Briefly: in our opinion, full (250% of the regular size of the position) speculative short position in gold, silver, and mining stocks is justified from the risk/reward perspective at the moment of publishing this Alert.

Palladium stole the spotlight yesterday as it plunged about $100 in just a few short hours. Taking the last 48 hours into account, palladium is down by about $150. This could never happen to gold… Right? But wait, it already did happen. About 6 years ago, 48 hours was all it took for gold to decline about $200. Many investors thought that this is a one-time development and that it will never be repeated. The palladium market’s plunge just provided a clear reality check. Big, volatile moves are still on the menu and the golden platter may be full of them once again. In fact, palladium’s action has immediate and meaningful implications for the gold market.

Before moving to the link between palladium and gold, let’s take a look at what the former did exactly.

Palladium Lessons for Gold and Silver Investors

The decline is truly breathtaking. This is regardless of the fact that palladium was previously rising in a parabolic manner and that such parabolas usually end in a dramatic way. It’s been obvious that there will be a sharp drop, but palladium investors were caught by surprise anyway. That’s what the volatility during a decline usually means – people are panicking and selling.

It will probably be similar when gold breaks below $1,000 (most likely later this year). People are getting comfortable with the current $1,100 - $1,350 price range – after all, gold has been moving inside the range (with small exceptions here and there) for years now. This comfort – or boredom – will not last forever and the clear sign of strength from the USD Index confirms it. Once gold moves below the $1,000 and it’s clear that the 2015 bottom was just a local bottom and not the final one, people will likely panic.

The long-term underperformance of mining stocks, the decisive breakout in the gold to silver ratio, the running correction and strength in the USD Index and many more factors all point to this outcome, but yet, people will still be very surprised. And that’s why the final part of the decline in gold might be just as volatile as the recent moves in palladium. And yes, volatility in silver is likely to be even greater than the one in gold – that’s why the gold to silver ratio spikes close to the end of the decline.

With the currently flagship precious metal (there’s no discussing which metal has been leading the sector lately) being hit, will the rest retain its gleam? That’s unlikely and today’s pre-market decline seems to confirm it.

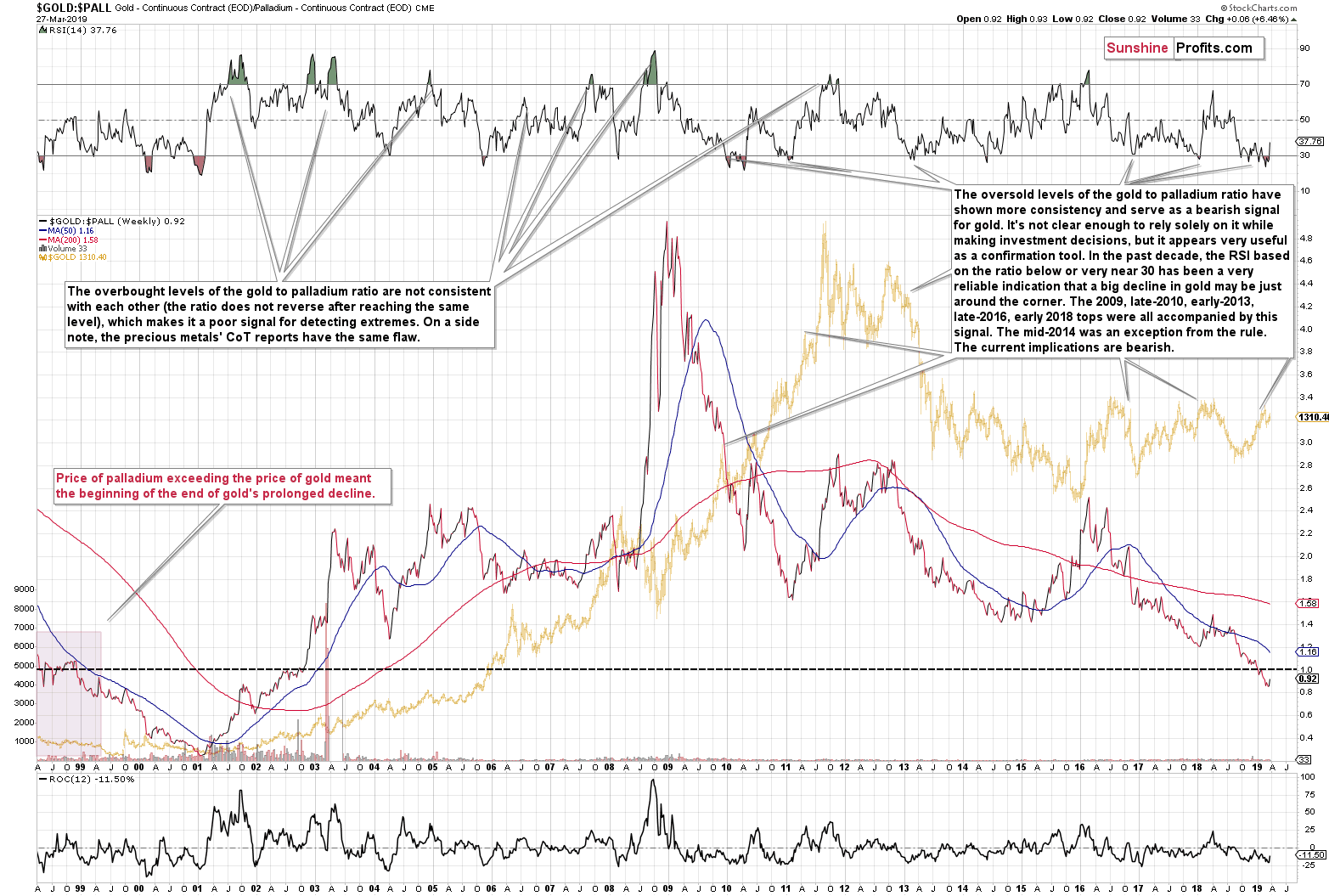

The palladium to gold ratio has also other implications.

There was just one period in the recent decades when the price of palladium exceeded the one of gold, so it’s important to keep in mind what it heralded back then. The previous moves below the critical 1.0 level in the palladium to gold ratio took place in 1998 and 1999. This was precisely when gold was beginning the final slide to its ultimate lows. Having just one analogous situation doesn’t provide a particularly meaningful implication yet, but since it’s something that confirms other signals, it’s definitely worth keeping in mind.

Moreover, palladium has been recently oversold when looking at the RSI indicator, which suggests that a downturn in gold has been – and still is – likely.

Having said that, let’s look at the most recent price changes.

Short-term Check on Gold, Silver and Miners

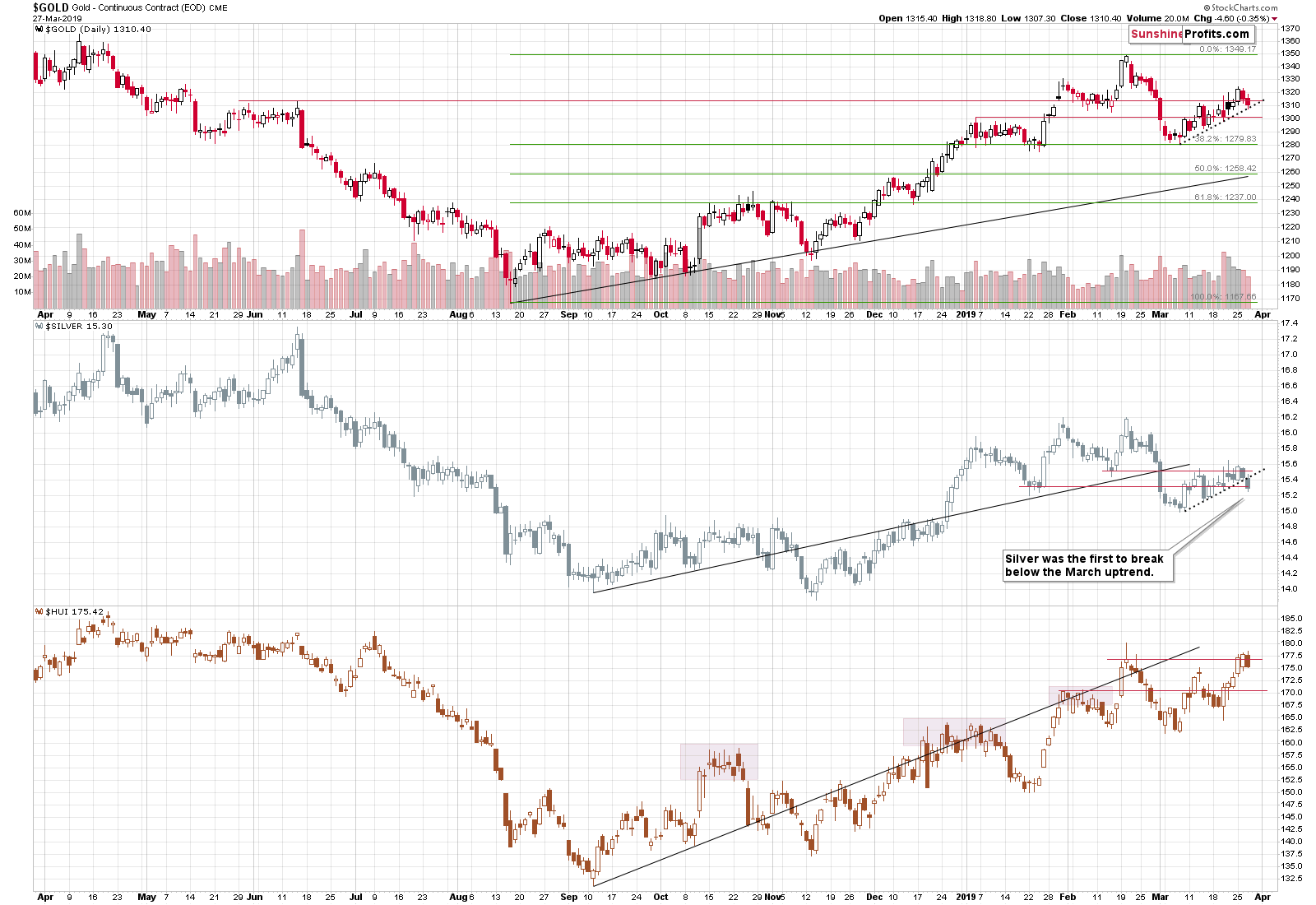

Silver was the first to break below its rising support line (the support line based on the March lows). The decline continues also today and based on the current prices (gold at $1301 and silver at $15.13), it’s clear that gold broke below its rising support line as well.

Gold miners invalidated the tiny breakout above the previous highs thus indicating that the triangle-vertex-based reversal that we discussed on Monday, worked as expected. Given today’s pre-market decline in gold and silver, it’s likely that miners’ decline will continue today as well, confirming the above.

The implications are bearish.

On an administrative note, our data center informed us that there might be some connectivity issues lasting two hours tomorrow morning (8 AM - 10 AM EST, which is 1 PM - 3 PM CET), so you may experience some delays while accessing our website. We will strive to provide you with our analysis before that time, but since it depends on the market, we cannot promise that we will manage to do so as intended. In other words, we will be posting our Alerts normally tomorrow, but our website might be slow to load or our e-mail notification might reach you with a 1-2 hour delay tomorrow. We apologize for any possible inconvenience caused.

Summary

Summing up, it’s almost certain that the next big move lower has already begun and that the 2013-like slide is in its early stage. Based on the updated version of the 2013-now link, the implications are even more bearish than we had initially assumed. Even the (already invalidated) tiny move higher in the mining stocks is in tune with what happened in late November 2012. The downside target for gold remains intact ($890), and the corrective upswing that we just saw seems to be rather natural part of the bigger move lower – not a beginning of an important move higher. And it seems that the corrective move higher in the PMs is either over or about to be over shortly.

Gold’s and miners’ very weak reaction to Fed’s surprisingly dovish remarks strongly confirms the bearish outlook for the following weeks. The outlook for the USDX is very bullish and it will almost certainly translate into lower PM prices. The analogy to 2012-2013 price moves suggests that the waiting for the PMs’ decline is practically over.

As we explained on Friday, if gold declines to $1,240, this might be an opportunity to go long, but it’s too early to say for sure at this time.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short position (250% of the full position) in gold, silver, and mining stocks is justified from the risk/reward perspective with the following stop-loss orders and exit profit-take price levels:

- Gold: profit-take exit price: $1,062; stop-loss: $1,357; initial target price for the DGLD ETN: $82.96; stop-loss for the DGLD ETN $39.87

- Silver: profit-take exit price: $12.32; stop-loss: $16.44; initial target price for the DSLV ETN: $47.67; stop-loss for the DSLV ETN $23.68

- Mining stocks (price levels for the GDX ETF): profit-take exit price: $13.12; stop-loss: $24.17; initial target price for the DUST ETF: $76.87; stop-loss for the DUST ETF $15.47

Note: the above is a specific preparation for a possible sudden price drop, it does not reflect the most likely outcome. You will find a more detailed explanation in our August 1st Alert. In case one wants to bet on junior mining stocks’ prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and target prices:

- GDXJ ETF: profit-take exit price: $17.52; stop-loss: $35.67

- JDST ETF: initial target price: $143.87 stop-loss: $30.97

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

The U.S. yield curve extended its inversion. Everyone and their brother knows that recession must definitely be on the horizon. We are all doomed, so gold can only go up now, right?

Yield Curve Inverted Even More. Is It Finally Time for Buying Gold?

Wednesday's trading session was slightly bearish, as stocks retraced some of their Tuesday's advance. The S&P 500 index was the highest since the early October a week ago. But then the market sold off. So was that sell-off a medium-term downward reversal or still just a correction?

S&P 500: More Sideways Trading Action

=====

On an administrative note, our data center informed us that there might be some connectivity issues lasting two hours tomorrow morning (8 AM - 10 AM EST, which is 1 PM - 3 PM CET), so you may experience some delays while accessing our website. We will strive to provide you with our analysis before that time, but since it depends on the market, we cannot promise that we will manage to do so as intended. In other words, we will be posting our Alerts normally tomorrow, but our website might be slow to load or our e-mail notification might reach you with a 1-2 hour delay tomorrow. We apologize for any possible inconvenience caused.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager