Briefly: in our opinion, full (300% of the regular position size) speculative short positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

No U-turn.

“Nah, he’s bluffing” – investors were initially overwhelmed by the irresistible urge to ignore the obvious.

It’s been many weeks – months in some cases – since the Fed started not only talking about hawkish action, but actually taking it. Each time, investors assumed that it was all just smoke and mirrors. And who can blame them? Over the years, they learned to expect more money, more stimulus, and overall more dovish action, regardless of what happened temporarily.

“Yeah, right!” – investors scoffed.

“We can afford higher hikes, there’s too much debt, the interest payments will be too high, and nobody can afford a mass default.” – they argued in the first hours after Jay spoke.

No U-turn. – The thought echoed again, but nobody paid any attention.

Everyone saw that the Fed decreased the pace at which the rates were increased. It used to be 0.75% per hike previously, and now it’s just 0.5% - isn’t it a sign of the Fed getting dovish?

The markets even confirmed the above narrative. The USD Index declined, while the S&P 500 moved higher – at least initially.

As the closing bell rang, investors still felt confident in their dovish narrative, but deep underneath, they knew that something major had just changed.

The doubts began with “Could it actually be the case that he means, what we says?”, they progressed to “Wait a minute, if the rates are to be higher throughout 2023, there really can’t be no dovish U-turn anytime soon – there’s no room for it…” and concluded “Cutting the rates only after the inflation stabilizes at 2%? We’re nowhere close, it’s a long way up for the interest rates!”.

Investors went to sleep somewhat confused. Some – the most leveraged ones - actually had trouble falling asleep.

When they woke up, they woke up to a new reality.

The USD Index is up.

The S&P 500 futures are down.

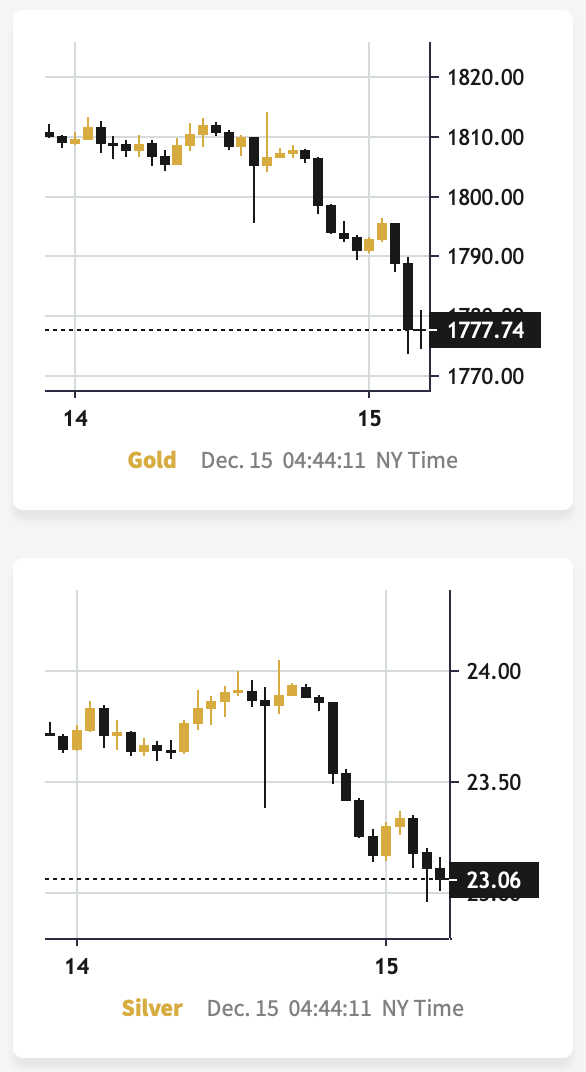

And gold… (chart courtesy by GoldPriceForecast.com).

Gold declined sharply below $1,800, while silver moved below $23 in less than 24 hours after trying to move above $24.

“OMG! It’s happening!” – investors felt as if they woke up not just after a night’s sleep, but after a yearly coma.

The U.S. markets were not open yet, but a quick glance at the GDXJ’s (proxy for junior mining stocks) prices in London trading revealed that the technical indications from the previous days didn’t lie. Juniors were down by more than 4%.

Then reality hit like Chuck Norris’ roundhouse kick.

“There will be no dovish U-turn anytime soon!”

“Wait a minute…” - neuronal connections speed up – “If the Fed is really hiking rates, and they are about to keep it up for the next year AND everyone was actually wrong to expect a U-turn, then…”

As the next thought emerged, some of the investors sharing it could feel the initial signs of characteristic cold sweat.

“Then the markets are really going to tumble big time.”

Suddenly, all previous reasoning for the U-turn started to look differently.

“Yeah, the pace of rate hikes might have decreased, but the Fed is still hiking! The business conditions are getting tighter, and there’s no end in sight. There’s nothing dovish or bullish about that!”

Does the extreme level of debt matter? “Well, why can’t the politicians just continue to raise the debt ceiling, just like they’ve done previously? They can, and they will, because that will be the easiest thing to do, and nobody wants to take the blame for triggering the crisis in the country.”

And the interest payments… If things get really bad, they can always tax the rich, tax the imports, or come up with money in all sorts of ways. Sure, many people won’t like it, but many more people don’t like inflation even more. That’s what remains the voters’ top concern, so that’s what will be fought – it’s as simple as that.

Besides, maybe the above would provide The Powers That Be with a great opportunity to move to a gov’t crypto currency? You know, when things in the current economic system get bad enough, people will probably meet major changes (like a move to gov’t crypto) with a feeling of relief instead of meeting the decision with torches and pitchforks.

Some investors’ thoughts raced through the above-mentioned points immediately, and some needed more time.

After each realization, sell orders followed for many assets, including commodities, stocks and gold. As more people woke up to the new reality, the flood of selling pressure intensified. And the pace at which they declined increased…

= = = = =

Some of the above have already happened. Some might have happened. And some might be waiting just around the corner.

How much of the above is fiction, and how much is reality? I’ll leave the decision up to you.

It will be very interesting to see how the story unfolds and probably extremely profitable for those, who are positioned accordingly before the price moves really pick up.

You have been warned.

Having said that, let’s take a look at the markets from a more fundamental angle.

The Gold Price Should Go Down With the Dip Buyers’ Ship

While risk assets slumped on Dec. 14 after the FOMC statement was released at 2 p.m. ET, the dip buyers helped push gold, the S&P 500 and the GDXJ ETF off their intraday lows. However, with Fed Chairman Jerome Powell reiterating his hawkish commitment, the crowd materially underestimates the challenges that lie ahead.

The FOMC statement read:

“The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 4-1/4 to 4-1/2 percent. The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.”

Thus, while the crowd has been predicting a dovish pivot for months, the FOMC noted that the U.S. federal funds rate (FFR) will seek higher ground in 2023. Therefore, while the crowd is still buying hope and selling reality, higher interest rates are profoundly bearish for risk assets.

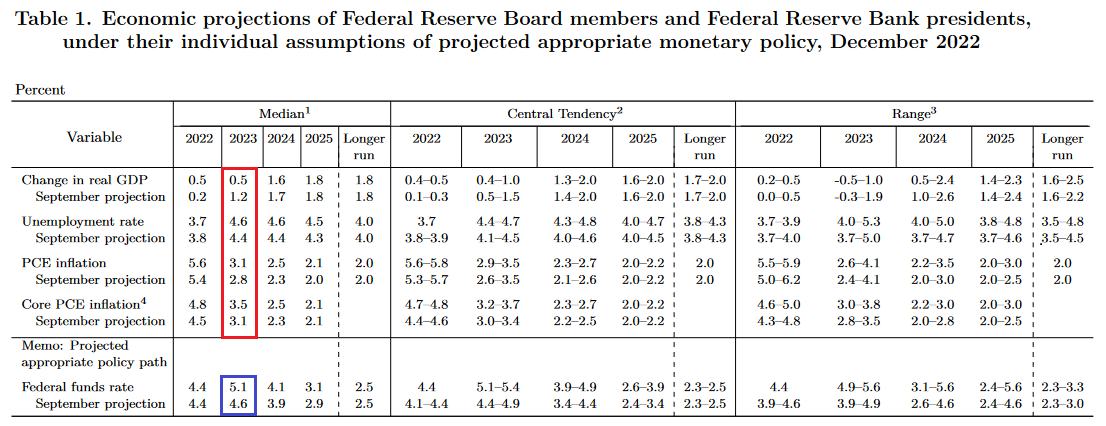

In addition, the Fed also released its December Summary of Economic Projections (SEP); and while we warned throughout 2021 and 2022 that the Fed was misjudging inflation, hawkish realities were abound.

Please see below:

To explain, the red rectangle above shows that the FOMC increased its median 2023 PCE Index and unemployment rate expectations from September, and reduced its real GDP growth estimate. As a result, the economic outlook continues to deteriorate, and the medium-term implications are highly bearish.

More importantly, the blue box above shows that the FOMC increased its median 2023 FFR estimate from 4.6% in September to 5.1% in December; and while the gold price behaves as if QE is on the horizon, the fundamentals couldn’t be more different.

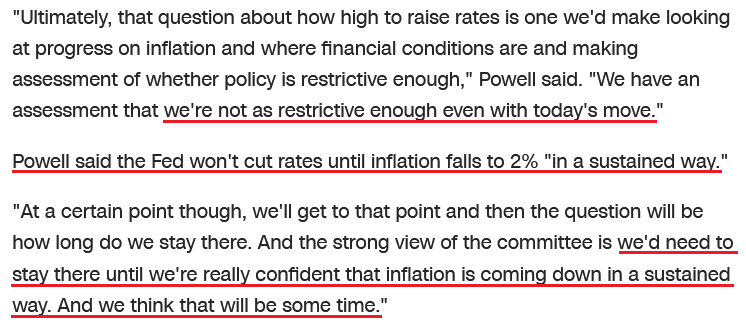

To that point, Powell said during his press conference:

“I would say it’s our judgment today that we’re not in a sufficiently restrictive policy stance yet, which is why we say that we would expect that ongoing hikes will be appropriate.”

He added:

“There’s an expectation really that the services inflation will not move down so quickly so that we’ll have to stay at it. We may have to raise rates higher to get to where we want to go and that’s really why we’re writing down those high rates and why we’re expecting that they will have to remain high for a time.”

So, while the pivot predictors remain hopeful for a dovish 180, the fundamentals never did, and still don’t, support lower interest rates anytime soon.

Please see below:

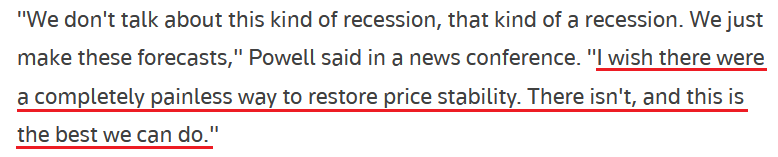

On top of that, we’ve warned repeatedly that bear markets don’t end when the unemployment rate is near a 50-year low; and with the crowd underestimating the demand destruction required to reduce inflation, their expectations are in la-la land. We wrote on Dec. 13:

The crowd's misunderstanding of inflation has them assuming the pricing pressures will ease with little economic damage. But, history contrasts this sentiment, and one can argue that the pandemic-induced imbalances make this bout even worse. As such, pain should confront the believers when reality returns.

Likewise, with Powell reiterating that point on Dec. 14, he understands these historical realities, even if he attempts to keep Americans’ spirits uplifted.

Please see below:

Therefore, while the pivot bulls are desperate for a return to pre-pandemic monetary policy, the realities confronting the financial markets in 2023 are much different. Yet, despite their several swings and misses in 2022, the narrative continues to percolate.

Please see below:

Moreover, while the ZeroHedge crew assumed the Fed was “done” at 3% and 4%, all of a sudden, now it’s 5%., even though the fundamentals still don’t support that sentiment.

For example, we warned that the FFR has eclipsed the peak year-over-year (YoY) core CPI in every inflation fight since 1961; and since the YoY core CPI peaked (for now) at 6.66% in September 2022, the historically-implied peak FFR is at least 6.67%.

Second, the Atlanta Fed’s Wage Growth Tracker re-accelerated in November, and so did average hourly earnings. Also, the Atlanta Fed’s Sticky Consumer Price Indexes (CPIs) hit new 2022 highs in November, and households’ checkable deposits hit a record high in Q3.

Consequently, the fundamental backdrop is not conducive to 2% inflation anytime soon, and data-driven investors like Hedgeye understand that sentiment does not match reality.

Please see below:

Third, we warned on numerous occasions that looser financial conditions are bullish for future inflation. To explain, we wrote on Dec. 14:

When a hawkish Fed creates recession anxiety, asset prices fall, which helps reduce inflation. In contrast, when a dovish Fed (or the perception of one) reduces recession anxiety, asset prices rally, which spurs more inflation. That’s why we wrote investors’ hopes for a dovish pivot actually reduce the chances of one occurring.

To that point, with the dip buyers not getting the memo, financial conditions have decoupled from the FFR and made the Fed’s inflation fight even more difficult.

Please see below:

To explain, the dark red line above tracks the FFR, while the green line above tracks Goldman Sachs U.S. Financial Conditions Index (FCI). For context, both scales are inverted, and falling lines represent a higher FFR and tighter financial conditions.

If you analyze the relationship, you can see that a higher FFR resulted in tighter financial conditions, which meant financial markets aided the Fed in its inflation fight.

In contrast, the green line's rise on the right side of the chart demonstrates how higher stock prices, lower interest rates, a weaker U.S. dollar and smaller credit spreads support inflation and make the Fed's job harder. Again, that's why investors' hopes for a dovish pivot actually reduce the chances of one occurring.

So, the more the markets dissent, the more inflation will reign, and the higher the Fed will need to push the FFR. As a result, don't be surprised if economic reality haunts the pivot bulls in the months ahead.

Overall, the dip buyers are determined to orchestrate a Santa Clause rally, and bullish seasonality aids their case. However, the setup is nearly identical to the summertime, where misguided narratives pushed gold, silver, mining stocks and the S&P 500 higher before they eventually sunk to new 2022 lows. Therefore, we view this bear market rally as no different.

Silver Slides Alongside Pivot Optimism

While we’ve warned repeatedly that inflationary realities do not support a dovish pivot, Powell was highly hawkish on Dec. 14. Yet, with unanchored inflation slowly eating away at the U.S. economy, the prospect of higher unemployment and a deep recession have the monetary gamblers looking for a way out of their current predicament.

Consequently, the new narrative proclaims that if a dovish Fed raises the inflation target, everyone will live happily ever after. For context, ZeroHedge has been leading the charge for some time.

Please see below:

Similarly, with hedge fund manager Bill Ackman – who is often of sound mind when it comes to investment logic – joining the fray, the difference between 2% and 3% inflation now means the difference between a painful recession and prosperity.

Please see below:

However, one of the biggest bubbles in the financial markets is investors’ belief that the Fed can decide whether the U.S. economy prospers or suffers. Remember, every Fed committee in history could have increased the inflation target to avoid a painful recession, but it didn’t work.

For one, once you get to 3% inflation, reducing the metric by another 1% is largely immaterial. Second, the destructive nature of inflation is highly underestimated, and the 1970s showed that turning dovish to support the economy ended in ruin, as all it did was spur more inflation, and eventually capsize the U.S. labor market.

As a result, while the narrative proclaims that the Fed can choose its desired level of pain, the reality is that the seeds have already been sowed. Furthermore, if the Fed could solve all of the financial markets’ problems by raising the inflation target to 3%, then why not choose 4%, 5% or 6%? As it stands, the Fed could have raised the inflation target to 9% and never raised rates once in 2022.

But, that gambit only works in theory, and the long-term consequences of unchecked inflation will only bring forth the painful recession that investors believe this Fed has the power to avoid. For example, the Fed’s autopsy of the 1965 to 1982 period titled “The Great Inflation” noted:

“In 1964, when this story began, inflation was 1 percent and unemployment was 5 percent. Ten years later, inflation would be over 12 percent and unemployment was above 7 percent. By the summer of 1980, inflation was near 14.5 percent, and unemployment was over 7.5 percent.”

Please see below:

Likewise, Paul Volcker’s realization that “over time inflation and the unemployment rate go together” is spot on, and if the crowd assumes that letting inflation faster will create a positive outcome, they’re highly uninformed about the historical relationship.

Thus, the important point is that it’s egotistical to assume that this Fed can accomplish something that almost no other committee has accomplished before; and since nine of the last 10 iterations of rising inflation ended with a recession (since 1948), it’s laughable to think that Powell and this generation of investors know how to magically solve inflation when generations before them couldn’t. Do you really think they’re that smart?

In reality, the crowd misjudges the fundamental path ahead, and the S&P 500 could send the silver price into a nosedive.

Overall, while many new narratives will swirl between now and the end of 2023, the harsh truth is that labeling something as satisfactory does not change its fundamental implications. For example, you can label 5% inflation as appropriate, but it doesn’t change the burden it puts on consumers and the uncertainty it puts on businesses. As such, high inflation has historically been bad for economic growth and the financial markets, and sentiment won’t change that.

So, while that same sentiment keeps the silver price uplifted in the short term, the fundamentals remain highly ominous.

Dollar Drama

With the USD Index pumping and dumping after the FOMC statement was released on Dec. 14, it may create confusion around why the fundamental bid disappeared. Well, with the dollar basket responding negatively to the S&P 500’s intraday uprising, risk-on sentiment proved problematic for the greenback.

Please see below:

To explain, the red line above tracks the one-minute movement of the S&P 500, while the green line above tracks the one-minute movement of the inverted (down means up) USD Index. If you analyze the left side of the chart, you can see that the S&P 500’s slide at 2 p.m. ET (the gray line is five minutes early) coincided with a sharp rise in the USD Index.

However, when the dip buyers pushed the S&P 500 higher in the late afternoon, the dollar basket slumped. But, please remember that these moves were largely driven by sentiment, and the greenback’s medium-term fundamental outlook is bright. As such, we expect new highs in 2023.

The Bottom Line

Powell was profoundly hawkish on Dec. 14, and we’ve been warning for months that the fundamental data support this response. Moreover, with problematic inflation poised to push the FFR higher than the consensus expects, a reality check should emerge in the coming months. So, while the bulls don’t care right now, they exhibited the same behavior in the summer, and their misguided optimism culminated with substantial drawdowns.

In conclusion, the PMs were mixed on Dec. 14, as silver ended the day in the green. In addition, the USD Index declined and the U.S. 10-Year real yield rose. Furthermore, while seasonality keeps spirits high in the interim, Powell is not the ally investors think he is, and they should learn this the hard way over the medium term.

Overview of the Upcoming Part of the Decline

- It seems to me that the corrective upswing is over (or about to be over) and that the next big move lower is already underway (or that it’s about to start).

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place and if we get this kind of opportunity at all – perhaps with gold prices close to $1,500 - $1,550.

- I plan to switch from the short positions in junior mining stocks or silver (whichever I’ll have at that moment) to long positions in junior mining stocks when gold / mining stocks move to their 2020 lows (approximately). While I’m probably not going to write about it at this stage yet, this is when some investors might consider getting back in with their long-term investing capital (or perhaps 1/3 or 1/2 thereof).

- I plan to return to short positions in junior mining stocks after a rebound – and the rebound could take gold from about $1,450 to about $1,550, and it could take the GDXJ from about $20 to about $24. In other words, I’m currently planning to go long when GDXJ is close to $20 (which might take place when gold is close to $1,450), and I’m planning to exit this long position and re-enter the short position once we see a corrective rally to $24 in the GDXJ (which might take place when gold is close to $1,550).

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold prices close to $1,400 and GDXJ close to $15 . This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,400, but at the moment it’s too early to say with certainty.

- The above is based on the information available today, and it might change in the following days/weeks.

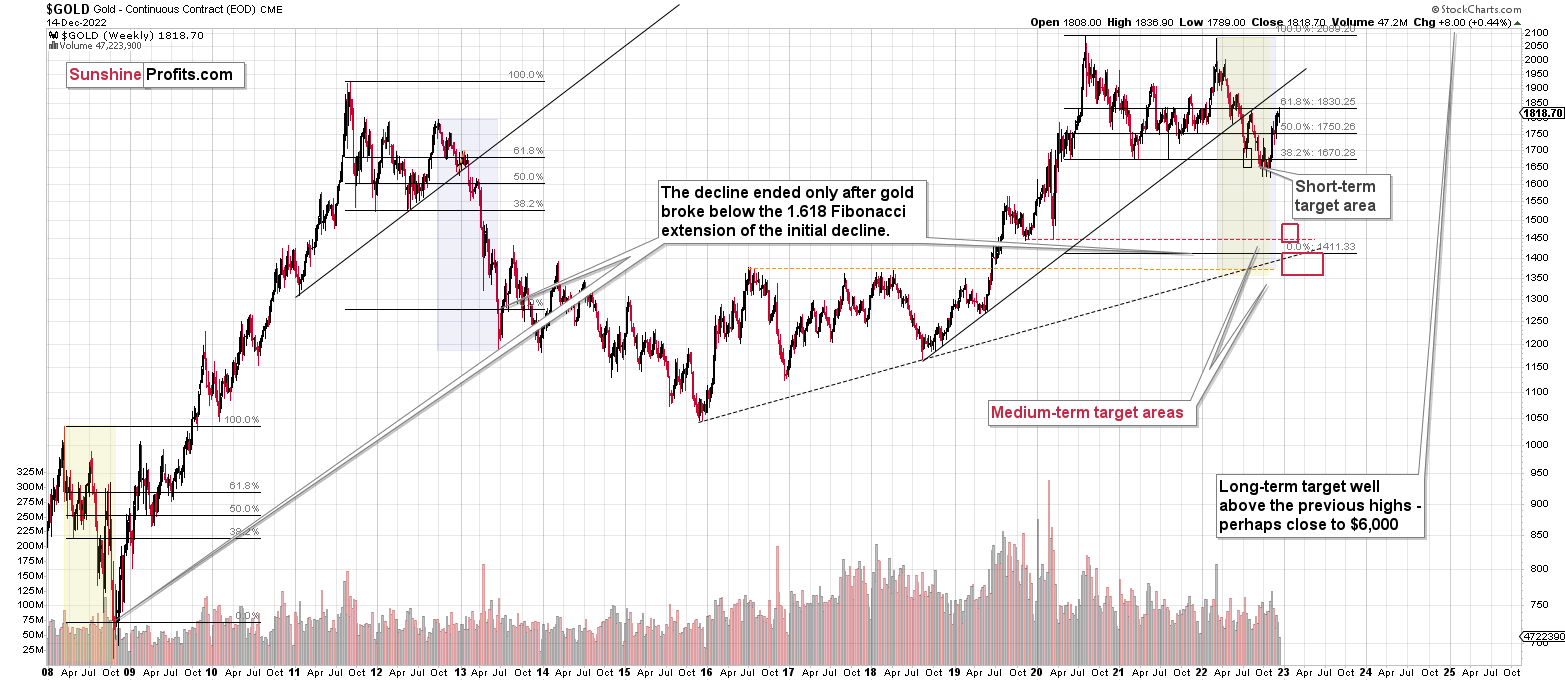

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding nor clear enough for me to think that they should be used for purchasing options, warrants, or similar instruments.

Letters to the Editor

There are no new letters for today, but I wanted to keep the below reminder in place, just to make sure that everyone had the chance to see it:

Please note that this section is going to go away within the next 1-8 weeks, as you can add comments/questions below the article on Golden Meadow – the platform that we’re using to provide our analyses. Your notification e-mails include an invitation link that allows you to access the “Gold Trading Alerts” space.

The first premium analysis had over 30 comments below it, and once I finish writing this article, I’ll head over to the comments section and catch up on yesterday’s comments.

Also, if you haven’t had the chance to see the video, in which I’m talking about the new platform and why we essentially moved from Sunshine Profits to Golden Meadow, I strongly encourage you to do so:

Summary

Summing up, it seems that the major bottom in the USD Index is in, while the correction in stocks, gold, silver, and mining stocks is over.

The nature of the recent corrections was mostly technical. No market moves up or down in a straight line, and seeing market corrections is rather normal. The excuse that markets used to correct this time was an incorrect (in my view) expectation that the Fed is going to make a dovish U-turn. The fact that even the positive employment numbers were ignored as a bearish indication of further rate hikes shows the extent of the recent/current irrationality.

However, as the irrationality ends, the medium-term trend is likely to be resumed. And this trend is down in case of the junior mining stocks. The latter are likely to decline profoundly based on declines in both: gold and the stock market.

In my opinion, the current trading position is going to become profitable in the following weeks, and quite possibly in the following days. And while I can’t promise any kind of performance, I fully expect it to become very profitable before it’s over and to prolong our 2022 winning streak.

After the final sell-off (that takes gold to about $1,350-$1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

Also, as a reminder, I will be doing a live webinar today – on Dec. 15 on 10 AM EST (4 PM CET) – it’s a live event for subscribers only and it’s available without an additional payment. You have likely received an invitation message already, but if not, you can find more information here.

As always, we'll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $20.32; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged). The binding profit-take level for the JDST: $27.87; stop-loss for the JDST: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures downside profit-take exit price: $12.32

SLV profit-take exit price: $11.32

ZSL profit-take exit price: $74.87

Gold futures downside profit-take exit price: $1,504

HGD.TO – alternative (Canadian) 2x inverse leveraged gold stocks ETF – the upside profit-take exit price: $18.47

HZD.TO – alternative (Canadian) 2x inverse leveraged silver ETF – the upside profit-take exit price: $46.87

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you’ve already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (as it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief