Briefly: in our opinion, full (300% of the regular position size) speculative short positions in mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

And so it happened; the United States of America has a new President. Joe Biden took office yesterday (Jan. 20) and there were no major disruptions across the country, just as I wrote previously. Gold rallied and the USD Index declined, quite likely based on inauguration-related uncertainty, but Janet Yellen seems to have added some fuel to these moves by making dovish remarks with regard to the necessity to “‘act big’ to revive a flagging economy”. On the other hand, Yellen said she doesn’t want the dollar to weaken, claiming that she simply wants the value of currencies to be determined by the markets. She also said that cryptocurrencies should be “curtailed”.

On a side note, the above is my biggest problem with the cryptocurrency market. I enjoy tech innovations and seeing how they improve people’s health and quality of life, and I’m not a neo-Luddite by any means, but part of my responsibility is to be as realistic as possible and report my findings to you. So… let’s keep in mind that wars started over the ability to control a given area’s money, and now governments would be expected to just give this power away?

If everyone or most people switch to cryptocurrencies and actually use them on a day-to-day basis, who will care about the interest rates set on some non-crypto currencies like the dollar and the euro? Naturally, there are debts that were taken on using the “regular” currencies, so that’s that, but the more people move to cryptos, the less power over the economy the governments would have. They are not that concerned with gold (at least not right now), as its inconvenient to be used on a day-to-day basis, besides, the world is moving away from tangible forms of money toward their electronic form. This is why cryptocurrencies are a threat that the powers that be can’t ignore. They’ve been pretending that it’s not a big deal, in order to not give the cryptos additional exposure or confirm that they are something to be concerned about (ignore it, maybe it’ll go away…), but at some point, they will have to admit that it’s becoming a problem for them – and that’s what Janet Yellen just effectively said.

One can hide gold or silver and use it on a black market, because its easily recognizable by everyone. With cryptocurrencies and ubiquitous online tracking, it’s much more difficult. My point here is that when cryptos become big enough to really threaten the financial system, they will be pushed back very hard. And it would be very easy to do so for the powers that be. Govt’s would risk severe backlash in this case, so they will not want to proceed until they feel that they have to, but Yellen’s comments are important as they show that this process might have already started.

With that said, let’s get back to the precious metals market.

The need to act big to revive the economy has been obvious for a long time and effectively this doesn’t change anything. The Fed is already in the middle of the open-ended QE, so it still prints as much as it wants. You can’t really get much more dovish than that. And gold still declined since August, invalidating its breakout above the 2011 high – which is a critical sign of weakness.

Consequently, it doesn’t seem to me that Yellen’s comments or the inauguration itself would be likely to trigger any lasting rally in gold. Sure, we might see a small upswing just because gold rallied visibly yesterday and some people want to jump on this bullish wagon, but in my view, this wagon is still heading for a cliff – a decline in the next several weeks / months very much remains in the cards.

Figure 1 – COMEX Gold Futures

Looking at the above chart, I marked the November consolidation with a blue rectangle, and I copied it to the current situation, based on the end of the huge daily downswing. Gold moved briefly below it in recent days, after which it rallied back up, and right now it’s very close to the upper right corner of the rectangle.

This means that the current situation remains very similar to what we saw back in November, right before another slide started – and this second slide was bigger than the first one. Consequently, there’s a good reason for gold to reverse any day (or hour) now.

Besides, there’s also a declining resistance line just around the corner.

And that’s not even the most important thing. The most important thing is that based on the similarity to how things developed between 2011 and 2013, gold’s downward trajectory is likely to have periodic corrections at this time – up to a point where it simply plunges.

Figure 2 - GOLD Continuous Contract (EOD)

When the current situation is compared to what we saw about a decade ago, it shows what one should expect, assuming that the history repeats itself.

Gold kept on declining with corrections along the way until April. In April, the decline accelerated profoundly. The biggest problem with the latter was that practically nobody expected this kind of volatility. Those who were thinking that it’s just another move lower that will be reversed were very surprised.

Right now, you know in advance that a bigger move lower is likely just around the corner, and you won’t be surprised when it comes. Whether we have to wait an additional few days or first see gold rally by $10 or $30 is not that important, if it’s about to slide $150 and then another $200 or so.

Figure 3 - COMEX Silver Futures

Silver corrected a bit more of this year’s downswing than gold, which is normal given the bearish outlook. The same goes for miners’ underperformance. Let’s keep in mind that silver’s “strength” is temporary – once the decline really starts, and it moves to its final part, silver is likely to catch up big time.

Figure 4 - VanEck Vectors Gold Miners ETF

Mining stocks didn’t correct half of their 2021 decline. They didn’t invalidate the breakdown below the rising support line, either. In fact, the GDX ETF closed yesterday’s session below the 50-day moving average. Technically, nothing changed yesterday.

Please note that the November – today consolidation is quite similar to the consolidation that we saw between April and June (see Figure 4 - green rectangles). Both shoulders of the head-and-shoulder formation can be identical, but they don’t have to be, so it’s not that the current consolidation has to end at the right border of the current rectangle. However, the fact that the price is already close to this right border tells us that it would be very normal for the consolidation to end any day now – most likely before the end of January.

If we see a rally to $37, or even $38, it won’t change much – the outlook will remain intact anyway and the right shoulder of the potential head-and-shoulders formation will remain similar to the left shoulder.

However, does the GDX have to first rally to $37 or $38 to decline? Absolutely not. It could turn south right away, thus surprising most market participants.

Figure 5 – USD Index

In Tuesday’s (Jan. 19) analysis, I commented on the above USD Index chart in the following way:

The USD Index is after a major breakout above the declining resistance lines and this breakout was confirmed. Consequently, the USD Index is likely to rally, but is it likely to rally shortly? The answer to this question is being clarified at the moment of writing these words, because the USD Index moved back to its rising short-term support line that’s based on the 2021 bottoms.

If the USD Index breaks below it, traders will view the 2021 rally as a zigzag corrective pattern and will probably sell the U.S. currency, causing it to decline, perhaps to the mid-January low or even triggering a re-test of the 2021 low.

If the USD Index performs well at this time and rallies back up after touching the support line, and then moves to new yearly highs, it will be then that traders realize that it was definitely not just a zigzag correction, but actually the major bottom. In the previous scenario, they would also realize that, but later, after an additional short-term decline.

It's now clear that the former scenario is being realized. The support levels that could trigger the USD’s reversal are based on the potential inverse head-and-shoulders pattern - the red line that’s slightly above 90, and the horizontal line that’s slightly below it. It’s also possible that the USD Index tests it yearly lows. None of the above would be likely to change the outlook for the precious metals sector, at least not beyond the immediate term.

Stocks rallied yesterday, and based on this rally, the weekly RSI moved close to 70 once again.

Figure 6 – S&P 500 Index

This is important because the last two major declines were preceded by this very signal. We saw the double-top in the RSI at about 70, exactly when the stock market started its big declines, and we’re seeing the same thing right now. If this was the only thing pointing to much lower stock values on the horizon, I would say that the situation is not so critical, but that’s not the only thing – far from it. Before moving to these non-technical details, let’s recall why the stock market analysis and the USD index analysis matters for precious metals investors and traders.

The analyses matter because gold, silver, and mining stocks are likely to decline in parallel with a decline in stocks and the USD’s rally. This is likely to take place up to a certain point, when precious metals show strength and refuse to decline further despite the stock market continuing to fall and the USDX continuing to rally. This kind of performance happened many times, including in the first half of last year.

Having said that, let’s discuss some non-technical issues.

The Record Player

With the museum of speculation adding more and more artifacts by the day, the U.S. equity collection may be in need of a bigger building.

Yesterday, the percentage of NASDAQ Composite companies trading above their 200-day moving average hit its highest level since 2004.

Please see below:

Figure 7 – (Source: Bloomberg/ Liz Ann Sonders)

And to highlight why averages exist in the first place, notice the identical pattern that emerged from 2009 to 2010 (the red boxes)? Following the 2008 financial (housing) crisis, U.S. equities bottomed in March of 2009. Several months later, euphoria took hold and the percentage of NASDAQ Composite companies trading above their 200-day MA surged back to record levels (near the end of 2009).

Another happy ending?

Not quite.

As valuations decoupled from reality, a Minsky Moment struck in early 2010, with the NASDAQ Composite plunging by more than 17% in just over two months.

Please see below:

Figure 8 – NASDAQ Composite Index

If that wasn’t enough, junk bonds (as a group) now trade at their highest price (and lowest yield) ever. For context, the chart below depicts the yield of junk bonds – an all-time low of 4.13%; and because yield is the inverse of price, it means that prices are at all-time highs.

Figure 9 – (Source: Bloomberg/ Lisa Abramowicz)

To explain, a company’s capital structure is made up of different financial instruments: on one side of the coin, you have senior secured bonds (the least risky because they have first claim on real assets); on the other side, you have equity (the riskiest because investors have from little to no recourse during bankruptcy). And sitting just a smidge above equity? Junk bonds. They trade like equity, they’re valued like equity and their risks are similar to equity. Being so far down in the capital structure, junk bond investors also leave empty handed during bankruptcies).

The key takeaway?

While the intricacies of corporate balance sheets aren’t important here, the message being sent is. Investors are eagerly throwing good money at bad investments, and eventually, the reckless behavior will come back to bite them.

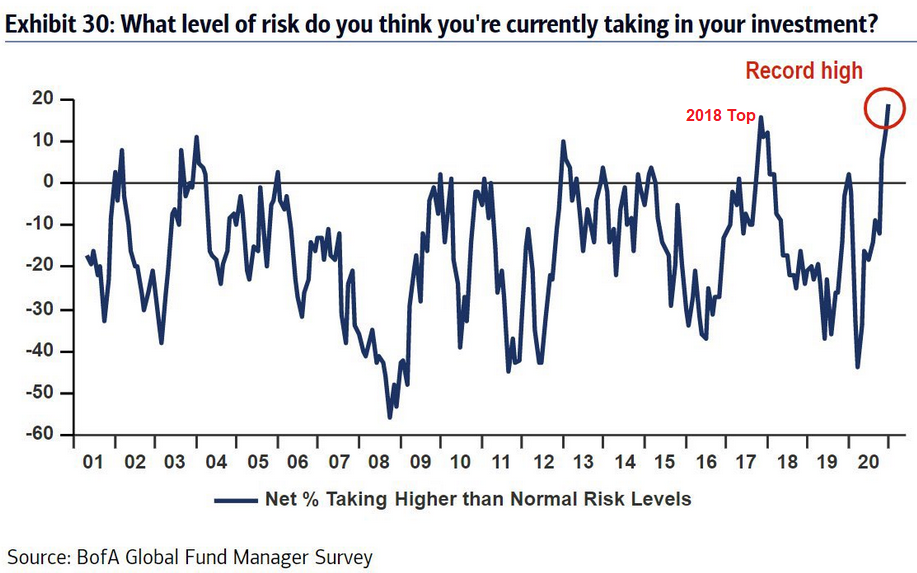

As further evidence, I highlighted (yesterday) that fund managers surveyed by Bank of America are ‘all aboard’ the equity train.

I wrote:

Figure 10

Unable to cash out of the U.S. equity casino, fund managers admitted to taking the most risk ever to achieve acceptable returns. And serving as a cherry on top, the ‘all aboard’ mentality has also coincided with fund managers’ cash balances hitting their lowest level since 2013.

Well, fast forward another day and we have another warning sign. Yesterday, the U.S. equity put/call ratio hit its lowest level since the dot-com bust.

Please see below:

Figure 11 – (Source: Bloomberg/ Liz Ann Sonders)

To explain, the above chart depicts the ratio (the 5-day moving average) of the number of put options purchased versus the number of call options purchased (Remember, investors purchase call options when they think an asset will appreciate and they purchase put options when they think an asset will decline.)

With the blue line moving lower, it means that more call options are being purchased than put options (and vice versa). Thus, with today’s ratio at its lowest level since 2000, it highlights how risk management has been thrown out the window.

In addition, notice how the early 2010 reading (the red circle above) aligns with the 200-day MA data (the first chart) – with both mirroring the behavior we’re seeing today?

History has proven that investors can only stretch the rubber band for so long. And with everyone crowded towards one side, when it eventually snaps, the drawdown will be fast and furious. Moreover, this kind of behavior is how 17% declines happen in just over two months.

As a closing argument, please see the chart below:

Figure 12

As stocks were making their parabolic move higher, corporate insiders sold more shares during the first two weeks of 2021 than ever before (with data going back to 1988).

To explain the significance, I wrote on Dec. 30:

Insiders are executives of S&P 500 companies who periodically buy and sell their own stock. Because ‘insiders’ possess inside information about their companies’ fundamentals, their buying/selling activity is a reliable indicator of the markets’ future prospects.

And speaking directly to the chart above, the black line (positioned at the top-half) depicts the ratio of insider sales versus insider purchases. If you focus on the area at the top-right of the chart (the yellow circle), you can see that recent insider sales outweighed purchases by nearly 8 to 1.

The bottom line?

Despite gold boarding the equity train yesterday, insiders (who actually work for these companies that investors are panic buying) are practically jumping out of the window. As a result, gold’s relationship with U.S. equities (the S&P 500) is both a gift and a curse.

Please see below:

Figure 13

While supportive on the upside – because gold and the S&P 500 have a relatively tight bond –equity tantrums tend to wake up the gold market. And with the clock ticking towards the next outburst, once it hits, it will likely be a while before the yellow metal calms down.

Letters to the Editor

Q: I came out of gold too soon but have dollars which I need to convert into GBP. What is your view of the exchange rate going forward, as I can hold off exchanging if you think the pound will soften while the USD strengthens.

A: I think (my opinion) that the USD will strengthen against other currencies, including the GBP. I don’t have a specific target in mind, though. I will be covering the USD Index in the Alerts, so when I write about the rally being over or close to being over in the USDX, the opposite might be the case with regard to the GBP/USD pair. I expect this to happen after gold bottoms, though. Again, it’s just my opinion, not investment advice.

Q: Thank you for your great work, both technical and fundamental.

I also much appreciate your analyses covering USD trends.

For Canadians, it would be great to see some remarks in the trading alerts about the CAD and its correlation to the USD in instances where it may affect Gold & Silver and Gold & Silver stocks trading in CAD.

A: Thank you for your kind words, I’m very happy to hear that you enjoy reading my analyses. It wouldn’t be possible for me to cover multiple currencies on each day (to be fair, I’d need to cover many more individual currencies as we have subscribers all over the world) and the CAD/USD currency pair is not directly related to the performance of the precious metals sector (it seems quite linked to crude oil, though). However, I can say that the USD part of the currency pair seems much more important right now, because of the critical situation in which the U.S. currency is currently in. So, the upswing in the CAD/USD that we saw last year is likely to be reversed (at least to a considerable extent) just as the USD Index is likely to reverse its decline (at least to a considerable extent).

Q: PR - Thank you for your detailed analysis today (Jan 19th).

The case you make for Gold dropping is very solid and extremely helpful.

To sum up: a rising US dollar; a rising 10-year yield; a rising 10-year treasury inflation adjusted index; record call options; record RAI; record shorts on the dollar; record long on the markets; a falling EUR; record losses forecasted on European banks; record debt to GDP etc.

Given that the above case indicates a high probability of an event or series of events resulting in volatility in both stock markets and precious metals markets, it would be helpful to lay out a case of what to look for in order to enter a long position in gold --- aside from a rising dollar while gold rises simultaneously. In other words, using each of the points you have highlighted (US Dollar, yields, etc.), what would we be looking for to build a solid case, like you have done for us, to take short positions or to take long positions in the near future.

I do realize it would be to some degree the opposite of the case you have built!

This is really to know what kind of levels to look for with regards to the US dollar, yields, etc., --- beyond GDX being at a certain level and gold hitting a certain dollar level.

A: That’s a very good question, thank you. My reply might be surprising, because it really IS mostly about looking for the day (or a few days) when gold is rising despite the rally in the USD Index.

To clarify, I expect that we’ll see this strength in gold well before the USD Index tops, general stock market bottoms, and likely months before we see changes on the fundamental front. And since all these other indications are likely to take place later, when they do, the buying opportunity will be long gone.

So, what we want to focus on here are the high-quality, high-probability-of-working indications that we’ll see at the very beginning of the turnaround. The best tool to do that in my view is to monitor the relative strength of the key markets and see if they are doing what they have usually done while bottoming. The high-quality early birds of signals that I’m looking for are:

- Gold being strong despite the USD’s strength, and despite other things that should make gold decline (or that have had this effect up to “this” time), this includes the stock market, but it could also include hawkish comments from the Fed, after which gold should plunge – if it reverses and rallies, it will also be a very strong indication that the bottom is in. Focusing on the USD Index covers most of such points (it would most likely rally given the above-mentioned comments). This point is most important.

- Mining stocks that were either strong on a daily basis in case of high volatility (like what we saw in March 2020), or strong for several days (or weeks) despite weakness in gold. This part is tricky, because after a relatively long time of strong performance (not declining despite gold’s declines), miners might then break lower on a very temporary basis, pretending to be weak once again. That’s how the early 2016 bottom formed, for example.

- Silver being already after a severe plunge during which it “caught up” with the pace of the decline of mining stocks.

- There’s a big disparity between individual mining stocks – some plunge while some stay strong on a given day.

Naturally, I’ll keep you updated through my Gold & Silver Trading Alerts.

Overview of the Upcoming Decline

- As far as the current overview of the upcoming decline is concerned, I think it has already begun.

- During the final part of the slide (which could end within the next 1-12 weeks or so), I expect silver to decline more than miners. That would align with how the markets initially reacted to the COVID-19 threat.

- The impact of all the new rounds of money printing in the U.S. and Europe on the precious metals prices is incredibly positive in the long run, which does not make the short-term decline improbable. Markets can and will get ahead of themselves and decline afterward – sometimes very profoundly – before continuing with their upward climb.

- The plan is to exit the current short positions in miners after they decline far and fast, but at the same time, silver drops just “significantly” (we expect this to happen in 1 – 5 weeks ). In other words, the decline in silver should be severe, but the decline in the miners should look “ridiculous”. That’s what we did in March when we bought practically right at the bottom . It is a soft, but simultaneously broad instruction, so additional confirmations are necessary.

- As a point of reference, given that the inverse pattern above mirrors today’s price action, the duration of the precious metals’ decline could last longer than my initial forecast. Keep in mind though, a prolonged bear market is not my base case; I’m merely indicating that the possibility exists.

- In absence, I expect a bottom to form with gold falling to roughly $1,700 - $1,750 . If – at the same time – gold moves to about $1,700 - $1,750 and miners are already after a ridiculously big drop (say, to $31 - $32 in the GDX ETF – or lower), we will probably exit the short positions in the miners and at the same time enter short positions in silver. However, it could also be the case that we’ll wait for a rebound before re-entering short position in silver – it’s too early to say at this time. It’s also possible that we’ll enter very quick long positions between those short positions.

- The precious metals market's final bottom is likely to take shape when gold shows significant strength relative to the USD Index . It could take the form of a gold’s rally or a bullish reversal, despite the ongoing USD Index rally.

Summary

Summing up, while we might see the continuation of the counter-trend upswing for the next few days, the outlook for gold and the rest of the precious metals market is bearish for at least the next few weeks.

After topping at its triangle-vertex-based reversal, gold moved sharply lower and it just invalidated the breakout above its declining resistance line, while breaking below the rising support line. All this happened as the USD Index rallied visibly above its declining resistance lines and invalidated the breakdown below the 2020 lows. This creates a strongly bearish combination for the precious metals market.

The USD Index and cryptocurrencies suggest that we’re seeing the repeat of early 2018, when the USD Index bottomed. Given the current correlations between PMs and the USD Index, the rally in the USDX is likely to have very bearish implications for the precious metals market.

Despite a recent decline, it seems that the USD Index is going to move higher in the following months and weeks, in turn causing gold to decline. At some point gold is likely to stop responding to dollar’s bearish indications, and based on the above analysis, it seems that this is already taking place.

Naturally, everyone's trading is their responsibility. But in our opinion, if there ever was a time to either enter a short position in the miners or increase its size if it was not already sizable, it's now. We made money on the March decline, and on the March rebound, with another massive slide already underway.

After the sell-off (that takes gold to about $1,500), we expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

Most importantly, please stay healthy and safe. We made a lot of money on the March decline and the subsequent rebound (its initial part) price moves (and we'll likely earn much more in the following weeks and months), but you have to be healthy to enjoy the results.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in mining stocks is justified from the risk to reward point of view with the following binding exit profit-take price levels:

Senior mining stocks (price levels for the GDX ETF): binding profit-take exit price: $32.02; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the DUST ETF: $28.73; stop-loss for the DUST ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

Junior mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $42.72; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the JDST ETF: $21.22; stop-loss for the JDST ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway. In our view, silver has greater potential than gold does):

Silver futures downside profit-take exit price: unclear at this time - initially, it might be a good idea to exit, when gold moves to $1,703.

Gold futures downside profit-take exit price: $1,703

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief