Trading position (short-term; our opinion): Short position with a stop-loss order at $60.22 and the initial downside target at $50.38 in crude oil is justified from the risk/reward perspective.

Crude oil moved yet again higher yesterday. What could stop the bulls? Any resistance(s) nearby? Other technical factors at play? The market is tense yet offering subtle clues. Please join us in examining their implications.

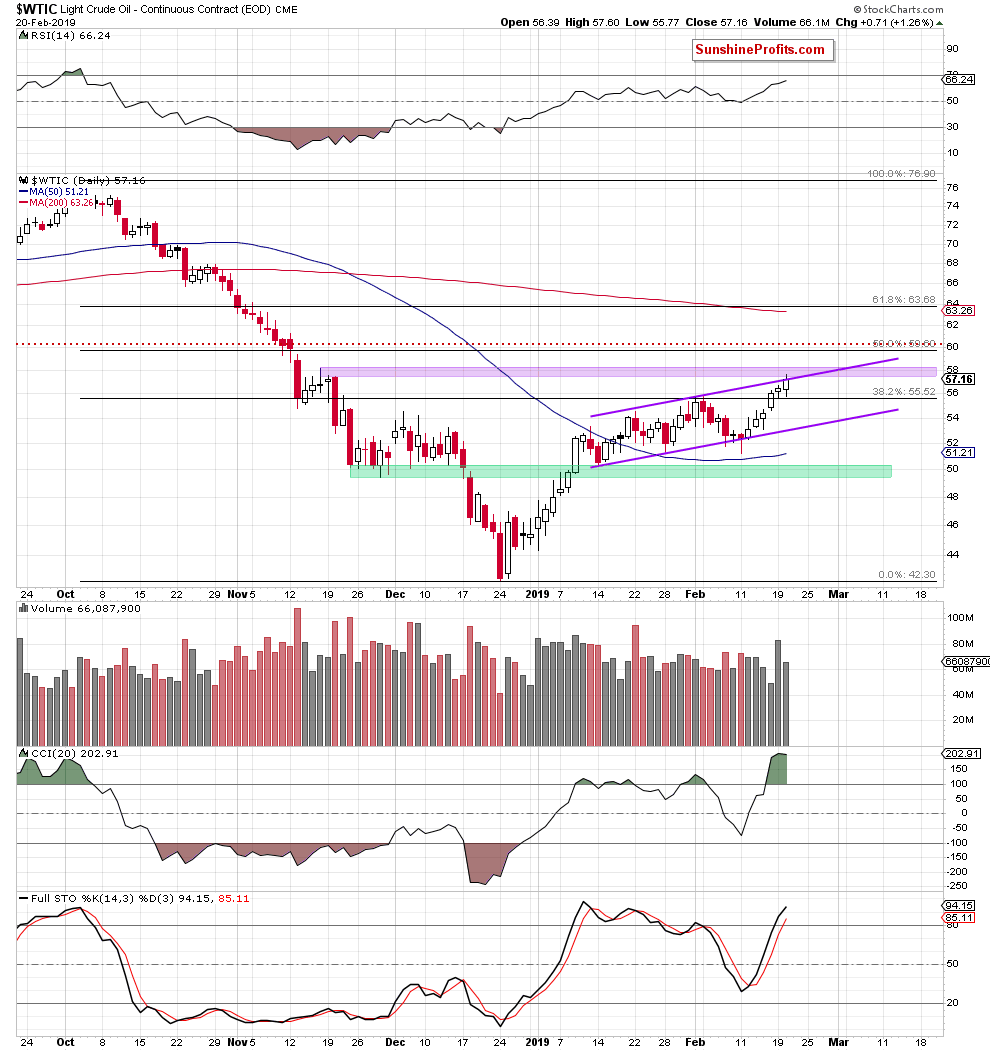

Let’s see the chart below (chart courtesy of http://stockcharts.com).

Yesterday, we wrote the following about Tuesday’s volume in connection with the candle’s shape:

(…) The volume increased significantly yesterday – the session attracted great interest. Only part of it can be explained by the fact that it was the first post-holiday trading day or that it makes up for lower Friday’s volume. Taking the shape of the candle into account (it has a small body with relatively significant lower knot), it looks more as a case of increased selling interest that the buyers had successfully repelled yesterday.

(…) However, there could still first be one more attempt to move higher, even on an intraday basis only. Considering all the above, it’s reasonable to expect a failure of the bulls and an invalidation of any potential small breakout above the upper line of the purple rising trend channel.

The situation developed in line with our assumptions and crude oil ventured a bit above the upper border of the purple rising trend channel only to close the day right on that upper purple line. The volume accompanying yesterday’s rise went down significantly compared to the day before, which gives some doubts about the bulls’ lasting strength.

Additionally, black gold moved to the purple resistance zone based on mid-November peaks, and the CCI and Stochastics are in their overbought areas. These factors suggest that the space for gains is limited and reversal in the coming day(s) remains very likely.

If that’s the case, the first downside target would be the lower border of the purple rising trend channel (currently at around $53.20). We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): Short position with a stop-loss order at $60.22 (we just moved it a bit higher) and the initial downside target at $50.38 in crude oil is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist