Briefly: in our opinion, full (250% of the regular size of the position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this Alert.

All eyes were on the quick increase in the values of mining stocks as they moved above their recent highs. Is this a repeat of 2016 when mining stocks were leading the way to much higher price levels? If so, then one should act quickly as gold and silver would be about to join the miners in their near-vertical run. But is it really the case?

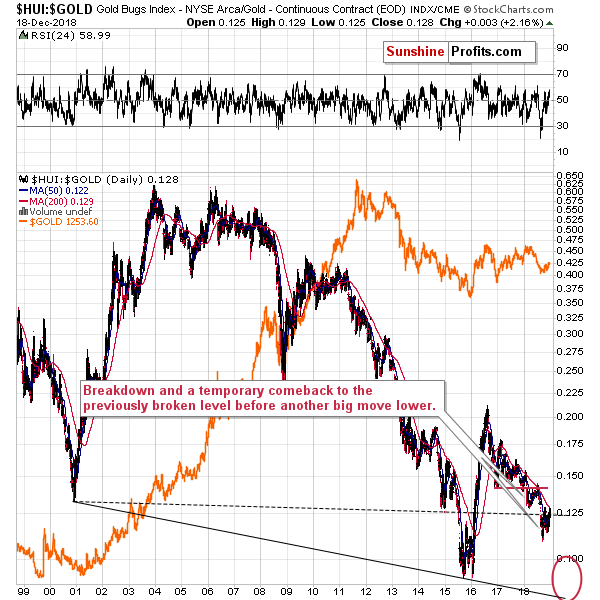

No and except for the analogy in the excitement that the rally brings, there’s little reason to view them as similar. Let’s take a look at the core chart that features both cases – the gold stocks to gold ratio. Miners strongly outperformed in 2016 and there’s no way that one might mistake the 2016 rally with anything else if it was repeating itself.

Gold Stocks: 2016 All Over Again?

It doesn’t take a lot of time to notice that the size of the move that we saw in the first several months (and even weeks) of 2016 is multiple times bigger than what we saw recently. The difference is so big that it’s practically not comparable.

What is more comparable to the recent performance of the ratio is what we saw in the early part of this year. The ratio was after a breakdown below the previous (2017) lows and it moved approximately back to these lows and verified them as resistance. That’s what we’re seeing right now. Gold miners to gold ratio broke below the early 2018 low and is now verifying this breakdown by moving approximately back to it.

The situation is not similar to 2016. It’s similar to this year’s action that preceded a big decline.

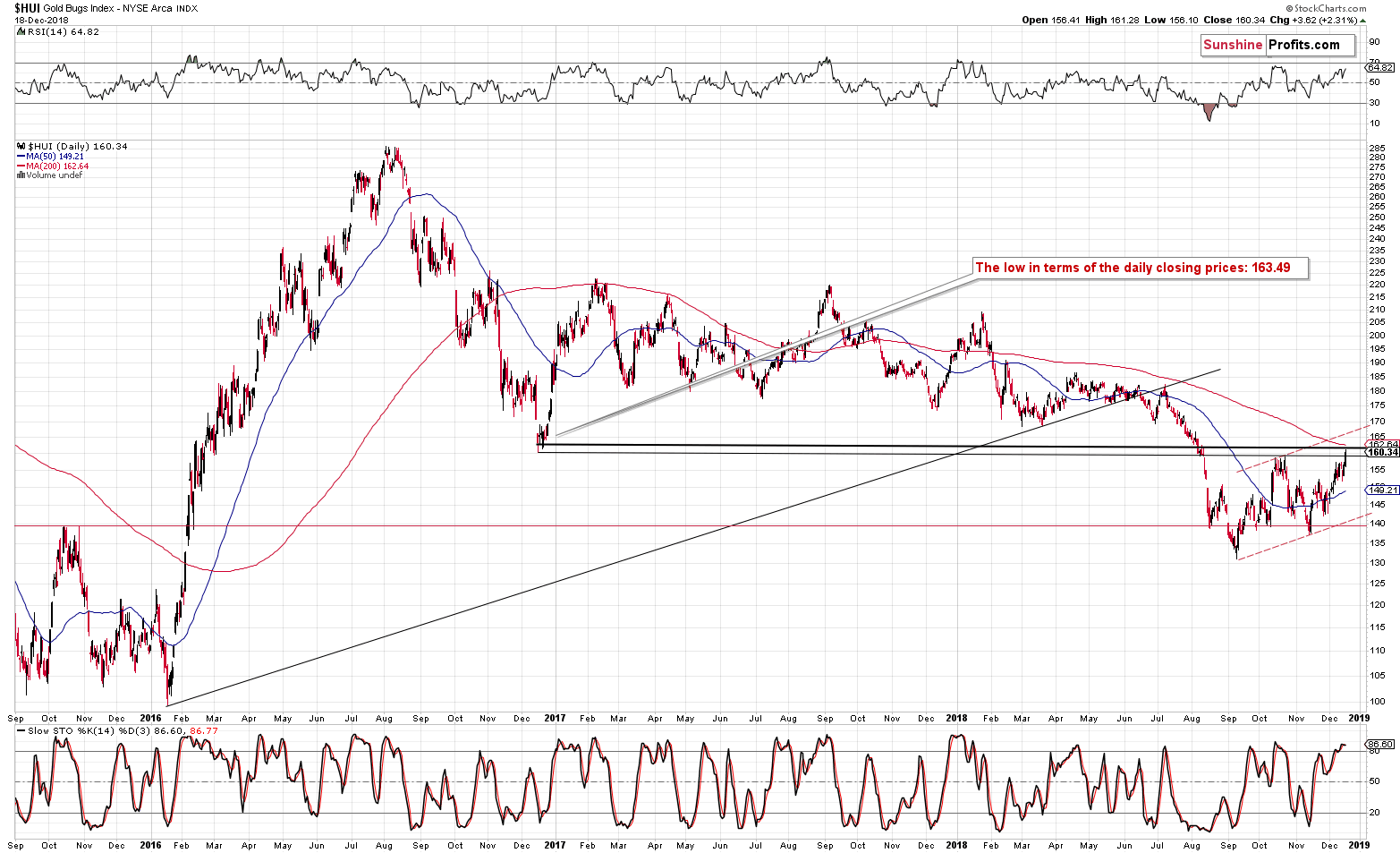

Let’s take a look at gold stocks directly.

What happened? Gold miners moved back to their previously broken support level – the late-2016 bottom. The lowest daily close of December 2016 was 163.49 and yesterday’s close was 160.34. The resistance was reached in intraday terms, though.

Are the implications bullish because the HUI Index moved a bit above their October highs? Not really. The October highs are not as important as the late-2016 bottom and the latter was just reached, not breached. Confirmed breakout above the latter might imply a rally all the way to the previous high slightly above 180. If such a rally became likely (it is not likely now) we would probably adjust our trading position. But doing so now would likely be exiting exactly at the wrong moment.

Especially that… Nothing else changed. Silver even declined yesterday. Let’s take a look at gold.

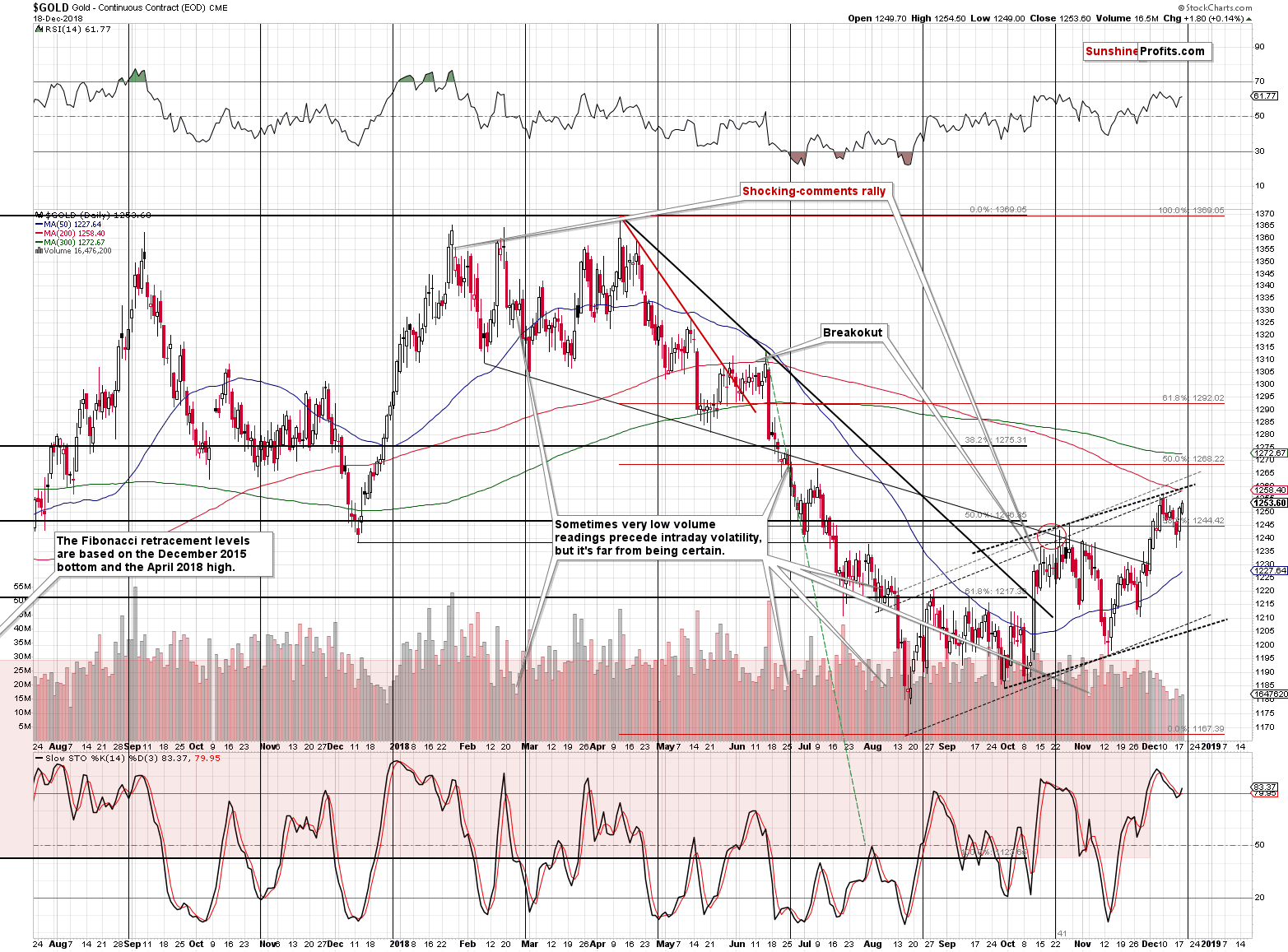

Gold’s Rally Right Before the Reversal

Gold remains below its recent lows and it moved higher on low volume. That’s not a confirmation of a rally, but rather an indication that the move is a counter-trend one. Plus, gold’s cyclical turning point is practically here and thus a bearish turnaround is very likely.

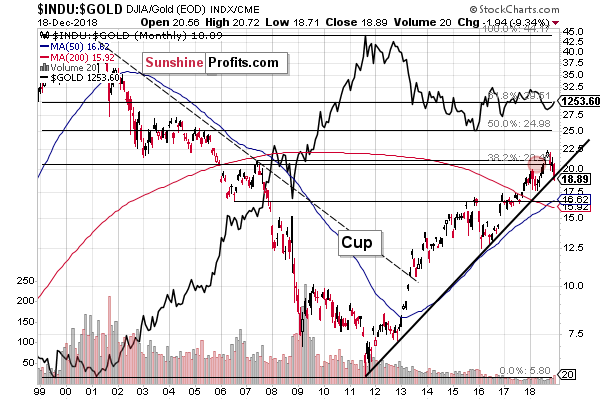

Gold-related Ratios

Looking at the all-important long-term chart featuring the Dow to gold ratio we see that it moved to its very long-term support line. This suggests reversal is either here, or just around the corner.

The 2016 – now rally in the ratio wasn’t accompanied by much lower gold prices. We saw a consolidation instead. Please note that it was exactly the same between 2011 and mid-2013. The ratio showed strength early and rallied sooner than gold declined. But, as we know too well, gold declined with vengeance. Based on many charts and factors that we featured previously and also based on the situation in the USD Index, it seems that we are likely to see this pattern’s repeat also this time. The move to the rising support line suggests that the waiting for the big decline in gold to start is over or very close to being over.

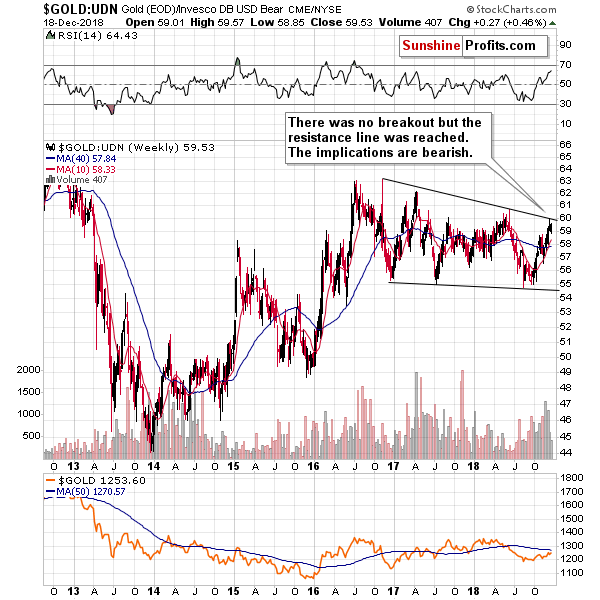

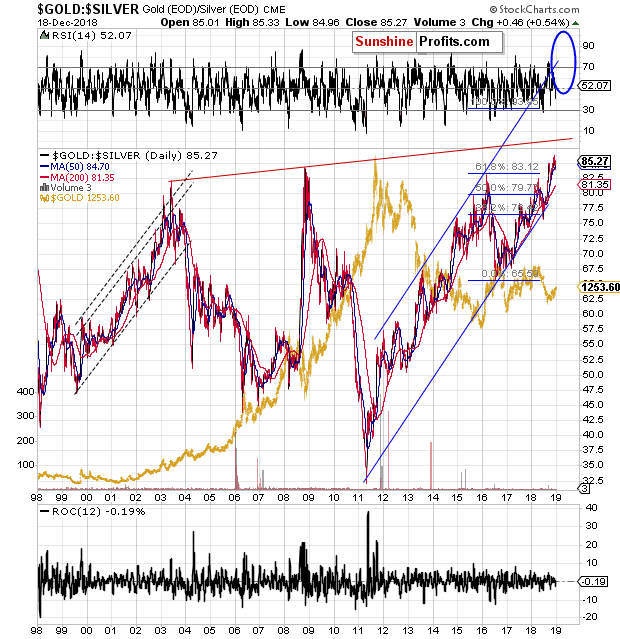

While we're discussing gold-related ratios, let’s take a look at the gold to silver ratio.

That’s yet another thing that makes the current situation very different from what we saw in 2016. In 2016 the gold to silver ratio was reaching its resistance and it topped below it. Now, the ratio is after a breakout above the previous highs and thus likely to continue its upward move.

What about the white metal?

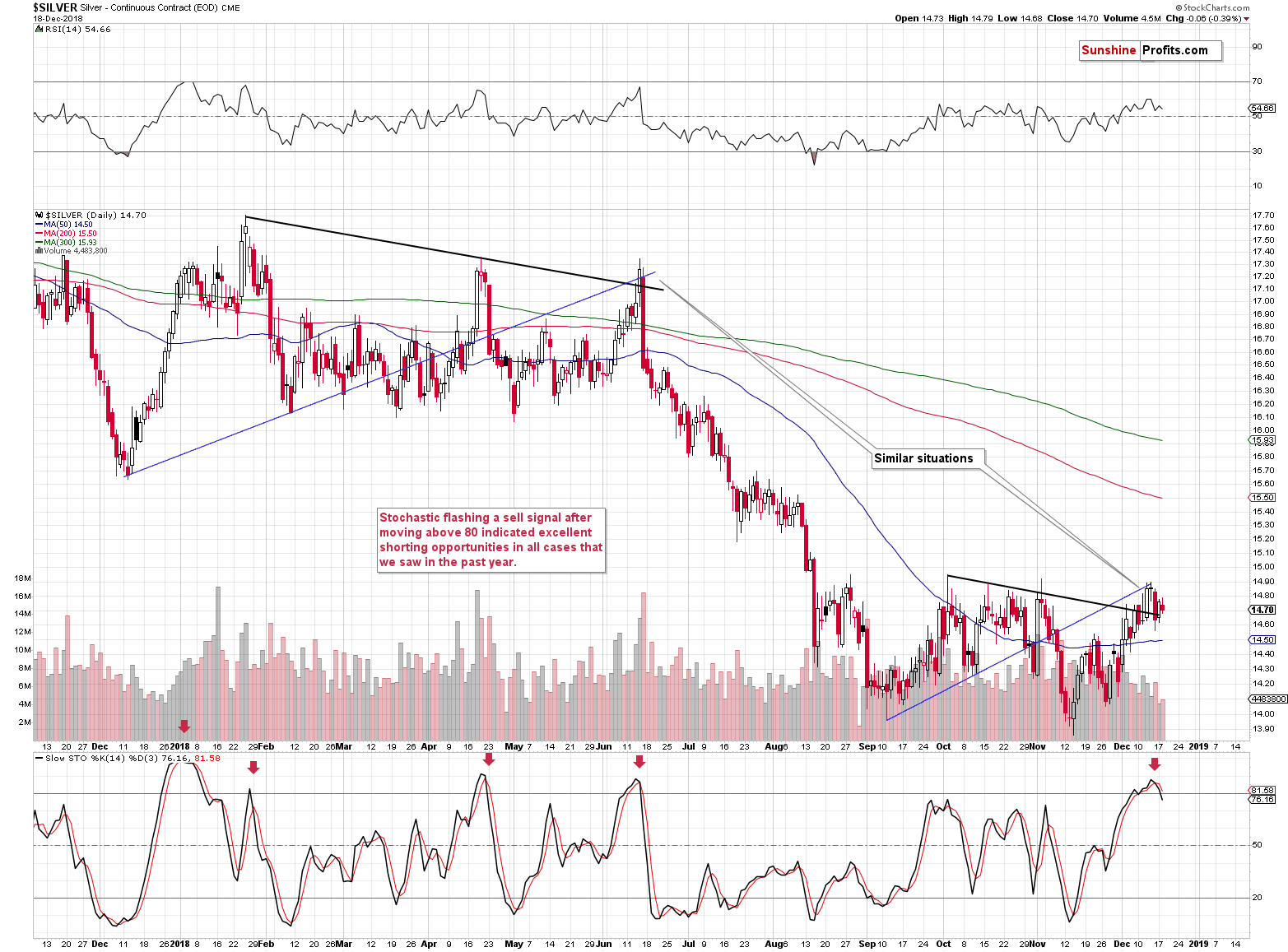

Silver’s Effective Signal

Silver is performing just as it’s likely to after the reversal and after its self-similar pattern. It appears to have topped just like it had topped in mid-June. Back then the decline was very volatile, but it seems that silver is simply taking its time and let’s keep in mind that a few-day delay between the top and the sharp plunge is quite normal. For instance, that’s what we saw in late January (several days) and in April (1 day).

There’s something else that’s very interesting on the above chart. The Stochastic indicator just flashed a clear sell signal after moving over the 80 level (thus while being overbought). What’s so interesting about this signal is that it had 100% efficiency in the past year. All 4 cases that we saw previously were excellent shorting opportunities. The January signal was not the exact top – the final formed later (and it was confirmed by another signal), but the signal did mark the end of the sharp upswing and it was a very good shorting opportunity overall.

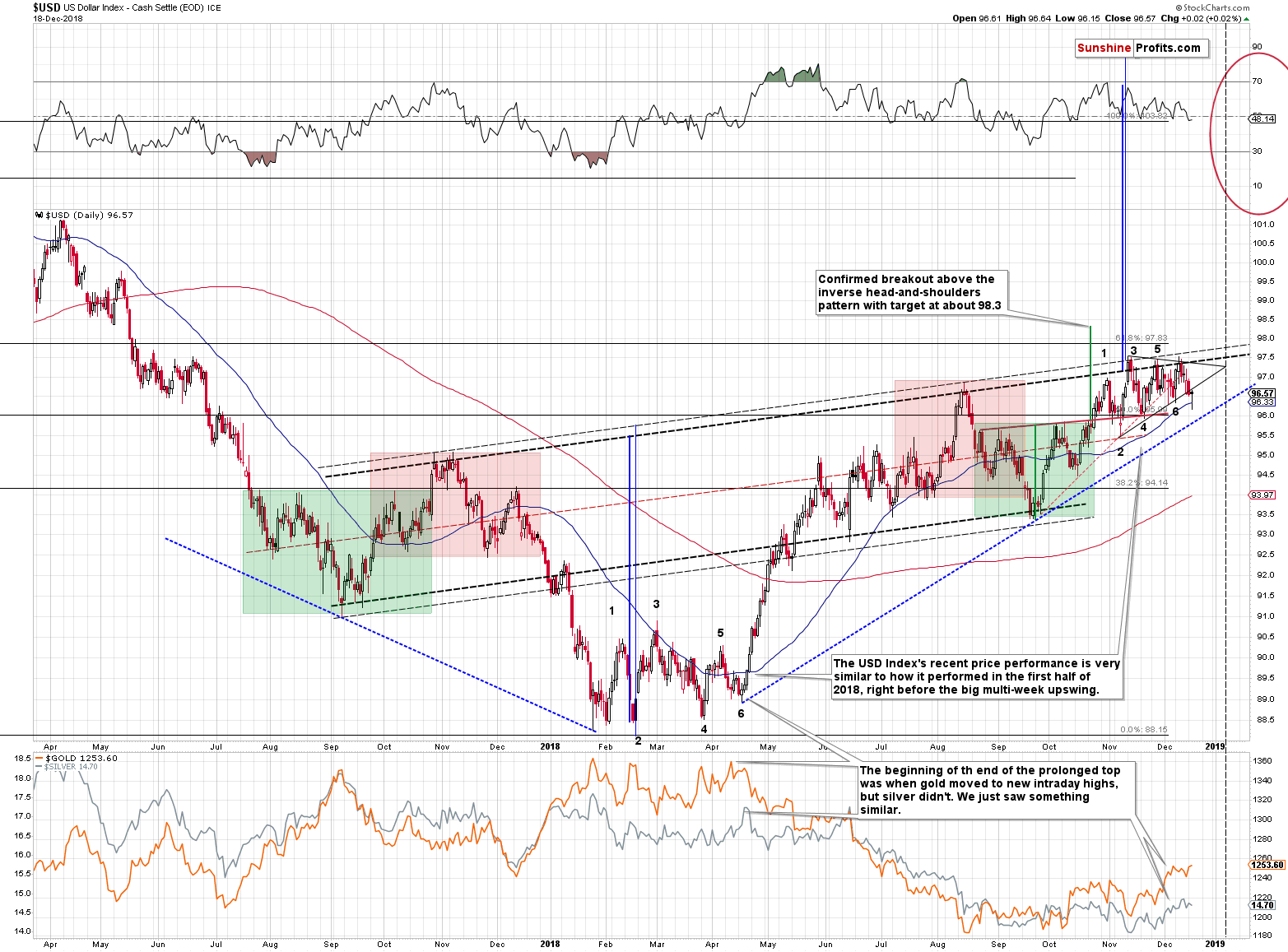

The situation in the USD Index is also interesting to say the least.

USD Index – Tiny, Suspicious Breakdown

In yesterday’s Alert, we wrote the following about the above chart:

In case of the USD Index, we saw a small move below the triangle pattern, but it was too tiny to be considered meaningful. If we based the lower border of the triangle on the second December intraday low, there would be no move below it at all. Consequently, even the short-term outlook for the USDX didn’t change based on what just happened.

The interesting thing about the above chart is the tiny breakdown below the triangle pattern that was then followed by another quick rally. It’s just as if someone wanted to trigger a move lower, but the market forces were pushing the price back higher. The markets are typically nervous before and right after interest rate announcements and other important news, so if someone wanted to push the price lower and perhaps profit on the resulting decline (as subsequently stop-loss orders are reached), it would be effective to try to do so now. This by itself, is not yet a proof that it’s happening, but the chart performance seems to confirm it. On a side note the above possibility is one of the reasons why waiting for confirmations of breakouts and breakdowns is usually a good idea. A given move might be artificially triggered and unsustainable. Confirmation of a given breakout or breakdown makes it much more likely that this move was real.

In this case, the outlook for the USD Index remains bullish and the implications for the precious metals market remain bearish.

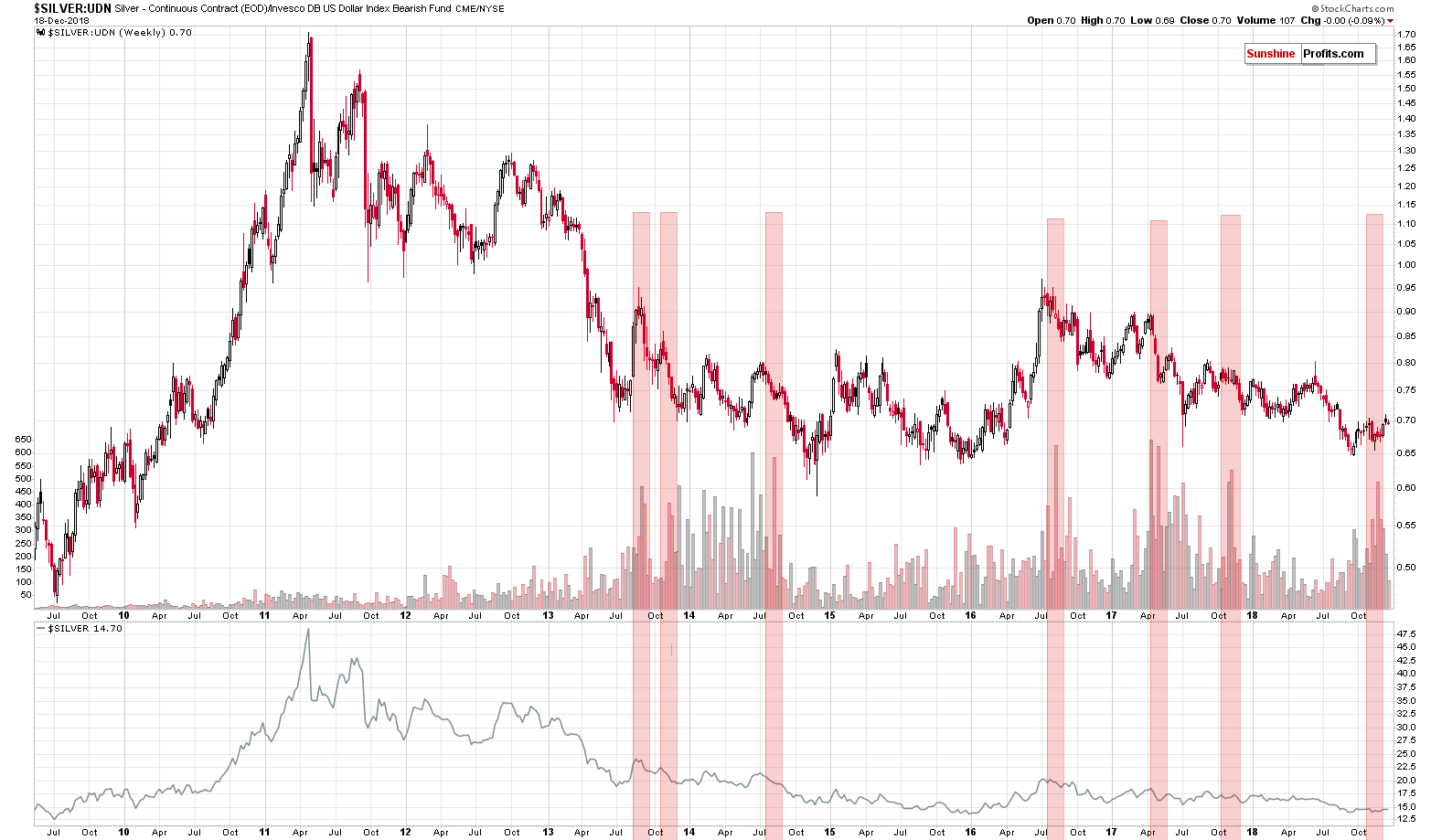

While we’re discussing currencies, we would like to show you gold and silver charts, where their prices are shown from the non-USD perspective. We were asked do to so by one of our subscribers, and so we deliver.

Gold and Silver Prices from the Non-USD Perspective

First, a few words on the methodology. The UDN ETF is an instrument that moves inversely to the USD Index, and by dividing the price of gold by its value means effectively looking at the average of gold prices in terms of major currencies other than the USD. On Kitco.com there is a “Kitco Gold Index” that’s about exactly the same thing. We would like to emphasize that we featured the gold to UDN ratio in our publicly available analyses months before they ever mentioned their non-USD index.

So, what did gold do? It just moved a declining resistance line based on the previous tops. The recent upswing might seem encouraging from the very short-term point of view, but it’s really a part of a horizontal consolidation that has lower highs and lower lows. The key thing here is that there was no move above the declining upper border of the trade channel and thus the price is likely to reverse and decline. That’s exactly how resistance works.

What about silver seen from the non-USD perspective?

The silver:UDN ratio doesn’t show anything special by itself. It moved a bit higher recently, but nothing to call home about. The ratio is relatively close to its previous lows. But, just because there is no interesting developments in terms of price, it doesn’t mean that there’s nothing interesting at all.

The hidden analytical gem is in the volume. More precisely it’s in the ratio of volumes between silver and UDN. Why would it be important? Because of the very high efficiency in detecting great shorting opportunities in the past years. This signal is not very precise in terms of time, but it is highly effective in determining the direction of the next big move.

Please take a look how silver performed after we saw huge volume spikes during weekly declines. While it was not always the case that silver declined right away, it still declined shortly and – more importantly – it declined profoundly. There were 6 previous cases that we marked with red and they were all excellent shorting opportunities. They were all go-short-and-do-nothing-until-silver-is-much-lower opportunities. We saw this signal a few weeks ago, which suggests that it either didn’t work this time, or that were in the delay period, just like what we saw in mid-2017. Back then silver corrected for a few weeks and then plunged with vengeance. Is this time really different? These words are usually costly.

Moreover, please note that there was no huge-volume spike in silver anywhere near the beginning of the 2016 rally. There were weeks when the volume was significant, but it was not as huge as in the cases that we marked and what we saw recently.

Miners Decline – Possible Reasons and Implications

So why did miners rally at all? In yesterday’s Alert, we provided the following warning:

The market may be hesitating to move before the Fed’s interest rate decision, or we could see a quick, intraday, expectations-based panic that could temporarily move the market either higher or lower. There would be no direct explanation as to why these moves happened, except investors’ and traders’ nervousness, and it’s usually best to just ignore these very short-term price moves and focus on the strong signals that were in place beforehand. We discussed them in the previous Alerts, so you are both: informed, and prepared. In particular, please note that yesterday’s analysis includes our comments on the possible outcomes based on the Fed’s decision and the strategy that seems optimal given these scenarios. If you didn’t have a chance to read it yet, we strongly suggest that you do so today.

The sentiment is strong (as shown on the chart featured in yesterday’s Alert) and it will therefore probably be particularly tempting to either drop the short position or to even go long. Based on the cold-facts analysis that would not be a good idea and ultimately it is the latter that creates value over time, not following emotions on the market and chasing the price. Even though gold is well below its 2011 high, on a short-term basis it’s high and it’s usually not a good idea to buy high – we want to buy low, possibly extremely low and there are strong signs suggesting that this buying opportunity is coming. Sometimes the sitting instead of trading is the toughest choice that an investor has to make and it seems that this is one of those cases.

The above remains up-to-date. It might have been the case that yesterday’s strength in the miners was simply part of the above-mentioned panic. It could have been the case that miners were not ready to decline before verifying the late-2016 bottom as resistance. Or, it could have been the case that the huge decline in the price of crude oil made investors think that miners’ costs will be lower and thus that their profits will be bigger in the future. Either way, as we discussed today, it doesn’t seem to be the case that we are seeing a repeat of 2016. It seems much more likely that we’re seeing the final part of the corrective upswing that is particularly emotional. The real strength of miners is not comparable to what we saw in 2016 and other markets don’t point to the similarity to that period either. There are, however, multiple long- and medium-term sell signal. Consequently, in our opinion, the short positions remain justified from the risk to reward point of view.

Summary

Summing up, this prolonged correction within the big downtrend has been very tiring, but based on the long-term factors being patient was very well worth it, and based on the short-term signs, it seems that the waiting is over or about to be over. The outlook for the precious metals market remains very bearish for the following weeks and months and short position remains justified from the risk to reward point of view, even if we see a few extra days of back and forth trading or even a small brief upswing. There is a very high probability of a huge downswing that makes the short position justified, not the outlook for the next few days. It's confirmed by multiple factors, i.a. weekly reversals, silver’s recent outperformance and reversal exactly when it was most likely, gold’s performance relative to the general stock market, USD’s self-similar pattern that’s confirmed by PMs performance, and many more.

As always, we’ll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short positions (250% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and exit profit-take price levels:

- Gold: profit-take exit price: $1,062; stop-loss: $1,272; initial target price for the DGLD ETN: $82.96; stop-loss for the DGLD ETN $47.17

- Silver: profit-take exit price: $12.32; stop-loss: $15.11; initial target price for the DSLV ETN: $47.67; stop-loss for the DSLV ETN $28.37

- Mining stocks (price levels for the GDX ETF): profit-take exit price: $13.12; stop-loss: $21.82; initial target price for the DUST ETF: $80.97; stop-loss for the DUST ETF $21.97

Note: the above is a specific preparation for a possible sudden price drop, it does not reflect the most likely outcome. You will find a more detailed explanation in our August 1 Alert. In case one wants to bet on junior mining stocks’ prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and target prices:

- GDXJ ETF: profit-take exit price: $17.52; stop-loss: $31.23

- JDST ETF: initial target price: $154.97 stop-loss: $51.78

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Important Details for New Subscribers

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts