Briefly: in our opinion, full (250% of the regular size of the position) speculative short position in gold, silver, and mining stocks is justified from the risk/reward point of view at the moment of publishing this Alert.

In yesterday's extensive analysis we focused on gold, so in today's analysis we'll move to the second-most-popular precious metal and the favorite of many - silver. Silver is the metal of choice for many individual investors mainly due to two reasons. One reason is that the suspected ongoing manipulation of the silver market and the manipulation theories always gather significant interest. This reason may or may not be justified. Another reason is silver's enormous potential in the long run and its uncanny ability to soar almost vertically in the final parts of a given upswing. This reason is very well justified.

While gold is likely to rally substantially in the following years (not before declining significantly first, though), silver is likely to outperform it by a huge margin. Why? For the same reason it soared 40 years ago - the market is much smaller (it might be cornered), and the nominal price is lower (it's easier to imagine that the price of something at $20 doubles than the price of something at $2000, which makes the cheaper good more appealing to some investors). And for multiple other reasons as silver is now used more widely in the industry (how could it not be since it's the best conductor of electricity?) while the silver stockpiles are not as high as they used to be. To be clear, we're not saying that there is shortage of silver (or shortage of gold), but we are saying that there are more reasons for silver to rally than there are reasons for gold to rally. And when the time comes, silver is likely to respond in a meaningful way to the bullish forces. This time has yet to come, though.

What's happening in the white metal? That's what we're going to investigate in today's Alert.

Spotlight on Silver

Let's start with a chart and a quote from yesterday's analysis:

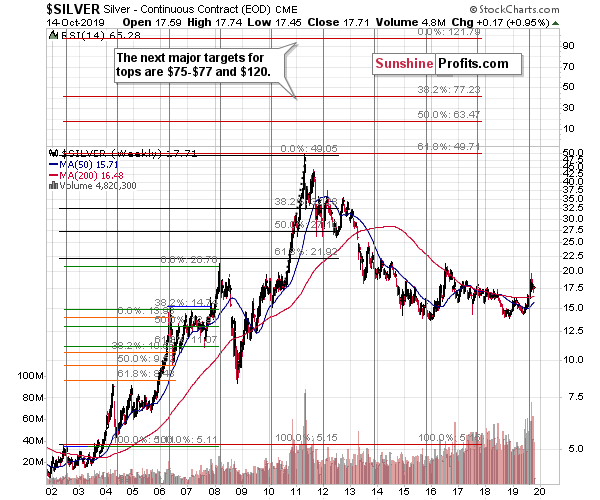

Every two years or so, silver tends to form a price extreme. Sometimes it's a major top, and sometimes it's a major bottom, but this indication is almost always correct. Please take a look at the chart above for details. The next turning point is right here, and silver is after a huge-volume rally. This is a classic combination that would indicate a major top. The most similar situation that we saw in the recent past with regard to both cyclicality and volume, was the 2008 top. Silver was after a sharp rally, and we saw a spike in silver's volume. The implications are strongly bearish for the following months.

The long-term turning point worked once again - silver reversed, and the trend is now down.

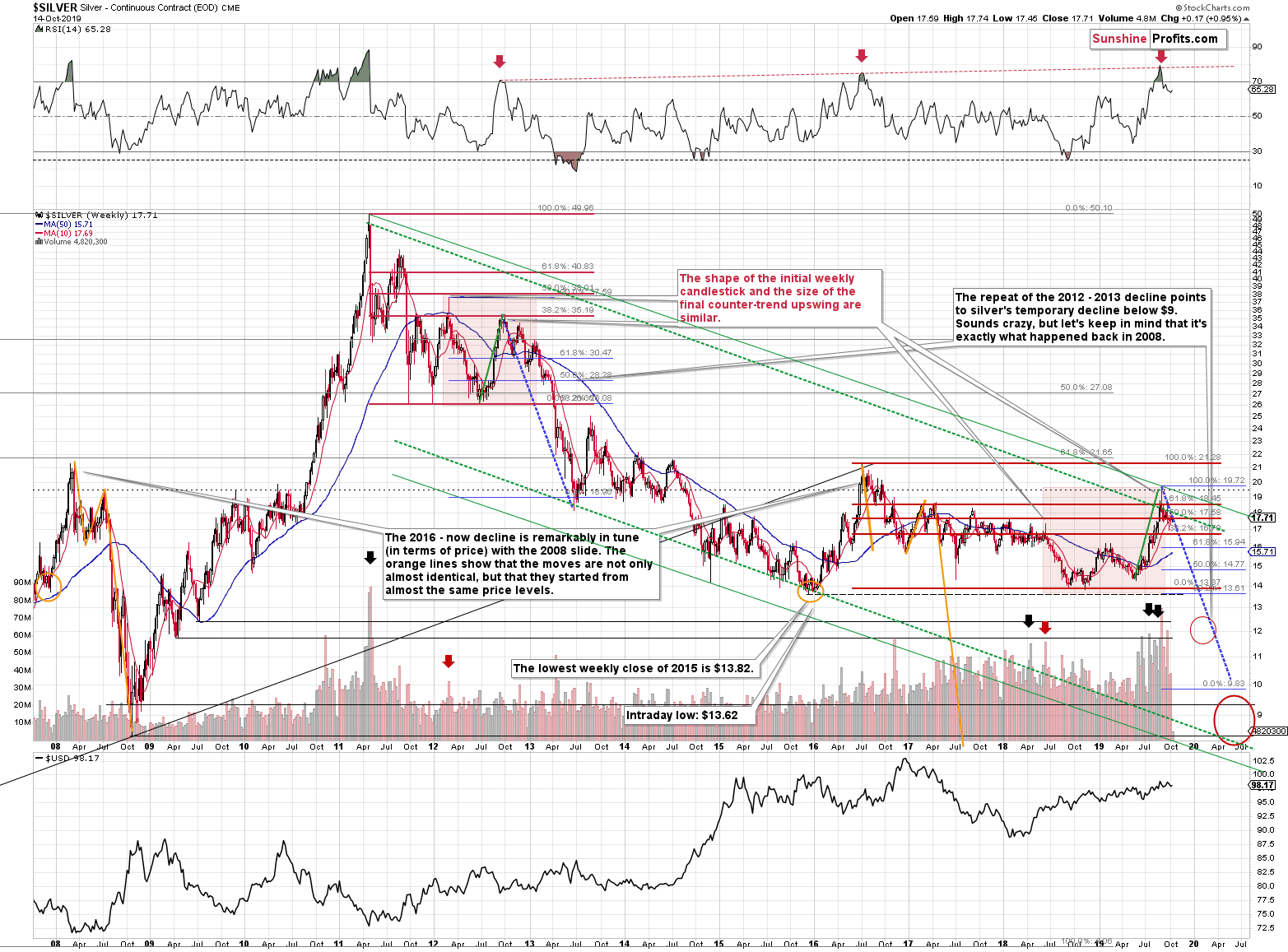

It may not be apparent based on the above chart, but the starting point of the most recent upswing is similar to something that we already saw.

It's the starting point of the most profound decline in silver that we saw in the previous decades - the 2008 slide. The horizontal dashed line proves that the price levels are indeed almost identical. How identical? Well, can you tell if the 2019 high is really above or just at the dashed line? Exactly. It's so close that it's impossible to tell without zooming in.

This level - the proximity of $20 - is more important than it appears at first sight. It served as resistance in late 2009, twice in early 2010, and silver accelerated its decline only after it broke through this barrier. This level then stopped the 2013 decline (twice) and it served as support in early 2014. Silver tried to break above this level in 2016, but it failed and invalidated the breakout shortly. Decline followed and higher prices have not been seen since that time. The final attempt to break above this level took place this year. And silver failed once again.

The take-away is clear - silver didn't end it's bear market just yet. It was forced to rally as gold rallied significantly this year, but silver's strength was only temporary, and it was not enough to take out the game-changing resistance.

By the way, do you remember yesterday's discussion of the invalidations of breakouts in gold in terms of the euro and the British pound? Please note how silver soared in 2013 and how it declined in 2016 after invalidations of a breakdown and breakout, respectively.

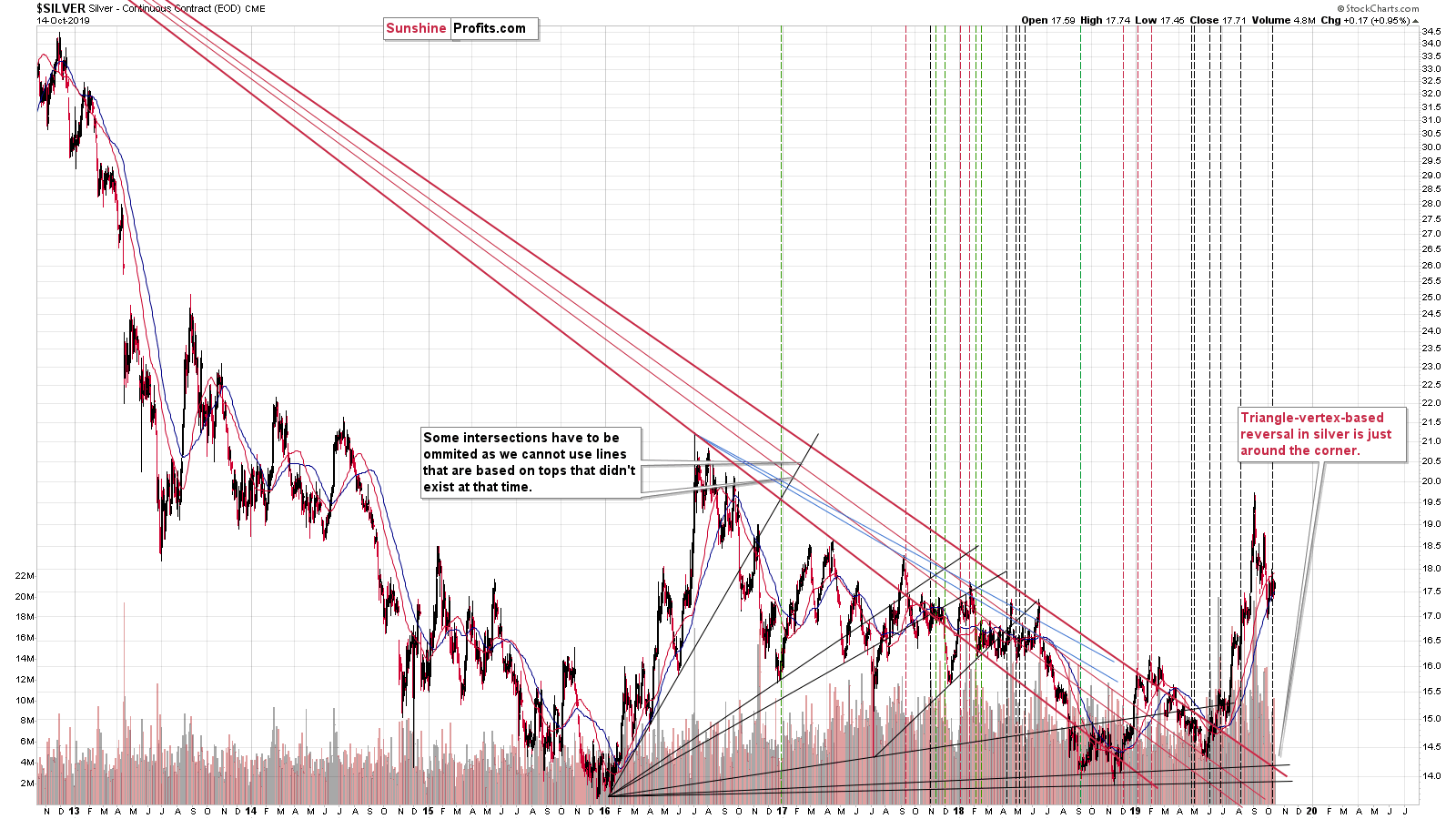

While discussing silver, it's worth mentioning it's recent triangle-vertex-based reversal.

Whenever a rising support line and a declining resistance line cross, a price extreme is often formed. Silver's recent reversal took place almost right at such a crossroad, just as we warned in advance. What does it mean going forward? It means that the odds are that the counter-trend rally in silver that we saw recently is most likely over.

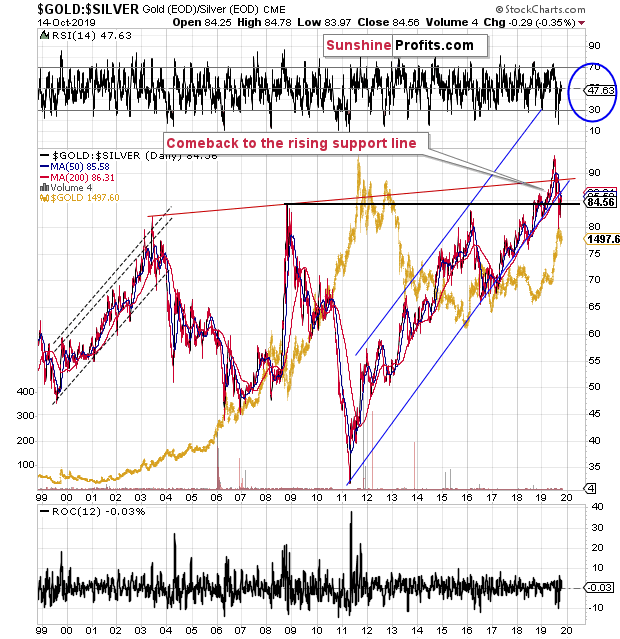

Comparing prices of gold and silver also tells us the same thing.

The gold to silver ratio declined recently, just as both gold and silver moved higher, but this decline was nothing more than a verification of the breakout above the 2008 high.

In a way, the decline in the ratio confirmed our earlier analysis. We've been emphasizing that the main trend in the ratio is up, which is yet another reason to think that the major trend in the precious metals sector remains down. Now, the fact that both metals moved higher while the ratio moved lower is a confirmation of the general tendency for the metals and ratio to move in the opposite directions.

Since the recent decline was just a verification of the breakout, higher ratio values - and lower gold and silver values - are to be expected.

The Short-Term in Precious Metals

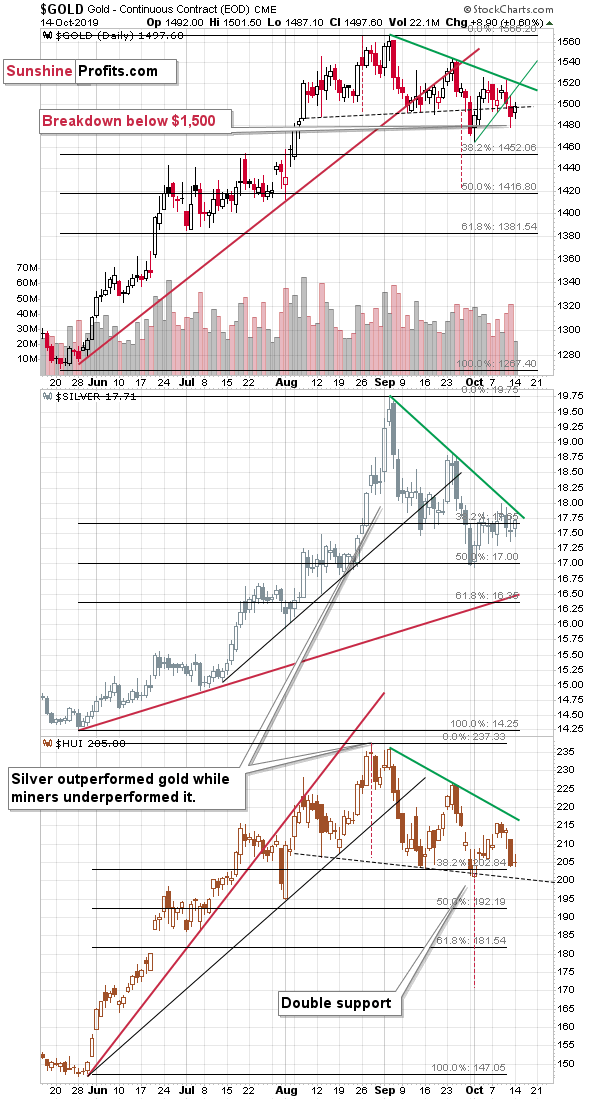

On a short-term basis, we see that yesterday's move higher in gold didn't take the yellow metal back above the $1,500 level. Conversely, the yellow metals closed the day below it. Interestingly, the daily upswing was accompanied by very low volume, which suggests that this move was just a pause within a decline. Silver reacted, but mining stocks didn't - they closed almost unchanged, which is yet another sign of their weakness. It's also another confirmation that the short-term top is already in and that lower precious metals prices are likely just around the corner.

...Last weekGold, silver, and mining stocks declined, and the way in which they Of course, that's just the tip of the signal iceberg.Let's consider what gold did in the previous cases when it topped while forming a few lower tops.This is particularly the case given gold's simultaneous decline with the USD Index. This caused a severe decline in the price of gold viewed from currencies other than the UIt isn't.The gold price in terms of the euro is showing the same thing. The breakout was invalidated. The implications are immediate and very bearish.And that's not a coincidence either.Gold Priced in GreenbackTo be clear, it is different, but not in a way that would prevent gold from declining at least $200 from the recent high.The move to which gold's top and the current decline are particularly similar are the 1996 top and the subsequent slide to the final lows. The 2014-2015 rally caused the USD Index to break above the declining very-long-term resistance line, which was verified as support three times. This is a textbook example of a breakout and we can't stress enough how important it is.The most notable verification was the final one that we saw in 2018. Since the 2018 bottom, the USD Index is moving higher and the consolidation that it's been in for about a year now is just a pause after the very initial part of the likely massive rally that's coming.If even the Fed and the U.S. President can't make the USD Index decline for long, just imagine how powerful the bulls really are here. The rally is likely to be huge and the short-term (here: several-month long) consolidation may already be over.There are two cases on the above chart when the USD Index was just starting its massive rallies: in the early 1980s and in 1995. What happened in gold at that time?These were the starting points of gold's most important declines of the past decades. The second example is much more in tune with the current situation as that's when gold was after years of prolonged consolidation. The early 1980s better compare to what happened after the 2011 top.Please note that just as what we see right now, gold initially showed some strength - in February 1996 - by rallying a bit above the previous highs. The USD Index bottomed in April 1995, so there was almost a yearly delay in gold's reaction. But in the end, the USD - gold relationship worked as expected anyway.The USD's most recent long-term bottom formed in February 2018 and gold [topped in August]. This time, it's a bit more than a year of delay, but it's unreasonable to expect just one situation to be repeated to the letter given different economic and geopolitical environments. The situations are not likely to be identical, but they are likely to be similar - and they are.What happened after the February 1995 top? Gold declined and kept on declining until reaching the final bottom. Only after this bottom was reached, a new powerful bull market started. But gold just rallied so significantly in the last several months!... And that's most likely what people were saying in early 1995, while they were buying at the top.It's easy to get carried away by momentum and emotions that it generates. We're here for you to analyze the market as objectively and with as much cold logic as possible. And the key points in gold's supposedly bullish story simply don't add up.Before summarizing, let's take a quick look at what happened in silver and mining stocks.We previously commented on the above silver chart in the following way:Every two years or so, silver tends to form a price extreme. Sometimes it's a major top, and sometimes it's a major bottom, but this indication is almost always correct. Please take a loThe long-term turning point worked once again - silver reversed and the trend i

Naturally, the key bearish factors for the medium term remain intact.

Key Factors to Keep in Mind

Critical factors:

- The USD Index broke above the very long-term resistance line and verified the breakout above it. Its huge upswing is already underway.

- The USD's long-term upswing is an extremely important and bearish factor for gold. There were only two similar cases in the past few decades, when USD Index was starting profound, long-term bull markets, and they were both accompanied by huge declines in gold and the rest of the precious metals market

- Out of these two similar cases, only one is very similar - the case when gold topped in February 1996. The similarity extends beyond gold's about a yearly delay in reaction to the USD's rally. Also the shape of gold price moves prior to the 1996 high and what we saw in the last couple of years is very similar, which confirm the analysis of the gold-USD link and the above-mentioned implications of USD Index's long-term breakout.

- The similarity between now and 1996 extends to silver and mining stocks - in other words, it goes beyond USD, gold-USD link, and gold itself. The white metal and its miners appear to be in a similar position as well, and the implications are particularly bearish for the miners. After their 1996 top, they erased more than 2/3rds of their prices.

- Many investors got excited by the gold-is-soaring theme in the last few months, but looking beyond the short-term moves, reveals that most of the precious metals sector didn't show substantial strength that would be really visible from the long-term perspective. Gold doesn't appear to be starting a new bull market here, but rather to be an exception from the rule.

- Gold's True Seasonality around the US Labor Day points to a big decline shortly.

Very important, but not as critical factors:

- Long-term technical signs for silver, i.a. the analogy in terms of price to what we saw in 2008, shows that silver could slide even below $10.

- Silver's very long-term cycles point to a major reversal taking place right now and since the most recent move was up, the implications are bearish (this is also silver's technical sign, but it's so important that it deserves its own point)

- Long-term technical signs for gold stocks point to this not being a new gold bull market beginning. Among others, it's their long-term underperformance relative to gold that hint this is rather a corrective upswing within a bear market that is not over yet.

- Record-breaking weekly volume in gold is a strong sign pointing to lower gold prices

Important factors:

- Extreme volume reading in the SIL ETF (proxy for silver stocks) is an effective indication that lower values of silver miners are to be expected

- Silver's short-term outperformance of gold, and gold stocks' short-term underperformance of gold both confirm that the precious metals sector is topping here

- Gold topped almost right at its cyclical turning point, which makes the trend reversal more likely

- Copper broke below its head-and-shoulders pattern and confirmed the breakdown. The last time we saw something similar was in April 2013, when the entire precious metals sector was on the verge of plunging lower.

Moreover, please note that while there may be a recession threat, it doesn't mean that gold has to rally immediately. Both: recession and gold's multi-year rally could be many months away - comparing what happened to bond yields in the 90s confirms that.

Copper moved above the neck level of its head-and-shoulders pattern that's based on the intraday lows, but it didn't invalidate the analogous level based on the weekly closing prices, so we don't think it's justified to say that this bearish formation was invalidated at this time.

Summary

Summing up, it seems that the corrective upswing in gold is over or almost over and that the big decline in gold is already underway (and that it had started in August as we had written previously). The invalidation of breakouts above the 2011 high in case of gold priced in the euro and the British pound confirm how bearish the outlook really is for the following months. Gold is likely starting to decline hundreds of dollars. If it rallies a few or even $20 dollars right now, it doesn't matter much given the above. The profits from the short position in gold, silver and mining stocks are likely to be legendary, but the difficult part is not to miss the decline. That's why we were so quick to get back to the short position in Friday. It was much better to do so than to risk missing out of this epic move.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short position (250% of the full position) in gold, silver, and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and exit profit-take price levels:

- Gold: profit-take exit price: $1,391; stop-loss: $1,573; initial target price for the DGLD ETN: $36.37; stop-loss for the DGLD ETN: $25.44

- Silver: profit-take exit price: $16.41; stop-loss: $19.06; initial target price for the DSLV ETN: $20.96; stop-loss for the DSLV ETN: $14.07

- Mining stocks (price levels for the GDX ETF): profit-take exit price: $24.62; stop-loss: $30.11; initial target price for the DUST ETF: $10.32; stop-loss for the DUST ETF $6.08

In case one wants to bet on junior mining stocks' prices, here are the stop-loss details and target prices:

- GDXJ ETF: profit-take exit price: $33.82; stop-loss: $41.22

- JDST ETF: profit-take exit price: $21.58 stop-loss: $12.46

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one, it's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (DGLD for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn't, then we will view both positions (in gold and DGLD) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Yesterday, the Nobel prizes in economics were awarded. Unfortunately, gold has been omitted and got nothing. How unfair! But looking at the Dutch central bank press release, gold would have much higher chances if they were the ones granting the prizes and not the Swedish central bank!

Gold, the Ultimate Safe Haven Asset. A Looming Nobel Prize?

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager