Trading position (short-term; our opinion): Short position with a stop-loss order at $58.37 and the initial (!) downside target at $50.38 in crude oil is justified from the risk/reward perspective.

Yesterday, the sellers were eventually rebutted and black gold closed the day slightly up. Do the bulls have a reason to celebrate and look to better days ahead? How likely is the return of the bears and lower prices? Or is it actually a sideways trading range only?

Let’s examine the charts below (charts courtesy of http://stockcharts.com).

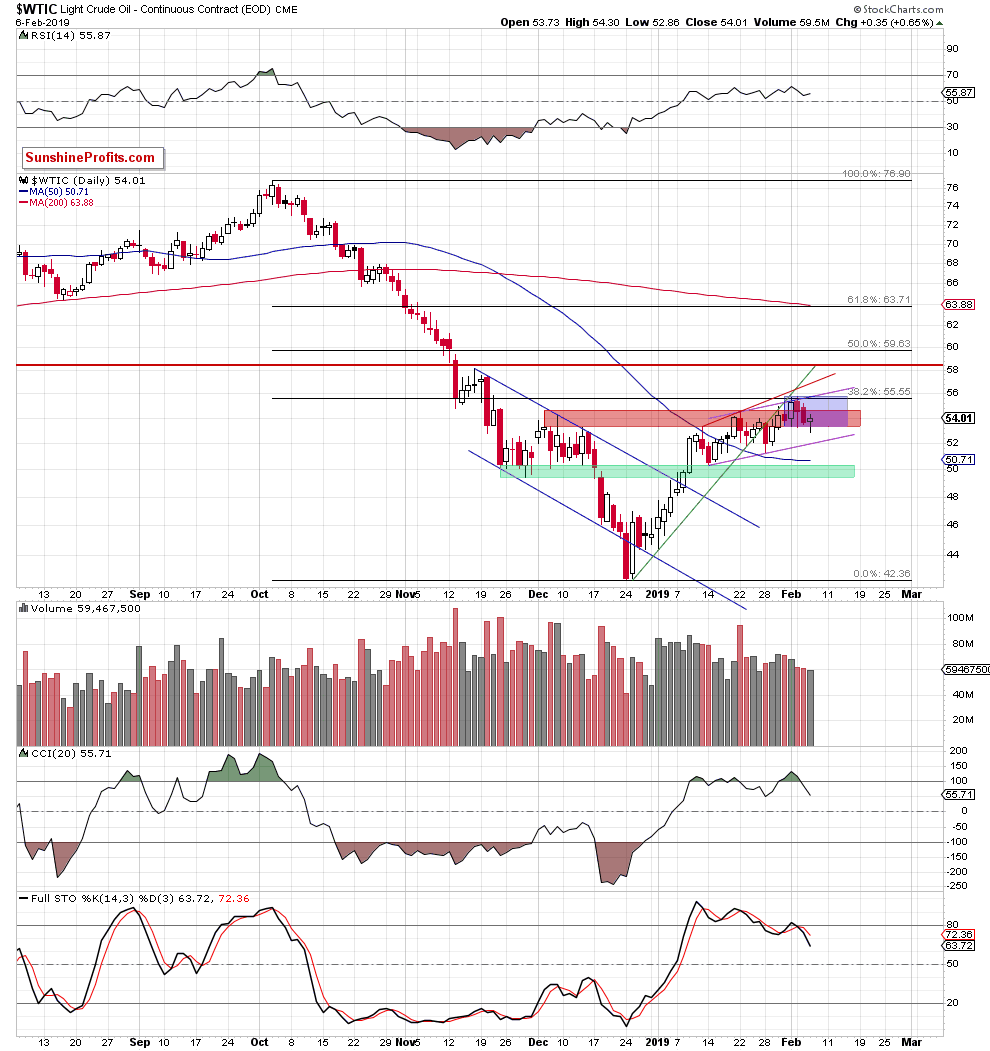

Looking at the daily chart with yesterday’s close as the last price point, we see that the overall situation in the very short term hasn’t changed much. Crude oil remains stuck inside the blue consolidation.

Yesterday, the sellers attempted to move lower, but ultimately failed. Black gold moved back into the formation which looks positive on the surface. After all, it’s an invalidation of the earlier tiny breakdown below the blue consolidation and a comeback into the red resistance zone. However, yesterday’s volume was not high enough so that we could talk about a meaningful reversal. Even if we see one more upswing, further deterioration is just around the corner.

Taking into account all the bearish factors presented, we continue to think that another bigger move will be to the downside and our analysis remains up-to-date:

(…) we believe that if oil extends losses from here and breaks below this week’s lows, we’ll see at least a test of the lower border of the purple rising trend channel (currently at around $52.04). If this support is broken, the next downside target will be the 50-day moving average (at $50.73) or even the green support area around the barrier of $50.

Let’s see today’s premarket price action for more clues:

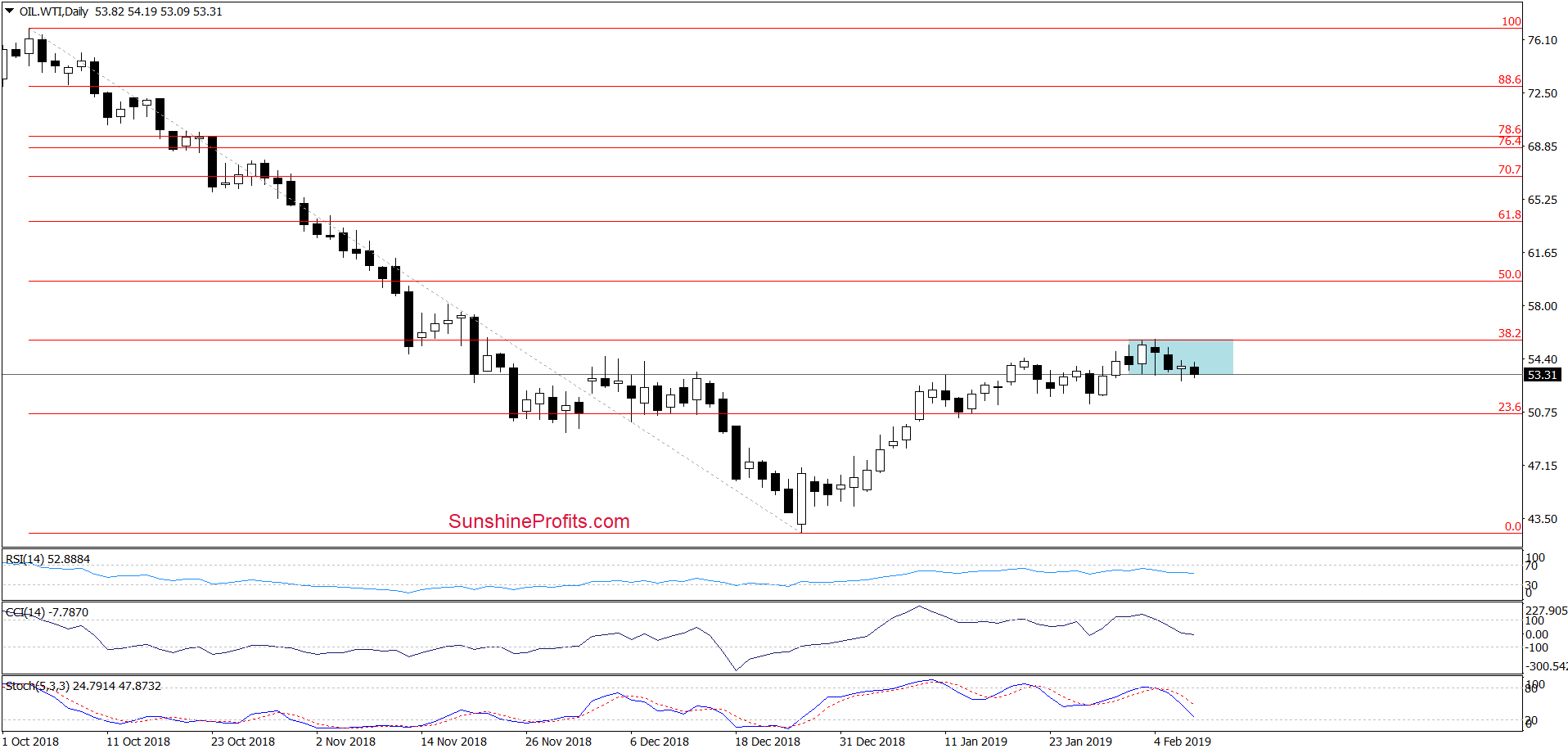

Looking at the daily chart including today’s price action, we do see some changes in the overall short-term situation. Crude oil looks to be making the move down to leave the blue consolidation. This supports our expectations of the eventual bearish resolution to the current blue consolidation.

Summing up, short position continues to be justified from the risk/reward perspective as crude oil is still trading under the major resistances: the 38.2% Fibonacci retracement, the upper border of the purple rising trend channel and the upper border of the red resistance zone. On top of that, Wednesday’s volume wasn’t high enough to speak of a true reversal, which in combination with the sell signals generated by the daily indicators increases the probability of yet another downside move.

Trading position (short-term; our opinion): Short position with a stop-loss order at $58.37 and the initial (!) downside target at $50.38 in crude oil is justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.