Briefly: in our opinion, full (300% of the regular position size) speculative short positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

Another day, another slide, another yearly low – that’s the current theme for junior miners. Is the day of reversal coming?

I started my analysis yesterday with an overview of the relative performance of gold, silver, and mining stocks. Those comments remain up-to-date.

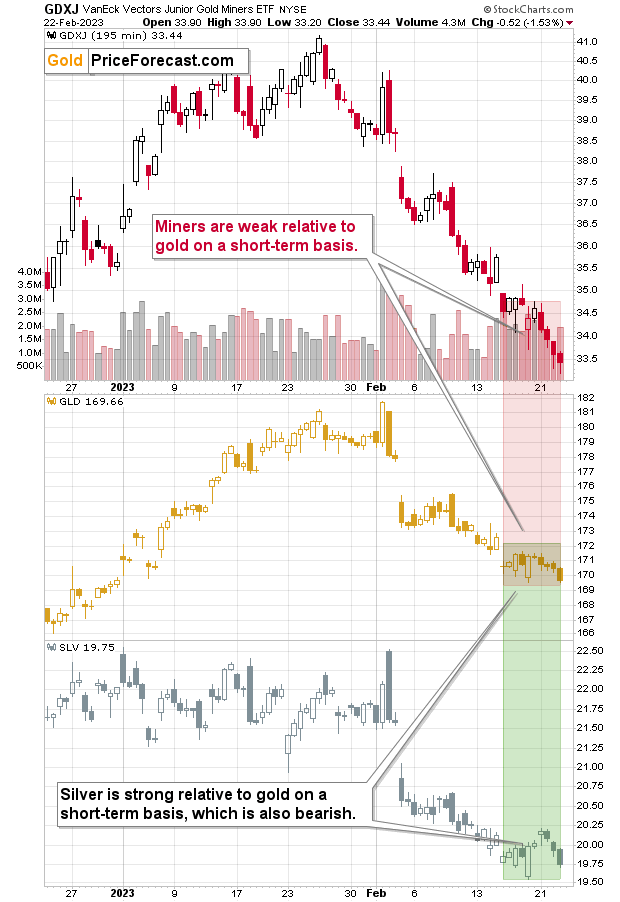

In short, while gold is moving back and forth, the GDXJ (a proxy for junior miners) is moving to new lows. In other words, junior miners clearly underperform gold.

Whenever miners refuse to decline while gold declines, it’s a bullish indication. Right now, we have the opposite of that.

Silver is now moving lower. However, it outperformed gold in a clear manner last week, so one could say that silver did flash its classic sell signal (short-term outperformance of gold).

Let’s zoom out a bit and see how these markets performed along with the USD Index in the last couple of weeks.

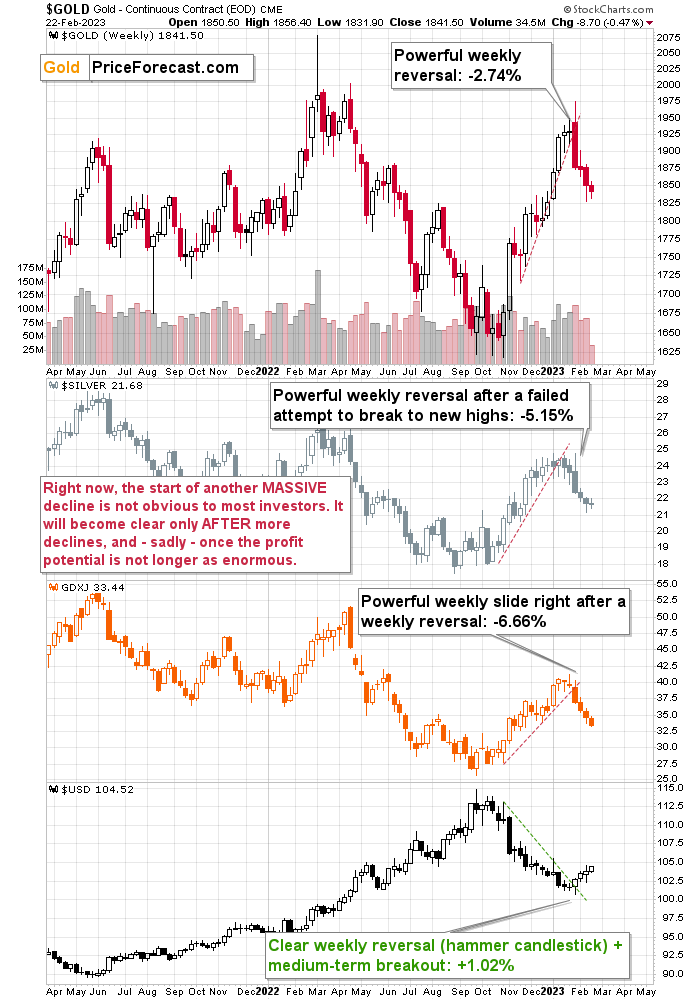

Here’s a chart that I featured on Feb. 6 (click to see how exactly that chart looked back then).

Back then, I emphasized the importance of the weekly reversals that we saw across the precious metals market and in the USD Index. I wrote the following:

In my view, the real interest rates are up and about to soar higher, the USD Index has most likely bottomed, and the precious metals have topped in a spectacular manner. The rally in gold, silver, and miners was indeed sizable, but… It’s over.

What’s next? Something exciting or something scary – depending on how positioned and informed one chooses to be.

Hopefully, what happened since that time was exciting for you and not scary (as it likely was for precious metals permabulls) – the precious metals prices tumbled while the USD Index soared.

Every week since that time (including this one that isn’t over yet) has meant lower prices for gold, silver, and mining stocks and higher values for the USDX.

However, since no market moves up or down in a straight line, there will be corrections – and it seems that the precious metals market is ripe for a corrective upswing. If not right away, then soon. In fact, the latter is more likely.

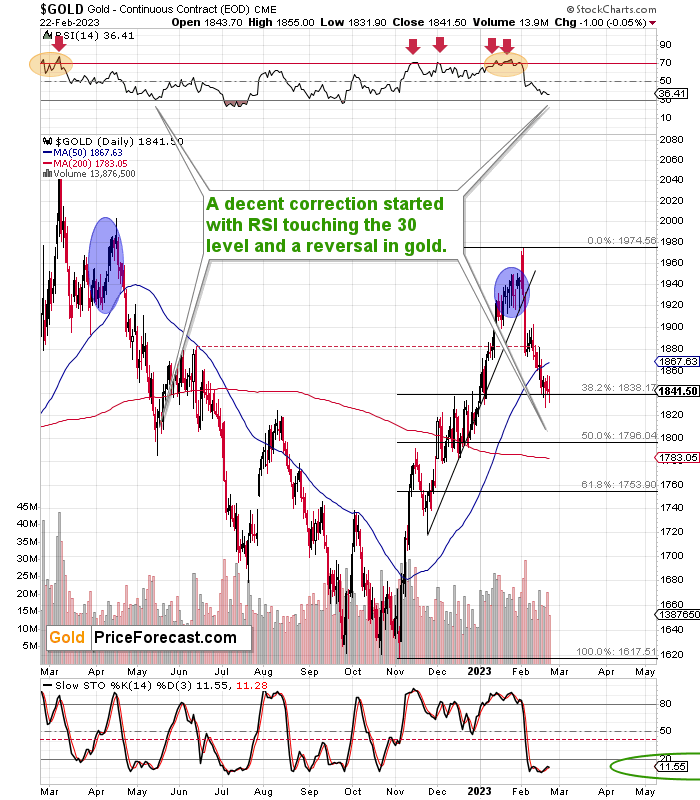

Looking at gold, we see that it’s trading back and forth close to its 38.2% Fibonacci retracement level, while the RSI indicator (upper part of the chart) is still visibly above 30.

The latter tells us that gold might need to decline some more before the reversal and a more meaningful correction take place. So, it points in the same direction as the miners’ underperformance of gold that I discussed earlier.

It’s not the RSI on its own that makes this indication so important, but rather the combination with the signal from miners and the fact that the current situation in gold is similar to what we saw in April/May 2022.

Since the price moves have been similar for weeks (the size of the short-term rally that preceded the top, the RSI’s position at the top, etc.), it’s quite likely that they will continue to be similar in the near future. Back in May 2022, gold kept on declining (with unimportant breathers along the way) until the RSI moved to the 30 level. Since it’s not there yet, gold might need to decline some more.

Of course, the above means that silver and mining stocks are likely to decline, too. In fact, miners are likely to decline more.

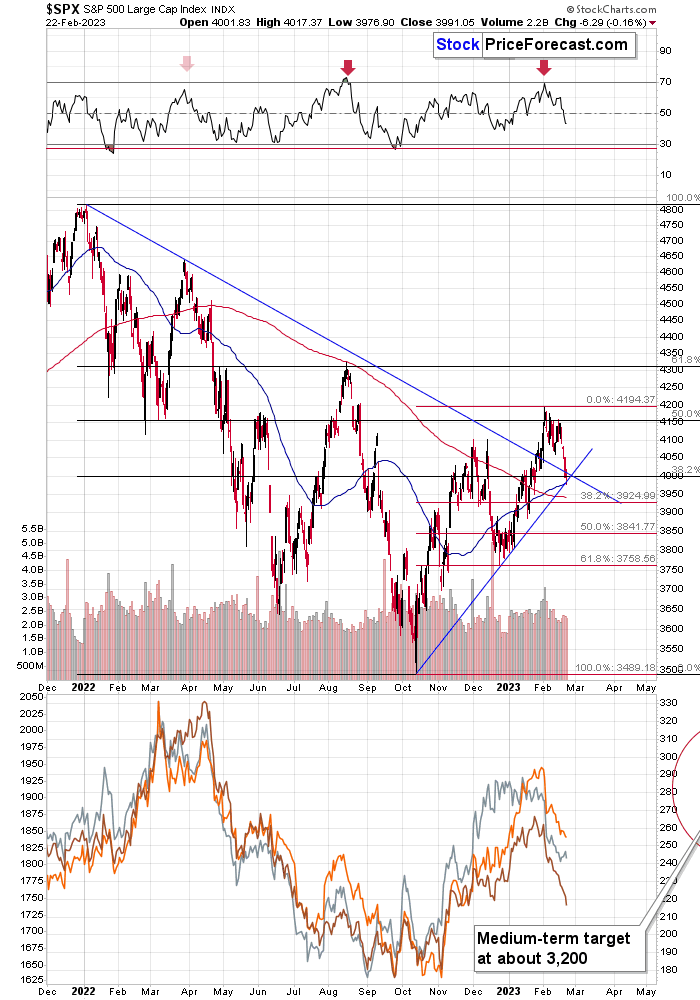

There’s also a very interesting situation in the general stock market that could impact the situation in the precious metals area – especially for junior miners.

The S&P 500 approached its medium- and short-term support lines as well as the psychologically important 4,000 level. The S&P closed slightly below the latter, but it was too near this level to view this breakdown as confirmed.

If stocks move higher right away, it could trigger a rebound in the precious metals market, as they (PMs and stocks) rallied and declined together.

On the other hand, if stocks break lower here, PMs could follow and finish their decline based on that. In other words, stocks’ decline could be the final push that gold, silver, and miners get in order to move to their short-term bottoms.

The comments that I made yesterday regarding the timing/targets for mining stocks, remain up-to-date.

But… Let’s keep in mind that it’s all just about the short term. The big picture is much, much, much more important right now, and the really big picture is as extremely bearish as it gets.

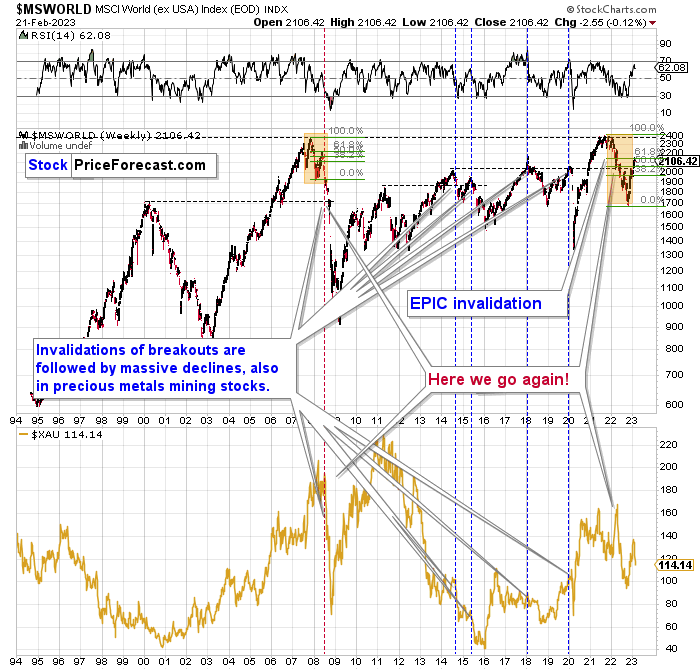

World stocks are repeating their 2008 performance with a slight difference – this time the initial decline from the similar price levels was bigger. The subsequent corrective upswing was bigger too, but these moves were proportional – in both cases (now and in 2008), stocks corrected about 61.8% of the initial decline.

And then it happened.

Carnage.

Not just in stocks but also in other assets, including gold, silver, and mining stocks. In particular, silver and gold stocks were truly hammered.

The lower part of the chart features the XAU Index, a proxy for both gold stocks and silver stocks.

First of all, this comparison of mining stocks and other stocks could appear shocking, and rightfully so.

The XAU Index is well below its… 1995 highs (yes, miners are really so weak), while world stocks are much higher.

The second shocker is how far and how fast miners declined in 2008. Starting with the final corrective upswing, the mining stocks index declined by a breathtaking 69.2%!

Less than a third of the starting value.

It took just a few months for this decline to materialize.

So far this year, the XAU Index has declined by 18.7%, counting from the yearly high to yesterday’s intraday low.

And so far this year, the GDXJ ETF has declined by 19.3%, using the same measurements.

As a result, the performance of both may be roughly comparable, or — more likely — junior miners may decline more due to their closer link to the general stock market. This means that based on the above-mentioned analogy to 2008, we can’t rule out a decline by about 70% (or more!) in the GDXJ starting at the recent short-term high ($41.16).

Shaving off 70% of that value leaves us with $12.35 as the possible downside target for the GDXJ ETF.

Impossible? It has already happened! (In the XAU, as the GDXJ wasn’t trading at that time yet).

So, yes, the outlook for the mining stocks is truly extremely bearish for the following months. However, in the very near term, it seems that we might see a corrective upswing, and this move might be worth trading. The emphasis is on “might” – I’ll send out an intraday Alert to my Gold Trading Alerts subscribers if there’s a good opportunity to adjust the trading position or simply go long.

Still, please make sure that you start with yourself, and plan ahead if this is something that you want to trade or not. Just because there is an opportunity out there doesn’t mean that it’s a good idea for everyone to participate in it. Trading this upswing might be risky, as with an environment this bearish, the risk seems to be about being out of the short position, so please take this into consideration.

Overview of the Upcoming Part of the Decline

- It seems to me that the corrective upswing is over.

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place and if we get this kind of opportunity at all – perhaps with gold prices close to $1,500 - $1,550.

- I plan to switch from the short positions in junior mining stocks or silver (whichever I’ll have at that moment) to long positions in junior mining stocks when gold / mining stocks move to their 2020 lows (approximately). While I’m probably not going to write about it at this stage yet, this is when some investors might consider getting back in with their long-term investing capital (or perhaps 1/3 or 1/2 thereof).

- I plan to return to short positions in junior mining stocks after a rebound – and the rebound could take gold from about $1,450 to about $1,550, and it could take the GDXJ from about $20 to about $24. In other words, I’m currently planning to go long when GDXJ is close to $20 (which might take place when gold is close to $1,450), and I’m planning to exit this long position and re-enter the short position once we see a corrective rally to $24 in the GDXJ (which might take place when gold is close to $1,550).

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold prices close to $1,400 and GDXJ close to $15 . This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,400, but at the moment it’s too early to say with certainty.

- The above is based on the information available today, and it might change in the following days/weeks.

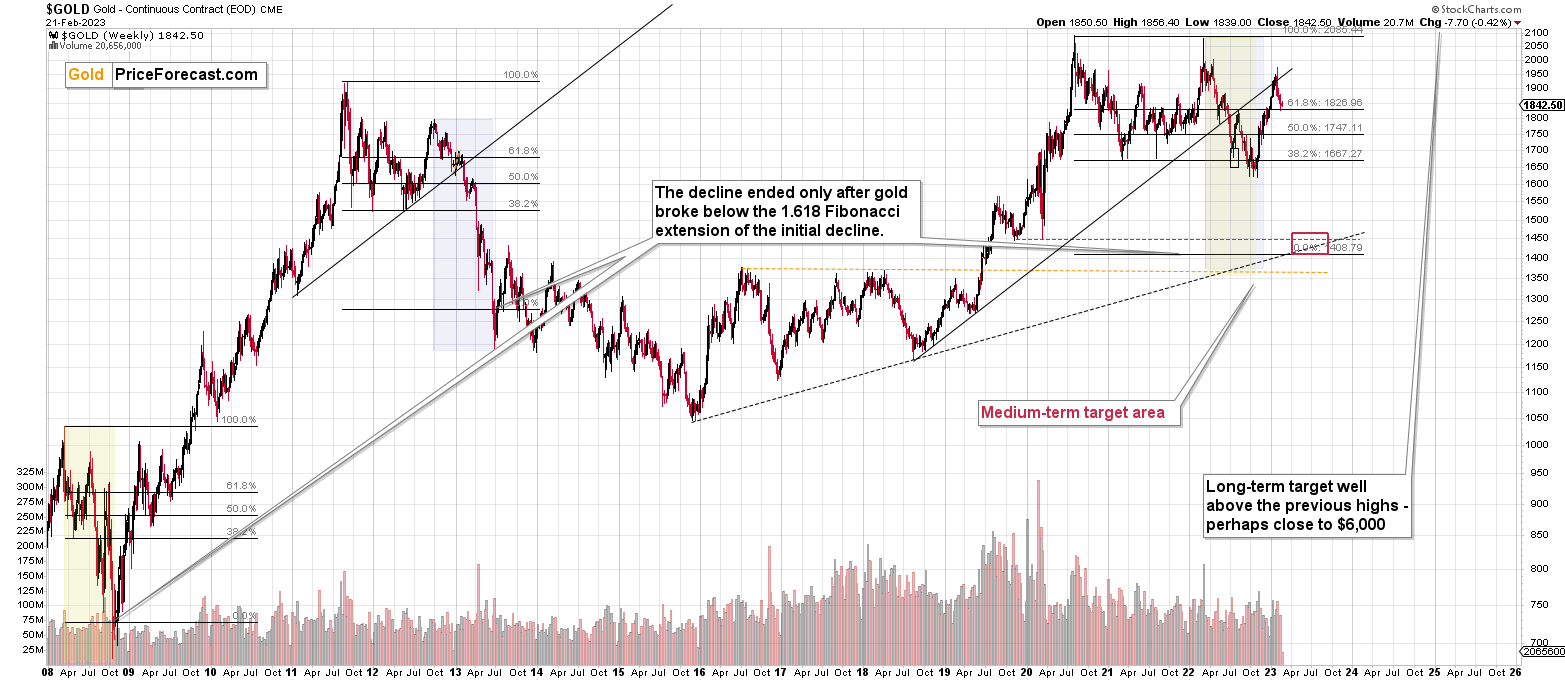

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding nor clear enough for me to think that they should be used for purchasing options, warrants, or similar instruments.

Letters to the Editor

I received a few messages in our e-mail inbox, but I will copy-paste them to the comments feed below my premium articles (as a reminder, the “Gold Trading Alert” space on Golden Meadow is reserved to subscribers – it’s not accessible publicly) along with my replies.

Please post your questions in the comments feed below the articles, if they are about issues raised within the article (or in the recent issues), and if they are about other, more universal matters, I encourage you to use the Ask the Community space (I’m also part of the community, after all), so that more people can contribute to the reply and then enjoy the answer. Of course, let’s keep the target-related discussions in the Gold Trading Alerts space.

Summary

To summarize, in my view, the real interest rates are up and about to soar higher, the USD Index most likely bottomed and is likely to soar, while the precious metals topped in a spectacular manner and are now likely to slide – either shortly or soon enough. The rally in gold, silver, and miners was indeed sizable, but… it’s over.

What’s next? Something exciting (and, in my view, very lucrative) or something scary – depending on how positioned and informed one chooses to be.

Also, please note that (paraphrasing Sun Tzu) “understanding the enemy without understanding your true self is only half of a victory.” Before applying any insights into actionable practice (and placing or adding to your trades), please make sure that the position that you’re about to enter and its size are aligned with your approach, your investment goals, and your risk tolerance.

In other words, I suggest starting with yourself, and tailoring the trade to you, not the other way around. Please consider your motivation for this trade and how it aligns with the rest of your approach and life in general.

Hint: don’t go for the easy answer like “money” or “profits,” but consider why the result of the trade is important – is this a part of your well-designed strategy and “you have it,” or is it something you “must absolutely do” – in other words, “it has you”…).

This will save you lots of stress, which is not only end in and of itself (your happiness and health are both closely linked to your stress levels), but it also helps you become a more profitable investor as less stress (or none thereof) means more objectivity and less risk of “running for the hills” right before a given trade becomes profitable (perhaps extremely so).

Given the above, gold’s invalidation of the temporary move above its very long-term resistance (the 2011 high!), and the situation in the USD Index, it seems that the next big move lower in the precious metals sector is already underway.

Now, as more investors realize that interest rates will have to rise sooner than expected, the prices of precious metals and mining stocks (as well as other stocks) are likely to fall. In my opinion, the current trading position is going to become profitable in the following weeks, and quite possibly in the following days. While I can’t promise any kind of performance, I fully expect it to become very profitable before it’s over and to prolong our 2022 winning streak.

After the final sell-off (that takes gold to about $1,350-$1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

As always, we'll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $20.32; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged). The binding profit-take level for the JDST: $22.87; stop-loss for the JDST: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures downside profit-take exit price: $14.32

SLV profit-take exit price: $13.42

ZSL profit-take exit price: $48.87

Gold futures downside profit-take exit price: $1,504

HGD.TO – alternative (Canadian) 2x inverse leveraged gold stocks ETF – the upside profit-take exit price: $16.47

HZD.TO – alternative (Canadian) 2x inverse leveraged silver ETF – the upside profit-take exit price: $36.87

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you’ve already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (as it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief