Trading position (short-term; our opinion): Short position with a stop-loss order at $58.37 and the initial (!) downside target at $50.38 in crude oil is justified from the risk/reward perspective.

Now it’s five trading days that oil finished higher. A good winning streak reminiscent of the post-Christmas rally. Is it really the case? Let’s take a close look at the mechanics and explanations as to what’s likely to expect next. And why exactly.

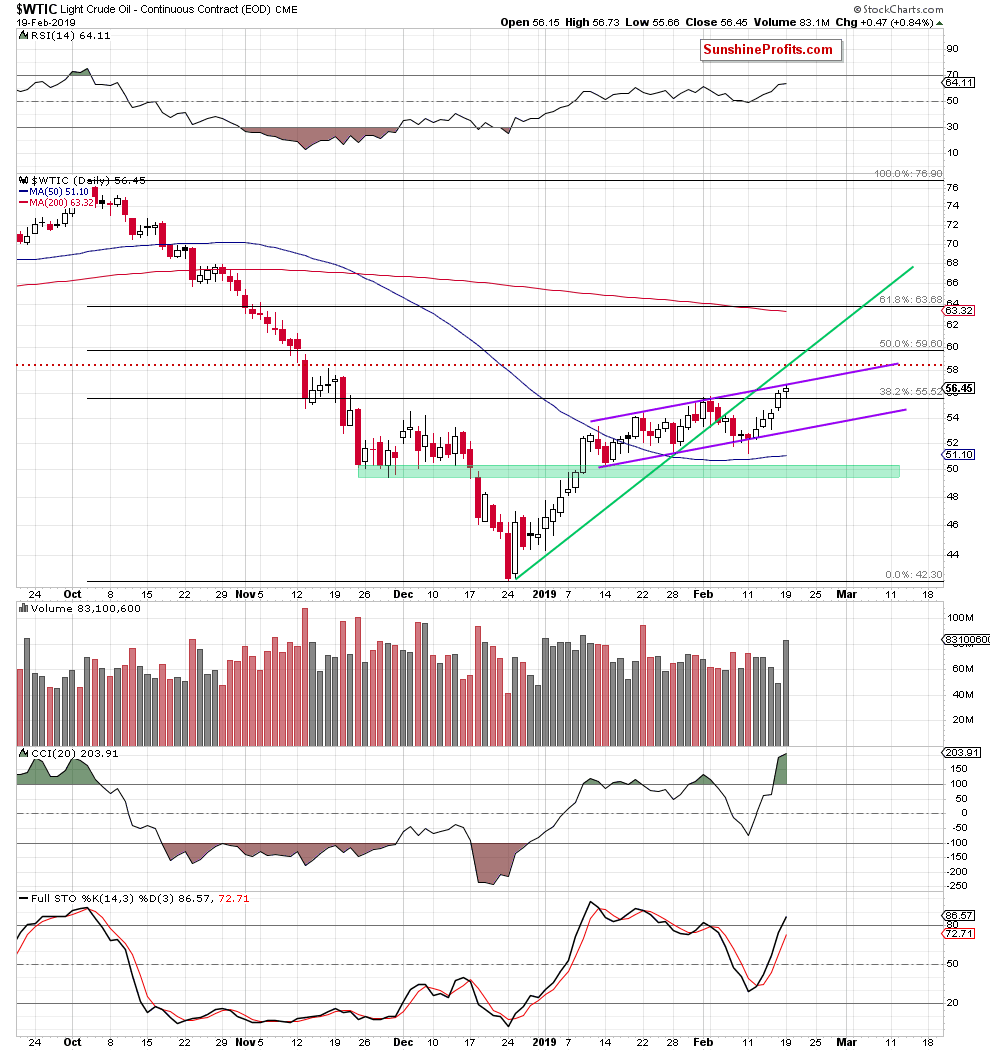

Let’s examine the chart below (charts courtesy of http://stockcharts.com).

Looking at the daily chart, we see that although black gold moved a bit higher yesterday, the short-term picture remains almost unchanged as the commodity is still trading inside the purple rising trend channel. Earlier today, we haven’t seen any serious breakout attempt to change the overall situation and oil looks headed lower as it changes hands currently at around $56.10.

Yesterday’s observations remain up-to-date:

(…) there are several reasons to doubt the continuation of the upward move. Let’s discuss them one by one.

First, despite Friday’s move, the commodity is still trading inside the purple rising trend channel. Its upper border has been strong enough to stop the buyers several times in the past, which increases the probability that we’ll see a similar price action in the very near future, too.

Second, crude oil still remains below the previously broken green line based on the previous important lows, which serves as an additional resistance.

Third, the CCI increased well above the level of 100. Last time we saw a similar reading of the indicator was before and at the October peak, which suggests that such a high level of CCI can precede another local top this time around, too.

Last but not least – actually, the most important – is the volume. As you see on the daily chart, it decreases from session to session, showing smaller involvement of the buyers in recent increases, which doesn’t bode well for any further rally. Of course, a new trading week is just getting started and we’ll carefully evaluate all the new information it brings us.

There’s one element of yesterday’s trading that is notable. It’s the volume, especially in connection with the candle’s shape.

The volume increased significantly yesterday – the session attracted great interest. Only part of it can be explained by the fact that it was the first post-holiday trading day or that it makes up for lower Friday’s volume. Taking the shape of the candle into account (it has a small body with relatively significant lower knot), it looks more as a case of increased selling interest that the buyers had successfully repelled yesterday.

This argument builds on the price rejection at the upper border of the purple rising trend channel and also on today’s trading that has so far erased yesterday’s advance and then some. It give credence to expectations for an eventual downward resolution in price to current chart situation.

However, there could still first be one more attempt to move higher, even on an intraday basis only. Considering all the above, it’s reasonable to expect a failure of the bulls and an invalidation of any potential small breakout above the upper line of the purple rising trend channel. That is, if the buyers manage to take the price above this important resistance at all.

Connecting the dots, we continue to believe that the space for gains remains limited and reversal in the coming day(s) is very likely.

Trading position (short-term; our opinion): Short position with a stop-loss order at $58.37 and the initial (!) downside target at $50.38 in crude oil is justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist