Briefly: in our opinion, full (250% of the regular size of the position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this alert.

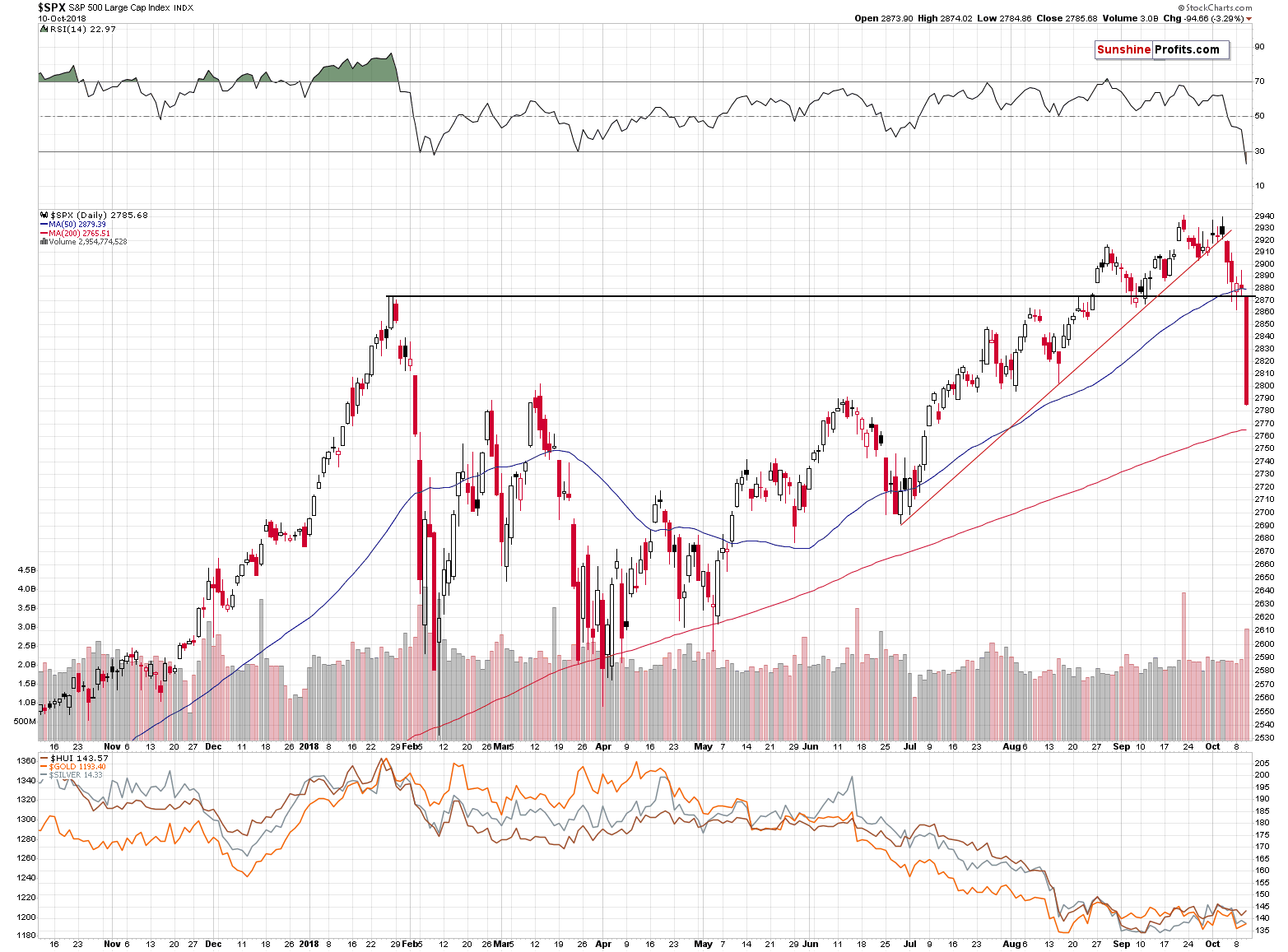

We didn’t see any meaningful action in the precious metals market yesterday, as the general stock market stole the spotlight. The S&P 500 declined profoundly after invalidating the breakout above the January 2018 high. In our Monday’s analysis, we explained that one shouldn’t count on any meaningful rally in gold if stocks decline or become very volatile and that’s exactly what we saw. Nothing really changed in the PMs. What’s next?

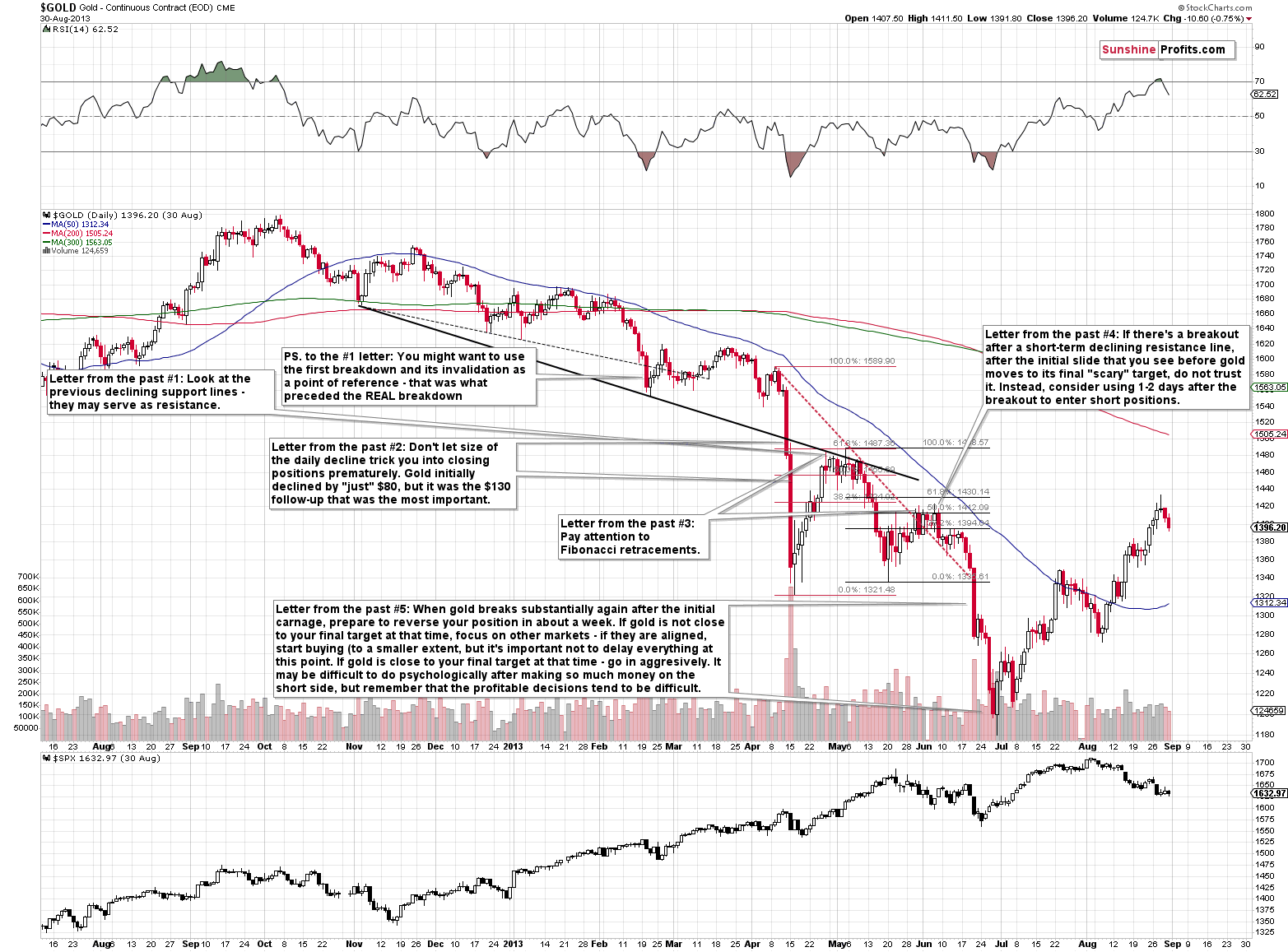

The big decline continues to be the most likely follow-up action. In yesterday’s Alert, we emphasized that in light of the analogy to what happened in 2013, the precious metals market is currently right before the big slide, and we might even see it this week. If the history repeated itself to the letter, the huge decline would have likely taken place yesterday. But, this history may only be “very similar” to what we have right now, it doesn’t have to be “identical”, and seeing a decline today or in the following days is also very likely.

Let’s not forget that in April 2013, the first part of the $200 two-day decline took place on Friday, and the second part took place on Monday. Moreover, the first day of the decline took place on the 12th of April 2013, while the second day of the decline took place on the 15th of April 2013. This Friday (tomorrow) and Monday will be 12th and 15th day of the month – exactly 5.5 years after the 2013 slide.

The history might repeat itself with regard to the days of the week and the day of the month, and the decline will start tomorrow. But, unless one used extremely risky and extremely short-term options, the exact timing matters little. The key thing is that the decline is still likely to be seen shortly.

Stocks’ Demise and Its Implications

As we wrote earlier, the general stock market stole the spotlight as it took a dive on relatively strong volume, taking some other assets with it (for instance crude oil plunged making our speculative short position in the black gold quite profitable in just a few days). The questions is, if this changes anything with regard to the analogy to 2013.

It’s not really the case. We plotted the general stock market’s performance below the one of gold and it turns out that in mid-April, stocks declined along with the gold. The decline in stocks was not huge, but it was visible, so it’s more or less in tune with what happened yesterday.

But, because of the size of the decline in the main stock indices, gold’s decline’s delay is understandable. Gold is supposed to be the hedge against risks and turmoil. It doesn’t necessarily work if the “risk” or “turmoil” is of lesser significance. For instance, World War 3 would have definitely caused gold to spike, but a 3% decline in stocks is not the end of the world. Yet, one might have expected gold to rally yesterday and it didn’t. It moved somewhat higher in today’s pre-market trading, but compared to what happened in stocks, it’s almost nothing. Perhaps if it wasn’t for the huge decline in stocks, gold would have already declined – people were reluctant to sell gold as they saw plunging stocks.

This may result in an interesting thought process. Stocks are declining and yet gold is not providing any meaningful protection. So, why would one want to hold the yellow metal anyway? It doesn’t provide any income and it has storage costs… I better sell it. And the next investor could think the same thing but at the same time they will already see that gold declined somewhat. That’s yet another reason to sell it as well. And the next investor… And so on and so forth. The disappointment with gold’s performance could be the direct trigger for the decline.

On a side note, if you’ve been surprised by the “letters” visible on the above chart – it’s a part of “Letters from 2013” analysis that we published in August. If you haven’t read it so far, it’s a good idea to do so today.

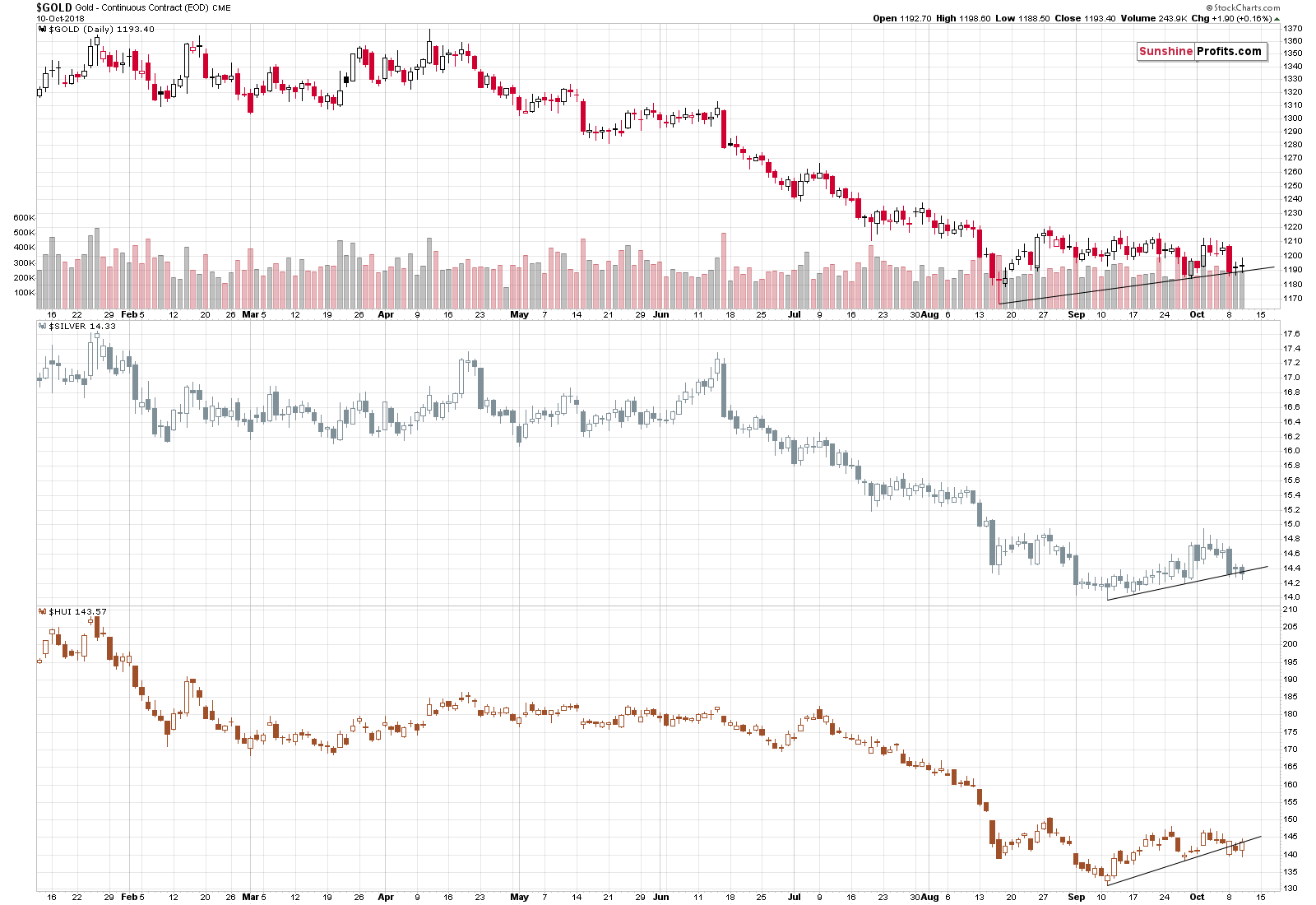

Gold Stocks: Strength vs. Breakdown

Gold stocks moved higher yesterday, but if we put yesterday’s moves into perspective, we see that gold stocks are verifying their breakdown below the rising short-term support line, while gold and silver are not yet below analogous lines. So, was yesterday’s upswing really a sign of strength? Not really.

If we look at strength in the mining stocks for more days in a row (not outperformance that’s followed by underperformance, like we saw recently), this may become an important bullish factor, but it’s too early to call it such right now.

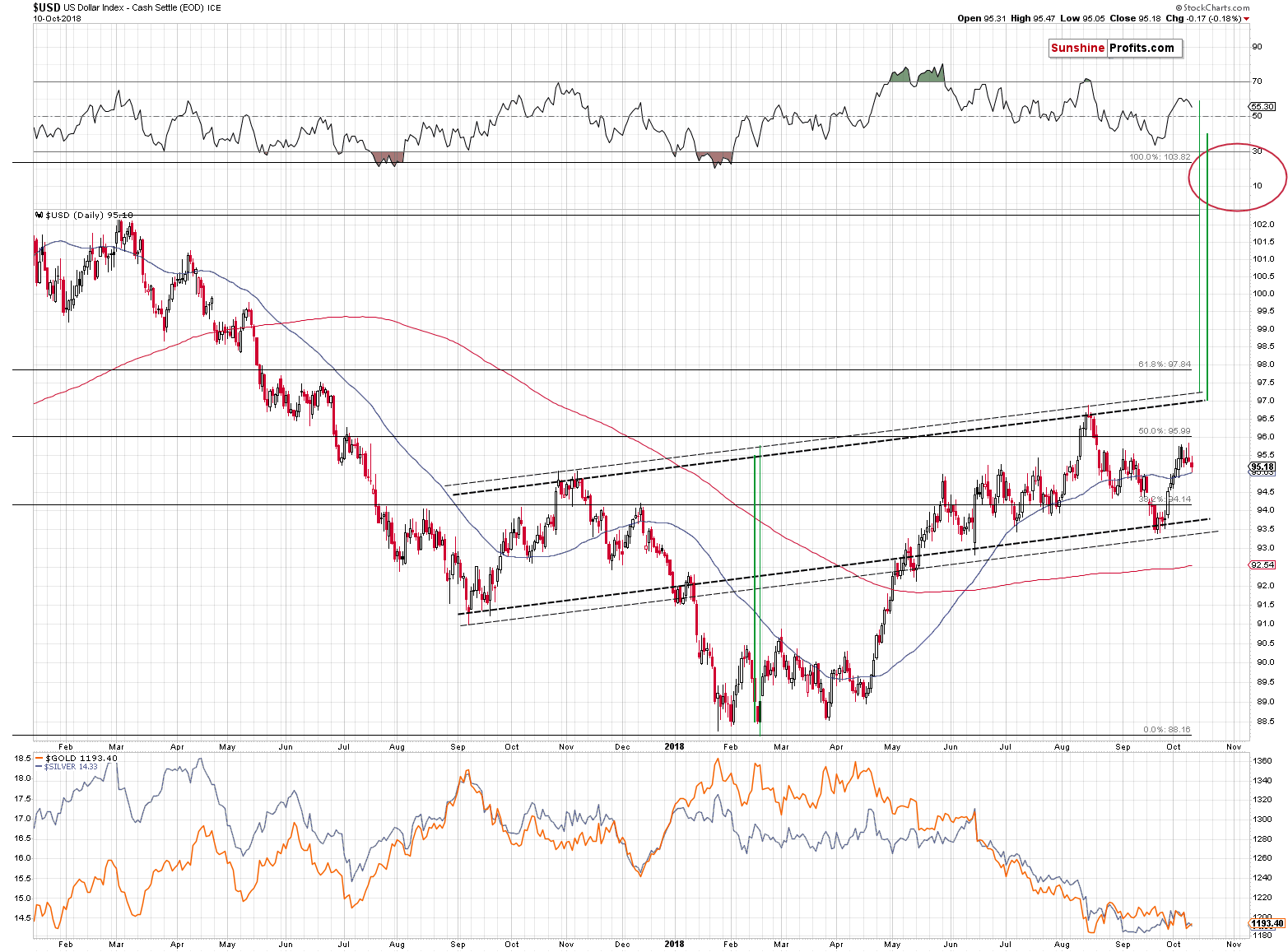

The USD Index: It’s Just a Pause, not the end of the Rally

Meanwhile, it seems that the USD Index continues to follow the pattern that we described in the September 21 Alert:

In short, the USDX moved to one of the rising support lines and at the same time it seems to have completed a zigzag correction. Interestingly, the rally that started in the first quarter of this year is symmetrical to the decline that preceded it. The April – May 2018 rally is similar to the December 2017 decline and the same goes for the rest of the move. The October – December 2017 top took form of a head-and-shoulders pattern and it seems that we have also seen a similar pattern in the USDX (July high being the left shoulder, and the early September top being the right shoulder). And, just like the September – October 2017 zigzag started the previous correction, the August – September 2018 zigzag might be ending the current one. The implications of this specific symmetry are bullish for the USDX and bearish for the precious metals sector.

In case of the above analogy, we are now in the situation that reflects what happened in August 2017. It’s not clear if what we’re seeing is the reflection of the late-August correction that was very sharp, or the early August correction that was rather moderate. But since the reflective nature of this analogy is not very precise, it’s enough to say that this is a similar correction. The important takeaway here is that this is a correction within an uptrend – not a game-changer. The implications for the precious metals market remain bearish.

Important Analyses

Before summarizing, we would like to emphasize that we have recently posted several analyses that are very important and that one should keep in mind, especially in the next several weeks. If you haven’t had the chance of reading them previously, we encourage you to do so today:

- Dear Gold Investor - Letters from 2013 - Analogy to 2013, which should make it easier to trade the upcoming sizable upswing (if enough factors point to it, that is) and to enter the market close to the final bottom.

- Gold to Soar Above $6,000 - discussion of gold’s long-term upside target of $6,000.

- Preparing for THE Bottom in Gold: Part 6 – What to Buy - extremely important analysis of the portfolio structure for the next huge, multi-year rally in the precious metals.

- Preparing for THE Bottom in Gold: Part 7 – Buy-and-hold on Steroids - description of a strategy dedicated to significantly boosting one’s long-term investment returns while staying invested in the PM sector.

- Gold’s Downside Target, Upcoming Rebound, and Miners’ Buy Plan - details regarding the shape of the following price moves, a buying plan for mining stocks, and a brief discussion of the final price targets for the current decline.

- Gold: What Happened vs. What Changed - discussion of the latest extreme readings from gold’s CoT report

- Key Factors for Gold & Silver Investors - discussion of key, long-term factors that support the bearish outlook for PMs. We are often asked what makes us so bearish – this article is a reply to this question.

- The Upcoming Silver Surprise - two sets of price targets for gold, silver and mining stocks: the initial and the final one.

- Precious Metals Sector: It’s 2013 All Over Again - comparison between 2013 and 2018 throughout the precious metals sector, the general stock market and the USD Index. Multiple similarities point to the repeat of a 2013-style volatile decline in the PMs.

- Changing One's Mind - Why, When, and How – discussing the way of analyzing the market that helps to stay focused on the growing one’s capital while not being influenced by the loss aversion bias.

Summary

Summing up, the outlook for the precious metals sector remains extremely bearish and based on the similarity to the 2013 decline, it seems that gold could truly plunge shortly – perhaps as early as this week. Theoretically, the decline should start this week, but the history may not repeat itself in 100%, so it’s better to be prepared right away and to also be prepared to wait for additional few days for the decline’s start. Perhaps the decline will start exactly 5.5 years after the 2013 decline – on Friday, the 12th, just like it did in April 2013. All in all, it seems that the huge profits on our short positions will soon become enormous.

As always, we’ll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short positions (250% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and exit profit-take price levels:

- Gold: profit-take exit price: $1,062; stop-loss: $1,226; initial target price for the DGLD ETN: $82.96; stop-loss for the DGLD ETN $53.67

- Silver: profit-take exit price: $12.72; stop-loss: $15.16; initial target price for the DSLV ETN: $46.97; stop-loss for the DSLV ETN $31.37

- Mining stocks (price levels for the GDX ETF): profit-take exit price: $13.12; stop-loss: $19.61; initial target price for the DUST ETF: $80.97; stop-loss for the DUST ETF $33.37

Note: the above is a specific preparation for a possible sudden price drop, it does not reflect the most likely outcome. You will find a more detailed explanation in our August 1 Alert. In case one wants to bet on junior mining stocks’ prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and target prices:

- GDXJ ETF: profit-take exit price: $17.52; stop-loss: $29.43

- JDST ETF: initial target price: $154.97 stop-loss: $64.88

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Important Details for New Subscribers

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

The bears have awakened. Dow dropped 3.6 percent. Are bears friends of gold?

Will October Stock Market Sell-Off Boost Gold?

Investors were selling stocks in panic yesterday, following breaking down below the support level of the late January local high. The S&P 500 index has retraced its three-month-long advance in one day, and it fell below the level of 2,800. Will this sell-off continue today?

Sell-off in October, Just Seasonality?

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts