Briefly: in our opinion, full (250% of the regular size of the position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this Alert.

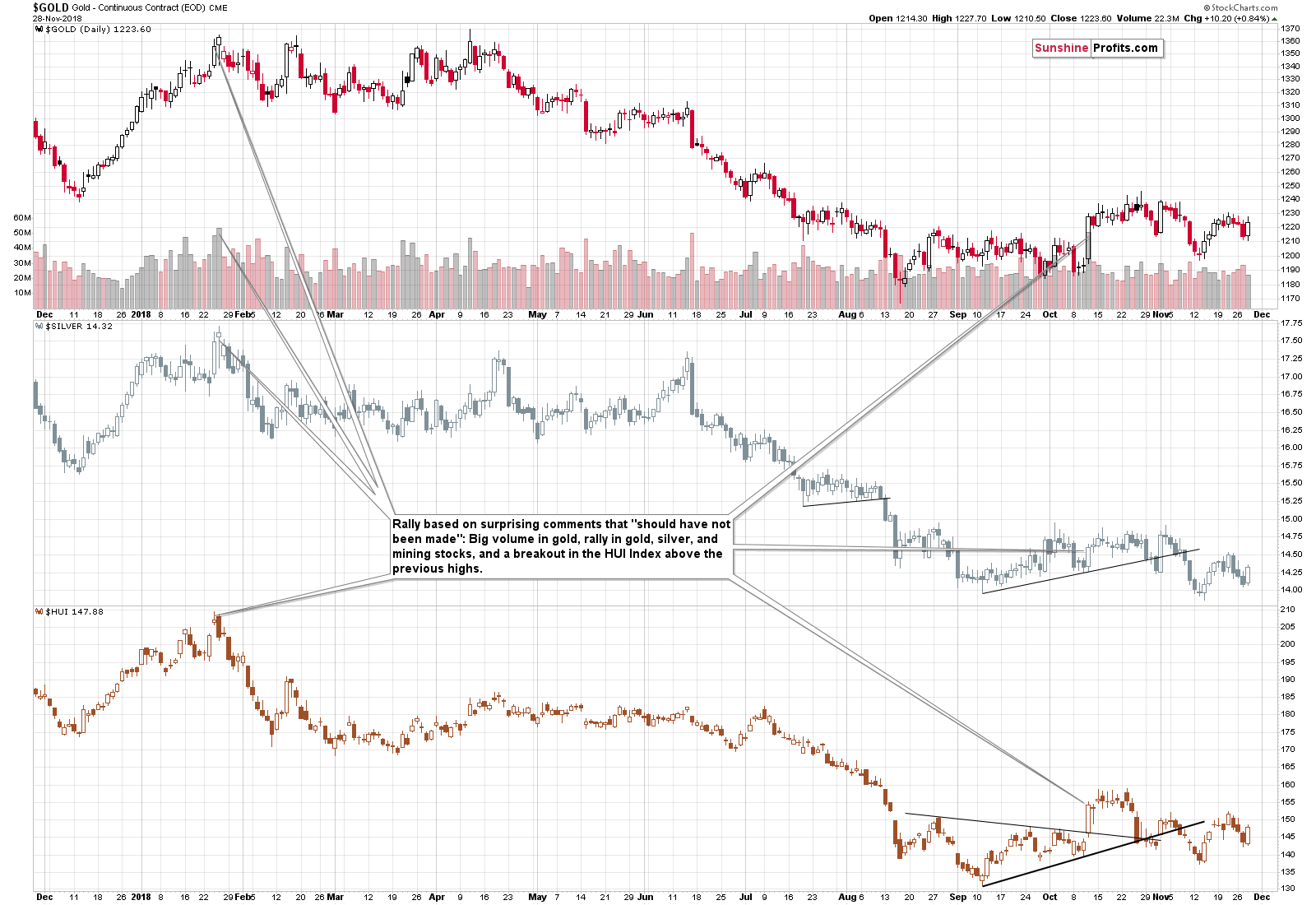

Powell’s comments triggered a substantial rally in gold, silver, and mining stocks simultaneously causing a decline in the USD Index. If the Fed really changed its approach toward raising interest rates, shouldn’t gold rally from here?

It might, but only for a few weeks, but it’s not likely that this will happen at all. Why? Because the Fed didn’t indicate a change in its approach toward the idea of increasing interest rates further.

During a speech before the Economic Club of New York, Fed’s Chair – Jerome Powell said that interest rates were “just below the broad range of estimates of the level that would be neutral for the economy.” The above was interpreted by the market as something dovish.

But is it really dovish? Absolutely not. What is “just below”? 10%? What is a broad range of estimates? Is 10% - 20% broad enough?What would any of the above imply for the Fed and why? What was clearly stated in terms of implications? Nothing.

The market was likely looking for a reason to rally after the sizable corrective downswing and Powell delivered it – quite likely intentionally.

Trump said that he wants to have lower interest rates or at least that they shouldn’t be increased so quickly. However, most likely, he really wanted the stock market to stop declining and – most of all – he most likely didn’t want to be the one to blame for the decline.

What could Powell do? He could admit that the Fed is not independent and say that they will no longer be raising the interest rates, but that would clearly do more harm than good, as the Fed’s reputation would be shattered. Or he could ignore Trump’s request completely and do nothing (or even say that they will not bow to anyone)… For some reason he may not want to make the angry President of the United States of America even angrier. And it’s not that surprising. So why not come up with something in between? And it seems that he did just that.

The Fed didn’t say that they changed anything regarding the interest rate hike plan. And yet, what Powell said was viewed by the market as dovish. Since nothing really changed, the outlook didn’t change either. The market will soon realize that it overreacted and the trends will be back to normal. This means a move lower in the precious metals sector, and a move higher in the USD Index. In case of the general stock market, it could be the case that Powell’s comments were enough to stop the decline and that the preceding long-term uptrend will resume as well.

Technically, nothing really changed. Gold, silver and mining stocks approximately erased the previous two days of declines and the outlook is just as it was three days ago. And it was bearish because of the long-, and medium-term factors. These factors have not changed at all based on Powell’s comments and thus the outlook remains very bearish for the following weeks.

One thing that we would like to point out about yesterday’s session, though, is that gold moved higher on volume that was smaller than the volume on which it had declined on the previous day. That’s a bearish sign as the volume often increases when the market moves in its true direction. In this case, that’s down.

Summing up, the outlook for the precious metals market remains very bearish for the following weeks and months and short position remains justified from the risk to reward point of view, even if we see a few extra days of back and forth trading or even a small brief upswing. It is a very high probability of a huge downswing that makes the short position justified, not the outlook for the next few days. It seems that our big profits on this short position will become enormous in the future and that we will not have to wait much longer. Gold’s inability to rally on the increased geopolitical tensions regarding Ukraine confirm this scenario and since Powell’s speech didn’t change anything (despite causing some short-term price action), the downtrend will likely resume shortly.

As always, we’ll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short positions (250% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and exit profit-take price levels:

- Gold: profit-take exit price: $1,062; stop-loss: $1,257; initial target price for the DGLD ETN: $82.96; stop-loss for the DGLD ETN $49.27

- Silver: profit-take exit price: $12.32; stop-loss: $15.11; initial target price for the DSLV ETN: $47.67; stop-loss for the DSLV ETN $28.37

- Mining stocks (price levels for the GDX ETF): profit-take exit price: $13.12; stop-loss: $20.83; initial target price for the DUST ETF: $80.97; stop-loss for the DUST ETF $27.67

Note: the above is a specific preparation for a possible sudden price drop, it does not reflect the most likely outcome. You will find a more detailed explanation in our August 1 Alert. In case one wants to bet on junior mining stocks’ prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and target prices:

- GDXJ ETF: profit-take exit price: $17.52; stop-loss: $31.23

- JDST ETF: initial target price: $154.97 stop-loss: $51.78

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Important Details for New Subscribers

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Stocks rallied on Wednesday following breaking out above their week-long consolidation. The S&P 500 accelerated higher after breaking above 2,700 mark. Will the uptrend continue? Or is this just another advance within a consolidation following October sell-off?

Powell spoke yesterday. The gold market considered his remarks as dovish. And the market is always right, isn’t it?

Should Gold Bulls Open Champagne?

In the previous week, GBP/USD wavered around the lower border of the declining trend channel. Yesterday, currency bears pushed the pair below it, testing the mid-November low. Will we see a post-double-bottom rally in the following days?

GBP/USD – Double Bottom or Further Declines?

=====

Hand-picked precious-metals-related links:

Fed's Powell Shakes Gold Out of Its Doldrums, Energizes Copper

=====

In other news:

Stocks rise, dollar sags on signs of more cautious Fed

Don't Count on the Fed Saving Stocks Again

Powell Opens Door to Possible Pullback in Fed Rate-Hike Outlook

Russia blocks Ukrainian Azov Sea ports: minister

S&P flags credit-boom risks in China amid trade war

Oil Tumbles Below $50 First Time in Year on Russia Output Stance

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts