Briefly: in our opinion, full (250% of the regular position size) speculative short positions in mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

Practically all markets moved against their main trends yesterday. Gold, silver, and miners - as well as stocks - moved higher, while the USD Index moved lower, at least initially. What gives? Why did all these moves take place, and how much did they change in the overall outlook?

The reply to the first question is that it was probably a technical rebound - some markets had to take a breather (stocks, for instance) and this changed the shape of the top / decline. Of course, that's in addition to the fact that gold made headlines yesterday, with the $3000 BofA prediction being made right in the title. None of these are likely to change the prevalent trend, unless we see major - and confirmed - breakouts above key technical levels. Have we seen them? Based on the reply to this question, the outlook has changed or it hasn't.

Let's take a closer look.

USDX in Focus

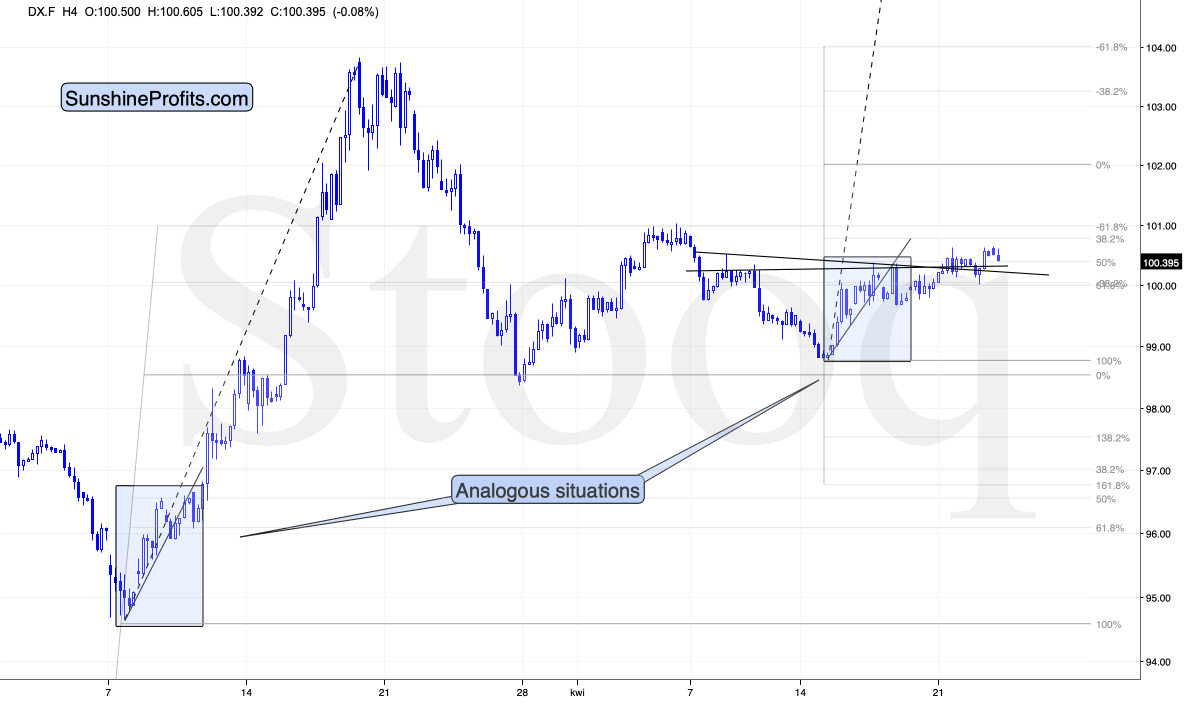

In short, the self-similarity to early-March continues, which means that our previous comments on the above chart remain up-to-date with a slight modification:

The USD index soared after forming an intraday reversal. It then declined, rallied back up, and declined quickly once again - all just as it did in early March.

The final 4-hour decline was sharp and it took place as the USDX broke below the rising support line that was based on the early intraday lows. We saw the analogous decline on Friday, and the USD Index has been moving slowly up since that time. Both situations are very similar from the pattern point of view.

Back then, the analogous price action triggered further upswings, which translated into lower prices of the precious metals. The bearish implications remains in place at this time as well.

Please note that the recent price action also almost created an inverse head and shoulders pattern (we'll have H&S patterns in other markets as well). Once the USD Index breaks above the mid-April highs, the pattern will be complete, and it would like result in a rally to about 102 level.

The modified update is that the inverse H&S pattern was already completed. Regardless of whether one chooses to draw the neckline of the pattern by connecting the 4-hour closes, or based on the recent intraday highs, we saw a breakout and it is being verified at the moment of writing these words.

Yesterday's early decline seemed like an invalidation of the pattern, but the USDX soon moved back up once again. At the moment of writing these words, the USDX is trading above the neckline of the pattern regardless of how one chooses to (reasonably) draw it.

Let's dig deeper. There are two key components on the USD Index: the euro and the yen (their exchange rates with the US dollar). Let's take a look at both of them.

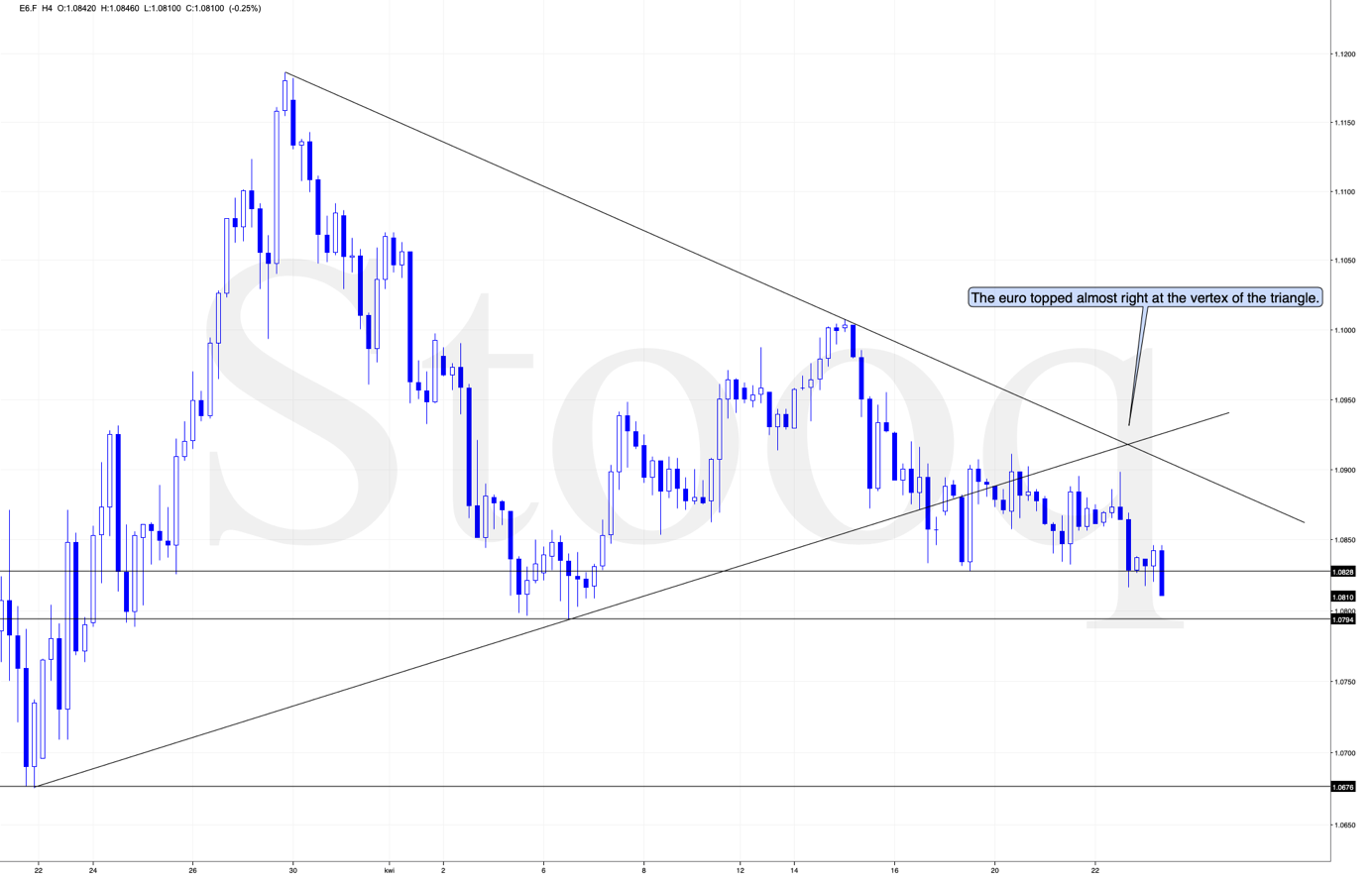

The euro just broke below its mid-April lows, shortly after topping almost exactly at its triangle-vertex-based reversal. The next support is provided by the early-April lows, but given the reversal, the odds are that the currency won't spend a lot of time at this support and instead decline more after a brief pause.

And the Japanese yen?

It also broke below its rising support line. In fact, it broke below two support lines and both breakdowns were already verified. After the second verification, the yen started to move lower in a specific manner. Namely, while it failed to move to new lows during the declines, it continuously formed lower highs, while the volatility declined.

This indicates that the yen is most likely preparing for a bigger move (as the declining volatility hints) and that the move is likely to be to the downside (both breakdowns were verified, plus the highs descend at greater pace than the lows ascend).

This means that nothing changed in case of the USD Index and its outlook - it remains bullish - and this is the case not only because of the inverse head and shoulders pattern, but most importantly because of all the factors that we outlined in this week's flagship Gold & Silver Trading Alert.

This means that the bearish implications for the precious metals market remain intact. While the USD Index has been moving higher relatively slowly, we don't expect this to continue for much longer. Once people get more scared, for instance because of prolonged lockdowns or rapid increases in new cases and/or death toll (which would lead to prolonged lockdowns) and/or declining stock markets around the world, the trend is likely to accelerate.

Stock Market Lessons for Gold

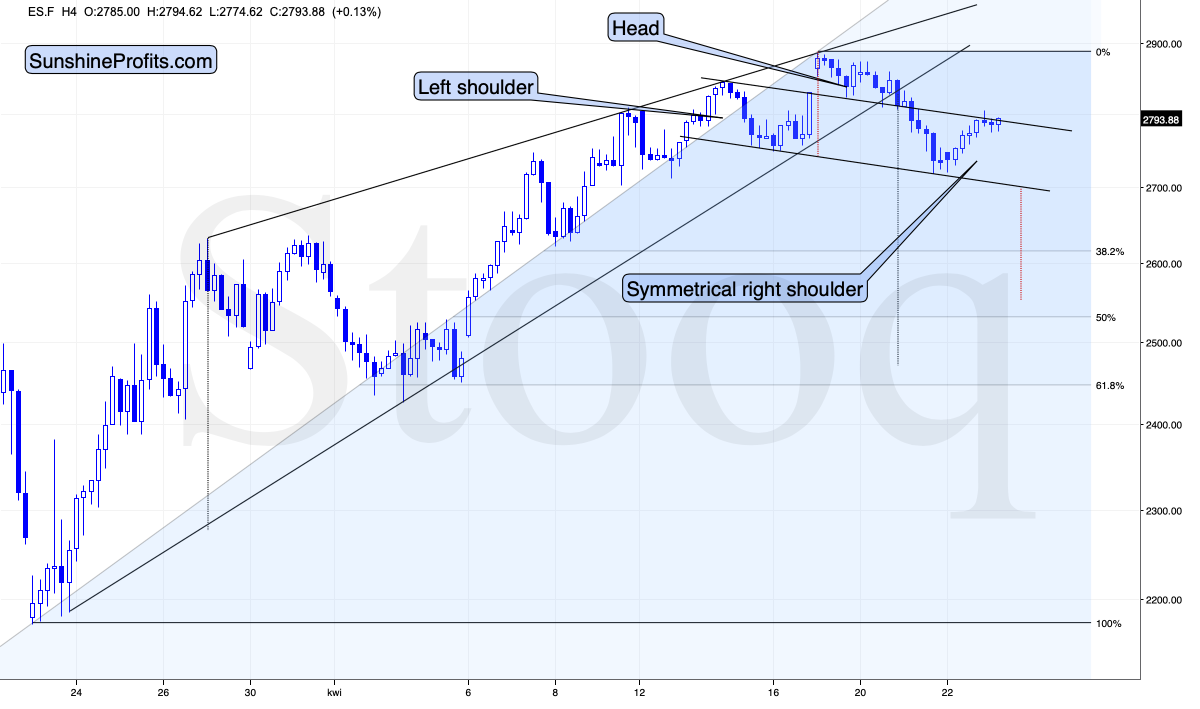

Stocks moved higher yesterday, but they were very far from invalidating their recent breakdown below the rising support line. Instead, the rally stopped at the line that's parallel to the neck level of what could become a head and shoulders pattern. Creating such lines allows us to see how high should a given market rally for the pattern to be symmetrical. These patterns don't have to be perfectly symmetrical, but quite often they tend to be.

This doesn't change the outlook for the general stock market, especially that other stock markets around the world have also failed to invalidate their own breakdowns.

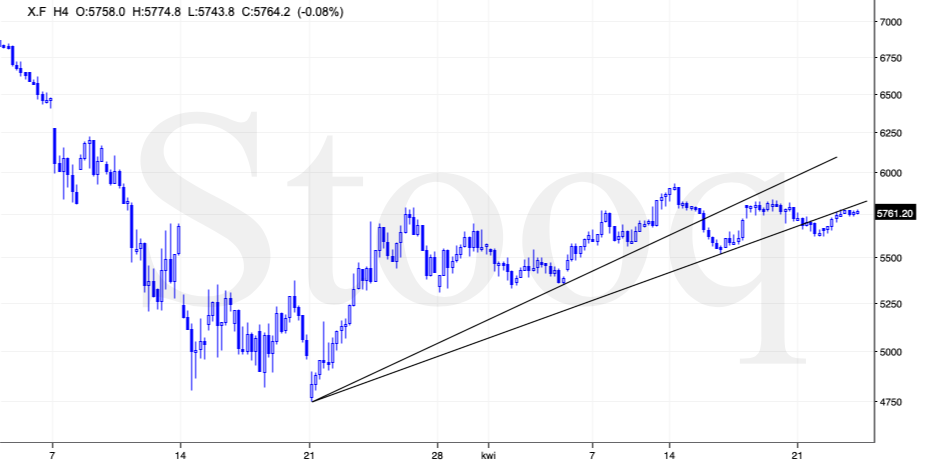

Here's the Japan's Nikkei 225 breakdown:

And here's German DAX's breakdown:

And here's the British FTSE and its breakdown (actually 2 breakdowns):

All these breakdowns remain intact. What we saw yesterday, was a corrective upswing that followed the breakdown. Are such upswings game-changers? Quite the opposite - they are relatively normal. The market is trying to move back above the previously broken support line and once it fails, it becomes clear that the price really doesn't want to move higher, but lower.

We're likely in this stage of the decline. In case of the S&P 500 futures, this correction could become the right shoulder of the bearish head and shoulders formation.

All in all, the outlook for the stock market definitely hasn't changed.

Ok, so, we have two key markets: the USD Index, and the stocks that have not changed their outlook and are likely to resume the trends that they started in March (or much sooner): up in case of the USDX and down in stocks. Back in March gold, silver, and mining stocks fell hard (especially silver and miners), so why they should - at least based on the above - decline shortly as well.

But maybe there are strong and confirmed signs that would point otherwise? Let's check.

Gold's Likely H&S Pattern

Gold made headlines and it rallied - that's a fact. But this doesn't automatically mean that the rally was bullish. A "rally" means that something happened, it doesn't imply anything for the future by itself. Please note that a top can only form after a "rally" - it cannot form after a "decline". The question is if gold's price action was justified given the underlying news, and what happened to the key technical patterns and resistance levels.

Gold's price action was justified as it made headlines.

Gold's price action didn't invalidate any technical patterns. In fact, it made the bearish head and shoulders pattern that we've been describing previously more symmetrical, and clearer.

As you can see gold declined shortly after reaching the price level at which it had topped in early April. It doesn't invalidate the previous pattern - it fits it.

At the same time, gold topped at the 61.8% Fibonacci retracement based on the previous April decline, which is a very reasonable target given that some bullish news emerged (gold made headlines).

So, did anything change with regard to gold's outlook? No. It remains bearish.

Actually, given that today is the day when the initial jobless claims are going to be released, gold (and silver) could temporarily move even higher before declining once again.

What about silver?

Silver's Rally and Its Implications

Silver rallied quite profoundly recently, but please note that it didn't move above the most recent high, and that it still moved in a way that's similar to what happened in early March. Silver broke above two very short-term declining resistance lines back then, and the same happened right now.

Moreover, back in early March, silver corrected almost 50% of the preceding downswing before topping. Right now, it corrected a bit above 50%.

Just as silver topped back then, it might be topping right now.

Similarly to what we see in gold, silver's rally is no reason for bulls to cheer.

Finally, let's take a look at the senior and junior mining stocks.

Miners in the Spotlight

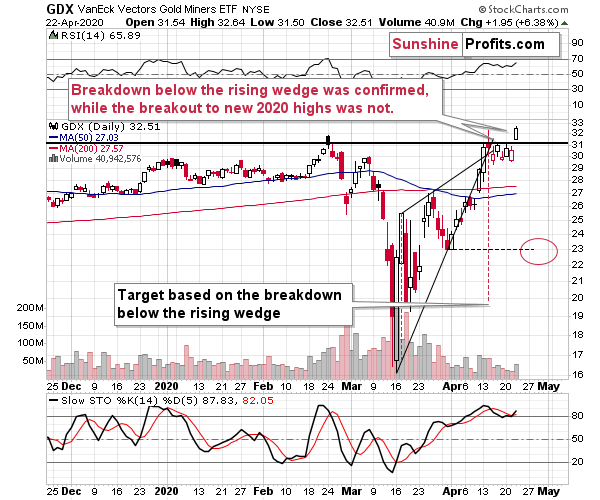

The proxy for seniors - GDX - managed to close at new yearly highs yesterday, which definitely caught the eye of many market participants.

Something major seems to have happened. But did something major really change? The breakout is not confirmed yet, and the situation in all the other markets that we featured so far today suggests that it won't be confirmed. Especially since there was no analogous breakout in junior miners.

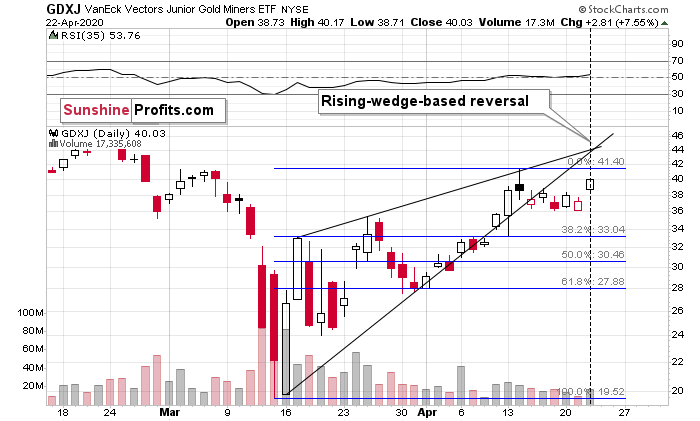

Juniors didn't even manage to move above the previous April intraday highs. On a side note, please note that we wrote that we'll likely have some kind of reversal on Wednesday - it seemed likely that it would be a bottom, but instead it seems that we saw a top instead.

The breakdowns below the rising wedge patterns in both: seniors and juniors were not invalidated, which suggests that the decline is still likely to take place. In fact, given the likelihood for the USDX to rally and stocks to decline, it would be unlikely for miners to move higher.

Finally, before summarizing, we would like to reply to questions that we received recently.

From the Readers' Mailbag

Q: (...) I have sold 1700 Gold Future option calls. Do you feel confident the decline will start tomorrow?

A: I think that gold will decline profoundly within the next 1-3 weeks, and the decline might continue as early as tomorrow. I do think that this is quite likely.

On a side note, we wouldn't suggest selling naked calls for gold as that leaves one exposed to significant geopolitical risk - if anything major happens that scares investors, gold could suddenly jump leaving one very vulnerable. Of course, that's just our general opinion, not an investment advice.

Q1: What is your target price for them in 1-3 week timeframe?

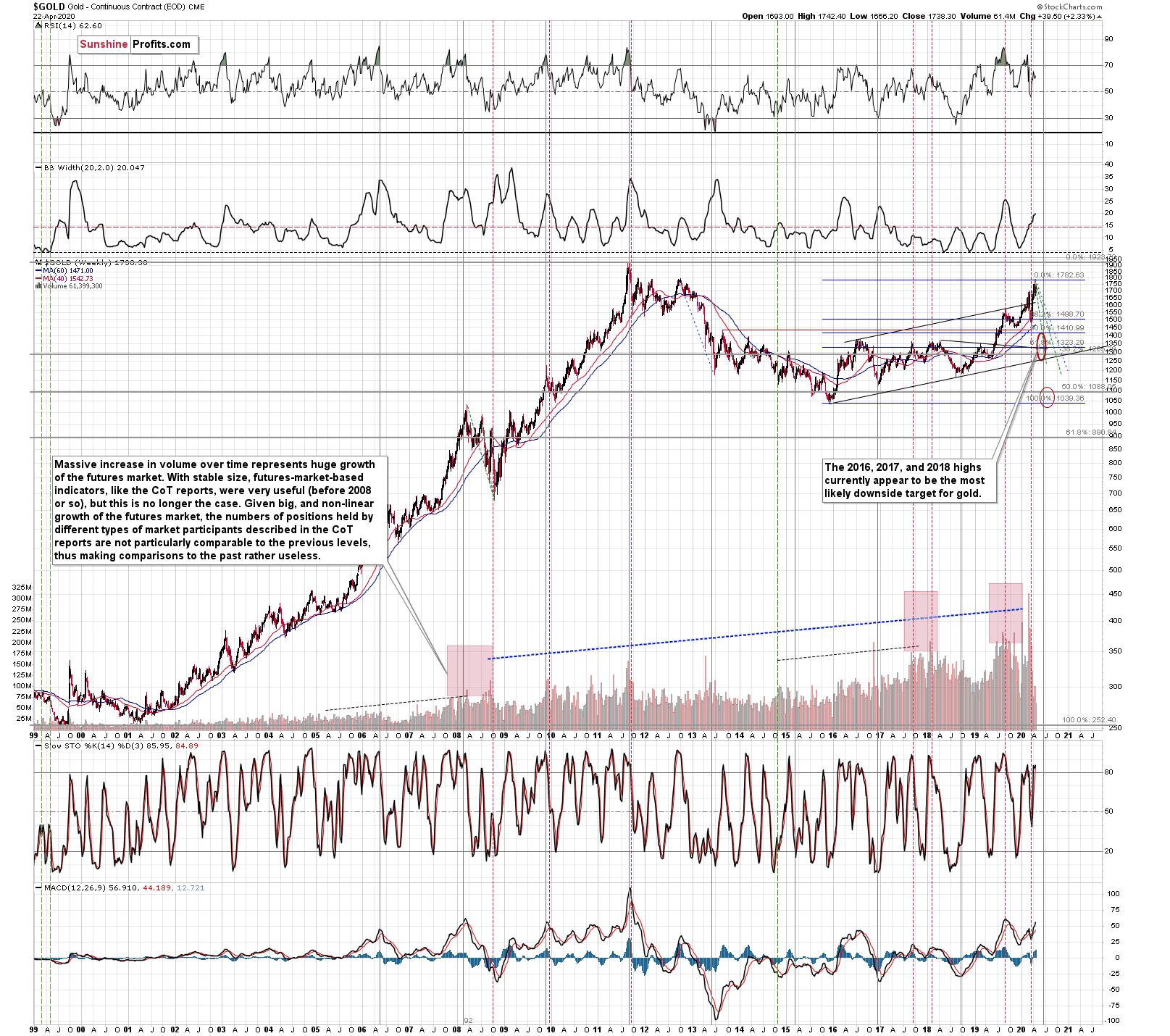

A: Exactly as stated in the "Trading" section in the Summary section of each Gold & Silver Trading Alert. Note: we are updating the price target for gold to $1,382.

Q2: Once we close in on the low in Gold and Silver prices, are you more bullish Gold or Silver for the years ahead once we get to this low?

A: Silver, as far as the following few years are concerned. We expect mining stocks to lead immediately after the bottom, though.

Q3: What percent of a person's overall allocation do you believe Americans with US dollars should make towards Gold and Silver at the upcoming low? 10-20% of total assets?

A: That depends on how much one believes in the precious metals upside potential. It's say the 5% - 20% would be good as insurance in general. I'm personally going to deploy the vast majority of my long-term investment capital into the precious metals market at that time. You will find more details in our gold portfolio report.

Q4: Do you think the breakdown of oil prices due to lack of demand could also happen to a lesser degree to silver prices as we move deeper into deflation given about 84% of silver demand is from manufacturing and jewelry? OR do you think investor demand will overtake any slowing down on the industrial side for silver?

A: We think something in between could happen. Both factors could come into play at the same time, and silver would slide very significantly (into single digits), but we don't think that silver would ever trade below $3, let alone in negative terms. There's no problem with silver storage - it's more bulky than gold, but not as bulky as crude oil.

Q: Looking at the long term gold chart, 2 things come to mind: double top vs cup and handle in the more remote future. What's likely to happen?

A: In our view, a very long-term cup-and-handle pattern is much more likely, and the upcoming slide is likely to be the big handle of the very big - multi-year - cup. This implies - technically - that once the 2011 highs are broken and the breakout is verified, gold is likely to soar very high. And that's in perfect tune with the current fundamental situation. Still, the fundamentals don't determine what's likely to happen in the next several weeks.

Q: Will there ever be a drop in gold and PM's, per your technical analysis?? Does it also imply that President Trump can keep increasing geo political tensions and tariffs and Gold will keep moving up? Is this the end of Bear market of PM's??

A: As you have already read above, we view the drop in the precious metals prices as likely based on the data that we have available right now. It may, but doesn't have to be accompanied by a decrease or increase in the geo-political tensions. We think that people will seek safe haven in the US dollar first and it would make gold price decline. At some point, it would change as gold would refuse to decline despite rallying USD. So far we haven't really seen the big rally in the USD Index despite what we saw in March - and we are likely to see it.

Summary

Summing up, the outlook for the precious metals market remains bearish for the next few weeks despite the very short-term upswing that we saw this week. In fact, based on the way the USD Index moved last week, it seems that the top in the PMs and miners is already in and the final part of the decline has already started.

Gold didn't invalidate the key technical resistance levels yesterday, and neither did silver. Miners' breakout to new 2020 highs in not confirmed, especially since junior miners were unable to rally even above their previous April highs.

After the sell-off, we expect the precious metals to rally significantly. The decline might take as little as 1-3 weeks, so it's important to stay alert to any changes.

Most importantly - stay healthy and safe. We're making a lot of money on these price moves (and we'll likely make much more in the following weeks and months), but you have to be healthy to really enjoy the results.

By the way, we recently opened a possibility to extend one's subscription for a year with a 10% discount in the yearly subscription fee (the profits that you took have probably covered decades of subscription fees...). It also applies to our All-Inclusive Package (if you didn't know - we just made huge gains shorting crude oil and are also making money on both the decline and temporary rebound in stocks). The boring time in the PMs is over and the time to pay close attention to the market is here - it might be a good idea to secure more access while saving 10% at the same time.

Important: If your subscription got renewed recently, but you'd like to secure more access at a discount - please let us know, we'll make sure that the discount applies right away, while it's still active. Moreover, please note that you can secure more access than a year - if you secured a yearly access, and add more years to your subscription, each following year will be rewarded with an additional 10% discount (20% discount total). We would apply this discount manually - please contact us for details.

Secure more access at a discount.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (250% of the full position) in mining stocks is justified from the risk to reward point of view with the following binding exit profit-take price levels:

Senior mining stocks (price levels for the GDX ETF): binding profit-take exit price: $10.32; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the DUST ETF: $231.75; stop-loss for the DUST ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

Junior mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $9.57; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the JDST ETF: $284.25; stop-loss for the JDST ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway. In our view, silver has greater potential than gold does):

Silver futures downside profit-take exit price: $8.58 (the downside potential for silver is significant, but likely not as big as the one in the mining stocks)

Gold futures downside profit-take exit price: $1,382 (the target for gold is least clear; it might drop to even $1,170 or so; the downside potential for gold is significant, but likely not as big as the one in the mining stocks or silver)

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one, it's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (DGLD for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn't, then we will view both positions (in gold and DGLD) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager