Briefly: in our opinion, full (300% of the regular position size) speculative short positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

Some might consider an additional (short) position in the FCX.

Remember all those intraday indications about head-and-shoulders patterns? Some of them got confirmed by weekly prices!

This is exciting because weekly prices tend to be more important and more meaningful than daily closing prices, which, in turn, are more meaningful than intraday extremes. I covered all those indications last week, and since they all remain up-to-date, in today’s analysis, I’m going to focus on one chart that includes all important changes that happened in the markets (there was one other important change – the first RISE session took place on Friday, but I’ll move to that after the regular part of the analysis) since Friday.

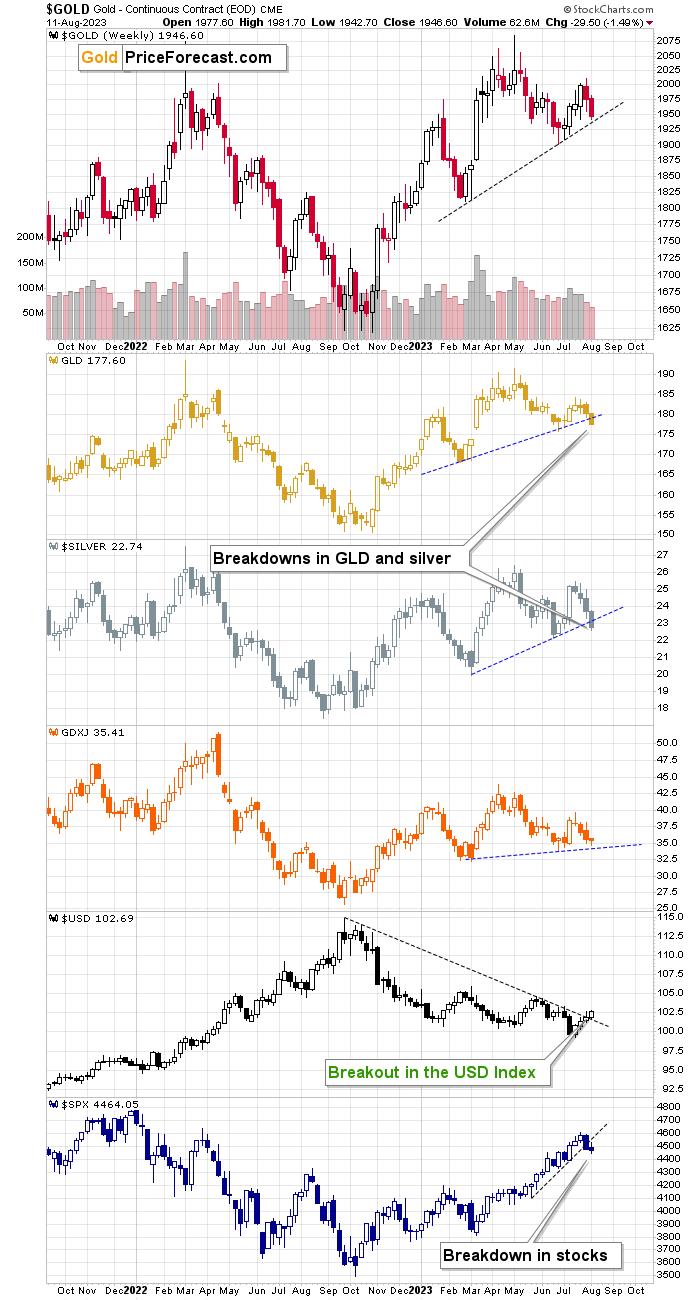

So, here’s what happened on a weekly basis:

- Gold futures declined visibly, but they remain above the neck level of the head and shoulders pattern.

- GLD ETF declined and closed the week below the neck level of the head and shoulders pattern, which is a very bearish development.

- Silver futures declined and closed the week below the neck level of the head and shoulders pattern, which is a very bearish development.

- The USD Index broke above its declining resistance line and closed the week visibly above it, making it 100% clear that the breakout was indeed verified.

- The S&P 500 broke and closed the week below its rising short-term support line. That was not a huge decline, but it seems like the first crack in the dam.

So, we got neutral indications from gold futures but bearish indications from GLD, silver futures, USD Index (as what’s bullish for the USDX is generally bearish for the precious metals sector), and the stock market.

Interestingly, junior mining stocks declined, but only a little, and they actually moved higher on Friday. Is this strength compared to gold, something really bullish?

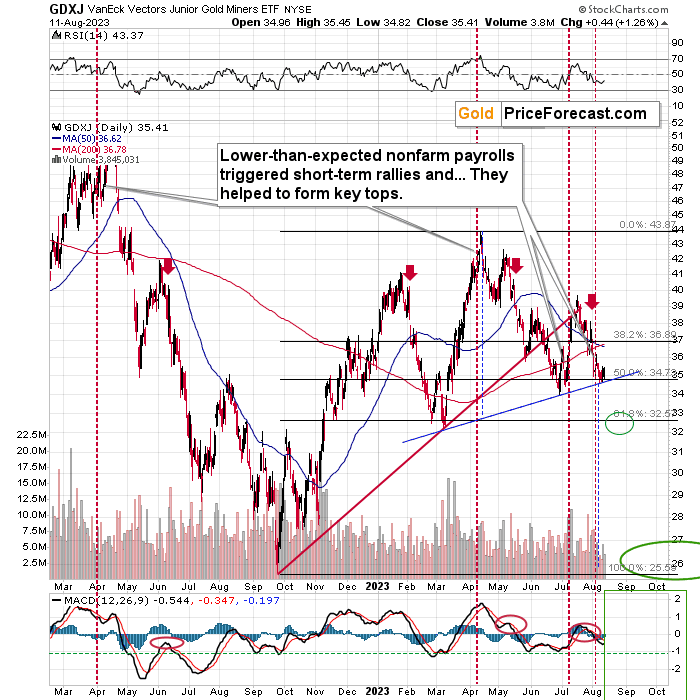

No. Junior miners had a good reason not to decline here but rather take an extra breather due to the support level. The current $35 level is important support as it’s based on the Aug. 2022 high, the early-Nov. 2022 high, the early-Mar. 2023 high, the 50% Fibonacci retracement based on the entire 2022-2023 rally, and that’s the level breaking that triggered a rebound several weeks ago.

So, this time, investors are cautious about this level, and it is perfectly normal.

It’s not rocket science to see what’s likely to happen, though. The USD Index is after a confirmed breakout, and stocks have broken below their support line. And while the situation in gold is rather unclear (futures are not breaking lower, but GLD is), silver is showing that the next move is down. So, yes, the GDXJ is likely to slide as well any day now, and the profit-taking plan that I outlined on Friday (including the details of going long) remains up-to-date.

The above ends today’s analysis, at least its part dedicated to markets. The following part is about the inaugural RISE session and the direction in which this is all going.

===

In short, the first Regain Inner Strength Experience session was a tremendous success. Before the key part of the session, I asked the participants about their overall wellbeing on a scale from 1 to 10, and the average was 6.1. I asked the same question after the key part of the session (about 30 minutes later), and it jumped to 8.1.

As far as I know, nobody’s financial status or anything else in their lives changed during those 40 minutes, and yet, due to the internal process that they went through, people were able to substantially increase their wellbeing. People moved from where they were halfway to the max! In 40 minutes! If that’s not how a spectacular success looks like, I don’t know what it would be.

Before the session, I had my own expectations regarding the session; and I considered a move up by one point on that scale to be a success. We got twice as much.

And it actually gets even better!

I asked for more detailed feedback at the end of the session, and it turned out that there was only one person whose wellbeing decreased from 10 to 8, but it came with extra info: “the experience is still growing in me”, which is actually perfect. After some reflection, this person could move “beyond 10” thanks to insights that they will get. If we take the above into account, the real increase in wellbeing would be even greater! One final number – the record increase in wellbeing was from 4 to 9.

One of the questions in the survey was what people appreciated the most about the session, and here are some of the replies (I’m putting in bold the parts that I find key and that I particularly like):

- That it worked

- that it helps how to find more certainty and solution to my issues by myself

- I liked PR’s hands-on approach. No wasting time with anything. This tells me that I need more of these exercises, but rarely someone provides them, let alone for free. I imagine myself doing an exercise in the morning as well.

- informative

- Move forward. The experience is still growing in me

- Direct and insightful

- Your presentation is very honest and right from your heart.

- Practical meditation

You can watch the recording over here (in the description of the event), you can watch it also below (but please use the above link if, for whatever reason the embed video function doesn’t work), and you can sign up for the RISE #2 session over here (Aug. 22 – 11 AM EST / 5 PM CET).

Now, while I’m experienced in working 1-on-1 during the Mastering Multidimensional Wealth | 1:1 Coaching Experience, and Reiss Motivational Profile® sessions, facilitating an online session was something new for me, and I didn’t manage to do everything that I had planned even though I added extra 30 minutes to the hourly session.

Next time, I will plan it better, and I will introduce the key exercise in a separate video.

To make watching the recording easier and more pleasant for you, here’s the breakdown:

- 0:00 – 17:15 – welcoming participants and introducing myself

- 17:15 – 36:40 – the theory behind the transformation exercise

- 36:40 – 59:21 – the transformation exercise along with the extra intro

- 59:21 – 1:20:35 – summarizing the exercise; survey

- 1:20:35 – 1:28:55 – final quick exercise regarding sharing positive wishes (plus a surprise in the second half of the exercise, which I don’t want to spoil; check it out) and the ending

Using the YT link might be most convenient as it then automatically takes you to the right part of the video (just click “more” on YT to expand video’s description, and then you’ll see the breakdown of chapters).

If you’re short on time and you trust the process (there’s a lot of science behind it and as you can see above, I talked about it for quite some time) you can skip the intros and move right to the transformation exercise.

===

One person in the feedback form wrote (in addition to writing that they found the session to be helpful) that they are wondering what the ultimate goal of these sessions is. In case you’re also wondering, here’s a (long, but probably worth reading) reply:

The increase in wellbeing that you saw in the session IS the ultimate goal of these sessions. This assists people in breaking out of the loss-stress cycle regardless of whose analyses they follow because, ultimately, everyone will lose money at some point or will be holding on to a position that’s in the red for some time before it becomes profitable. And that’s not pleasant. In the loss-stress cycle, the above causes stress (and all sorts of unpleasant emotions: fear, anxiety, shame, guilt, sadness, anger, and frustration are the most common), which in turn makes it more difficult for one to remain objective about the situation, and they take worse investment decisions next time, perhaps making emotional decisions to increase their positions/leverage, or to drop those positions entirely. The irony here is that many tend to drop their positions right before the situation turns around, and they become profitable because it is at the price extremes that emotions are at their highest. And as people make those less-objective decisions, the chances for more losses increase. Which increases stress, which decreases profits, which causes stress, and so on. Capital, health, and wellbeing in general all are negatively impacted.

What is the default way in which people can try to self-regulate? Some people will engage in sports activities, meditate, engage in their non-market hobbies, etc., but some will want to vent their frustration publicly. While this is understandable, it’s also harmful to others because some of those “others” might have been on the verge of panic, and they wouldn’t have panicked if left alone, but when they see someone else panicking or venting, they will probably be pushed to react in the same way, thus exacerbating the stress-loss cycle.

Now, I’m doing my best with my analytical part, but I can only do so much – I’m human after all, and neither I nor anyone else can be reasonably expected to pick all the tops and all the bottoms (I did pick the 2020 bottom, though). So, I’ve been thinking if there’s something else that I can do for you in the one-to-many arrangement, where I can assist multiple people at the same time. I’ve been thinking about it for a long time, and I finally realized that if I can make people break out of the stress-loss cycle (whether they are following my analyses or someone else’s analyses) then this will be the ultimate game-changer. The true success always comes within, anyway.

Also, I have a deep conviction that we’re living in times that are so difficult on many fronts, but in particular relating to mental health (and I don’t mean illnesses, but being on top of the mental game – happy, relaxed, and fulfilled) that the basics, or at least a large part of them should be available either for free or at a price that’s affordable for everyone. With 1-on-1 services it’s different, because it fully engages the provider and makes them unavailable to do anything else.

I’ve been collecting insights from various sources (believe me, what’s in RISE is the tip of the tip of the iceberg of what I learned and tested in the previous years) and in cooperation with the Stanford School of Medicine (and others), I came up with the idea to provide the Regain Inner Strength Experience sessions for free, and also to provide a course with key insights and exercises for next to nothing (probably $5 per month). This course, entitled “From Fear to Fortune” is currently in the making. This way, everyone will be able to enjoy their lives more, make more money on their trades, and make Golden Meadow a better, more supportive platform – everybody wins.

All this will also serve as an intro to many other courses (and then newsletters), some with basics of finance and investing, some aimed at more advanced areas in finance and wellbeing (you’d be surprised how much can be done with just breath – and yet very few people discuss that). We’ll greatly expand investment and financial scope of what’s available but also on the front where those “other” important things are – like communication, relationships, memory, preventing neurodegenerative diseases, increasing life quality in general, and many more.

Like I said, I experienced quite a lot (I’m working in the markets, I’m a CEO and I dedicate less than 1h total per week to workouts and yet when doctors look at my bloodwork, they ask if I’m a professional athlete – how? Research and efficiency in what I’m doing – it’s all connected), and it’s really surprising to me how underutilized the synergy between the finance, wellbeing and self-development has been up to this point.

So, the long answer to the question is that this is leading to increased wellbeing of everyone, who participates, increased profitability (of course, no guarantees, but you know very well how one thing leads to the other), and building a platform that will allow for enormous scaling of this effect. To make the world a better place and become happier and wealthier while doing so.

Also, while I’m at it, I’d like to mention two things:

- I re-introduced my 1-on-1 service, because it was previously described in a manner that didn’t really emphasize what it is that I can do. The new and up-to-date name of the service is Mastering Multidimensional Wealth | 1:1 Coaching Experience . I have only 4 seats available, because I assume that this will be an ongoing weekly experience for those, who enter into this engagement. That’s where the biggest benefits can be reaped. However, it might be best to start with 30 minutes at first to just get to know me in this sort of work (it’s priced at a fraction of the regular session’s value), and we’ll both see if we’re a good match. If so, I’ll likely have some ideas for you even during those 30 minutes, and you’ll see if my approach makes sense for you, and whether you want to go into a longer engagement – where a true transformation can (and likely would) happen. If you feel that this is something that could be helpful to you at this stage of your life, you can book your seat here.

- The above has only 4 seats available even though there are 5 workdays in a week (I plan to have one of those sessions per day), because the fifth session will be reserved for someone, who will have a priority due to the specific nature of the cooperation. Namely, I would like to enter into a partnership with someone (just one person) – a visionary investor who seeks to leave a profound mark on the world, and I plan to use all my insights to make sure that this person’s wellbeing will increase as much as possible thanks to our cooperation.

I can and will do all the above work related to Golden Meadow, anyway, but a partnership would speed things up substantially. I described what my plan and motivation are, and if you share my passion and are moved by the work that I’m undertaking, please consider this a call to action.

I’d like to welcome a strategic investment of $1M from a single individual who is not only driven by financial potential but also by the profound impact that can be achieved. It isn't just an investment in numbers, but an investment in a vision that encompasses collective well-being. By partnering with me, you'd not only be enriching your financial journey, but also contributing to the betterment of the world.

If you resonate with the deep resonance of this vision and want to explore the extraordinary potential that this investment partnership offers, please reach out today. Also, I’ll be in California in about a month, and I’ll be happy to meet to discuss the vision for the company with this person. This is your chance to ignite transformation not only within your wealth portfolio but on a global scale. Let’s start a conversation that has the power to shape not just your future, but the world's.

Overview of the Upcoming Part of the Decline

- It seems that the recent – and probably final – corrective upswing in the precious metals sector is over.

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place and if we get this kind of opportunity at all.

- I plan to switch from the short positions in junior mining stocks or silver (whichever I’ll have at that moment) to long positions in junior mining stocks when gold / mining stocks move to their 2020 lows (approximately). While I’m probably not going to write about it at this stage yet, this is when some investors might consider getting back in with their long-term investing capital (or perhaps 1/3 or 1/2 thereof).

- I plan to return to short positions in junior mining stocks after a rebound – and the rebound could take gold from about $1,450 to about $1,550, and it could take the GDXJ from about $20 to about $24. In other words, I’m currently planning to go long when GDXJ is close to $20 (which might take place when gold is close to $1,450), and I’m planning to exit this long position and re-enter the short position once we see a corrective rally to $24 in the GDXJ (which might take place when gold is close to $1,550).

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold prices close to $1,400 and GDXJ close to $15 . This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,400, but at the moment it’s too early to say with certainty.

- The above is based on the information available today, and it might change in the following days/weeks.

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding nor clear enough for me to think that they should be used for purchasing options, warrants, or similar instruments.

Letters to the Editor

Please post your questions in the comments feed below the articles, if they are about issues raised within the article (or in the recent issues). If they are about other, more universal matters, I encourage you to use the Ask the Community space (I’m also part of the community), so that more people can contribute to the reply and enjoy the answers. Of course, let’s keep the target-related discussions in the premium space (where you’re reading this).

Summary

To summarize, the medium-term trend in the precious metals sector remains clearly down, and it seems that the next short-term downswing is already underway. We recently saw major reversals and the recent decline is taking place just like it’s “supposed to” take place.

Even though the stock market is higher than it was at the end of 2022, USD Index is lower, and gold is higher too, this is a down year for both: silver and GDXJ. Junior miners magnify stock markets’ declines to a huge extent, and they also magnify gold’s declines. It seems that miners just can’t wait to move to lower levels.

We’re likely to see an opportunity to take profits from the current short position in the GDXJ (and perhaps go long) if it moves below $33.

Given the current set-up in gold, silver, and mining stocks, and the USD Index that seems to be the most likely outcome. With the USDX moving to its May highs, it’s likely that the GDXJ will move to its yearly lows – and it’s 61.8% Fibonacci retracement and then they both would be likely to correct.

Consequently, I’m moving the target level for the GDXJ up and I’m also adjusting all the other targets.

This does NOT mean that the downside potential for the GDXJ decreased. The GDXJ is still likely to slide to its 2022 low, and then below it.

This means that the profit potential remains enormous.

However, the odds for a corrective upswing from about $33 are too big to be ignored. When GDXJ goes to $33 and we close our position there, it will be 9th profitable trade in a row (in case of the GDXJ – I’m not taking into account option plays or any other leveraged instruments).

Of course, since the move lower is likely to continue after the correction, one might choose to wait it out and not make any adjustments to the short position – it’s always up to you to decide how you want to approach your trades – I’m providing my opinions on the outlook.

Once the profits from the short position are in, and the GDXJ is trading at about $33 (details below), I think that entering small (50% of the regular position size) long positions in the GDXJ will be justified from the risk to reward point of view, with a binding take-profit target at $34.48. And when this target is reached in the GDXJ, I think that re-entering a big (300% of the regular size of the position – note: this is not 300% of the size of your trading capital! Just a bigger-than-usual position, but either way, don’t make it too big for you to handle emotionally in case of a temporary setback) short position in the GDXJ will be justified from the risk to reward point of view.

In other words, I plan to catch the correction with a small position and then get back on the short size of the market at higher prices to increase the overall gains.

Next week, the analyses will focus primarily on the fundamental aspects of the market as I will be away from my computer more often, so above serves as the game plan for that time. If some adjustments are necessary, I’ll keep you informed.

===

Finally, since sliding GDXJ prices is such a great piece of news, here’s… Even more great news! We’re once again opening the possibility to extent your subscription for up to three years (at least by one year) with a 20% discount from the current prices.

Locking in those is a great idea not only because it’s perfect time to be ready for what’s next in the precious metals market, but also because the inflation might persist longer than expected and prices of everything (including our subscriptions) are going to go up in the future as well. Please reach out to our support – they will be happy to assist you and make sure that your subscription days are properly extended at those promotional terms. So, for how many year’s would you like to lock-in your subscription?

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $32.72; stop-loss: none.

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged). The binding exit level for the JDST: $8.09; stop-loss for the JDST: none.

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures downside exit price: $22.03 (stop-loss: none)

SLV exit price: $20.12 (stop-loss: none)

ZSL exit price: $22.18 (stop-loss: none)

Gold futures downside exit price: $1,912 (stop-loss: none)

Spot gold downside exit price: $1,881 (stop-loss: none)

HGD.TO – alternative (Canadian) 2x inverse leveraged gold stocks ETF – the exit price: $7.22 (stop-loss: none due to vague link in the short term with the U.S.-traded GDXJ)

HZD.TO – alternative (Canadian) 2x inverse leveraged silver ETF – the exit price: $17.08 (stop-loss: none)

///

Optional / additional trade idea that I think is justified from the risk to reward point of view:

Short position in the FCX with $27.13 as the short-term profit-take level.

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you’ve already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (as it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

===

On a side note, while commenting on analyses, please keep the Pillars of the Community in mind. It’s great to provide points that help others be more objective. However, it’s important to focus on the facts and discuss them in a dignified manner. There is not much of the latter in personal attacks. As more and more people join our community, it is important to keep it friendly. Being yourself, even to the point of swearing, is great, but the point is not to belittle other people or put them in a position of “shame” (whether it works or not). Everyone can make mistakes, and everyone does, in fact, make mistakes. We all here have the same goal: to have a greater understanding of the markets and pick better risk-to-reward situations for our trades. We are on the same side.

On another – and final – side note, the number of messages, comments etc. that I’m receiving is enormous, and while I’m grateful for such engagement and feedback, I’m also starting to realize that there’s no way in which I’m going to be able to provide replies to everyone that I would like to, while keeping any sort of work-life balance and sanity ;) Not to mention peace of mind and calmness required to approach the markets with maximum objectivity and to provide you with the service of the highest quality – and best of my abilities.

Consequently, please keep in mind that I will not be able to react / reply to all messages. It will be my priority to reply to messages/comments that adhere to the Pillars of the Community (I wrote them, by the way) and are based on kindness, compassion and on helping others grow themselves and their capital in the most objective manner possible (and to messages that are supportive in general). I noticed that whatever one puts their attention to – grows, and that’s what I think all communities need more of.

Sometimes, Golden Meadow’s support team forwards me a message from someone, who assumed that I might not be able to see a message on Golden Meadow, but that I would notice it in my e-mail account. However, since it’s the point here to create a supportive community, I will specifically not be providing any replies over email, and I will be providing them over here (to the extent time permits). Everyone’s best option is to communicate here, on Golden Meadow, ideally not in private messages (there are exceptions, of course!) but in specific spaces or below articles, because even if I’m not able to reply, the odds are that there will be someone else with insights on a given matter that might provide helpful details. And since we are all on the same side (aiming to grow ourselves and our capital), a to of value can be created through this kind of collaboration :).

Thank you.

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief