Briefly: in our opinion, full (250% of the regular size of the position) speculative short position in gold, silver, and mining stocks is justified from the risk/reward point of view at the moment of publishing this Alert.

The 2019 ended with a decline in USD Index and reversals in the precious metals market. Different parts of the PM market formed different kinds of them, but they were still reversals.

Reversals, Anywhere You Look

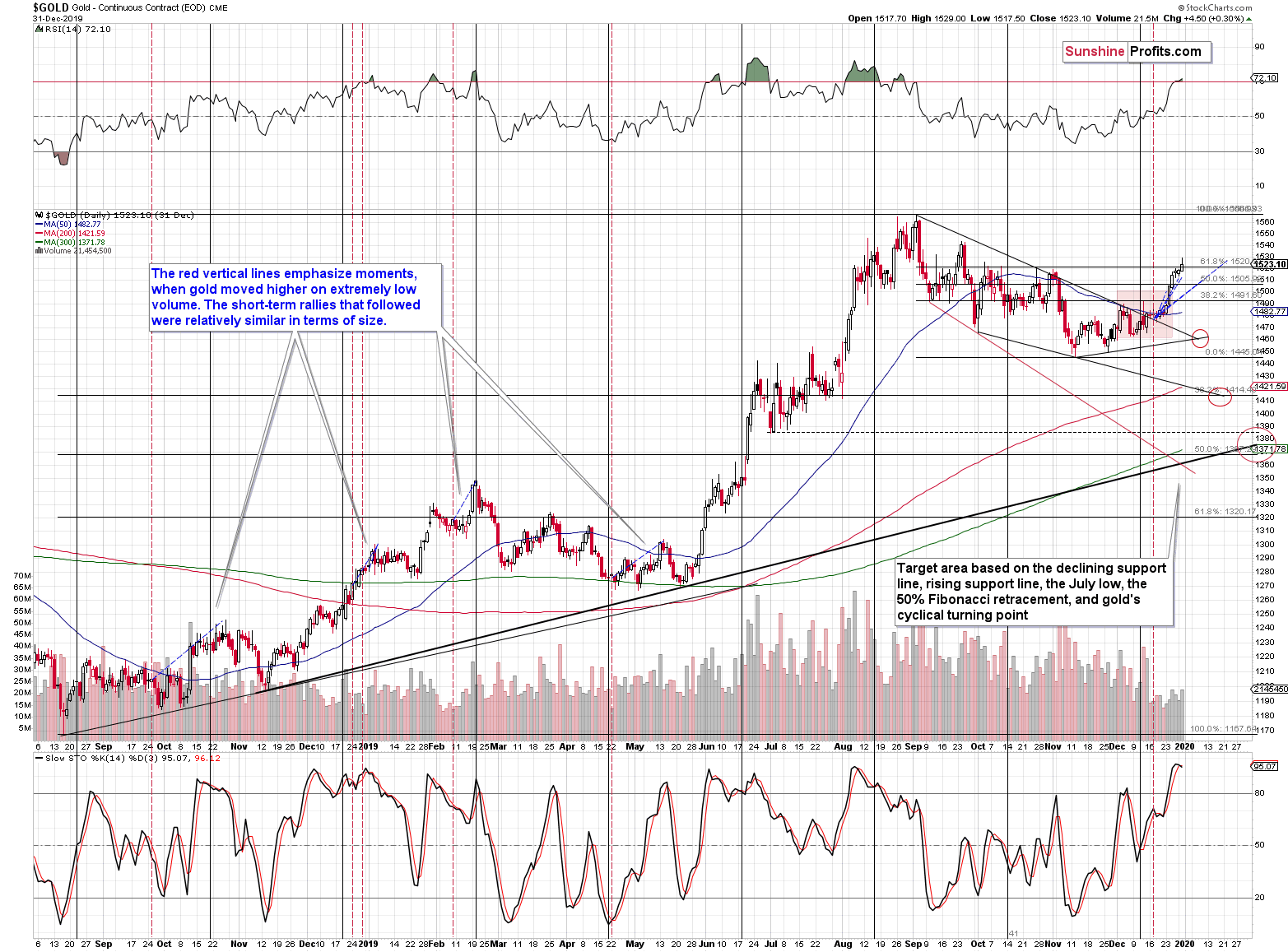

Gold formed a shooting star candlestick with a higher daily close.

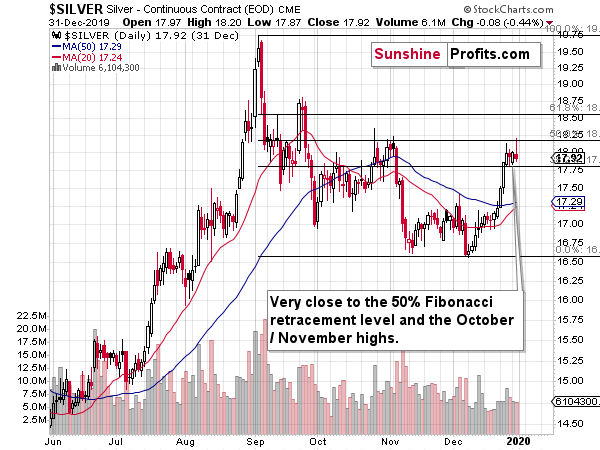

Silver formed a shooting star candlestick with a lower daily close.

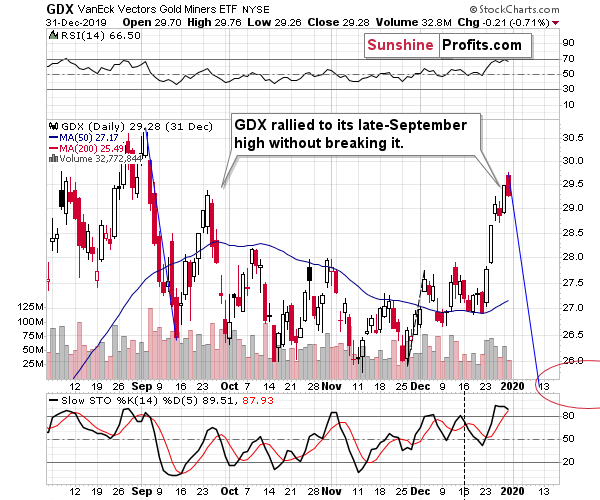

Mining stocks reversed in their own way. The GDX ETF declined back to the late-September 2019 high, while HUI and XAU indices formed less clear reversal shooting stars with lower daily closes.

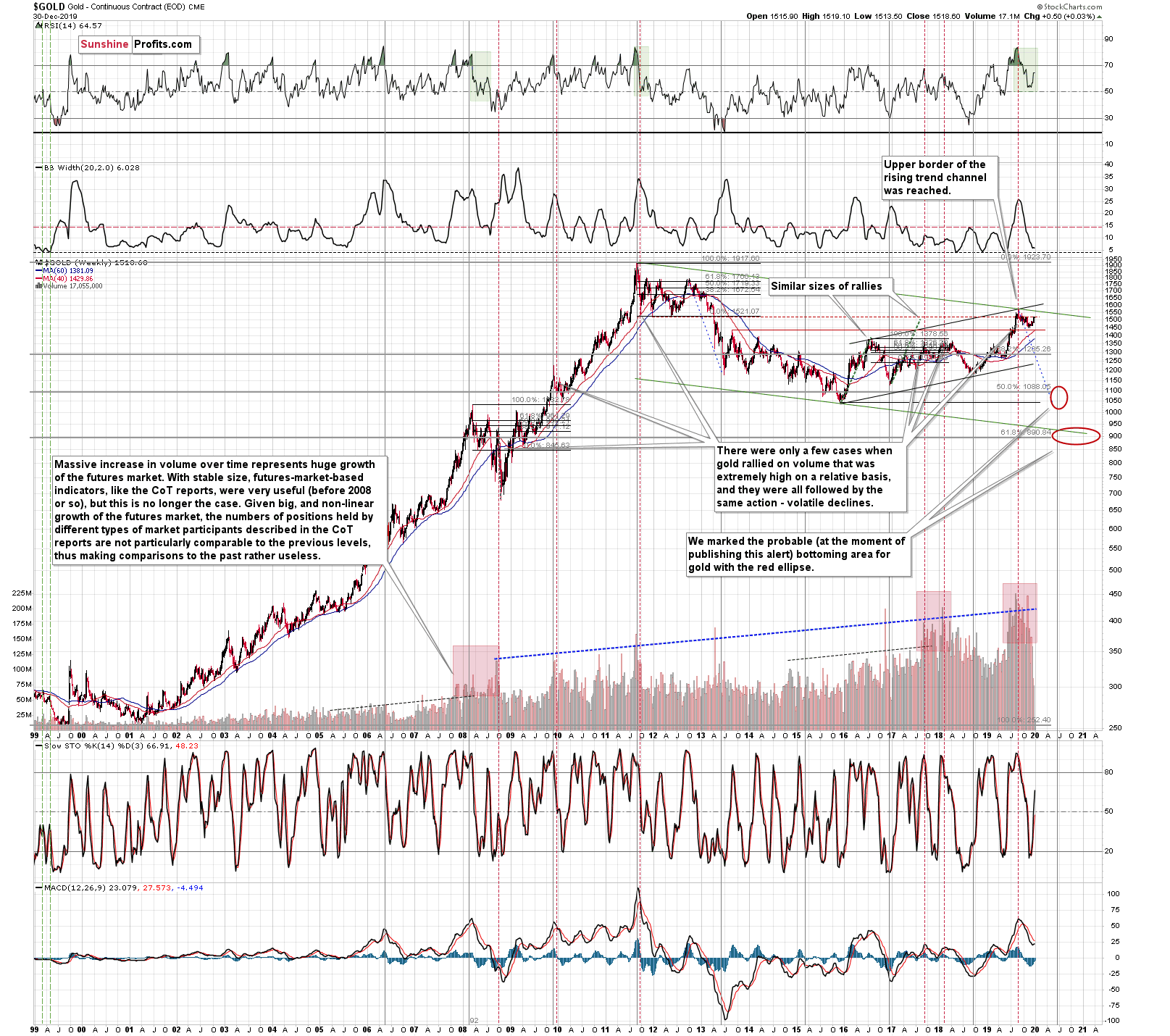

What does it all mean? It means that what we wrote previously is indeed taking place. This week's Monday analysis provides the background for all the other analyses of the week, including this one, so we strongly encourage you to read it if you haven't had the chance to do so already. In short, gold reversed slightly above the 61.8% Fibonacci retracement level, just like it had done in all three similar cases from the past.

This Action in Gold Smacks Of...

These cases are:

- the initial 2008 decline and the corrective upswing before the huge drop

- the initial 2011 decline and the corrective (2012) upswing before the huge drop

- the initial 2016 decline and the corrective upswing before the huge drop.

In all three cases, the top before the main part of the decline took place not right at the 61.8% Fibonacci retracement, but slightly above it. Yes, in each and every one of them.

This means that Tuesday's move above the 61.8% Fibonacci retracement is not bullish because it's a move above an important retracement. It's bearish, because it's exactly what happened in three similar cases right at the top.

Yes, it's not easy to be bearish on gold right now, after it moved higher for several days in a row, but exactly the same feeling was present at the final 2008, 2011 and 2016 highs. The tops are formed when people are very bullish about a certain asset's outlook and gold is no exception.

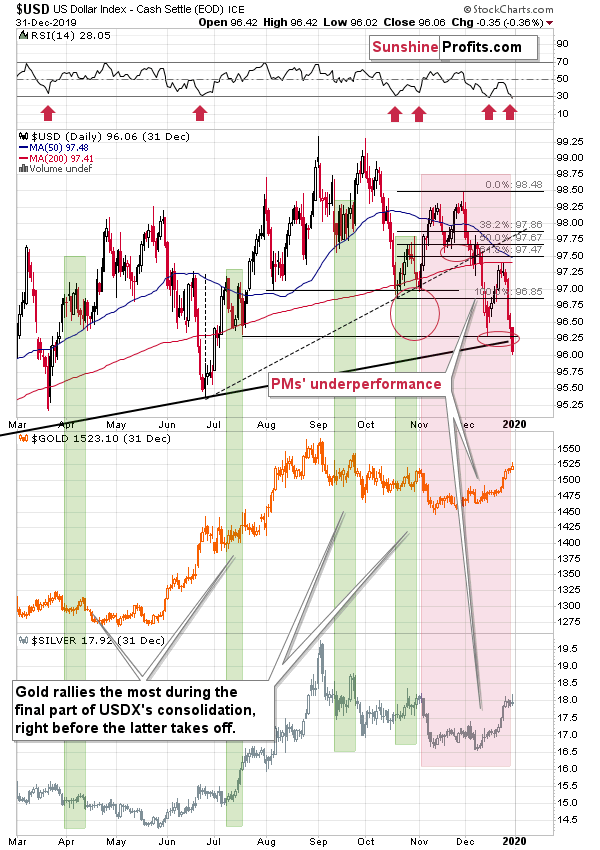

In the USDX part of yesterday's analysis, we wrote about a bottoming USD Index and the fact that gold tends to rally the most during the final part of greenback's consolidation and this is more than up-to-date with regard to today's movement. The USD Index seems to be testing its previous low and the medium-term support line, while gold's rally is likely providing us with its relatively strong, yet final breath. Gold is likely to decline once the USDX rallies once again. And based on numerous factors, the odds are that it will happen shortly.

Please note that the USD Index declined visibly on Tuesday, and it broke below the rising medium-term support line and the previous December low. This breakdown was not yet verified and given today's pre-market upswing, and the fact that the RSI moved below 30 thus flashing a buy signal, the odds are that it will be invalidated.

The relative performance of gold and silver compared to the USDX had bearish implications for the former. PMs reversed instead of soaring, which suggests that the buying power is drying up, perhaps it had already dried up.

Summary

Summing up, based on multiple similarities present in gold, silver and mining stocks, as well as on the critical situation in the USD Index, the medium-term outlook for the precious metals market is very bearish. January is usually a positive month for gold, but this bullish impact disappears when one takes into account the likely bottom in the USD Index. Given the proximity of the triangle-based reversals in gold, silver stocks' big volume spike, and divergence between HUI and GDX, it seems that the short-term rally in gold, silver, and miners is now very close to being over. In other words, the profit potential of our trading positions remains intact. This is especially the case given the remarkable similarity to the final 2008, 2012, and 2016 highs where gold topped slightly above the 61.8% Fibonacci retracement.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short position (250% of the full position) in gold, silver, and mining stocks is justified from the risk/reward perspective with the following stop-loss orders and binding exit profit-take price levels:

- Gold futures: profit-take exit price: $1,391; stop-loss: $1,573; initial target price for the DGLD ETN: $36.37; stop-loss for the DGLD ETN: $25.44

- Silver futures: profit-take exit price: $15.11; stop-loss: $19.06; initial target price for the DSLV ETN: $24.88; stop-loss for the DSLV ETN: $14.07

- Mining stocks (price levels for the GDX ETF): profit-take exit price: $23.21; stop-loss: $31.12; initial target price for the DUST ETF: $14.69; stop-loss for the DUST ETF $4.59

In case one wants to bet on junior mining stocks' prices, here are the stop-loss details and target prices:

- GDXJ ETF: profit-take exit price: $30.32; stop-loss: $44.22

- JDST ETF: profit-take exit price: $35.88 stop-loss: $8.28

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one, it's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (DGLD for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn't, then we will view both positions (in gold and DGLD) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager