Trading position (short-term; our opinion): Short positions (with the stop-loss order at $68.15 and the initial downside target at $56.57) are justified from the risk/reward perspective.

Wednesday’s session brought one more upswing, which took black gold to a fresh March peak. Will the nearest resistances withstand the buying pressure?

Technical Picture of Crude Oil

Let's examine the charts below (charts courtesy of http://stockcharts.com).

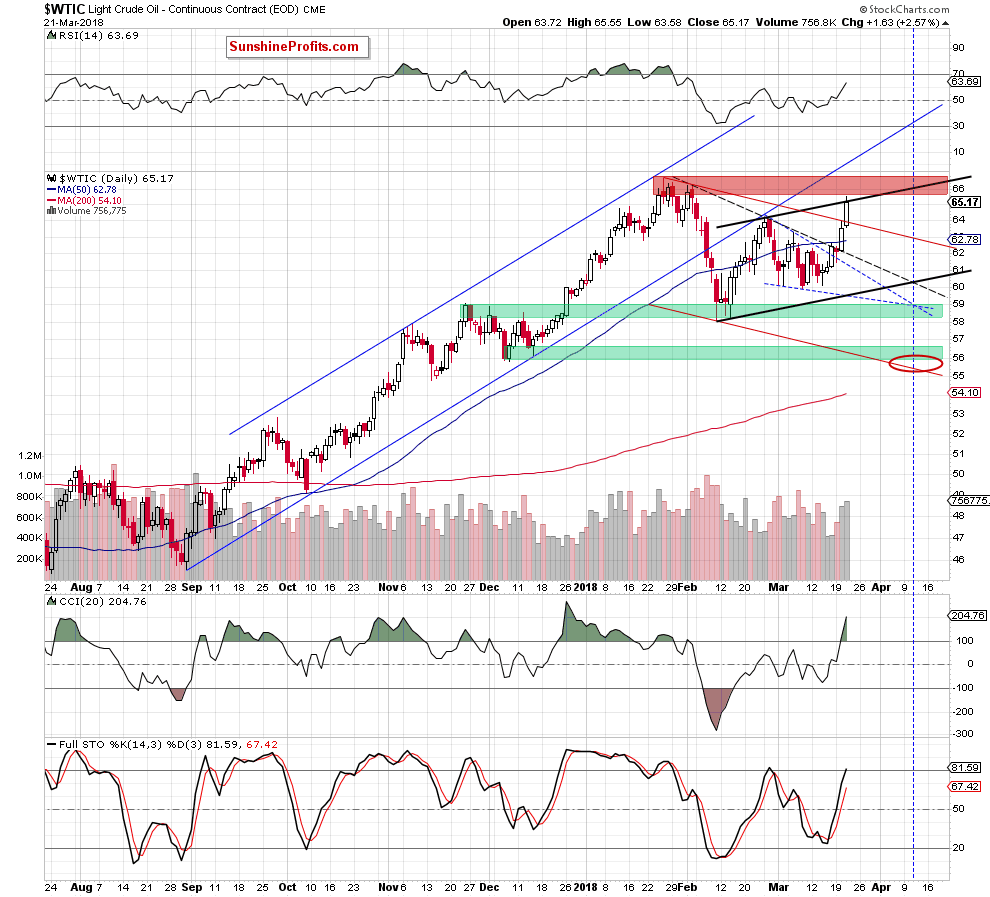

Looking at the daily chart, we see that crude oil extended gains after the market’s open, which resulted in a breakout above the red declining resistance line based on the previous highs and the late February peak.

This positive development, encouraged oil bulls to act, which triggered further improvement and a climb to the major short-term resistance zone created by the January and February highs.

As you see on the very short-term chart this area is also reinforced by the upper border of the black rising trend channel, which increases the probability of reversal – especially when we factor in the medium-term picture.

What do we mean by that?

Let’s recall the quote from our yesterday's alert:

(…) if black gold closes today’s session above these resistances, the way to the north will likely be open.

Why only likely?

Because (…) black gold is currently trading in the blue consolidation between February high and low, which together created the biggest red candle since months.

Therefore, if oil bulls want to go higher they will have to break above the upper line of the formation at $65.40. Until this time, reversal and lower prices are likely (…)

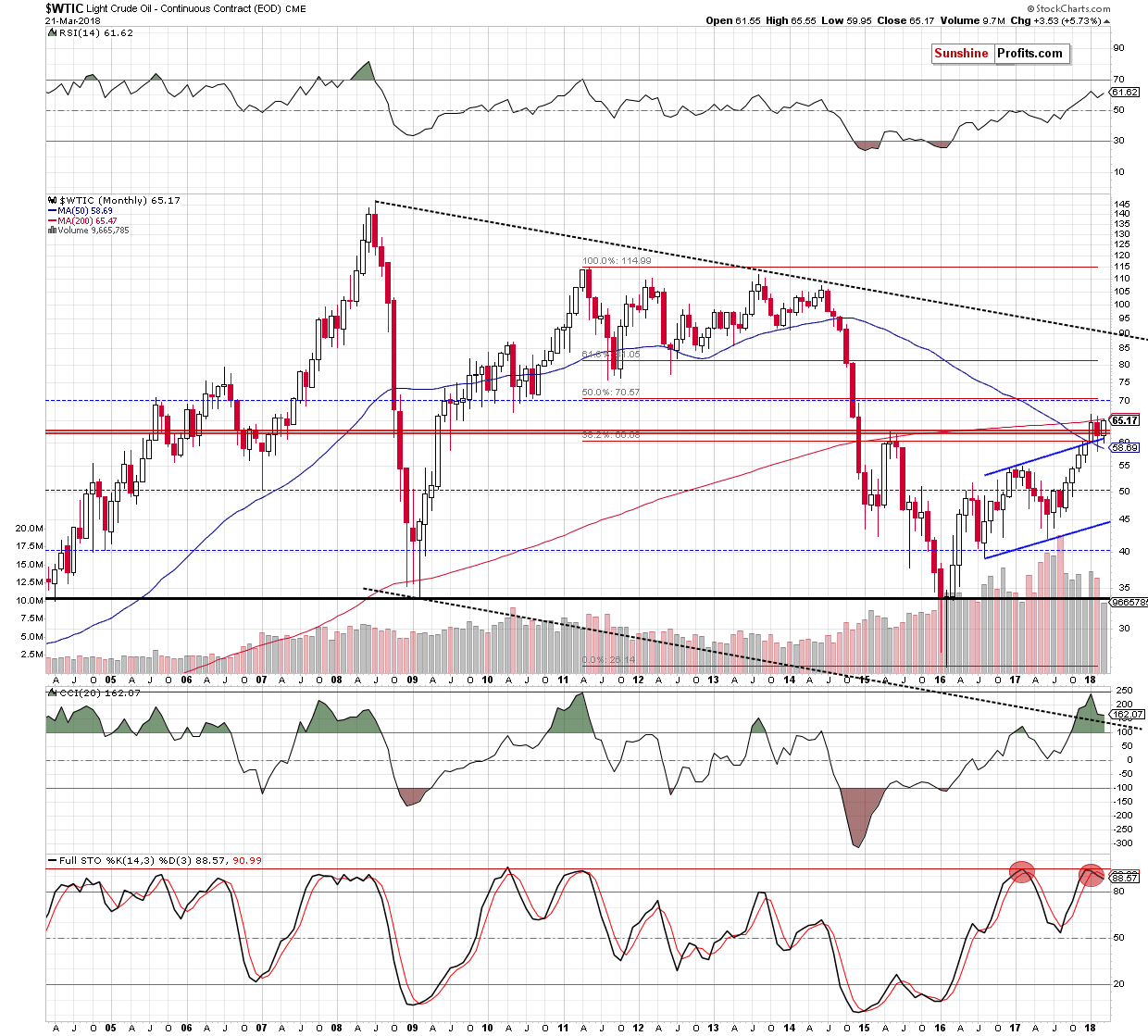

On top of that, when we zoom out our picture, we’ll see one more important resistance in this area. Let’s take a look at the monthly chart below.

From this perspective, we see that light crude also increased to the 200-month moving average, which stopped oil bulls two times in the previous months. Additionally, the sell signal generated by the Stochastic Oscillator remains in the cards, supporting lower prices of black gold in the coming month(s).

Connecting the dots, despite yesterday’s move to the upside, crude oil is still trading under strong, major resistance zone, which continues to block the way to the north. Therefore, we believe that short positions continue to be justified from the risk/reward perspective as reversal and lower prices are just around the corner.

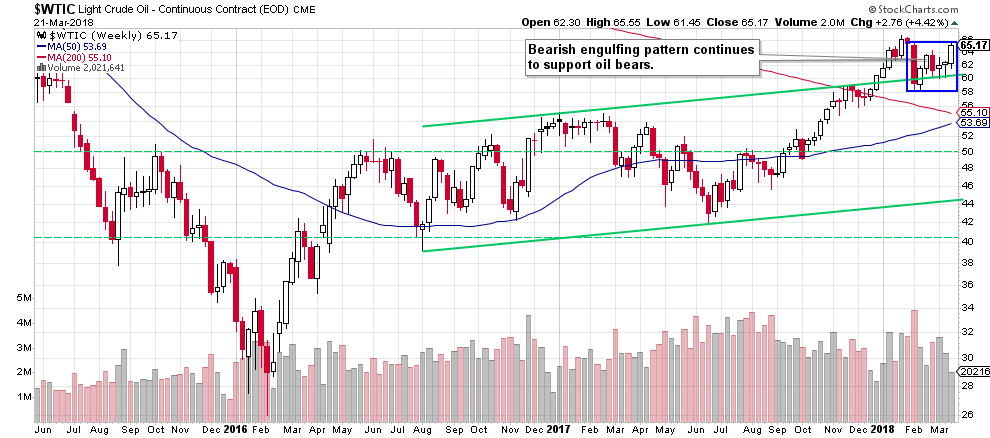

If this is the case and oil bears push the commodity to the south, we’ll see (at least) a comeback to the major support zone based on the barrier of $60 and the upper border of the green rising trend channel (seen on the weekly chart) in the following days.

As always, we’ll keep you - our subscribers - informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts