Briefly: in our opinion, full (250% of the regular size of the position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this Alert.

The USD Index finally soared yesterday, but gold and silver investors did little except yawning. Nothing changed in gold or silver prices yesterday. Miners didn’t move as well. What gives? If they are not plunging given a rally in the USDX, then the USDX is not really an important factor and gold and (especially) silver could rally on their own, correct?

While gold and silver could rally regardless of what’s happening in the USD Index, it’s not likely to take place until the market is fully in the bull mode once again, and preferably at the later stage thereof. As we explained in the previous Alerts, this is not where the PMs are right now, and there is another explanation for the above phenomenon. The PMs reaction is simply delayed, because yesterday’s action was only a comeback to the previous trading range – not a breakout to new highs.

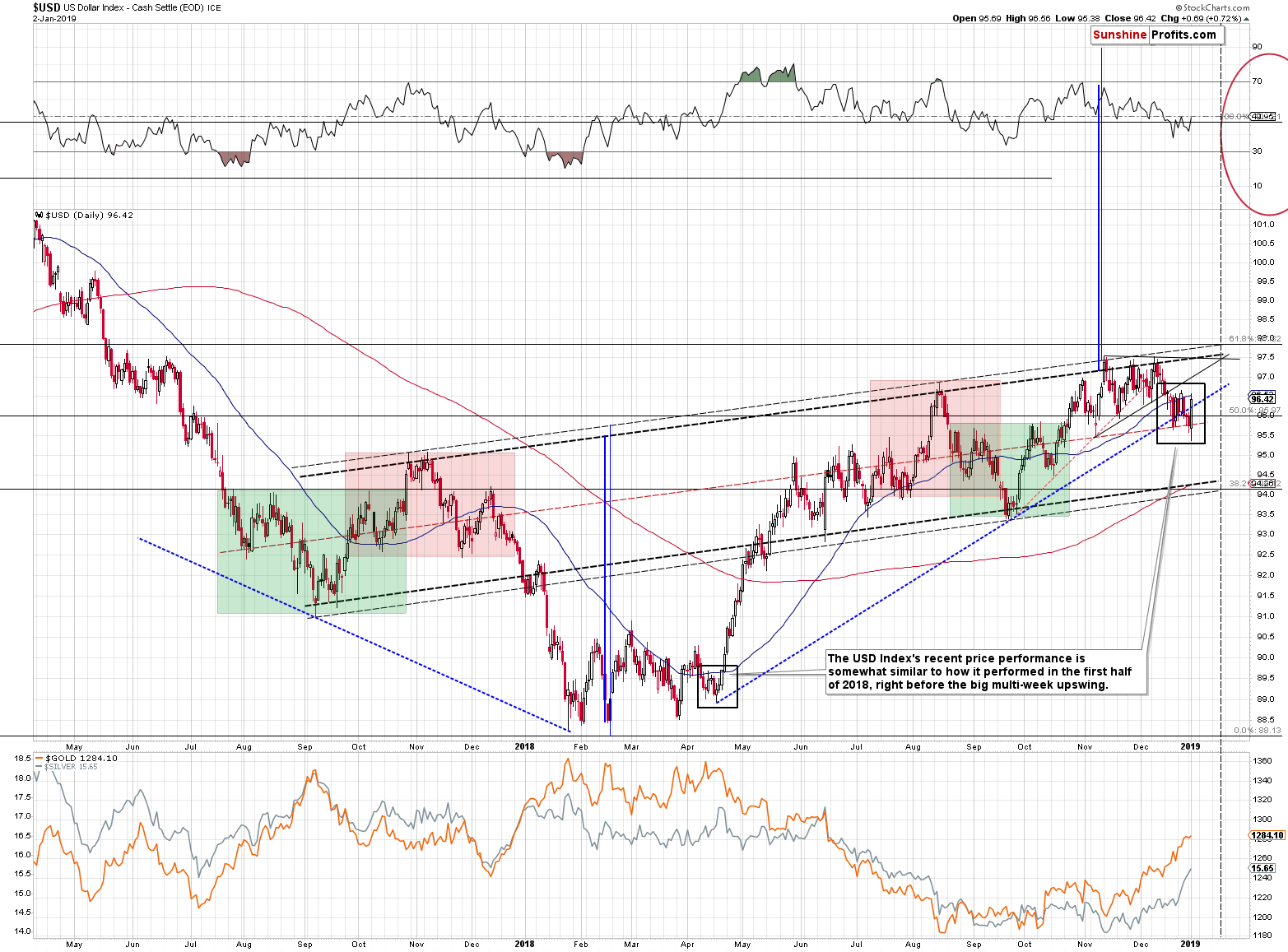

Most investors don’t know about the self-similar pattern that we currently have in the USD Index. They don’t know how similar the February – April period is to the late-October – today period, including the shape of the tops and bottoms as well as the position relative to the 50-day moving average at the end of the pattern. They also don’t know that silver outperformed gold during the similar time in April, thus increasing the level of similarity.

To most investors, yesterday’s rally is just a part of a pause that we are seeing after the triple top that we saw in November and December. It simply doesn’t look bullish at the first sight and there’s nothing exciting about it. Consequently, it’s no wonder that the PM investors didn’t react to it. But they are very likely to start reacting once the move becomes more visible.

The breakdown below the rising blue support line was invalidated, which is a clear bullish sign, especially given the shape of yesterday’s session. The USD Index moved initially lower, but then it reversed with vengeance and rallied a full index point from the intraday bottom. The dam is broken, even though most people still don’t realize that.

If the USD Index keeps on rallying and exceeds the 2018 highs, while gold and silver still refuse to decline, we will have a strong bullish sign for the PMs. But we don’t have it right now; we most likely have a delay in the reaction.

Since nothing really happened in the prices of PMs and miners, we don’t have more charts for you today, but before summarizing, we would like to comment on an article that we read on Gold-Eagle.com. One of the points made in it is that silver is a good investment from a very long-term point of view. And we couldn’t agree more. It is and we expect it to outperform gold, especially in the late stage of the bull market. However, the author also makes claims about silver being in a bull market as of late 2018 after forming a bottom in December 2015 and this is something that we would like to discuss.

The author makes 10 points that supposedly explain “how we know for certain” that this is the case. They all include logical errors, which is something that we will elaborate on. We are not going to discuss the incorrectly drawn inverse head-and-shoulders pattern that is described on silver’s chart, because it’s quite obvious that what is marked looks nothing like the inverse H&S pattern. That’s one of the favorite formations of gold promoters (note: in the closing paragraph, the author mentions a silver dealer, encourages people to buy and mention him as they might receive a benefit) as it’s quite ambiguous and easy to “herald” to those who are not experienced traders – only the latter will question something in the analysis.

We will also not discuss the way the gold to silver ratio is used as we have already done so last January. The chart that is featured doesn’t discuss the recent breakout in the ratio and the fact that the next strong resistance is at about 100. Moving from the current levels to 100 in the ratio is likely to have a tremendous impact on the silver price because of both: the move in the ratio, and the fact that the rally in the ratio usually corresponds to a decline in both precious metals. Therefore, silver’s price would likely decline due to both factors: the decline in general, and the underperformance relative to gold.

Is the price moving sideways? It’s an inverse head-and-shoulders pattern, silver is bottoming, and it will rally soon. Is the price declining? It’s manipulation and it will end shortly (we’ve been reading this for – literally – more than a decade), thus silver is going to rally soon. Is the price rallying? That’s a normal state and should continue indefinitely unless silver is rallying too slow – then it’s also a proof of manipulation, because it should be moving only up, without any corrections.

The above is generally how the PM-promoting texts look like, even though they are being provided as objective analyses. They should be treated like ads, not as the unquestionable truth.

Wait, aren’t you guys always bearish? Aren’t you the same as gold and silver promoters, only in the opposite direction?

No. And here’s a proof. Moreover, our previous speculative trade was a profitable long one.

Having said that, let’s move to the list of the supposedly bullish proofs that silver has already bottomed in December 2015. We will put our comments below each point.

THIS BEGS THE QUESTION: Is silver in a bull market or a bear market as of late 2018?

I believe silver has begun another bull market. Why? What do we know for certain?

- The dollar will devalue. Consumer prices will rise. That new truck in 1965 cost perhaps $2,500, but now costs $40,000 to $60,000. Silver prices will rise as they have since 1991.

The stated fact is true, but it doesn’t prove the point in any way. The dollar will devalue, but why would this support a medium-term move in silver, let alone a short-term move? How much did the new truck cost in 1980 and how much did it cost in 2001? Did the truck prices decline during these 21 years?Absolutely not. Based on this calculator it seems that the prices have about doubled on average during this time frame. Of course, there are other calculators, but likely none of them will show you a decline in prices. And yet, silver declined from $50 to below $5. If silver managed to stay over 20 years in a bear market, declining over 10x while at the same time the truck prices increased along with the prices of other consumer goods, then why would this be any proof for even a medium-term bottom? It’s not. The dollar can continue to devalue, and silver can continue to decline for months and even years (the latter is not likely based on other reasons, though). - The Federal Reserve wants inflation, not deflation, in asset prices—particularly bonds and stocks. Expect more dollar devaluation as they may sacrifice the dollar and stock market prices to maintain bond markets.

Once again, there is some truth to the above – the Fed definitely doesn’t want deflation and it’s happy with modest inflation. However, did anything change with regard to what the Fed wants in the past decades? Did it previously want deflation and now it wants inflation? No. The same was the case while silver declined from $50 to below $5, therefore these factors should not prevent silver’s decline and are no indication, let alone proof that it formed a major bottom in 2015. Moreover, there’s more to the monetary world than just the Fed. There are ECB, BOJ, and other monetary authorities, and not many of them want deflation. What if the other monetary authorities want more inflation than the Fed? The value of the dollar would then increase as all currencies are priced relative to each other. - The Federal government will spend more every year, always run deficits, and will increase debt… until they can’t. Official national debt exceeds $21.8 trillion and can never be repaid with dollars of current value. Either default or massive inflation will occur in our future. Both will boost silver prices.

…And this tells absolutely nothing about whether silver bottomed in 2015 or not. The above may happen in a year, or in a decade. Or sometime in between, or later. And silver may have medium-term rallies and declines in the meantime. The above is a reason to expect higher silver prices over the long run but doesn’t tell us anything about the timing. - The paper COMEX market sets silver prices. The financial elite manage and often suppress prices. Occasionally silver prices run higher and panic the short sellers and powers-that-be. Another massive rally will occur, perhaps soon.

Occasionally… Like for about 10 years? Even without discussing what determines the silver price, we can say that the above is by no means an indication, let alone proof that silver bottomed in 2015. What happened in 2011 and in 2008? Did the mechanics on the silver market change? And yet, silver started major price declines then. If the status quo didn’t prevent these price declines, then why should it prevent them now? - Since 1991 silver prices have moved upward as the dollar has devalued. Industrial demand and supply of silver are increasing. Investment demand (You should buy silver!) has been weak for several years. Tech stocks were better investments since 2011. But tech stocks have broken their uptrends and have fallen over 20% from their recent highs. Expect lower tech stock prices and higher silver prices in 2018 – 2020.

We’re not sure how any of the above sentences justifie silver’s bottom in 2015, so we cannot elaborate further. Silver moved higher and dollar has devalued and previously silver had moved lower while the dollar had devalued. Silver moved both: down and up while the dollar devalued. So what? Different parts of the stock market (like tech stocks, utilities, etc.) perform differently and so do different markets, but why would it indicate anything for silver with regard to the 2015 bottom? - Another credit crunch, like 2008, is coming. A stock correction/crash is occurring. Stocks have further to fall in 2019.

We dedicated several previous Alerts to the link between gold and the stock market. The implications apply to silver as well. The stock market seems to have reversed. There may be credit crunch coming, but it doesn’t tell us anything regarding the timing of the medium-term bottoms. It might be coming, but the silver prices can still decline in the meantime. What if the credit crunch comes in 5 years? Silver can decline more than once during that time. Also, let’s keep in mind that silver declined along with stocks in 2008… - Silver is no one’s liability. This will become more important when markets crash. Silver will remain valuable long after people have forgotten crazy tech stock prices, negative interest rate bonds, current political nonsense, stock buybacks, and guaranteed to devalue fiat currencies.

These are all fundamental factors, not directly related to timing and thus they don’t indicate, let alone prove that silver bottomed in 2015. Was silver’s anyone’s liability from 1980 to 2001? Was it a liability in 2008 at the top? Or in 2011? No, and yet, its price declined at those times. And it can decline again despite the above. - Silver is inexpensive compared to gold, the DOW, S&P 500, M2 and total debt. Other articles have documented these ratios.

Compared to gold, silver just broke a critical level which suggests that it will become even more inexpensive in the following months. No other ratios were provided in the article. - Bull market rallies in silver prices are substantial when gold to silver ratios are high, such as now.

That’s generally true, but it’s also tricky in terms of implications, because just because the gold to silver ratio is high, it doesn’t mean that it can’t get higher in the following weeks. It can, and is likely to, based on its breakout. Once the ratio tops and PMs bottom, silver’s rally is indeed likely to start a substantial rally. - Our current financial system uses debt-based fiat dollars. This is unlikely to change for years, perhaps decades. Silver will retain its value and appreciate to many times its current price.

… And the above doesn’t tell us anything about the timing factor. The above is true whether silver bottomed already or will bottom in the following months.

That’s it. These are all of the points that are supposed to explain why silver has started another bull market “for certain”. None of them proves it. Almost none of them even indicate anything related to timing. If the above points were made with regard to the question “why is silver likely to rally – in general – in the coming years?”, then some of them would be justified. As far as detecting bottoms is concerned, they don’t tell one much, and they definitely do not prove that silver bottomed in 2015.

Summary

Summing up, this prolonged correction within the big downtrend has been very tiring, but based on the long-term factors being patient was very well worth it, and based on the short-term signs it seems that the waiting is over or about to be over. The outlook for the precious metals market remains very bearish for the following weeks and months and short position remains justified from the risk to reward point of view, even if we see a few extra days of back and forth trading or even a small brief upswing. There is a very high probability of a huge downswing that makes the short position justified, not the outlook for the next few days. It's confirmed by multiple factors, i.a. silver’s extreme outperformance and miners’ underperformance, gold’s performance link with the general stock market, gold getting Cramerized, and the bullish outlook for the USD Index (especially in light of yesterday’s bullish reversal).

As always, we’ll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short positions (250% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and exit profit-take price levels:

- Gold: profit-take exit price: $1,062; stop-loss: $1,303; initial target price for the DGLD ETN: $82.96; stop-loss for the DGLD ETN $45.87

- Silver: profit-take exit price: $12.32; stop-loss: $15.73; initial target price for the DSLV ETN: $47.67; stop-loss for the DSLV ETN $27.48

- Mining stocks (price levels for the GDX ETF): profit-take exit price: $13.12; stop-loss: $21.82; initial target price for the DUST ETF: $80.97; stop-loss for the DUST ETF $21.97

Note: the above is a specific preparation for a possible sudden price drop, it does not reflect the most likely outcome. You will find a more detailed explanation in our August 1 Alert. In case one wants to bet on junior mining stocks’ prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and target prices:

- GDXJ ETF: profit-take exit price: $17.52; stop-loss: $31.23

- JDST ETF: initial target price: $154.97 stop-loss: $51.78

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Important Details for New Subscribers

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts