Briefly: in our opinion, full (250% of the regular size of the position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this Alert.

There is an undeniable link between gold and silver. One move in a given direction, and the other will follow. One breaks above a certain price level, the other would be likely to follow as well. But over time, their prices deviate from each other and in the past decade the gold to silver ratio moved from below 35 to over 80. Fortunately, when analyzed from the proper angle, these moves in the ratio become useful signals that reveal what is likely waiting just around the corner. And careful consideration of the surrounding markets – silver mining stocks – can tell one even more and provide the necessary confirmations.

There was no trading in the US yesterday, so there are literally no changes on the charts that we might feature today and thus everything that we wrote yesterday remains up-to-date. In today’s pre-market trading gold is down by $1.70, while silver is down by $0.13, which doesn’t invalidate anything from the previous analyses.

There are two things that we would still like to discuss today and they both relate to silver: the gold to silver ratio and the recent performance of the silver stocks. Let’s start with the former.

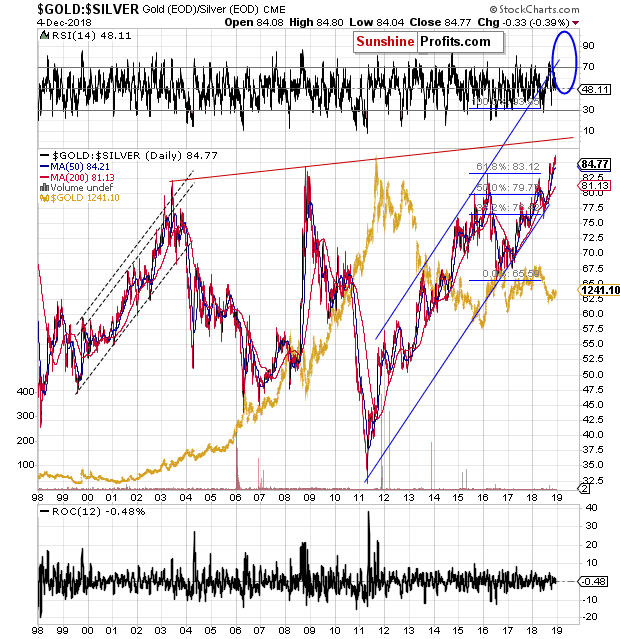

Despite the recent very short-term upswing in both precious metals, the gold to silver ratio didn’t decline. It further validates the breakout above the previous highs and is yet another reason for one to expect much lower prices of PMs. The ratio generally moves in the opposite direction to the price of gold. The link is not very precise during regular sessions, but it is tremendously useful when it comes to the major price extremes and long-term trends.

The gold to silver ratio spiked in 2003, and while it was not the exact bottom in gold, it was very early in the bull market. The early 2004 bottom in the ratio corresponded to gold’s top and the late 2005 top corresponded to the beginning of a major rally in gold. The 2008 spike corresponded to the major bottom in gold and the subsequent decline in the ratio that ended in 2011 corresponded to a huge rally in gold.The early 2016 top and subsequent decline reflected the late-2015 bottom in gold and the subsequent rally. The mid-2016 bottom in the ratio corresponded to the 2016 top in gold.

The lack of precision and the fact that one often leads the other may seem like a flaw, but it’s really a great advantage. If the developments in the gold to silver ratio can lead gold with regard to major price moves and bottoms, then major breakouts in it are truly important and they are likely to be heralding upcoming major breakdowns in gold. And what precedes the major breakout and breakdowns? Major price moves. In this case, a big move higher in the gold to silver ratio and a big move lower in gold appear to be just around the corner.

Having said that, let’s move to the analysis of the silver stocks.

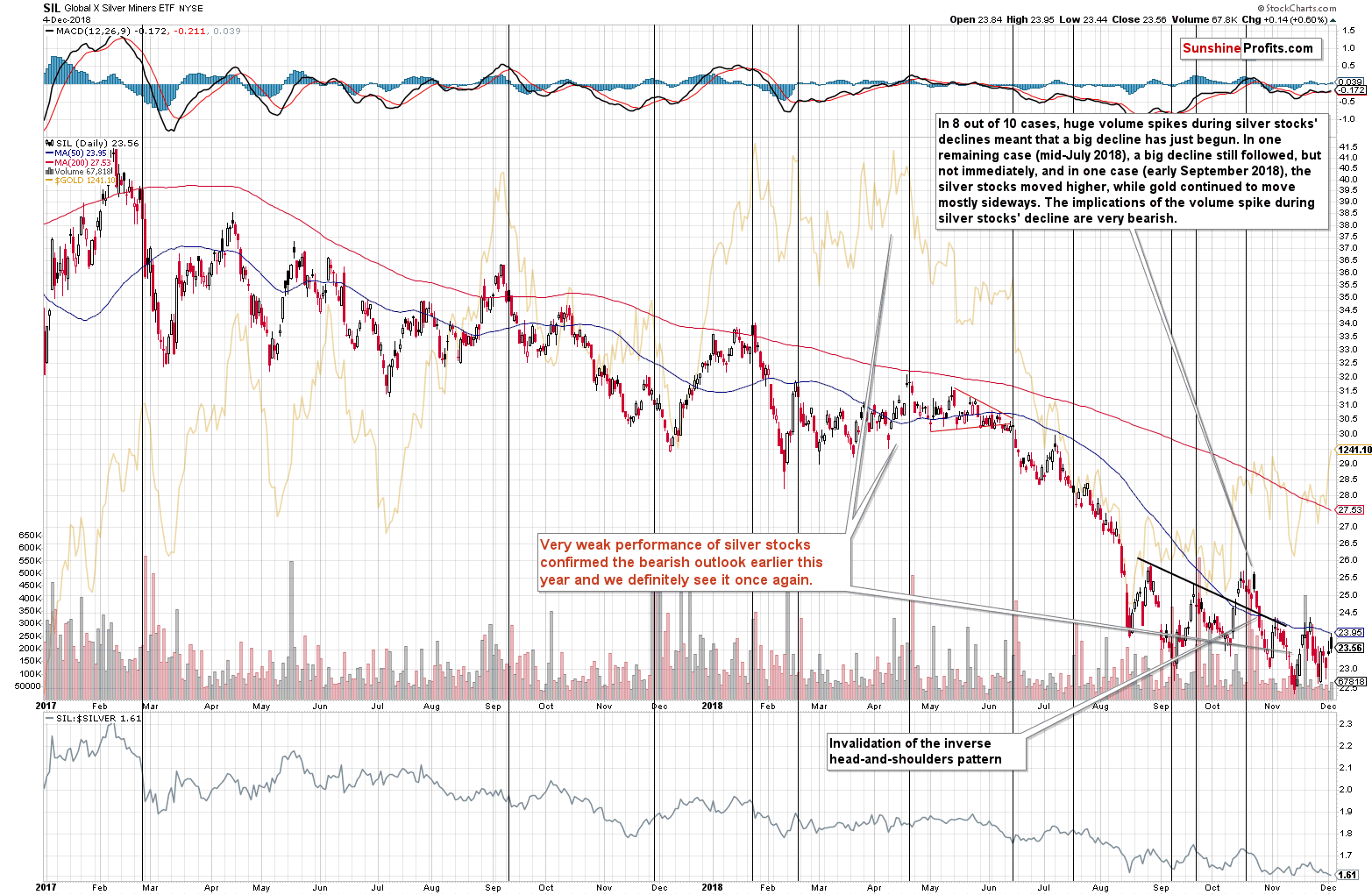

There’s not much that we can say about them, except that their performance has been weak in the past several weeks. And this observation about the silver miners is exactly the reason why we are featuring them.Earlier this year, before gold declined substantially, we saw the same thing – silver miners were weak. They didn’t really join gold in its upswings between February and May and they didn’t follow gold’s footsteps to any significant degree in the past few months either. The similarity between these cases serves as a bearish confirmation.

All in all, both silver-related charts confirm the bearish outlook that we’ve been describing in the recent past and we can currently summarize it just like we have done it yesterday:

Summing up, the outlook for the precious metals market remains very bearish for the following weeks and months and short position remains justified from the risk to reward point of view, even if we see a few extra days of back and forth trading or even a small brief upswing. There is a very high probability of a huge downswing that makes the short position justified, not the outlook for the next few days. The strongly bearish analogies to 2013 and 1999, miners’ underperformance, the number of intraday reversals in the GLD ETF, the triangle-based reversals in gold and silver, the outlook for the USD Index as well as the situation in the gold to palladium ratio are only several of multiple reasons pointing to much lower precious metals’ prices in the near future.

As always, we’ll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short positions (250% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and exit profit-take price levels:

- Gold: profit-take exit price: $1,062; stop-loss: $1,257; initial target price for the DGLD ETN: $82.96; stop-loss for the DGLD ETN $49.27

- Silver: profit-take exit price: $12.32; stop-loss: $15.11; initial target price for the DSLV ETN: $47.67; stop-loss for the DSLV ETN $28.37

- Mining stocks (price levels for the GDX ETF): profit-take exit price: $13.12; stop-loss: $20.83; initial target price for the DUST ETF: $80.97; stop-loss for the DUST ETF $27.67

Note: the above is a specific preparation for a possible sudden price drop, it does not reflect the most likely outcome. You will find a more detailed explanation in our August 1 Alert. In case one wants to bet on junior mining stocks’ prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and target prices:

- GDXJ ETF: profit-take exit price: $17.52; stop-loss: $31.23

- JDST ETF: initial target price: $154.97 stop-loss: $51.78

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Important Details for New Subscribers

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

The stock market is expected to accelerate the short-term downtrend today following Wednesday's one-day pause as investors' sentiment worsened once again. Will the S&P 500 index get back to its late October low?

=====

Hand-picked precious-metals-related links:

PRECIOUS-Gold declines on profit-taking, firm dollar

=====

In other news:

The Relentless Flattening in Treasury Yield Curve Has Stalled

Powell’s Dovish Rate Tilt Reflects Fear of Fool-in-Shower Trap

It's my deal, no deal or no Brexit at all: UK PM May

European Stocks Hit Two-Year Low on Worst Day Since February

Central bank warnings on the global economy are getting louder

Oil tumbles 5 percent after OPEC hints at smaller output cut

Emails, SMS & phone calls: aggressive Spanish lending rings alarm bells

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts