Briefly: in our opinion, full (250% of the regular size of the position) speculative short position in gold, silver, and mining stocks is justified from the risk/reward perspective at the moment of publishing this Alert.

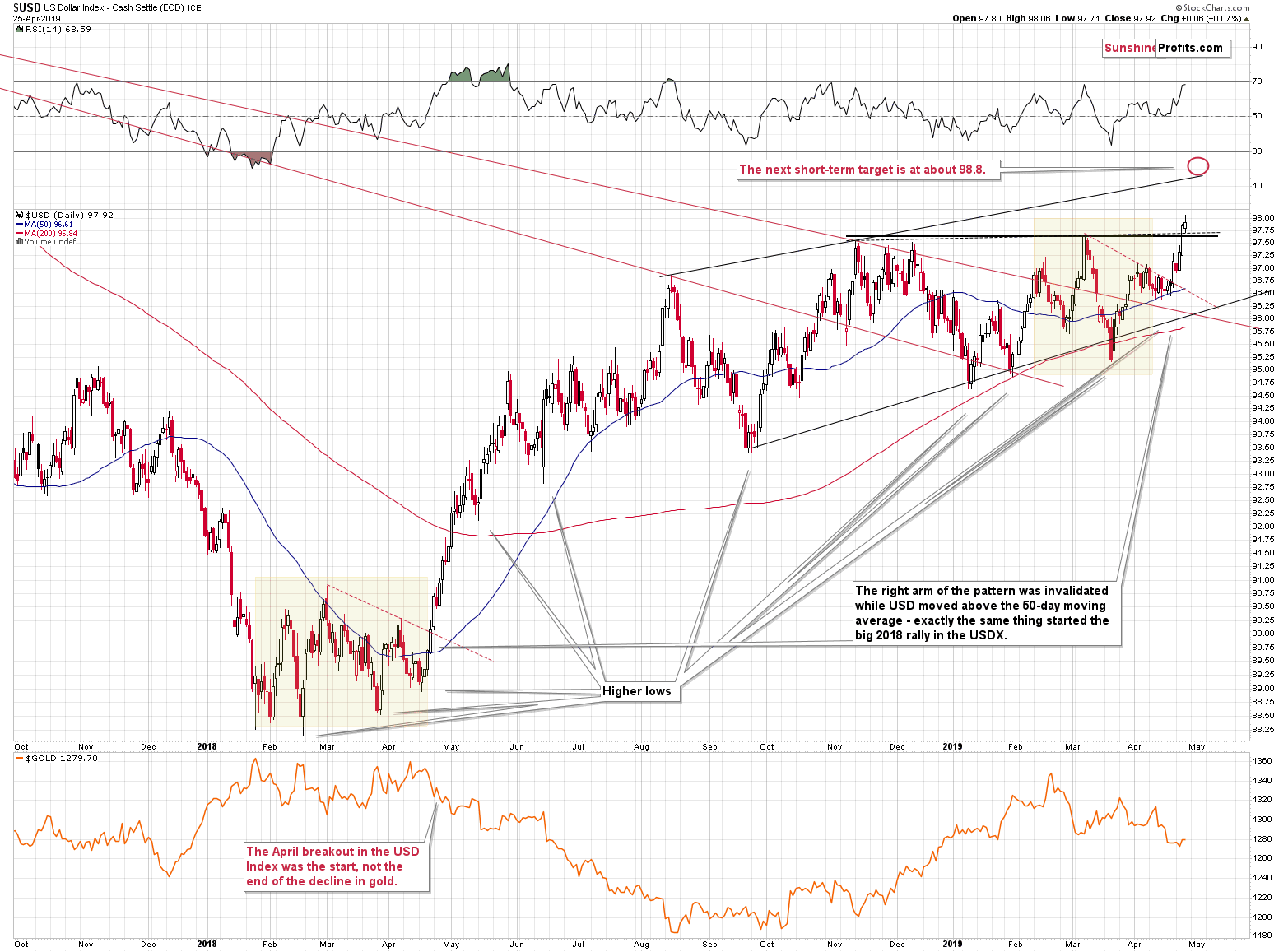

Gold and silver have barely done anything yesterday, but mining stocks moved down. Their decline indicates that the recent move higher was just a pause. Then again, let's keep in mind that miners tend to fake their last over- or underperformance before the major trend change. We had seen it in early 2016 and we even saw it in September 2018. What didn't happen yesterday is more important than what did, though. The USD Index didn't invalidate the breakout above the 97.5 level. This is the first time it managed to keep the ground gained. All 4 previous breakouts from 2018 and 2019 were invalidated on the next day or even during the breakout session. Something has just proved to be different. And this "something" is likely to be very profitable.

That "Something" and the USD Index

In yesterday's Alert, we discussed the situation in the USDX in the following way:

We would like to add that gold was not really reacting to USD's rally immediately when it happened. It did decline, but the reaction was not as volatile as it theoretically should be given the size of USD's move. Yesterday, we saw an even weaker reaction in gold. Actually, it's quite normal, given that the USDX attempted to break above the 98 level several times in the previous months. All the previous attempts have failed, so why should this time be any different?

You know that this time actually is different. The general investment public doesn't know, however. This is the rally that followed the dovish surprise from the Fed, which means that USD is showing excessive strength against the bearish forces. This kind of strength in the face of adversity can easily take the USD well above the previous highs. In other words, even though it doesn't appear to be the case for most investors at the first sight, this time the USDX has a very good chance of successfully breaking higher.

The short-term resistance is at about 98.8 (red ellipse on the above chart), but the much more important resistance is at the 2017 high.

Just as we had indicated to you in the previous Alerts, this time already proved to be different. Ideally, we would like to see also the third (and weekly) closing price above the previous highs, but what we have seen so far already serves as a bullish confirmation. The precious metals investors don't seem to be fully aware of the change yet, but we are seeing the first signs of the change in their approach.

Meanwhile, Throughout the PMs...

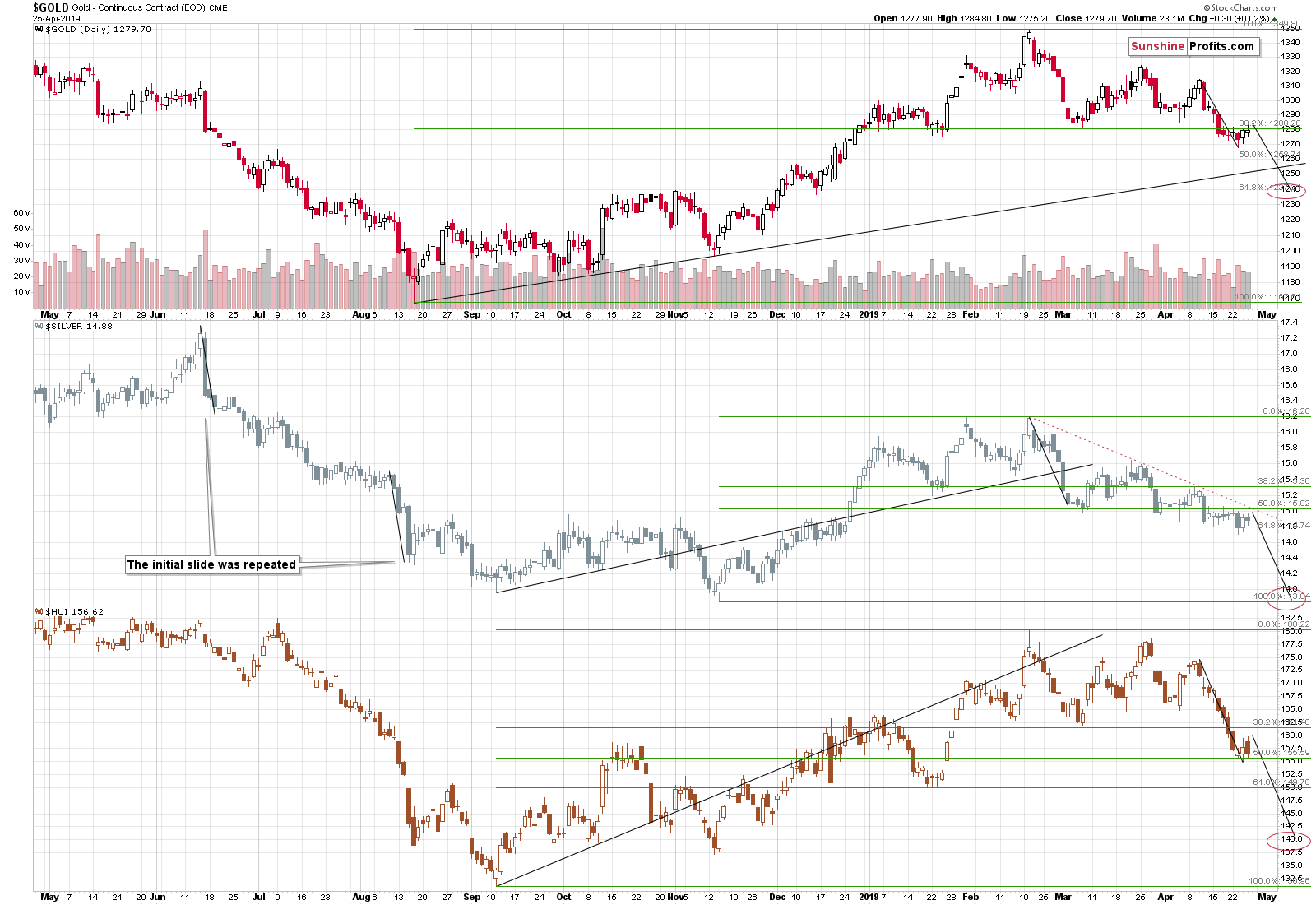

Mining stocks declined, almost erasing Wednesday's gains. This is not yet a response that's significant enough given the importance of USD's breakout, but it's the first step in the reasonably expected direction.

Other than the above, there's not much that we can say about the price changes on the precious metals market, as nothing really changed. We would like to, however, emphasize that miners' recent decline has been severe enough to highlight their underperformance of gold.

Applying the Fibonacci retracements to the recent upswing shows that gold erased about 38.2% of the previous rally, miners erased about 50% thereof, and silver erased more than 50%. This is in tune with our expectations - silver slides more than gold due to the major breakout in the gold to silver ratio. Miners decline more than gold, because that's what tends to happen during initial stages of big declines. In particular, that's what took place during the 2012-2013 decline that's similar to the current move.

The above chart also features the target prices. These are the targets that we described in the previous Alerts and on the above chart you can see them confirmed by two simple techniques. The first is a general rule and the second is something specific to silver.

The general rule is that the moves that precede consolidations tend to be similar to the ones that follow. Applying this technique to the most recent decline in gold and gold miners, we get targets of about $1,240 and 140, respectively.

The white metal didn't decline as significantly in April as gold and miners did, and since it's just before a breakdown that should trigger a volatile decline, we should use a different technique. The above one would generate a target that was likely to be too close. During the 2018 decline, silver moved in the same way at the start of the decline and then during the post-breakdown decline in August. Since silver is about to break lower, we also applied the size of the initial slide in the white metal to the current price. The result is a target a bit below $14 - more or less at the 2018 low.

Naturally, the above two techniques are not enough to create meaningful targets on their own, but they do a great job confirming the targets that we already outlined previously based on other techniques.

Summary

Summing up, the breakdown in gold is confirmed from multiple angles, miners underperform to an extreme extent, while silver appears ready to slide any hour now - it's difficult to imagine a more bearish combination for the short term. As if that wasn't enough, the USD Index seems to have bottomed. All the above creates an excellent shorting opportunity in the precious metals sector. There will likely come a time later this year when we will get in the back-up-the-truck territory with regard to precious metals, but we are not even close to these discounted price levels. However, it looks like the final slide towards them has already started. Based on the likelihood of seeing a temporary turnaround next week, we might have a good chance of exiting the current short position or even switching to a long one at that time.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short position (250% of the full position) in gold, silver, and mining stocks is justified from the risk/reward perspective with the following stop-loss orders and exit profit-take price levels:

- Gold: profit-take exit price: $1,241; stop-loss: $1,357; initial target price for the DGLD ETN: $51.87; stop-loss for the DGLD ETN $39.87

- Silver: profit-take exit price: $14.03; stop-loss: $15.72; initial target price for the DSLV ETN: $37.47; stop-loss for the DSLV ETN $26.97

- Mining stocks (price levels for the GDX ETF): profit-take exit price: $18.41; stop-loss: $24.17; initial target price for the DUST ETF: $34.28; stop-loss for the DUST ETF $15.47

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so - we think senior mining stocks are more predictable in the case of short-term trades - if one wants to do it anyway, we provide the details), here are the stop-loss details and target prices:

- GDXJ ETF: profit-take exit price: $26.42; stop-loss: $35.67

- JDST ETF: profit-take exit price: $78.21 stop-loss: $30.97

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one, it's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (DGLD for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn't, then we will view both positions (in gold and DGLD) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

As always, most analysts focus not on what they really should. After March FOMC meeting, everyone was talking about the more dovish dot-plot. But the Fed also announced that it will end the unwinding of its balance sheet in September. As these changes are revolutionary and may entail potentially huge consequences for the precious markets, we invite you to read our today's article about the new Fed's balance sheet policy and find out whether it will be positive for the gold prices.

Will Fed's New Balance Sheet Policy be a Reason to Buy Gold?

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager