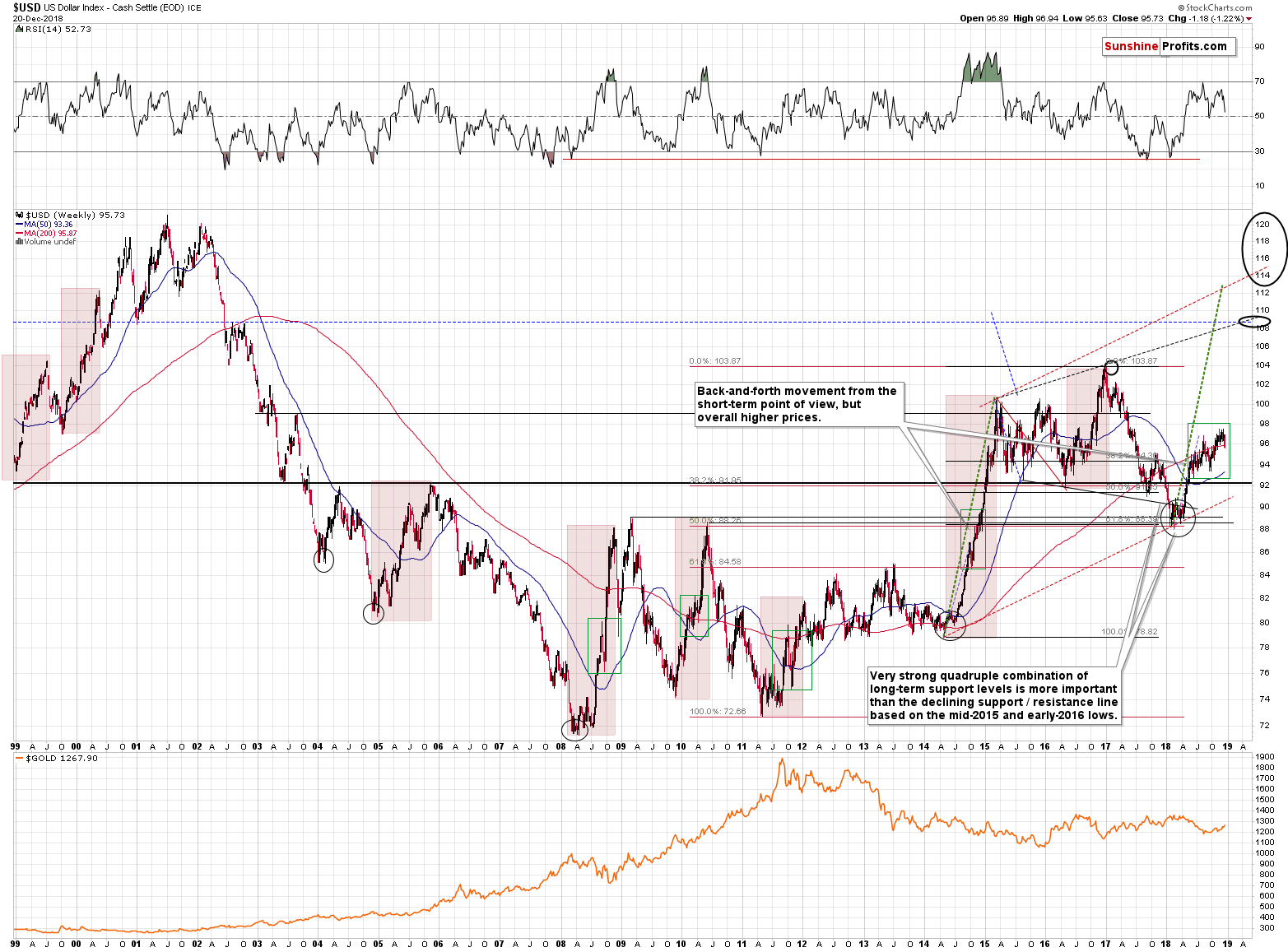

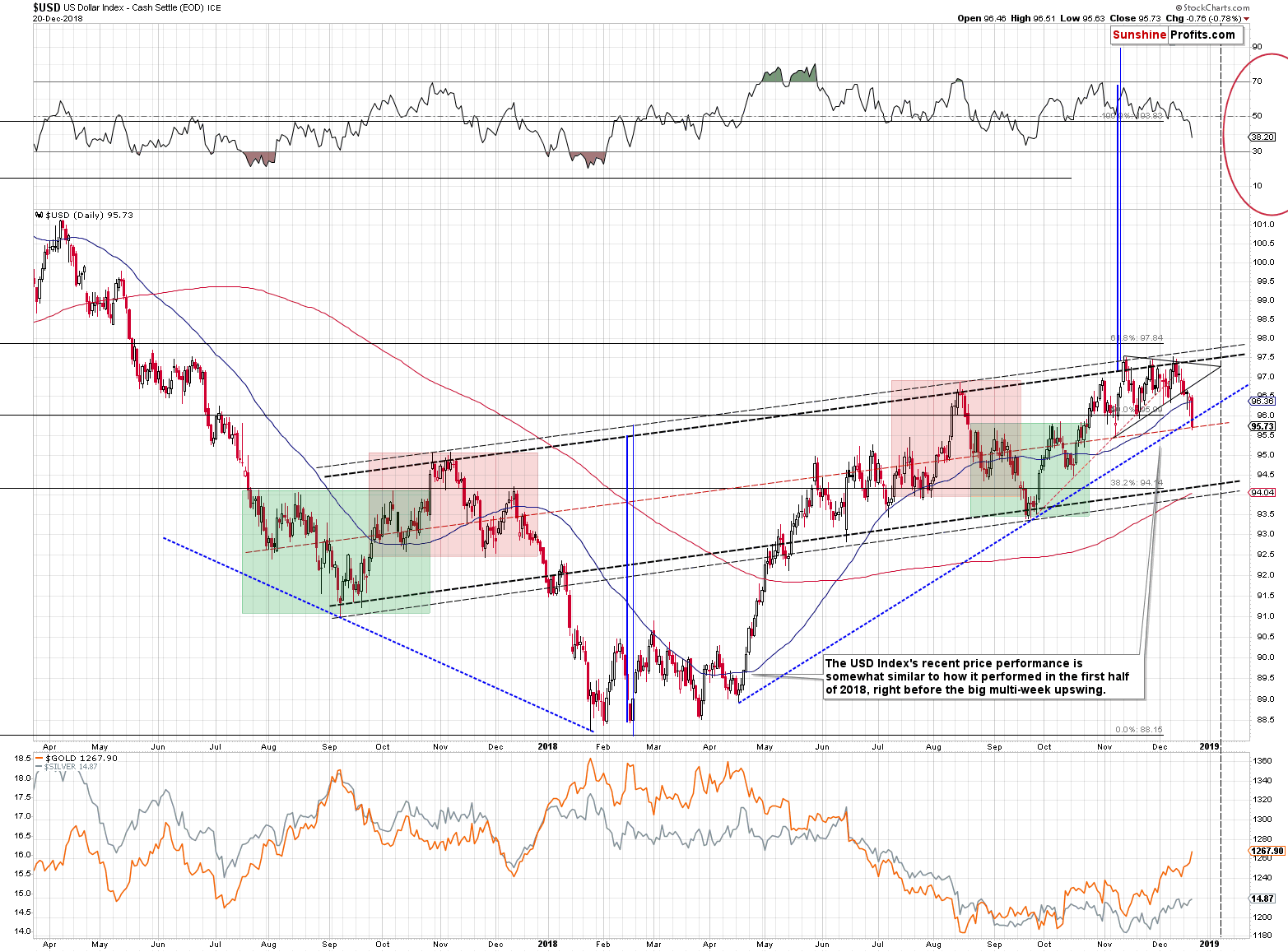

What about the USD Index? It declined profoundly yesterday, so it’s critical to check what changed in the outlook for it. Let’s start by putting the recent past into a bigger perspective.

The Officials Claim that They Want Lower USD. Will They Get It?

The officials claim and / or are actively pursuing higher interest rates (because the economy can handle them) and lower USD values (so that the US exports stay competitive), but things don’t work that way. If you raise interest rates, then non-US investors have greater motivation to purchase US dollars and use them for bonds and other interest-providing instruments. This creates demand for the USD and with greater demand, comes higher price. The higher price of the USD means more deflationary forces (or less inflationary forces) and greater value of the USD relative to other currencies. The latter directly translates into higher USD Index values.

There’s been a lot of talk about lower USD, but rates kept rising. And what happened to the USD Index value?

It rallied this year and it’s not been a small upswing. It was below 90 earlier in 2018 and it’s now at about 96, after temporarily rallying above 97. The market doesn’t listen to what the officials want (precisely: it does, but it has only temporary impact on the prices) and instead focus on what the officials are doing. The USD Index is in a medium- and long-term uptrend, and it’s not because everything is perfect with the US economy. It’s not, but things are definitely not better with the EU economy or in Japan where the interest rates are kept very low. And since currencies are valued in relative terms, the USD still wins – and it’s moving higher despite we sometimes hear how beneficial would lower value of the USD be for the US exports.

Technically, we see that the US currency didn’t end its rally that started earlier this year. The rally just took a more back-and-forth tone. And it’s quite normal. We marked the back-and-forth action that we saw during the previous sizable USDX rallies. The rallies are marked in red and the back-and-forth parts of the rallies are marked with green rectangles. They vary in size, but overall, they were not seen close to the final parts of the upswings – they were seen in their middle parts or a bit before the middle.

The rally started from about 88 and the most recent high was over 97. If it’s not even the middle of the upswing, then we can expect the USD Index to rally to 106 level at least. The medium-term outlook for the USD Index remains very bullish.

What about the short-term changes?

Some things changed, and some things didn’t. The thing that did change is the extent, to which the last few weeks were similar to the January – April bottoming pattern. It’s no longer a near-perfect similarity, at least not in the way that we described it earlier. Yesterday’s low didn’t take the USD Index below the November low, so the patterns are still somewhat similar to the previous bottom and in this case, this week’s decline would be the analogy to the late-March or mid-April decline.

Please keep in mind that the thing that triggered the final decline in the USD Index and the final bottom were comments from US Treasure Secretary Steven Mnuchin, who said that the US welcomes lower US dollar values. This is not something that should have been said. It caused sharply lower USD values in the very short term and was followed by much higher values in the rest of the year. Please note that these comments started a few-month long consolidation and the USD Index rallied only after it was completed.

Fast forward to October 2018. Trump makes “crazy comments” about Fed’s interest rate policy and the USD declines shortly thereafter. And… It started a consolidation pattern that’s been in place for a few months now. The current post-comments consolidation is not as long as the previous one, but it’s not much shorter either.

The action in gold and the 4 tops that we recently saw and marked on the gold chart earlier today, suggest that the analogy to what happened in the first half of this year is likely already completed. This might also be the case for the USD Index.

The technical details that suggest so are the tiny breakdown below the rising medium-term support line that we marked with blue (most important support line of this year) and the move back to the middle of the trading range (marked with red) of the rising trend channel.

The breakdown below the rising blue support line is too small to be viewed as confirmed and since it was just one day below it, we would need to see two additional closes below it to view the breakdown as confirmed. Without the confirmation, the breakdown is not particularly important. The USD Index moved a bit higher today, so it might invalidate this breakdown as early as today.

Stock Market’s Link with Gold

So far today, we wrote quite a lot about PMs, miners, and the USD Index. However, many investors will not care about these markets (well maybe except for gold – the people will likely care for several days based on Jim Cramer’s recommendation). They will care about the stock market. That’s what most people base their retirement investments on and that’s what will cause sleepless nights if it declines too much.

What can we say about the stock market and its possible impact on the gold price?

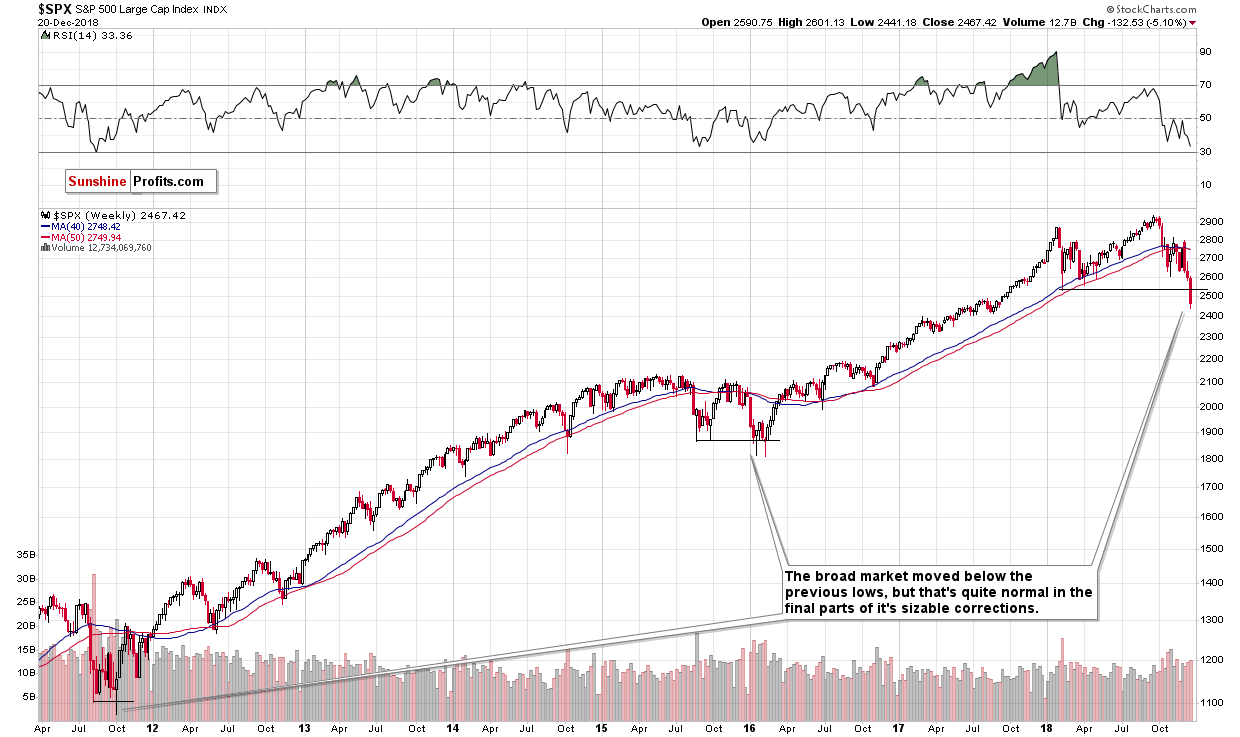

First of all, let’s say that the breakdown below the previous lows in the general stock market should not be taken at its face value. Breakdowns usually lead to lower prices – that’s the entire point of looking at them. However, in case of the general stock market, it’s quite normal to see this kind of fake breakdown at the end of a corrective decline. That’s how the 2011 decline ended and that’s how the 2015 – 2016 decline ended. Both biggest declines of the previous years ended in this way, so the fact that we saw something similar recently is not necessarily bearish. It might even be viewed as a bullish sign if we had some sort of indication that the decline is going to reverse.

The good news is that we have them.

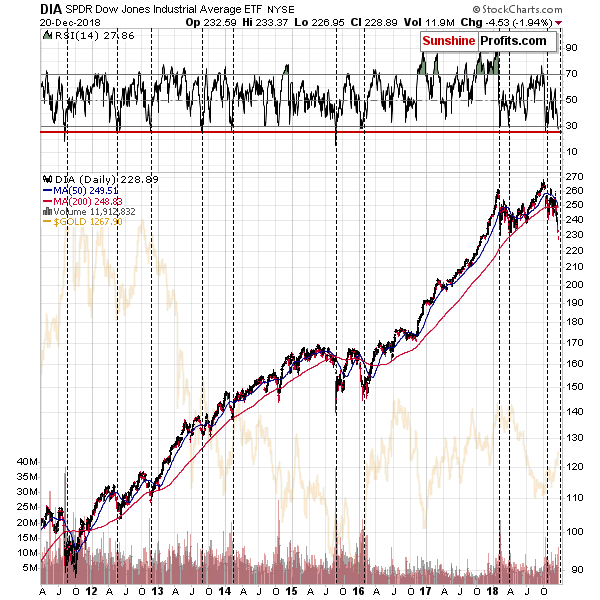

The DIA ETF, a proxy for the Dow Jones Industrial Average, has a very useful trait. The RSI indicator based on it shows when the value of the stock market becomes too low on a short-term basis. And this signal is rarely wrong. Seeing a move below 30 in the RSI means that we are going to see a bottom shortly or that we have just seen it. We marked the signals with vertical dashed lines and the efficiency of this signal is not something that should be ignored.

Ok, so the stock market is going to bottom, but why should I care if I’m trading and investing in gold?

The link between stocks and gold is not static. It changes over time. It doesn’t make this link useless, though. The link is usually stable for medium-term price moves. For instance, if gold recently rallied with stocks and declined with stocks and we are seeing a bottoming pattern in stocks, it’s likely bullish for gold. However, we saw something opposite in the most recent months. Gold moved lower along with higher stocks and it rallied along with lower stocks. Gold magnified stocks’ movement while declining and gold moved less profoundly than stocks when it rallied (and stocks declined).

What does this mean? That stocks’ bottom is likely at hand or already in and that it very likely corresponds to gold’s top. It also suggests that stocks rally will be magnified by gold and that the latter will fall really far.

Summary

Summing up, this prolonged correction within the big downtrend has been very tiring, but based on the long-term factors being patient was very well worth it, and based on the short-term signs it seems that the waiting is over or about to be over. The outlook for the precious metals market remains very bearish for the following weeks and months and short position remains justified from the risk to reward point of view, even if we see a few extra days of back and forth trading or even a small brief upswing. There is a very high probability of a huge downswing that makes the short position justified, not the outlook for the next few days. It's confirmed by multiple factors, i.a. weekly reversals, silver’s recent outperformance and reversal exactly when it was most likely, gold’s performance link with the general stock market, gold getting Cramerized, mining stocks not making new highs while gold does, and the bullish outlook for the USD Index.

Since the outlook didn’t change and the price is higher, we are moving the stop-loss for gold higher. The stop-loss was placed at $1,272 when reaching such level would automatically invalidate the short position, but it is not the case right now. We are adjusting it accordingly. Please keep in mind that stop-loss level is not a target price or a price level that we expect to be reached. It’s a level that – when reached on an intraday basis – would change the outlook by itself. The outlook might change well before the price reaches SL level and thus the position might be closed earlier (that is if it moves unfavorably relative to the current position). Naturally, the outlook favors lower, not higher precious metals prices and discussing the above doesn’t change that. It’s important to have a plan also in case the price moves in the unlikely way. Napoleon Bonaparte said that a leader has the right to be beaten, but never the right to be surprised. This applies to trading as well. The price may move in the unlikely direction, but one needs to have a plan for that as well. And that’s why we are discussing and actively monitoring the stop-loss levels – it’s not because the outlook changed. The latter remains bearish for the PMs and points made in today’s Alert confirm it.

As always, we’ll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short positions (250% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and exit profit-take price levels:

- Gold: profit-take exit price: $1,062; stop-loss: $1,303; initial target price for the DGLD ETN: $82.96; stop-loss for the DGLD ETN $45.87

- Silver: profit-take exit price: $12.32; stop-loss: $15.11; initial target price for the DSLV ETN: $47.67; stop-loss for the DSLV ETN $28.37

- Mining stocks (price levels for the GDX ETF): profit-take exit price: $13.12; stop-loss: $21.82; initial target price for the DUST ETF: $80.97; stop-loss for the DUST ETF $21.97

Note: the above is a specific preparation for a possible sudden price drop, it does not reflect the most likely outcome. You will find a more detailed explanation in our August 1 Alert. In case one wants to bet on junior mining stocks’ prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and target prices:

- GDXJ ETF: profit-take exit price: $17.52; stop-loss: $31.23

- JDST ETF: initial target price: $154.97 stop-loss: $51.78

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Important Details for New Subscribers

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

The price of gold cannot decline and stay below the gold production costs. Myth or fact? We invite you to read our today’s article about the mining costs and find out whether they provide a floor for gold prices.

From the beginning of the week the situation of currency bulls was not very favorable. Their lack of strength to continue the last week's march to the north in combination with the breakdown below an important support line awakened the imagination of the sellers and pushed the currency pair to a fresh December low earlier today. Are there any supports on the horizon that can save the buyers from further declines?

USD/JPY - Reward for Perseverance

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts