Briefly: in our opinion, full (300% of the regular position size) speculative short positions in mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

The Fed spoke. The markets reacted. And – as it’s usually the case – the technical indications correctly preceded the news and subsequent market moves.

I started yesterday’s analysis with the following:

The world is holding its breath for today’s comments from the Fed, knowing that one of the approaches would be a game-changer.

If the Fed hints that it’s ready to taper its stimulus, the long-term rates will likely rally, whereas stocks, precious metals and commodities will likely slide. But if they don’t do that, it seems that whatever has been going on in the above markets will likely continue based on their technical developments.

In the case of gold, it means either a measured late-2012-style decline or a more powerful slide similar to the moves we saw in 2008 and 2020. Which one will it be? Either way, the next big move is likely to be to the downside (even if dovish comments were to spur some immediate-term gains). Why? Because history tends to rhyme, and right now, gold is simply repeating its price patterns from the past that were preceded by relatively similar events (invalidation of the breakout to new all-time highs – just like in 2008; similarity with regard to price moves, volume, and key indicators – just like in 2011-2012).

I will elaborate on this in the following part of today’s analysis, but in short, the Fed indicated that it may raise rates sooner than previously expected in response to strong growth and rising inflationary pressures. And the markets plunged. Furthermore, it seems that it’s just the first crack in a huge bearish dam.

Let’s take a look at the charts.

Gold declined profoundly, and it’s now about $70 lower than it was at the beginning of this week. However, the exact number is not that important. What is important, gold broke below not only its rising support line but also its declining medium-term support line (the one based on the 2020 and 2021 highs).

The breakout above this line supposedly was “a proof” of much higher gold prices – at least that’s what the gold bulls were saying. And I disagreed. On a side note, while I didn’t check it myself (well, it’s impossible to read every article out there), based on the correspondence I’m receiving, it appears I’ve been the only one of the more popular authors to be actually bearish on gold at this time. Please keep that in mind, along with me saying that yesterday’s decline is just the beginning.

Sure, gold might correct today or tomorrow, but the trend is now clearly down.

Quoting yesterday’s analysis:

Why would the above chart be so exciting? Because gold just broke below its rising dashed support line and closed the day below it. This is the first time that it managed to do that, despite coming close to it a few times before. The excitement is even bigger because of what happened on an intraday basis – gold moved back to its declining support line based on the 2020 and 2021 highs and then it moved back up. Consequently, based on the same session, both bulls and bears have an indication that “they were right all along”. Was yesterday’s session a major breakdown, or a confirmation of the May breakout?

But how excited can you get if it’s clear that gold is simply repeating its price patterns from the past that were preceded by relatively similar events (invalidation of breakout to new all-time highs – just like in 2008; similarity with regard to price moves, volume, and key indicators – just like in 2011-2012).

Watching a football match is not as exciting when you already know the outcome, is it?

What’s likely to happen now? Gold is likely to move back and forth, but will ultimately break below the declining support line, which will be a major “uh-oh” moment for those who think that gold will move higher from here based on the very positive fundamental situation. Yes, it is very positive, but it doesn’t mean that gold would rally right away. It could decline despite the fundamentals, just like it did in 2008 and in 2013. And it seems that it’s about to slide.

My previous comments on the analogies to 2008 and 2012 remain up-to-date:

Back in 2008, gold corrected to 61.8% Fibonacci retracement, but it stopped rallying approximately when the USD Index started to rally, and the general stock market accelerated its decline.

Taking into consideration that the general stock market has probably just topped, and the USD Index is about to rally, then gold is likely to slide for the final time in the following weeks/months. Both above-mentioned markets support this bearish scenario and so do the self-similar patterns in terms of gold price itself.

Moreover, while the pace of gold’s decline in 2012 started off slow, the momentum picked up later on as the drawdown became more vicious. As a result, the tepid pace of gold’s current slide remains deceptive and isn’t a cause for concern.

Please see below:

The relatively broad bottom with higher lows is what preceded both final short-term rallies – the current one, and the 2012 one. Their shape as well as the shape of the decline that preceded these broad bottoms is very similar. In both cases, the preceding decline had some back-and-forth trading in its middle, and the final rally picked up pace after breaking above the initial short-term high.

Interestingly, the 2012 rally ended on huge volume, which is exactly what we saw also on May 19 this year. Consequently, forecasting much higher gold prices here doesn’t seem to be justified based on the historical analogies.

The thing I would like to emphasize here is that gold didn’t form the final top at the huge-volume reversal on Sep. 13, 2012. It moved back and forth for a while and moved a bit above that high-volume top, and only then the final top took place (in early October 2012).

The same happened in September and in October 2008. Gold reversed on huge volume in mid-September, and it was approximately the end of the rally. The final top, however, formed after some back-and-forth trading and a move slightly above the previous high.

Consequently, the fact that gold moved a bit above its own high-volume reversal (May 19, 2021) is not an invalidation of the analogy, but rather its continuation.

The lower part of the above chart shows how the USD Index and the general stock market performed when gold ended its late-2012 rally and was starting its epic decline. In short, that was when the USD Index bottomed, and when the general stock market topped.

Also, please note that while it might seem bullish that gold managed to rally above its declining black resistance line recently (the one based on the 2020 top and the 2021 top), please note that the same happened in 2012 – I marked the analogous line with red. The breakout didn’t prevent gold from sliding. When the price reached the line, we saw a short-term bounce, but nothing more than that – the gold price fell through it in the following weeks. Consequently, if history rhymes, the support provided by the current declining medium-term support line is unlikely to trigger anything more than a short-term bounce. And since we’re already after this event, gold’s next attempt to break below it might be successful.

Having said that, let’s take a look at silver.

Silver’s Failed Attempts to Break Out

Silver price confirmed its breakdown below its rising support line, and it has just finished invalidating its fifth attempt to break above the early January highs. This is a clearly bearish combination, even without taking into account the similarity between now, 2020, and 2008.

Let’s keep in mind that silver might hesitate to decline substantially at first, but then play a huge catch-up close to the end of the decline – just as it did in 2020.

Miners: The Breakdown Is Confirmed

The breakdown in the GDX ETF is also crystal clear. Moreover, it’s now fully confirmed, as the GDX ETF closed below its rising dashed support line for the third day in a row.

On Tuesday, I wrote that the buy signal from the Stochastic indicator is not to be trusted:

We saw a buy signal from the stochastic indicator, but the breakdown in terms of closing prices is more important, as the buy signals from the stochastic (below 20) were not that reliable so far this year. Please note that the mid-January buy signal was followed by much lower prices in the following weeks. The same was the case with the first buy signal that we saw in late February.

And indeed, the supposedly bullish signal has already been reversed by another sell signal. Thus, the trend remains down and the outlook remains bearish.

The confirmation of the breakdown is also clear in the case of the 4-hour chart featuring the proxy for junior miners – the GDXJ ETF.

On the above chart, we see that the huge-volume rally has once again worked as a sell signal – in the past, it often heralded short-term declines like the current one.

And speaking of volume and 4-hour charts, let’s circle back to the senior miners – the GDX ETF.

Please note the spike in volume during the final part of yesterday’s session. There was only one time in the recent past when we saw something similar, and that was when gold miners were after a several-week-long rally. It was in early 2021, and it meant that the move lower was not accidental, but rather the beginning of something bigger.

The same seems to be the case now. However, the difference this time is that the markets are repeating a much bigger pattern and the slide is likely to be much greater – just as the long-term HUI Index chart indicates.

Just as gold, gold miners are repeating their price patterns from 2008 and 2011-2013. And just as I indicated earlier, the sell signal from the Stochastic indicator marked a key turning point – the point after which the biggest part of the decline started.

Once again, what we saw yesterday was likely just the beginning.

The additional factors that confirm this outcome are: the rallying USD Index and an invalidation of the breakout to new highs in the general stock market.

The USD Index soared, and it was perfectly natural for it to do so, given its short- and medium-term breakouts as well as the analogy to 2016.

In contrast, the general stock market has just invalidated its breakout to new highs. When the same thing happened in 2020, it started an avalanche of selling, and since history tends to repeat itself, things don’t look good for the stock market at this time.

Having said that, let’s discuss what the Fed did (and what it didn’t do) in greater detail.

Oops!

On Apr. 30, I warned that Jerome Powell, Chairman of the U.S. Federal Reserve (FED), was materially behind the inflation curve.

I wrote:

With Powell changing his tune from not seeing any “unwelcome” inflation on Jan. 14 to “we are likely to see upward pressure on prices, but [it] will be temporary” on Apr. 28, can you guess where this story is headed next?

And with the FED Chair revealing on Jun. 16 what many of us already knew, he conceded:

Moreover, while Powell added that “our expectation is these high inflation readings now will abate,” he also conceded that “you can think of this meeting that we had as the ‘talking about talking about’ [tapering] meeting, if you’d like.”

However, because actions speak louder than words, notice the monumental shift below?

If you analyze the red box, you can see that the FED increased its 2021 Personal Consumption Expenditures (PCE) Index projection from a 2.4% year-over-year (YoY) rise to a 3.4% YoY rise. But even more revealing, the original projection was made only three months ago. Thus, the about-face screams of inflationary anxiety.

On top of that, while Powell believes that “these high inflation readings now will abate,” I warned on Jun. 16 that the FED’s estimates are looking more and more like wishful thinking.

I wrote:

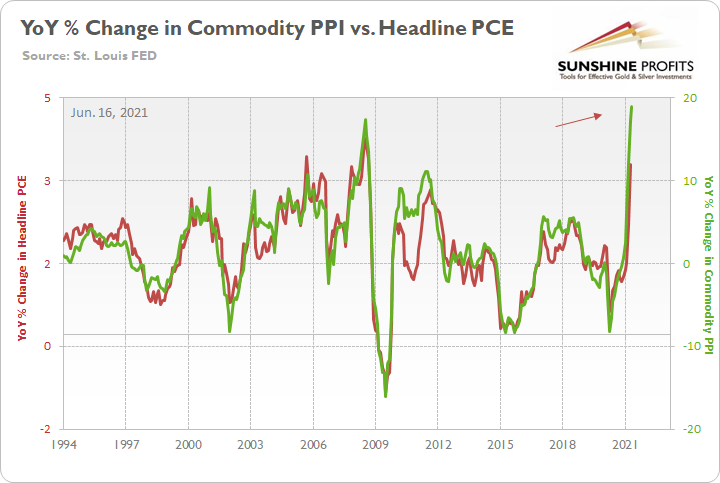

If we begin with the reported figure [an 18.98% YoY increase], the commodity PPI implies a roughly 4.75% YoY increase in the Personal Consumption Expenditures (PCE) Index when the data is released on Jun. 25.

Please see below:

To explain, the green line above tracks the YoY percentage change in the commodity PPI, while the red line above tracks the YoY percentage change in the headline PCE Index. If you analyze the right side of the chart, you can see that a material gap is clearly visible. What’s more, if we substitute the 18.98% jump with the non-base-effects comparison of 12.60%, it still implies a rise in the headline PCE Index of roughly 3.60%.

A Hawkish Shift

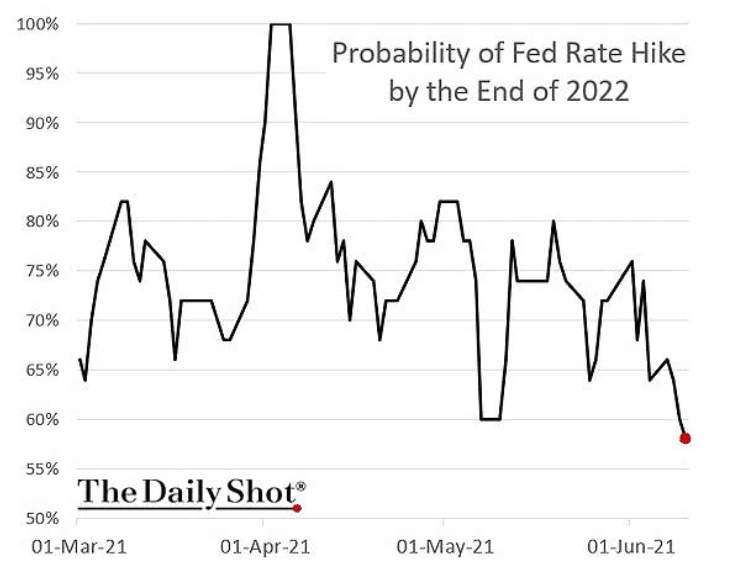

Furthermore, while Powell attempted to downplay the significance, the FED’s latest ‘dot plot’ has seven FOMC participants signaling a rate hike in 2022 and 13 FOMC participants signaling a rate hike in 2023. For context, there are 18 participants in total.

Please see below:

To explain, the vertical scale on the right side of the chart represents the U.S. federal funds rate and the blue dots depict FED officials’ projections for the rate and when they will likely materialize. If you analyze the arrow near the middle of the chart, you can see that seven members expect the U.S. federal funds rate to range between roughly 0.25% and 0.75% in 2022. In addition, 13 FED officials expect the U.S. federal funds rate to range between roughly 0.25% and 1.75% in 2023. For context, this is a hawkish shift that market participants haven’t been expecting.

As evidence, the perceived probability of a rate hike by the end of 2022 sunk to a 2021 low on Jun. 12. However, after the FED’s material about-face on Jun. 16, I’m sure these positions have been recalibrated.

Please see below:

The Reverse Repos Upheaval

Adding to the FED’s ills, I’ve been warning for weeks about the upheaval in the repo market. With the FED’s daily reverse repurchase agreements hitting an all-time high of 584 billion on Jun. 14 (with another $521 billion sold on Jun. 16), excess liquidity has become a game of hot potato.

To explain, I wrote on Jun. 15:

The FED sold $209 billion worth of daily reverse repos on May 17. On Jun. 14, that figure ballooned to $584 billion.

Please see below:

A reverse repurchase agreement (repo) occurs when an institution offloads cash to the FED in exchange for a Treasury security (on an overnight or short-term basis). And with U.S. financial institutions currently flooded with excess liquidity, they’re shipping cash to the FED at an alarming rate.

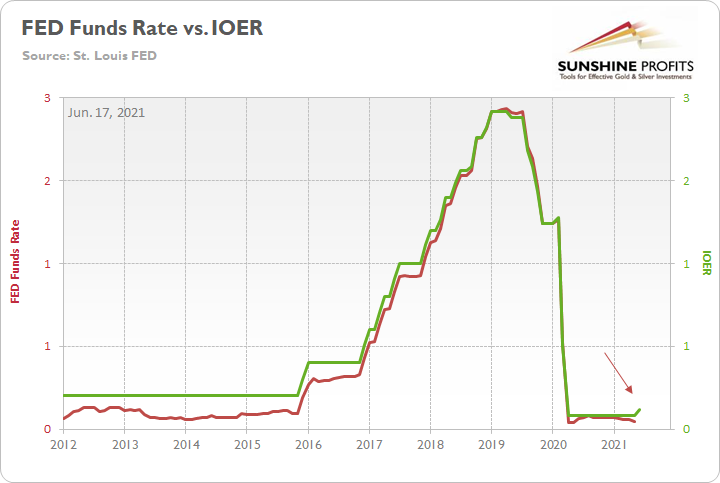

The green line above tracks the daily reverse repo transactions executed by the FED, while the red line above tracks the U.S. federal funds rate. Moreover, notice what happened the last time reverse repos moved above 400 billion? If you focus your attention on the red line, you can see that after the $400 billion level was breached in December 2015, the FED’s rate-hike cycle began. Thus, with current inflation dwarfing 2015 levels and U.S. banks practically throwing cash at the FED, is this time really different?

And what was the FED’s solution on Jun. 16?

Sticking another dagger into the heart of QE, the FED increased the interest rate on excess reserves (IOER) from 0.10% to 0.15%. Translation? The FED hopes that offering a higher interest rate will deter counterparties from participating in the reverse repo transactions. However, whether it will or won’t is not important. The headline is that the FED is draining liquidity from the system, and increasing the IOER is another sign that the U.S. federal funds rate could soon seek higher ground.

Please see below:

To explain, the red line above tracks the U.S. federal funds rate, while the green line above tracks the IOER. If you analyze the behavior, you can see that the two have a rather close connection. And while we don’t expect the FED to raise interest rates anytime soon, officials’ words, actions, and the macroeconomic data signal that the tapering is likely to come in September.

Employment Conditions Are About to Change

To that point, I wrote on Jun. 16:

With the writing on the wall and employment the last piece left in the FED’s puzzle of excuses, once the U.S. labor market strengthens, we can likely kiss the liquidity goodbye.

And while Powell said that “the recovery is incomplete and risks to the economic outlook remain,” he added:

However, what the FED Chair misses in his “one and two years out” estimate is that U.S. job openings are now at an all-time high. More importantly, though, prior to COVID-19, the correlation between U.S. job openings and U.S. nonfarm payrolls was 0.95.

Please see below:

Conversely, with the correlation falling to 0.55 since Mar. 1 (when the coronavirus crisis erupted), was it the lack of childcare options, unfair wages, or health concerns that kept U.S. citizens out of the labor market? Well, while all three are valid rebuttals, with enhanced unemployment benefits providing more income than what many citizens were earning from their jobs, exiting the labor force was a rational decision.

However, with roughly 30% of beneficiaries scheduled to lose benefits by/in July (and a nationwide expiration in September), employment should become increasingly attractive in the coming months.

As further evidence, while the Centers for Disease Control and Prevention’s (CDC) eviction moratorium expires on Jun. 30 (though several states have additional protections), economic distress could ensue. However, with companies like Chipotle Mexican Grill raising their average wage to $15 per hour, U.S. citizens won’t be left out in the cold.

Case in point: according to the U.S. Bureau of Labor Statistics (BLS), the average weekly unemployment benefit is $378. And if we add the $300 in enhanced unemployment benefits, an individual grosses $35,256 per year. In a similar fashion, if a person works 40 hours per week at Chipotle Mexican Grill, the individual grosses $31,200 per year. And while the latter is a reduction from the former, the spread is not wide enough to sink the U.S. economy.

The Housing Market

In addition, weakness in the U.S. housing market remains worthy of our attention. Sentiment has declined, demand is waning, building permits have rolled over and deflationists consistently cite these issues. However, with the Mortgage Bankers Association (MBA) releasing its Weekly Mortgage Applications Survey on Jun. 16, Joel Kan, MBA's Associate Vice President of Economic and Industry Forecasting, said that "mortgage applications bounced back after three weeks of declines, increasing over 4 percent last week. Both purchase and refinance applications were up, including a 5.5 percent gain in refinances.”

Please see below:

Thus, while the outlook is weak, the situation isn’t as dire as it’s portrayed. Likewise, while building permits (which often lead housing starts, which often lead selling prices) signal that more weakness is forthcoming, a 2008-style collapse is unlikely to occur over the next three-to-six months (unless the FED aggressively tapers and raises interest rates).

Also, signaling relative housing strength, I warned previously that the Shelter Consumer Price Index (CPI) hasn’t participated in the inflationary surge. However, with rising rents poised to add further upward pressure to the headline CPI in the coming months (it often occurs with a three-month lag), another alarm bell went off on Jun. 15.

To explain, CoreLogic – the leading global property information, analytics and data-enabled solutions provider – revealed that single-family “rent growth exceeded pre-pandemic rates across all price tiers, including low-end rentals.”

Please see below:

In addition, Molly Boesel, principal economist at CoreLogic, added:

“Single-family rent growth showed a strong rebound in April 2021 with all price tiers back above their pre-pandemic rent growth rate. While rent growth slowed last April at the start of the pandemic, the rate of rent growth this April was running above pre-pandemic levels even when compared with 2019 and shows no signs of diminishing.”

Also contrasting the deflationary thesis, OECD Composite Leading Indicators (CLIs) shows that more and more countries are producing above-trend economic growth. And with a continuation of the theme likely to enhance global GDP, deflationary forecasts are increasingly out of touch with reality.

Please see below:

To explain, the blue bars above represent the percentage of OECD CLIs that are recording above-trend growth. And with the reading on the right side of the chart (64.1%) signaling significant economic resiliency, inflationary concerns remain extremely valid.

To that point, the U.S. 10-Year Treasury yield rallied by 3.97% on Jun. 16. And for the sake of entertainment, notice the headline that CNBC PRO pitched on Jun. 15? For context, when CNBC jumps on a narrative, it’s a sign that the minority has become the consensus.

Finally, hedge fund manager Kyle Bass told CNBC on Jun. 15 that the CPI is “designed to artificially be low. If you look at a non-chain-weighted index of inflation, we think it's running about 12%."

And what does he predict will be the eventual climax?

In conclusion, Powell finally acknowledged reality and his sour sentiment sunk the PMs in the process. And while he hedged by saying that “lift-off is well into the future,” investors’ faith in the FED suffered a material blow on Jun. 16. Moreover, market participants are likely asking themselves, “If FED officials could be so wrong about the PCE Index, what else are they missing?” Thus, I’ll conclude with what I wrote on Jun. 16: with the critics growing louder by the day, the FED’s confidence game will likely implode in September.

Overview of the Upcoming Part of the Decline

- It seems likely to me that the current corrective upswing is very close to being over, given gold’s similarity to what happened in 2012, USD’s similarity to 2016 and the situation in the general stock market.

- After miners slide once again in a meaningful and volatile way, but silver doesn’t (and it just declines moderately), I plan to switch from short positions in miners to short positions in silver (this could take another 1-2 weeks to materialize). I plan to exit those short positions when gold shows substantial strength relative to the USD Index, while the latter is still rallying. This might take place with gold close to $1,450 - $1,500 and the entire decline (from above $1,700 to about $1,475) would be likely to take place within 1-12 weeks, and I would expect silver to fall hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold – after gold has already declined substantially) is likely to be the best entry point for long-term investments, in my view. This might happen with gold close to $1,475, but it’s too early to say with certainty at this time. In other words, the entire decline could take between 1 and 12 weeks, with silver declines occurring particularly fast in the final 1-2 weeks.

- If gold declines even below $1,500 (say, to ~$1350 or so), then it could take another 10 weeks or so for it to bottom, but this is not what I view as a very likely outcome.

- As a confirmation for the above, I will use the (upcoming or perhaps we have already seen it?) top in the general stock market as the starting point for the three-month countdown. The reason is that after the 1929 top, gold miners declined for about three months after the general stock market started to slide. We also saw some confirmations of this theory based on the analogy to 2008. All in all, the precious metals sector would be likely to bottom about three months after the general stock market tops. If the general stock market puts the final top in the first half of May (which seems quite likely given NASDAQ’s top in late April), then we might expect the precious metals sector to bottom sometime in August.

- The above is based on the information available today, and it might change in the following days/weeks.

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding or clear enough for me to think that they should be used for purchasing options, warrants or similar instruments.

Summary

To summarize, it seems likely to me that the corrective upswing is over, given gold’s similarity to what happened in 2012 and 2018 and its turnaround at the double triangle-vertex-based reversal point, USD’s similarity to 2016, action in the silver, and gold miners, and the situation in the general stock market.

After the sell-off (that takes gold to about $1,350 - $1,500), we expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

Most importantly, please stay healthy and safe. We made a lot of money last March and this March, and it seems that we’re about to make much more on the upcoming decline, but you have to be healthy to enjoy the results.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $24.12; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged) and GDXD (3x leveraged – which is not suggested for most traders/investors due to the significant leverage). The binding profit-take level for the JDST: $39.87; stop-loss for the JDST: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the GDXD: $94.87; stop-loss for the GDXD: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures upside profit-take exit price: unclear at this time - initially, it might be a good idea to exit, when gold moves to $1,512.

Gold futures upside profit-take exit price: $1,512.

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief