Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Even though crude oil grew slightly after the opening of the Thursday session, the bears quickly realized that they can thwart pro-growth plans of their rivals and started attacking. What were the consequences of their action?

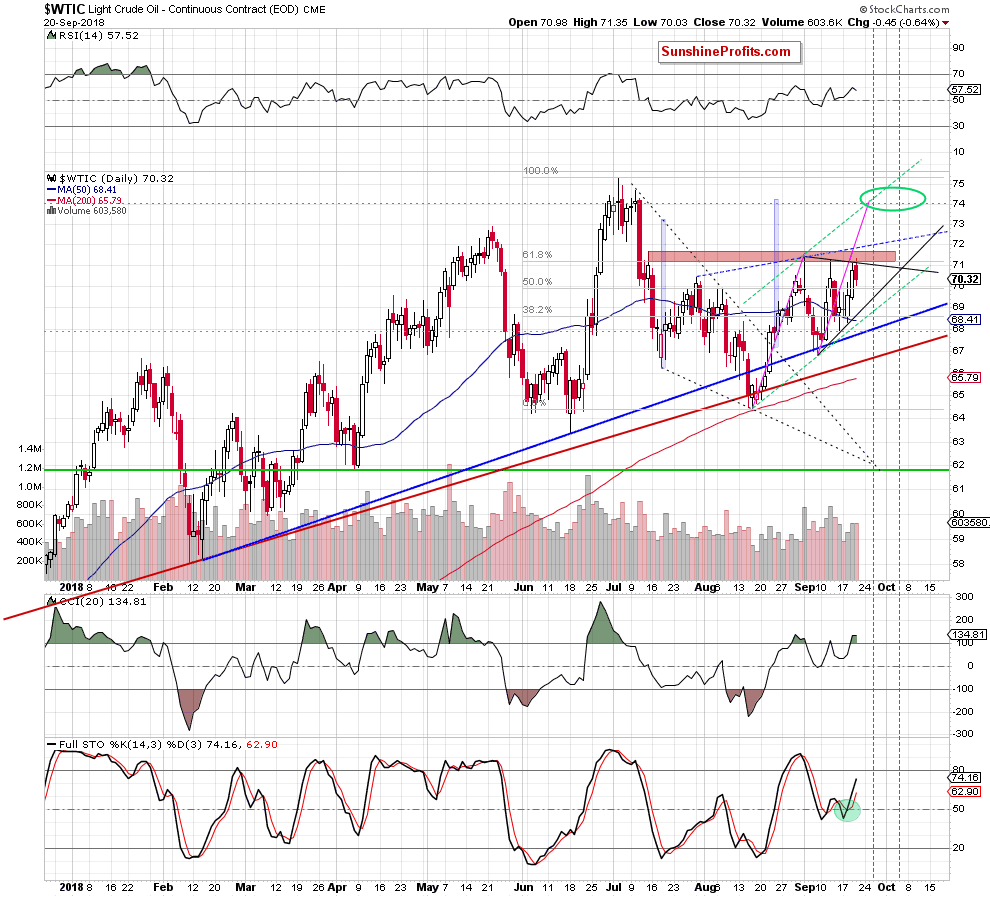

Let’s examine the charts below (charts courtesy of http://stockcharts.com).

Technical Picture of Crude Oil

Quoting our yesterday’s Oil Trading Alert:

(…) the price of light crude increased once again, almost touching the major resistance zone marked with red.

(…) the commodity also increased to the very short-term back resistance line based on the previous highs, which is the upper border of the black triangle (the lower border of the formation is created by the black support line based on the recent lows).

(…) Such situation doesn’t look encouraging from the bulls’ point of view – especially when we factor in the fact that yesterday’s intraday high was lower than September 12 peak, which was also lower than the September 4 high. Three lower peaks in a row suggest that bulls may lose their strength and the next move to the south is just around the corner.

Looking at the daily chart, we see that although black gold increased a bit (less than 50 cents) after the market open, all the above-mentioned resistances stopped the buyers (as we had expected), triggering a pullback.

Yesterday's price drop caused an invalidation of a tiny breakout above the upper border of the black trend channel, which emphasizes the importance of the red resistance zone for the future of light crude and shows that oil bears defend it very fiercely.

Therefore, we believe that as long as there is no successful breakout above it and the blue dashed line based on late-July and early-September peaks (the neck line of a potential reverse head and shoulders about which we wrote on September 10, 2018) a bigger move to the upside is doubtful and short-lived moves in both directions inside the black triangle should not surprise us.

Nevertheless, if oil bulls show strength and manage to push the price of black gold above the neck line of the potential pattern, we’ll likely re-open long positions on the following day. As always, we’ll keep you - our subscribers - informed should anything change.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts