Trading position (short-term; our opinion): None positions are justified from the risk/reward perspective.

Although oil bulls managed to invalidate yesterday’s breakdown under short-term support, the broader picture of black gold doesn’t look encouraging. Why today's session may turn out to be crucial for the near future of crude oil?

Let’s take a look at the charts below (charts courtesy of http://stockcharts.com/).

Yesterday, we wrote the following:

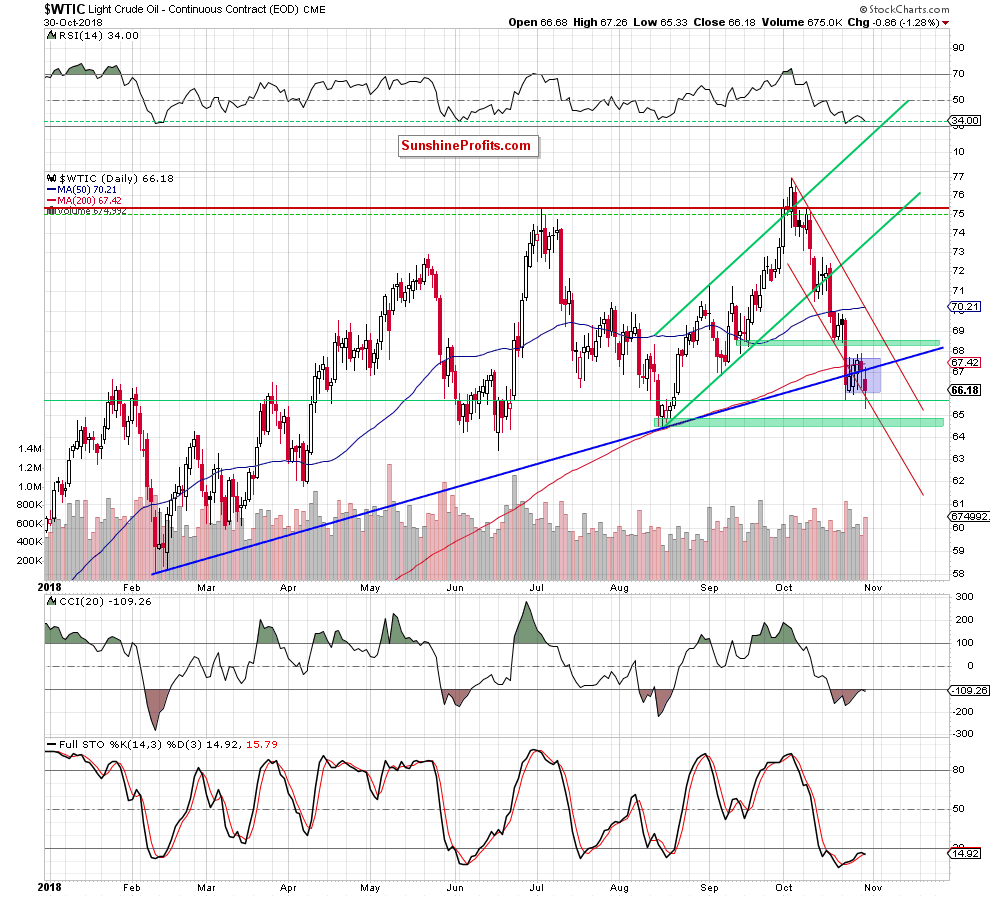

(…) it seems that lower prices of crude may be just around the corner. If this is the case and the commodity extends losses in the very near future (maybe even later in the day), we can see not only a re-test of the lower border of the very short-term red declining trend channel, but also a test of the last week’s low or even a drop to the next support area created by the mid-August lows (around $64.50-$65) in the following days.

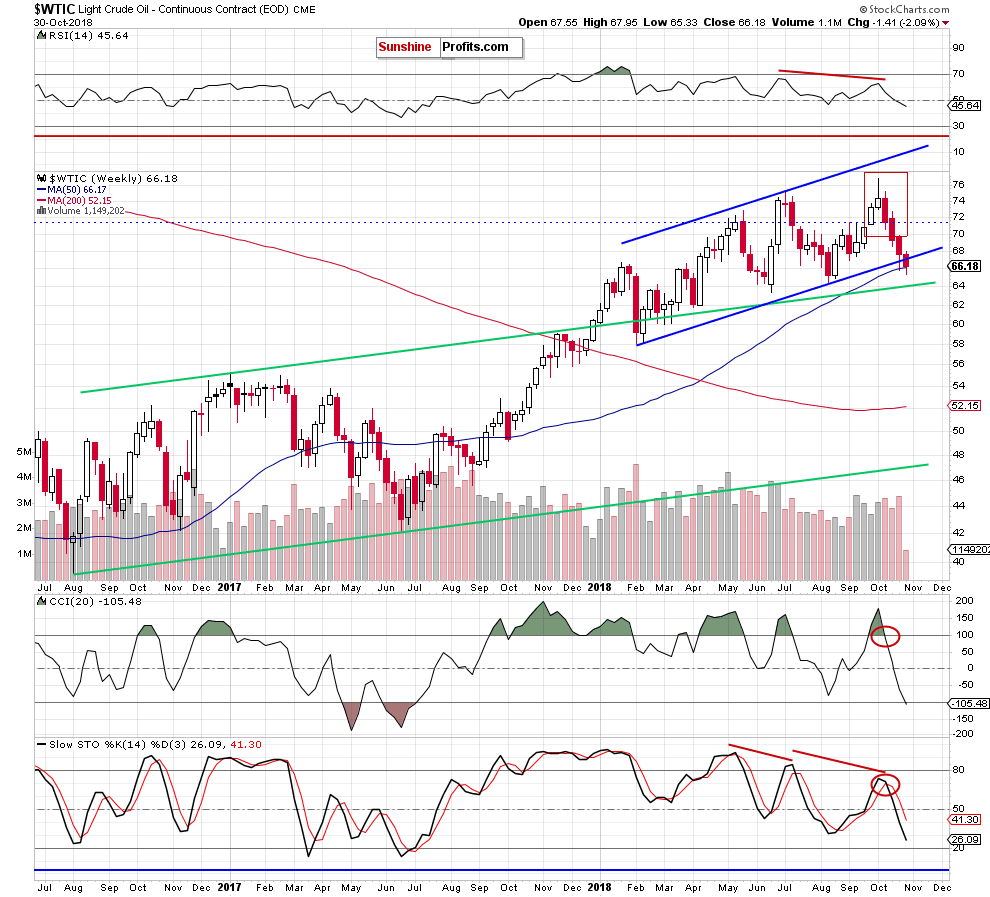

From today’s point of view, we see that although crude oil moved a bit higher after the market’s open, the previously-broken blue resistance line (the lower border of the blue rising trend channel seen on the weekly chart) stopped the buyers, triggering a downswing to our downside targets.

Thanks to oil bears’ action light crude hit a fresh October low and re-tested the lower line of the trend channel. Despite this deterioration oil bulls managed to take the commodity higher before the session closure, which resulted in an invalidation of the earlier breakdown below the last week’s low.

Although this is a positive development (which could translate into a rebound if today’s data from the EIA support the price), we should keep in mind that crude oil is still trading under the medium-term blue trend channel and the major support/resistance line seen on the long-term chart below.

From this perspective, we see that the price of black gold slipped not only below the 200-month moving average, but also under the lower border of the green rising wedge which doesn’t bode well for oil bulls.

Nevertheless, the situation will turn into bearish if the sellers manage to keep gained levels. In other words, if crude oil closes today’s session (what will also mean a closure of the whole month) under the green line, the way to the lower prices can be opened.

Finishing today’s commentary on black gold, we would like to add that the CCI and the Stochastic Oscillator generated the sell signals, suggesting that another bigger move will likely be to the downside (even if we see a short-term rebound earlier). We will keep you informed should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): None positions are justified from the risk/reward perspective. As always, we’ll keep you - our subscribers - informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts